0001803914FALSE00018039142024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

PLBY GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39312 | | 37-1958714 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

10960 Wilshire Blvd., Suite 2200 Los Angeles, California | | 90024 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (310) 424-1800

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | PLBY | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2024, PLBY Group, Inc. (the “Company”) issued a press release announcing its financial results for the Company’s second fiscal quarter ended June 30, 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K (this “Report”) and incorporated herein by reference.

The information under Item 2.02 of this Report, including Exhibit 99.1, attached hereto, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or Securities Act of 1933, as amended, expect as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

Exhibit

No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Dated: August 8, 2024 | PLBY GROUP, INC. |

| |

| By: | /s/ Chris Riley |

| Name: | Chris Riley |

| Title: | General Counsel and Secretary |

Exhibit 99.1

PLBY Group Reports Second Quarter 2024 Financial Results

Enters Exclusivity Period to Repay Senior Debt at a Significant Discount

Announces Return of Playboy Magazine and Playmate Franchise

Launches New Playboy.com Website Featuring Original Content

LOS ANGELES – August 8, 2024 (GLOBE NEWSWIRE) – PLBY Group, Inc. (NASDAQ: PLBY) (“PLBY Group” or the “Company”), a leading pleasure and leisure lifestyle company and owner of Playboy, one of the most recognizable and iconic brands in the world, today announced financial and operational results for the quarter ended June 30, 2024.

Comments from Ben Kohn, Chief Executive Officer of PLBY Group

“We have taken significant steps to position Playboy for future success, aimed at strengthening our balance sheet and enhancing our operations. Our senior lenders have agreed to give us an exclusive period of time to repay all of the debt at a significant discount, which would meaningfully reduce total company leverage. To accomplish this, we have engaged a leading investment bank to help secure new financing.”

“In recent months, we made substantial progress to bring one of the most iconic lifestyle brands in all of entertainment into the digital age. Playboy is the quintessential lifestyle brand with a rich heritage, reaching not only across generations, but across content categories as well. We are confident that by rebuilding key content verticals such as men’s lifestyle, automotive, sports and travel, we can vastly expand the ways in which consumers interact with our brand—through social media, events and experiences, and content on a newly redesigned Playboy.com, which debuted earlier this week. The power of the creator economy is the key to building a successful and relevant content business in today’s rapidly changing media ecosystem, and we plan to partner with creators of all types to produce dynamic, fresh content across all of our distribution channels. We are creating exciting opportunities for advertising and sponsorship partners to reach new consumers by re-establishing Playboy as the premier aspirational lifestyle brand. This new strategy is already delivering results, including a multi-million dollar pipeline of sponsorship deals. A key part of this strategy was revamping our social media accounts, driving nearly 30 million Instagram video views in the past three months alone, according to Emplifi, our social media insights provider.”

“Playboy magazine, scheduled to return in early 2025, will serve as a powerful promotional tool for our relaunch, and will feature not only Playmate and celebrity collaborations, but also many iconic franchises such as the Playboy Interview, 20 Questions and the Playboy Advisor. Playboy is known for launching the careers of some of the most talented women in the world, and we are reviving that legacy with a global search for our newest Playmate, kicking off with an eight-city casting tour starting next month in New York City and culminating in the reveal of the 2024 Playmate of the Year in the new magazine.”

“The rebuilding of our licensing business continues to progress. In the past few months, we’ve signed multiple new deals, including with a new apparel and accessories licensing partner in China, a global condoms and gel lubricants partner, a new e-commerce shop partner, and multiple other deals, amounting to a total of over $45 million in minimum guarantees over the coming years. Our pipeline continues to grow and we are optimistic about what lies ahead for our licensing business.”

Financial Highlights

•Secured an agreement with the Company’s senior lenders to give it an exclusive period of time to repay its senior debt at a significant discount, subject to the negotiation and execution of definitive agreements relating to the amendment and subsequent refinancing of the Company’s senior debt.

•Filed a prospectus with the Securities and Exchange Commission relating to a new At-The-Market (“ATM”) program, which will allow the Company to offer its common stock, from time to time, in transactions that are deemed to be “at the market” offerings, not to exceed an aggregate amount of $15 million. Any sales pursuant to the ATM will be conducted through Roth Capital Partners as sales agent, although the Company does not plan on executing the ATM at current trading levels of PLBY shares and management will be cognizant of dilution when considering sales in the future.

Second Quarter 2024 Financial Results

Total revenue was $24.9 million compared to $35.1 million in the prior year period, reflecting a year-over-year decrease of $10.2 million, or 29%. Approximately $1.4 million of the decrease was attributable to the Playboy.com e-commerce business no longer being operated by the Company in 2024, which was in addition to a $5.0 million decline in licensing revenue attributable primarily to the termination of two China licensees in late 2023. There were also declines at Honey Birdette and in the Company’s legacy digital business.

Direct-to-consumer revenue declined $5.2 million, or 26%, year-over-year, to $14.5 million. Revenues from Playboy.com e-commerce declined by $1.4 million, as the Company transitioned it from an owned-and-operated model to a licensing model, while revenue from Honey Birdette decreased by $3.8 million, or 21% year-over-year, due largely to an approximately 50% reduction in the number of days on sale as the Company focuses on brand health and gross margin.

Licensing revenue declined $5.0 million, or 49%, year-over-year, to $5.3 million. The decrease is primarily attributable to China and the termination of two of the Company’s three largest licensing agreements in late 2023, which management has already begun to remedy by entering into multiple new licensing agreements in recent months.

Digital subscriptions and content revenue was $5.1 million, consistent with the prior year period. An increase in creator platform revenue was offset by a decline in legacy media.

Net loss from continuing operations was $16.7 million, an improvement of $115.6 million from a net loss from continuing operations of $132.3 million in the prior year period, as the Company significantly cut costs and expenses and due to a $146.2 million impairment charge in the prior year period which did not recur.

Total net loss was $16.7 million, an improvement of $115.2 million from a total net loss of $131.8 million in the second quarter of 2023.

Adjusted EBITDA loss was $2.9 million, a decline of $2.8 million from a $0.1 million adjusted EBITDA loss during the prior year period. This reflects a $4.9 million decrease in licensing EBITDA due largely to two contracts terminated in China in late 2023, a $0.7 million decline in Honey Birdette EBITDA, partially offset by a $1.9 million reduction in corporate expense and a $1.3 million Playboy.com EBITDA loss in the prior year period that did not recur.

The Company ended the second quarter with approximately $17 million in cash and cash equivalents.

Webcast Details

The Company will host a webcast at 5 p.m. Eastern Time today to discuss the second quarter 2024 financial results. Participants may access the live webcast on the events section of the PLBY Group website at https://www.plbygroup.com/investors.

About PLBY Group, Inc.

PLBY Group, Inc. is a global pleasure and leisure company connecting consumers with products, content, and experiences that help them lead more fulfilling lives. PLBY Group’s flagship consumer brand, Playboy, is one of the most recognizable brands in the world, with products and content available in approximately 180 countries. PLBY Group’s mission—to create a culture where all people can pursue pleasure — builds upon over 70 years of creating groundbreaking media and hospitality experiences and fighting for cultural progress rooted in the core values of equality, freedom of expression and the idea that pleasure is a fundamental human right. Learn more at http://www.plbygroup.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. The Company’s actual results may differ from their expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect”, “estimate”, “project”, “budget”, “forecast”, “anticipate”, “intend”, “plan”, “may”, “will”, “could”, “should”, “believes”, “predicts”, “potential”, “continue”, and similar expressions (or the negative versions of such words or expressions) are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations with respect to future performance, growth plans and anticipated financial impacts of its strategic opportunities and corporate transactions.

These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from those discussed in the forward-looking statements. Factors that may cause such differences include, but are not limited to: (1) the inability to maintain the listing of the Company’s shares of common stock on Nasdaq; (2) the risk that the Company’s completed or proposed transactions disrupt the Company’s current plans and/or operations, including the risk that the Company does not complete any such proposed transactions or achieve the expected benefits from any transactions; (3) the ability to recognize the anticipated benefits of corporate transactions, commercial collaborations, commercialization of digital assets, cost reduction initiatives and proposed transactions, which may be affected by, among other things, competition, the ability of the Company to grow and manage growth profitably, and the Company’s ability to retain its key employees; (4) costs related to being a public company, corporate transactions, commercial collaborations and proposed transactions; (5) changes in applicable laws or regulations; (6) the possibility that the Company may be adversely affected by global hostilities, supply chain delays, inflation, interest rates, foreign currency exchange rates or other economic, business, and/or competitive factors; (7) risks relating to the uncertainty of the projected financial information of the Company, including changes in the Company’s estimates of cash flows and the fair value of certain of its intangible assets, including goodwill; (8) risks related to the organic and inorganic growth of the Company’s businesses, and the timing of expected business milestones; (9) changing demand or shopping patterns for the Company’s products and services; (10) failure of licensees, suppliers or other third-parties to fulfill their obligations to the Company; (11) the Company’s ability to comply with the terms of its indebtedness and other obligations; (12) changes in financing markets or the inability of the Company to obtain financing on attractive terms; and (13) other risks and uncertainties indicated from time to time in the Company’s annual report on Form 10-K, including those under “Risk Factors” therein, and in the Company’s other filings with the Securities and Exchange Commission. The Company cautions that the foregoing list of factors is not exclusive, and readers should not place undue reliance upon any forward-looking statements, which speak only as of the date which they were made. The Company does not undertake any obligation to update or revise any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

Contact:

Investors: investors@plbygroup.com

Media: press@plbygroup.com

PLBY Group, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | |

| | Three Months Ended

June 30, |

| | 2024 | | 2023 |

| Net revenues | | $ | 24,885 | | | $ | 35,101 | |

| Costs and expenses: | | | | |

| Cost of sales | | (8,018) | | | (9,659) | |

| Selling and administrative expenses | | (25,489) | | | (32,517) | |

| Impairments | | (599) | | | (146,240) | |

| Other operating income, net | | 18 | | | 259 | |

| Total operating expense | | (34,088) | | | (188,157) | |

| Operating loss | | (9,203) | | | (153,056) | |

| Nonoperating (expense) income: | | | | |

| Interest expense | | (6,588) | | | (5,757) | |

| Gain on extinguishment of debt | | — | | | 7,980 | |

| Fair value remeasurement gain | | — | | | 9,523 | |

| Other (expense) income, net | | (245) | | | 175 | |

| Total nonoperating (expense) income | | (6,833) | | | 11,921 | |

| Loss from continuing operations before income taxes | | (16,036) | | | (141,135) | |

| (Expense) benefit from income taxes | | (616) | | | 8,868 | |

| Net loss from continuing operations | | (16,652) | | | (132,267) | |

| Income (loss) from discontinued operations, net of tax | | — | | | 452 | |

| Net loss | | (16,652) | | | (131,815) | |

| Net loss attributable to PLBY Group, Inc. | | $ | (16,652) | | | $ | (131,815) | |

| Net loss per share from continuing operations, basic and diluted | | $ | (0.23) | | | $ | (1.77) | |

| Net income (loss) per share from discontinued operations, basic and diluted | | — | | | 0.01 | |

| Net loss per share, basic and diluted | | $ | (0.23) | | | $ | (1.76) | |

| Weighted-average shares outstanding, basic and diluted | | 73,040,566 | | | 74,916,379 | |

Non-GAAP Reconciliation

This release presents the financial measure earnings before interest, taxes, depreciation and amortization, or “EBITDA” and “Adjusted EBITDA”, which are not financial measures under the accounting principles generally accepted in the United States of America (“GAAP”). “EBITDA” is defined as net income or loss before interest, income tax expense or benefit, and depreciation and amortization. “Adjusted EBITDA” is defined as EBITDA adjusted for stock-based compensation and other special items determined by Company management. Adjusted EBITDA is intended as a supplemental measure of the Company’s performance that is neither required by, nor presented in accordance with, GAAP. The Company believes that the use of EBITDA and Adjusted EBITDA provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing its financial measures with those of comparable companies, which may present similar non-GAAP financial measures to investors. However, investors should be aware that when evaluating EBITDA and Adjusted EBITDA, the Company may incur future expenses similar to those excluded when calculating these measures. In addition, the Company’s presentation of these measures should not be construed as an inference that the Company’s future results will be unaffected by unusual or nonrecurring items. The Company’s computation of Adjusted EBITDA may not be comparable to other similarly titled measures computed by other companies, because not all companies may calculate Adjusted EBITDA in the same fashion.

In addition to adjusting for non-cash stock-based compensation, non-cash charges for the fair value remeasurements of certain liabilities and non-recurring non-cash impairments, asset write-downs and inventory reserve charges, the Company typically adjusts for non-operating expenses and income, such as non-recurring special projects, including the implementation of internal controls, non-recurring gain or loss on the sale of assets, expenses associated with financing activities, and reorganization and severance expenses that result from the elimination or rightsizing of specific business activities or operations.

Because of these limitations, EBITDA and Adjusted EBITDA should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. The Company compensates for these limitations by relying primarily on the Company’s GAAP results and using EBITDA and Adjusted EBITDA on a supplemental basis. Investors should review the reconciliation of net loss to EBITDA and Adjusted EBITDA below and not rely on any single financial measure to evaluate the Company’s business.

The following table reconciles the Company’s net loss from continued operations to EBITDA and Adjusted EBITDA (in thousands):

GAAP Net Loss to Adjusted EBITDA Reconciliation

(in thousands)

| | | | | | | | | | | |

| Three Months Ended

June 30, |

| 2024 | | 2023 |

| Net loss | $ | (16,652) | | | $ | (131,815) | |

| Adjusted for: | | | |

| (Income) loss from discontinued operations, net of tax | — | | | (452) | |

| Net loss from continuing operations | (16,652) | | | (132,267) | |

| Adjusted for: | | | |

| Interest expense | 6,588 | | | 5,757 | |

Gain on extinguishment of debt | — | | | (7,980) | |

| Expense (benefit) from income taxes | 616 | | | (8,868) | |

| Depreciation and amortization | 2,511 | | | 1,848 | |

| EBITDA | (6,937) | | | (141,510) | |

| Adjusted for: | | | |

| Stock-based compensation | 2,005 | | | 3,151 | |

| Impairments | 599 | | | 146,240 | |

| Inventory reserve charges | — | | | — | |

| Mandatorily redeemable preferred stock fair value remeasurement | — | | | (9,523) | |

| Write-down of capitalized software | — | | | — | |

| Adjustments | 1,397 | | | 1,548 | |

| Adjusted EBITDA | $ | (2,936) | | | $ | (94) | |

v3.24.2.u1

Cover Page

|

Aug. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 08, 2024

|

| Entity Registrant Name |

PLBY GROUP, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39312

|

| Entity Tax Identification Number |

37-1958714

|

| Entity Address, Address Line One |

10960 Wilshire Blvd.

|

| Entity Address, Address Line Two |

Suite 2200

|

| Entity Address, City or Town |

Los Angeles

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90024

|

| City Area Code |

310

|

| Local Phone Number |

424-1800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

PLBY

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001803914

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

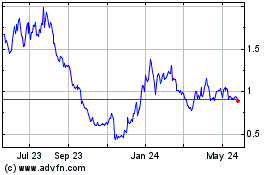

PLBY (NASDAQ:PLBY)

Historical Stock Chart

From Jan 2025 to Feb 2025

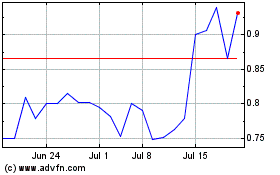

PLBY (NASDAQ:PLBY)

Historical Stock Chart

From Feb 2024 to Feb 2025