UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number: 001-41829

Primech Holdings Ltd.

23 Ubi Crescent

Singapore 408579

+65 6286 1868

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒

Form 40-F ☐

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Primech Holdings Ltd furnishes under the cover

of Form 6-K the following in connection with the annual general meeting of its shareholders:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Primech Holdings Ltd. |

| |

|

|

| Date: July 26, 2024 |

By: |

/s/ Kin Wai Ho |

| |

Name: |

Kin Wai Ho |

| |

Title: |

Chief Executive Officer |

EXHIBIT INDEX

3

Exhibit 99.1

Primech Holdings Ltd.

23 Ubi Crescent

Singapore 408579

PROXY STATEMENT AND NOTICE OF

ANNUAL GENERAL MEETING OF SHAREHOLDERS

| To the shareholders of |

|

July 26, 2024 |

| Primech Holdings Ltd. |

|

Singapore |

To our shareholders:

It is my pleasure to invite you to our Annual

General Meeting of Shareholders of Primech Holdings Ltd. (the “Company”) on August 19, 2024, at 9:00 P.M., Singapore time

(August 19, 2024, at 9:00 A.M., Eastern Time). The meeting will be held at 23 Ubi Crescent, Singapore 408579 (the “AGM”).

The matters to be acted upon at the meeting are

described in the Notice of Annual General Meeting of Shareholders and Proxy Statement.

YOUR VOTE IS VERY IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL

GENERAL MEETING OF SHAREHOLDERS, WE URGE YOU TO VOTE AND SUBMIT YOUR PROXY BY MAIL OR WITH THE VOTING INSTRUCTION OF YOUR BANK OR BROKER.

IF YOU ARE A REGISTERED SHAREHOLDER AND ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON. IF YOU HOLD YOUR

SHARES THROUGH A BANK OR BROKER AND WANT TO VOTE YOUR SHARES IN PERSON AT THE MEETING, PLEASE CONTACT YOUR BANK OR BROKER TO OBTAIN A

LEGAL PROXY. THANK YOU FOR YOUR SUPPORT.

| |

By order of the Board of Directors, |

| |

|

| |

/s/ Kin Wai Ho |

| |

Kin Wai Ho |

| |

Chief Executive Officer |

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

Primech Holdings Ltd. (THE “COMPANY”)

| TIME: |

|

August 19, 2024, at 9:00 P.M., Singapore Time

(August 19, 2024, at 9:00 A.M., Eastern Time) |

| |

|

|

| PLACE: |

|

23 Ubi Crescent

Singapore 408579 |

The notice of the AGM sets out the business proposed

to be conducted at the AGM, which includes both routine and special business, with the record date of July 19, 2024 for purposes of determining

eligibility to vote. The notice of AGM includes a proxy card together with voting instruction and is available at https://ts.vstocktransfer.com/irhlogin/Primech.

The AGM will be held physically, shareholders

who are overseas will be able to watch and listen to the proceeding by webcast. Shareholders will also be able to submit questions relating

to the items on the Proposals set out in the Notice of AGM in advance of the AGM. In order to be able to watch and listen to the meeting,

shareholders are required to use the following link: http://meeting.vstocktransfer.com/2024Primech, and to submit questions in advance,

shareholders are required to register in advance of the AGM, by emailing to ir@primech.com.sg.

Shareholders wishing to vote are required to complete

a proxy card together with voting instruction (contained in the notice of the AGM) to appoint the chairman of the AGM to cast their votes

in accordance with their instructions. The proxy card must be completed and returned in accordance with the instructions contained therein

by August 15, 2024, at 11:59 A.M., Singapore Time (August 14, 2024, at 11:59 P.M., Eastern Time).

YOU ARE RECEIVING

THIS VOTING INFORMATION ON A RECORD DATE OF JULY 19, 2024.

THUS, FOR YOUR VOTING INSTRUCTIONS TO BE COUNTED YOU

MUST BE A HOLDER ON JULY 19, 2024, OTHERWISE YOUR VOTES WILL NOT COUNT.

The purpose of the AGM is for the Shareholders

of the Company to consider and, if thought fit, pass, with or without modifications, the following resolutions:

AS ROUTINE BUSINESS:

| Proposal One |

|

By an ordinary resolution, to receive and adopt the Directors’

Statement, the audited financial statements of the Company for the financial year ended March 31, 2024; |

| |

|

|

| Proposal Two |

|

By an ordinary resolution, to receive and adopt the audited financial

statements in relation to Form 20-F for the financial year ended March 31, 2024; |

| |

|

|

| Proposal Three |

|

By ordinary resolutions, to approve the re-election

of the following Directors who are retiring by rotation pursuant to Regulation 88 of the Constitution of the Company and who, being

eligible, offer themselves for re-election as Directors:

(a) Mr.

Ho Kin Wai

(b)

Mr. Sng Yew Jin |

| |

|

|

| Proposal Four |

|

By an ordinary resolution, to approve payment of Directors’ fees

of US$77,500 for the financial year ended March 31, 2024. |

| |

|

|

| Proposal Five |

|

By an ordinary resolution, to approve the appointment of Weinberg &

Co. LA, LLP, as auditor of the Company for the financial year ending March 31, 2025 and that the Directors be empowered to fix the auditors’

remuneration in their absolute discretion; |

| Proposal Six |

|

By an ordinary resolution, to approve the appointment of M/s Paul Wan &

Co, as auditor of the Company for the financial year ending March 31, 2025 and that the Directors be empowered to fix the auditors’

remuneration in their absolute discretion; |

| |

|

|

| Proposal Seven |

|

By an ordinary resolution, to adjourn the Annual General Meeting to

a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there are insufficient

votes for, or otherwise in connection with, the approval of Proposal One, Proposal Two, Proposal Three, Proposal Four, Proposal Five

and/or Proposal Six. |

AS SPECIAL BUSINESS:

| Proposal Eight |

|

By an ordinary resolution, to resolve that: |

| |

|

|

| |

|

(a) |

Pursuant to Section 161 of the Singapore Companies Act

1967 (the “Singapore Companies Act”) the Directors be and are hereby authorized to issue such number of new ordinary

shares in the capital of the Company as may be approved by the board of Directors (the “Board”), such shares to

rank pari passu in all respects with the existing issued ordinary shares in the capital of the Company in connection with

the initial public offering of the Company at the price(s) to be determined by the Board and on such terms and conditions as the

Board may at any time and from time to time think fit and allot the same to such members of the public and/or private placees who

shall have applied for the shares in connection with the admission of the Company to Nasdaq, as the Board may decide. |

| |

|

|

|

|

| |

|

(b) |

Pursuant to Section 161 of the Companies Act 1967 and all

applicable laws (including but not limited to the listing rules of Nasdaq (the “Nasdaq Listing Rules”)), the Directors

be and are hereby authorized to: (a) (i) issue (in addition to the new ordinary shares referred to in paragraph (a) above) new ordinary

shares whether by way of rights, bonus or otherwise; and/or (ii) make or grant offers, agreements or options (collectively “Instruments”)

that might or would require new ordinary shares to be issued during the continuance of this authority or thereafter, including but

not limited to the creation and issue of (as well as adjustments to) options, warrants, debentures or other instruments convertible

into new ordinary shares, at any time and upon such terms and conditions and for such purposes and to such persons as the Directors

may in their absolute discretion deem fit; and (b) (notwithstanding this authorization conferred may have ceased to be in force)

issue new ordinary shares in pursuance of any Instruments made or granted by the Directors while this authorization was in force,

provided that: |

| |

|

|

|

|

| |

|

|

(1) |

the aggregate number of new ordinary shares to be issued pursuant to

such authority (including new ordinary shares to be issued in pursuance of the Instruments, made or granted pursuant to this authorization

but excluding new ordinary shares which may be issued pursuant to any adjustments (“Adjustments”) effected under

any relevant Instrument, which Adjustments shall be made in compliance with all applicable laws (including the Nasdaq Listing Rules)

for the time being in force (unless such compliance has been waived by the Nasdaq) and the Constitution for the time being of the

Company; |

| |

|

|

|

|

| |

|

|

(2) |

in exercising such authority, the Company shall comply with all applicable

laws, including the provisions of the Act, the Nasdaq Listing Rules for the time being in force (unless such compliance has been

waived by the Nasdaq) and the Constitution for the time being of the Company; and |

| |

|

|

|

|

| |

|

|

(3) |

unless revoked or varied by the Company in a general meeting by ordinary

resolution, such authority shall continue in force until (i) the conclusion of the next annual general meeting of the Company or

(ii) the date by which the next annual general meeting of the Company is required by law to be held, whichever is earlier. |

NOTES REGARDING THE PROPOSED RESOLUTIONS

Per the Constitution of the Company, ordinary

resolution in relation to Proposals One through Six, inclusive, are routine business to be transacted at the AGM.

| (i) |

Proposal One covers the Singapore statutory financial statements which

were prepared in conformity with the provisions of the Singapore Companies Act and will be made available to the shareholders on

the Company’s website at https://www.primechholdings.com on and from August 2, 2024, being not less than fourteen days

before the date of the AGM, as required under the Singapore Law. |

| |

|

| (ii) |

Proposal Two covers the audited financial statements for financial

year ended March 31, 2024, which was included in the Form 20-F filed by the Company on July 23, 2024. |

| |

|

| (iii) |

Proposal Three covers the Directors who are required to retire at the

AGM of the Company pursuant to Regulation 88 of the Constitution of the Company, which requires that at each AGM one-third of the

Company’s Directors (or, if their number is not a multiple of three, then the number nearest to but not more than one-third

of the Directors) are required to retire from office by rotation and shall be eligible for re-election at the AGM. Set forth below

are brief biographies of Mr. Ho Kin Wai and Mr. Sng Yew Jin who will be standing for re-election as Directors at the AGM. |

| |

|

| (iv) |

Proposal Four deals with the approval of the payment of Directors’

fees of US$77,500 for the financial year ended March 31, 2024. |

| |

|

| (iv) |

Proposal Five and Six deal with the re-appointments of the independent

auditors, Weinberg & Co. LA, LLP and M/s Paul Wan & Co, who has served as the Company’s statutory Auditors for the

financial year March 31, 2024. The Audit Committee has approved and recommended to the Board the re-appointments of Weinberg &

Co. LA, LLP and M/s Paul Wan & Co as the Company’s statutory Auditors for the financial year ending March 31, 2025 and

to perform other appropriate services. As a result, the Board has approved, subject to the shareholders’ approval, the re-appointments

of Weinberg & Co. LA, LLP and M/s Paul Wan & Co and, pursuant to Section 205(16) of the Singapore Companies Act, the Directors

request shareholders to empower them to fix the auditors’ remuneration in their absolute discretion. |

Per the Constitution of the Company, ordinary

resolutions in relation to Proposals Eight is special business to be transacted at the AGM.

| (v) |

Proposal Eight is to authorize the Directors to issue ordinary shares

and make or grant offers, agreements or options that might or would require the issuance of ordinary shares. If this resolution is

approved, the authorization would be effective from the date of the AGM until (i) the conclusion of the next annual general meeting

of the Company or (ii) the date by which the next annual general meeting of the Company is required by law to be held, whichever

is earlier. |

DEFINITIONS

For purposes of this Notice (including the proxy

card together with voting instruction) the following definitions are used.

Beneficial Shareholders: are persons or

entities holding their interests in the Company’s shares as, or through, a participant in the Depository Trust Company, or DTC,

in book entry form at a broker, dealer, securities depository or other intermediary and who are reflected in the books of such intermediary;

also commonly referred to in the United States as “street name holders”.

Shareholder of Record: a person or entity

whose name is reflected in the Company’s register of members as of July 19, 2024, and who is not necessarily a Beneficial Shareholder.

MEETING TO BE HELD PHYSICALLY

The

AGM will be held physically, shareholders who are overseas will be able to watch and listen to the proceeding by webcast. Shareholders

will also be able to submit questions relating to the items on the Proposals set out in the Notice of AGM in advance of the AGM. In order

to be able to watch and listen to the meeting, shareholders are required to use the following link: http://meeting.vstocktransfer.com/2024Primech,

and to submit questions in advance, shareholders are required to register in advance of the AGM, by emailing to ir@primech.com.sg.

The Notice of AGM, Proxy Form and the Company’s Annual Report 2024 are available on the VStock’s website at https://ts.vstocktransfer.com/irhlogin/Primech

and the

U.S. Securities and Exchange Commission website at http://www.sec.gov. A shareholder (whether individual or corporate) who is overseas

and/or is unable to attend the AGM physically may vote by appointing the Chairman of the meeting as his/her/its proxy to vote on his/her/its

behalf at the AGM.

| WHO MAY VOTE: |

|

You may vote if you were a shareholder of record on July 19, 2024. |

| |

|

|

| ANNUAL REPORT: |

|

A copy of our 2024 Annual Report on Form 20-F (the “Annual Report”)

is available on at the SEC’s website at http://www.sec.gov and in print upon request. |

| |

|

|

| DATE OF MAILING: |

|

This notice and the proxy statement are first being mailed to shareholders

on or about July 26, 2024. |

| |

By order of the Board of Directors, |

| |

|

| |

/s/ Kin Wai Ho |

| |

Kin Wai Ho. |

| |

Chief Executive Officer |

ABOUT THE ANNUAL GENERAL MEETING OF SHAREHOLDERS

What am I voting on?

You will be voting on the following:

| Proposal One |

|

By an ordinary resolution, to receive and adopt the Directors’

Statement, the audited financial statements of the Company for the financial year ended March 31, 2024; |

| |

|

|

| Proposal Two |

|

By an ordinary resolution, to receive and adopt the audited financial

statements in relation to Form 20-F for the financial year ended March 31, 2024; |

| |

|

|

| Proposal Three |

|

By ordinary resolutions, to approve the re-election

of the following Directors who are retiring by rotation pursuant to Regulation 88 of the Constitution of the Company and who, being

eligible, offer themselves for re-election as Directors:

(a) Mr.

Ho Kin Wai

(b)

Mr. Sng Yew Jin |

| Proposal Four |

|

By an ordinary resolution, to approve payment of Directors’ fees of US$77,500 for the financial year ended March 31, 2024; |

| |

|

|

| Proposal Five |

|

By an ordinary resolution, to approve the appointment of Weinberg &

Co. LA, LLP, as auditor of the Company the financial year ending March 31, 2025 and that the Directors be empowered to fix the auditors’

remuneration in their absolute discretion; |

| |

|

|

| Proposal Six |

|

By an ordinary resolution, to approve the appointment of M/s Paul Wan &

Co, as auditor of the Company for the financial year ending March 31, 2025 and that the Directors be empowered to fix the auditors’

remuneration in their absolute discretion; |

| |

|

|

| Proposal Seven |

|

By an ordinary resolution, to adjourn the Annual General Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of Proposal One, Proposal Two, Proposal Three, Proposal Four, Proposal Five and/or Proposal Six; and |

| |

|

|

| Proposal Eight |

|

By an ordinary resolution, to resolve that: |

| |

|

|

|

|

| |

|

(a) |

Pursuant to Section 161 of the Singapore Companies Act 1967 (the “Singapore Companies Act”) the Directors be and are hereby authorized to issue such number of new ordinary shares in the capital of the Company as may be approved by the board of Directors (the “Board”), such shares to rank pari passu in all respects with the existing issued ordinary shares in the capital of the Company in connection with the initial public offering of the Company at the price(s) to be determined by the Board and on such terms and conditions as the Board may at any time and from time to time think fit and allot the same to such members of the public and/or private placees who shall have applied for the shares in connection with the admission of the Company to Nasdaq, as the Board may decide. |

| |

|

|

|

|

| |

|

(b) |

Pursuant to Section 161 of the Companies Act 1967 and all applicable laws (including but not limited to the listing rules of Nasdaq (the “Nasdaq Listing Rules”)), the Directors be and are hereby authorized to: (a) (i) issue (in addition to the new ordinary shares referred to in paragraph (a) above) new ordinary shares whether by way of rights, bonus or otherwise; and/or (ii) make or grant offers, agreements or options (collectively “Instruments”) that might or would require new ordinary shares to be issued during the continuance of this authority or thereafter, including but not limited to the creation and issue of (as well as adjustments to) options, warrants, debentures or other instruments convertible into new ordinary shares, at any time and upon such terms and conditions and for such purposes and to such persons as the Directors may in their absolute discretion deem fit; and (b) (notwithstanding this authorization conferred may have ceased to be in force) issue new ordinary shares in pursuance of any Instruments made or granted by the Directors while this authorization was in force, provided that: |

| |

|

|

|

|

| |

|

|

(1) |

the aggregate number of new ordinary shares to be issued pursuant to such authority (including new ordinary shares to be issued in pursuance of the Instruments, made or granted pursuant to this authorization but excluding new ordinary shares which may be issued pursuant to any adjustments (“Adjustments”) effected under any relevant Instrument, which Adjustments shall be made in compliance with all applicable laws (including the Nasdaq Listing Rules) for the time being in force (unless such compliance has been waived by the Nasdaq) and the Constitution for the time being of the Company; |

| |

|

|

|

|

| |

|

|

(2) |

in exercising such authority, the Company shall comply with all applicable laws, including the provisions of the Act, the Nasdaq Listing Rules for the time being in force (unless such compliance has been waived by the Nasdaq) and the Constitution for the time being of the Company; and |

| |

|

|

|

|

|

|

|

(3) |

unless revoked or varied by the Company in a general meeting by ordinary resolution, such authority shall continue in force until (i)

the conclusion of the next annual general meeting of the Company or (ii) the date by which the next annual general meeting of the Company

is required by law to be held, whichever is earlier. |

Who is entitled to vote?

You may vote if you owned ordinary shares of the Company

as of the close of business on July 19, 2024, which we refer to as the “Record Date”. Each ordinary share is entitled to one

vote. As of July 19, 2024, we had 38,050,000 ordinary shares issued and outstanding.

Basis of voting

Votes shall be taken on a poll with one vote

for each share. In respect of both the routine business and the special business to be transacted at the Annual General Meeting, in order

for a resolution to be passed, more than 50% of the eligible votes cast on the resolution must be in favor of the resolution. Whilst

shares for which an abstention from voting has been recorded are counted toward the quorum of the meeting, the calculation of the percentage

of votes cast in favor of the resolution disregards abstained votes. A person entitled to more than one vote need not use all his votes

or cast all the votes he uses in the same way.

How do I provide voting instructions before

the Annual General Meeting?

If you are a shareholder who hold their shares beneficially

through an institutional holder of record, such as a bank or broker (sometimes referred to as holding shares “in street name”),

you will receive voting instructions from that holder of record.

If you are a shareholder of record, meaning that

you hold your shares in certificate form, you have the following options:

To provide voting instructions by Mail

1) Check the appropriate boxes on the voting

instruction form

2) Sign and date the voting instruction form.

3)

Return the voting instruction form in the envelope provided.

If you hold your shares through an account with

a bank or broker, your ability to vote by the Internet depends on their voting procedures. Please follow the directions that your bank

or broker provides.

Please note that the latest we will accept voting

instructions is on August 15, 2024, at 11:59 A.M., Singapore Time (August 14, 2024, at 11:59 P.M., Eastern Time).

Can I change my mind after I return my proxy?

You may change your voting instructions at any

time before the polls close at the conclusion of voting at the Annual General Meeting. You may do this by (1) signing another proxy card

with voting instructions with a later date and returning it to us before the Annual General Meeting, or (2) voting at the Annual General

Meeting.

What if I return my proxy card but do not

provide voting instructions?

Proxies that are signed and returned but do not

contain instructions will be voted “FOR” Proposal One, Two, Three, Four, Five and Six, in accordance with the best judgment

of the named proxies on any other matters properly brought before the Annual General Meeting.

What does it mean if I receive more than one

proxy card or instruction form?

It indicates that your ordinary shares are registered

differently and are in more than one account. To ensure that all shares are voted, please sign and return all proxy cards. We encourage

you to register all your accounts in the same name and address. Those holding shares through a bank or broker should contact their bank

or broker and request consolidation.

How many votes must be present to hold the

Annual General Meeting?

Your shares are counted as present at the Annual

General Meeting if you attend the Annual General Meeting and vote in person or if you properly return a proxy by internet or mail. In

order for us to conduct our Annual General Meeting, at least two shareholders must be present in person or by proxy. This is referred

to as a quorum. Abstentions and broker non-votes will be counted for purposes of establishing a quorum at the Annual General Meeting.

If a quorum is not present or represented, the chairman of the Annual General Meeting may, with the consent of the Annual General Meeting,

adjourn the Annual General Meeting from time to time, without notice other than announcement at the Annual General Meeting, until a quorum

is present or represented.

How many votes are needed to approve the Company’s

proposals?

Proposal One. The adoption of the Directors’

Statement, the audited financial statements of the Company for the financial year ended March 31, 2024; This proposal requires affirmative

(“FOR”) votes of a majority of votes cast by shares present or represented by proxy and entitled to vote at the Annual General

Meeting.

Proposal Two. The adoption of the audited financial

statements in relation to Form 20-F for the financial year ended March 31, 2024; This proposal requires affirmative (“FOR”)

votes of a majority of votes cast by shares present or represented by proxy and entitled to vote at the Annual General Meeting.

Proposal Three. The re-appointments of Mr. Ho

Kin Wai and Mr. Sng Yew Jin. Each ordinary resolution under this proposal requires affirmative (“FOR”) votes of a majority

of votes cast by shares present or represented by proxy and entitled to vote at the Annual General Meeting.

Proposal Four. The approval of the payment of

Directors’ fees of US$77,500 for the financial year ended March 31, 2024. This proposal requires affirmative (“FOR”)

votes of a majority of votes cast by shares present or represented by proxy and entitled to vote at the Annual General Meeting.

Proposal Five. The appointment of auditor, Weinberg&

Co. LA, LLP. This proposal requires affirmative (“FOR”) votes of a majority of votes cast by shares present or represented

by proxy and entitled to vote at the Annual General Meeting.

Proposal Six. The appointment of auditor, M/s Paul

Wan & Co. This proposal requires affirmative (“FOR”) votes of a majority of votes cast by shares present or represented

by proxy and entitled to vote at the Annual General Meeting.

Proposal Seven. The adjournment of the Annual

General Meeting to a later date or dates in the event that there are insufficient votes for, or otherwise in connection with, the approval

Proposal One, Proposal Two, Proposal Three, Proposal Four, Proposal Five and/or Proposal Six. This proposal requires affirmative (“FOR”)

votes of a majority of votes cast by shares present or represented by proxy and entitled to vote at the Annual General Meeting.

Proposal Eight. The authorization for the Directors

to issue ordinary shares and make or grant offers, agreements or options that might or would require the issuance of ordinary shares.

This proposal requires affirmative (“FOR”) votes of three-fourths of votes cast by shares present or represented by proxy

and entitled to vote at the Annual General Meeting.

What are Abstentions and Broker Non-Votes?

All votes will be tabulated by the inspector

of election appointed for the Annual General Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker

non-votes. An abstention is the voluntary act of not voting by a shareholder who is present at the Annual General Meeting and entitled

to vote. A broker “non-vote” occurs when a broker nominee holding shares for a beneficial owner does not vote on a particular

proposal because the nominee does not have discretionary power for that particular item and has not received instructions from the beneficial

owner. If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted

to exercise voting discretion with respect to some of the matters to be acted upon at the Annual General Meeting. If you do not give

your broker or nominee specific instructions regarding such matters, your proxy will be deemed a “broker non-vote.”

The question of whether your broker or nominee

may be permitted to exercise voting discretion with respect to a particular matter depends on whether the particular proposal is deemed

to be a “routine” matter and how your broker or nominee exercises any discretion they may have in the voting of the shares

that you beneficially own. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters

that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations

of the NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of shareholder, such

as mergers, shareholder proposals, elections of directors (even if not contested), executive compensation (including any advisory shareholder

votes on executive compensation and on the frequency of shareholder votes on executive compensation), and certain corporate governance

proposals, even if management-supported.

For any proposal that is considered a “routine”

matter, your broker or nominee may vote your shares in its discretion either for or against the proposal even in the absence of your

instruction. For any proposal that is considered a “non-routine” matter for which you do not give your broker instructions,

the shares will be treated as broker non-votes. “Broker non-votes” occur when a beneficial owner of shares held in street

name does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.”

Broker non-votes will not be considered to be shares “entitled to vote” on any “non-routine” matter and therefore

will not be counted as having been voted on the applicable proposal. Therefore, if you are a beneficial owner and want to ensure that

shares you beneficially own are voted in favor or against any or all of the proposals in this proxy statement, the only way you can do

so is to give your broker or nominee specific instructions as to how the shares are to be voted.

Abstentions and broker non-votes are not counted

as votes cast on an item and therefore will not affect the outcome of any proposal presented in this proxy statement. Abstention and

broker non-votes, if any, will be counted for purposes of determining whether there is a quorum present at the Annual General Meeting.

Note that if you are a beneficial holder and

do not provide specific voting instructions to your broker, the broker that holds your shares will not be authorized to vote on Proposal

Eight because this is considered a non-routine matter. Proposal One, Proposal Two, Proposal Three, Proposal Four, Proposal Five and Proposal

Six are considered to be routine matters and, accordingly, if you do not instruct your broker, bank or other nominee on how to vote the

shares in your account for Proposal, brokers will be permitted to exercise their discretionary authority to vote for the approval of

such proposal.

Accordingly, we encourage you to provide voting

instructions to your broker, whether or not you plan to attend the Annual General Meeting.

SHAREHOLDER PARTICIPATION IN THE AGM

Shareholders can submit their questions in advance

of the AGM in relation of the resolutions set out in the Notice of AGM:

| |

(a) |

By email to ir@primech.com.sg |

All questions submitted in advance of the AGM

must be received by August 12, 2024.

Shareholders (including CPF and SRS members)

who wish to submit their questions by post or by email are required to indicate their full name (for individuals)/company name (for corporates),

NRIC/passport number/company registration number (where applicable), contact number, shareholding type and number of shares held, together

with their submission of questions, to the office address or email address provided. Persons who hold Shares through relevant intermediaries

(as defined in Section 181 of the Companies Act 1967), other than CPF and SRS Investors, should contact their respective relevant intermediaries

through which they hold such Shares to submit their questions related to the resolutions to be tabled for approval at the AGM based on

the abovementioned instructions.

The Company will endeavour to address all substantial

and relevant questions received from members prior to and on the day of the AGM by publishing their responses posted on the U.S. Securities

and Exchange Commission website and the Company’s website. Where substantially similar questions are received, the Company will

consolidate such questions and consequently not all questions may be individually addressed.

The result of the AGM will be published on the

U.S. Securities and Exchange Commission website and the Company’s website after the AGM concludes.

Shareholders who wish to exercise their voting

rights at the AGM may (where such members are individuals or corporates) appoint the Chairman of the AGM as their proxy to vote on their

behalf at the AGM.

CUT-OFF TIMES

Submission of “Proxy Card together with

Voting Instruction”

For submission of your “Proxy Card together

with Voting Instruction” –on August 15, 2024, at 11:59 A.M., Singapore Time (August 14, 2024, at 11:59 P.M., Eastern Time).

Kindly note that Shareholders will not

be able to vote during the webcast of the AGM proceedings on the resolutions to be tabled for approval at the AGM. Shareholders

who wish to exercise their votes must submit the “Proxy Card together with Voting Instruction” for the Chairman of the AGM

to cast votes on their behalf.

Submission of questions to the Company

For submission by email to the Company of questions

to be raised at the AGM – by August 12, 2024, at 8:59 P.M., Singapore Time (August 12, 2024, at 8:59 A.M., Eastern Time).

PERSONAL DATA

By participating in the AGM (through pre-registration,

attendance or the submission of any questions to be raised at the AGM) and/or any adjournment thereof, submitting an instrument appointing

a proxy and/or any adjournment thereof or submitting any details of the shareholder’s representative(s) in connection with the

AGM, a shareholder of the Company (whether a Beneficial Shareholder or a Shareholder of Record) (i) consents to the collection, use and

disclosure of the shareholder’s personal data by the Company (or its agents) for the purpose of the processing and administration

by the Company (or its agents) of proxies and representatives appointed for the AGM (including any adjournment thereof) and the preparation

and compilation of the attendance lists, minutes and other documents relating to the AGM (including any adjournment thereof), and in

order for the Company (or its agents) to comply with any applicable laws, listing rules, regulations and/or guidelines (collectively,

the “Purposes”), (ii) warrants that where the shareholder discloses the personal data of the shareholder’s representative(s)

to the Company (or its agents), the shareholder has obtained the prior consent of representative(s) for the collection, use and disclosure

by the Company (or its agents) of the personal data of such representative(s) for the Purposes, and (iii) agrees that the shareholder

will indemnify the Company in respect of any penalties, liabilities, claims, demands, losses and damages as a result of the shareholder’s

breach of warranty.

FORWARD-LOOKING STATEMENTS

This notice contains forward-looking statements

concerning future events. These forward-looking statements, are necessarily estimates and involve a number of risks and uncertainties

that could cause actual results to differ materially from those suggested by the forward-looking statements. As a consequence, these

forward-looking statements should be considered in light of various important factors. Words such as “may,” “expects,”

“intends,” “plans,” “believes,” “anticipates,” “hopes,” “estimates,”

and variations of such words and similar expressions are intended to identify forward-looking statements. These forward-looking statements

are based on the information available to, and the expectations and assumptions deemed reasonable by the Company at the time these statements

were made. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, no assurance

can be given that such expectations will prove to have been correct. These statements involve known and unknown risks and are based upon

a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are

beyond the Company’s control. Actual results may differ materially from those expressed or implied by such forward looking statements.

Important factors that could cause actual results to differ materially from estimates or projections contained in the forward- looking

statements include the factors set out in the Company’s filings with the SEC. The Company undertakes no obligation to update publicly

or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this notice or to reflect

the occurrence of unanticipated events

BY ORDER OF THE BOARD

Primech Holdings Ltd

(Company Registration No. 202042000N)

| /s/ Kin Wai Ho |

|

| Kin Wai Ho |

|

| Chief Executive Officer |

|

Date: July 26, 2024

CORPORATION INFORMATION

Registered Office

23 Ubi Crescent

Singapore 408579

Place of incorporation: Singapore

Date of incorporation: December 29,

2020

Website: https://www.primechholdings.com |

Company Secretary

Yeo Keng Nien

10 Jalan Kilang,

#04-06, Bukit Merah Enterprise Center

Singapore 159410 |

| |

|

Transfer Agent

Vstock Transfer, LLC

18 Lafayette Place

Woodmere, NY 11598

USA Tel: +1(212)828-8436

Email: action@vstocktransfer.com |

|

PROPOSAL ONE

BY AN ORDINARY RESOLUTION, TO RECEIVE AND ADOPT

THE DIRECTORS’ STATEMENT, THE AUDITED FINANCIAL STATEMENTS OF THE COMPANY FOR THE FINANCIAL YEAR ENDED MARCH 31, 2024

(ITEM 1 OF THE PROXY CARD)

Background

We are proposing the receipt and adoption of

the Directors’ Statement and the audited financial statements of the Company for the financial year ended March 31, 2024. The audited

financial statements are in reference to the Singapore Statutory Financial Statements which were prepared in conformity with the provisions

of the Singapore Companies Act. Although the Company’s governing documents do not require the submission of this matter to shareholders,

the Board of Directors considers it desirable that the adoption of the Director’s Statement and the audited financial statements

of the Company be ratified by shareholders.

Vote Required

This proposal requires affirmative (“FOR”)

votes of a majority of votes cast by shares present or represented by proxy and entitled to vote at the Annual General Meeting and voting

affirmatively or negatively on such matter. Unless otherwise instructed on the proxy or unless authority to vote is withheld, shares

represented by executed proxies will be voted “FOR” this Proposal.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT THE SHAREHOLDERS VOTE “FOR” THIS PROPOSAL.

PROPOSAL TWO

BY AN ORDINARY RESOLUTION, TO RECEIVE AND ADOPT

THE AUDITED FINANCIAL STATEMENTS IN RELATION TO FORM 20-F FOR THE FINANCIAL YEAR ENDED MARCH 31, 2024

(ITEM 2 OF THE PROXY CARD)

Background

We are proposing the receipt and adoption of

the audited financial statements of the Company for the financial year ended March 31, 2024 in relation to Form 20-F. The audited financial

statements are in reference to the Singapore Statutory Financial Statements which were prepared in conformity with the provisions of

the Singapore Companies Act.

Vote Required

This proposal requires affirmative (“FOR”)

votes of a majority of votes cast by shares present or represented by proxy and entitled to vote at the Annual General Meeting and voting

affirmatively or negatively on such matter. Unless otherwise instructed on the proxy or unless authority to vote is withheld, shares

represented by executed proxies will be voted “FOR” this Proposal.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT THE SHAREHOLDERS VOTE “FOR” THIS PROPOSAL.

PROPOSAL THREE

BY ORDINARY RESOLUTIONS, TO APPROVE THE RE-ELECTION

OF MR. HO KIN WAI AND MR. SNG YEW JIN WHO ARE RETIRING BY ROTATION PURSUANT TO REGULATION 88 OF THE CONSTITUTION OF THE COMPANY AND WHO,

BEING ELIGIBLE, OFFER THEMSELVES FOR RE-ELECTION AS A DIRECTORS, TO SERVE A TERM EXPIRING AT THE NEXT ANNUAL GENERAL MEETING OF SHAREHOLDERS

OR UNTIL HIS SUCCESSOR IS DULY ELECTED AND QUALIFIED.

(ITEMS 3(A) TO 3(B) OF THE PROXY CARD)

Background

Our Board of Directors currently consists of

5 Directors, Mr. Kin Wai Ho, Mr. Yew Jin Sng, Dr. Chan Kai Yue Jason, Mr. William Mirecki, and Mr. Yuen Poi Lam William. At the Annual

General Meeting, the shareholders will vote on the re-election of Mr. Chan Kai Yue Jason, Mr. William Mirecki, and Mr. Yuen Poi Lam William

as Directors of the Company. Pursuant to Regulation 88 of the Company’s Constitution, one-third of the Directors on the Board of

Directors will be up for re-election at the next Annual General Meeting of shareholders, at which time shareholders will vote on the

election and qualification of their successors.

All shares duly voted will be voted for the election

of directors as specified by the shareholders. No proxy may be voted for more people than the number of nominees listed below. Unless

otherwise instructed, the proxy holders will vote the proxies received by them FOR the election of each of the nominees named

below, all of whom are presently directors. If any nominee is unable or declines to serve as a director at the time of the Annual General

Meeting, although we know of no reason to anticipate that this will occur, the proxies will be voted for any nominee designated by the

present Board to fill the vacancy.

The following paragraphs set forth information

regarding the current ages, positions, and business experience of the nominees.

Mr. Kin Wai Ho was appointed as

the Chairman of our Company from November 2021 to January 2023 and redesignated as Chief Executive Officer in January 2023. He was appointed

as a director of our Company in June 2021. Since February 2018, Mr. Ho co-founded and was subsequently an executive director of Sapphire

Universe, an investment holding company. Since November 2021, Mr. Ho has been a non-executive director of Fit Boxx Holdings Limited,

a retail company. From June 2017 to May 2023, Mr. Ho served as an independent director of Lapco Holdings Limited (HKEx: 8472), an environmental

hygiene service company. Mr. Ho has also served as a director of Faith Elite Limited since May 2018, Ever Sound International Limited

since December 2008, Oriental Unicorn Limited since October 2020, Ever App Limited since September 2013, Sapphire Universe Holdings Pte.

Ltd since June 2020, Primech A & P since April 2018, and HomeHelpy since November 2019. From May 2018 to November 2021, Mr. Ho served

as a vice chairman of Fit Boxx Holdings Limited, a company engaged in the sourcing, marketing, selling and distribution of a variety

of beauty device products, fitness, health care products, and other related products. From September 2015 to September 2020, Mr. Ho served

as the Chairman of the board of directors and chief executive officer of Jimu Group Limited (previously known as Ever Smart International

Holdings Limited) (HKEx: 8187), a footwear design and development, production management, and logistics management service company. From

2009 to 2015, Mr. Ho served as an executive director of Ever Smart International Enterprise Limited, a footwear trading company. From

2003 to 2009, Mr. Ho served as a sales merchandiser of Betastar Trading Limited, a footwear trading private company. From 2000 to 2001,

Mr. Ho served as a programmer at JP Morgan Chase & Co., a multinational investment bank and financial services holding company. Mr.

Ho obtained a Bachelor of Science degree in Management from the Royal Holloway and Bedford New College, University of London in 1999

and a Master of Science in Interactive Multimedia from Middlesex University in 2001.

Mr. Yew Jin Sng was appointed as

our Senior Vice President, Business Development in November 2021 and was appointed as a director of our Company in January 2023. Mr.

Sng is responsible for the management of our Group’s key clients and supporting our President in formulating strategies in respect

of client management. From April 2018 to December 2020, Mr. Sng served as the chief executive officer of Primech Services & Engrg

Pte Ltd where he oversaw the management of the company’s business operations. Mr. Sng also has been serving as a director of Primech

A & P and Primech Services & Engrg Pte Ltd since 2020 and 2013, respectively. Prior to joining us, Mr. Sng founded Megapact Agencies/Megapact

Systems Services and partnered Transmarco Group to helm a joint venture software company, Datacom Services, as its general manager, in

1983, and left Datacom in 1985 to run Megapact Agencies as the managing director. From 1970 to 1980, Mr. Sng served as a systems manager

of NCR Corporation in Singapore (NYSE: NCR), software, managed and professional services, consulting and technology company. From 1980

to 1983, Mr. Sng served as a divisional manager of Asian Computer Services Pte Ltd, a subsidiary of Haw Par Corporation. Mr. Sng obtained

a Diploma in Management Studies from the Singapore Institute of Management in 1976.

Board Diversity Matrix

This table below provides certain information

regarding the diversity of our Board of Directors as of the date of this proxy statement.

| As of July 25, 2024 |

| Country of Principal Executive Offices |

|

Singapore |

| Foreign Private Issuer |

|

Yes |

| Disclosure Prohibited Under Home Country Law |

|

No |

| Total Number of Directors |

|

5 |

| | |

Female | | |

Male | | |

Non-Binary | | |

Did Not

Disclose

Gender | |

| Part I: Gender Identity | |

| | |

| | |

| | |

| |

| Directors | |

| — | | |

| 5 | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Part II: Demographic Background | |

| | | |

| | | |

| | | |

| | |

| Underrepresented Individual in Home Country Jurisdiction | |

| — | | |

| — | | |

| — | | |

| — | |

| LGBTQ+ | |

| — | | |

| — | | |

| — | | |

| — | |

| Did Not Disclose Demographic Background | |

| — | | |

| — | | |

| — | | |

| — | |

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors

or officers has been convicted in a criminal proceeding, excluding traffic violations or similar misdemeanors, nor has any been a party

to any judicial or administrative proceeding during the past five years that resulted in a judgment, decree or final order enjoining

the person from future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation

of federal or state securities laws, except for matters that were dismissed without sanction or settlement. Except as set forth in our

discussion in “Related Party Transactions” in our Annual Report, our directors and officers have not been involved in any

transactions with us or any of our affiliates or associates which are required to be disclosed pursuant to the rules and regulations

of the SEC.

Vote Required

Each ordinary resolution under this proposal

requires affirmative (“FOR”) votes of a majority of votes cast by shares present or represented by proxy and entitled to

vote at the Annual General Meeting and voting affirmatively or negatively on such matter. Unless otherwise instructed on the proxy or

unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR” this Proposal.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT THE SHAREHOLDERS VOTE “FOR” THIS PROPOSAL.

PROPOSAL FOUR

BY AN ORDINARY RESOLUTION, TO APPROVE PAYMENT

OF DIRECTORS’ FEES OF US$77,500 FOR THE FINANCIAL YEAR ENDED MARCH 31, 2024

(ITEM 4 OF THE PROXY CARD)

Background

Pursuant to Regulation 65 of Company’s

Constitution, our shareholders must approve the compensation we pay to our directors for services rendered in their capacity as directors.

We are now asking our shareholders to approve payments to our Board of Directors for the financial year ended March 31, 2024, amounting

to US$77,500.

We believe the authorizations requested in this

Proposal Five will benefit our shareholders by enabling us to attract and retain qualified individuals to serve as members of our Board

and to continue to provide advice to, and independent oversight of, management.

Vote Required

This proposal requires affirmative (“FOR”)

votes of a majority of votes cast by shares present or represented by proxy and entitled to vote at the Annual General Meeting and voting

affirmatively or negatively on such matter. Unless otherwise instructed on the proxy or unless authority to vote is withheld, shares

represented by executed proxies will be voted “FOR” this Proposal.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT THE SHAREHOLDERS VOTE “FOR” THIS PROPOSAL.

PROPOSAL FIVE

BY AN ORDINARY RESOLUTION, TO APPROVE THE APPOINTMENT

OF WEINBERG & CO. LA, LLP AS AUDITOR OF THE COMPANY FOR THE FINANCIAL YEAR ENDING MARCH 31, 2025, AND THAT THE DIRECTORS BE EMPOWERED

TO FIX THE AUDITORS’ REMUNERATION IN THEIR ABSOLUTE DISCRETION.

(ITEM 5 ON THE PROXY CARD)

Background

We are proposing to approve the appointment of Weinberg

& Co. LA, LLP as auditor of the Company for the financial year ending March 31, 2025. The Audit Committee of the Board of Directors

has appointed Weinberg & Co. LA, LLP to serve as the auditor of the Company for the financial year 2025. Although the Company’s

governing documents do not require the submission of this matter to shareholders, the Board of Directors considers it desirable that the

appointment of Weinberg & Co. LA, LLP be approved by shareholders.

Audit services to be provided by Weinberg &

Co. LA, LLP for the financial year 2024 will include the examination of the consolidated financial statements of the Company and services

related to periodic filings made with the SEC.

A representative of Weinberg & Co. LA, LLP

is not expected to be present at the Annual General Meeting and therefore will not (i) have the opportunity to make a statement if they

so desire or (ii) be available to respond to questions from shareholders.

If the appointment of Weinberg & Co. LA, LLP is

not approved, the Audit Committee of the Board of Directors will reconsider the appointment.

Vote Required

This Proposal requires affirmative (“FOR”)

votes of a majority of votes cast by shareholders present or represented by proxy and entitled to vote at the Annual General Meeting.

Unless otherwise instructed on the proxy or unless authority to vote is withheld, shares represented by executed proxies will be voted

“FOR” this proposal.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT THE SHAREHOLDERS VOTE “FOR” THIS PROPOSAL.

PROPOSAL SIX

BY AN ORDINARY RESOLUTION, TO APPROVE THE APPOINTMENT

OF M/S PAUL WAN & CO AS AUDITOR COMPANY FOR THE FINANCIAL YEAR ENDING MARCH 31, 2025, AND THAT THE DIRECTORS BE EMPOWERED TO FIX

THE AUDITORS’ REMUNERATION IN THEIR ABSOLUTE DISCRETION.

(ITEM 6 ON THE PROXY CARD)

Background

We are proposing to approve the appointment of M/s Paul Wan & Co as

auditor of the Company for the financial year ending March 31, 2025. The Audit Committee of the Board of Directors has appointed M/s Paul

Wan & Co to serve as auditor of the Company for the financial year 2025. Although the Company’s governing documents do not require

the submission of this matter to shareholders, the Board of Directors considers it desirable that the appointment of M/s Paul Wan &

Co be approved by shareholders.

A representative of M/s Paul Wan & Co is

not expected to be present at the Annual General Meeting and therefore will not (i) have the opportunity to make a statement if they

so desire or (ii) be available to respond to questions from shareholders.

If the appointment of M/s Paul Wan & Co

is not approved, the Audit Committee of the Board of Directors will reconsider the appointment.

Vote Required

This Proposal requires affirmative (“FOR”)

votes of a majority of votes cast by shareholders present or represented by proxy and entitled to vote at the Annual General Meeting.

Unless otherwise instructed on the proxy or unless authority to vote is withheld, shares represented by executed proxies will be voted

“FOR” this proposal.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT THE SHAREHOLDERS VOTE “FOR” THIS PROPOSAL.

PROPOSAL SEVEN

BY AN ORDINARY RESOLUTION, TO ADJOURN THE

ANNUAL GENERAL MEETING TO A LATER DATE OR DATES, IF NECESSARY, TO PERMIT FURTHER SOLICITATION AND VOTE OF PROXIES IN THE EVENT THAT

THERE ARE INSUFFICIENT VOTES FOR, OR OTHERWISE IN CONNECTION WITH, THE APPROVAL OF PROPOSAL ONE, PROPOSAL TWO, PROPOSAL THREE,

PROPOSAL FOUR, PROPOSAL FIVE, AND/OR PROPOSAL SIX

(ITEM 7 ON THE PROXY CARD)

General

Proposal Seven, if adopted, will allow the Board

to adjourn the Annual General Meeting to a later date or dates to permit further solicitation of proxies. The Adjournment Proposal will

only be presented to our shareholders in the event that there are insufficient votes for, or otherwise in connection with, the approval

of Proposal One, Proposal Two, Proposal Three, Proposal Four, Proposal Five and/or Proposal Six.

If Proposal Seven is not approved by our shareholders,

the Board may not be able to adjourn the Annual General Meeting to a later date in the event that there are insufficient votes for, or

otherwise in connection with, the approval of Proposal One, Proposal Two, Proposal Three, Proposal Four, Proposal Five and/or Proposal

Six.

Vote Required

This proposal requires affirmative (“FOR”)

votes of at least a majority of votes cast by shareholders present or represented by proxy and entitled to vote at the Annual General

Meeting. Unless otherwise instructed on the proxy or unless authority to vote is withheld, shares represented by executed proxies will

be voted “FOR” this proposal.

Recommendation of the Board

THE BOARD UNANIMOUSLY RECOMMENDS THAT THE

SHAREHOLDERS VOTE “FOR” THIS PROPOSAL.

PROPOSAL EIGHT

THE AUTHORIZATION OF THE DIRECTORS OF THE COMPANY

TO ISSUE NEW ORDINARY SHARES OR TO MAKE OR GRANT OFFERS WHICH MAY REQUIRE NEW ORDINARY SHARES TO BE ISSUED

(ITEM 8 OF THE PROXY CARD)

Background

The Company is proposing to authorize the Board

of Directors to issue such number of new ordinary shares in the capital of the Company as may be approved by the board of Directors in

connection with the initial public offering of the Company at the price(s) to be determined by the Board and on such terms and conditions

as the Board may at any time and from time to time think fit, as well as issue new ordinary shares whether by way of rights, bonus or

otherwise, or to make or grant offers, agreements or options (collectively “Instruments”) that might or would require

new ordinary shares to be issued, including but not limited to the creation and issue of (as well as adjustments to) options, warrants,

debentures or other instruments convertible into new ordinary shares, at any time and upon such terms and conditions and for such purposes

and to such persons as the Directors may in their absolute discretion deem fit. This authority would further extend to the issuance of

new ordinary shares in pursuance of any Instruments made or granted by the Directors while the authorization is in force.

This is provided that:

| |

(1) |

the aggregate number of new ordinary shares to be issued pursuant to

such authority, excluding any new ordinary shares which may be issued pursuant to any adjustments (“Adjustments”),

shall be made in compliance with all applicable laws (including the Nasdaq Listing Rules) for the time being in force (unless such

compliance has been waived by the Nasdaq) and the Constitution for the time being of the Company; |

| |

|

|

| |

(2) |

in exercising such authority, the Company shall comply with all applicable

laws, including the provisions of the Act, the Nasdaq Listing Rules for the time being in force (unless such compliance has been

waived by the Nasdaq) and the Constitution for the time being of the Company; and |

| |

|

|

| |

(3) |

unless revoked or varied by the Company in a general meeting by ordinary

resolution, such authority shall continue in force until (i) the conclusion of the next annual general meeting of the Company or

(ii) the date by which the next annual general meeting of the Company is required by law to be held, whichever is earlier. |

Vote Required

This Proposal requires affirmative (“FOR”)

votes of a majority of votes cast by shareholders present or represented by proxy and entitled to vote at the Annual General Meeting.

Unless otherwise instructed on the proxy or unless authority to vote is withheld, shares represented by executed proxies will be voted

“FOR” this proposal.

Recommendation of the Board

THE BOARD UNANIMOUSLY RECOMMENDS THAT THE

SHAREHOLDERS VOTE “FOR” THIS PROPOSAL.

OTHER MATTERS

GENERAL

The Board of Directors does not know of any matters

other than those stated in this Proxy Statement that are to be presented for action at the meeting. If any other matters should properly

come before the meeting, it is intended that proxies in the accompanying form will be voted on any such other matters in accordance with

the judgment of the persons voting such proxies. Discretionary authority to vote on such matters is conferred by such proxies upon the

persons voting them.

The Company will bear the cost of preparing,

printing, assembling and mailing the proxy card, Proxy Statement and other material which may be sent to shareholders in connection with

this solicitation. It is contemplated that brokerage houses will forward the proxy materials to beneficial owners at our request. In

addition to the solicitation of proxies by use of the mails, officers and regular employees of the Company may solicit proxies without

additional compensation, by telephone or telegraph. We may reimburse brokers or other persons holding Shares in their names or the names

of their nominees for the expenses of forwarding soliciting material to their principals and obtaining their proxies.

If you have questions about the Annual General

Meeting or other information related to the proxy solicitation, you may contact the Company at +65 6286 1868.

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Shareholders wishing to communicate with the

Board of Directors or any individual director may write to the Board of Directors or the individual director at Primech Holdings Ltd,

23 Ubi Crescent, Singapore 408579. Any such communication must state the number of Shares beneficially owned by the shareholder making

the communication. All such communications will be forwarded to the Board of Directors or to any individual director or directors to

whom the communication is directed unless the communication is clearly of a marketing nature or is unduly hostile, threatening, illegal,

or similarly inappropriate, in which case the Company has the authority to discard the communication or take appropriate legal action

regarding the communication.

WHERE YOU CAN FIND MORE INFORMATION

The Company files reports and other documents

with the SEC under the Exchange Act. The Company’s SEC filings made electronically through the SEC’s EDGAR system are available

to the public at the SEC’s website at http://www.sec.gov. You may also read and copy any document we file

with the SEC at the SEC’s public reference room located at 100 F Street, NE, Room 1580, Washington, DC 20549. Please call the SEC

at (800) SEC-0330 for further information on the operation of the public reference room.

| |

By order of the Board of Directors, |

| |

|

| |

/s/ Kin Wai Ho |

| |

Kin Wai Ho |

| |

Chief Executive Officer |

Exhibit

99.2

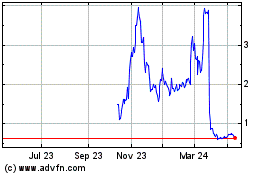

Primech (NASDAQ:PMEC)

Historical Stock Chart

From Oct 2024 to Nov 2024

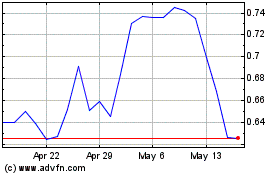

Primech (NASDAQ:PMEC)

Historical Stock Chart

From Nov 2023 to Nov 2024