Company provides preliminary 2025 guidance

and advance notification of a proposed financing transaction to

provide a $30 million unsecured promissory note

P3 Health Partners Inc. (“P3” or the “Company”) (NASDAQ: PIII),

a patient-centered, physician-led population health management

company, is targeting profitability in 2025, with initial revenue

guidance for the year of $1.350 billion to $1.500 billion and

Adjusted EBITDA of negative ($35) million to $5 million.

“The execution of our previously announced $130+ million EBITDA

growth initiatives is going as planned, most of which have been

actioned and implemented. Given our progress, we are targeting to

be profitable in 2025. Additionally, we have highly supportive

shareholders and the contemplated financing will provide adequate

liquidity to fund expected working capital needs,” said Aric

Coffman, CEO of P3. "Our business model remains fundamentally

strong as we continue to drive value for our PCP partners, payors,

and patients. We intend to issue full 2025 guidance at the time

when we report our fourth quarter 2024 earnings results.”

The Company is currently engaged in discussions with its largest

shareholder for a proposed financing transaction to provide an

additional $30 million unsecured promissory note and warrants, on

terms that are expected to be similar to the financing transaction

completed in December 2024. Any financing transaction remains

subject to the approval of a committee of independent,

disinterested directors of the Company and the negotiation and

execution of definitive documentation.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy securities. Any securities offered

by the Company will not be and have not been registered under the

Securities Act of 1933 and may not be offered or sold in the United

States absent registration or an applicable exemption from

registration requirements.

Fiscal 2025 Guidance

Year Ended

December 31, 2025

Low

High

At-Risk Members(1)

108,000

118,000

Total Revenues (in millions)

$

1,350

$

1,500

Adjusted EBITDA(2) (in millions)

$

(35)

$

5

(1) See “Key Performance Metrics” for

additional information on how the Company defines “at-risk

members.”

(2) The Company is not able to provide a

quantitative reconciliation of guidance for Adjusted EBITDA (loss).

For more information regarding the non-GAAP financial measures

discussed in this press release, please see “Non-GAAP Financial

Measures” below.

The foregoing 2025 outlook statements represent management's

current estimate as of the date of this release. Actual results may

differ materially depending on a number of factors. Investors are

urged to read the “Cautionary Note Regarding Forward-Looking

Statements” included in this release. Management does not assume

any obligation to update these estimates.

About P3 Health Partners (NASDAQ: PIII):

P3 Health Partners Inc. is a leading population health

management company committed to transforming healthcare by

improving the lives of both patients and providers. Founded and led

by physicians, P3 has an expansive network of more than 3,100

affiliated primary care providers across the country. Our local

teams of health care professionals manage the care of thousands of

patients in 24 counties across four states. P3 supports primary

care providers with value-based care coordination and

administrative services that improve patient outcomes and lower

costs. Through partnerships with these local providers, the P3 care

team creates an enhanced patient experience by navigating,

coordinating, and integrating the patient’s care within the

healthcare system. For more information, visit www.p3hp.org and

follow us on LinkedIn and Facebook.

Non-GAAP Financial Measures

In addition to the financial results prepared in accordance with

accounting principles generally accepted in the U.S. ("GAAP"), this

press release contains certain non-GAAP financial measures as

defined by the SEC rules, including Adjusted EBITDA. EBITDA is

defined as GAAP net income (loss) before (I) interest, (ii) income

taxes and (iii) depreciation and amortization. Adjusted EBITDA is

defined as EBITDA, further adjusted to exclude the effect of

certain supplemental adjustments, such as (a) mark-to-market

warrant gain/loss, (ii) premium deficiency reserves, (iii)

equity-based compensation expense and (iv) certain other items that

we believe are not indicative of our core operating performance. We

believe these non‐GAAP financial measures provide an additional

tool for investors to use in evaluating ongoing operating results

and trends and in comparing our financial measures with other

similar companies. We do not consider these non‐GAAP measures in

isolation or as an alternative to financial measures determined in

accordance with GAAP. These non-GAAP financial measures are subject

to inherent limitations as they reflect the exercise of judgments

by management about which expense and income are excluded or

included in determining these non‐GAAP financial measures. In

addition, other companies may calculate non-GAAP financial measures

differently or may use other measures to evaluate their

performance, all of which could reduce the usefulness of our

non-GAAP financial measures as tools for comparison.

Key Performance Metrics

In addition to our GAAP and non-GAAP financial information, the

Company also monitors “at-risk members” to help us evaluate our

business, identify trends affecting our business, formulate

business plans and make strategic decisions. At-risk membership

represents the approximate number of Medicare members for whom we

receive a fixed percentage of premium under capitation arrangements

as of the end of a particular period.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. We intend such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in Section 27A

of the Securities Act of 1933, as amended, Section 21E of the

Securities Exchange Act of 1934, as amended. Words such as

"anticipate," "believe," "budget," "contemplate," "continue,"

"could," "envision," "estimate," "expect," "guidance," "indicate,"

"intend," "may," "might," "plan," "possibly," "potential,"

"predict," "probably," "pro-forma," "project," "seek," "should,"

"target," or "will," or the negative or other variations thereof,

and similar words or phrases or comparable terminology, are

intended to identify forward-looking statements. These

forward-looking statements address various matters, including the

Company’s future expected growth strategy and operating

performance; outlook as to total revenue, at-risk membership, and

Adjusted EBITDA for the full year 2025; our ability to enhance our

capabilities and achieve sustainable profitability; and a proposed

financing transaction with our largest shareholder and the expected

terms thereof, all of which reflect the Company’s expectations

based upon currently available information and data. Because such

statements are based on expectations as to future financial and

operating results and are not statements of fact, actual results

may differ materially from those projected or estimated and you are

cautioned not to place undue reliance on these forward-looking

statements. These forward-looking statements are not guarantees of

future performance, conditions or results, and involve a number of

known and unknown risks, uncertainties, assumptions and other

important factors, many of which are outside the Company's control,

that could cause actual results or outcomes to differ materially

from those discussed in the forward-looking statements.

Important risks and uncertainties that could cause our actual

results and financial condition to differ materially from those

indicated in forward-looking statements include, among others, our

ability to continue as a going concern; our potential need to raise

additional capital to fund our existing operations or develop and

commercialize new services or expand our operations; our ability to

achieve or maintain profitability; our ability to maintain

compliance with our debt covenants in the future, or obtain

required waivers from our lenders if future operating performance

were to fall below current projections, and if there are material

changes to management’s assumptions, we could be required to

recognize non-cash charges to operating earnings for goodwill

and/or other intangible asset impairment; our ability to identify

and develop successful new geographies, physician partners, payors

and patients; changes in market or industry conditions, regulatory

environment, competitive conditions, and receptivity to our

services; our ability to fund our growth and expand our operations;

changes in laws and regulations applicable to our business; our

ability to maintain our relationships with health plans and other

key payors; our ability to establish and maintain effective

internal controls and the impact of the material weaknesses we have

identified; our ability to maintain the listing of our securities

on The Nasdaq Stock Market, LLC; increased labor costs; our ability

to recruit and retain qualified team members and independent

physicians; our ability to agree on terms and complete a financing

transaction with our largest shareholder; and the factors described

under Part I, Item 1A. “Risk Factors” and Part II, Item 7.

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in our Annual Report on Form 10-K for the

year ended December 31, 2023, filed with the SEC on March 28, 2024,

and in our subsequent filings with the SEC.

All information in this press release is as of the date hereof,

and we undertake no duty to update or revise this information

unless required by law. You are cautioned not to place undue

reliance on any forward-looking statements contained in this press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213364052/en/

Ryan Halsted

Investor Relations Gilmartin Group ir@p3hp.org

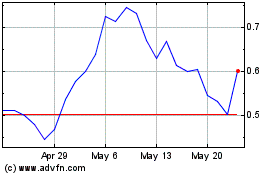

P3 Partners (NASDAQ:PIII)

Historical Stock Chart

From Jan 2025 to Feb 2025

P3 Partners (NASDAQ:PIII)

Historical Stock Chart

From Feb 2024 to Feb 2025