Form 8-K - Current report

07 February 2025 - 8:08AM

Edgar (US Regulatory)

0000833640false00008336402025-02-062025-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 6, 2025

______________

Power Integrations, Inc.

(Exact name of registrant as specified in its charter)

______________

| | | | |

| | | | |

(State or other jurisdiction | | | | |

| | | | |

5245 Hellyer Avenue

San Jose, California 95138-1002

(Address of principal executive offices, including zip code)

Registrant's telephone number, including area code (408) 414-9200

______________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

| | | | Name of each exchange on which registered |

Common Stock, $0.001 Par Value | | | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

Emerging growth company | ☐ |

| |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02. Results of Operations and Financial Condition.

On February 6, 2025 the Registrant issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | |

| | Power Integrations, Inc. |

| | | |

Dated: | February 6, 2025 | By: | /s/ SANDEEP NAYYAR |

| | | Sandeep Nayyar |

| | | Chief Financial Officer |

Power Integrations Reports Fourth-Quarter and Full-Year Financial Results

Quarterly revenues increased 18 percent year-over-year to $105.2 million ; GAAP earnings were $0.16 per diluted share; non-GAAP earnings were $0.30 per diluted share

SAN JOSE, CALIF. – February 6, 2025 – Power Integrations (NASDAQ: POWI) today announced financial results for the quarter and year ended December 31, 2024. Net revenues for the fourth quarter were $105.2 million, down nine percent from the prior quarter and up 18 percent from the fourth quarter of 2023. GAAP net income for the fourth quarter was $9.1 million or $0.16 per diluted share compared to $0.25 per diluted share in the prior quarter and $0.25 per diluted share in the fourth quarter of 2023. Cash flow from operations for the fourth quarter was $14.7 million.

In addition to its GAAP results, the company provided non-GAAP measures that exclude stock-based compensation, amortization of acquisition-related intangible assets and the related tax effects. Non-GAAP net income for the fourth quarter of 2024 was $17.2 million or $0.30 per diluted share compared to $0.40 per diluted share in the prior quarter and $0.22 per diluted share in the fourth quarter of 2023. A reconciliation of GAAP to non-GAAP financial results is included with the tables accompanying this press release.

For the full year, net revenues were $419.0 million, compared to $444.5 million in the prior year. Full-year GAAP net income was $32.2 million or $0.56 per diluted share, compared to $0.97 per diluted share in the prior year. Non-GAAP net income was $1.16 per diluted share, compared to $1.29 per diluted share in the prior year. Cash flow from operations for the full year was $81.2 million.

Commented Balu Balakrishnan, chairman and CEO of Power Integrations: “Fourth-quarter revenues were up 18 percent year-over-year, and we expect another double-digit increase in the first quarter. While the demand outlook is cloudy, especially in light of uncertainty around trade policy, we expect growth in a variety of end-markets in 2025, including renewable energy, high-voltage DC transmission, metering, automotive, appliances and more. Products featuring our proprietary PowiGaN™ technology should contribute significant growth this year as adoption accelerates across a broad set of high-voltage power-conversion applications.”

Additional Highlights

| ● | Power Integrations paid a dividend of $0.21 per share on December 31, 2024. A dividend of $0.21 per share will be paid on March 31, 2025, to stockholders of record as of February 28, 2025. |

| ● | The company utilized $1.9 million for share repurchases during the fourth quarter, leaving $48.1 million remaining on its repurchase authorization as of December 31. |

Financial Outlook

The company issued the following forecast for the first quarter of 2025:

| ● | Revenues are expected to be flat compared to the fourth quarter of 2024, plus or minus five percent. |

| ● | GAAP gross margin is expected to be between 55 percent and 55.5 percent, and non-GAAP gross margin is expected to be between 55.5 percent and 56 percent. The difference between GAAP and non-GAAP is primarily attributable to stock-based compensation, with a smaller impact from amortization of acquisition-related intangible assets. |

| ● | GAAP operating expenses are expected to be approximately $54 million; non-GAAP operating expenses are expected to be approximately $45 million. Non-GAAP operating expenses are expected to exclude approximately $9 million of stock-based compensation. |

Conference Call Today at 1:30 p.m. Pacific Time

Power Integrations management will hold a conference call today at 1:30 p.m. Pacific time. A live webcast of the call will be available on the investor section of the company's website, http://investors.power.com. Members of the investment community can register for the conference call by visiting https://emportal.ink/3C0h3y6.

About Power Integrations

Power Integrations, Inc. is a leading innovator in semiconductor technologies for high-voltage power conversion. The company’s products are key building blocks in the clean-power ecosystem, enabling the generation of renewable energy as well as the efficient transmission and consumption of power in applications ranging from milliwatts to megawatts. For more information, please visit www.power.com.

Note Regarding Use of Non-GAAP Financial Measures

In addition to the company's consolidated financial statements, which are presented according to GAAP, the company provides certain non-GAAP financial information that excludes stock-based compensation expenses recorded under ASC 718-10, amortization of acquisition-related intangible assets and the tax effects of these items. The company uses these measures in its financial and operational decision-making and, with respect to one measure, in setting performance targets for compensation purposes. The company believes that these non-GAAP measures offer important analytical tools to help investors understand its operating results, and to facilitate comparability with the results of companies that provide similar measures. Non-GAAP measures have limitations as analytical tools and are not meant to be considered in isolation or as a substitute for GAAP financial information. For example, stock-based compensation is an important component of the company’s compensation mix and will continue to result in significant expenses in the company’s GAAP results for the foreseeable future but is not reflected in the non-GAAP measures. Also, other companies, including companies in Power Integrations’ industry, may calculate non-GAAP measures differently, limiting their usefulness as comparative measures. Reconciliations of non-GAAP measures to GAAP measures are attached to this press release.

Note Regarding Forward-Looking Statements

The above statements regarding the company’s forecast for its first-quarter financial performance and expectation of growth across a wide range of applications in 2025 are forward-looking statements reflecting management's current expectations and beliefs. These statements are based on current information that is, by its nature, subject to rapid and even abrupt change. Due to risks and uncertainties associated with the company's business, actual results could differ materially from those projected or implied by these statements. These risks and uncertainties include, but are not limited to: the company’s ability to supply products and its ability to conduct other aspects of its business such as competing for new design wins; changes in global economic and geopolitical conditions, including such factors as inflation, armed conflicts and trade negotiations, which may impact the level of demand for the company’s products; potential changes and shifts in customer demand away from end products that utilize the company's integrated circuits to end products that do not incorporate the company's products; the effects of competition, which may cause the company’s revenues to decrease or cause the company to decrease its selling prices for its products; unforeseen costs and expenses; and unfavorable fluctuations in component costs or operating expenses resulting from changes in commodity prices and/or exchange rates. In addition, new product introductions and design wins are subject to the risks and uncertainties that typically accompany development and delivery of complex technologies to the marketplace, including product development delays and defects and market acceptance of the new products. These and other risk factors that may cause actual results to differ are more fully explained under the caption “Risk Factors” in the company's most recent Annual Report on Form 10-K, filed with the Securities and Exchange Commission on February 12, 2024. The company is under no obligation (and expressly disclaims any obligation) to update or alter its forward-looking statements, whether because of new information, future events or otherwise, except as otherwise required by law.

Power Integrations, PowiGaN and the Power Integrations logo are trademarks or registered trademarks of Power Integrations, Inc. All other trademarks are property of their respective owners.

POWER INTEGRATIONS, INC.

CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per-share amounts)

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | December 31,

2024 | | December 31,

2023 |

NET REVENUES | | $ | 105,250 | | $ | 115,837 | | $ | 89,507 | | $ | 418,973 | | $ | 444,538 |

| | | | | | | | | | | | | | | |

COST OF REVENUES | | | 47,983 | | | 52,666 | | | 43,299 | | | 194,222 | | | 215,582 |

| | | | | | | | | | | | | | | |

GROSS PROFIT | | | 57,267 | | | 63,171 | | | 46,208 | | | 224,751 | | | 228,956 |

| | | | | | | | | | | | | | | |

OPERATING EXPENSES: | | | | | | | | | | | | | | | |

Research and development | | | 25,689 | | | 25,829 | | | 23,505 | | | 100,790 | | | 96,067 |

Sales and marketing | | | 16,931 | | | 17,119 | | | 15,472 | | | 67,825 | | | 64,598 |

General and administrative | | | 10,728 | | | 8,641 | | | 8,282 | | | 38,207 | | | 33,232 |

Total operating expenses | | | 53,348 | | | 51,589 | | | 47,259 | | | 206,822 | | | 193,897 |

| | | | | | | | | | | | | | | |

INCOME (LOSS) FROM OPERATIONS | | | 3,919 | | | 11,582 | | | (1,051) | | | 17,929 | | | 35,059 |

| | | | | | | | | | | | | | | |

OTHER INCOME | | | 3,384 | | | 2,750 | | | 3,282 | | | 12,825 | | | 10,848 |

| | | | | | | | | | | | | | | |

INCOME BEFORE INCOME TAXES | | | 7,303 | | | 14,332 | | | 2,231 | | | 30,754 | | | 45,907 |

| | | | | | | | | | | | | | | |

PROVISION (BENEFIT) FOR INCOME TAXES | | | (1,837) | | | 41 | | | (12,040) | | | (1,480) | | | (9,828) |

| | | | | | | | | | | | | | | |

NET INCOME | | $ | 9,140 | | $ | 14,291 | | $ | 14,271 | | $ | 32,234 | | $ | 55,735 |

| | | | | | | | | | | | | | | |

EARNINGS PER SHARE: | | | | | | | | | | | | | | | |

Basic | | $ | 0.16 | | $ | 0.25 | | $ | 0.25 | | $ | 0.57 | | $ | 0.97 |

Diluted | | $ | 0.16 | | $ | 0.25 | | $ | 0.25 | | $ | 0.56 | | $ | 0.97 |

| | | | | | | | | | | | | | | |

SHARES USED IN PER-SHARE CALCULATION: | | | | | | | | | | | | | | | |

Basic | | | 56,848 | | | 56,817 | | | 56,937 | | | 56,820 | | | 57,195 |

Diluted | | | 57,097 | | | 57,004 | | | 57,272 | | | 57,130 | | | 57,622 |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

SUPPLEMENTAL INFORMATION: | | Three Months Ended | | Twelve Months Ended |

| | December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | December 31,

2024 | | December 31,

2023 |

Stock-based compensation expenses included in: | | | | | | | | | | | | | | | |

Cost of revenues | | $ | 541 | | $ | 496 | | $ | 499 | | $ | 2,090 | | $ | 1,692 |

Research and development | | | 3,280 | | | 2,997 | | | 2,947 | | | 12,587 | | | 10,939 |

Sales and marketing | | | 2,074 | | | 1,876 | | | 1,827 | | | 8,064 | | | 6,888 |

General and administrative | | | 3,394 | | | 2,969 | | | 2,230 | | | 12,335 | | | 9,009 |

Total stock-based compensation expense | | $ | 9,289 | | $ | 8,338 | | $ | 7,503 | | $ | 35,076 | | $ | 28,528 |

| | | | | | | | | | | | | | | |

Cost of revenues includes: | | | | | | | | | | | | | | | |

Amortization of acquisition-related intangible assets | | $ | 147 | | $ | 147 | | $ | 482 | | $ | 1,034 | | $ | 1,928 |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | December 31,

2024 | | December 31,

2023 |

REVENUE MIX BY END MARKET | | | | | | | | | | | | | | | |

Communications | | | 13% | | | 12% | | | 27% | | | 12% | | | 29% |

Computer | | | 15% | | | 14% | | | 9% | | | 14% | | | 12% |

Consumer | | | 37% | | | 38% | | | 29% | | | 39% | | | 27% |

Industrial | | | 35% | | | 36% | | | 35% | | | 35% | | | 32% |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

POWER INTEGRATIONS, INC. |

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO GAAP RESULTS |

(in thousands, except per-share amounts) |

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | December 31,

2024 | | December 31,

2023 |

RECONCILIATION OF GROSS PROFIT | | | | | | | | | | | | | | | |

GAAP gross profit | | $ | 57,267 | | $ | 63,171 | | $ | 46,208 | | $ | 224,751 | | $ | 228,956 |

GAAP gross margin | | | 54.4% | | | 54.5% | | | 51.6% | | | 53.6% | | | 51.5% |

| | | | | | | | | | | | | | | |

Stock-based compensation included in cost of revenues | | | 541 | | | 496 | | | 499 | | | 2,090 | | | 1,692 |

Amortization of acquisition-related intangible assets | | | 147 | | | 147 | | | 482 | | | 1,034 | | | 1,928 |

| | | | | | | | | | | | | | | |

Non-GAAP gross profit | | $ | 57,955 | | $ | 63,814 | | $ | 47,189 | | $ | 227,875 | | $ | 232,576 |

Non-GAAP gross margin | | | 55.1% | | | 55.1% | | | 52.7% | | | 54.4% | | | 52.3% |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | December 31,

2024 | | December 31,

2023 |

RECONCILIATION OF OPERATING EXPENSES | | | | | | | | | | | | | | | |

GAAP operating expenses | | $ | 53,348 | | $ | 51,589 | | $ | 47,259 | | $ | 206,822 | | $ | 193,897 |

| | | | | | | | | | | | | | | |

Less: Stock-based compensation expense included in operating expenses | | | | | | | | | | | | | | | |

Research and development | | | 3,280 | | | 2,997 | | | 2,947 | | | 12,587 | | | 10,939 |

Sales and marketing | | | 2,074 | | | 1,876 | | | 1,827 | | | 8,064 | | | 6,888 |

General and administrative | | | 3,394 | | | 2,969 | | | 2,230 | | | 12,335 | | | 9,009 |

Total | | | 8,748 | | | 7,842 | | | 7,004 | | | 32,986 | | | 26,836 |

| | | | | | | | | | | | | | | |

Non-GAAP operating expenses | | $ | 44,600 | | $ | 43,747 | | $ | 40,255 | | $ | 173,836 | | $ | 167,061 |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | December 31,

2024 | | December 31,

2023 |

RECONCILIATION OF INCOME FROM OPERATIONS | | | | | | | | | | | | | | | |

GAAP income (loss) from operations | | $ | 3,919 | | $ | 11,582 | | $ | (1,051) | | $ | 17,929 | | $ | 35,059 |

GAAP operating margin | | | 3.7% | | | 10.0% | | | –1.2% | | | 4.3% | | | 7.9% |

| | | | | | | | | | | | | | | |

Add: Total stock-based compensation | | | 9,289 | | | 8,338 | | | 7,503 | | | 35,076 | | | 28,528 |

Amortization of acquisition-related intangible assets | | | 147 | | | 147 | | | 482 | | | 1,034 | | | 1,928 |

| | | | | | | | | | | | | | | |

Non-GAAP income from operations | | $ | 13,355 | | $ | 20,067 | | $ | 6,934 | | $ | 54,039 | | $ | 65,515 |

Non-GAAP operating margin | | | 12.7% | | | 17.3% | | | 7.7% | | | 12.9% | | | 14.7% |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | December 31,

2024 | | December 31,

2023 |

RECONCILIATION OF PROVISION FOR INCOME TAXES | | | | | | | | | | | | | | | |

GAAP provision (benefit) for income taxes | | $ | (1,837) | | $ | 41 | | $ | (12,040) | | $ | (1,480) | | $ | (9,828) |

GAAP effective tax rate | | | –25.2% | | | 0.3% | | | –539.7% | | | –4.8% | | | –21.4% |

| | | | | | | | | | | | | | | |

Tax effect of adjustments to GAAP results | | | (1,366) | | | (160) | | | (9,556) | | | (2,153) | | | (11,653) |

| | | | | | | | | | | | | | | |

Non-GAAP provision (benefit) for income taxes | | $ | (471) | | $ | 201 | | $ | (2,484) | | $ | 673 | | $ | 1,825 |

Non-GAAP effective tax rate | | | –2.8% | | | 0.9% | | | –24.3% | | | 1.0% | | | 2.4% |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | December 31,

2024 | | December 31,

2023 |

RECONCILIATION OF NET INCOME PER SHARE (DILUTED) | | | | | | | | | | | | | | | |

GAAP net income | | $ | 9,140 | | $ | 14,291 | | $ | 14,271 | | $ | 32,234 | | $ | 55,735 |

| | | | | | | | | | | | | | | |

Adjustments to GAAP net income | | | | | | | | | | | | | | | |

Stock-based compensation | | | 9,289 | | | 8,338 | | | 7,503 | | | 35,076 | | | 28,528 |

Amortization of acquisition-related intangible assets | | | 147 | | | 147 | | | 482 | | | 1,034 | | | 1,928 |

Tax effect of items excluded from non-GAAP results | | | (1,366) | | | (160) | | | (9,556) | | | (2,153) | | | (11,653) |

| | | | | | | | | | | | | | | |

Non-GAAP net income | | $ | 17,210 | | $ | 22,616 | | $ | 12,700 | | $ | 66,191 | | $ | 74,538 |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Average shares outstanding for calculation of non-GAAP net income per share (diluted) | | | 57,097 | | | 57,004 | | | 57,272 | | | 57,130 | | | 57,622 |

| | | | | | | | | | | | | | | |

Non-GAAP net income per share (diluted) | | $ | 0.30 | | $ | 0.40 | | $ | 0.22 | | $ | 1.16 | | $ | 1.29 |

| | | | | | | | | | | | | | | |

GAAP net income per share (diluted) | | $ | 0.16 | | $ | 0.25 | | $ | 0.25 | | $ | 0.56 | | $ | 0.97 |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

POWER INTEGRATIONS, INC. |

CONSOLIDATED BALANCE SHEETS |

(in thousands) |

| | | | | | | | | | | | | | | |

| | | | | | December 31,

2024 | | September 30,

2024 | | December 31,

2023 |

ASSETS | | | | | | | | | | | | | | | |

CURRENT ASSETS: | | | | | | | | | | | | | | | |

Cash and cash equivalents | | | | | | | | $ | 50,972 | | $ | 58,469 | | $ | 63,929 |

Short-term marketable securities | | | | | | | | | 249,023 | | | 245,282 | | | 247,640 |

Accounts receivable, net | | | | | | | | | 27,172 | | | 16,634 | | | 14,674 |

Inventories | | | | | | | | | 165,612 | | | 167,680 | | | 163,164 |

Prepaid expenses and other current assets | | | | | | | | | 21,260 | | | 19,821 | | | 22,193 |

Total current assets | | | | | | | | | 514,039 | | | 507,886 | | | 511,600 |

| | | | | | | | | | | | | | | |

PROPERTY AND EQUIPMENT, net | | | | | | | | | 149,562 | | | 153,313 | | | 164,213 |

INTANGIBLE ASSETS, net | | | | | | | | | 8,075 | | | 8,283 | | | 4,424 |

GOODWILL | | | | | | | | | 95,271 | | | 95,271 | | | 91,849 |

DEFERRED TAX ASSETS | | | | | | | | | 36,485 | | | 36,393 | | | 28,325 |

OTHER ASSETS | | | | | | | | | 25,394 | | | 23,845 | | | 19,457 |

Total assets | | | | | | | | $ | 828,826 | | $ | 824,991 | | $ | 819,868 |

| | | | | | | | | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | | | | | | | | |

CURRENT LIABILITIES: | | | | | | | | | | | | | | | |

Accounts payable | | | | | | | | $ | 29,789 | | $ | 27,091 | | $ | 26,390 |

Accrued payroll and related expenses | | | | | | | | | 13,987 | | | 13,337 | | | 13,551 |

Taxes payable | | | | | | | | | 961 | | | 1,063 | | | 1,016 |

Other accrued liabilities | | | | | | | | | 10,580 | | | 9,267 | | | 7,910 |

Total current liabilities | | | | | | | | | 55,317 | | | 50,758 | | | 48,867 |

| | | | | | | | | | | | | | | |

LONG-TERM LIABILITIES: | | | | | | | | | | | | | | | |

Income taxes payable | | | | | | | | | 3,871 | | | 6,351 | | | 6,244 |

Other liabilities | | | | | | | | | 19,866 | | | 18,669 | | | 12,516 |

Total liabilities | | | | | | | | | 79,054 | | | 75,778 | | | 67,627 |

| | | | | | | | | | | | | | | |

STOCKHOLDERS' EQUITY: | | | | | | | | | | | | | | | |

Common stock | | | | | | | | | 22 | | | 22 | | | 23 |

Additional paid-in capital | | | | | | | | | 18,734 | | | 11,347 | | | — |

Accumulated other comprehensive income (loss) | | | | | | | | | (3,023) | | | 1,008 | | | (1,462) |

Retained earnings | | | | | | | | | 734,039 | | | 736,836 | | | 753,680 |

Total stockholders' equity | | | | | | | | | 749,772 | | | 749,213 | | | 752,241 |

Total liabilities and stockholders' equity | | | | | | | | $ | 828,826 | | $ | 824,991 | | $ | 819,868 |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

POWER INTEGRATIONS, INC. |

CONSOLIDATED STATEMENTS OF CASH FLOWS |

(in thousands) |

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | December 31,

2024 | | December 31,

2023 |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | | | | | | | | |

Net income | | $ | 9,140 | | $ | 14,291 | | $ | 14,271 | | $ | 32,234 | | $ | 55,735 |

Adjustments to reconcile net income to cash provided by operating activities | | | | | | | | | | | | | | | |

Depreciation | | | 7,743 | | | 8,454 | | | 8,887 | | | 33,303 | | | 35,203 |

Amortization of intangible assets | | | 208 | | | 208 | | | 543 | | | 1,279 | | | 2,173 |

Loss on disposal of property and equipment | | | 24 | | | 208 | | | 14 | | | 240 | | | 100 |

Stock-based compensation expense | | | 9,289 | | | 8,338 | | | 7,503 | | | 35,076 | | | 28,528 |

Accretion of discount on marketable securities | | | (385) | | | (343) | | | (497) | | | (1,637) | | | (351) |

Deferred income taxes | | | 336 | | | (5,206) | | | 705 | | | (8,352) | | | (9,247) |

Increase (decrease) in accounts receivable allowance for credit losses | | | 214 | | | (785) | | | — | | | (245) | | | (454) |

Change in operating assets and liabilities: | | | | | | | | | | | | | | | |

Accounts receivable | | | (10,752) | | | 523 | | | 13,865 | | | (12,253) | | | 6,616 |

Inventories | | | 2,068 | | | 2,204 | | | (12,918) | | | (2,448) | | | (27,744) |

Prepaid expenses and other assets | | | (1,613) | | | 3,542 | | | (346) | | | 4,001 | | | (1,183) |

Accounts payable | | | 1,540 | | | 2,031 | | | (2,553) | | | 3,454 | | | (5,435) |

Taxes payable and other accrued liabilities | | | (3,086) | | | (546) | | | (13,207) | | | (3,471) | | | (18,182) |

Net cash provided by operating activities | | | 14,726 | | | 32,919 | | | 16,267 | | | 81,181 | | | 65,759 |

| | | | | | | | | | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | | | | | | | | |

Purchases of property and equipment | | | (3,045) | | | (5,731) | | | (6,143) | | | (17,286) | | | (20,884) |

Purchases of marketable securities | | | (8,135) | | | (19,751) | | | (18,196) | | | (105,716) | | | (191,211) |

Proceeds from sales and maturities of marketable securities | | | 2,796 | | | 18,414 | | | 36,045 | | | 106,602 | | | 197,942 |

Acquisition | | | — | | | (9,520) | | | — | | | (9,520) | | | — |

Net cash provided by (used) in investing activities | | | (8,384) | | | (16,588) | | | 11,706 | | | (25,920) | | | (14,153) |

| | | | | | | | | | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | | | | | | | | |

Net proceeds from issuance of common stock | | | — | | | 3,009 | | | — | | | 5,700 | | | 6,237 |

Repurchase of common stock | | | (1,902) | | | — | | | (47,444) | | | (27,881) | | | (55,278) |

Payments of dividends to stockholders | | | (11,937) | | | (11,364) | | | (11,343) | | | (46,037) | | | (44,008) |

Net cash used in financing activities | | | (13,839) | | | (8,355) | | | (58,787) | | | (68,218) | | | (93,049) |

| | | | | | | | | | | | | | | |

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | | | (7,497) | | | 7,976 | | | (30,814) | | | (12,957) | | | (41,443) |

| | | | | | | | | | | | | | | |

CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | | | 58,469 | | | 50,493 | | | 94,743 | | | 63,929 | | | 105,372 |

| | | | | | | | | | | | | | | |

CASH AND CASH EQUIVALENTS AT END OF PERIOD | | $ | 50,972 | | $ | 58,469 | | $ | 63,929 | | $ | 50,972 | | $ | 63,929 |

Contacts

Joe Shiffler

Power Integrations, Inc.

(408) 414-8528

joe@power.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

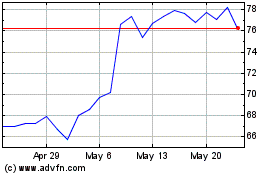

Power Integrations (NASDAQ:POWI)

Historical Stock Chart

From Jan 2025 to Feb 2025

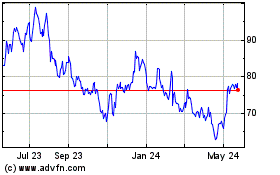

Power Integrations (NASDAQ:POWI)

Historical Stock Chart

From Feb 2024 to Feb 2025