Revenue increased 26% year-over-year to $362.1

million

Third quarter results were affected by lower

risk adjustments, higher medical expenses in the current year, and

retroactive adjustments

Executing key 2025 initiatives with a focus on

improvements in profitability metrics

Management to Host Conference Call and Webcast

November 12, 2024 at 4:30 PM ET

P3 Health Partners Inc. (“P3” or the “Company”) (NASDAQ: PIII),

a patient-centered and physician-led population health management

company, today announced its financial results for the third

quarter ended September 30, 2024.

“As we execute on our strategic initiatives, we believe P3 will

be well-positioned to unlock the value built within our platform

and generate sustainable, profitable growth in the medium and long

term,” said Aric Coffman, CEO of P3. “We have identified more than

$130 million of potential improvement opportunities, and while

near-term dynamics have negatively affected our financial results,

demand for our platform has never been stronger as we continue to

deliver value to patients, payors and our PCP partners. Our

business model is fundamentally strong, as shown by our member and

top-line growth, quality outcomes, and provider retention.”

Third Quarter 2024 Financial Results

- Total revenue was $362.1 million, an increase of 26% compared

to $288.4 million in the third quarter of the prior year

- Capitated revenue was $357.7 million, an increase of 25%

compared to $285.2 million in the third quarter of the prior

year

- Gross profit was a loss of $39.8 million, as compared to gross

profit of $9.1 million in the prior year. Gross profit PMPM was a

loss of $103, compared to $29 PMPM in the prior year

- Medical margin(1) was $0.5 million compared to $36.2 million in

the prior year. Medical margin PMPM(1) was $1, compared to a

medical margin PMPM of $115 in the prior year

- Net loss was $102.9 million compared to a net loss of $37.3

million in the third quarter of the prior year. Net loss PMPM was

$267 compared to a net loss PMPM of $119 in the prior year

- Adjusted EBITDA loss(1) was $71.0 million compared to $22.3

million in the third quarter of the prior year. Adjusted EBITDA

loss PMPM(1) was $184, compared to Adjusted EBITDA loss PMPM of $71

in the third quarter of the prior year

- In light of a lower-than-expected 2024 risk adjustment,

continued elevated medical cost pressures, and retroactive

adjustments, the Company is withdrawing its previous guidance for

fiscal year ending December 31, 2024, provided on its second

quarter 2024 earnings call on August 7, 2024, and investors should

no longer rely on it.

(1) Adjusted EBITDA, Adjusted EBITDA per

member, per month (“PMPM”), medical margin, and medical margin PMPM

are non-GAAP financial measures. For reconciliations of these

measures to the most directly comparable GAAP measures, if

applicable, and more information regarding the Company’s use of

non-GAAP financial measures, please see the section titled

“Non-GAAP Financial Measures.”

(2) See “Key Performance Metrics” for

additional information on how the Company defines “at-risk

members.”

Management to Host Conference Call and Webcast on November

12, 2024 at 4:30 PM ET

Title & Webcast

P3 Health Third Quarter Earnings

Conference Call

Date & Time

November 12, 2024, 4:30pm Eastern Time

Conference Call Details

Toll-Free 1-833-316-0546 (US)

International 1-412-317-0692 Ask to be joined into the P3 Health

Partners call

The conference call will also be webcast

live in the "Events & Presentations" section of the Investor

page of the P3 website (ir.p3hp.org). The Company’s press release

will be available at ir.p3hp.org website in advance of the

conference call. An archived recording of the webcast will be

available at ir.p3hp.org for a period of 90 days following the

conference call.

About P3 Health Partners (NASDAQ: PIII):

P3 Health Partners Inc. is a leading population health

management company committed to transforming healthcare by

improving the lives of both patients and providers. Founded and led

by physicians, P3 has an expansive network of more than 3,100

affiliated primary care providers across the country. Our local

teams of health care professionals manage the care of thousands of

patients in 27 counties across five states. P3 supports primary

care providers with value-based care coordination and

administrative services that improve patient outcomes and lower

costs. Through partnerships with these local providers, the P3 care

team creates an enhanced patient experience by navigating,

coordinating, and integrating the patient’s care within the

healthcare system. For more information, visit www.p3hp.org and

follow us on @p3healthpartners and

Facebook.com/p3healthpartners.

Non-GAAP Financial Measures

In addition to the financial results prepared in accordance with

accounting principles generally accepted in the U.S. ("GAAP"), this

press release contains certain non-GAAP financial measures as

defined by the SEC rules, including Adjusted EBITDA and Adjusted

EBITDA PMPM, medical margin, and medical margin PMPM. EBITDA is

defined as GAAP net income (loss) before (i) interest, (ii) income

taxes and (iii) depreciation and amortization. Adjusted EBITDA is

defined as EBITDA, further adjusted to exclude the effect of

certain supplemental adjustments, such as (i) mark-to-market

warrant gain/loss, (ii) premium deficiency reserves, (iii)

equity-based compensation expense, (iv) certain transaction and

other related costs and (v) certain other items that we believe are

not indicative of our core operating performances. Adjusted EBITDA

PMPM is defined as Adjusted EBITDA divided by the number of at-risk

Medicare members each month divided by the number of months in the

period. We believe these non‐GAAP financial measures provide an

additional tool for investors to use in evaluating ongoing

operating results and trends and in comparing our financial

measures with other similar companies. Medical margin represents

the amount earned from capitation revenue after medical claims

expenses are deducted and medical margin PMPM is defined as medical

margin divided by the number of Medicare members each month divided

by the number of months in the period.

Medical claims expenses represent costs incurred for medical

services provided to our members. As our platform grows and matures

over time, we expect medical margin to increase in absolute

dollars; however, medical margin PMPM may vary as the percentage of

new members brought onto our platform fluctuates. New membership

added to the platform is typically dilutive to medical margin PMPM.

We do not consider these non‐GAAP measures in isolation or as an

alternative to financial measures determined in accordance with

GAAP. These non-GAAP financial measures are subject to inherent

limitations as they reflect the exercise of judgments by management

about which expense and income are excluded or included in

determining these non‐GAAP financial measures. In addition, other

companies may calculate non-GAAP financial measures differently or

may use other measures to evaluate their performance, all of which

could reduce the usefulness of our non-GAAP financial measures as

tools for comparison. The tables at the end of this press release

present a reconciliation of Adjusted EBITDA to net income (loss)

and Adjusted EBITDA PMPM to net income (loss) PMPM, medical margin

to gross profit, and medical margin PMPM to gross profit PMPM,

which are the most directly comparable financial measures

calculated in accordance with GAAP.

Key Performance Metrics

In addition to our GAAP and non-GAAP financial information, the

Company also monitors “at-risk members” to help us evaluate our

business, identify trends affecting our business, formulate

business plans and make strategic decisions. At-risk membership

represents the approximate number of Medicare members for whom we

receive a fixed percentage of premium under capitation arrangements

as of the end of a particular period.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. We intend such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in Section 27A

of the Securities Act of 1933, as amended, Section 21E of the

Securities Exchange Act of 1934, as amended. Words such as

"anticipate," "believe," "budget," "contemplate," "continue,"

"could," "envision," "estimate," "expect," "guidance," "indicate,"

"intend," "may," "might," "plan," "possibly," "potential,"

"predict," "probably," "pro-forma," "project," "seek," "should,"

"target," or "will," or the negative or other variations thereof,

and similar words or phrases or comparable terminology, are

intended to identify forward-looking statements. These

forward-looking statements address various matters, including the

Company’s future expected growth strategy and operating

performance; and the Company’s ability to execute on its identified

strategic improvement opportunities, all of which reflect the

Company’s expectations based upon currently available information

and data. Because such statements are based on expectations as to

future financial and operating results and are not statements of

fact, actual results may differ materially from those projected or

estimated and you are cautioned not to place undue reliance on

these forward-looking statements. These forward-looking statements

are not guarantees of future performance, conditions or results,

and involve a number of known and unknown risks, uncertainties,

assumptions and other important factors, many of which are outside

the Company's control, that could cause actual results or outcomes

to differ materially from those discussed in the forward-looking

statements.

Important risks and uncertainties that could cause our actual

results and financial condition to differ materially from those

indicated in forward-looking statements include, among others, our

ability to continue as a going concern; our potential need to raise

additional capital to fund our existing operations or develop and

commercialize new services or expand our operations; our ability to

achieve or maintain profitability; our ability to maintain

compliance with our debt covenants in the future, or obtain

required waivers from our lenders if future operating performance

were to fall below current projections, and if there are material

changes to management’s assumptions, we could be required to

recognize non-cash charges to operating earnings for goodwill

and/or other intangible asset impairment; our ability to identify

and develop successful new geographies, physician partners, payors

and patients; changes in market or industry conditions, regulatory

environment, competitive conditions, and receptivity to our

services; our ability to fund our growth and expand our operations;

changes in laws and regulations applicable to our business; our

ability to maintain our relationships with health plans and other

key payors; the impact of fluctuations in risk adjustments; our

ability to establish and maintain effective internal controls and

the impact of material weaknesses we have identified; our ability

to maintain the listing of our securities on Nasdaq; increased

labor costs and medical expense; our ability to recruit and retain

qualified team members and independent physicians; and the factors

described under Part I, Item 1A. “Risk Factors” and Part II, Item

7. “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in our Annual Report on Form 10-K for the

year ended December 31, 2023, filed with the SEC on March 28, 2024,

and in our subsequent filings with the SEC.

All information in this press release is as of the date hereof,

and we undertake no duty to update or revise this information

unless required by law. You are cautioned not to place undue

reliance on any forward-looking statements contained in this press

release.

P3 HEALTH PARTNERS INC. and

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except per

share amounts)

(unaudited)

September 30, 2024

December 31, 2023

ASSETS

CURRENT ASSETS:

Cash

$

62,962

$

36,320

Restricted cash

5,136

4,614

Health plan receivable, net of allowance

for credit losses of $150

123,325

118,497

Clinic fees, insurance and other

receivable

2,495

2,973

Prepaid expenses and other current

assets

11,032

3,613

Assets held for sale

10,123

—

TOTAL CURRENT ASSETS

215,073

166,017

Property and equipment, net

6,315

8,686

Intangible assets, net

594,865

666,733

Other long-term assets

17,080

19,531

TOTAL ASSETS (1)

$

833,333

$

860,967

LIABILITIES,

MEZZANINE EQUITY, AND STOCKHOLDERS’ EQUITY

CURRENT LIABILITIES:

Accounts payable

$

13,468

$

8,663

Accrued expenses and other current

liabilities

49,205

36,884

Accrued payroll

4,409

3,506

Health plan settlements payable

41,169

34,992

Claims payable

230,736

178,009

Premium deficiency reserve

29,441

13,670

Accrued interest

35,929

23,648

Short-term debt

208

—

Liabilities held for sale

753

—

TOTAL CURRENT LIABILITIES

405,318

299,372

Operating lease liability

11,158

13,622

Warrant liabilities

19,718

1,085

Contingent consideration

—

4,907

Long-term debt, net

133,228

108,319

TOTAL LIABILITIES (1)

569,422

427,305

COMMITMENTS AND CONTINGENCIES

MEZZANINE EQUITY:

Redeemable non-controlling interest

143,397

291,532

STOCKHOLDERS’ EQUITY:

Class A common stock, $0.0001 par value;

800,000 shares authorized; 161,972 and 116,588 shares issued and

outstanding as of September 30, 2024 and December 31, 2023,

respectively

16

12

Class V common stock, $0.0001 par value;

205,000 shares authorized; 195,957 and 196,569 shares issued and

outstanding as of September 30, 2024 and December 31, 2023,

respectively

20

20

Additional paid in capital

565,054

509,442

Accumulated deficit

(444,576

)

(367,344

)

TOTAL STOCKHOLDERS’ EQUITY

120,514

142,130

TOTAL LIABILITIES, MEZZANINE EQUITY, AND

STOCKHOLDERS’ EQUITY

$

833,333

$

860,967

____________________

(1)

The Company’s condensed consolidated

balance sheets include the assets and liabilities of its

consolidated variable interest entities (“VIEs”). As discussed in

Note 13 “Variable Interest Entities,” P3 LLC is itself a VIE. P3

LLC represents substantially all the assets and liabilities of the

Company. As a result, the language and amounts below refer only to

VIEs held at the P3 LLC level. The condensed consolidated balance

sheets include total assets that can be used only to settle

obligations of P3 LLC’s consolidated VIEs totaling $13.0 million

and $8.6 million as of September 30, 2024 and December 31, 2023,

respectively, and total liabilities of P3 LLC’s consolidated VIEs

for which creditors do not have recourse to the general credit of

the Company totaled $15.8 million and $13.6 million as of September

30, 2024 and December 31, 2023, respectively. These VIE assets and

liabilities do not include $46.9 million and $44.2 million of net

amounts due to affiliates as of September 30, 2024 and December 31,

2023, respectively, as these are eliminated in consolidation and

not presented within the condensed consolidated balance sheets.

P3 HEALTH PARTNERS INC. and

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share amounts)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

OPERATING REVENUE:

Capitated revenue

$

357,706

$

285,153

$

1,116,146

$

909,473

Other patient service revenue

4,418

3,198

13,623

10,041

TOTAL OPERATING REVENUE

362,124

288,351

1,129,769

919,514

OPERATING EXPENSE:

Medical expense

401,920

279,220

1,149,148

867,061

Premium deficiency reserve

18,168

(12,489

)

15,771

(9,361

)

Corporate, general and administrative

expense

27,219

33,065

81,230

97,931

Sales and marketing expense

134

654

870

2,512

Depreciation and amortization

21,673

21,721

64,905

65,041

TOTAL OPERATING EXPENSE

469,114

322,171

1,311,924

1,023,184

OPERATING LOSS

(106,990

)

(33,820

)

(182,155

)

(103,670

)

OTHER INCOME (EXPENSE):

Interest expense, net

(5,647

)

(4,002

)

(15,339

)

(11,939

)

Mark-to-market of stock warrants

5,737

755

14,626

(327

)

Other

445

190

1,073

(455

)

TOTAL OTHER INCOME (EXPENSE)

535

(3,057

)

360

(12,721

)

LOSS BEFORE INCOME TAXES

(106,455

)

(36,877

)

(181,795

)

(116,391

)

INCOME TAX BENEFIT (PROVISION)

3,605

(412

)

565

(928

)

NET LOSS

(102,850

)

(37,289

)

(181,230

)

(117,319

)

LESS: NET LOSS ATTRIBUTABLE TO REDEEMABLE

NON-CONTROLLING INTEREST

(56,338

)

(23,993

)

(103,998

)

(85,008

)

NET LOSS ATTRIBUTABLE TO CONTROLLING

INTEREST

$

(46,512

)

$

(13,296

)

$

(77,232

)

$

(32,311

)

NET LOSS PER SHARE (Note 9):

Basic

$

(0.29

)

$

(0.12

)

$

(0.55

)

$

(0.37

)

Diluted

$

(0.31

)

$

(0.12

)

$

(0.64

)

$

(0.41

)

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING

(Note 9):

Basic

161,890

114,198

139,292

88,010

Diluted

164,701

312,679

141,723

288,379

P3 HEALTH PARTNERS INC. and

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Nine Months Ended September

30,

2024

2023

CASH FLOWS FROM

OPERATING ACTIVITIES:

Net loss

$

(181,230

)

$

(117,319

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

64,905

65,041

Equity-based compensation

5,031

4,259

Amortization of original issue discount

and debt issuance costs

13

405

Accretion of contingent consideration

—

113

Gain on write off of contingent

consideration

(4,907

)

—

Mark-to-market adjustment of stock

warrants

(14,626

)

327

Premium deficiency reserve

15,771

(9,361

)

Changes in operating assets and

liabilities:

Health plan receivable

(4,828

)

(45,258

)

Clinic fees, insurance, and other

receivable

445

5,275

Prepaid expenses and other current

assets

(7,402

)

(429

)

Other long-term assets

(2

)

(1,214

)

Accounts payable, accrued expenses, and

other current liabilities

1,780

2,758

Accrued payroll

903

2,405

Health plan settlements payable

6,177

21,814

Claims payable

52,727

4,290

Accrued interest

12,281

7,092

Operating lease liability

72

(348

)

Net cash used in operating activities

(52,890

)

(60,150

)

CASH FLOWS FROM

INVESTING ACTIVITIES:

Purchases of property and equipment

—

(2,039

)

Purchase price received in advance of

asset sale

15,000

—

Net cash provided by (used in) investing

activities

15,000

(2,039

)

CASH FLOWS FROM

FINANCING ACTIVITIES:

Proceeds from long-term debt, net of

original issue discount

25,000

14,101

Payment of debt issuance costs

(100

)

(173

)

Proceeds from liability-classified

warrants and private placement offering, net of offering costs

paid

40,547

87,244

Proceeds from at-the-market sales, net of

offering costs paid

33

—

Deferred offering costs paid

(507

)

—

Payment of tax withholdings upon

settlement of restricted stock unit awards

(127

)

—

Repayment of short-term and long-term

debt

(1,663

)

—

Proceeds from short-term debt

1,871

—

Net cash provided by financing

activities

65,054

101,172

Net change in cash and restricted cash

27,164

38,983

Cash and restricted cash, beginning of

period

40,934

18,457

Cash and restricted cash, end of

period

$

68,098

$

57,440

RECONCILIATION OF NET LOSS TO

ADJUSTED EBITDA LOSS

(in thousands, except

PMPM)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net loss

$

(102,850

)

$

(37,289

)

$

(181,230

)

$

(117,319

)

Interest expense, net

5,647

4,002

15,339

11,939

Depreciation and amortization

21,673

21,721

64,905

65,041

Income tax (benefit) provision

(3,605

)

412

(565

)

928

Mark-to-market of stock warrants

(5,737

)

(755

)

(14,626

)

327

Premium deficiency reserve

18,168

(12,489

)

15,771

(9,361

)

Equity-based compensation

1,958

2,251

5,031

4,259

Other(1)

(6,254

)

(185

)

(4,242

)

2,868

Transaction and other related costs(2)

—

—

—

70

Adjusted EBITDA loss

$

(71,000

)

$

(22,332

)

$

(99,617

)

$

(41,248

)

Adjusted EBITDA loss PMPM

$

(184

)

$

(71

)

$

(87

)

$

(44

)

_____________________________________________

(1)

Other during the three and nine months

ended September 30, 2024 consisted of (i) interest income and (ii)

gain recognized upon the settlement and write-off of contingent

consideration related to an acquisition completed in a prior year

partially offset by (iii) severance and related expense in

connection with our chief executive officer transition and (iv)

valuation allowance on our notes receivable. Other during the three

and nine months ended September 30, 2023 consisted of (i) interest

income offset by (ii) cybersecurity incident loss with respect to

the nine months ended September 30, 2023, (iii) restructuring and

other charges, including severance and benefits paid to employees

pursuant to workforce reduction plans with respect to the nine

months ended September 30, 2023, (iv) the disposition of our

Pahrump operations, (v) expenses for third-party consultants to

assist us with the development, implementation, and documentation

of new and enhanced internal controls and processes for compliance

with Sarbanes-Oxley Section 404(b) with respect to the nine months

ended September 30, 2023, (vi) a legal settlement outside of the

ordinary course of business with respect to the nine months ended

September 30, 2023, and (vii) valuation allowance on our notes

receivable.

(2)

Transaction and other related costs during

the nine months ended September 30, 2023 consisted of legal fees

incurred related to acquisition-related litigation.

MEDICAL MARGIN

(in thousands, except

PMPM)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Capitated revenue

$

357,706

$

285,153

$

1,116,146

$

909,473

Less: medical claims expense

(357,166

)

(248,918

)

(1,037,965

)

(783,497

)

Medical margin

$

540

$

36,235

$

78,181

$

125,976

Medical margin PMPM

$

1

$

115

$

69

$

135

RECONCILIATION OF GROSS PROFIT

(LOSS) TO MEDICAL MARGIN

(in thousands)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Gross profit (loss)

$

(39,796

)

$

9,131

$

(19,379

)

$

52,453

Other patient service revenue

(4,418

)

(3,198

)

(13,623

)

(10,041

)

Other medical expense

44,754

30,302

111,183

83,564

Medical margin

$

540

$

36,235

$

78,181

$

125,976

RECONCILIATION OF TOTAL

OPERATING EXPENSE TO ADJUSTED OPERATING EXPENSE

(in thousands)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Total operating expense

$

469,114

$

322,171

$

1,311,924

$

1,023,184

Medical expense

(401,920

)

(279,220

)

(1,149,148

)

(867,061

)

Depreciation and amortization

(21,673

)

(21,721

)

(64,905

)

(65,041

)

Premium deficiency reserve

(18,168

)

12,489

(15,771

)

9,361

Equity-based compensation

(1,958

)

(2,251

)

(5,031

)

(4,259

)

Other

6,157

(7

)

3,564

(2,404

)

Transaction and other related costs

—

—

—

(70

)

Adjusted operating expense

$

31,552

$

31,461

$

80,633

$

93,710

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112304615/en/

Ryan Halsted Investor Relations Gilmartin Group ir@p3hp.org

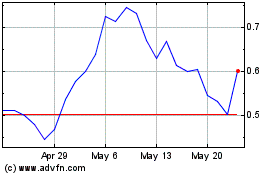

P3 Partners (NASDAQ:PIII)

Historical Stock Chart

From Feb 2025 to Mar 2025

P3 Partners (NASDAQ:PIII)

Historical Stock Chart

From Mar 2024 to Mar 2025