Onfolio Holdings Inc. (Nasdaq: ONFO, ONFOW)

(OTC: ONFOP) (the "Company" or "Onfolio"), a company that acquires

and manages a diversified portfolio of online businesses, today

announced that its chairman and chief executive officer released

the following letter to Onfolio shareholders.

A longer version as part of a “2024 In Review” piece has been

posted on the Company’s corporate website at

https://onfolio.com/2024-in-review.

Dear Shareholders,

What a difference a year makes.

Looking back on 2024, I’d like to reflect on our journey and

progress in light of our original thesis. We started with four key

beliefs:

- There are hundreds or thousands of

profitable online businesses undervalued due to idiosyncratic risks

or suboptimal operations.

- Aggregating these businesses reduces individual risk,

strengthening the portfolio.

- Our operational expertise enables us to run and grow these

businesses more effectively than their previous management.

- Our public company status allows us

to access capital at costs lower than the returns generated by our

acquisitions.

In 2024, we made significant strides in all these areas.

1. Strategic Acquisitions Strengthened Our

Portfolio

We acquired three new businesses, adding eight revenue streams

and $6M in revenue:

- RevenueZen (RZ) (January 2024): A

content marketing agency with $1.4M revenue and $227K net profit.

RZ retained its entire team post-acquisition, enhancing operational

expertise across our portfolio. This acquisition demonstrated our

ability to structure deals with minimal upfront cash, utilizing

promissory notes, preferred shares, and seller financing.

- DDSRank (July 2024): A niche SEO agency for dentists ($500K

revenue, $200K net profit). Funded via one of our our SPV funds,

preferred shares, and seller notes, requiring minimal Onfolio

cash.

- Eastern Standard (ES) (October 2024): A digital marketing

agency well known in the health and education industries, with $4MM

revenue and $630K net profit. This was structured similarly to

DDSRank, with SPV fund participation enabling us to secure a

majority stake while preserving capital.

Each acquisition reinforced our ability to execute

capital-efficient deals while improving operational efficiency.

2. Evolving Our Operating Model

Effective post-acquisition management is key to our success.

While we initially operated as a centralized entity and later

decentralized entirely, in 2024, we adopted a hybrid

model;“centralized strategy, decentralized execution.” This allows

portfolio company leaders to focus on their strengths while

benefiting from Onfolio’s shared expertise, strategic oversight,

and best practices.

This approach enhances operational efficiency, accelerates

growth, and enables acquired businesses to maintain and expand

profitability. It also allows us to actively participate in

strategic hiring, key decision-making, and resource allocation,

maximizing value creation across our holdings.

3. Expanding Our Capital Strategy with SPVs

In March 2024, we launched SPVs (Special Purpose Vehicles),

allowing accredited investors to co-invest in acquisitions. This

proved instrumental in funding DDSRank and ES, enabling us to

secure valuable businesses while preserving Onfolio’s cash. While

SPVs involve higher capital costs due to equity sharing, they

provide an effective solution for funding accretive deals without

reliance on traditional debt markets.

For SPV investors, this offers exposure to specific online

businesses with a clear return profile, albeit with higher risk and

less diversification than Onfolio itself. While not a long-term

strategy, SPVs will remain part of our acquisition playbook in

2025, alongside preferred shares.

4. Quoting Our Preferred Shares on OTCQB

A major milestone was quoting our preferred shares on OTCQB,

providing liquidity for early investors and expanding access for

new ones. Each share pays a $3 annual dividend, appealing to

income-focused investors. Since 2022, we’ve raised $1.5M in

preferred share financing and issued $3M of preferred shares as

part of acquisition financing.

This liquidity should drive demand, potentially allowing us to

raise capital more efficiently in 2025 at a lower cost (12%) than

SPVs. We anticipate growing this funding channel, unlocking further

acquisition opportunities with minimal dilution.

On the Verge of Profitability

Throughout 2024, we have significantly reduced our losses and we

now appear to be essentially at profitability. We’ve reached a

position where we can continue operations without requiring

additional fundraising or acquisitions to achieve profitability,

yet we will continue to pursue both because they accelerate our

growth and long-term value creation. With this foundation, we

expect to move firmly into sustained profitability in the near

term.

Looking Ahead to 2025

With our acquisition model validated, capital access expanded,

and operational efficiencies improving, 2025 promises even greater

momentum. Our roadmap is clear:

- Continue acquiring high-quality

businesses, where synergies create exponential value.

- Expand capital raising efforts, leveraging preferred shares and

SPVs.

- Further optimize operations,

scaling our playbook for sustained growth.

If we execute well, we anticipate achieving significant

profitability in the near term, reinforcing our ability to deliver

compounded returns for our shareholders.

Onward to an even stronger 2025.

About Onfolio Holdings

Onfolio acquires and manages a diversified portfolio of online

businesses. Onfolio acquires business that meet its investment

criteria, being that such businesses operate in sectors with

long-term growth opportunities, have positive and stable cash

flows, face minimal threats of technological or competitive

obsolescence and can be managed by our existing team or have strong

management teams largely in place. The Company excels at finding

acquisition opportunities where the seller has not fully optimized

their business, and Onfolio's experience and skillset allows it to

add increased value to these existing businesses.

Visit www.onfolio.com for more information.

Safe Harbor Statement

The information posted in this release may contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. You can identify these

statements by use of the words "may," "will," "should," "plans,"

"explores," "expects," "anticipates," "continues," "estimates,"

"projects," "intends," and similar expressions. Forward-looking

statements involve risks and uncertainties that could cause actual

results to differ materially from those projected or anticipated.

These risks and uncertainties include, but are not limited to,

general economic and business conditions, effects of continued

geopolitical unrest and regional conflicts, competition, changes in

technology and methods of marketing, delays in completing new

customer offerings, changes in customer order patterns, changes in

customer offering mix, continued success in technological advances

and delivering technological innovations, delays due to issues with

outsourced service providers, those events and factors described by

us in Item 1.A "Risk Factors" in our most recent Form 10-K and Form

10-Q; other risks to which our Company is subject; other factors

beyond the Company's control. Any forward-looking statement made by

us in this press release is based only on information currently

available to us and speaks only as of the date on which it is made.

We undertake no obligation to publicly update any forward-looking

statement, whether written or oral, that may be made from time to

time, whether as a result of new information, future developments

or otherwise.

Investor Contact

investors@onfolio.com

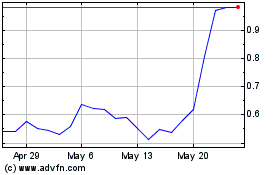

Onfolio (NASDAQ:ONFO)

Historical Stock Chart

From Jan 2025 to Feb 2025

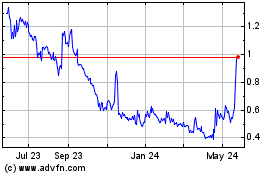

Onfolio (NASDAQ:ONFO)

Historical Stock Chart

From Feb 2024 to Feb 2025