Pool Corporation Provides Swimming Pool Season Update and Revises 2024 Guidance

25 June 2024 - 6:01AM

Pool Corporation (Nasdaq/GSM:POOL) today provided an update on the

swimming pool season and revised its 2024 earnings guidance. The

second quarter and full year expected results outlined below are

based on preliminary data and analysis and are subject to change

based on the completion of the company’s quarter-end close

processes.

“As we near completion of the second quarter,

which passes over the traditional peak of the swimming pool season

from late May to early June, we are providing an update on current

trends and their expected impact on our results. The most recent

pool permit data suggests persistently weak demand for new pool

construction, and with the peak selling season almost complete, we

now believe that new pool construction activity could be down 15%

to 20% for the year with remodel activity down as much as 15%. With

more than 60% of our business derived from recurring revenues and

generally not impacted by macroeconomic conditions, we are heavily

focused on managing controllable expenses and generating free cash

flow while providing best-in-class service to all of our customers.

We remain committed to our ongoing improvements in operational

initiatives, increasing productivity and growing share through

organic growth of our expansive sales center network and

offerings,” commented Peter D. Arvan, president and CEO.

For the year-to-date period, our sales are

trending down approximately 6.5% from the comparable period in

2023. The discretionary components of our business, which are the

most affected by general economic conditions, have been challenged

by cautious consumer spending on big ticket items like swimming

pools and outdoor living projects resulting in sales of building

materials declining 11% for the year compared to the same period in

2023. However, we are encouraged as maintenance-related product

sales have remained stable, evidenced by volume growth in

chemicals, and equipment sales (excluding cleaners) being down only

2% for the year, an improvement from the 3% decline realized in the

first quarter of 2024.

Given the significance of the second quarter to

our full year results, we have revised our expectations, as further

described below, for the second quarter and the 2024 fiscal year as

we do not expect to see meaningful positive change in discretionary

categories through the remainder of 2024.

- We now believe

that new pool units could be down 15% to 20% in 2024, and

remodeling activity for 2024 may be down as much as 15% compared to

our previous estimate of flat to down 10% compared to 2023.

- With the

seasonal weighting of our business, we expect that the lower level

of sales will impact second quarter results more significantly,

resulting in expected earnings per diluted share in the range of

$4.85 to $4.95.

- For the full

year, we lowered our projected diluted EPS range to $11.04 to

$11.44 per share from $13.19 to $14.19, both including our $0.19

first quarter 2024 tax benefit.

- Our second

quarter range and revised annual range do not include additional

tax benefits related to stock option exercises that may be realized

after March 31, 2024.

“Despite the recent trends dampening

discretionary spending, we continue to believe that the desire for

swimming pools and outdoor living projects remains strong, which

allows our industry to grow over time as new pools are added to the

installed base every year. We are confident that the strategic

investments in our business position us for growth coming out of

this economic cycle and are allowing us to continue to gain market

share by providing unmatched value to our customers and suppliers,”

said Arvan.

POOLCORP will release its second quarter 2024

earnings results before the market opens on July 25, 2024, and will

hold a conference call to discuss the results at 10:00 a.m. Central

Time (11:00 a.m. Eastern Time) that same day.

About Pool Corporation

POOLCORP is the world’s largest wholesale

distributor of swimming pool and related backyard products.

POOLCORP operates approximately 440 sales centers in North America,

Europe and Australia, through which it distributes more than

200,000 products to roughly 125,000 wholesale customers. For more

information, please visit www.poolcorp.com.

Forward-Looking Statements

This news release includes “forward-looking”

statements that involve risks and uncertainties that are generally

identifiable through the use of words such as “believe,” “expect,”

“anticipate,” “intend,” “plan,” “estimate,” “project,” “should,”

“will,” “may,” and similar expressions and include projections of

earnings. The forward-looking statements in this release are made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements speak

only as of the date of this release, and we undertake no obligation

to update or revise such statements to reflect new circumstances or

unanticipated events as they occur. Actual results may differ

materially due to a variety of factors, including the sensitivity

of our business to weather conditions; changes in economic

conditions, consumer discretionary spending, the housing market,

inflation or interest rates; our ability to maintain favorable

relationships with suppliers and manufacturers; the extent to which

home-centric trends will continue to moderate or reverse;

competition from other leisure product alternatives or mass

merchants; our ability to continue to execute our growth

strategies; changes in the regulatory environment; new or

additional taxes, duties or tariffs; excess tax benefits or

deficiencies recognized under ASU 2016-09 and other risks detailed

in POOLCORP’s 2023 Annual Report on Form 10-K, Quarterly Reports on

Form 10-Q and other reports and filings filed with the Securities

and Exchange Commission (SEC) as updated by POOLCORP's subsequent

filings with the SEC.

Investor Relations Contacts:

Kristin S. Byars985.801.5153kristin.byars@poolcorp.com

Curtis J. Scheel985.801.5341curtis.scheel@poolcorp.com

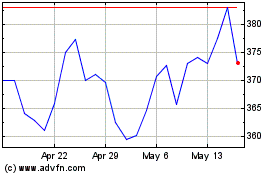

Pool (NASDAQ:POOL)

Historical Stock Chart

From Jan 2025 to Feb 2025

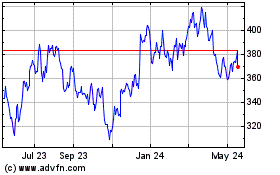

Pool (NASDAQ:POOL)

Historical Stock Chart

From Feb 2024 to Feb 2025