UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of January 2025

Commission File Number: 001-37643

PURPLE BIOTECH LTD.

(Translation of registrant’s name into English)

4 Oppenheimer Street, Science Park, Rehovot

7670104, Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

As previously disclosed, on June 9, 2021,

Purple Biotech Ltd. (the “Company”) entered into an Open Market Sale AgreementSM (the “ATM Agreement”)

with Jefferies LLC (the “Agent”), as sales agent, pursuant to which the Company may offer and sell American Depositary Shares

(the “ADSs”), with each ADS representing two hundred of the Company’s ordinary shares (the “Shares”), from

time to time in an “at the market offering” program.

The ADSs will be offered and sold pursuant

to a sales agreement prospectus, dated May 22, 2023, forming a part of the Company’s registration statement on Form F-3, as amended

(File No. 333-268710), initially filed with the Securities and Exchange Commission on December 7, 2022 and declared effective on May 22,

2023, as supplemented by the prospectus supplements, dated October 17, 2023 and January 6, 2025. The initial sales agreement prospectus

registered the offer and sale of up to $12.0 million of Shares. The prospectus supplement filed on October 17, 2023 reduced the amount

of Shares available to be sold pursuant to the ATM Agreement to $3.0 million of Shares. As of the date hereof, the Company has sold an

aggregate of approximately $4.0 million of Shares under the initial sales agreement prospectus effective on May 22, 2023 and the prospectus

supplement filed on October 17, 2023. On January 6, 2025, the Company determined to increase the amount available for sale under the ATM

Agreement, up to an additional aggregate offering price of $1,330,000, from and after the date hereof.

Because there is no minimum offering amount

required pursuant to the ATM Agreement, the total number of ADSs to be sold under the ATM Agreement, if any, and proceeds to the Company,

if any, are not determinable at this time. The Company expects to use any net proceeds primarily for working capital and general corporate

purposes. The Company has not yet determined the amount of net proceeds to be used specifically for any particular purpose or the timing

of these expenditures. Accordingly, the Company’s management will have significant discretion and flexibility in applying the net

proceeds from the sale of these securities, if any.

A copy of the opinion of ABZ Law Office relating

to the validity of the Shares underlying the ADSs that may be sold pursuant to the ATM Agreement and a copy of the opinion of Haynes and

Boone, LLP relating to the validity of the ADSs that may be sold pursuant to the ATM Agreement were filed with the Company’s registration

statement on Form F-3, as amended (File No. 333-268710).

This Report on Form 6-K, including the exhibits

filed herewith, shall not constitute an offer to sell or the solicitation of an offer to buy the ADSs that may be sold pursuant to the

ATM Agreement, nor shall there be any offer, solicitation or sale of the ADSs in any state or country in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such state or country.

Incorporation by Reference

This Report on Form 6-K, including all exhibits attached hereto, is

hereby incorporated by reference into each of the Registrant’s Registration Statement on Form S-8 filed with the Securities

and Exchange Commission on May 20, 2016 (Registration file number 333-211478), the Registrant’s Registration Statement on Form S-8 filed with the Securities and Exchange Commission on June 6, 2017 (Registration file number 333-218538), the Registrant’s

Registration Statement on Form F-3, as amended, originally filed with the Securities and Exchange Commission on July 16, 2018 (Registration

file number 333-226195), the Registrant’s Registration Statement on Form S-8 filed with the Securities and Exchange Commission

on March 28, 2019 (Registration file number 333-230584), the Registrant’s Registration Statement on Form F-3 filed with

the Securities and Exchange Commission on September 16, 2019 (Registration file number 333-233795), the Registrant’s Registration

Statement on Form F-1 filed with the Securities and Exchange Commission on December 27, 2019 (Registration file number 333-235729),

the Registrant’s Registration Statement on Form F-3 filed with the Securities and Exchange Commission on May 13, 2020

(Registration file number 333-238229), the Registrant’s Registration Statement on Form S-8 filed with the Securities and

Exchange Commission on May 18, 2020 (Registration file number 333-238481), each of the Registrant’s Registration Statements on Form F-3 filed with the Securities and Exchange Commission on July 10, 2020 (Registration file numbers 333-239807 and 333-233793), the

Registrant’s Registration Statement on Form S-8 filed with the Securities and Exchange Commission on April 4, 2022 (Registration

file number 333-264107) and the Registrant’s Registration Statement on Form F-3 filed with the Securities and Exchange

Commission on March 23, 2023 (Registration file number 333-270769), the Registrant’s Registration Statement on Form F-3, as

amended, originally filed with the Securities and Exchange Commission on December 8, 2022 (Registration file number 333-268710), the Registrant’s

Registration Statement on Form F-1, as amended, originally filed with the Securities and Exchange Commission on October

30, 2023 (Registration file number 333-275216) and the Registrant’s Registration Statement on Form F-1, filed with

the Securities and Exchange Commission on July 22, 2024 (Registration file number 333-280947), to be a part thereof from the date on which

this report is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| January 6, 2025 |

PURPLE BIOTECH LTD. |

| |

|

| |

By: |

/s/ Gil Efron |

| |

|

Gil Efron |

| |

|

Chief Executive Officer |

2

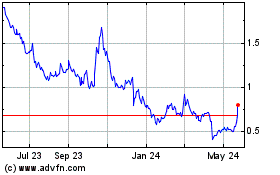

Purple Biotech (NASDAQ:PPBT)

Historical Stock Chart

From Dec 2024 to Jan 2025

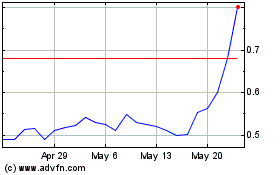

Purple Biotech (NASDAQ:PPBT)

Historical Stock Chart

From Jan 2024 to Jan 2025