Onyx Acquisition Co. I Announces Redemption of its Public Shares and Intent to Delist

26 October 2024 - 8:01AM

Onyx Acquisition Co. I. (the “Company”) (Nasdaq: ONYX), a special

purpose acquisition company, today announced that it will redeem

all of its outstanding Class A ordinary shares included as part of

the units issued in its initial public offering (the “Public

Shares”), effective as of the close of business on November 13,

2024, because the Company will not consummate an initial business

combination within the time period required by its amended and

restated memorandum and articles of association (the “Articles”).

Accordingly, the Company will not be seeking a further extension as

contemplated by the preliminary proxy statement filed with the

Securities and Exchange Commission (the “Commission”) on October

11, 2024.

As stated in the Company’s Articles, if the

Company is unable to complete an initial business combination by

November 5, 2024, the Company will: (i) cease all operations except

for the purpose of winding up; (ii) as promptly as reasonably

possible but not more than ten business days thereafter, redeem the

Public Shares, at a per-Share price, payable in cash, equal to the

aggregate amount then on deposit in the Company’s trust account

(the “Trust Account”), including interest earned on the funds held

in the Trust Account and not previously released to the Company

(less taxes payable and up to US$100,000 of interest to pay

dissolution expenses), divided by the number of then issued and

outstanding Public Shares, which redemption will completely

extinguish public shareholders’ rights as shareholders (including

the right to receive further liquidating distributions, if any);

and (iii) as promptly as reasonably possible following such

redemption, subject to the approval of the Company's remaining

shareholders and the board of directors, liquidate and dissolve,

subject in each case to its obligations under Cayman Islands law to

provide for claims of creditors, and the requirements of other

applicable law.

The per-share redemption price for the Public

Shares is expected to be approximately $11.42 (after taking

into account the removal of $100,000 of the accrued interest in the

Trust Account for dissolution expenses) (the “Redemption Amount”).

The balance of the Trust Account as of October 25, 2024 was

approximately $15,315,732.02, inclusive of accrued and unposted

interest. In accordance with the terms of the related trust

agreement, the Company expects to retain $100,000 of the interest

from the Trust Account to pay dissolution expenses.

As of the close of business on November 13,

2024, the Public Shares will be deemed cancelled and will represent

only the right to receive the Redemption Amount.

The Redemption Amount will be payable to the

holders of the Public Shares upon delivery of their shares to the

Company’s transfer agent, Continental Stock Transfer & Trust

Company. Beneficial owners of Public Shares held in “street name,”

however, will not need to take any action in order to receive the

Redemption Amount.

There will be no redemption rights or

liquidating distributions with respect to the Company’s warrants,

which will expire worthless.

The Company’s sponsor has waived its redemption

rights with respect to the outstanding founder shares and private

placement warrants. After November 13, 2024, the Company shall

cease all operations except for those required to wind up the

Company’s business.

Because the Company will not consummate an

initial business combination within the periods required under its

Articles and Nasdaq Listing Rule IM 5101-2, the Company intends to

file a Form 25 with the Commission on November 4, 2024 in order to

delist the Company’s securities from the Nasdaq Capital Market. The

Company thereafter expects to file a Form 15 with the Commission to

terminate the registration of the Company’s securities under the

Securities Exchange Act of 1934, as amended.

Forward-Looking Statements

This press release includes "forward-looking

statements" within the meaning of the safe harbor provisions of the

United States Private Securities Litigation Reform Act of 1995.

Such statements can be identified by the fact that they do not

relate strictly to historical or current facts. When used in this

press release, words such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,”

“possible,” “potential,” “predict,” “project,” “should,” “strive,”

“would” and similar expressions may identify

forward-looking statements, but the absence of these words

does not mean that a statement is not forward-looking. Such

statements include, but are not limited to, statements regarding

the expected Redemption Amount and anticipated filings with the

Commission. These statements are based on current expectations on

the date of this press release and involve a number of risks and

uncertainties that may cause actual results to differ

significantly, including, without limitation, the risk

factors described under “Item 1A. Risk Factors” of the

Company’s Annual Report on Form 10-K filed with the SEC on

March 29, 2024, in our subsequently filed Quarterly Reports on

Form 10-Q filed with the SEC, and in other reports the

Company may file with the Commission from time to time.

All such forward-looking statements speak

only as of the date of this press release. The Company expressly

disclaims any obligation or undertaking to update or revise any

forward-looking statements, whether as the result of new

developments or otherwise, except as required by applicable law.

Readers are cautioned not to put undue reliance on forward-looking

statements.

ContactMatthew VodolaChief Financial Officer

973 879 9932mvodola@onyxacqu.com

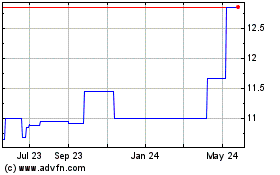

Onyx Acquisition Company I (NASDAQ:ONYXU)

Historical Stock Chart

From Oct 2024 to Nov 2024

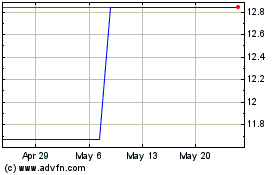

Onyx Acquisition Company I (NASDAQ:ONYXU)

Historical Stock Chart

From Nov 2023 to Nov 2024