0001847345

false

0001847345

2023-08-18

2023-08-18

0001847345

PWUPU:UnitsEachConsistingOfOneClassOrdinaryShareParValue0.0001PerShareAndOnehalfOfOneRedeemableWarrantMember

2023-08-18

2023-08-18

0001847345

PWUPU:ClassOrdinarySharesParValue0.0001PerShareIncludedAsPartOfUnitsMember

2023-08-18

2023-08-18

0001847345

PWUPU:RedeemableWarrantsEachExercisableForOneClassOrdinaryShareFor11.50PerShareIncludedAsPartOfUnitsMember

2023-08-18

2023-08-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 18, 2023

PowerUp

Acquisition Corp.

(Exact

Name of Registrant as Specified in Its Charter)

| Cayman

Islands |

|

001-41293 |

|

N/A |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

No.) |

|

(I.R.S.

Employer

Identification

No.) |

188

Grand Street Unit #195

New

York, NY 10013

(Address

of Principal Executive Offices)

(646)

807-8832

(Registrant’s

Telephone Number)

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Units,

each consisting of one Class A ordinary share, par value $0.0001 per share, and one-half of one Redeemable Warrant |

|

PWUPU |

|

The

Nasdaq Stock Market LLC |

| Class

A Ordinary Shares, par value $0.0001 per share, included as part of the Units |

|

PWUP |

|

The

Nasdaq Stock Market LLC |

| Redeemable

Warrants each exercisable for one Class A Ordinary Share for $11.50 per share, included as part of the units |

|

PWUPW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry into a Material Definitive Agreement.

As

previously disclosed, on July 14, 2023, PowerUp Acquisition Corp., a Cayman Islands exempted company (the “Company”), entered

into a purchase agreement (the “Purchase Agreement”) with PowerUp Sponsor LLC, a Delaware limited liability company (the

“Original Sponsor”) and SRIRAMA Associates, LLC, a Delaware limited liability company (the “New Sponsor”), pursuant

to which the New Sponsor agreed to purchase from the Original Sponsor 4,317,500 Class A ordinary shares, of the Company and 6,834,333

private placement warrants, each exercisable for one Class A Ordinary Share for an aggregate purchase price of $1.00 (the “Purchase

Price”), payable at the time the Company completes an initial business combination. In addition to the payment of the Purchase

Price, the New Sponsor also assumed the responsibilities and obligations of the Original Sponsor related to the Company.

On

August 18, 2023 (the “Effective Date”), the parties to the Purchase Agreement closed the transactions contemplated thereby.

As a result, and as disclosed in Item 5.02, the New Sponsor replaced the Company’s current directors and officers with directors

and officers of the Company selected in the New Sponsor’s sole discretion.

The

foregoing description of the Purchase Agreement is not complete and is qualified in its entirety by reference to the text of such document,

which is filed as Exhibit 10.1 hereto and which is incorporated herein by reference.

Item

5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

The

disclosures set forth in Item 1.01 are incorporated by reference into this Item 5.02.

Change

in Company Officers and Directors

On

the Effective Date, in connection with the Purchase Agreement, (i) Bruce Hack, Jack Tretton, Peter Blacklow, Julie Uhrman, and Kyle Campbell

(the “Resigning Directors”) tendered their resignations as members of the board of directors of the Company (the “Board”),

(ii) Jack Tretton, Michael Olson, and Gabriel Schillinger resigned as officers of the Company, (iii) Surendra Ajjarapu, Michael L. Peterson,

Donald G. Fell, Mayur Doshi, and Avinash Wadhwani were appointed as members of the Board (each, a “New Director”), (iv) Surendra

Ajjarapu was appointed Chairman of the Board, and (v) Surendra Ajjarapu and Howard Doss were appointed as the Company’s Chief Executive

Officer and Chief Financial Officer, respectively (each, a “New Officer”). As of the Effective Date, there was no known disagreement

with any of the Resigning Directors on any matter relating to the Company’s operations, policies or practices.

The

Board is divided into three classes: Class I, Class II, and Class III. The Class I directors shall stand appointed for a term expiring

at the Company’s first annual general meeting, the Class II directors shall stand appointed for a term expiring at the Company’s

second annual general meeting and the term of office of the Class III directors shall stand appointed for a term expiring at the Company’s

third annual general meeting. On or before the Company’s first annual general meeting the Company expects to designate each

New Director into a class, and at each annual general meeting thereafter, directors appointed to succeed those directors whose terms

expire shall be appointed for a term of office to expire at the second succeeding annual general meeting after their appointment.

The

following sets forth certain information concerning each New Director and New Officer’s past employment history, directorships

held in public companies, if any, and, for directors, their qualifications for service on the Board.

Surendra

Ajjarapu

Suren

Ajjarapu (age: 53) has served as Chairman of the Board, Chief Executive Officer and Secretary of TrXADE HEALTH, INC (Nasdaq: MEDS) a

Delaware corporation, and its predecessor company since July 2010. He is also currently a director of Oceantech Acquisition I Corp.,

traded on Nasdaq under the symbol “OTECU”, serves as Chairman of the board of directors

of Kernel Group Holdings, Inc., a special purpose acquisition company (NASDAQ: KRNL) (“KRNL”) (since December 2022) and Semper

Paratus Acquisition Corporation, a special purpose acquisition company (NASDAQ: LGSTU). Beginning in 2021, Mr. Ajjarapu served

as Chief Executive Officer and Chairman of Aesther Healthcare Acquisition Corp., a special purpose acquisition company that consummated

its initial business combination in February 2023. Mr. Ajjarapu is currently serving as a director of the merged company, Ocean Biomedical,

Inc. (NASDAQ: OCEA) (f.k.a Aesther Healthcare Acquisition Corp.). Since March 2018, Mr. Ajjarapu has served as Executive Chairman of

the Board of Kano Energy Corp., a company involved in the development of renewable natural gas sites in the United States. Mr. Ajjarapu

was a Founder and served as Chief Executive Officer and Chairman of the Board of Sansur Renewable Energy, Inc., a company involved in

developing wind power sites in the Midwest of the United States, from March 2009 to December 2012. Mr. Ajjarapu was also a Founder, President

and Director of Aemetis, Inc., a biofuels company (NASDAQ: AMTX), and a Founder, Chairman and Chief Executive Officer of International

Biofuels, a subsidiary of Aemetis, Inc., from January 2006 to March 2009. Mr. Ajjarapu was Co-Founder, Chief Operations Officer, and

Director of Global Information Technology, Inc., an IT outsourcing and systems design company, headquartered in Tampa, Florida with major

operations in India. Mr. Ajjarapu graduated from South Dakota State University with a M.S. in Environmental Engineering, and from the

University of South Florida with an M.B.A., specializing in International Finance and Management. Mr. Ajjarapu is also a graduate of

the Venture Capital and Private Equity program at Harvard University.

Howard

Doss

Howard

Doss (age: 69) is a seasoned chief financial officer and accountant. He currently serves as Chief Financial Officer of KRNL. And, beginning

in 2021, he served as Chief Financial Officer of Aesther Healthcare Acquisition Corp., a special purpose acquisition company until it

consummated its initial business combination in February 2023. He has also served as chief financial officer of TRxADE HEALTH, INC.,

an online marketplace for health traded on Nasdaq under the symbol “MEDS.” Mr. Doss has served in a variety of capacities

with accounting and investment firms. He joined the staff of Seidman & Seidman (BDO Seidman, Dallas) in 1977 and in 1980 he joined

the investment firm Van Kampen Investments, opening the firm’s southeast office in Tampa, Florida in 1982. He remained with the

firm until 1996 when he joined Franklin Templeton. After working for the Principal Financial Group office in Tampa, Florida, Mr. Doss

was City Executive for U.S. Trust in Sarasota, Florida, responsible for high net worth individuals. He retired from that position in

2009. He served as CFO and Director for Sansur Renewable Energy, an alternative energy development company, from 2010 to 2012. Mr. Doss

has also served as President of STARadio Corp. since 2005. Mr. Doss is a member of the America Institute of CPA’s. He is a graduate

of Illinois Wesleyan University.

Michael

L. Peterson

Michael

Peterson (age: 61) commenced serving as President, Chief Executive Officer and as a member of the Board of Directors of Lafayette Energy

Corp. in April 2022. Beginning in September 2021, Mr. Peterson served as a member of the Board of Directors, Audit Committee (Chair),

Compensation Committee and Nominating and Corporate Governance Committee of Aesther Healthcare Acquisition Corp. (Nasdaq: AEHA), a special

purpose acquisition company, that consummated its initial business combination in February 2023. Mr. Peterson is currently serving as

a director of the merged company, Ocean Biomedical, Inc. (Nasdaq: OCEA) (f.k.a Aesther Healthcare Acquisition Corp.). In addition, Mr.

Peterson commenced serving as an independent director of Oceantech Acquisition I Corp., in

March 2023, began serving as an independent director of KRNL in December 2022 and as an independent director of Semper Paratus Acquisition

Corporation in June 2023. Mr. Peterson has served as the president of Nevo Motors, Inc. since December 2020, which was established

to commercialize a range extender generator technology for the heavy-duty electric vehicle market but is currently non-operational. Since

May 2022, Mr. Peterson has served as a member of the Board of Directors and as the Chairperson of the Audit Committee of Trio Petroleum

Corp., an oil and gas exploration and development company which is in the process of going public. Since February 2021, Mr. Peterson

has served on the board of directors and as the Chairman of the Audit Committee of Indonesia Energy Corporation Limited (NYSE American:

INDO). Mr. Peterson previously served as the president of the Taipei Taiwan Mission of The Church of Jesus Christ of Latter-day Saints,

in Taipei, Taiwan from June 2018 to June 2021. Mr. Peterson served as an independent member of the Board of Directors of TRxADE HEALTH,

INC (formerly Trxade Group, Inc.) from August 2016 to May 2021 (Nasdaq: MEDS). Mr. Peterson served as the Chief Executive Officer of

PEDEVCO Corp. (NYSE American:PED), a public company engaged primarily in the acquisition, exploration, development and production of

oil and natural gas shale plays in the US from May 2016 to May 2018. Mr. Peterson served as Chief Financial Officer of PEDEVCO between

July 2012 and May 2016, and as Executive Vice President of Pacific Energy Development (PEDEVCO’s predecessor) from July 2012 to

October 2014, and as PEDEVCO’s President from October 2014 to May 2018. Mr. Peterson joined Pacific Energy Development as its Executive

Vice President in September 2011, assumed the additional office of Chief Financial Officer in June 2012, and served as a member of its

board of directors from July 2012 to September 2013. Mr. Peterson formerly served as Interim President and CEO (from June 2009 to December

2011) and as director (from May 2008 to December 2011) of Pacific Energy Development, as a director (from May 2006 to July 2012) of Aemetis,

Inc. (formerly AE Biofuels Inc.), a Cupertino, California-based global advanced biofuels and renewable commodity chemicals company (NASDAQ:AMTX),

and as Chairman and Chief Executive Officer of Nevo Energy, Inc. (NEVE) (formerly Solargen Energy, Inc.), a Cupertino, California-based

developer of utility-scale solar farms which he helped form in December 2008 (from December 2008 to July 2012). From 2005 to 2006, Mr.

Peterson served as a managing partner of American Institutional Partners, a venture investment fund based in Salt Lake City. From 2000

to 2004, he served as a First Vice President at Merrill Lynch, where he helped establish a new private client services division to work

exclusively with high-net-worth investors. From September 1989 to January 2000, Mr. Peterson was employed by Goldman Sachs & Co.

in a variety of positions and roles, including as a Vice President. Mr. Peterson received his MBA at the Marriott School of Management

and a BS in statistics/computer science from Brigham Young University.

Donald

G. Fell

Donald

G. Fell (age 77) brings along a wealth of experience in the field of economics and business to the Company. Mr. Fell served as an independent

director of Aesther Healthcare Acquisition Corp., a special purpose acquisition company, from 2021 until it consummated its initial business

combination in February 2023. Mr. Fell has served as an independent director of TRxADE HEALTH, INC (Nasdaq: MEDS) since January 2014,

as well as a director of Trxade Nevada since December 2013. In addition, he commenced serving as

an independent director of OTEC in March 2023. In addition, Mr. Fell commenced serving as

an independent director of Oceantech Acquisition I Corp., in March 2023, began serving as

an independent director of KRNL in December 2022 and as an independent director of Semper Paratus Acquisition Corporation in June 2023.

He is presently Professor and Institute Director for the Davis, California-based Foundation for Teaching Economics and adjunct

professor of economics for the University of Colorado, Colorado Springs. Mr. Fell held positions with the University of South Florida

as a member of the Executive MBA faculty, Director of Executive and Professional Education and Senior Fellow of the Public Policy Institute

from 1995 to 2012. Mr. Fell was also a visiting professor at the University of LaRochelle, France, and an adjunct professor of economics

at both Illinois State University and The Ohio State University. Mr. Fell holds undergraduate and graduate degrees in economics from

Indiana State University and his all but dissertation (ABD) in economics from Illinois State University. Through his work with the Foundation

for Teaching Economics and the University of Colorado, Colorado Springs he has overseen graduate institutes on economic policy and environmental

economics in 44 states, throughout Canada, the Islands and Eastern Europe.

Avinash

Wadhwani

Mr.

Wadhwani (age: 55) is currently the Executive Vice President and Strategic Advisor of TransForm Solution Inc., a business process outsourcing

(BPO) company that specializes in analytics, digital interventions, and operations management, a role he has served in since May 2023.

From April 2009 to April 2020, Mr. Wadhwani held positions at Cognizant Technology Solutions (“Cognizant”), a multi billion

dollar, IT services and consulting company, ending his tenure at Cognizant as Assoc. Director, Capital Markets & Investment Banking.

Mr. Wadhwani served as Senior Manager, Business Development – Banking & Capital Markets at Headstrong (now Genpact (NYSE: G))

from 2003 to 2005 and as Assistant Vice President at Polaris Software Services from 1999 to 2002. In India, Mr. Wadhwani served as the

Head of Institutional Equity Sales at Daewoo Finance (India) Ltd. from 1994 to 1999 and in product marketing and sales at Tata Consultancy

Services from 1991 to 1994. Throughout his career, Mr. Wadhwani has negotiated and closed several multi-year, multi-million dollar global

technology service deals across the financial services, retail and media & entertainment industries. He is the co-founder of a SaaS

based blockchain startup, which he was instrumental in conceptualizing, architecting and building from the ground up. Mr. Wadhwani brings

hands on experience working at startups, growth stage organizations, and Fortune 500 companies. He serves on the board of Semper Paratus

Acquisition Corp (NASDAQ: LGST) and on the board of a U.S. based nonprofit, Quench and Nourish. Mr. Wadhwani earned a degree in Computer

Science and a Masters in Marketing degree, both from the University of Mumbai. He holds an MBA (Executive) from the Columbia Business

School in New York City.

Mayur

Doshi

Mr.

Doshi (age: 61) is President and CEO of Alfagene Bioscience, Inc. He has successfully initiated several companies and for the last ten

years has been the CEO of Apogee Pharma. He has over 20 years of experience in the global generic pharmaceutical market. He is a trained

chemist and seasoned entrepreneur with extensive experience in active pharmaceutical ingredients. He has more than twenty years of Pharmaceutical

and Bio-tech industry experience; entering the generic pharmaceutical industry in 1988. He is Chairman and Managing Director of Apogee

Pharma, Inc., a major importer of APIs (Active Pharmaceutical Ingredients). He works closely with his clients assisting them in bringing

new generic drugs to market, including Barr Pharmaceuticals, DuPont Pharmaceuticals, Sandoz, Wyeth and Watson. He is also a major investor

in a generic pharmaceutical company and is the founder of, and primary investor in, AlfaGene. He worked and managed extensively in the

Pharmaceutical industry and created a multimillion dollar company. Mr. Doshi also serves as a philanthropist for various organizations.

None

of our directors or officers will receive any cash compensation for services rendered to us. Our sponsor, directors and officers, or

any of their respective affiliates, will be reimbursed for any out-of-pocket expenses incurred in connection with activities on our behalf

such as identifying potential target businesses and performing due diligence on suitable business combinations.

In

addition, each of the New Officers and New Directors are expected to enter into a standard indemnity agreement. There are no family relationships

between the New Officers or New Directors and any other board member or executive officer. Moreover, the New Officers and New Directors

are not a party to any transaction with any related person required to be disclosed pursuant

to Item 404(a) of Regulation S-K other than the transactions contemplated by the Agreement.

Committee

Appointments

The

Company has an audit committee, a compensation committee, and a nominating committee. As a result of the recent departures from the Board

and the new appointments, the committees of the Board currently consist of the following members:

Audit

Committee: Michael L. Peterson (Chair), Avinash Wadhwani, and Donald G. Fell.

Compensation

Committee: Donald G. Fell (Chair), Michael L. Peterson, and Avinash Wadhwani.

Nominating

Committee: Donald G. Fell (Chair), Michael L. Peterson, and Avinash Wadhwani.

Director

Independence

Nasdaq

listing standards require that a majority of the Company’s Board be independent. An “independent director” is defined

generally as a person other than an officer or employee of the company or its subsidiaries or any other individual having a relationship

which in the opinion of the company’s board of directors, would interfere with the director’s exercise of independent judgment

in carrying out the responsibilities of a director. The Board has determined that Michael L. Peterson, Donald G. Fell, Mayur Doshi, and

Avinash Wadhwani are “independent directors” as defined in the Nasdaq listing standards and applicable SEC rules.

Item

8.01 Other Events.

As

previously reported, the Company determined to make a true-up payment in the amount of approximately $0.02 per share to the shareholders

of record as of April 19, 2023 that exercised their right to redeem their shares for a pro rata portion of the funds in the Company’s

trust account. The Company made such payments on August 18, 2023.

Item

9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

POWERUP

ACQUISITION CORP. |

| |

|

|

| |

By:

|

/s/

Surendra Ajjarapu |

| |

|

Surendra

Ajjarapu |

| |

|

Chief

Executive Officer |

| |

|

|

| Date:

August 23, 2023 |

|

|

v3.23.2

Cover

|

Aug. 18, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 18, 2023

|

| Entity File Number |

001-41293

|

| Entity Registrant Name |

PowerUp

Acquisition Corp.

|

| Entity Central Index Key |

0001847345

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

188

Grand Street Unit #195

|

| Entity Address, City or Town |

New

York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10013

|

| City Area Code |

(646)

|

| Local Phone Number |

807-8832

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A ordinary share, par value $0.0001 per share, and one-half of one Redeemable Warrant |

|

| Title of 12(b) Security |

Units,

each consisting of one Class A ordinary share, par value $0.0001 per share, and one-half of one Redeemable Warrant

|

| Trading Symbol |

PWUPU

|

| Security Exchange Name |

NASDAQ

|

| Class A Ordinary Shares, par value $0.0001 per share, included as part of the Units |

|

| Title of 12(b) Security |

Class

A Ordinary Shares, par value $0.0001 per share, included as part of the Units

|

| Trading Symbol |

PWUP

|

| Security Exchange Name |

NASDAQ

|

| Redeemable Warrants each exercisable for one Class A Ordinary Share for $11.50 per share, included as part of the units |

|

| Title of 12(b) Security |

Redeemable

Warrants each exercisable for one Class A Ordinary Share for $11.50 per share, included as part of the units

|

| Trading Symbol |

PWUPW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PWUPU_UnitsEachConsistingOfOneClassOrdinaryShareParValue0.0001PerShareAndOnehalfOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PWUPU_ClassOrdinarySharesParValue0.0001PerShareIncludedAsPartOfUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=PWUPU_RedeemableWarrantsEachExercisableForOneClassOrdinaryShareFor11.50PerShareIncludedAsPartOfUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

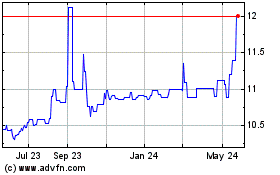

PowerUp Acquisition (NASDAQ:PWUPU)

Historical Stock Chart

From Jan 2025 to Feb 2025

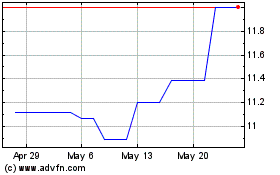

PowerUp Acquisition (NASDAQ:PWUPU)

Historical Stock Chart

From Feb 2024 to Feb 2025