false000175848800-000000000017584882025-02-192025-02-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 19, 2025

OneSpaWorld Holdings Limited

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Commonwealth of The Bahamas |

|

001-38843 |

|

Not Applicable |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

Harry B. Sands, Lobosky Management Co. Ltd. Office Number 2 Pineapple Business Park Airport Industrial Park P.O. Box N-624 Nassau, Island of New Providence, Commonwealth of The Bahamas (Address of principal executive offices) |

Tel: (242) 322-2670

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

☐ |

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

☐ |

|

Pre-commencements communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Shares, par value (U.S.) |

|

OSW |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

Emerging Growth Company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On February 19, 2025, OneSpaWorld Holdings Limited (the “Company”) issued a press release announcing the Company’s financial results for the fourth quarter ended December 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

The information in this Item 2.02, including Exhibit 99.1, is intended to be furnished pursuant to Item 2.02 of Form 8-K, “Results of Operations and Financial Condition” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

OneSpaWorld Holdings Limited |

|

|

|

|

Date: February 19, 2025 |

By: |

|

/s/ Stephen B. Lazarus |

|

|

|

Stephen B. Lazarus |

|

|

|

Chief Financial Officer and Chief Operating Officer |

Exhibit 99.1

OneSpaWorld Reports Record Fourth Quarter and Fiscal Year 2024 Results

Total Revenues of $217.2 Million, Income from Operations of $17.2 Million and Adjusted EBITDA of $26.7 Million

Reaffirms Fiscal Year 2025 Guidance

Introduces First Quarter 2025 Guidance of $215 to $220 Million in Revenue and $25 to $27 Million in Adjusted EBITDA

Board Declares Quarterly Dividend of $0.04 Per Share

Nassau, Bahamas, February 19, 2025 – OneSpaWorld Holdings Limited (NASDAQ: OSW) (“OneSpaWorld,” or the “Company”), the pre-eminent global provider of health and wellness services and products onboard cruise ships and in destination resorts around the world, today announced its financial results for its fourth quarter and twelve months of fiscal 2024, ended December 31, 2024.

Leonard Fluxman, Executive Chairman, Chief Executive Officer and President, commented: “We delivered a strong finish to an excellent year with fiscal 2024 marking another record for Total revenues, Income from operations and Adjusted EBITDA. Our second consecutive year of record performance continues to evidence the combined power of our global operations, innovation across our business, outstanding team, and strong financial position; all focused on delivering extraordinary experiences for our health and wellness center guests and invaluable service to our cruise line and destination resort partners. I want to especially recognize our dedicated, passionate and enormously capable team whose steadfast commitment and contributions every day produced our robust results.”

Mr. Fluxman continued: “Our year was highlighted by Total revenues increasing 13% to $895.0 million, Income from operations increasing 44% to $78.1 million, and Adjusted EBITDA increasing 26% to $112.1 million, compared with our fiscal 2023 prior record levels. Our results reflect increases across all key operating metrics driven by increasing productivity as our team implemented our strategic growth, operating and guest experience initiatives across our business. We added seven new maritime health and wellness centers and entered into a seven-year agreement with Royal Caribbean International and Celebrity Cruises, extending our more than 30-year relationship. And, based on our strong competitive position, balance sheet and outlook, our board approved the initiation of a quarterly cash dividend and share repurchase program. We are equally proud to have published our inaugural Sustainability & Social Responsibility Report documenting our unwavering commitment to exemplary care for our employees, outstanding service to our cruise line and destination resorts partners and their guests, and responsible stewardship of the environment and the communities our Company impacts across the globe.”

“We begin fiscal 2025 strongly positioned and expect to deliver another year of record performance,” concluded Mr. Fluxman.

Stephen Lazarus, Chief Financial Officer and Chief Operating Officer, added, “we ended the year with total cash of $58.6 million and full availability of our $50 million revolving loan facility, giving us total liquidity of $108.6 million. The year saw us enhance our capital structure, reducing debt to $100 million and increasing our public float with the full exit of our private equity investor, Steiner Leisure Limited. We move forward with an efficient capital structure and strong cash flow generation that will enable us to invest in continuing to drive long-term growth, together with our dividend and share repurchase programs and debt paydown.”

Mr. Lazarus concluded, “with our strong 2024 performance and a positive outlook, we affirm our recently provided full fiscal year 2025 guidance, reflecting high-single digit Revenues and Adjusted EBITDA growth at the mid-points of our guidance ranges as compared to fiscal 2024 results.”

Fourth Quarter 2024 Highlights:

•Total revenues increased 11% to $217.2 million compared to $194.8 million for the fourth quarter of 2023;

•Income from operations increased 37% to $17.2 million compared to $12.6 million for the fourth quarter of 2023; and

•Adjusted EBITDA increased 14% to $26.7 million compared to $23.4 million for the fourth quarter of 2023.

Fiscal Year 2024 Highlights:

•Total revenues increased 13% to $895.0 million compared to $794.0 million for fiscal year 2023;

•Income from operations increased 44% to $78.1 million compared to $54.2 million for fiscal year 2023; and

•Adjusted EBITDA increased 26% to $112.1 million compared to $89.2 million for fiscal year 2023.

Operating Network Update:

|

|

|

|

|

• |

|

Cruise Ship Count: The Company ended the fourth quarter with health and wellness centers on 199 ships and an average ship count of 188 for the quarter, compared with 193 ships and an average ship count of 184 ships for the fourth quarter of 2023. |

|

• |

|

Destination Resort Count: The Company ended the fourth quarter with 50 destination resort health and wellness centers and an average destination resort count of 51 for the quarter, compared with 51 destination resort health and wellness centers and an average destination resort count of 51 for the fourth quarter of fiscal 2023. |

|

|

|

|

|

• |

|

Staff Count: The Company ended the fourth quarter with 4,352 personnel operating our cruise ship health and wellness centers, compared with 4,120 personnel on vessels at December 31, 2023. |

Liquidity Update:

|

|

|

|

|

• |

|

Cash at December 31, 2024 totaled $58.6 million after payment of dividends totaling $4.2 million in the quarter. Liquidity, including the Company’s fully undrawn $50 million credit facility, totaled $108.6 million at December 31, 2024. |

|

• |

|

The Company expects to generate positive Cash flow from operations for fiscal year 2025. |

The Company’s results are reported in this press release on a GAAP basis and on an as adjusted non-GAAP basis. A reconciliation of GAAP to non-GAAP financial information is provided at the end of this press release. This press release also refers to Adjusted EBITDA and Adjusted Net Income (non-GAAP financial measures), the terms for which definition and reconciliation are presented below.

Fourth Quarter Ended December 31, 2024 Compared to December 31, 2023

•Total revenues increased 11% to $217.2 million compared to $194.8 million for the fourth quarter of 2023. The increase in each of Service revenues and Product revenues were driven by fleet expansion which contributed $11.2 million, a 5% increase in our guest spend, which positively impacted revenue by $8.6 million, and $3.7 million of higher onboard penetration leading to more guests utilizing our cruise ship health and wellness centers. Contributing to the increased volume and spend was $3.5 million in increased pre-booked revenue on health and wellness centers included in our ship count as of December 31, 2024.

•Cost of services were $145.3 million compared to $131.8 million for the fourth quarter of 2023. The increase was primarily attributable to costs associated with increased Service revenues of $175.8 million in the quarter from our health and wellness centers at sea and on land, compared with Service revenues of $158.9 million in the fourth quarter of 2023.

•Cost of products were $35.0 million compared to $30.7 million in the fourth quarter of 2023. The increase was primarily attributable to costs associated with increased Product revenues of $41.4 million for the quarter from our health and wellness centers at sea and on land, compared to Product revenues of $35.9 million for the fourth quarter of 2023.

•Net income was $14.4 million, or Net income per diluted share of $0.14, as compared to Net loss of ($7.3) million or Net loss per diluted share of ($0.07) for the fourth quarter of 2023. The change was primarily attributable to a $10.8 million positive change in the fair value of warrant liabilities reflected in Other income (expense), a $7.2 million decrease in Interest expense, net and a $4.6 million increase in Income from operations. All warrants were exercised or cancelled in 2024 with zero expense incurred during the fourth quarter of 2024. The change in fair value of warrant liabilities was the result of the remeasurement to fair value of the warrants exercised during the fourth quarter of 2023, reflecting changes in market prices of our common stock and other observable inputs deriving the value of these financial instruments. The $7.2 million decrease in Interest expense, net, was primarily attributable to lower debt balances, offset by a one-time $5.4 million deleveraging fee incurred during the fourth quarter of 2023. The $4.6 million change in Income from operations primarily derived from the increase in the number of health and wellness centers onboard ships operating during the year and increased productivity of our Maritime health and wellness centers.

•Adjusted net income was $21.4 million, or Adjusted net income per diluted share of $0.20, as compared to Adjusted net income of $12.5 million, or Adjusted net income per diluted share of $0.12, for the fourth quarter of 2023.

•Adjusted EBITDA was $26.7 million compared to Adjusted EBITDA of $23.4 million in the fourth quarter of 2023.

Fiscal Year 2024 Ended December 31, 2024 Compared to December 31, 2023

•Total revenues increased 13% to $895.0 million compared to $794.0 million for the year ended December 31, 2023. The increase in each of Service revenues and Product revenues was driven by a 4% increase in our revenue days of the existing fleet, which positively impacted revenue by $39.3 million, a 4% increase in our guest spend, leading to a $32.4 million increase, and fleet expansion, which contributed $31.8 million. Contributing to the increased volume and spend was $20.3 million in increased pre-booked revenue on health and wellness centers included in our ship count as of December 31, 2024.

•Cost of services were $599.8 million compared to $541.4 million in the year ended December 31, 2023. The increase was primarily attributable to costs associated with increased Service revenues of $723.3 million for the year ended December 31, 2024, compared with Service revenues of $648.1 million for the year ended December 31, 2023.

•Cost of products were $145.8 million compared to $125.6 million for the year ended December 31, 2023. The increase was primarily attributable to costs associated with increased Product revenues of $171.7 million for the year ended December 31, 2024, compared to Product revenues of $146.0 million for the year ended December 31, 2023.

•Net income was $72.9 million, or Net income per diluted share of $0.69, as compared to Net loss of ($3.0) million or Net loss per diluted share of ($0.03) for the year ended December 31, 2023. The change was primarily attributable to a $45.2 million positive change in the fair value of warrant liabilities reflected in Other income (expense), a $12.2 million decrease in Interest expense, net and a $23.9 million increase in Income from operations. All warrants were exercised or cancelled in 2024. The change in fair

value of warrant liabilities was the result of the remeasurement to fair value of the warrants exercised during fiscal year 2023 reflecting changes in market prices of our common stock and other observable inputs deriving the value of these financial instruments. The $12.2 million decrease in Interest expense, net, was primarily due to lower debt balances, offset by a one-time $5.4 million deleveraging fee incurred during the fourth quarter of 2023. The $23.9 million change in Income from operations primarily derived from the increase in the number of health and wellness centers onboard ships operating during the year and increased productivity of our Maritime health and wellness centers.

•Adjusted net income was $89.7 million, or Adjusted net income per diluted share of $0.85, compared to Adjusted net income of $61.9 million, or Adjusted net income per diluted share of $0.63, in the year ended December 31, 2023.

•Adjusted EBITDA was $112.1 million compared to Adjusted EBITDA of $89.2 million for the year ended December 31, 2023.

Balance Sheet Highlights

•Cash at December 31, 2024, was $58.6 million, compared to $28.9 million at December 31, 2023.

•Total debt, net of deferred financing costs was $98.6 million at December 31, 2024, compared to $158.2 million at December 31, 2023. The $50 million revolving facility entered into during the third quarter of 2024 remained undrawn at December 31, 2024.

Fiscal Year 2025 Guidance

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2025 |

|

|

Year Ended December 31, 2025 |

Total Revenues |

|

$ |

215-220 million |

* |

$ |

950-970 million |

Adjusted EBITDA |

|

$ |

25-27 million |

|

$ |

115-125 million |

* The Company noted that due to the leap year in fiscal 2024, the first quarter of fiscal 2025 includes one less operating day versus the first quarter of fiscal 2024. In addition, the Company expects a higher number of dry docks for the first quarter of fiscal 2025 versus the first quarter of fiscal 2024. The combination of both factors is expected to negatively impact Total revenues for the first quarter of fiscal 2025 by approximately $4.3 million. In addition, the Company noted that it expects to open health and wellness centers on board nine new ship builds in fiscal 2025, the majority of which are expected to commence voyages in the fourth quarter of fiscal 2025.

Conference Call Details

A conference call to discuss the fourth quarter and twelve months of 2024 financial results is scheduled for Wednesday, February 19, 2025, at 10:00 a.m. Eastern Time. Investors and analysts interested in participating in the call are invited to dial 1-877-283-8977 (international callers please dial 1-412-542-4171) and provide the passcode 10196413 approximately 10 minutes prior to the start of the call. A live audio webcast of the conference call will be available online at https://onespaworld.com/investor-relations. A replay of the call will be available by dialing 844-512-2921 (international callers please dial 412-317-6671) and entering the passcode 10196413. The conference call replay will be available from 2:00 p.m. Eastern Time on Wednesday, February 19, 2025 until 11:59 p.m. Eastern Time on Wednesday, February 26, 2025. The Webcast replay will remain available for 90 days.

About OneSpaWorld

Headquartered in Nassau, Bahamas, OneSpaWorld is one of the largest health and wellness services companies in the world. OneSpaWorld’s distinguished health and wellness centers offer guests a comprehensive suite of premium health, wellness, fitness and beauty services, treatments, and products, currently onboard 199 cruise ships and at 50 destination resorts around the world. OneSpaWorld holds the leading market position within the cruise industry segment of the international leisure market, which it has earned over six decades upon its exceptional service; expansive global recruitment, training and logistics platforms; irreplicable operating infrastructure; powerful team; and product innovation, delivering tens of millions of extraordinary guest experiences and outstanding service to its cruise line and destination resort partners.

On March 19, 2019, OneSpaWorld completed a series of mergers pursuant to which OSW Predecessor, comprised of direct and indirect subsidiaries of Steiner Leisure Ltd., and Haymaker Acquisition Corp. (“Haymaker”), a special purpose acquisition company, each became indirect wholly owned subsidiaries of OneSpaWorld (the “Business Combination”). Haymaker is the acquirer and OSW Predecessor the predecessor, whose historical results have become the historical results of OneSpaWorld.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. The expectations, estimates, and projections of the Company may differ from its actual results and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” or the negative or other variations thereof and similar expressions are intended to identify such forward looking statements. These forward-looking statements

include, without limitation, expectations with respect to future performance of the Company, including projected financial information (which is not audited or reviewed by the Company’s auditors), and the future plans, operations and opportunities for the Company and other statements that are not historical facts. These statements are based on the current expectations of the Company’s management and are not predictions of actual performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Factors that may cause such differences include, but are not limited to: the impact of outbreaks of illnesses on our business, operations, results of operations and financial condition, including liquidity for the foreseeable future; the demand for the Company’s services together with the possibility that the Company may be adversely affected by other economic, business, and/or competitive factors or changes in the business environment in which the Company operates; changes in consumer preferences or the market for the Company’s services; changes in applicable laws or regulations; the availability or competition for opportunities for expansion of the Company’s business; difficulties of managing growth profitably; the loss of one or more members of the Company’s management team; loss of a major customer and other risks and uncertainties included from time to time in the Company’s reports (including all amendments to those reports) filed with the SEC. The Company cautions that the foregoing list of factors is not exclusive. You should not place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based, except as required by law. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this communication.

Non-GAAP Financial Measures

We refer to certain financial measures that are not recognized under U.S. generally accepted accounting principles (“GAAP”). Please see “Note Regarding Non-GAAP Financial Information” and “Reconciliation of GAAP to Non-GAAP Financial Information” below for additional information and a reconciliation of the non-GAAP financial measures to the most comparable GAAP financial measures.

ONESPAWORLD HOLDINGS LIMITED AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

|

|

|

$ |

|

% |

|

|

|

|

|

$ |

|

% |

|

|

2024 |

|

2023 |

|

Inc/(Dec) |

|

Inc/(Dec) |

|

2024 |

|

2023 (1) |

|

Inc/(Dec) |

|

Inc/(Dec) |

|

REVENUES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service revenues |

$ |

175,811 |

|

$ |

158,887 |

|

$ |

16,924 |

|

|

11 |

% |

$ |

723,273 |

|

$ |

648,091 |

|

$ |

75,182 |

|

|

12 |

% |

Product revenues |

|

41,395 |

|

|

35,919 |

|

|

5,476 |

|

|

15 |

% |

|

171,746 |

|

|

145,954 |

|

|

25,792 |

|

|

18 |

% |

Total revenues |

|

217,206 |

|

|

194,806 |

|

|

22,400 |

|

|

11 |

% |

|

895,019 |

|

|

794,045 |

|

|

100,974 |

|

|

13 |

% |

COST OF REVENUES AND OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of services |

|

145,332 |

|

|

131,708 |

|

|

13,624 |

|

|

10 |

% |

|

599,756 |

|

|

541,356 |

|

|

58,400 |

|

|

11 |

% |

Cost of products |

|

34,984 |

|

|

30,700 |

|

|

4,284 |

|

|

14 |

% |

|

145,799 |

|

|

125,649 |

|

|

20,150 |

|

|

16 |

% |

Administrative |

|

5,416 |

|

|

4,349 |

|

|

1,067 |

|

|

25 |

% |

|

18,451 |

|

|

17,111 |

|

|

1,340 |

|

|

8 |

% |

Salary, benefits and payroll taxes |

|

9,351 |

|

|

9,097 |

|

|

254 |

|

|

3 |

% |

|

35,630 |

|

|

36,805 |

|

|

(1,175 |

) |

|

(3 |

)% |

Amortization of intangible assets |

|

4,516 |

|

|

4,205 |

|

|

311 |

|

|

7 |

% |

|

16,947 |

|

|

16,823 |

|

|

124 |

|

|

1 |

% |

Long-lived assets impairment |

|

376 |

|

|

2,129 |

|

|

(1,753 |

) |

|

(82 |

)% |

|

376 |

|

|

2,129 |

|

|

(1,753 |

) |

|

(82 |

)% |

Total cost of revenues and operating expenses |

|

199,975 |

|

|

182,188 |

|

|

17,787 |

|

|

10 |

% |

|

816,959 |

|

|

739,873 |

|

|

77,086 |

|

|

10 |

% |

Income from operations |

|

17,231 |

|

|

12,618 |

|

|

4,613 |

|

|

37 |

% |

|

78,060 |

|

|

54,172 |

|

|

23,888 |

|

|

44 |

% |

OTHER (EXPENSE) INCOME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

(1,209 |

) |

|

(8,427 |

) |

|

7,218 |

|

|

86 |

% |

|

(8,881 |

) |

|

(21,115 |

) |

|

12,234 |

|

|

58 |

% |

Change in fair value of warrant liabilities |

|

— |

|

|

(10,821 |

) |

|

10,821 |

|

|

100 |

% |

|

7,677 |

|

|

(37,557 |

) |

|

45,234 |

|

|

120 |

% |

Total other (expense) income, net |

|

(1,209 |

) |

|

(19,248 |

) |

|

18,039 |

|

|

94 |

% |

|

(1,204 |

) |

|

(58,672 |

) |

|

57,468 |

|

|

98 |

% |

Income (loss) before income tax expense |

|

16,022 |

|

|

(6,630 |

) |

|

22,652 |

|

|

342 |

% |

|

76,856 |

|

|

(4,500 |

) |

|

81,356 |

|

|

1808 |

% |

INCOME TAX EXPENSE (BENEFIT) |

|

1,634 |

|

|

674 |

|

|

960 |

|

|

142 |

% |

|

3,992 |

|

|

(1,526 |

) |

|

5,518 |

|

|

362 |

% |

NET INCOME (LOSS) |

$ |

14,388 |

|

$ |

(7,304 |

) |

$ |

21,692 |

|

|

297 |

% |

$ |

72,864 |

|

$ |

(2,974 |

) |

$ |

75,838 |

|

|

2550 |

% |

NET INCOME (LOSS) PER SHARE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.14 |

|

$ |

(0.07 |

) |

|

|

|

|

$ |

0.70 |

|

$ |

(0.03 |

) |

|

|

|

|

Diluted |

$ |

0.14 |

|

$ |

(0.07 |

) |

|

|

|

|

$ |

0.69 |

|

$ |

(0.03 |

) |

|

|

|

|

WEIGHTED-AVERAGE SHARES OUTSTANDING: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

104,627 |

|

|

100,232 |

|

|

|

|

|

|

104,024 |

|

|

97,826 |

|

|

|

|

|

Diluted |

|

105,478 |

|

|

100,232 |

|

|

|

|

|

|

104,940 |

|

|

97,826 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Selected Statistics |

|

|

|

|

|

|

|

|

|

|

|

|

Period End Ship Count |

|

|

199 |

|

|

|

193 |

|

|

|

199 |

|

|

|

193 |

|

Average Ship Count (1) |

|

|

188 |

|

|

|

184 |

|

|

|

190 |

|

|

|

180 |

|

Average Weekly Revenues Per Ship |

|

$ |

83,913 |

|

|

$ |

75,903 |

|

|

$ |

86,213 |

|

|

$ |

80,013 |

|

Average Revenues Per Shipboard Staff Per Day |

|

$ |

550 |

|

|

$ |

520 |

|

|

$ |

572 |

|

|

$ |

555 |

|

Revenue Days (2) |

|

|

17,307 |

|

|

|

16,959 |

|

|

|

69,365 |

|

|

|

65,670 |

|

Period End Resort Count |

|

|

50 |

|

|

|

51 |

|

|

|

50 |

|

|

|

51 |

|

Average Resort Count (3) |

|

|

51 |

|

|

|

51 |

|

|

|

52 |

|

|

|

50 |

|

Average Weekly Revenues Per Resort |

|

$ |

13,219 |

|

|

$ |

15,165 |

|

|

$ |

13,962 |

|

|

$ |

15,242 |

|

Capital Expenditures (in thousands) |

|

$ |

3,310 |

|

|

$ |

2,544 |

|

|

$ |

6,743 |

|

|

$ |

5,415 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Forecasted |

|

|

|

Q1 2025 |

|

|

FY 2025 |

|

Period End Ship Count |

|

|

|

199 |

|

|

|

|

207 |

|

Average Ship Count (1) |

|

|

|

193 |

|

|

|

|

195 |

|

Period End Resort Count |

|

|

|

50 |

|

|

|

|

50 |

|

Average Resort Count (2) |

|

|

|

49 |

|

|

|

|

50 |

|

|

|

(1) |

Average Ship Count reflects the fact that during the period ships were in and out of service and is calculated by adding the total number of days that each of the ships generated revenue during the period, divided by the number of calendar days during the period. |

|

|

(2) |

Revenue Days reflects a day on which the health and wellness centers are open onboard a revenue generating cruise with passengers. |

|

|

(3) |

Average Resort Count reflects the fact that during the period destination resort health and wellness centers were in and out of service and is calculated by adding the total number of days that each destination resort health and wellness center generated revenue during the period, divided by the number of calendar days during the period. |

Note Regarding Non-GAAP Financial Information

This press release includes financial measures that are not calculated in accordance with GAAP, including Adjusted net income (loss), Adjusted net income (loss) per diluted share and Adjusted EBITDA.

We define Adjusted net income as Net income (loss), adjusted for items, including Change in fair value of warrant liabilities: increase in Depreciation and amortization resulting from the Business Combination; Long-lived assets impairment; and Stock-based compensation. Adjusted net income per diluted share is defined as Adjusted net income divided by Diluted weighted average shares outstanding during the period, as if such shares had been outstanding during the entire three and twelve month periods ended December 31, 2024 and 2023.

We define Adjusted EBITDA as Net income (loss) adjusted for items, including Income tax expense (benefit); Interest expense, net; Change in fair value of warrant liabilities; Depreciation and amortization; Long-lived assets impairment; Stock-based compensation; and Business combination costs as set forth below.

We believe that these non-GAAP measures, when reviewed in conjunction with GAAP financial measures, and not in isolation or as substitutes for analysis of our results of operations under GAAP, are useful to investors as they are widely used measures of performance and the adjustments we make to these non-GAAP measures provide investors further insight into our profitability and additional perspectives in comparing our performance to other companies and in comparing our performance over time on a consistent basis. Adjusted net income (loss), Adjusted net income (loss) per diluted share and Adjusted EBITDA have limitations as profitability measures in that they do not include total amounts for interest expense on our debt and provision for income taxes, and the effect of our expenditures for capital assets and certain intangible assets. In addition, all of these non-GAAP measures have limitations as profitability measures in that they do not include the effect of non-cash stock-based compensation expense and the impact of certain expenses related to items that are settled in cash. Because of these limitations, the Company relies primarily on its GAAP results.

In the future, we may incur expenses similar to those for which adjustments are made in calculating Adjusted EBITDA. Our presentation of Adjusted EBITDA should not be construed as a basis to infer that our future results will be unaffected by extraordinary, unusual, or nonrecurring items.

Reconciliation of GAAP to Non-GAAP Financial Information

The following table reconciles Net income (loss) to Adjusted net income (loss) for the fourth quarters and year-to-date periods ended December 31, 2024 and 2023 and Adjusted net income (loss) per diluted share for the fourth quarters and year-to-date periods ended December 31, 2024 and 2023 (amounts in thousands, except per share amounts):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net income (loss) |

|

$ |

14,388 |

|

|

$ |

(7,304 |

) |

|

$ |

72,864 |

|

|

$ |

(2,974 |

) |

Change in fair value of warrant liabilities |

|

|

— |

|

|

|

10,821 |

|

|

|

(7,677 |

) |

|

|

37,557 |

|

Depreciation and amortization (a) |

|

|

3,761 |

|

|

|

3,761 |

|

|

|

15,044 |

|

|

|

15,044 |

|

Long-lived assets impairment |

|

|

376 |

|

|

|

2,129 |

|

|

|

376 |

|

|

|

2,129 |

|

Stock-based compensation |

|

|

2,907 |

|

|

|

3,093 |

|

|

|

9,071 |

|

|

|

10,138 |

|

Adjusted net income |

|

$ |

21,432 |

|

|

$ |

12,500 |

|

|

$ |

89,678 |

|

|

$ |

61,894 |

|

Adjusted net income per diluted share |

|

$ |

0.20 |

|

|

$ |

0.12 |

|

|

$ |

0.85 |

|

|

$ |

0.63 |

|

Diluted weighted average shares outstanding |

|

|

105,478 |

|

|

|

100,232 |

|

|

|

104,940 |

|

|

|

97,826 |

|

(a) Depreciation and amortization refers to addback of purchase price adjustments to tangible and intangible assets resulting from the Business Combination.

The following table reconciles Net (loss) income to Adjusted EBITDA for the fourth quarter and year-to-date periods ended December 31, 2024 and 2023 (amounts in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net income (loss) |

|

$ |

14,388 |

|

|

$ |

(7,304 |

) |

|

$ |

72,864 |

|

|

$ |

(2,974 |

) |

Income tax expense (benefit) |

|

|

1,634 |

|

|

|

674 |

|

|

|

3,992 |

|

|

|

(1,526 |

) |

Interest expense, net |

|

|

1,209 |

|

|

|

8,427 |

|

|

|

8,881 |

|

|

|

21,115 |

|

Change in fair value of warrant liabilities |

|

|

— |

|

|

|

10,821 |

|

|

|

(7,677 |

) |

|

|

37,557 |

|

Depreciation and amortization |

|

|

6,186 |

|

|

|

5,542 |

|

|

|

24,276 |

|

|

|

22,040 |

|

Long-lived assets impairment |

|

|

376 |

|

|

|

2,129 |

|

|

|

376 |

|

|

|

2,129 |

|

Stock-based compensation |

|

|

2,907 |

|

|

|

3,093 |

|

|

|

9,071 |

|

|

|

10,138 |

|

Business combination costs (b) |

|

|

— |

|

|

|

— |

|

|

|

293 |

|

|

|

713 |

|

Adjusted EBITDA |

|

$ |

26,700 |

|

|

$ |

23,382 |

|

|

$ |

112,076 |

|

|

$ |

89,192 |

|

(b) Business combination costs refers to legal and advisory fees incurred by OneSpaWorld in connection with the secondary offering and warrant conversion.

Contact:

ICR:

Investors:

Allison Malkin, 203-682-8225

allison.malkin@icrinc.com

Follow OneSpaWorld:

Instagram: @onespaworld

LinkedIn: OneSpaWorld

Facebook: @onespaworld

v3.25.0.1

Document and Entity Information

|

Feb. 19, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 19, 2025

|

| Entity Registrant Name |

OneSpaWorld Holdings Limited

|

| Entity Central Index Key |

0001758488

|

| Entity Incorporation, State or Country Code |

C5

|

| Entity Tax Identification Number |

00-0000000

|

| Entity File Number |

001-38843

|

| Contact Personnel Name |

Harry B. Sands, Lobosky Management Co. Ltd.

|

| Entity Address, Address Line One |

Office Number 2

|

| Entity Address, Address Line Two |

Pineapple Business Park

|

| Entity Address, Address Line Three |

Airport Industrial Park

|

| Entity Address, City or Town |

Nassau

|

| Entity Address, Country |

BS

|

| Entity Address, Postal Zip Code |

P.O. Box N-624

|

| City Area Code |

242

|

| Local Phone Number |

322-2670

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares, par value (U.S.)$0.0001 per share

|

| Trading Symbol |

OSW

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

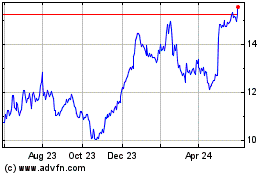

OneSpaWorld (NASDAQ:OSW)

Historical Stock Chart

From Jan 2025 to Feb 2025

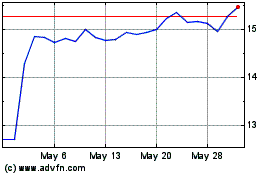

OneSpaWorld (NASDAQ:OSW)

Historical Stock Chart

From Feb 2024 to Feb 2025