UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(RULE 14d-100)

Tender Offer Statement under Section 14(d)(1)

or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 7)

Performance

Shipping Inc.

(Name

of Subject Company (Issuer))

Sphinx

Investment Corp.

(Offeror)

Maryport

Navigation Corp.

(Parent of Offeror)

George

Economou

(Affiliate of Offeror)

(Names of Filing Persons)

Common

shares, $0.01 par value

(including

the associated Preferred stock purchase rights)

(Title of Class of Securities)

Y67305105

(CUSIP Number of Class of Securities)

Kleanthis Spathias

c/o Levante Services Limited

Leoforos Evagorou 31, 2nd Floor,

Office 21

1066 Nicosia, Cyprus

+35 722 010610

(Name, address and telephone number of person authorized

to receive notices and communications on behalf of filing persons)

With

a copy to:

Richard M. Brand

Kiran S. Kadekar

Cadwalader, Wickersham & Taft LLP

200 Liberty Street

New York, NY 10281

(212) 504-6000

| |

¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate

any transactions to which the statement relates:

|

x |

third-party tender offer subject to Rule 14d-1. |

|

¨ |

issuer tender offer subject to Rule 13e-4. |

|

¨ |

going-private transaction subject to Rule 13e-3. |

|

x |

amendment to Schedule 13D under Rule 13d-2. |

Check

the following box if the filing is a final amendment reporting the results of the tender offer: ¨

If applicable, check the appropriate box(es) below

to designate the appropriate rule provision(s) relied upon:

|

¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

|

¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

As permitted by General Instruction G to Schedule

TO, this Schedule TO is also Amendment No. 12 to the Schedule 13D filed by Sphinx Investment Corp. (the “Offeror”),

Maryport Navigation Corp. and Mr. George Economou on August 25, 2023 (and amended on August 31, 2023, September 5, 2023 and September

15, 2023, further amended twice on each of October 11, 2023 and October 30, 2023, and further amended on November 15, 2023, December 5,

2023, March 26, 2024 and June 27, 2024) in respect of the Common Shares of the Company.

CUSIP No. Y67305105

| |

| |

| |

1. |

Names of Reporting Persons

Sphinx Investment Corp. |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

o |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

WC |

| |

|

|

| |

5. |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Republic of the Marshall Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,033,859* |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,033,859* |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,033,859* |

| |

12. |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

| |

13. |

Percent of Class Represented by Amount in Row (11)

8.3%** |

| |

14. |

Type of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

|

* All reported Common Shares are held by Sphinx

Investment Corp. Sphinx Investment Corp. is a wholly-owned subsidiary of Maryport Navigation Corp., which is a Liberian company controlled

by Mr. Economou.

** Based on the 12,432,158 Common

Shares stated by the Issuer as being outstanding as at July 24, 2024 in Exhibit

99.2 to Form 6-K filed with the United States Securities and Exchange Commission (the “SEC”) on July

25, 2024 (the “Form 6-K”).

CUSIP No. Y67305105

| |

| |

| |

1. |

Names of Reporting Persons

Maryport Navigation Corp. |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

o |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

AF |

| |

|

|

| |

5. |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Liberia |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,033,859* |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,033,859* |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,033,859* |

| |

12. |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

| |

13. |

Percent of Class Represented by Amount in Row (11)

8.3%** |

| |

14. |

Type of Reporting Person (See Instructions)

CO |

| |

|

|

|

|

|

* All reported Common Shares are held by Sphinx

Investment Corp. Sphinx Investment Corp. is a wholly-owned subsidiary of Maryport Navigation Corp., which is a Liberian company controlled

by Mr. Economou.

** Based on the 12,432,158

Common Shares stated by the Issuer as being outstanding as at July 24, 2024 in its Form

6-K.

CUSIP No. Y67305105

| |

| |

| |

1. |

Names of Reporting Persons

George Economou |

| |

|

|

| |

2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

(a) |

o |

| |

|

(b) |

x |

| |

|

|

| |

3. |

SEC Use Only |

| |

|

|

| |

4. |

Source of Funds (See Instructions)

AF |

| |

|

|

| |

5. |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

| |

|

|

| |

6. |

Citizenship or Place of Organization

Greece |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

1,033,859* |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

1,033,859* |

| |

11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,033,859* |

| |

12. |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

| |

13. |

Percent of Class Represented by Amount in Row (11)

8.3%** |

| |

14. |

Type of Reporting Person (See Instructions)

IN |

| |

|

|

|

|

|

* All reported Common Shares are held by Sphinx

Investment Corp. Sphinx Investment Corp. is a wholly-owned subsidiary of Maryport Navigation Corp., which is a Liberian company controlled

by Mr. Economou.

** Based on the 12,432,158

Common Shares stated by the Issuer as being outstanding as at July 24, 2024 in its Form

6-K.

This Amendment No. 7 (this

“Amendment No. 7”) is filed by the Offeror (as defined below), Maryport (as defined below) and Mr. George Economou

and amends and supplements the Tender Offer Statement on Schedule TO originally filed with the Securities and Exchange Commission (the

“SEC”) on October 11, 2023 and amended and supplemented pursuant to Amendment No. 1 and Amendment No. 2, each of which

was filed with the SEC on October 30, 2023, Amendment No. 3 which was filed with the SEC on November 15, 2023, Amendment No. 4 which was

filed with the SEC on December 5, 2023, Amendment No. 5 which was filed with the SEC on March 26, 2024, and Amendment No. 6 which was

filed with the SEC on June 27, 2024 (such original Tender Offer Statement on Schedule TO as so amended and supplemented (including any

exhibits and annexes attached thereto), the “Original Schedule TO”), and as hereby amended and supplemented (including

by the exhibits and annexes hereto), together with any subsequent amendments and supplements thereto, this “Schedule TO”)

by Sphinx Investment Corp., a corporation organized under the laws of the Republic of the Marshall Islands (the “Offeror”),

Maryport Navigation Corp., a corporation organized under the laws of the Republic of Liberia that is the direct parent of the Offeror

(“Maryport”), and Mr. George Economou, who directly owns Maryport and controls each of the Offeror and Maryport. This

Schedule TO relates to the tender offer by the Offeror to purchase all of the issued and outstanding common shares, par value $0.01

per share (the “Common Shares”), of Performance Shipping Inc., a corporation

organized under the laws of the Republic of the Marshall Islands (the “Company”)

(including the associated preferred stock purchase rights (the “Rights”, and together with the Common Shares, the “Shares”)

issued pursuant to the Stockholders’ Rights Agreement, dated as

of December 20, 2021, between the Company and Computershare Inc. as Rights Agent (as it may

be amended from time to time)), for $3.00 per Share in cash, without interest, less any applicable withholding taxes, upon the

terms and subject to the conditions set forth in (a) the Amended and Restated Offer to Purchase, dated October 30, 2023, a copy of which

is attached to the Schedule TO as Exhibit (a)(1)(G), as amended and supplemented by the Supplement to the Amended and Restated Offer to

Purchase dated December 5, 2023, a copy of which is attached to the Schedule TO as Exhibit (a)(1)(O) (the “Offer to Purchase”),

(b) the related revised Letter of Transmittal, a copy of which is attached to the Schedule TO as Exhibit (a)(1)(H) (the “Letter

of Transmittal”), and (c) the related revised Notice of Guaranteed Delivery, a copy of which is attached to the Schedule TO

as Exhibit (a)(1)(I) (the “Notice of Guaranteed Delivery”) (which three documents, including any amendments or supplements

thereto, collectively constitute the “Offer”).

As permitted by General Instruction

G to Schedule TO, this Schedule TO is also Amendment No. 12 to the Schedule 13D filed by the Offeror, Maryport and Mr. Economou on August

25, 2023 (and amended on August 31, 2023, September 5, 2023 and September 15, 2023, further amended twice on each of October 11, 2023

and October 30, 2023, and further amended on November 15, 2023, December 5, 2023, March 26, 2024, and June 27, 2024) in respect of the

Common Shares.

This Amendment No. 7 is being

filed to amend and supplement the Schedule TO. Except as amended hereby to the extent specifically provided herein, all terms of the Offer

and all other disclosures set forth in the Schedule TO and the Exhibits thereto remain unchanged and are hereby expressly incorporated

into this Amendment No. 7 by reference. Capitalized terms used and not otherwise defined in this Amendment No. 7 shall have the meanings

assigned to such terms in the Schedule TO and the Offer to Purchase.

Items 1 through 9 and Item 11

The Offer to Purchase and Items 1 through 9 and

Item 11 of the Schedule TO are hereby amended and supplemented as set forth below:

| 1. | The information set forth in the section of the Offer to Purchase entitled “Summary

Term Sheet” is hereby amended and supplemented by deleting the fourth sentence of the discussion set forth under the

caption “WHO IS OFFERING TO BUY MY SHARES?” in its entirety and replacing it with the following: |

“The Offeror, Maryport and Mr.

Economou beneficially own an aggregate of approximately 8.3% of the issued and outstanding Shares, based on the number of Shares publicly

disclosed by the Company as outstanding as of July 24, 2024.”

| 2. | The information set forth in the section of the Offer to Purchase entitled “Summary

Term Sheet” is hereby amended and supplemented by deleting the last sentence of the discussion set forth under the caption

“WHAT ARE THE CLASSES AND AMOUNTS OF SECURITIES SOUGHT IN THE OFFER?” in its entirety and replacing it with the following: |

“According to Exhibit

99.2 to Form 6-K, which was filed by the Company with the Securities and Exchange Commission (the “SEC”) on July

25, 2024, there were 12,432,158 Common Shares outstanding as of July

24, 2024.”

| 3. | The information set forth in the section of the Offer to Purchase entitled “Summary

Term Sheet” is hereby amended and supplemented by deleting the discussion set forth under the caption “WHAT

IS THE MARKET VALUE OF MY SHARES AS OF A RECENT DATE?” in its entirety and replacing it with the following: |

“On October 10, 2023, the last

full trading day before the commencement of the Offer, the closing price of the Shares on the Nasdaq Capital Market was $1.68 per Share.

On August 14, 2024, the last full trading day before the filing of Amendment No. 7 to Schedule TO, the closing price of Common Shares

reported on the Nasdaq Capital Market was $2.04 per Share. The Offer represents a

premium of 78.6% over the Company’s closing Share price on October 10, 2023, and a premium of 47.1% over the Company’s closing

Share price on August 14, 2024. We advise you to obtain a recent quotation for the Shares and further consult with your financial and

other advisors in deciding whether to tender your Shares. See Section 6 of the Offer to Purchase - “PRICE RANGE OF THE SHARES;

DIVIDENDS”.”

| 4. | The information set forth in the section of the Offer to Purchase entitled “Summary

Term Sheet” is hereby amended and supplemented by deleting the discussion set forth under the caption “THE COMPANY

CLAIMS THAT THE SATISFACTION OF THE SERIES C CONDITION IS NOT WITHIN THE CONTROL OF THE COMPANY, THE BOARD OR THE SPECIAL COMMITTEE.

WHAT IS THE OFFEROR’S POSITION?” in its entirety and replacing it with the following: |

“The Amended Company Recommendation states that “the

Special Committee believes that none of the Company’s governing documents, including its Articles of Incorporation and bylaws and

the Series C Certificate, or applicable law, including the [Marshall Islands Business Corporations Act],

grant the Company, the Board or the Special Committee the authority to effect a cancellation of the Series C Preferred Stock for no consideration”.

Because the Offeror disagrees, the Offeror has initiated legal proceedings in the High Court of the Republic of the Marshall Islands against

the Company, Chairperson Aliki Paliou, Company Chief Executive Officer Andreas Michalopoulos, former Company directors Symeon Palios (together

with Paliou and Michalopoulos, the “Paliou Family Insiders”), Giannakis (John) Evangelou, Antonios Karavias, Christos

Glavanis and Reidar Brekke (all of the foregoing persons, the “Director Defendants”) and controlling shareholders Mango

and Mitzela, to, among other things, seek such cancellation. See Section 18 of

the Offer to Purchase – “legal proceedings” for further information regarding

this litigation.”

| 5. | The information set forth in the section of the Offer to Purchase entitled

“Summary Term Sheet” is hereby amended and supplemented by deleting

the last three sentences of the fifth full paragraph (“Series C Condition”) of the discussion set forth under the caption

“WHAT ARE THE MOST SIGNIFICANT OFFER CONDITIONS?” and replacing them with the following: |

“THE OFFEROR BELIEVES THAT THIS CONDITION IS WITHIN THE CONTROL OF THE COMPANY

AND THE MEMBERS OF ITS BOARD; HOWEVER, THE AMENDED COMPANY RECOMMENDATION STATES THAT THE SPECIAL COMMITTEE BELIEVES THAT IT IS NOT. Because

the Offeror disagrees, the Offeror has initiated legal proceedings in the High Court of the Republic of the Marshall Islands against the

company, the Paliou Family Insiders, the other Director Defendants and controlling shareholders Mango and Mitzela. See section 18 of the

Offer to Purchase – “legal proceedings” for further information regarding this litigation.”

| 6. | The information set forth in the section of the Offer to Purchase entitled “Summary

Term Sheet” is hereby amended and supplemented by deleting the third full paragraph of the discussion set forth under

the caption “DOES THE COMPANY CONTROL ANY OF THE CONDITIONS OF THE OFFER?” in its entirety and replacing it with the

following: |

“The Amended Company Recommendation states that “none

of the Company’s governing documents, including its Articles of Incorporation and bylaws and the Series C Certificate, or applicable

law, including the BCA, grant the Company, the Board or the Special Committee the authority to effect a cancellation” of

the Series C Shares held by Mango, Mitzela, Giannakis (John) Evangelou, Antonios Karavias, Christos Glavanis and Reidar Brekke for

no consideration. Because the Offeror disagrees, the Offeror has initiated legal proceedings in the High Court of the Republic of

the Marshall Islands against the Company, the Paliou Family Insiders, the other Director Defendants and controlling shareholders Mango

and Mitzela, to, among other things, seek such cancellation. See Section 18 of

the Offer to Purchase – “legal proceedings” for further information

regarding this litigation.”

| 7. | The information set forth in the section of the Offer to Purchase entitled “INTRODUCTION”

is hereby amended and supplemented by deleting the eighth full paragraph thereof in its entirety and replacing it with the following: |

“According to Exhibit

99.2 to Form 6-K filed by the Company with the SEC on July 25, 2024, there were 12,432,158 Common

Shares outstanding as of July 24, 2024. See Section 12 of the Offer to Purchase –

“CERTAIN EFFECTS OF THE OFFER”.”

| 8. | The information set forth in Section 7 of the Offer to Purchase entitled “CERTAIN INFORMATION

CONCERNING THE COMPANY” is hereby amended and supplemented by deleting the third full paragraph thereof in its entirety and

replacing it with the following: |

“According to Exhibit 99.2

to Form 6-K filed by the Company with the SEC on July 25, 2024, there were 12,432,158

Common Shares outstanding as of July 24, 2024.”

| 9. | The information set forth in Section 8 of the Offer to Purchase entitled “CERTAIN INFORMATION

CONCERNING THE OFFEROR” is hereby amended and supplemented by deleting the seventh full paragraph thereof in its entirety and

replacing it with the following: |

“The Offeror, Maryport and Mr. Economou

beneficially own, in the aggregate, 1,033,859 Common Shares representing approximately 8.3% of the issued and outstanding Shares. The

foregoing percentage is based upon the 12,432,158 Shares stated by the Company as being outstanding

as of July 24, 2024 in Exhibit 99.2 to Form 6-K filed by the Company with the SEC on July

25, 2024.”

| 10. | Section 10 of the Offer to Purchase entitled “BACKGROUND OF THE OFFER; PAST CONTACTS OR

NEGOTIATIONS WITH THE COMPANY” is hereby supplemented by adding the following to the end thereof: |

“On August 9, 2024, the Supreme

Court of the State of New York located in the County of New York granted the defendants’ motions to dismiss the litigation filed

by the Offeror on October 27, 2023 (the “New York Cancellation Proceedings”) on the sole basis that New York lacked

personal jurisdiction over the defendants. The Court did not reach the merits of the suit.

On August 13, 2024, the Offeror initiated

legal proceedings in the High Court of the Republic of the Marshall Islands against the Company, the Paliou Family Insiders, the other

Director Defendants and controlling shareholders Mango and Mitzela (the “RMI Cancellation Proceedings”). The complaint

filed in the High Court (the “RMI Complaint”) is substantially similar to the complaint previously filed in New York.

During the pendency of the New York Cancellation Proceedings, the defendants conceded that the High Court has personal jurisdiction over

them.

On August 15, 2024, the Offeror filed

Amendment No. 7 to Schedule TO with respect to the Offer.”

| 11. | The information set forth in Section 18 of the Offer to Purchase entitled “LEGAL PROCEEDINGS”

is hereby amended and supplemented by deleting the disclosure under Section 18 in its entirety and replacing it with the following: |

“On October 27, 2023,

the Offeror initiated the New York Cancellation Proceedings in the Supreme Court of the State of New York located in the County of New

York against the Paliou Family Insiders, the other Director Defendants, the Company and controlling shareholders Mango and Mitzela by

filing a summons and complaint with such court. A copy of the complaint in the New York Cancellation Proceedings (the “New

York Complaint”) was filed by the Offeror with the SEC as an exhibit to Amendment No. 1 to the Schedule TO filed by the Offeror

in respect of the Offer. On January 29, 2024, the defendants filed motions to dismiss the New York

Complaint. On March 14, 2024, the Offeror filed an omnibus opposition memorandum

of law. On April 4, 2024, the defendants filed reply memoranda of law in further support of their motions to dismiss. On August 9, 2024,

the Court granted the defendants’ motions to dismiss on the sole basis that New York lacked personal jurisdiction over the defendants.

The Court did not reach the merits of the suit.

On August 13, 2024, the Offeror

initiated the RMI Cancellation Proceedings in the High Court of the Republic of the Marshall Islands against the Company, the Paliou Family

Insiders, the other Director Defendants, and controlling shareholders Mango and Mitzela. The RMI Complaint is substantially similar to

the complaint previously filed in New York. During the pendency of the New York Cancellation Proceedings, the defendants conceded that

the High Court has personal jurisdiction over them.

The RMI Complaint alleges

that the defendants abused the machinery of the Company to disenfranchise common shareholders and grant control of the Company to the

Paliou Family Insiders. The RMI Complaint further alleges that the defendants orchestrated the 2022 Exchange Offer, the sole purpose of

which was to grant control of the Company to the Paliou Family Insiders without requiring them to pay a control premium. More specifically,

the RMI Complaint alleges that (i) the defendants carefully designed the 2022 Exchange Offer that gave common shareholders the unappealing

opportunity to convert their Shares to super-voting Series C Preferred Shares only after a year of holding illiquid, non-voting Series

B Preferred Shares, and during a time of apparent peril for the Company, (ii) this ensured that the Paliou Family Insiders—through

Mango and Mitzela, entities wholly owned by defendants Aliki Paliou and Andreas Michalopoulos, respectively—and other insiders would

exchange their Shares, while public shareholders largely did not, and (iii) in fact, the 2022 Exchange Offer had no economic rationale;

its only purpose was to give control to the Paliou Family Insiders, at the expense of the voting and other rights of common shareholders.

As also alleged in the complaint, to further solidify the Paliou Family Insiders’ control after the 2022 Exchange Offer, the defendants

caused the Company to perform a series of dilutive stock issuances and a reverse stock split. As a result of the transactions described

in the RMI Complaint, the Paliou Family Insiders went from having minority voting power to nearly 90% of the Company’s voting power,

and public shareholders saw the value of their Shares drop precipitously. As explained in the RMI Complaint, the Offeror believes that

the Director Defendants’ approval of the transactions that gave the Paliou Family Insiders control of the Company and disenfranchised

common shareholders constituted breaches of fiduciary duties.

The RMI Complaint asserts

five causes of action. Count I asserts a claim for breach of the fiduciary duty of loyalty against the Director Defendants, Mango, and

Mitzela. Count II asserts a claim for breach of the fiduciary duty of care against the Director Defendants, Mango, and Mitzela. Count

III asserts a claim for breach of the fiduciary duty of good faith against the Director Defendants, Mango, and Mitzela. Count IV asserts

a claim for aiding and abetting breaches of fiduciary duties against Mango and Mitzela. Count V seeks a declaration that the Series C

Preferred Shares issued to Defendants are void because the directors that approved the Exchange Offer were conflicted in that they owed

loyalties to the Paliou Family Insiders.

In the RMI Cancellation Proceedings,

the Offeror is requesting that the High Court among other things: (1) declare the Series C Preferred Shares purportedly held (directly

or indirectly) by Mango, Mitzela, or any Director Defendant void and not entitled to vote; (2) cancel the Series C Preferred Shares Certificate;

(3) cancel the Series C Preferred Shares issued to Mango, Mitzela, and any Director Defendant; or, in the alternative, rescind the issuance

of any Series C Preferred Shares issued to Mango, Mitzela, and any Director Defendant; or, in the alternative, to provide an equivalent

result, require the Company to issue, to the extent necessary, additional Series C Preferred Shares or another new class of preferred

shares to non-defendant common shareholders to put them in the same economic, voting, governance and other position as they would have

been in had the Series C Preferred Shares issued to Mango, Mitzela, and the Director Defendants been cancelled; (4) cancel the Common

Shares issued to Mango, Mitzela, and any Director Defendant through conversion of Series C Preferred Shares; or, in the alternative, rescind

the issuance of any such Common Shares issued to Mango, Mitzela, or any Director Defendant; or, in the alternative, to provide an equivalent

result, require the Company to issue, to the extent necessary, additional Common Shares to non-defendant common shareholders to put them

in the same position as they would have been in had such conversions not occurred; (5) enjoin any further conversions of Series C Preferred

Shares into Common Shares; (6) enjoin Mango, Mitzela, any Director Defendant, and anyone acting in concert with those defendants, from

exercising the voting rights of their Series C Preferred Shares, declaring dividends, or otherwise reaping the benefits of ownership of

Series C Preferred Shares; (6) rescind any Series C Preferred Shares issued to retail shareholders and declaring such retail shareholders

entitled to receive any Common Shares and funds they tendered to receive Series C Preferred Shares; (7) enjoin holders of Series B Preferred

Shares from converting such shares to Series C Preferred Shares; (8) enjoin the holders of Series C Preferred Shares from converting such

shares to Common Shares; (9) award the Offeror damages (including punitive damages), together with pre- and post-judgment interest, in

an amount to be proven at trial; (10) award the Offeror the costs and disbursements of the Cancellation Proceedings, including reasonable

attorneys’ fees; and (11) grant the Offeror any other relief that the court may deem just and proper.

The

outcome of the RMI Cancellation Proceedings cannot be predicted with certainty. The Case Number for the RMI Cancellation Proceedings is

Civil Action No. 2024-01276 HCT/CIV/Maj.”

Item 12. Exhibits.

Item 12 of the Schedule TO

is hereby amended and supplemented by adding the following text thereto:

SIGNATURES

After due inquiry and to the

best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: August 15, 2024

| |

SPHINX INVESTMENT CORP. |

| |

|

| |

By: Levante Services Limited |

| |

|

| |

By: |

/s/

Kleanthis Costa Spathias |

| |

Kleanthis Costa Spathias |

| |

Director |

| |

|

| |

MARYPORT NAVIGATION CORP. |

| |

|

| |

By: Levante Services Limited |

| |

|

| |

By: |

/s/ Kleanthis

Costa Spathias |

| |

Kleanthis Costa Spathias |

| |

Director |

| |

|

| |

George Economou |

| |

|

| |

/s/

George Economou |

| |

George Economou |

EXHIBIT INDEX

| Exhibit |

|

Description |

| |

|

|

| (a)(1)(A) |

|

Offer to Purchase* |

| |

|

|

| (a)(1)(B) |

|

Form of Letter of Transmittal* |

| |

|

|

| (a)(1)(C) |

|

Form of Notice of Guaranteed Delivery* |

| |

|

|

| (a)(1)(D) |

|

Form of Letter to Brokers, Dealers, Commercial Banks,

Trust Companies and Other Nominees* |

| |

|

|

| (a)(1)(E) |

|

Form of Letter to Clients for Use by Brokers, Dealers,

Commercial Banks, Trust Companies and Other Nominees* |

| |

|

|

| (a)(1)(F) |

|

Form of Summary Advertisement as published in the New

York Times on October 11, 2023 * |

| |

|

|

| (a)(1)(G) |

|

Amended and Restated Offer to Purchase* |

| |

|

|

| (a)(1)(H) |

|

Form of revised Letter of Transmittal* |

| |

|

|

| (a)(1)(I) |

|

Form of revised Notice of Guaranteed Delivery* |

| |

|

|

| (a)(1)(J) |

|

Form of revised Letter to Brokers, Dealers, Commercial

Banks, Trust Companies and Other Nominees* |

| |

|

|

| (a)(1)(K) |

|

Form of revised Letter to Clients for Use by Brokers,

Dealers, Commercial Banks, Trust Companies and Other Nominees* |

| |

|

|

| (a)(1)(L) |

|

Complaint filed by Sphinx Investment Corp. in the Supreme

Court of the State of New York located in the County of New York* |

| |

|

|

| (a)(1)(M) |

|

Press Release issued by Sphinx Investment Corp. on

October 30, 2023* |

| |

|

|

| (a)(1)(N) |

|

Press Release issued by Sphinx Investment Corp. on

November 15, 2023* |

| |

|

|

| (a)(1)(O) |

|

Supplement to Amended and Restated Offer to Purchase

dated December 5, 2023* |

| |

|

|

| (a)(1)(P) |

|

Press Release issued by Sphinx Investment Corp. on March

26, 2024* |

| |

|

|

| (a)(1)(Q) |

|

Press Release issued by Sphinx Investment Corp. on June

27, 2024* |

| |

|

|

| (a)(1)(R) |

|

Complaint filed by Sphinx Investment Corp. in the High Court of the Republic

of the Marshall Islands on August 13, 2024 (and stamped by such Court as received on August 15, 2024)** |

| |

|

|

| (b) |

|

Not applicable. |

| |

|

|

| (d) |

|

Not applicable. |

| |

|

|

| (g) |

|

Not applicable. |

| |

|

|

| (h) |

|

Not applicable. |

| |

|

|

| 107 |

|

Filing Fee Table* |

* Previously filed

** Filed herewith

Exhibit (a)(1)(R)

James H. Power

HOLLAND & KNIGHT LLP

21 West 52nd Street

New York, New York 10019

Telephone: (212) 513-3200

Facsimile: (212) 385-9100

james.power@hklaw.com

Melvin Narruhn

RMI Bar Admission No. 161

PO Box 774

RRE Business Complex, RM101

Majuro, MH 96960

Telephone: (692) 455-0304

mallippen@yahoo.com

Counsel for Plaintiff Sphinx Investment Corp.

Jonathan M. Watkins (pro hac vice to be submitted)

Jared Stanisci (pro hac vice to be submitted)

CADWALADER, WICKERSHAM & TAFT LLP

200 Liberty Street

New York, New York 10281

Telephone: (212) 504-6000

Facsimile: (212) 504-6666

jonathan.watkins@cwt.com

jared.stanisci@cwt.com

Of Counsel

IN THE HIGH COURT OF

THE REPUBLIC OF THE MARSHALL ISLANDS

|

Sphinx Investment Corp., a Republic of the Marshall Islands Corporation,

Plaintiff,

-against-

Aliki Paliou, Andreas Nikolaos Michalopoulos, Symeon Palios, Giannakis

(John) Evangelou, Antonios Karavias, Christos Glavanis, Reidar Brekke, Mango Shipping Corp., Mitzela Corp., and Performance Shipping Inc.,

a Republic of the Marshall Islands Corporation,

Defendants. |

Civil Action No.

COMPLAINT |

Plaintiff Sphinx Investment

Corp. (“Sphinx”) submits this Complaint against Aliki Paliou, Andreas Nikolaos Michalopoulos, and Symeon Palios (the

“Paliou Family Insiders”); Giannakis (John) Evangelou, Antonios Karavias, Christos Glavanis, and Reidar Brekke (together

with the Paliou Family Insiders, the “Director Defendants”); Mango Shipping Corp. (“Mango”); Mitzela

Corp. (“Mitzela”); and Performance Shipping Inc. (“PSI” or the “Company”).

NATURE

OF THE ACTION

1. The

Director Defendants schemed to seize control of PSI, a Republic of the Marshall Islands Corporation, for Mango, Mitzela, and the Paliou

Family Insiders, thus entrenching Chair Paliou and her family—all at the expense of the public holders of PSI’s common shares

(the “Common Shares”). Under this scheme, the Paliou Family Insiders effectively issued to themselves a new class of

super-voting shares—each with 10x voting power. That inflated Defendant Aliki Paliou’s control of the voting power (held through

Defendant Mango, her wholly owned investment vehicle) from 46.3% to over 88% as of March 2024. Combined with the voting power of

her husband, Defendant Andreas Nikolaos Michalopoulos—the Company’s CEO, who had owned only 1% of the stock—the pair

now controls more than 90% of the voting power of the Company’s capital stock. By improperly commandeering control (without paying

a control premium, and without paying any consideration at all to the holders of the Common Shares), the Director Defendants breached

their duties of loyalty and care, and they disenfranchised common stockholders. When given the opportunity to remedy that harm, PSI’s

Board of Directors (the “Board”), including Defendants Paliou and Michalopoulos (who remain Directors), refused. Shareholder

Sphinx thus sues to reinstate the voting and economic rights of the common stockholders who were harmed and disenfranchised by Defendants’

improper scheme.

2. Defendants

carried out their scheme (and effected subsequent transactions to dilute the value of the Common Shares to the benefit of the Paliou Family

Insiders), with the advice and assistance of Maxim Group, LLC (“Maxim”), a New York-based investment bank. Maxim has,

as described below, been censured and fined by the United States Securities and Exchange Commission for its conduct; as the press has

noted, Maxim “has [] come under heavy criticism from investors and industry figures for the highly dilutive equity deals it has

done for a collection of smaller, mostly Greek shipowners,” including PSI.1

3. Another

Greek shipowner for which Maxim ha carried out such a “highly dilutive equity deal” is Seanergy Maritime Holdings Corp., a

Marshall Islands company that is the subject of a similar lawsuit in this Court. See Sphinx Investment Corp. v. Tsantanis, et al.,

Civil Action No. 2024-00357.

4. The

market has recognized that PSI is dominated by—and subject to the self-interested whims of—the Paliou Family Insiders: as

of June 2023, before Sphinx’s views were publicly reported, PSI traded at a remarkable 97% discount to Net Asset Value.

The market has also recognized the merits of Sphinx’s claims—since Sphinx began purchasing stock in the Company, PSI stock

has risen about 73% as of August 2024.

1

Brady, Joe, Maxim Group-tied Deals Slow to a Crawl as All Eyes Turn to New York Courts. TradeWinds, Nov. 2, 2023.

5. Sphinx,

which owns about 8.4% of the Company’s Common Shares, believes that PSI’s intrinsic value dwarfs its market value. It has

thus launched a proxy contest by delivering a notice to the Company proposing: (i) the nomination of John Liveris for election to

the Board at the next Annual General Meeting of Shareholders (the “Annual Meeting”), (ii) to bring before the

next Annual Meeting an advisory, non-binding proposal that the Board be declassified before the 2025 Annual General Meeting of Shareholders,

and (iii) to bring before the next Annual Meeting four advisory, non-binding proposals that the Company’s shareholders request

the resignation of four current Board members, including Defendant Michalopoulos. Further, on October 11, 2023, Sphinx commenced

a tender offer to buy all outstanding Common Shares of PSI—at nearly double their then-market value—in order to acquire the

Company’s outstanding Common Shares, eliminate the dual-class capital structure that has devaluated the Common Shares, replace the

conflicted Board, and correct the Director Defendants’ improper takeover. The stock price spiked following the announcement. Despite

the market’s positive reaction and the obvious benefit to public common shareholders given the significant premium to the pre-offer

price that Sphinx is offering them, PSI announced its opposition to Sphinx’s tender offer. The Company claims that Sphinx’s

offer price undervalues PSI despite Sphinx’s offer price being nearly double the then-market price. The Company’s position

thus highlights the magnitude of stockholder harm caused by Defendants’ scheme to improperly seize de jure control of the

company, which also has the consequence of artificially depressing the value of the publicly traded common stock. The Company also claims

that it is unable to unwind the Company’s improper dual-class capital structure in order to effectuate the tender offer—a

purported “problem” created through the Paliou Family Insiders’ breaches of fiduciary duties that, the Company says,

makes it impossible to remedy the Director Defendants’ misconduct.

6. There

is a pressing need for the common shareholders’ voting rights to be restored before the Company’s next Annual Meeting. The

annual meeting votes will otherwise be tainted by Defendants’ self-dealing. Plaintiff thus seeks, among other relief, the cancellation

of the shares (the “Series C Preferred Shares”) of the Company’s Series C Convertible Cumulative Redeemable

Perpetual Preferred Stock (the “Series C Preferred Stock”) issued to the Director Defendants and their investment vehicles

as part of Defendants’ scheme and a declaration that those Series C Preferred Shares are not entitled to vote at the Company’s

next Annual Meeting. Given that some public shareholders also participated in the Exchange Offer, Plaintiff requests that the Series C

Preferred Shares issued to those shareholders be rescinded and the Common Shares that they tendered in to the Exchange Offer be reinstated.

Defendants’ Tactics

7. A

few members of a wealthy and powerful family abused the corporate machinery of a publicly traded, Nasdaq-listed company, PSI (NASDAQ:

PSHG), to disenfranchise common stockholders and take for themselves much of the Company’s value. PSI is part of a triumvirate of

closely related public shipping companies—which also includes Diana Shipping Inc. (“Diana Shipping”) and OceanPal Inc.—that

are all controlled by the Paliou family and exploited for the family’s benefit, to the detriment of shareholders.

8. During

his tenure as PSI’s Chair and Chief Executive Officer, Defendant Paliou’s father, Defendant Symeon Palios, accumulated a 47.6%

beneficial ownership position in the Company, largely through related-party transactions with the Company. In 2020, Defendant Palios put

his interests in PSI in a newly created entity: Mango. He then transferred sole ownership of Mango to his daughter, Defendant Aliki Paliou.

Next, he stepped down as PSI’s Chairperson so that Defendant Paliou could assume that role. He also stepped down as CEO so that

his son-in-law (Defendant Paliou’s husband), Defendant Andreas Michalopoulos, could be tapped to take over as the new CEO, completing

the transfer of the Palios family fiefdom to the next generation. Meanwhile, Palios’s other daughter, Semiramis

Paliou, is the Chairperson of OceanPal Inc (a recent spinoff of Diana Shipping), while Palios himself remains Chairman of Diana Shipping.

9. Palios’s

moves left PSI with a Board dominated by the interests of a single family—those of the Paliou Family Insiders.

Paliou Family Insiders

10. When

the global pandemic caused a sharp downturn in PSI’s business in 2020 and 2021, the Company faced a pressing need to raise capital.

But that would mean issuing more shares—diluting the Paliou Family Insiders’ interest in PSI. To insulate Mango and the Paliou

Family Insiders—and only Mango and the Paliou Family Insiders—from dilution, the Director Defendants approved a scheme that

would place on public holders of PSI’s Common Shares (i.e., those other than Defendants) the entire burden of the loss of

voting power expected to stem from the issuance of new shares.

11. Far

from having their voting power diluted, under the scheme Mango’s and the Paliou Family Insiders’ voting power skyrocketed.

Defendants carefully designed an Exchange Offer from which Mango would emerge with an overwhelming proportion of the voting power of PSI’s

stock; seize de jure control of the Company; yet pay no control premium. And that is exactly what has happened.

12. The

Exchange Offer gave holders of Common Shares the economically irrational “opportunity” to exchange their readily tradeable,

Nasdaq-listed shares for an illiquid, nonvoting Series B class of preferred shares (the “Series B Preferred Shares”)

that they would be unable to sell.

13. Then,

under the offer’s terms, after spending a year in illiquid, non-voting limbo, while the Company was in a state of apparent financial

peril, the holders of the Series B Preferred Shares could have their shares converted to the Series C Preferred Shares with

ten-times the voting power of the Common Shares and with other rights, including receiving dividends (from which common stockholders were

excluded) and a liquidation preference.

14. Mango,

however, knew that unlike other owners of Common Shares, it would not need to put its investment in year-long limbo; it could sell through

private block sales and other means available only to insiders. And that’s precisely how things played out—the Board permitted

Mango to use a private placement to jump the line and exchange its Series B Preferred Shares for Series C Preferred Shares several

months early, in October 2022. Meanwhile, the smattering of public shareholders who accepted the Exchange Offer were left to wait.

15. The

Director Defendants’ scheme was designed to be unfair—to favor Mango at the expense of other owners of Common Shares. The

Director Defendants took none of the customary steps to evaluate and ensure the fairness of the Exchange Offer to holders of Common Shares.

They obtained no fairness opinion. They held no shareholder vote. Nor, on information and belief, did they form a special committee of

independent directors to consider the offer. Instead, the Board, dominated by the power and influence of narrow family interests, knowingly

engaged in a scheme to transfer voting power (and more) from the public holders of Common Shares to Mango and the Paliou Family Insiders.

16. The

result of the Exchange Offer was a foregone conclusion, one dictated by the offer’s design. As the Director Defendants planned

and intended, almost all Series B Preferred Shares were issued to Mango, thus increasing Mango’s voting power from 46.3% to

over 88% once the Series B Preferred Shares were further exchanged for Series C Preferred Shares.2

17. On

information and belief, the Director Defendants orchestrated the Exchange Offer with the intention that, after the offer was consummated

(and the Paliou Family Insiders safely out of the Common Shares), the Director Defendants would dilute the value of the Company’s

Common Shares through serial issuances of Common Shares or rights to Common Shares that diminished the value and voting power of public

holders of Common Shares—while solidifying the insiders’ control. And indeed, once Mango was firmly in control through the

Exchange Offer and protected from any loss in value of the Common Shares, the Company proceeded with a series of dilutive issuances throughout

2022 and 2023 that slashed the value of the Common Shares—dilution so extreme that PSI was twice informed that it had violated Nasdaq’s

listing rules.

18. These

dilutive issuances were orchestrated with help from Maxim, an investment bank that has become well known for its role in several value-destructive

transactions throughout the shipping industry. Other Maxim-led transactions have drawn the ire of the SEC, which issued a censure and

cease-and-desist order and imposed a civil penalty. As part of its cease-and-desist proceedings the SEC has asserted that Maxim ignored

or failed to investigate red flags indicative of potentially unregistered offerings, pump-and-dump schemes, or other manipulative activity

in low-priced securities. Maxim was the sole placement agent for PSI’s dilutive issuances in 2022 and early 2023.

2

In a Schedule 13D/A filed with the SEC on September 1, 2023, Mango disclosed that it held a 68.4% interest in PSI. But that

is misleading. As the 13D/A makes clear, that figure reflects Mango’s voting power if it were to “conver[t] 1,314,792 Series

C Preferred Shares held directly by Mango” to Common Shares. Yet, upon information and belief, Mango has not converted any of its

1,314,792 Series C Preferred Shares to Common Shares and it thus controlled in excess of 88% of the voting power of the Company’s

capital stock as of March 2024.

19. As

set forth in this Complaint, by formulating and approving the Exchange Offer and thereby improperly creating a dual-class capital structure

that delivered control of PSI to Company insiders, Defendants breached their fiduciary duties under Marshall

Islands law, which governs.3

20. To

remedy the Director Defendants’ breaches of fiduciary duties—and to prevent future boards from engaging in similar improper

conduct—Plaintiff requests that the Court (1) declare that the Series C Preferred Shares and Common Shares issued

to the Director Defendants, Mango, and Mitzela through the Exchange Offer are void; (2) cancel the Series C Preferred Shares

issued to the Director Defendants, Mango, and Mitzela; (3) cancel any Common Shares that the Director Defendants, Mango, and Mitzela

have obtained by converting their Series C Preferred Shares into Common Shares; (4) enjoin any further conversions of Series C

Preferred Shares into Common Shares; (5) rescind the Series C Preferred Shares issued to public shareholders and reissue Common

Shares to those shareholders; and (6) cancel the Series C Preferred Shares Certificate and declare that only the Common

Shares are eligible to vote at the next Annual Meeting.

3

The Marshall Islands’ Business Corporations Act provides that its provisions “shall be applied and construed

to make the laws of the Republic, with respect to the subject matter hereof, uniform with the laws of the State of Delaware and other

states of the United States of America with substantially similar legislative provisions. Insofar as it does not conflict with any other

provision of this Act, the non-statutory law of the State of Delaware and of those other states of the United States of America with

substantially similar legislative provisions is hereby declared to be and is hereby adopted as the law of the Republic.” MI BCA

§ 13.

THE

PARTIES

21. Plaintiff

Sphinx Investment Corp. is incorporated in the Marshall Islands. As of August 2024, Sphinx owns about 8.4% of the Common Shares of

PSI.

22. Defendant

Aliki Paliou is currently the Chairperson of the Board and was a member of the Board at the time of the Exchange Offer. She is the wife

of Defendant Michalopoulos (a member of the Board and current CEO of PSI) and daughter of Defendant Palios (PSI’s former Chair and

CEO). Paliou is the sole shareholder of Mango, which controlled over 88% of the Company’s capital stock through its ownership of

Series C Preferred Shares and Common Shares as of March 2024. She obtained that interest from her father (Defendant Palios)

and through the Exchange Offer.

23. Defendant

Andreas Nikolaos Michalopoulos is the Chief Executive Officer of PSI and a member of the Board, positions he held at the time of the Exchange

Offer. He also serves as Director and Secretary of PSI. He is married to Defendant Paliou. He is also the owner of Mitzela, which controlled

about 3.8% of the voting power of the Company’s capital stock through its ownership of Series C Preferred Shares and Common

Shares as of March 2024. Mitzela participated in the Exchange Offer, through which Michalopoulos increased his voting power (through

Mitzela) from less than 1% to about 3.8%. As of March 2024, Paliou and Michalopoulos together controlled more than 90% of the voting

power of the Company’s capital stock. Michalopoulos is a former CFO, Treasurer, and Director of Diana Shipping.

24. Defendant

Symeon Palios was the CEO of PSI from 2010 through October 2020. He also served as Chairman of the Board from 2010 until 2022, including

during the time of the Exchange Offer. Palios currently serves as Director and Chairman of the Board of NYSE-listed, Marshall Islands-incorporated

Diana Shipping, a position in which he has served since 2005.

25. Defendant

Giannakis (John) Evangelou served as a PSI Director and Chairman of PSI’s Audit Committee from early 2011 until February 28,

2022, including during the time of the Exchange Offer.

26. Defendant

Antonios Karavias served as a PSI Director from 2010 until February 28, 2022, including during the time of the Exchange Offer.

27. Defendant

Christos Glavanis served as a PSI Director and as Chairman of the Compensation Committee from February 2020 to February 2022,

including during the time of the Exchange Offer. He served as Director of Diana Shipping from August 1, 2018, to February 19,

2020, while Defendant Palios served as Chairman of that company.

28. Defendant

Reidar Brekke served as a Director from 2010 until February 28, 2022, including during the time of the Exchange Offer.

29. Defendant

Mango Shipping Corp. is incorporated in the Marshall Islands. Mango is owned and controlled by Defendant Paliou.

30. Defendant

Mitzela Corp. is incorporated in the Marshall Islands. Mitzela is owned and controlled by Defendant Michalopoulos.

31. Defendant

Performance Shipping, Inc. is incorporated in the Marshall Islands. PSI was formed in 2010 to pursue vessel acquisitions in the container-shipping

industry. It is a spinoff of Diana Shipping, the company for which Defendant Palios currently serves as Chairman. At all relevant times,

PSI shares were publicly traded on The Nasdaq Stock Market.

JURISDICTION

AND VENUE

32. This

Court has subject matter jurisdiction under Article VI, Section 3 of the Constitution of the Republic of the Marshall Islands

and 27 MIRC Ch. 2 § 213.

33. This

Court has personal jurisdiction over PSI, Mango, and Mitzela under 52 MIRC Ch. 1 § 15(b) and 27 MIRC Ch. 2 §

251(o).

34. The

Court has personal jurisdiction over the Director Defendants under 27 MIRC Ch. 2 § 251(i) and 251(n).

35. Defendants

have conceded, in related litigation, that: “the three corporate defendants [PSI, Mango, and Mitzela] are all incorporated under

Marshall Islands law and subject to personal jurisdiction there. The seven individuals named as defendants [the same individuals named

here] are also subject to personal jurisdiction in the Marshall Islands.” Defendants made those concessions in support of their

argument that New York courts lacked personal jurisdiction over Defendants in a New York matter substantially similar to this one, Sphinx

Investment Corp. v. Paliou et al, Index No. 655326/2023 (New York County). That argument was successful: on August 9,

2024, the court dismissed the lawsuit solely for lack of personal jurisdiction in New York, without reaching the merits.

statement

of facts

Mango Acquires a Minority Interest in PSI

36. PSI

was incorporated in January 2010 under the laws of the Marshall Islands.

37. PSI

filed its initial registration statement with the SEC on October 15, 2010. As of the date of PSI’s prospectus included in its

Initial Registration Statement, about 55% of its shares were owned by Diana Shipping, a NYSE-listed company whose then-chairman and CEO

was Defendant Symeon Palios, the father of Defendant Aliki Paliou.

38. Between

2010 and 2019, Defendant Palios personally accumulated a 47.8% beneficial ownership position in PSI’s Common Shares. Palios acquired

most of this position through related-party transactions with PSI in which Palios sold PSI indirect interests in shipping vessels.

39. In

September 2020, Palios transferred his entire beneficial interest in PSI to Mango. Palios then transferred his interest in Mango

to his daughter, Defendant Aliki Paliou.

40. Upon

the consummation of those transactions, Defendant Paliou, as the sole shareholder of Mango, had a 46.7% beneficial interest in PSI.

41. Also

during 2020, Defendant Paliou was appointed to the Board, and her husband, Defendant Michalopoulos,

was made CEO, a position he still holds.

The Exchange Offer

42. In

2020, the global shipping industry experienced a sharp downturn. That triggered industrywide efforts to raise capital, including through

issuances of equity. Under the Company’s then-existing capital structure, raising capital by issuing of Common Shares would have

resulted in the dilution of the voting rights of all holders of Common Shares, including Mango.

43. Defendants,

however, plotted to prevent any dilution of their power. Rather than pursuing capital-raising transactions with third parties on customary

terms, PSI, at the direction of the Director Defendants, concocted a complicated scheme designed to benefit its largest shareholder, Mango,

and the Paliou Family Insiders—at the expense of the public shareholders.

44. Under

this scheme (the “Exchange Offer”), PSI offered holders of Common Shares the opportunity to exchange their tradeable

Common Shares for illiquid, non-voting Series B Preferred Shares, which would eventually, a year later, become convertible into allegedly

super-voting Series C Preferred Shares. And while the Series C Preferred Shares purport to be convertible into Common Shares,

they are only so convertible after a six-month waiting period, thus further restricting public shareholders’ ability to liquidate

any Series C Preferred Shares.

45. The

Exchange Offer had a minimum tender condition of 2,033,091 Common Shares. The Offer noted that Mango “beneficially owns 2,352,047

Common shares” and that Mango “intends to exchange all such Common shares beneficially owned by it pursuant to this Exchange

Offer for Series B Preferred Shares, and then exercise its Series B Conversion Right to acquire Series C Preferred Shares.”

Mango’s decision to tender was thus enough to make the outcome of the Exchange Offer a foregone conclusion.

46. The

Exchange Offer presented ordinary holders of Common Shares with a Hobson’s choice. They could retain their Common Shares, which

were tradeable but would soon be stripped of voting power, and whose value was depressed by having been economically subordinated to the

dividend rights of the new preferred shares. Or, by tendering into the Exchange Offer, they could preserve their dividend rights and voting

power (only after spending an uncomfortable eighteen months holding illiquid non-voting Series B Preferred Shares followed by conversion

to Series C Preferred Shares during a time of apparent peril for the Company). Such a loss of liquidity is anathema to any shareholder.

Worse still, under that second option, even after converting their Series B Preferred Shares into Series C Preferred Shares,

the economic value of public stockholders’ investment would be slashed: they could only achieve liquidity from their Series C

Preferred Shares on the open markets by converting back into the Common Shares, yet the price of those shares would be depressed—in

the extreme—by the presence of the new, economically superior and super-voting Series C Preferred Shares.

47. Mango,

however, faced no Hobson’s choice: it used its ties to insiders to arrange private transactions to transition out of Series B

Preferred Shares early, and it can arrange further private transactions to directly unlock liquidity from its Series C Preferred

Shares.

48. Mango

and the Board followed through on their plan. On October 17, 2022, PSI entered into a stock purchase agreement with Mango through

which PSI offered another advantage to Mango by giving it the exclusive opportunity to exchange its non-voting Series B Preferred

Shares for super-voting Series C Preferred Shares ahead of the publicly advertised schedule. This private placement transaction occurred

several months before other shareholders who tendered into the Exchange Offer were given the opportunity to convert.

49. PSI

launched the Exchange Offer during the 2021 Christmas holidays, a slow time in the capital markets, and during the peak of the Covid Omicron

surge. This ensured that few market participants would pay attention, so Mango could obtain a larger beneficial interest in PSI for itself.

50. The

Director Defendants, including the Paliou Family Insiders—Defendants Palios, Paliou, and Michalopoulos—directed that the Exchange

Offer occur.

51. Ultimately

and unsurprisingly, the Exchange Offer was significantly undersubscribed. 90% of Series B Preferred Shares were issued to Company

insiders, with around 83% going to Mango. And after the private placement, Mango’s control of the voting power of the Company’s

capital stock increased from about 46% to in excess of 88% as of March 2024.

52. Through

the Exchange Offer and its ensuing conversion of its Series B Preferred shares to Series C Preferred Shares, Mango obtained

de jure control of PSI—without paying a control premium (or anything at all to common shareholders).

53. The

Exchange Offer also purported to provide the Series C Preferred Shares with sweeping consent rights, including, among other things,

that a majority of the holders of those shares can veto any attempt by the Company to: create another class of stock that ranks superior

to or in parity with the Series C Preferred Shares; increase or decrease the number of issued preferred shares; amend the by-laws

or Certificate of Incorporation of the Company; issue any indebtedness that would restrict the ability of the Series C Preferred

Shares to receive dividends; declare bankruptcy or wind up the affairs of the Company; effect a change of control in substantially all

of the Company’s consolidated assets; modify the nature of a subsidiary’s business; enter into any agreement that restricts

the Company’s ability to perform its obligations to holders of Series C Preferred Shares.

54. On

February 28, 2022, PSI held its annual meeting. During that meeting, the Board was reduced from seven to five members. Defendant

Paliou was elected Board Chair, further cementing Mango’s control over PSI. Defendants Palios, Evangelou, and Glavanis did not stand

for re-election, and Defendants Karavias and Brekke resigned from the Board.

More Efforts To Dilute Common Shares

55. After

the consummation of the Exchange Offer, when Mango owned relatively few Common Shares, PSI, using Maxim as its sole placement agent, conducted

a series of Common Share issuances from May 2022 through March 2023. These issuances substantially diluted the value and voting

power of the Common Shares that remained outstanding just after the Exchange Offer, while insulating the Paliou Family Insiders from any

of the costs normally borne by shareholders in a capital raise.

56. Specifically,

in May 2022, the Company announced a public offering of 7,620,000 shares at $1.05 per share, for a total of $8,000,000. In July 2022,

the Company issued 17,000,000 Common Shares for $0.35 per share, for a total of $5,950,000. In August 2022, the Company entered into

a securities purchase agreement to sell 33,333,333 Common Shares, at $0.45 per share, for a total of $15,000,000. In February 2023,

the Company announced an agreement to sell 5,556,000 Common Shares for $2.25 per share, for a total of $12,500,000.

57. So

significant was the dilution that on July 13, 2022, PSI received notification from Nasdaq stating that because the closing bid price

of the Common Shares for 30 straight business days, from May 27, 2022 to July 12, 2022, was below the minimum $1.00 per share

bid price requirement for continued listing on the Nasdaq Capital Market, PSI violated Nasdaq Listing Rule 5550(a)(2). As a result,

PSI conducted a 1:15 reverse stock split on November 15, 2022.

58. Despite

the reverse stock split, PSI received another notification from Nasdaq on April 18, 2023 that its closing bid price was too low for

30 straight days and that PSI had thus again violated Rule 5550(a)(2).

59. Since

the close of the Exchange Offer, the Company has paid no dividends to holders of Common Shares, but it has paid substantial dividends

to the holders of the Series B Preferred Stock and Series C Preferred Stock.

60. In

the wake of the Exchange Offer, PSI essentially became a “penny stock,” its share price having dropped from over $70 in December 2021

to less than $1 in May 2023 and less than $2 as of the filing of this Complaint.

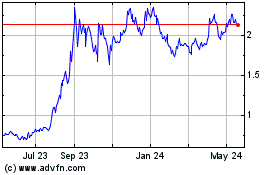

PSI (NASDAQ: PSHG) Historical Stock Price4

4

The data in this chart is taken from Yahoo! Finance. The data accounts for the 1:15 reverse stock split that occurred on

November 15, 2022.

61. Typically

companies trading as “penny stocks” have minimal assets, low levels of liquidity, and modest operations. But not PSI. PSI

has valuable, highly marketable assets and little debt. In fact, as of July 2024, PSI

had seven “operating” Aframax tanker vessels, with four additional “newbuilding” LR1 and LR2 tanker vessels

expected to be delivered in the fourth quarter of 2025 and first and second quarter of 2026. Each of the Aframax

tanker vessels is worth tens of millions of dollars. Yet, as of June 30, 2024, PSI had a market capitalization of just $26,590,000

compared with stockholders’ equity of $254,040,000, or about 10 times the market capitalization. Despite PSI’s massive intrinsic

value, the market has thus recognized that poor management and domination by the Paliou Family Insiders makes PSI a poor investment.

Performance Shipping Fleet

|

|

| “P. Aliki” (recently renamed after Defendant Paliou) |

“P. Monterrey” (ex. “Phoenix Beacon”) |

|

|

| “P. Long Beach” (ex. “Fos Hamilton”) |

“P. Blue Moon” |

|

|

| “P. Sophia” |

“P. Yanbu” |

|

|

| “P. Briolette” |

“P. Blue Moon” |

Sphinx Attempts to Engage with the Board in

Advance of Its Proxy Contest

62. On

August 7, 2023, Sphinx began purchasing shares of PSI. On August 25, 2023, Sphinx filed an initial beneficial ownership report

on Schedule 13D, disclosing its beneficial ownership of over 9% of the then-outstanding Common Shares. PSI’s stock price quickly

ballooned.

PSI Stock Climbs After Sphinx Purchases and

Announcements

63. On

August 31, 2023, Sphinx sent a letter to PSI’s Board (furnished on Schedule 13D) stating, among other things, its belief that

the Company’s dual-class capital structure, together with the Exchange Offer through which the Company effected that structure,

violated Marshall Islands law.

64. The

letter added that the Board’s implementation of the dual-class capital structure was a product of several knowing breaches of fiduciary

duties by the Director Defendants and asked the Board to immediately:

(a) publicly

acknowledge the impropriety and invalidity of the Company’s current dual class structure;

(b) publicly

acknowledge that the voting, conversion, and other preferential rights purported to be given to the Company’s Series C Preferred

Shares are invalid; and

(c) announce

that no votes or consents purported to be cast or given by holders of the Series C Preferred Shares, and that no requests for conversion

of the Series C Preferred Shares into Common Shares, would be counted or recognized.

65. On

September 1, 2023, Defendant Michalopoulos filed (almost six months late) an initial Schedule 13D with respect to the securities

he acquired in the Exchange Offer. Defendant Paliou also filed an amendment to her Schedule 13D that day, more than two months late—her

original Schedule 13D itself having been two months late as well.

66. At

no time did Michalopoulos’s or Paliou’s Schedule 13Ds (or any amendment) disclose any plans for the Exchange Offer or the

issuance of the Series B Preferred Shares, the Series C Preferred Shares, or the series of dilutive issuances that followed

the Exchange Offer.

67. On

September 4, 2023, Sphinx wrote the Board noting that Defendant Michalopoulos indirectly acquired Series C Preferred Shares

as part of the Exchange Offer. The letter requested explanations for:

(a) Michalopoulos’s

and Paliou’s tardy Schedule 13D filings;

(b) the

lack of Schedule 13D disclosures by Michalopoulos and Paliou regarding the Exchange Offer;

(c) why

Paliou and Michalopoulos did not identify themselves as a “group” for purposes of Section 13(d)(3) of the Exchange

Act or Rule 13d-3 given that (among other things) they are married; and

(d) a

recent increase in the number of outstanding Common Shares from 10,910,319 to 11,309,235.

68. The

next day, on September 5, 2023, PSI responded to Sphinx’s letters of August 31 and September 4, rejecting Sphinx’s

assertions of impropriety and declining to provide the explanations requested by Sphinx.

69. On

September 15, 2023, in compliance with the Company’s bylaws, Sphinx delivered a notice of nomination of a candidate for election

to the Board for the 2024 Annual Meeting. PSI attempted to refuse delivery of a physical copy of the nomination notice. On September 25,

2023, Sphinx attempted to deliver a physical copy of a supplementary notice of nomination and shareholder proposals, and PSI again attempted

to refuse delivery.

70. On

October 11, 2023, Sphinx announced a cash tender offer by which it offered to buy all Common Shares for $3 per share—nearly

triple the market price at the time Sphinx began investing in PSI. The market reacted positively to this offer, and the stock price immediately

increased by about $0.60, or 35%. PSI refused to allow Sphinx’s courier to deliver a package containing a physical copy of the tender

offer at PSI’s offices. The tender offer has since been extended and remains outstanding as of the filing of this Complaint.

71. Despite

the positive market reaction to the tender offer, on October 25, 2023, the Board filed a Schedule 14D-9 announcing that a special

committee of the Board (the “Special Committee”) “unanimously recommends that the Company’s shareholders reject

the offer and not tender their common shares for the purchase pursuant to the offer.” The Schedule 14D-9 of the Company was most

recently amended on December 20, 2023.

72. In

support of the Special Committee’s recommendation (which was reaffirmed in the amended Schedule 14D-9), the Company gave “reasons”

that included the following: (1) the Company’s net asset value per Common Share, which

the Company stated was calculated by Newbridge Securities Corporation, the Special Committee's financial advisor, to

be approximately $7.11 per Common Share, exceeds the consideration represented by the offer and the offer therefore undervalues the outstanding

Common Shares; and (2) the offer is illusory, because the (in the Special Committee’s

view) “highly conditional” nature of the offer creates significant doubt that the offer will be consummated. The Special Committee

noted in particular in this respect that the offer remained conditioned on the “Series C Condition” (generally relating

to the cancellation of the Series C Preferred Stock), which, the Special Committee alleged, is not within the authority of the

Board or the Company to satisfy, including because the Special Committee believed that none of the Company’s governing documents

or applicable law grant the Company, the Board or the Special Committee the authority to effect a cancellation of the Series C Preferred

Stock for no consideration. The Company also stated that the offer is subject to other conditions which, the Special Committee

alleged, “give the Offeror wide latitude not to consummate the Offer, especially in light of the lengthy extension of the Offer—for

a period of more than four months—creating a greater likelihood of the occurrence of circumstances on the basis of which the Offeror

could claim a condition is not satisfied.”

73. The

first purported rationale is ironic because Sphinx’s offer price was nearly twice the then-market value of the stock. If the offer

price undervalued the Company, then the Paliou Family Insiders’ mismanagement has caused the market to do so doubly.

74. As

for the Special Committee’s claim that the offer conditions give Sphinx wide latitude

not to consummate the tender offer, it direct contradicts of the Special Committee’s claim in its original October 25, 2023

recommendation that there was “significant doubt as to whether the Offer will be consummated by the stated expiration date of the

Offer.” First, in the view of the Special Committee, the tender offer was not open for long enough. However, since the tender offer’s

extension, the Special Committee claimed it would be open for too long. This “flip-flop” reveals the disingenuity of both

statements.

75. Further,

the only example of a condition that the Special Committee alleged provides Sphinx with “wide latitude” not to consummate

the tender offer is within the full control of the Company and the members of its Board and relates to matters that Sphinx believes have

been historically abused by Company insiders to obtain and maintain control over the Company’s governance and economics. This purported

rationale only underscores: (1) the extent to which the Paliou Family Insiders have sought to entrench themselves through the improper

creation of the Company’s dual-class capital structure; and (2) the importance of obtaining relief from this Court to restore

the voting power and economic rights of public shareholders.

76. As

further evidence of the Paliou Family Insiders’ efforts at entrenchment and willingness to deny common shareholders their voting

franchise, the Company has not held an annual meeting since February 22, 2023—almost 18 months ago.

claims

for relief

Plaintiff states these claims

for relief against Defendants.

FIRST

CAUSE OF ACTION

Breach of Fiduciary Duty of Loyalty Against

the Director Defendants, Mango, and Mitzela

77. Plaintiff

incorporates by reference the above paragraphs as if fully stated here.

78. At

all relevant times, each of the Director Defendants was a Director of PSI and accordingly owed PSI fiduciary duties. Defendant Michalopoulos

also owed PSI fiduciary duties as an officer of the Company.

79. At

all relevant times, Mango dominated and controlled the Company.

80. As

a shareholder with de facto control at the time of the Exchange Offer, Mango also owed fiduciary duties to PSI.

81. As

a shareholder with de facto control at the time of the Exchange Offer, Mitzela also owed fiduciary duties to PSI.

82. As

fiduciaries of PSI, each of the Director Defendants, Mango, and Mitzela owed a duty of undivided loyalty to PSI.

83. This

duty not only bars blatant self-dealing, but also requires the fiduciary to avoid situations in which a fiduciary’s personal interest

possibly conflicts with the interests of the company.

84. By

effecting the Exchange Offer, the Director Defendants, Mango, and Mitzela put their own pecuniary and personal interests above the interests

of PSI, and otherwise failed to act independently.

85. Defendants

Paliou and Mango received a material personal benefit from the Exchange Offer: majority control of PSI. Paliou also lacks independence

from her husband who likewise received a material personal benefit from the Exchange Offer through Mitzela.

86. Defendants

Michalopoulos and Mitzela received a material personal benefit from the Exchange Offer through their and Paliou’s increased voting

power. Michalopoulos lacks independence from his wife, Defendant Paliou, who received that same benefit through the Exchange Offer. Through

his participation in the Exchange Offer, Michalopoulos also obtained Series C Preferred Shares through Mitzela, which he owns and

controls.

87. Defendant

Palios received a material personal benefit from the Exchange Offer in the form of his family’s control of PSI. He also lacks independence

from his daughter, Defendant Paliou, and his son-in-law, Defendant Michalopoulos—both of whom received material personal benefits

from the Exchange Offer as described above.

88. Director

Defendants Evangelou, Karavias, Glavanis, and Brekke, while purportedly independent, were in fact dominated by the interests of the Paliou

Family Insiders. They all had long-term, lucrative appointments on the Board, thanks to the patronage of the Paliou Family Insiders. Here

too, each failed to act independently, in breach of their duty of loyalty. This is evidenced by, among other facts, the unusual nature

of the Exchange Offer, the lack of any material benefit to the Company in engaging in the Exchange Offer as compared to other means of

financing or capital raising, the clear and unique benefits conferred upon the Paliou Family Insiders through the Exchange Offer, the

failure of any of the Director Defendants to take reasonable steps to ensure that the Exchange Offer was fair to public shareholders,

such as obtaining a fairness opinion, and the failure to obtain a control premium for public shareholders in connection with the transfer

of de jure voting control to Mango. Additionally, on information and belief, at least two of these former Director Defendants benefitted

from the improper transactions that they approved.

89. Defendant