Strong finish to 2024 with continued progress

in cost-savings initiatives to drive adjusted EBITDA margin

expansion in 2025 and beyond

Company issues full-year 2025 financial

guidance

Fourth Quarter and Full-Year 2024 Results (all

comparisons are to the prior year period)

Fourth quarter 2024 revenue was $708 million, as reported

- Non-respiratory revenue was $565 million, which was flat

compared to the prior year period due to a decline in U.S. Donor

Screening revenue, a business the Company is exiting; Labs revenue

grew 4%, as reported and in constant currency, excluding COVID-19

and non-core revenues1

- Respiratory revenue was $143 million, a decrease of 18%, as

reported and in constant currency, due to the anticipated

year-over-year decline in COVID-19 and influenza revenues

Full-year 2024 revenue was $2.8 billion, as reported

- Non-respiratory revenue was $2.3 billion, which was flat

compared to the prior year due to a decline in U.S. Donor Screening

revenue; Labs revenue grew 3% as reported and 4% in constant

currency, excluding COVID-19 and non-core revenues1

- Respiratory revenue was $504 million, a decrease of 30% as

reported and in constant currency, due to the anticipated

year-over-year decline in COVID-19 revenue; excluding COVID-19

revenue, respiratory revenue increased by 4% as reported and in

constant currency

QuidelOrtho Corporation (Nasdaq: QDEL) (the “Company” or

“QuidelOrtho”), a global provider of innovative in-vitro diagnostic

technologies designed for point-of-care settings, clinical labs and

transfusion medicine, today announced financial results for the

fourth quarter and full-year ended December 29, 2024.

“We are pleased with our 2024 business performance and ended the

year with positive momentum leading into 2025,” said Brian J.

Blaser, President and Chief Executive Officer, QuidelOrtho. “The

growth of our underlying business with its recurring revenue

business model continued to perform well. In addition, we made

excellent progress on implementing our cost-savings initiatives

that were defined in 2024, and we are targeting additional cost

savings across the business. We expect that these initiatives will

help us operate more effectively and deliver incremental margin

improvement in 2025 and beyond.”

Fourth Quarter 2024 Financial Results

The Company reported fourth quarter 2024 total revenue of $708

million, compared to $743 million in the prior year period. The

year-over-year decrease was due to lower COVID-19 and influenza

revenue. Foreign currency translation did not significantly impact

the Company’s fourth quarter 2024 revenue.

GAAP diluted loss per share for the fourth quarter of 2024 was

$2.28, compared to diluted earnings per share (“EPS”) of $0.10 in

the prior year period. GAAP net loss for the fourth quarter of 2024

was $153 million, compared to net income of $7 million in the prior

year period. GAAP operating loss for the fourth quarter of 2024 was

$100 million, compared to an operating income of $40 million in the

prior year period, and GAAP operating margin was (14)% in the

fourth quarter of 2024, compared to 5% in the prior year period.

Fourth quarter 2024 results included $37 million in

integration-related charges.

Adjusted diluted EPS for the fourth quarter of 2024 was $0.63,

compared to $1.17 in the prior year period. Adjusted EBITDA for the

fourth quarter of 2024 was $150 million, compared to $195 million

in the prior year period. Adjusted EBITDA margin for the fourth

quarter of 2024 was 21%, compared to 26% in the prior year period.

The changes in adjusted diluted EPS and adjusted EBITDA were

primarily related to the anticipated year-over-year decline in

COVID-19 and influenza revenues.

1

Fourth quarter and full-year 2024

non-core revenue includes revenue from contract manufacturing.

Full-Year 2024 Financial Results

The Company reported total revenue for the full-year 2024 of

$2.78 billion, compared to $3.00 billion in the prior year. The

year-over-year decrease was due to lower COVID-19 revenue. Foreign

currency translation had an unfavorable impact of approximately 60

basis points on the Company’s full-year 2024 results.

GAAP diluted loss per share for the full-year 2024 was $30.16,

compared to $0.15 in the prior year. GAAP net loss for the

full-year 2024 was $2.03 billion, compared to $10 million in the

prior year. GAAP operating loss for the full-year 2024 was $1.96

billion, which included a non-cash goodwill impairment charge of

approximately $1.82 billion, compared to operating income of $139

million in the prior year. GAAP operating margin was (70)% for the

full-year 2024, compared to 5% in the prior year. Full-year 2024

results included $127 million in integration-related charges.

Adjusted diluted EPS for the full-year 2024 was $1.85, compared

to $4.13 in the prior year. Adjusted EBITDA for the full-year 2024

was $543 million, compared to $723 million in the prior year.

Adjusted EBITDA margin for the full-year 2024 was 19.5%, compared

to 24% in the prior year. The changes in adjusted diluted EPS and

adjusted EBITDA were primarily related to the anticipated

year-over-year decline in COVID-19 revenue.

Fiscal Year 2025 Financial Guidance

Based on its current business outlook, the Company is issuing

its fiscal year 2025 financial guidance, as follows:

Total revenues (reported)

$2.60 - $2.81 billion*

Adjusted EBITDA

$575 – $615 million

Adjusted EBITDA margin

22%

Adjusted diluted EPS

$2.07 - $2.57

* Full-year revenue is expected to be

negatively impacted by foreign currency exchange of $55 million

based on currency rates as of January 31, 2025. Please see page 7

of the Fourth Quarter and Full-year 2024 Financial Results

presentation on the “Investor Relations” page of the Company’s

website for the full list of assumptions on which the Company’s

2025 financial guidance is based.

A reconciliation of forward-looking non-GAAP measures, including

adjusted EBITDA, adjusted EBITDA margin and adjusted diluted EPS,

to the most directly comparable GAAP measures is not provided

because comparable GAAP measures for such measures are not

reasonably accessible or reliable due to the inherent difficulty in

forecasting and quantifying measures that would be necessary for

such reconciliation. We are not, without unreasonable effort, able

to reliably predict the impact of impairment charges and related

tax benefits, employee compensation costs and other adjustments.

These items are uncertain, depend on various factors and may have a

material impact on our future GAAP results. In addition, the

Company believes any such reconciliation would imply a degree of

precision and certainty that could be confusing to investors. See

"Forward-Looking Statements" and "Non-GAAP Financial Measures."

Conference Call Information

QuidelOrtho will hold a conference call today beginning at 2:00

p.m. PT / 5:00 p.m. ET to discuss its financial results. Interested

parties can access the call on the “Events & Presentations”

section of the “Investor Relations” page of the Company’s website

at https://ir.quidelortho.com. Presentation materials will also be

posted to the “Events & Presentations” section of the “Investor

Relations” page of the Company’s website at the time of the call.

Those unable to access the webcast may join the call via phone by

dialing 833-470-1428 (domestic) or +1 929-526-1599 (international)

and entering Conference ID number 356254.

A replay of the conference call will be available shortly after

the event on the “Investor Relations” page of the Company’s website

under the “Events & Presentations” section.

QuidelOrtho is dedicated to advancing diagnostics to power a

healthier future. For more information, please visit

quidelortho.com and follow QuidelOrtho on LinkedIn, Facebook and

X.

About QuidelOrtho Corporation

QuidelOrtho Corporation (Nasdaq: QDEL) is a world leader in

in-vitro diagnostics, developing and manufacturing intelligent

solutions that transform data into understanding and action for

more people in more places every day.

Offering industry-leading expertise in immunoassay and molecular

testing, clinical chemistry, and transfusion medicine, bringing

fast, accurate and reliable diagnostics when and where they are

needed – from home to hospital, lab to clinic. So that patients,

clinicians and health officials can spot trends sooner, respond

quicker and chart the course ahead with accuracy and

confidence.

Building upon its many years of groundbreaking innovation,

QuidelOrtho continues to partner with customers across the

healthcare continuum and around the globe to forge a new diagnostic

frontier. One where insights and solutions know no bounds,

expertise seamlessly connects and a more informed path is

illuminated for each of us.

Source: QuidelOrtho Corporation

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements are any statement contained herein that is

not strictly historical, including, but not limited to,

QuidelOrtho’s commercial, integration and other strategic goals,

financial guidance and related assumptions and other future

financial condition and operating results, including expected

results of cost-savings initiatives, and other future plans,

objectives, strategies, expectations and intentions. Without

limiting the foregoing, the words “may,” “will,” “could,” “would,”

“should,” “might,” “expect,” “anticipate,” “believe,” “estimate,”

“plan,” “intend,” “goal,” “project,” “strategy,” “future,”

“continue,” “aim,” “strive,” “seek,” or similar words, expressions

or the negative of such terms or other comparable terminology are

intended to identify forward-looking statements. Such statements

are based on the beliefs and expectations of QuidelOrtho’s

management as of today and are subject to significant known and

unknown risks and uncertainties. Actual results or outcomes may

differ significantly from those set forth or implied in the

forward-looking statements. The following factors, among others,

could cause actual results to differ from those set forth or

implied in the forward-looking statements: fluctuations in demand

for QuidelOrtho’s non-respiratory and respiratory products; supply

chain, production, logistics, distribution and labor disruptions

and challenges; the challenges and costs of integrating,

restructuring and achieving anticipated synergies as a result of

the business combination of Quidel Corporation and Ortho Clinical

Diagnostics Holdings plc; and other macroeconomic, geopolitical,

market, business, competitive and/or regulatory factors affecting

the business of QuidelOrtho generally, including those discussed in

QuidelOrtho’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023 and subsequent reports filed with the Securities

and Exchange Commission (the “Commission”), including under Part I,

Item 1A, “Risk Factors” of the Form 10-K. You should not rely on

forward-looking statements as predictions of future events because

these statements are based on assumptions that may not come true

and are speculative by their nature. All forward-looking statements

are based on information currently available to QuidelOrtho and

speak only as of the date hereof. QuidelOrtho undertakes no

obligation to update any of the forward-looking information or

time-sensitive information included in this press release, whether

as a result of new information, future events, changed expectations

or otherwise, except as required by law.

Non-GAAP Financial Measures

This press release contains financial measures that are

considered non-GAAP financial measures under applicable rules and

regulations of the Commission, including but not limited to

“constant currency Labs revenue changes, excluding COVID-19 and

non-core revenues,” “constant currency respiratory revenue

changes,” “constant currency respiratory revenue changes, excluding

COVID-19 revenue,” “adjusted diluted EPS,” “adjusted EBITDA,”

“adjusted EBITDA margin,” and other non-GAAP financial measures

included in the reconciliation tables accompanying this press

release. These non-GAAP financial measures should be considered

supplemental to, and not a substitute for, financial information

prepared in accordance with U.S. generally accepted accounting

principles (“GAAP”). These non-GAAP financial measures eliminate

impacts of certain non-cash, unusual or other items that the

Company does not consider indicative of its ongoing operating

performance, and the Company generally uses these non-GAAP

financial measures to facilitate management’s financial and

operational decision-making, including evaluation of the Company’s

historical operating results and comparison to competitors’

operating results. The Company’s definitions of these non-GAAP

measures may differ from similarly titled measures used by others.

These non-GAAP financial measures reflect an additional way of

viewing aspects of the Company’s operations that, when viewed with

GAAP results and the reconciliations to corresponding GAAP

financial measures, may provide a more complete understanding of

factors and trends affecting the Company’s business. Because

non-GAAP financial measures exclude the effect of items that will

increase or decrease the Company’s reported results of operations,

management strongly encourages investors to review the Company’s

consolidated financial statements and reports filed with the

Commission in their entirety. Reconciliations of the non-GAAP

financial measures to the most directly comparable GAAP financial

measures are included in the tables accompanying this press

release.

QuidelOrtho

Consolidated Statements of

Operations

(Unaudited)

(In millions except per share

data)

Three Months Ended

Fiscal Year Ended

December 29, 2024

December 31, 2023

December 29, 2024

December 31, 2023

Total revenues

$

707.8

$

742.6

$

2,782.9

$

2,997.8

Cost of sales, excluding amortization of

intangibles

381.7

360.0

1,496.4

1,500.7

Selling, marketing and administrative

187.5

187.6

766.8

763.2

Research and development

47.3

59.3

218.7

245.0

Amortization of intangible assets

47.9

51.2

203.4

204.8

Acquisition and integration costs

36.9

33.0

127.2

113.4

Goodwill impairment charge

78.7

—

1,822.6

—

Asset impairment charge

—

1.3

56.9

4.5

Other operating expenses

28.2

10.1

51.8

27.1

Operating (loss) income

(100.4

)

40.1

(1,960.9

)

139.1

Interest expense, net

40.6

36.7

163.5

147.6

Other expense, net

(0.1

)

12.6

7.1

20.6

Loss before income taxes

(140.9

)

(9.2

)

(2,131.5

)

(29.1

)

Provision for (benefit from) income

taxes

12.5

(16.2

)

(104.5

)

(19.0

)

Net (loss) income

$

(153.4

)

$

7.0

$

(2,027.0

)

$

(10.1

)

Basic (loss) earnings per share

$

(2.28

)

$

0.10

$

(30.16

)

$

(0.15

)

Diluted (loss) earnings per share

$

(2.28

)

$

0.10

$

(30.16

)

$

(0.15

)

Weighted-average shares outstanding -

basic

67.3

66.9

67.2

66.8

Weighted-average shares outstanding -

diluted

67.3

67.3

67.2

66.8

QuidelOrtho

Condensed Consolidated Balance

Sheets

(Unaudited)

(In millions)

December 29, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

98.3

$

118.9

Marketable securities

—

48.4

Accounts receivable, net

282.4

303.3

Inventories

533.7

577.8

Prepaid expenses and other current

assets

262.4

262.1

Assets held for sale

42.1

—

Total current assets

1,218.9

1,310.5

Property, plant and equipment, net

1,380.2

1,443.8

Marketable securities

—

7.4

Right-of-use assets

168.7

169.6

Goodwill

649.5

2,492.0

Intangible assets, net

2,735.6

2,934.3

Deferred tax assets

25.0

25.9

Other assets

270.7

179.6

Total assets

$

6,448.6

$

8,563.1

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

246.0

$

294.8

Accrued payroll and related expenses

116.9

84.8

Income tax payable

5.4

11.1

Current portion of borrowings

341.8

139.8

Other current liabilities

288.7

303.3

Total current liabilities

998.8

833.8

Operating lease liabilities

167.2

172.8

Long-term borrowings

2,141.3

2,274.8

Deferred tax liabilities

76.5

192.2

Other liabilities

55.3

83.6

Total liabilities

3,439.1

3,557.2

Total stockholders’ equity

3,009.5

5,005.9

Total liabilities and stockholders’

equity

$

6,448.6

$

8,563.1

QuidelOrtho

Condensed Consolidated Statements

of Cash Flows

(Unaudited)

(In millions)

Fiscal Year Ended

December 29, 2024

December 31, 2023

Cash provided by operating activities

$

83.0

$

280.2

Cash used for investing activities

(149.9

)

(187.6

)

Cash provided by (used for) financing

activities

48.8

(265.8

)

Effect of exchange rates on cash

(2.9

)

(1.2

)

Net decrease in cash, cash equivalents and

restricted cash

(21.0

)

(174.4

)

Cash, cash equivalents and restricted cash

at beginning of period

119.5

293.9

Cash, cash equivalents and restricted cash

at end of period

$

98.5

$

119.5

Reconciliation to amounts within the

consolidated balance sheets:

Cash and cash equivalents

$

98.3

$

118.9

Restricted cash in Other assets

0.2

0.6

Cash, cash equivalents and restricted

cash

$

98.5

$

119.5

QuidelOrtho

Reconciliation of Non-GAAP

Financial Information - Adjusted Net Income

(In millions, except per share

data; unaudited)

Three Months Ended

Fiscal Year Ended

December 29, 2024

Diluted EPS

December 31, 2023

Diluted EPS

December 29, 2024

Diluted EPS

December 31, 2023

Diluted EPS

Net (loss) income

$

(153.4

)

$

(2.28

)

$

7.0

$

0.10

$

(2,027.0

)

$

(30.16

)

$

(10.1

)

$

(0.15

)

Adjustments:

Amortization of intangibles

47.9

51.2

203.4

204.8

Acquisition and integration costs

36.9

33.0

127.2

113.4

Goodwill impairment charge

78.7

—

1,822.6

—

Asset impairment charge

—

1.3

56.9

4.5

Asset write off

20.0

—

20.0

—

Incremental depreciation on PP&E fair

value

adjustment

8.3

8.2

35.1

33.5

Amortization of deferred cloud computing

implementation costs

4.1

3.3

14.7

9.2

Loss on disposal

1.2

—

1.2

—

EU medical device regulation transition

costs

0.5

0.6

2.0

2.5

Tax indemnification expense

—

12.8

—

12.6

Employee compensation charges

—

—

5.6

—

Credit Agreement amendment fees

—

—

4.0

—

Non-cash interest expense for deferred

consideration

—

—

—

0.7

(Gain) loss on investments

(0.7

)

2.4

(0.7

)

3.6

Other adjustments

0.6

(0.9

)

4.0

1.7

Income tax impact of adjustments

(38.6

)

(30.0

)

(174.6

)

(87.5

)

Discrete tax items

37.1

(10.3

)

30.6

(11.2

)

Adjusted net income

$

42.6

$

0.63

$

78.6

$

1.17

$

125.0

$

1.85

$

277.7

$

4.13

Weighted-average shares outstanding -

diluted

67.6

67.3

67.4

67.3

QuidelOrtho

Reconciliation of Non-GAAP

Financial Information - Adjusted EBITDA

(In millions, unaudited)

Three Months Ended

Fiscal Year Ended

December 29, 2024

December 31, 2023

December 29, 2024

December 31, 2023

Net (loss) income

$

(153.4

)

$

7.0

$

(2,027.0

)

$

(10.1

)

Depreciation and amortization

109.3

115.4

453.4

457.2

Interest expense, net

40.6

36.7

163.5

147.6

Provision for (benefit from) income

taxes

12.5

(16.2

)

(104.5

)

(19.0

)

Acquisition and integration costs

36.9

33.0

127.2

113.4

Goodwill impairment charge

78.7

—

1,822.6

—

Asset impairment charge

—

1.3

56.9

4.5

Asset write off

20.0

—

20.0

—

Amortization of deferred cloud computing

implementation costs

4.1

3.3

14.7

9.2

Loss on disposal

1.2

—

1.2

—

EU medical device regulation transition

costs

0.5

0.6

2.0

2.5

Tax indemnification expense

—

12.8

—

12.6

Employee compensation charges

—

—

5.6

—

Credit Agreement amendment fees

—

—

4.0

—

(Gain) loss on investments

(0.7

)

2.4

(0.7

)

3.6

Other adjustments

0.6

(0.9

)

4.0

1.7

Adjusted EBITDA

$

150.3

$

195.4

$

542.9

$

723.2

Total revenues

707.8

742.6

2,782.9

2,997.8

Adjusted EBITDA margin

21.2

%

26.3

%

19.5

%

24.1

%

QuidelOrtho

Reconciliation of Non-GAAP

Financial Information - Revenues by Business Unit and Region

(In millions, unaudited)

Three Months Ended

December 29, 2024

December 31, 2023

% Change

Currency Impact

Constant Currency(a)

Less: COVID-19 revenue

impact

Constant Currency(a)

ex COVID-19 Revenue

Respiratory revenues

$

143.2

$

174.6

(18.0

)%

—

%

(18.0

)%

(1.2

)%

(16.8

)%

Non-Respiratory revenues

564.6

568.0

(0.6

)%

(0.4

)%

(0.2

)%

—

%

(0.2

)%

Total revenues

$

707.8

$

742.6

(4.7

)%

(0.3

)%

(4.4

)%

(1.3

)%

(3.1

)%

Three Months Ended

December 29, 2024

December 31, 2023

% Change

Currency Impact

Constant Currency(a)

Less: COVID-19 revenue

impact

Constant Currency(a)

ex COVID-19 Revenue

Labs

$

359.7

$

351.9

2.2

%

(0.6

)%

2.8

%

(0.4

)%

3.2

%

Immunohematology

136.7

132.3

3.3

%

(0.2

)%

3.5

%

—

%

3.5

%

Donor Screening

19.8

33.1

(40.2

)%

(0.1

)%

(40.1

)%

—

%

(40.1

)%

Point of Care

184.8

216.8

(14.8

)%

—

%

(14.8

)%

(1.3

)%

(13.5

)%

Molecular Diagnostics

6.8

8.5

(20.0

)%

1.4

%

(21.4

)%

(2.8

)%

(18.6

)%

Total revenues

$

707.8

$

742.6

(4.7

)%

(0.3

)%

(4.4

)%

(1.3

)%

(3.1

)%

Three Months Ended

December 29, 2024

December 31, 2023

% Change

Currency Impact

Constant Currency(a)

Less: COVID-19 revenue

impact

Constant Currency(a)

ex COVID-19 Revenue

North America

$

399.6

$

450.3

(11.3

)%

0.1

%

(11.4

)%

(1.1

)%

(10.3

)%

EMEA

85.9

90.9

(5.5

)%

0.6

%

(6.1

)%

(1.0

)%

(5.1

)%

China

86.9

77.1

12.7

%

1.8

%

10.9

%

—

%

10.9

%

Other

135.4

124.3

8.9

%

(4.0

)%

12.9

%

(0.3

)%

13.2

%

Total revenues

$

707.8

$

742.6

(4.7

)%

(0.3

)%

(4.4

)%

(1.3

)%

(3.1

)%

(a)

The term “constant currency”

means we have translated local currency revenues for all reporting

periods to U.S. dollars using currency exchange rates held constant

for each period. This additional non-GAAP financial information is

not meant to be considered in isolation from or as a substitute for

financial information prepared in accordance with GAAP.

Fiscal Year Ended

December 29, 2024

December 31, 2023

% Change

Currency Impact

Constant Currency(a)

Less: COVID-19 revenue

impact

Constant Currency(a)

ex COVID-19 Revenue

Respiratory revenues

$

503.9

$

714.6

(29.5

)%

—

%

(29.5

)%

(33.9

)%

4.4

%

Non-Respiratory revenues

2,279.0

2,283.2

(0.2

)%

(0.8

)%

0.6

%

—

%

0.6

%

Total revenues (b)

$

2,782.9

$

2,997.8

(7.2

)%

(0.6

)%

(6.6

)%

(7.6

)%

1.0

%

Fiscal Year Ended

December 29, 2024

December 31, 2023

% Change

Currency Impact

Constant Currency(a)

Less: COVID-19 revenue

impact

Constant Currency(a)

ex COVID-19 Revenue

Labs (b)

$

1,426.7

$

1,425.4

0.1

%

(0.9

)%

1.0

%

(0.4

)%

1.4

%

Immunohematology

522.6

512.4

2.0

%

(1.2

)%

3.2

%

—

%

3.2

%

Donor Screening

115.5

136.1

(15.1

)%

—

%

(15.1

)%

—

%

(15.1

)%

Point of Care

694.1

892.2

(22.2

)%

—

%

(22.2

)%

(24.9

)%

2.7

%

Molecular Diagnostics

24.0

31.7

(24.3

)%

0.5

%

(24.8

)%

(20.9

)%

(3.9

)%

Total revenues (b)

$

2,782.9

$

2,997.8

(7.2

)%

(0.6

)%

(6.6

)%

(7.6

)%

1.0

%

Fiscal Year Ended

December 29, 2024

December 31, 2023

% Change

Currency Impact

Constant Currency(a)

Less: COVID-19 revenue

impact

Constant Currency(a)

ex COVID-19 Revenue

North America

$

1,619.8

$

1,877.1

(13.7

)%

—

%

(13.7

)%

(11.1

)%

(2.6

)%

EMEA

335.8

327.3

2.6

%

0.4

%

2.2

%

(1.0

)%

3.2

%

China

325.0

310.1

4.8

%

(1.4

)%

6.2

%

—

%

6.2

%

Other

502.3

483.3

3.9

%

(3.6

)%

7.5

%

(0.3

)%

7.8

%

Total revenues (b)

$

2,782.9

$

2,997.8

(7.2

)%

(0.6

)%

(6.6

)%

(7.6

)%

1.0

%

(a)

The term “constant currency”

means we have translated local currency revenues for all reporting

periods to U.S. dollars using currency exchange rates held constant

for each period. This additional non-GAAP financial information is

not meant to be considered in isolation from or as a substitute for

financial information prepared in accordance with GAAP.

(b)

The fiscal year ended December

31, 2023 includes an approximate $19 million settlement award from

a third party related to one of the Company’s collaboration

agreements.

QuidelOrtho

Reconciliation of Non-GAAP

Financial Information - Labs Revenue

(In millions, unaudited)

Three Months Ended

December 29, 2024

December 31, 2023

% Change

Currency Impact

Constant Currency(a)

Total Labs revenue

$

359.7

$

351.9

2.2

%

(0.6

)%

2.8

%

COVID-19 revenue

(0.7

)

(1.8

)

Non-core revenue (b)

(19.2

)

(22.0

)

Total Labs revenue, ex-COVID-19 and

non-core revenues

$

339.8

$

328.1

3.6

%

(0.6

)%

4.2

%

Fiscal Year Ended

December 29, 2024

December 31, 2023

% Change

Currency Impact

Constant Currency(a)

Total Labs revenue

$

1,426.7

$

1,425.4

0.1

%

(0.9

)%

1.0

%

COVID-19 revenue

(2.5

)

(8.3

)

Non-core revenue (b)

(94.2

)

(125.0

)

Total Labs revenue, ex-COVID-19 and

non-core revenues

$

1,330.0

$

1,292.1

2.9

%

(1.0

)%

3.9

%

(a)

The term “constant currency”

means we have translated local currency revenues for all reporting

periods to U.S. dollars using currency exchange rates held constant

for each period. This additional non-GAAP financial information is

not meant to be considered in isolation from or as a substitute for

financial information prepared in accordance with GAAP.

(b)

Fourth quarter and full-year 2024

non-core revenue includes revenue from contract manufacturing.

Full-year 2023 non-core revenue includes revenue from contract

manufacturing and a third-party settlement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212064272/en/

Investor Contact: Juliet Cunningham Vice President,

Investor Relations IR@quidelortho.com Media Contact: D.

Nikki Wheeler Senior Director, Corporate Communications

media@quidelortho.com

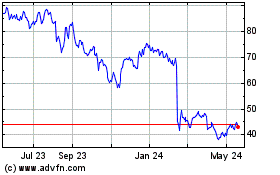

QuidelOrtho (NASDAQ:QDEL)

Historical Stock Chart

From Jan 2025 to Feb 2025

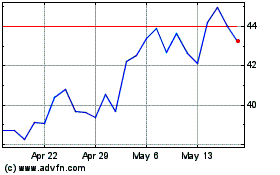

QuidelOrtho (NASDAQ:QDEL)

Historical Stock Chart

From Feb 2024 to Feb 2025