false

0000944809

0000944809

2024-02-27

2024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2024

OPKO Health, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

|

001-33528

|

|

75-2402409

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

4400 Biscayne Blvd.

|

Miami,

|

Florida

|

|

33137

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (305) 575-4100

|

Not Applicable

|

|

Former name or former address, if changed since last report

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

OPK

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

ITEM 2.02.

|

Results of Operations and Financial Condition.

|

On February 27, 2024, OPKO Health, Inc. (the “Company”) issued a press release announcing operating and financial highlights for the quarter ended December 31, 2023. The press release also contains information on how to access the conference call the Company is hosting to provide a business update and discuss its financial and operating results for the fourth quarter ended December 31, 2023, as well as provide financial guidance. A copy of the press release is attached hereto as Exhibit 99.1.

The information included herein and in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 as amended or the Exchange Act, except as expressly set forth by specific reference in such a filing.

|

ITEM 9.01.

|

Financial Statements and Exhibits.

|

|

Exhibit

No.

|

|

Description

|

| |

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

OPKO Health, Inc.

|

| |

|

|

|

| |

|

By:

|

/s/ Adam Logal

|

|

Date: February 27, 2024

|

|

Name:

|

Adam Logal

|

| |

|

Title:

|

Senior Vice President, Chief Financial Officer

|

| |

|

|

|

Exhibit 99.1

OPKO Health Reports Fourth Quarter 2023 Business Highlights and Financial Results

Conference call begins at 4:30 p.m. Eastern time today

MIAMI (February 27, 2024) – OPKO Health, Inc. (NASDAQ: OPK) reports business highlights and financial results for the three and 12 months ended December 31, 2023.

Business highlights from the fourth quarter and subsequent weeks included the following:

| |

●

|

ModeX advanced its antiviral and immune-oncology product pipeline. ModeX advanced its pipeline of antiviral and immune-oncology programs utilizing its next-generation multispecific antibodies, with expectations for one oncology program to enter the clinic this year. In 2023, Modex secured two collaborations including one with Merck to develop MDX-2201, its vaccine for Epstein-Barr virus, and another with BARDA to develop novel multispecific antibodies against viral infectious disease threats.

|

| |

●

|

NGENLA® has now been approved in over 50 countries including the U.S., Japan, EU Member States, Canada and Australia. Pfizer, OPKO’s commercial partner, has launched NGENLA in all priority global markets. OPKO is entitled to gross profit sharing in all global markets based on sales of both NGENLA and Genotropin. NGENLA is the first once-weekly product approved for the treatment of pediatric growth hormone deficiency in Japan, Canada, Australia, the United Kingdom, Taiwan, the United Arab Emirates and Brazil.

|

| |

●

|

BioReference Health continued implementing its REACH program to improve operating efficiencies and enhance productivity. With the goal of achieving profitability this year, BioReference continued to implement initiatives to reduce costs and improve productivity by enhancing innovation of its higher-value specialty testing segments. Other efforts to return this business to profitability include expanding into new markets and marketing to new customer segments, such as pharmaceutical companies.

|

| |

●

|

Approvals received for OPKO Health-branded Storefront on Alibaba’s Tmall Global Platform in China. NextPlat Corp., a global e-Commerce provider, is launching an OPKO Health-branded online storefront on Alibaba's Tmall Global e-commerce platform in China. This new online storefront will initially list up to 40 OPKO health and wellness products featuring an assortment of nutraceuticals for bone, joint and eye health, as well as supplements for nutrition and immunity defense. NextPlat intends to significantly expand the OPKO online storefront with a wide array of veterinary and animal health products, subject to final Chinese regulatory approval, which is expected during the second quarter of 2024.

|

Fourth Quarter Financial Results

| |

●

|

Pharmaceuticals: Revenue from products in the fourth quarter of 2023 increased to $43.0 million from $37.9 million in the fourth quarter of 2022, driven by growing sales from our international operations, positively impacted by foreign currency fluctuations of approximately $1.3 million. Furthermore, sales of RAYALDEE increased to $9.3 million from $9.1 million in the prior-year period. Revenue from the transfer of intellectual property was $14.7 million in the fourth quarter of 2023 compared with $8.1 million in the 2022 period, which included revenue of $12.2 million and $3.0 million, respectively, of gross profit share payments for NGENLA; the fourth quarter of 2023 included a catch-up payment of $3.1 million for the U.S. for the third quarter of 2023. Total costs and expenses were $73.8 million in the fourth quarter of 2023 compared with $68.0 million in the prior-year period. The increase was primarily from higher cost of product revenues reflecting sales growth from OPKO’s international operating companies, negatively impacted by unfavorable foreign currency fluctuations of $1.1 million. Furthermore, research and development expenses increased as we continued to invest in our pipeline of immune-oncology and infectious disease programs. Operating loss was $16.0 million in the fourth quarter of 2023 compared with $22.0 million in the fourth quarter of 2022.

|

| |

●

|

Diagnostics: Revenue from services in the fourth quarter of 2023 was $124.2 million compared with $139.4 million in the prior-year period. The decrease reflects lower clinical test reimbursement of $9.0 million due to the mix of testing ordered, partially offset by an increase of $0.9 million from higher clinical test volume. COVID-19 testing volume and reimbursement decreased by $7.1 million due to higher utilization of antigen point-of-care diagnostic tests, as well as a shift in customer mix. Total costs and expenses for the fourth quarter of 2023 were $166.4 million compared with $162.5 million in the fourth quarter of 2022. This increase is primarily due to non-recurring employee retention and severance costs associated with our ongoing REACH initiatives. Through these initiatives, the Company has reduced ongoing expenses on an annualized basis by $10.1 million. Operating loss in the fourth quarter of 2023 was $42.3 million, including $4.7 million of non-recurring expenses and $5.4 million of revenue adjustments, compared with an operating loss of $23.1 million in the 2022 period.

|

| |

●

|

Consolidated: Consolidated total revenues for the fourth quarter of 2023 were $181.9 million compared with $185.4 million for the comparable 2022 period. Operating loss for the fourth quarter of 2023 was $69.1 million compared with an operating loss of $55.3 million for the 2022 quarter. Net loss for the fourth quarter of 2023 was $65.5 million, or $0.09 per share, compared with a net loss of $85.2 million, or $0.11 per share, for the 2022 quarter. Net loss for the 2023 period included a mark-to-market adjustment of $3.2 million compared with $49.1 million in the 2022 period related to the decrease in the share price of GeneDx. In addition, OPKO reported an income tax benefit in the 2023 period of $6.0 million compared with $17.0 million in the 2022 period.

|

| |

●

|

Cash and cash equivalents: Cash and cash equivalents were $95.9 million as of December 31, 2023. Subsequent to the close of the fourth quarter, OPKO completed the sale of $230 million aggregate principal amount of 3.75% Convertible Senior Notes due 2029 and exchanged approximately $144.4 million of the Company’s outstanding 4.50% Convertible Senior Notes due 2025. The Company used approximately $50.0 million of the net proceeds to repurchase shares of the Company’s common stock from purchasers of the notes. Additionally, OPKO issued and sold approximately $71.1 million aggregate principal amount of its 3.75% Convertible Senior Notes due 2029 to several holders, including Company affiliates in exchange for the outstanding 5% Convertible Promissory Notes and accrued interest.

|

Conference Call and Webcast Information

OPKO’s senior management will provide a business update, discuss fourth quarter financial results, provide financial guidance and answer questions during a conference call and audio webcast today beginning at 4:30 p.m. Eastern time. Participants are encouraged to pre-register for the conference call using this link. Callers who pre-register will receive a unique PIN to gain immediate access to the call and bypass the live operator. Participants may register at any time, including up to and after the call start time. Those unable to pre-register can participate by dialing 833-630-0584 (U.S.) or 412-317-1815 (International). A webcast of the call can also be accessed at OPKO’s Investor Relations page and here.

A telephone replay will be available until March 5, 2024 by dialing 877-344-7529 (U.S.) or 412-317-0088 (International) and providing the passcode 6034226. A webcast replay will be available beginning approximately one hour after the completion of the live conference call here.

About OPKO Health

OPKO Health is a multinational biopharmaceutical and diagnostics company that seeks to establish industry-leading positions in large, rapidly growing markets by leveraging its discovery, development and commercialization expertise, and its novel and proprietary technologies. For more information, visit www.opko.com.

Cautionary Statement Regarding Forward Looking Statements

This press release contains "forward-looking statements," as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "plans," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning, including statements regarding expected financial performance and expectations regarding the market for and sales of our products, whether our products will launch in all the territories in which they have been approved for sale, the timing of such launches, our product development efforts and the expected benefits of our products, whether the relationship with our commercial and strategic partners will be successful, whether our commercial and strategic partners will be able to commercialize our products and successfully utilize our technologies, our ability to market and sell any of our products in development, whether we will continue to successfully advance products in our pipeline and whether they can be commercialized, our expectations about RAYALDEE, whether BioReference’s cost-cutting initiatives and attempts at returning to its core business will be successful, as well as other non-historical statements about our expectations, beliefs or intentions regarding our business, technologies and products, financial condition, strategies or prospects. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking statements. These factors include those described in our Annual Reports on Form 10-K filed and to be filed with the Securities and Exchange Commission and under the heading “Risk Factors” in our other filings with the Securities and Exchange Commission, as well as the continuation and success of our relationship with our commercial partners, liquidity issues and the risks inherent in funding, developing and obtaining regulatory approvals of new, commercially-viable and competitive products and treatments. In addition, forward-looking statements may also be adversely affected by general market factors, competitive product development, product availability, federal and state regulations and legislation, the regulatory process for new products and indications, manufacturing issues that may arise, patent positions and litigation, among other factors. The forward-looking statements contained in this press release speak only as of the date the statements were made, and we do not undertake any obligation to update forward-looking statements. We intend that all forward-looking statements be subject to the safe-harbor provisions of the PSLRA.

Contacts:

LHA Investor Relations

Yvonne Briggs, 310-691-7100

ybriggs@lhai.com

or

Bruce Voss, 310-691-7100

bvoss@lhai.com

—Tables to Follow—

OPKO Health, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(in millions)

Unaudited

| |

As of

|

| |

December 31,

2023

|

|

December 31,

2022

|

|

Assets:

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

$

|

95.9

|

|

|

$

|

153.2

|

|

|

Other current assets

|

|

213.6

|

|

|

|

241.3

|

|

|

Total current assets

|

|

309.5

|

|

|

|

394.5

|

|

|

In-process research and development and goodwill

|

|

793.3

|

|

|

|

790.9

|

|

|

Other assets

|

|

908.9

|

|

|

|

981.9

|

|

|

Total Assets

|

$

|

2,011.7

|

|

|

$

|

2,167.3

|

|

| |

|

|

|

|

|

|

|

|

Liabilities and Equity:

|

|

|

|

|

|

|

|

|

Accounts payable

|

$

|

69.7

|

|

|

$

|

67.0

|

|

|

Accrued expenses

|

|

90.1

|

|

|

|

98.3

|

|

|

Current portion of convertible notes

|

|

0.0

|

|

|

|

3.1

|

|

|

Other current liabilities

|

|

40.3

|

|

|

|

45.1

|

|

|

Total current liabilities

|

|

200.1

|

|

|

|

213.5

|

|

|

Long-term portion of convertible notes

|

|

214.3

|

|

|

|

210.4

|

|

|

Deferred tax liabilities, net

|

|

126.8

|

|

|

|

126.4

|

|

|

Other long-term liabilities, principally contract liabilities,

leases, contingent consideration, and lines of credit

|

|

81.3

|

|

|

|

55.4

|

|

|

Total Liabilities

|

|

622.5

|

|

|

|

605.7

|

|

|

Equity

|

|

1,389.2

|

|

|

|

1,561.6

|

|

|

Total Liabilities and Equity

|

$

|

2,011.7

|

|

|

$

|

2,167.3

|

|

OPKO Health, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(in millions, except share and per share data)

Unaudited

| |

For the three months ended

December 31,

|

|

For the twelve months ended

December 31,

|

| |

|

2023

|

|

|

|

2022

|

|

|

|

2023

|

|

|

|

2022

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue from services

|

$

|

124.2

|

|

|

$

|

139.4

|

|

|

$

|

515.3

|

|

|

$

|

755.6

|

|

|

Revenue from products

|

|

43.0

|

|

|

|

37.9

|

|

|

|

167.5

|

|

|

|

142.9

|

|

|

Revenue from transfer of intellectual property and other

|

|

14.7

|

|

|

|

8.1

|

|

|

|

180.7

|

|

|

|

105.7

|

|

|

Total revenues

|

|

181.9

|

|

|

|

185.4

|

|

|

|

863.5

|

|

|

|

1,004.2

|

|

|

Costs and expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of service revenues

|

|

112.4

|

|

|

|

106.4

|

|

|

|

445.8

|

|

|

|

627.6

|

|

|

Cost of product revenues

|

|

24.8

|

|

|

|

23.0

|

|

|

|

99.5

|

|

|

|

88.4

|

|

|

Selling, general, and administrative

|

|

72.9

|

|

|

|

74.0

|

|

|

|

300.6

|

|

|

|

372.7

|

|

|

Research and development

|

|

19.4

|

|

|

|

19.5

|

|

|

|

89.6

|

|

|

|

73.9

|

|

|

Contingent consideration

|

|

(0.0

|

)

|

|

|

(0.6

|

)

|

|

|

(1.0

|

)

|

|

|

(1.3

|

)

|

|

Amortization of intangible assets

|

|

21.5

|

|

|

|

21.6

|

|

|

|

86.0

|

|

|

|

87.8

|

|

|

Gain on sale of assets

|

|

0.0

|

|

|

|

(3.2

|

)

|

|

|

0.0

|

|

|

|

(18.6

|

)

|

|

Total costs and expenses

|

|

251.0

|

|

|

|

240.7

|

|

|

|

1,020.5

|

|

|

|

1,230.5

|

|

|

Operating loss

|

|

(69.1

|

)

|

|

|

(55.3

|

)

|

|

|

(157.0

|

)

|

|

|

(226.3

|

)

|

|

Other expense, net

|

|

(3.4

|

)

|

|

|

(46.9

|

)

|

|

|

(27.4

|

)

|

|

|

(165.2

|

)

|

|

Loss before income taxes and investment losses

|

|

(72.5

|

)

|

|

|

(102.2

|

)

|

|

|

(184.4

|

)

|

|

|

(391.5

|

)

|

|

Income tax benefit (provision)

|

|

6.0

|

|

|

|

17.0

|

|

|

|

(4.4

|

)

|

|

|

63.5

|

|

|

Loss before investment losses

|

|

(66.5

|

)

|

|

|

(85.2

|

)

|

|

|

(188.8

|

)

|

|

|

(328.0

|

)

|

|

Loss from investments in investees

|

|

(0.0

|

)

|

|

|

(0.0

|

)

|

|

|

(0.1

|

)

|

|

|

(0.4

|

)

|

|

Net loss

|

$

|

(65.5

|

)

|

|

$

|

(85.2

|

)

|

|

$

|

(188.9

|

)

|

|

$

|

(328.4

|

)

|

|

Loss per share,

basic and diluted

|

$

|

(0.09

|

)

|

|

$

|

(0.11

|

)

|

|

$

|

(0.25

|

)

|

|

$

|

(0.46

|

)

|

|

Weighted average common shares outstanding, basic and diluted

|

|

751,506,257

|

|

|

|

750,169,485

|

|

|

|

751,716,915

|

|

|

|

719,060,942

|

|

# # #

v3.24.0.1

Document And Entity Information

|

Feb. 27, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

OPKO Health, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 27, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-33528

|

| Entity, Tax Identification Number |

75-2402409

|

| Entity, Address, Address Line One |

4400 Biscayne Blvd.

|

| Entity, Address, City or Town |

Miami

|

| Entity, Address, State or Province |

FL

|

| Entity, Address, Postal Zip Code |

33137

|

| City Area Code |

305

|

| Local Phone Number |

575-4100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

OPK

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000944809

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

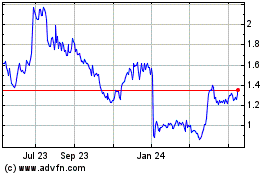

Opko Health (NASDAQ:OPK)

Historical Stock Chart

From Dec 2024 to Dec 2024

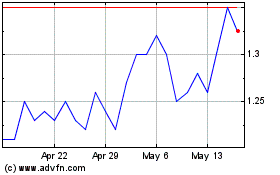

Opko Health (NASDAQ:OPK)

Historical Stock Chart

From Dec 2023 to Dec 2024