Prenetics Global Limited (NASDAQ: PRE) (“Prenetics” or the

“Company”), a leading genomics-driven health sciences company,

today announced unaudited financial results for the fourth quarter

and full year ended December 31, 2023, along with recent business

updates.

Financial Highlights

- Revenue from continuing operations

of US$21.7 million in the full year 2023, an increase of 65.2% as

compared to the full year 2022.

- Revenue from continuing operations

of US$5.4 million in the fourth quarter 2023, an increase of 90.8%

as compared to the fourth quarter 2022.

- Adjusted EBITDA from continuing

operations of US$(24.8) million in the full year 2023.

- Adjusted EBITDA from continuing

operations of US$(6.2) million in the fourth quarter 2023.

- Cash and other short-term assets1

of US$93.7 million as of December 31, 2023. Additionally,

Insighta2, our 50/50 joint venture in early cancer detection with

Professor Dennis Lo, had a cash balance of US$79.1 million in its

balance sheet as of December 31, 2023.

Danny Yeung, Chief Executive Officer and

Co-Founder of Prenetics said: "As we reflect on the past

year, we knew that 2023 was set to be a challenging yet

transformational period for Prenetics, especially as we emerged

from the shadow of COVID. Our focus remained unwaveringly on

driving our existing business units, ACT Genomics and CircleDNA,

towards growth and profitability. I am proud to announce that for

the first time in our history, both units achieved profitability in

December 2023, while increasing full year revenue from continuing

operations by 65.2%, setting a precedent for a promising fiscal

trajectory into 2024.

With this significant turnaround, we are

confidently revising our revenue projections for the full year 2024

to be in the range of US$33 million to US$36 million with

profitability being a major focus. This progress is not just a

milestone but also a catalyst that empowers us to judiciously

invest our capital and resources into new business ventures. We

foresee vast opportunities within the consumer healthcare sector

and look forward to sharing more about our strategic initiatives in

due course.

This past year also marked the completion of a

pivotal 500-person clinical trial with Insighta, our early cancer

detection venture with Prof. Dennis Lo, yielding very positive

results. We expect to publish these findings towards the end of

2024, and we are gearing up for an even more extensive overseas

clinical trial beginning in Q3 of this year. Details of this will

be shared in the next earnings update.

In summary, 2023 was a testament to our

commitment to executing our strategic objectives and operational

excellence. Looking ahead to 2024, with a strong cash position, no

debt, a dedicated management team and potentially large

opportunities in consumer healthcare, we are poised to build on our

momentum and delivering long-term value to our shareholders. Stay

tuned as we continue this exciting journey, with transformative

developments on the horizon."

Recent Highlights

- ACT Genomics and CircleDNA business

units achieved EBITDA breakeven (non-IFRS) in December 2023, the

first time in the Company’s history.

- The two units are expected to

generate a combined revenue in the range of US$33 million to US$36

million, up from US$21.7 million in 2023.

- Insighta’s 500-participants clinical

trial for early cancer detection has been completed and is

preparing for publication of full results which is expected by the

end of 2024.

- Our management team is diligently

pursuing significant new ventures within the consumer healthcare

market, with more information to be revealed in the upcoming

period.

_____________________1 Represents current

assets, including cash and cash equivalents and short-term deposits

totaling US$61.7 million, financial assets at fair value through

profit or loss of US$11.0 million, and trade receivables of US$4.1

million, amongst other accounting line items under current assets.2

As of December 31, 2023, we owned 50% shareholding in Insighta,

which was accounted for under equity-accounted investee.

Equity-accounted investees, totaling US$98.5 million as of December

31, 2023, were classified as non-current assets on our balance

sheet.

Full Year 2023 Financial

ResultsTotal revenue from continuing operations for the

full year of 2023 was US$21.7 million, representing an increase of

65.2% from the previous year.

Adjusted net loss attributable to equity

shareholders of Prenetics was US$(28.4) million for the year ended

December 31, 2023. The difference between adjusted net loss of

US$(28.4) million and net loss for the year of US$(63.0) million

are primarily attributable to non-cash and non-recurring

adjustments, including: (i) non-cash impairment loss of goodwill of

US$3.9 million; (ii) non-cash fair value changes on financial

assets at fair value through profit or loss of US$7.1 million;

(iii) non-recurring restructuring charges of US$2.4 million and

loss from discontinued products; and (iv) non-cash equity-settled

share-based payment expenses of US$10.6 million, offset by non-cash

fair value gain on warrant liabilities of US$3.4 million. While

such non-cash charges increase our reported net loss in the year,

in our view such charges had no impact on the Company's cash

balance and were not representative of our overall financial

health.

About PreneticsPrenetics

(NASDAQ:PRE),a leading genomics-driven health sciences company, is

revolutionizing prevention, early detection, and treatment. Our

prevention arm, CircleDNA, uses whole exome sequencing to offer the

world's most comprehensive consumer DNA test. Insighta, our $200

million joint venture with renowned scientist Prof. Dennis Lo,

underscores our unwavering commitment to saving lives through

pioneering multi-cancer early detection technologies. Lastly, ACT

Genomics, our treatment unit, is the first Asia-based company to

achieve FDA clearance for comprehensive genomic profiling of solid

tumors via ACTOnco. Each of Prenetics' units synergistically

enhances our global impact on health, truly embodying our

commitment to 'enhancing life through science’. To learn more about

Prenetics, please visit www.prenetics.com.

Investor Relations

Contact:investors@prenetics.com

Forward-Looking Statements This

press release contains forward-looking statements. These statements

are made under the "safe harbor" provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Statements that are not

historical facts, including statements about the Company's goals,

targets, projections, outlooks, beliefs, expectations, strategy,

plans, objectives of management for future operations of the

Company, and growth opportunities are forward-looking statements.

In some cases, forward-looking statements can be identified by

words or phrases such as "may," "will," "expect," "anticipate,"

"target," "aim," "estimate," "intend," "plan," "believe,"

"potential," "continue," "is/are likely to" or other similar

expressions. Forward-looking statements are based upon estimates

and forecasts and reflect the views, assumptions, expectations, and

opinions of the Company, which involve inherent risks and

uncertainties, therefore they should not be relied upon as being

necessarily indicative of future results. A number of factors could

cause actual results to differ materially from those contained in

any forward-looking statement, including but not limited to: the

Company’s ability to further develop and grow its business,

including new products and services; its ability to execute on its

new business strategy in genomics, precision oncology, and

specifically, early detection for cancer; the results of case

control studies and/or clinical trials; and its ability to identify

and execute on M&A opportunities, especially in precision

oncology. In addition to the foregoing factors, you should also

carefully consider the other risks and uncertainties described in

the “Risk Factors” section of the Company’s most recent

registration statement and the prospectus therein, and the other

documents filed by the Company from time to time with the U.S.

Securities and Exchange Commission. All information provided in

this press release is as of the date of this press release, and the

Company does not undertake any duty to update such information,

except as required under applicable law.

Basis of PresentationUnaudited

Non-IFRS Financial Measures has been provided in the financial

statements tables included at the end of this press release. An

explanation of these measures is also included below under the

heading “Unaudited Non-IFRS Financial Measures”.

Unaudited Non-IFRS Financial

MeasuresTo supplement Prenetics’ consolidated financial

statements prepared in accordance with International Financial

Reporting Standards (“IFRS”), the Company is providing non-IFRS

measures, adjusted EBITDA from continuing operations, adjusted

gross profit from continuing operations and adjusted (loss)/profit

attributable to equity shareholders of Prenetics. These non-IFRS

financial measures are not based on any standardized methodology

prescribed by IFRS and are not necessarily comparable to

similarly-titled measures presented by other companies. Management

believes these non-IFRS financial measures are useful to investors

in evaluating the Company's ongoing operating results and

trends.

Management is excluding from some or all of its

non-IFRS results (1) Employee equity-settled share-based payment

expenses, (2) depreciation and amortization, (3) finance income and

exchange gain or loss, net, and (4) certain items that may not be

indicative of our business, results of operations, or outlook,

including but not limited to non-cash and/ or non-recurring items.

These non-IFRS financial measures are limited in value because they

exclude certain items that may have a material impact on the

reported financial results. Management accounts for this limitation

by analyzing results on an IFRS basis as well as a non-IFRS basis

and also by providing IFRS measures in the Company's public

disclosures.

In addition, other companies, including

companies in the same industry, may not use the same non-IFRS

measures or may calculate these metrics in a different manner than

management or may use other financial measures to evaluate their

performance, all of which could reduce the usefulness of these

non-IFRS measures as comparative measures. Because of these

limitations, the Company's non-IFRS financial measures should not

be considered in isolation from, or as a substitute for, financial

information prepared in accordance with IFRS. Investors are

encouraged to review the non-IFRS reconciliations provided in the

tables captioned “Reconciliation of loss from operations from

continuing operations under IFRS and adjusted EBITDA from

continuing operations (Non-IFRS)”, “Reconciliation of gross profit

from continuing operations under IFRS and adjusted gross profit

from continuing operations (Non-IFRS)” and “Reconciliation of

(loss)/profit attributable to equity shareholders of Prenetics

under IFRS and adjusted (loss)/profit attributable to equity

shareholders of Prenetics (Non-IFRS)” set forth at the end of this

document.

PRENETICS GLOBAL

LIMITEDUnaudited consolidated statements of

financial position(Expressed in United States dollars

unless otherwise indicated)

|

|

December 31, |

|

|

2023 |

|

2022 |

| Assets |

|

|

|

|

Property, plant and equipment |

$ |

5,777,794 |

|

$ |

13,102,546 |

| Intangible assets |

|

13,424,648 |

|

|

14,785,875 |

| Goodwill |

|

29,170,123 |

|

|

33,800,276 |

| Interests in equity-accounted

investees |

|

98,464,875 |

|

|

788,472 |

| Financial assets at fair value

through profit or loss |

|

9,371,064 |

|

|

— |

| Deferred tax assets |

|

27,680 |

|

|

243,449 |

| Deferred expenses |

|

3,530,756 |

|

|

6,307,834 |

| Other non-current assets |

|

743,173 |

|

|

1,292,462 |

| Non-current

assets |

|

160,510,113 |

|

|

70,320,914 |

| Deferred expenses |

|

8,312,890 |

|

|

4,577,255 |

| Inventories |

|

3,126,776 |

|

|

4,534,072 |

| Trade receivables |

|

4,058,007 |

|

|

41,691,913 |

| Deposits, prepayments and

other receivables |

|

5,284,848 |

|

|

6,889,114 |

| Amount due from a related

company |

|

5,123 |

|

|

— |

| Amount due from an

equity-accounted investee |

|

132,114 |

|

|

— |

| Financial assets at fair value

through profit or loss |

|

11,034,200 |

|

|

17,537,608 |

| Short-term deposits |

|

16,000,000 |

|

|

19,920,160 |

| Cash and cash equivalents |

|

45,706,448 |

|

|

146,660,195 |

| Current

assets |

|

93,660,406 |

|

|

241,810,317 |

| Total

assets |

$ |

254,170,519 |

|

$ |

312,131,231 |

|

Liabilities |

|

|

|

| Deferred tax liabilities |

$ |

2,614,823 |

|

$ |

3,185,440 |

| Warrant liabilities |

|

223,850 |

|

|

3,574,885 |

| Lease liabilities |

|

867,215 |

|

|

3,763,230 |

| Other non-current

liabilities |

|

823,345 |

|

|

949,701 |

| Non-current

liabilities |

|

4,529,233 |

|

|

11,473,256 |

| Trade payables |

|

1,671,019 |

|

|

7,291,133 |

| Accrued expenses and other

current liabilities |

|

8,174,815 |

|

|

15,611,421 |

| Contract liabilities |

|

6,111,017 |

|

|

5,674,290 |

| Lease liabilities |

|

1,502,173 |

|

|

2,882,933 |

| Liabilities for puttable

financial instrument3 |

|

14,622,529 |

|

|

17,138,905 |

| Tax payable |

|

7,402,461 |

|

|

8,596,433 |

| Current

liabilities |

|

39,484,014 |

|

|

57,195,115 |

| Total

liabilities |

|

44,013,247 |

|

|

68,668,371 |

| Equity |

|

|

|

| Share

capital4 |

|

18,308 |

|

|

13,698 |

| Reserves |

|

206,339,490 |

|

|

237,050,429 |

| Total equity

attributable to equity shareholders of the Company |

|

206,357,798 |

|

|

237,064,127 |

| Non-controlling interests |

|

3,799,474 |

|

|

6,398,733 |

| Total equity |

|

210,157,272 |

|

|

243,462,860 |

| Total equity and

liabilities |

$ |

254,170,519 |

|

$ |

312,131,231 |

PRENETICS GLOBAL

LIMITEDUnaudited consolidated statements of profit

or loss and other comprehensive income(Expressed in United

States dollars unless otherwise indicated)

| |

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

(Restated) |

|

|

|

(Restated) |

|

Continuing operations |

|

|

|

|

|

|

|

| Revenue |

$ |

5,428,460 |

|

|

$ |

2,844,571 |

|

|

$ |

21,742,675 |

|

|

$ |

13,163,841 |

|

| Direct costs |

|

(2,758,288 |

) |

|

|

(1,765,186 |

) |

|

|

(12,912,788 |

) |

|

|

(9,545,546 |

) |

| Gross profit |

|

2,670,172 |

|

|

|

1,079,385 |

|

|

|

8,829,887 |

|

|

|

3,618,295 |

|

| Other income and other net

gain |

|

715,562 |

|

|

|

818,043 |

|

|

|

4,507,103 |

|

|

|

429,857 |

|

| Selling and distribution

expenses5 |

|

(1,908,415 |

) |

|

|

(1,203,237 |

) |

|

|

(8,243,379 |

) |

|

|

(4,738,099 |

) |

| Research and development

expenses5 |

|

(2,586,477 |

) |

|

|

(1,463,036 |

) |

|

|

(11,661,760 |

) |

|

|

(5,988,905 |

) |

| Impairment loss of

goodwill |

|

(3,900,268 |

) |

|

|

— |

|

|

|

(3,900,268 |

) |

|

|

— |

|

| Administrative and other

operating expenses5 |

|

(10,362,374 |

) |

|

|

(10,942,029 |

) |

|

|

(41,438,301 |

) |

|

|

(59,341,636 |

) |

| Loss from operations |

|

(15,371,800 |

) |

|

|

(11,710,874 |

) |

|

|

(51,906,718 |

) |

|

|

(66,020,488 |

) |

| Fair value loss on financial

assets at fair value through profit or loss |

|

(3,190,379 |

) |

|

|

(7,689,311 |

) |

|

|

(7,134,786 |

) |

|

|

(9,363,495 |

) |

| Share-based payment on

listing6 |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(89,546,601 |

) |

| Fair value loss on preference

shares liabilities |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(60,091,353 |

) |

| Fair value gain on warrant

liabilities |

|

671,550 |

|

|

|

6,498,365 |

|

|

|

3,351,035 |

|

|

|

3,196,538 |

|

| Share of loss of

equity-accounted investees |

|

(688,183 |

) |

|

|

— |

|

|

|

(858,900 |

) |

|

|

— |

|

| Other finance costs |

|

1,073 |

|

|

|

(51,014 |

) |

|

|

(119,662 |

) |

|

|

(3,994,755 |

) |

| Loss before taxation |

|

(18,577,739 |

) |

|

|

(12,952,834 |

) |

|

|

(56,669,031 |

) |

|

|

(225,820,154 |

) |

| Income tax

(expense)/credit |

|

(10,678 |

) |

|

|

(150,282 |

) |

|

|

269,359 |

|

|

|

244,816 |

|

| Loss from continuing

operations |

|

(18,588,417 |

) |

|

|

(13,103,116 |

) |

|

|

(56,399,672 |

) |

|

|

(225,575,338 |

) |

| Discontinued

operation |

|

|

|

|

|

|

|

| (Loss)/profit from

discontinued operation, net of tax7 |

|

(1,026,983 |

) |

|

|

14,711,059 |

|

|

|

(8,377,660 |

) |

|

|

35,121,951 |

|

| (Loss)/profit for the

period/year |

|

(19,615,400 |

) |

|

|

1,607,943 |

|

|

|

(64,777,332 |

) |

|

|

(190,453,387 |

) |

| Other comprehensive

income for the period/year |

|

|

|

|

|

|

|

| Item that may be reclassified

subsequently to profit or loss: |

|

|

|

|

|

|

|

|

Exchange difference on translation of foreign operations |

|

1,118,149 |

|

|

|

2,759,672 |

|

|

|

1,795,623 |

|

|

|

(4,842,932 |

) |

| Total comprehensive

income for the period/year |

$ |

(18,497,251 |

) |

|

$ |

4,367,615 |

|

|

$ |

(62,981,709 |

) |

|

$ |

(195,296,319 |

) |

| (Loss)/profit

attributable to: |

|

|

|

|

|

|

|

| Equity shareholders of

Prenetics |

$ |

(19,047,124 |

) |

|

$ |

1,607,942 |

|

|

$ |

(62,723,871 |

) |

|

$ |

(190,453,333 |

) |

| Non-controlling interests |

|

(568,276 |

) |

|

|

1 |

|

|

|

(2,053,461 |

) |

|

|

(54 |

) |

| |

$ |

(19,615,400 |

) |

|

$ |

1,607,943 |

|

|

$ |

(64,777,332 |

) |

|

$ |

(190,453,387 |

) |

| Total comprehensive

income attributable to: |

|

|

|

|

|

|

|

| Equity shareholders of

Prenetics |

$ |

(18,677,610 |

) |

|

$ |

4,367,614 |

|

|

$ |

(61,112,335 |

) |

|

$ |

(195,296,265 |

) |

| Non-controlling interests |

|

180,359 |

|

|

|

1 |

|

|

|

(1,869,374 |

) |

|

|

(54 |

) |

| |

$ |

(18,497,251 |

) |

|

$ |

4,367,615 |

|

|

$ |

(62,981,709 |

) |

|

$ |

(195,296,319 |

) |

| (Loss)/earnings per

share: |

|

|

|

|

|

|

|

| Basic |

$ |

(1.57 |

) |

|

$ |

0.21 |

|

|

$ |

(5.58 |

) |

|

$ |

(37.57 |

) |

| Diluted |

|

(1.57 |

) |

|

|

0.21 |

|

|

|

(5.58 |

) |

|

|

(37.57 |

) |

| Loss per share -

Continuing operations: |

|

|

|

|

|

|

|

| Basic |

|

(1.49 |

) |

|

|

(2.07 |

) |

|

|

(4.83 |

) |

|

|

(44.50 |

) |

| Diluted |

|

(1.49 |

) |

|

|

(2.07 |

) |

|

|

(4.83 |

) |

|

|

(44.50 |

) |

| Weighted average

number of common shares: |

|

|

|

|

|

|

|

| Basic |

|

12,114,922 |

|

|

|

7,692,436 |

|

|

|

11,246,010 |

|

|

|

5,069,315 |

|

| Diluted |

|

12,114,922 |

|

|

|

7,692,436 |

|

|

|

11,246,010 |

|

|

|

5,069,315 |

|

PRENETICS GLOBAL

LIMITEDUnaudited Non-IFRS Financial

Measures(Expressed in United States dollars unless

otherwise indicated)

Reconciliation of loss from

operations from continuing operations under IFRS

and adjusted EBITDA from continuing operations

(Non-IFRS)

|

|

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

(Restated) |

|

|

|

(Restated) |

| Loss from operations

from continuing operations under IFRS |

$ |

(15,371,800 |

) |

|

$ |

(11,710,874 |

) |

|

$ |

(51,906,718 |

) |

|

$ |

(66,020,488 |

) |

| Employee equity-settled

share-based payment expenses |

|

2,055,858 |

|

|

|

3,557,088 |

|

|

|

10,588,944 |

|

|

|

26,154,915 |

|

| Depreciation and

amortization |

|

1,564,816 |

|

|

|

526,005 |

|

|

|

6,671,022 |

|

|

|

2,076,858 |

|

| Other strategic financing,

transactional expense and non-recurring expenses |

|

6,263,188 |

|

|

|

2,647,418 |

|

|

|

14,081,833 |

|

|

|

14,130,281 |

|

| Finance income, exchange gain

or loss, net |

|

(673,740 |

) |

|

|

(419,881 |

) |

|

|

(4,253,472 |

) |

|

|

191,126 |

|

| Adjusted EBITDA from

continuing operations (Non-IFRS) |

$ |

(6,161,678 |

) |

|

$ |

(5,400,244 |

) |

|

$ |

(24,818,391 |

) |

|

$ |

(23,467,308 |

) |

Reconciliation of gross profit from

continuing operations under IFRS and adjusted gross profit from

continuing operations (Non-IFRS)

| |

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

| |

|

|

(Restated) |

|

|

|

(Restated) |

| Gross profit from

continuing operations under IFRS |

$ |

2,684,103 |

|

$ |

1,079,385 |

|

$ |

8,843,818 |

|

$ |

3,618,295 |

| Employee equity-settled

share-based payment expenses |

|

11,522 |

|

|

— |

|

|

11,522 |

|

|

— |

| Depreciation and

amortization |

|

309,812 |

|

|

188,154 |

|

|

1,435,709 |

|

|

501,786 |

| Adjusted gross profit

from continuing operations (Non-IFRS) |

$ |

3,005,437 |

|

$ |

1,267,539 |

|

$ |

10,291,049 |

|

$ |

4,120,081 |

Reconciliation of (loss)/profit

attributable to equity shareholders of Prenetics under IFRS and

adjusted (loss)/profit attributable to equity shareholders of

Prenetics (Non-IFRS)

| |

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

(Restated) |

|

|

|

(Restated) |

| (Loss)/profit

attributable to equity shareholders of Prenetics under

IFRS |

$ |

(19,047,124 |

) |

|

$ |

1,607,942 |

|

|

$ |

(62,723,871 |

) |

|

$ |

(190,453,333 |

) |

| Employee equity-settled

share-based payment expenses |

|

2,055,858 |

|

|

|

3,241,872 |

|

|

|

10,588,944 |

|

|

|

31,580,384 |

|

| Other strategic financing,

transactional expense and non-recurring expenses |

|

8,248,151 |

|

|

|

1,269,453 |

|

|

|

19,984,232 |

|

|

|

13,675,709 |

|

| Share-based payment on

listing |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

89,546,601 |

|

| Fair value loss on preference

shares liabilities |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

60,091,353 |

|

| Fair value gain on warrant

liabilities |

|

(671,550 |

) |

|

|

(6,498,365 |

) |

|

|

(3,351,035 |

) |

|

|

(3,196,538 |

) |

| Fair value loss on financial

assets at fair value through profit or loss |

|

3,190,379 |

|

|

|

7,689,311 |

|

|

|

7,134,786 |

|

|

|

9,363,495 |

|

| Restructuring costs |

|

— |

|

|

|

2,709,143 |

|

|

|

— |

|

|

|

30,378,741 |

|

| Adjusted (loss)/profit

attributable to equity shareholders of Prenetics

(Non-IFRS) |

$ |

(6,224,286 |

) |

|

$ |

10,019,356 |

|

|

$ |

(28,366,944 |

) |

|

$ |

40,986,412 |

|

_____________________3 In

connection with the acquisition of ACT Genomics, the remaining

shareholders of ACT Genomics - representing 25.61% of the fully

diluted shareholding of ACT Genomics that Prenetics does not own -

were granted put options which allow these remaining shareholders

to put their remaining shares to Prenetics under certain

conditions. The liabilities arising from such put option are

recorded as liabilities for puttable financial instrument, and are

valued at the present value of the exercise price of the put

option.

4 Represents number of authorized

and issued shares as follows:

|

|

December 31, |

|

|

2023 |

|

2022 |

|

Number of authorized shares of $0.0015 each (2022: $0.0001

each) |

33,333,333 |

|

500,000,000 |

|

Number of issued shares |

12,205,200 |

|

136,983,110 |

5 Includes equity-settled

share-based payment expenses (excluding share-based payment on

listing) from continuing operations as follows:

|

|

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

(Restated) |

|

|

|

(Restated) |

| Direct costs |

$ |

11,522 |

|

|

$ |

— |

|

$ |

11,522 |

|

$ |

— |

| Selling and distribution

expenses |

|

(632 |

) |

|

|

43,257 |

|

|

99,929 |

|

|

122,910 |

| Research and development

expenses |

|

675,928 |

|

|

|

321,235 |

|

|

2,812,174 |

|

|

1,980,010 |

| Administrative and other

operating expenses |

|

1,339,419 |

|

|

|

3,152,921 |

|

|

7,572,081 |

|

|

23,810,797 |

| Total equity-settled

share-based payment expenses (excluding share-based payment on

listing) |

$ |

2,026,237 |

|

|

$ |

3,517,413 |

|

$ |

10,495,706 |

|

$ |

25,913,717 |

6 The acquisition of the net

assets of Artisan Acquisition Corp. (“Artisan”) on May 18, 2022

does not meet the definition of a business under IFRS and has

therefore been accounted for as a share-based payment. The excess

of fair value of Prenetics shares issued over the fair value of

Artisan’s identifiable net assets acquired represents compensation

for the service of a stock exchange listing for its shares and is

expensed as incurred.

7 We ceased our COVID-19

testing business entirely in 2023 Q2, and other DNA testing

operations in the EMEA regions in 2023 Q4. As a result, COVID-19

testing business and the operations in the EMEA regions are

reported as a discontinued operation under IFRS 5 Non-current

Assets Held for Sale and Discontinued Operations. In accordance

with IFRS 5, the results of the discontinued operation have been

presented separately from the continuing operations in the

consolidated statements of profit or loss and other comprehensive

income. The comparative information in the consolidated statements

of profit or loss and other comprehensive income has also been

re-presented to show the results of discontinued operation

separately.

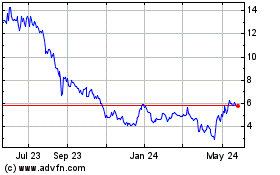

Prenetics Global (NASDAQ:PRE)

Historical Stock Chart

From Jan 2025 to Feb 2025

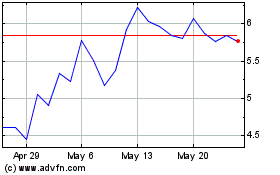

Prenetics Global (NASDAQ:PRE)

Historical Stock Chart

From Feb 2024 to Feb 2025