Powell Industries, Inc. (NASDAQ: POWL), a leading supplier of

custom-engineered solutions for the management, control and

distribution of electrical energy, today announced results for the

first quarter fiscal 2025 ended December 31, 2024. All comparisons

are to the first quarter of fiscal 2024, unless otherwise noted.

First Quarter Key Financial

Highlights:

- Revenues totaled $241 million, an

increase of 24%;

- Gross profit of $60 million, or

24.7% of revenue;

- Net income of $35 million, or $2.86

per diluted share, increased 44%;

- New orders(1) totaled $269

million;

- Backlog(2) as of December 31, 2024

remained at $1.3 billion;

- Cash and short-term investments as

of December 31, 2024 totaled $373 million.

Brett A. Cope, Powell’s Chairman and Chief

Executive Officer, stated, “Powell recorded a strong start to

Fiscal 2025 highlighted by new order growth of 36%. We saw strong

order activity across each of our market sectors, as our Electric

Utility and Oil & Gas markets continue to benefit from robust

tailwinds that support our expectation for volume growth in 2025.

We were awarded a large LNG project situated along the U.S. Gulf

Coast during the quarter as we expect this market sector to see

improved activity levels relative to Fiscal 2024. Revenue also grew

24% and we delivered earnings per diluted share of $2.86 despite

what is typically a seasonally softer first quarter. Overall, we

remain very encouraged by both our backlog as well as the volume

and composition of projects in our pipeline.”

First Quarter Fiscal 2025

Results Revenues totaled $241.4 million,

an increase of 24% compared to $194.0 million in the prior year,

and a 12% decline compared to $275.1 million in the fourth quarter

of Fiscal 2024, as the first quarter has historically been

seasonally lower than the remainder of the fiscal year. The

increase compared to the prior year was driven by higher revenue

levels across all major market sectors. Revenue from the Oil &

Gas sector increased 14% to $95.7 million, while revenue from the

Electric Utility and Commercial & Other Industrial sectors grew

26% to $51.2 million and 80% to $44.3 million, respectively.

Gross profit of $59.5 million, or 24.7% of

revenue, increased 24% compared to $48.2 million, or 24.8% of

revenue, in the prior year, but decreased 26% compared to $80.4

million, or 29.2% of revenue, in the fourth quarter. Gross margin

improved compared to the prior year, primarily due to higher

revenues with the gross profit margin percentage remaining flat,

while the sequential decline in gross margin was mainly driven by

typical seasonality we have historically experienced during the

first fiscal quarter.

New orders totaled $269 million compared to $198

million in the prior year and $267 million in the fourth quarter.

The growth compared to the prior year was driven by robust order

activity in the Oil & Gas market sector as well as strong

bookings within the Electric Utility market sector.

Backlog totaled $1.3 billion as of December 31,

2024, essentially remaining the same as the backlog at both

September 30, 2024 and December 31, 2023.

Net income of $34.8 million, or $2.86 per

diluted share, increased 44% compared to $24.1 million, or $1.98

per diluted share, in the prior year, and decreased 25% compared to

$46.1 million, or $3.77 per diluted share, in the fourth

quarter.

Cope added, “Our planned manufacturing capacity

upgrades remain on track to be completed during the middle of

fiscal 2025, which will help to facilitate organic growth within

our targeted markets and commercialize new products. Our

diversification efforts continue to present new opportunities and

awards for Powell across markets such as data centers, utilities,

carbon capture, hydrogen, and more. As a result, our backlog today

is more diverse across market sectors than ever before,

increasingly comprised of rapidly expanding applications for our

custom-engineered products.”

OUTLOOK

Commenting on the Company's outlook, Michael

Metcalf, Powell’s Chief Financial Officer, said, “As we look ahead

to the remainder of Fiscal 2025, we are encouraged by the sustained

commercial momentum across our end markets through the first fiscal

quarter, which has allowed us to maintain both the quality and

quantity of our backlog. Combined with our ongoing focus on

optimizing margin levers and the strength of our balance sheet,

Powell is well-positioned to deliver robust revenue and earnings

throughout the rest of Fiscal 2025.”

CONFERENCE CALL Powell

Industries has scheduled a conference call for Friday, February 7,

2025 at 11:00 a.m. Eastern time. To participate in the

conference call, dial 1-833-953-2431 (domestic) or 1-412-317-5760

(international) at least 10 minutes before the call begins and ask

for the Powell Industries conference call. A telephonic replay of

the conference call will be available through February 14, 2025 and

may be accessed by calling 1-877-344-7529 (domestic) or

1-412-317-0088 (international) and using passcode 2987033#.

Investors, analysts and the general public will

also have the opportunity to listen to the conference call over the

Internet by visiting powellind.com. To listen to the live call on

the web, please visit the website at least 15 minutes before the

call begins to register, download and install any necessary audio

software. For those who cannot listen to the live webcast, an

archive will be available shortly after the call and will remain

available for approximately 90 days at powellind.com.

About Powell IndustriesPowell

Industries, Inc., headquartered in Houston, Texas, develops,

designs, manufactures and services custom-engineered equipment and

systems that distribute, control and monitor the flow of electrical

energy and provide protection to motors, transformers and other

electrically powered equipment. Powell Industries, Inc. primarily

serves the oil and gas and petrochemical markets, the electric

utility market, and commercial and other industrial markets. Beyond

these major markets, we also provide products and services to the

light rail traction power market and other markets that include

universities and government entities. We are continuously

developing new channels to electrical markets through original

equipment manufacturers and distribution market channels. For more

information, please visit powellind.com.

Any forward-looking statements in the preceding

paragraphs of this release, including those related to our outlook,

are made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Investors are cautioned

that such forward-looking statements involve risks and

uncertainties in that actual results may differ materially from

those projected in the forward-looking statements. In the course of

operations, we are subject to certain risk factors, competition and

competitive pressures, sensitivity to general economic and

industrial conditions, international political and economic risks,

availability and price of raw materials and execution of business

strategy. For further information, please refer to the Company's

filings with the Securities and Exchange Commission, copies of

which are available from the Company without charge.

POWELL INDUSTRIES, INC. &

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

| |

Three Months Ended December 31, |

| |

2024 |

|

2023 |

|

(In thousands, except per share data) |

|

|

|

| |

(Unaudited) |

| |

|

|

|

|

Revenues |

$ |

241,431 |

|

|

$ |

194,017 |

|

| Cost of goods sold |

181,907 |

|

|

145,823 |

|

| Gross profit |

|

59,524 |

|

|

|

48,194 |

|

| |

|

|

|

| Selling, general and

administrative expenses |

21,476 |

|

|

20,347 |

|

| Research and development

expenses |

2,476 |

|

|

1,967 |

|

| Operating income |

35,572 |

|

|

25,880 |

|

| |

|

|

|

| Other expenses (income): |

|

|

|

| Interest income, net |

(3,865) |

|

|

(3,998) |

|

| Income before income taxes |

39,437 |

|

|

29,878 |

|

| |

|

|

|

| Income tax provision |

4,674 |

|

|

5,793 |

|

| |

|

|

|

| Net income |

$ |

34,763 |

|

|

$ |

24,085 |

|

| |

|

|

|

| Earnings per share: |

|

|

|

|

Basic |

$ |

2.89 |

|

|

$ |

2.02 |

|

|

Diluted |

$ |

2.86 |

|

|

$ |

1.98 |

|

| |

|

|

|

| Weighted average shares: |

|

|

|

|

Basic |

12,037 |

|

|

11,941 |

|

|

Diluted |

12,152 |

|

|

12,174 |

|

| |

|

|

|

| |

|

|

|

|

SELECTED FINANCIAL DATA: |

|

|

|

| |

|

|

|

|

Depreciation |

$ |

1,755 |

|

|

$ |

1,641 |

|

|

Capital Expenditures |

$ |

2,189 |

|

|

$ |

1,235 |

|

|

Dividends Paid |

$ |

3,185 |

|

|

$ |

3,124 |

|

POWELL INDUSTRIES, INC. &

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS

| |

|

|

|

| |

December 31, 2024 |

|

September 30, 2024 |

|

(In thousands) |

|

| |

(Unaudited) |

|

|

| Assets: |

|

|

|

| |

|

|

|

|

Cash, cash equivalents and short-term investments |

$ |

373,397 |

|

|

$ |

358,392 |

|

| |

|

|

|

|

Other current assets |

388,539 |

|

|

418,089 |

|

| |

|

|

|

|

Property, plant and equipment, net |

101,957 |

|

|

103,421 |

|

|

|

|

|

|

|

Long-term assets |

48,782 |

|

|

48,278 |

|

|

|

|

|

|

|

Total assets |

$ |

912,675 |

|

|

$ |

928,180 |

|

|

|

|

|

|

| |

|

|

|

| Liabilities and equity: |

|

|

|

| |

|

|

|

|

Current liabilities |

$ |

396,669 |

|

|

$ |

428,015 |

|

|

|

|

|

|

|

Deferred and other long-term liabilities |

|

19,674 |

|

|

|

17,092 |

|

|

|

|

|

|

|

Stockholders’ equity |

496,332 |

|

|

483,073 |

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

$ |

912,675 |

|

|

$ |

928,180 |

|

| |

|

|

|

| |

|

|

|

|

SELECTED FINANCIAL DATA: |

|

|

|

| |

|

|

|

|

Working capital |

$ |

365,267 |

|

|

$ |

348,466 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

(1) New orders (bookings) represent the

estimated value of contracts added to existing backlog (unsatisfied

performance obligations). (2) The amounts recorded in backlog

may not be a reliable indicator of our future operating results and

may not be indicative of continuing revenue performance over future

fiscal quarters or years primarily due to unexpected contract

adjustments, cancellations or scope reductions.

|

Contacts: |

Michael W.

Metcalf, CFO |

| |

Powell Industries, Inc. |

| |

713-947-4422 |

| |

|

| |

Robert Winters or Ryan Coleman |

| |

Alpha IR Group |

| |

POWL@alpha-ir.com |

| |

312-445-2870 |

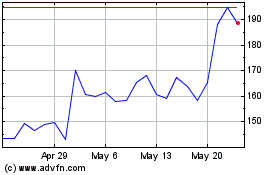

Powell Industries (NASDAQ:POWL)

Historical Stock Chart

From Jan 2025 to Feb 2025

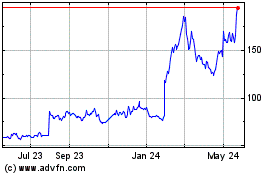

Powell Industries (NASDAQ:POWL)

Historical Stock Chart

From Feb 2024 to Feb 2025