As filed with the Securities and Exchange

Commission on May 8, 2024

Registration No. 333-278591

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No.1 to

FORM F-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Qilian International Holding Group Limited

(Exact name of registrant as specified in its

charter)

| Cayman Islands |

|

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

No. 152 Hongliang East 1st Street, No. 1703,

Tianfu New District, Chengdu, 610200

People’s Republic of China

+86-028-64775180

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, DE 19711

+1 (302) 738-6680

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Joan Wu, Esq.

Hunter Taubman Fischer & Li LLC

950 Third Avenue, 19th Floor

New York, NY 10022

212-530-2208

Approximate date of commencement of proposed sale

to the public: From time to time after the effective date of the registration statement.

If the only securities

being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

¨

If any of the securities

being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act

of 1933, check the following box. x

If this Form is

filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is

a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is

a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing

with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is

a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company

x

If an emerging growth

company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not

to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to

Section 7(a)(2)(B) of the Securities Act. ¨

| † |

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange

Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and

may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is

effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state

where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED May 8, 2024

PROSPECTUS

Qilian International Holding Group Limited

$200,000,000

Class A Ordinary Shares, Preferred Shares,

Debt Securities

Warrants, Rights and Units

We may, from time to time

in one or more offerings, offer and sell up to $200,000,000 in the aggregate of Class A ordinary shares of par value $0.00166667 per

share in the capital of the Company (the “Class A Ordinary Shares”), preferred shares of par value $0.00166667 per

share in the capital of the Company (the “Preferred Shares”), warrants, units and rights to purchase Class A Ordinary

Shares, Preferred Shares, debt securities, rights or any combination of the foregoing, either individually or as units comprised of one

or more of the other securities. The prospectus supplement for each offering of securities will describe in detail the plan of distribution

for that offering. For general information about the distribution of securities offered, please see “Plan of Distribution”

in this prospectus.

This prospectus provides a

general description of the securities we may offer. We will provide the specific terms of the securities offered in one or more supplements

to this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings.

The prospectus supplement and any related free writing prospectus may add, update or change information contained in this prospectus.

You should read carefully this prospectus, the applicable prospectus supplement and any related free writing prospectus, as well as the

documents incorporated or deemed to be incorporated by reference, before you invest in any of our securities. This prospectus may not

be used to offer or sell any securities unless accompanied by the applicable prospectus supplement.

Pursuant to General Instruction

I.B.5. of Form F-3, in no event will we sell the securities covered hereby in a public primary offering with a value exceeding more than

one-third of the aggregate market value of our Class A Ordinary Shares in any 12-month period so long as the aggregate market value of

our voting and non-voting common equity held by non-affiliates remains below $75,000,000. During the 12 calendar months prior to and

including the date of this prospectus, we have not offered or sold any securities pursuant to General Instruction I.B.5 of Form F-3.

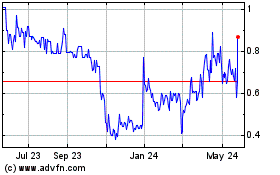

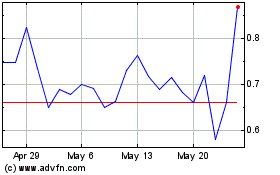

Our Class A Ordinary Shares

are listed on the Nasdaq Capital Market under the symbol “QLI”. On May 6, 2024, the last reported sale price of our Class

A Ordinary Shares on the Nasdaq Capital Market was $0.70 per share. The applicable prospectus supplement will contain information, where

applicable, as to other listings, if any, on the Nasdaq Capital Market or other securities exchange of the securities covered by the

prospectus supplement.

We are not a Chinese operating

company but a Cayman Islands holding company with operations conducted by our subsidiaries and through contractual arrangements (the

“VIE Agreements”) with Gansu QLS (the “VIE”) and its subsidiaries

in China. As a result of the VIE Agreements, we are the primary beneficiary of Gansu QLS for accounting

purposes and treat it as a PRC consolidated entity under U.S. GAAP. We consolidate the financial results of Gansu QLS and its subsidiaries

in our consolidated financial statements in accordance with U.S. GAAP. Neither we nor our investors own any equity ownership in, direct

foreign investment in, or control through such ownership/investment of Gansu QLS. This structure involves unique risks to

investors. The VIE Agreements have not been tested in court.

Our

corporate structure is subject to risks associated with our contractual arrangements with the VIE. The Company that investors will own

may never have a direct ownership interest in the businesses that are conducted by the VIE. If the PRC government finds that the agreements

that establish the structure for operating the VIE and its subsidiaries’ business in China do not comply with PRC laws and regulations,

or if these regulations or the interpretation of existing regulations change or are interpreted differently in the future, we could be

subject to severe penalties or be forced to relinquish our interests in the operations of the VIE. This would result in the VIE being

deconsolidated. The majority of our assets, including the necessary licenses to conduct business in China, are held by the VIE and its

subsidiaries. A significant part of our revenue is generated by the VIE. An event that results in the deconsolidation of the VIE would

have a material effect on the VIE and its subsidiaries’ operations and result in the value of our securities may diminish substantially

in value or even become worthless. The Company, our Hong Kong entity, the VIE and its subsidiaries, and our investors face uncertainty

about potential future actions by the PRC government that could affect the enforceability of the contractual arrangements with the VIE

and, consequently, significantly affect the financial performance of the VIE and our company as a whole.

In

addition, while we will take every precaution available to enforce the contractual and corporate relationship of the VIE agreements,

these contractual arrangements are less effective than direct ownership and we may incur substantial costs to enforce the terms of the

arrangements. For example, the VIE, its subsidiaries, and their shareholders could breach their contractual arrangements with us by,

among other things, failing to conduct their operations in an acceptable manner or taking other actions that are detrimental to our interests.

If we had direct ownership of the VIE and its subsidiaries (which we do not), we would be able to exercise our rights as a shareholder

to effect changes in the board of directors of the VIE, which in turn could implement changes, subject to any applicable fiduciary obligations,

at the management and operational level. However, under VIE Agreements, we will only rely on the performance by the VIE and its shareholders

of their obligations under the contracts to direct the operation of the VIE and its subsidiaries. As such, the shareholders of VIE and

its subsidiaries may not act in the best interests of our company or may not perform their obligations under these contracts. In addition,

failure of the VIE shareholders to perform certain obligations could compel us to rely on legal remedies available under PRC laws, including

seeking specific performance or injunctive relief, and claiming damages, which may not be effective. Further, it is uncertain whether

any new PRC laws or regulations relating to variable interest entity structures will be adopted or if adopted, what they would provide.

PRC regulatory authorities could disallow this structure, which would materially adversely affect the value of Qilian International’s shares, and could cause the value of such securities to significantly decline or become worthless. Qilian International faces

numerous challenges in enforcing these contractual agreements due to uncertainties under Chinese law as well as jurisdictional limits.

Please see the factors set forth under “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure”

and “Risk Factors—Risks Related to Doing Business in China” beginning

on page 11 of in our most recent annual report on Form 20-F, filed on February 15, 2024 for a detailed description of various

risks related to our corporate structure and doing business in China and other information that should be considered before making a

decision to purchase any of our securities.

Investing

in our securities involves a high degree of risk. See “Risk Factors” on page 7 of this prospectus and

in the documents incorporated by reference in this prospectus, as updated in the applicable prospectus supplement, any related free writing

prospectus and other future filings we make with the Securities and Exchange Commission that are incorporated by reference into this

prospectus, for a discussion of the factors you should consider carefully before deciding to purchase our securities.

We may sell these securities

directly to investors, through agents designated from time to time or to or through underwriters or dealers. For additional information

on the methods of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus. If any underwriters

are involved in the sale of any securities with respect to which this prospectus is being delivered, the names of such underwriters and

any applicable commissions or discounts will be set forth in a prospectus supplement. The price to the public of such securities and the

net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is [●], 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part

of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, under the Securities Act of 1933,

as amended, or the Securities Act, using a “shelf” registration process. Under this shelf registration process, we may from

time to time sell Class A Ordinary Shares, Preferred Shares, debt securities, warrants, units and rights to purchase Class A Ordinary

Shares, Preferred Shares, debt securities or any combination of the foregoing, either individually or as units comprised of one or more

of the other securities, in one or more offerings up to a total dollar amount of $200,000,000. We have provided to you in this prospectus

a general description of the securities we may offer. Each time we sell securities under this shelf registration, we will, to the extent

required by law, provide a prospectus supplement that will contain specific information about the terms of that offering. We may also

authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings.

The prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or

change information contained in this prospectus or in any documents that we have incorporated by reference into this prospectus. To the

extent there is a conflict between the information contained in this prospectus and the prospectus supplement or any related free writing

prospectus, you should rely on the information in the prospectus supplement or the related free writing prospectus; provided that if

any statement in one of these documents is inconsistent with a statement in another document having a later date – for example,

a document filed after the date of this prospectus and incorporated by reference into this prospectus or any prospectus supplement or

any related free writing prospectus – the statement in the document having the later date modifies or supersedes the earlier statement.

We have not authorized

any dealer, agent or other person to give any information or to make any representation other than those contained or incorporated

by reference in this prospectus and any accompanying prospectus supplement, or any related free writing prospectus that we may

authorize to be provided to you. You must not rely upon any information or representation not contained or incorporated by reference

in this prospectus or an accompanying prospectus supplement, or any related free writing prospectus that we may authorize to be

provided to you. This prospectus and the accompanying prospectus supplement, if any, do not constitute an offer to sell or the

solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus and

the accompanying prospectus supplement constitute an offer to sell or the solicitation of an offer to buy securities in any

jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume

that the information contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus is

accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by

reference is correct on any date subsequent to the date of the document incorporated by reference (as our business, financial

condition, results of operations and prospects may have changed since that date), even though this prospectus, any applicable

prospectus supplement or any related free writing prospectus is delivered or securities are sold on a later date.

As permitted by SEC rules and

regulations, the registration statement of which this prospectus forms a part includes additional information not contained in this prospectus.

You may read the registration statement and the other reports we file with the SEC at its website or at its offices described below under

“Where You Can Find More Information.”

Unless the context otherwise

requires, all references in this prospectus to “QLI,” “Qilian,” “we,” “us,” “our,”

“the Company” or similar words refer to Qilian International Holding Group Limited, together with our subsidiaries.

COMMONLY USED DEFINED TERMS

Unless otherwise indicated or the context otherwise

requires in this prospectus:

● “Ahan”

refers to Jiuquan Ahan Biotechnology Co., Ltd., a limited liability company organized under the laws of the PRC, which is 100% owned

by Gansu QLS;

● “Ahan®

Antibacterial Paste” refers to a disinfection paste made from a mixture of 11 traditional Chinese herbal ingredients used to treat

refractory chronic skin diseases;

● “APIs”

refers to Active Pharmaceutical Ingredients, which refer to any substance or mixture of substances intended to be used in the manufacture

of a drug (medicinal) product and that, when used in the production of a drug, becomes an active ingredient of the drug product;

● “Cangmen”

refers to Tibet Cangmen trading Co., Ltd., a limited liability company organized under the laws of the PRC, which is 100% owned by

Gansu QLS;

● “Chengdu QLS”

refers to Chengdu Qilianshan Biotechnology Co., Ltd., a limited liability company organized under the laws of the PRC, which is 79.71%

owned by Gansu QLS;

● “China”

or the “PRC” refers to the People’s Republic of China, including Hong Kong Special Administrative Region and the Macau

Special Administrative Region, unless referencing specific laws and regulations adopted by the PRC and other legal or tax matters only

applicable to mainland China, and excluding, for the purposes of this prospectus only, Taiwan; “PRC subsidiaries” and “PRC

entities” refer to entities established in accordance with PRC laws and regulations;

● “Class

A Ordinary Shares” refers to the Class A ordinary shares of par value US$0.00166667 per share in the capital of the Company;

● “Class

B Ordinary Shares” refers to the Class B ordinary shares of par value US$0.00166667 per share in the capital of the Company;

● “Gan Di Xin®”

refers to an innovative antitussive and expectorant medicine made from raw licorice materials;

● “Gansu QLS”

refers to Gansu Qilianshan Pharmaceutical Co. Ltd., a limited liability company organized under the laws of the PRC, which Qilian International

controls via a series of contractual arrangements between WFOE and Gansu QLS;

● “Gansu QLS,”

“variable interest entity” or “ VIE” refers to Gansu Qilianshan Pharmaceutical Co., Ltd., a company incorporated

in the People’s Republic of China;

● “WFOE”

or “PRC Subsidiary” refers to Qilian International Trade (Chengdu) Co., Ltd., formerly known as Chengdu Qilian Trading

Co., Ltd., and Qilian Shan International Trade (Hainan) Co., Ltd., both of which are limited liability company organized under

the laws of the PRC and are wholly-owned by Qilian International (Hong Kong) Holdings Limited, a limited liability company organized under

the laws of Hong Kong;

●“Hainan Trade”

refers to Qilian Shan International Trade (Hainan) Co., Ltd., a limited liability company organized under the laws of the PRC and

is wholly-owned by Qilian International (Hong Kong) Holdings Limited, a limited liability company organized under the laws of Hong Kong.

● “Heparin Sodium

Preparation” refers to a primary ingredient for pharmaceutical companies to produce medications used in treating cardiovascular

diseases, cerebrovascular diseases, and hemodialysis;

● “Moshangfa”

refers to Moshangfa (Gansu) Fertilizer Industry Co., Ltd., formerly known as Jiuquan Qiming Biotechnology Co., Ltd., a limited

liability company organized under the laws of the PRC, which is 100% owned by Gansu QLS;

● “Preferred

Shares” refers to the preferred shares of par value US$0.00166667 per share in the capital of the Company;

● “QLI,”

“Qilian,” “Qilian International,” or “the Company” refers to Qilian International Holding Group Limited,

an exempted company registered in the Cayman Islands with limited liability;

● “Qilian HK”

refers to Qilian International’s wholly owned subsidiary, Qilian International (Hong Kong) Holdings Limited, a Hong Kong corporation;

● “Qilian Shan®

Licorice Extract” refers to a primary ingredient for pharmaceutical companies to manufacture traditional licorice tablets;

● “Qilian Shan®

Licorice Liquid Extract” refers to a primary ingredient for medical preparation companies to produce compound licorice oral solutions;

● “Qilian Shan®

Oxytetracycline APIs” refers to an active ingredient used by pharmaceutical companies in the manufacturing of medications that use

oxytetracycline;

● “Qilian Shan®

Oxytetracycline Tablets” refers to tablets used to prevent and treat a wide range of diseases in chickens, turkeys, cattle, swine,

and human;

● “RMB”

and “Renminbi” refer to the legal currency of China;

● “Rugao”

refers to to Rugao Tianlu Animal Products Co., Ltd., a limited liability company organized under the laws of the PRC, which is 100%

owned by Chengdu QLS;

● “Samen”

refers to Tibet Samen Trading Co., Ltd., a limited liability company organized under the laws of the PRC, which was 100% owned by

Gansu QLS. Samen was dissolved in June 2023;

● “Shares”

or “shares” refers to any share in the capital of the Company, including Class A Ordinary Shares, Preferred Shares and Class

B Ordinary Shares;

● “TCM”

refers to Traditional Chinese Medicine, a style of traditional medicine built on a foundation of more than 2,500 years of Chinese medical

practice that includes various forms of herbal medicine, acupuncture, massage (tui na), exercise (qigong), and dietary therapy;

● “TCMD”

refers to Traditional Chinese Medicine Derivatives, a type of product derived from TCM that has been prepared through modern medicine

manufacturing procedures to be ready for use;

● “VIE Agreements”

refers to a series of contractual arrangements, including Exclusive Service Agreement, as amended on August 27, 2019 and later terminated

and replaced by Hainan Exclusive Service Agreement on December 1, 2022, the Call Option Agreement, the Equity Pledge Agreement, the

Shareholders’ Voting Rights Proxy Agreement and Powers of Attorney, and the Spousal Consents;

● “US$,”

“U.S. dollars,” “$” and “dollars” refer to the legal currency of the United States; and

● “we,” “us,” “our company”

and “our” refer to Qilian International Holding Group Limited and its consolidated subsidiaries. We conduct operations in

China through our PRC subsidiaries.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and our SEC

filings that are incorporated by reference into this prospectus contain or incorporate by reference forward-looking statements within

the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements other than statements of

historical fact are “forward-looking statements,” including any projections of earnings, revenue or other financial items,

any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects

or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs,

goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. The words “believe,”

“anticipate,” “estimate,” “plan,” “expect,” “intend,” “may,” “could,”

“should,” “potential,” “likely,” “projects,” “continue,” “will,”

and “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking

statements contain these identifying words. Forward-looking statements reflect our current views with respect to future events, are based

on assumptions and are subject to risks and uncertainties. We cannot guarantee that we actually will achieve the plans, intentions or

expectations expressed in our forward-looking statements and you should not place undue reliance on these statements. There are a number

of important factors that could cause our actual results to differ materially from those indicated or implied by forward-looking statements.

These important factors include those discussed under the heading “Risk Factors” contained or incorporated by reference in

this prospectus and in the applicable prospectus supplement and any free writing prospectus we may authorize for use in connection with

a specific offering. These factors and the other cautionary statements made in this prospectus should be read as being applicable to all

related forward-looking statements whenever they appear in this prospectus. Except as required by law, we undertake no obligation to update

publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

OUR BUSINESS

History and Development of the Company

Qilian International Holding

Group Limited is not a Chinese operating company but a Cayman Islands holding company with its business operations conducted by Gansu

Qilianshan Pharmaceutical Co., Ltd. (the “VIE”, “Gansu QLS”) and its subsidiaries established in the PRC.

Qilian International Holding Group Limited is a Cayman Islands exempted company with limited liability incorporated on February 7,

2019. Qilian International (Hong Kong) Holdings Limited., which we refer to as “Qilian HK”, our wholly-owned subsidiary, was

incorporated in Hong Kong on January 30, 2019. Qilian HK’s wholly owned subsidiary, Chengdu Qilian Trading Co., Ltd.,

formerly known as Qilian International Trade (Chengdu) Co., LTD, which we refer to as “WFOE”, was organized pursuant to PRC

laws on May 15, 2019. Gansu Qilianshan Pharmaceutical Co. Ltd., which we refer to as Gansu QLS, the VIE, was established in August 30,

2006, as a result of restructuring from Gansu State-operated Qilianshan Pharmaceutical Factory, which was incorporated in July 1969

in Jiuquan, Gansu Province, PRC pursuant to PRC laws. Gansu QLS’ shareholders include certain PRC residents and corporate entities

controlled by PRC residents.

Pursuant to PRC laws, each

entity formed under PRC law shall have certain business scope approved by the Administration of Industry and Commerce or its local counterpart.

As such, WFOE’s business scope is to primarily engage in business development, technology service, technology consulting, intellectual

property service and business management consulting. Since the sole business of WFOE is to provide Gansu QLS with technical support, consulting

services and other management services relating to its day-to-day business operations and management in exchange for a consulting fee,

which is at WFOE’s discretion and can be the net income of Gansu QLS, such business scope is necessary and appropriate under the

PRC laws. Gansu QLS, on the other hand, has been granted a business scope different from WFOE to enable it to develop, manufacture, market

and sell its products.

Since we intend to acquire

upstream and downstream companies manufacturing traditional Chinese medicine pieces, which is prohibited to be invested in by foreign

investors, our WFOE cannot hold equity of Gansu QLS. We control Gansu QLS through contractual arrangements. Qilian International is a

holding company with no business operation other than holding the shares in Qilian HK and Qilian HK is a pass-through entity with no business

operation. WFOE is exclusively engaged in the business of managing the operation of Gansu QLS and its subsidiaries.

Gansu QLS, the VIE, was established

in August 30, 2006, by restructuring from Gansu State-operated Qilianshan Pharmaceutical Factory, which was incorporated in July 1969

in Jiuquan, Gansu Province, PRC pursuant to PRC laws.

On April 17, 2020, Rugao

was incorporated under the laws of the People’s Republic of China. Rugao is the 100% owned subsidiary of Chengdu QLS. It was intended

to be used as procurement and manufacturing assistance entity for Chengdu QLS and as a point of expansion for the VIE and its subsidiaries’

sausage casings business in Jiangsu Province.

On January 12, 2021,

ordinary shares of par US$0.00166667 each in the capital of the Company (the “Ordinary Shares”) commenced trading on the Nasdaq Global Market under the symbol “QLI.” We raised approximately

US$23,865,085 in net proceeds from our initial public offering after deducting underwriting commissions and the offering expenses payable

by us. As part of Qilian International Holding Group Limited’s (the “Company”) efforts to optimize its corporate structure,

Qilian International Trade (Chengdu) Co. Ltd (“Chengdu Trade”) and Gansu Qilianshan Pharmaceutical Co., Ltd. (“Gansu

QLS”) executed certain exclusive service termination agreement (the “Service Termination Agreement”) to terminate certain

contractual service arrangements between Chengdu Trade and Gansu QLS. As a result of the aforementioned termination, Chengdu Trade will

no longer have contractual control over, nor receive the economic benefits of Gansu QLS. In connection with such termination, Hainan

Trade, a wholly-owned subsidiary of Qilian International (Hong Kong) Holdings Limited, entered into a certain exclusive service agreement

with Gansu QLS (the “Hainan Exclusive Service Agreement”), through which Hainan Trade obtained contractual control over Gansu

QLS. The Service Termination Agreement became effective on December 1, 2022. The Hainan Exclusive Service Agreement was signed on

December 1, 2022. Pursuant to the Hainan Exclusive Service Agreement between Gansu QLS and Hainan Trade, Hainan Trade provides Gansu

QLS with technical support, consulting services and other management services relating to its day-to-day business operations and management,

on an exclusive basis, utilizing its advantages in technology, business management and information. For services rendered to Gansu QLS

by Hainan Trade under this agreement, Hainan Trade is entitled to collect a service fee that shall be equal to 99.214% of the net profits

of Gansu QLS. The Hainan Exclusive Service Agreement shall remain in effect for ten years unless earlier terminated upon written confirmation

from both Hainan Trade and Gansu QLS before expiration. Otherwise, this agreement shall be extended by another ten years automatically.

The Hainan Exclusive Service Agreement does not prohibit related party transactions. Hainan Trade enjoys a favorable income tax rate

and individual income tax rate for its employees of 15%. The Company expects change of the structure described above will save income

tax expense and attracting talent in long term.

In the opinion of Gansu Quanyi

Law Firm, the Company’s PRC legal counsel, the contractual arrangements between Gansu Qilianshan Pharmaceutical Co., Ltd. and

Qilian Shan International Trade (Hainan) Co., Ltd are valid, binding and enforceable under current PRC law. However, these contractual

arrangements may not be as effective in providing control as direct ownership. There are substantial uncertainties regarding the interpretation

and application of current or future PRC laws and regulation regarding such contractual arrangements and their effectiveness.

On August 11, 2023, Zhongqiao

was established as a limited liability company organized under the laws of the PRC. Hainan Trade owns 51% equity interests of Zhongqiao.

The remaining 49% equity interests are owned by Sichuan Shihua Investment Management Co., Ltd., a PRC company controlled by Yuchang

Xin, the brother of Zhanchang Xin, our Chief Executive Officer and Chairman of the Board.

On November 27, 2023,

we applied to transfer our Ordinary Shares to The Nasdaq Capital Market (the “Capital Market”), as allowed under

the Nasdaq Listing Rules. On December 13, 2023, the transfer from The Nasdaq Global Market to the Capital Market was approved. Effective

at the opening of business on December 15, 2023, our Ordinary Shares were transferred to the Capital Market and continued to

trade under the symbol “QLI”.

On 19 April 2024, we held

an extraordinary general meeting at which shareholders resolved:

(a) to increase the Company's

authorized share capital, with effect from such date as the board of directors of the Company should determine, from US$166,667 divided

into 100,000,000 Ordinary Shares of par value US$0.00166667 each to US$833,335 divided into 500,000,000 Ordinary Shares of par value

US$0.00166667 each (the “Share Capital Increase”);

(b) that immediately following

the Share Capital Increase being effected, the Company re-designate and re-classify its authorized share capital as follows (the “Share

Capital Reorganization”):

(i) each

then issued and outstanding Ordinary Share be re-designated and re-classified into one Class A Ordinary Share of par value US$0.00166667

each;

(ii) of

the then remaining authorized but unissued Ordinary Shares;

(a) 50,000,000

Ordinary Shares be re-designated and re-classified into 50,000,000 Preferred Shares of par value US$0.00166667 each;

(b) 100,000,000

Ordinary Shares be re-designated and re-classified into 100,000,000 Class B ordinary shares of par value US$0.00166667 each (each being

a “Class B Share”); and

(c) each

of the remaining authorized but unissued Ordinary Shares be re-designated and re-classified into Class A Ordinary Shares; and

(c) immediately following

the Share Capital Increase being effected the Company adopt an amended and restated memorandum and articles of association in substitution

for and to the exclusion of the existing memorandum and articles of association of the Company.

The Share Capital Increase

and the Share Capital Reorganization were subsequently made effective, pursuant to resolutions passed by the Company's board of directors,

on April 29, 2024. Following the Company's adoption of the amended and restated articles of association, 120,000,000 Class A Ordinary

Shares owned directly by Zhanchang Xin were re-classified and re-designated into Class B Ordinary Shares pursuant to resolutions passed

by the directors of the Company.

Following

the Share Capital Increase and the Share Capital Reorganization, the authorized share capital of the Company became US$833,335

divided into 350,000,000 Class A Ordinary Shares of par value US$0.00166667 each, 100,000,000 Class B Ordinary Shares of par value US$0.00166667

each, and 50,000,000 Preferred Shares of par value US$0.00166667 each.

Our principal executive

offices are located at No. 152 Hongliang East 1st Street, No. 1703, Tianfu New District, Chengdu, China. The VIE and its subsidiaries’

telephone at this address is +86-0937-2689523. We maintain a corporate website at http://qilianinternational.com. The information contained

in, or accessible from, our website or any other website does not constitute a part of this prospectus. Our agent for service of process

in the United States is Puglisi & Associates, located at 850 Library Avenue, Suite 204, Newark, Delaware 19711.

The SEC maintains a website

at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically

with the SEC using its EDGAR system.

Business Overview

The WFOE and the VIE and its

subsidiaries operate a pharmaceutical and chemical company based in China that focuses on the development, manufacture, marketing, and

sale of oxytetracycline products, licorice products, traditional Chinese medicine derivatives (“TCMD”) product, heparin product,

sausage casings, and fertilizers. The VIE and its subsidiaries independently developed Gan Di Xin® and Ahan® Antibacterial Paste

within their research and development department. The products of the VIE and its subsidiaries are sold in more than 20 provinces in China.

| ● |

Licorice products include Gan Di Xin®, Qilian Shan® Licorice Extract, and Qilian Shan® Licorice Liquid Extract. The VIE and its subsidiaries’ Gan Di Xin® is an innovative antitussive and expectorant medicine made from raw licorice materials. The VIE and its subsidiaries’ Qilian Shan® Licorice Extract is a primary ingredient for pharmaceutical companies to manufacture traditional licorice tablets. The VIE and its subsidiaries’ Qilian Shan® Licorice Liquid Extract is the primary ingredient for medical preparation companies to produce compound licorice oral solutions. |

| ● |

Oxytetracycline products include Qilian Shan® Oxytetracycline Tablets and Qilian Shan® Oxytetracycline Active Pharmaceutical Ingredients (“API”). The VIE and its subsidiaries’ Qilian Shan® Oxytetracycline Tablets are used to prevent and treat a wide range of diseases in chickens, turkeys, cattle, swine, and human. The VIE and its subsidiaries’ Qilian Shan® Oxytetracycline APIs are used by pharmaceutical companies in the manufacturing of medications that use oxytetracycline as an active ingredient. |

| ● |

TCMD product includes Ahan® antibacterial paste, which is made from a mixture of 11 traditional Chinese herbal ingredients. It is used to treat refractory chronic skin diseases. |

| ● |

Heparin product includes Heparin Sodium Preparation. It is a primary ingredient for pharmaceutical companies to produce medications used in treating cardiovascular diseases, cerebrovascular diseases, and hemodialysis. |

| ● |

Sausage casings include Zhu Xiaochang® Sausage Casings, which are all-natural food products used for culinary purposes. |

| ● |

Fertilizer products include Xiongguan® Organic Fertilizer and Xiongguan® Organic-Inorganic Compound Fertilizer. The VIE and its subsidiaries’ Xiongguan® Organic Fertilizer is designed to improve crop yield, increase soil’s chemical properties, and reduce soil compaction. The VIE and its subsidiaries’ Xiongguan® Organic-Inorganic Compound Fertilizer is made from both organic materials and traditional chemical fertilizer, and is designed to increased plant growth. |

The following diagram illustrates

our current corporate structure:

Corporate Information

Our principal executive office

is located at No. 152 Hongliang East 1st Street, No. 1703, Tianfu New District, Chengdu, China. Our telephone number is + 86-028-64775180.

We maintain a website at http://qilianinternational.com that contains information about our Company, though no information contained on

our website is part of this prospectus.

RISK FACTORS

Investing in our securities

involves a high degree of risk. You should carefully consider the risk factors set forth under “Risk Factors” described in

our most recent annual report on Form 20-F, filed on February 15, 2024, together with all other information contained or incorporated

by reference in this prospectus and any applicable prospectus supplement and in any related free writing prospectus in connection with

a specific offering, before making an investment decision. Each of the risk factors could materially and adversely affect our business,

operating results, financial condition and prospects, as well as the value of an investment in our securities, and the occurrence of any

of these risks might cause you to lose all or part of your investment.

USE OF PROCEEDS

Except as described in any

prospectus supplement and any free writing prospectus in connection with a specific offering, we currently intend to use the net proceeds

from the sale of the securities offered under this prospectus to fund the development and commercialization of our projects and the growth

of our business, primarily working capital, and for general corporate purposes. We may also use a portion of the net proceeds to acquire

or invest in technologies, products and/or businesses that we believe will enhance the value of our Company, although we have no current

commitments or agreements with respect to any such transactions as of the date of this prospectus. We have not determined the amount of

net proceeds to be used specifically for the foregoing purposes. As a result, our management will have broad discretion in the allocation

of the net proceeds and investors will be relying on the judgment of our management regarding the application of the proceeds of any sale

of the securities. If a material part of the net proceeds is to be used to repay indebtedness, we will set forth the interest rate and

maturity of such indebtedness in a prospectus supplement. Pending use of the net proceeds will be deposited in interest bearing bank accounts.

DILUTION

If required, we will set forth

in a prospectus supplement the following information regarding any material dilution of the equity interests of investors purchasing securities

in an offering under this prospectus:

| ● |

the net tangible book value per share of our equity securities before and after the offering; |

| |

|

| ● |

the amount of the increase in such net tangible book value per share attributable to the cash payments made by purchasers in the offering; and |

| |

|

| ● |

the amount of the immediate dilution from the public offering price which will be absorbed by such purchasers. |

DESCRIPTION OF SHARE CAPITAL

The following description

of our share capital (which includes a description of securities we may offer pursuant to the registration statement of which this prospectus,

as the same may be supplemented, forms a part) does not purport to be complete and is subject to and qualified in its entirety by our

Amended and Restated Memorandum and Articles of Association (“M&A”) and by the applicable provisions of Cayman Islands

law.

Our authorized share capital

is US$833,335 divided into 350,000,000 Class A Ordinary Shares of par value US$0.00166667 each, 100,000,000 Class B ordinary shares of

par value US$0.00166667 each, and 50,000,000 Preferred Shares of par value US$0.00166667 each.

As of the date of this

prospectus, there were 35,750,000 Class A Ordinary Shares issued and outstanding.

The following description

of our share capital is intended as a summary only and is qualified in its entirety by reference to our M&A, which have been filed

previously with the SEC, and applicable provisions of Cayman Islands law.

We, directly or through agents,

dealers or underwriters designated from time to time, may offer, issue and sell, together or separately, up to $200,000,000 in the aggregate

of:

| ● |

Class A

Ordinary Shares of US$0.00166667 par value each; |

| |

|

| ● |

Preferred

Shares, US$0.00166667 par value each; |

| |

|

| ● |

secured or unsecured debt securities consisting of notes, debentures or other evidences of indebtedness which may be senior debt securities, senior subordinated debt securities or subordinated debt securities, each of which may be convertible into equity securities; |

| |

|

| ● |

warrants to purchase our securities; |

| |

|

| ● |

rights to purchase our securities; or |

| |

|

| ● |

units comprised of, or other combinations of, the foregoing securities. |

We may issue the debt

securities as exchangeable for or convertible into Class A Ordinary Shares or other securities. The debt securities, the Class A Ordinary

Shares and the warrants are collectively referred to in this prospectus as the “securities.” When a particular series of

securities is offered, a supplement to this prospectus will be delivered with this prospectus, which will set forth the terms of the

offering and sale of the offered securities.

Class A Ordinary Shares

As

of the date of this prospectus, there were 23,750,000 Class A Ordinary Shares issued and outstanding.

Dividends

Subject to the provisions of the Companies

Act (Revised) of the Cayman Islands (the "Companies Act") and any rights attaching to any class or classes of shares

under and in accordance with the amended and restated articles of association of the Company (the “Articles”):

| (a) |

the directors may declare dividends or distributions out of our funds which are lawfully available for that purpose; and |

| (b) |

the Company’s shareholders may, by ordinary resolution, declare dividends but no such dividend shall exceed the amount recommended by the directors. |

Subject to the requirements

of the Companies Act regarding the application of a company’s share premium account and with the sanction of an ordinary resolution,

dividends may also be declared and paid out of any share premium account. The directors when paying dividends to shareholders may make

such payment either in cash or in specie.

Unless provided by the rights

attached to a share, no dividend shall bear interest.

Voting Rights

Subject to any rights

or restrictions as to voting attached to any shares, unless any share carries special voting rights, on a show of hands every shareholder

who is present in person and every person representing a shareholder by proxy shall have one vote per Class A Ordinary Share and one vote per Class B Ordinary Share. On a poll, every shareholder who is present in person and every person representing a shareholder by

proxy shall have one vote for each Class A Ordinary Share and fifty votes per Class B Ordinary Share of which he or the person represented

by proxy is the holder. In addition, all shareholders holding shares of a particular class are entitled to vote at a meeting of the holders

of that class of shares. Votes may be given either personally or by proxy.

Transfer of Shares

Provided that a transfer

of shares complies with applicable rules of Nasdaq, a shareholder may transfer shares to another person by completing an instrument

of transfer in a common form or in a form prescribed by Nasdaq or in any other form approved by the directors, executed:

| (a) |

where the

shares are fully paid, by or on behalf of that shareholder; and |

| |

|

| (b) |

where the

shares are partly paid, by or on behalf of that shareholder and the transferee. |

The transferor shall be

deemed to remain the holder of a share until the name of the transferee is entered into the register of members of the Company.

Our board of directors

may, in its absolute discretion, decline to register any transfer of any share that has not been fully paid up or is subject

to a company lien. Our board of directors may also decline to register any transfer of such share unless:

| (a) |

the instrument

of transfer is lodged with the Company, accompanied by the certificate for the shares to which

it relates and such other evidence as our board of directors may reasonably require to show the right of the transferor to make the

transfer; |

| |

|

| (b) |

the instrument of transfer

is in respect of only one class of shares; |

| |

|

| (c) |

the instrument of transfer is properly stamped, if required; |

| |

|

| (d) |

the shares transferred

is fully paid and free of any lien in favor of us; |

| |

|

| (e) |

any fee related to the transfer has been paid to us; and |

| |

|

| (f) |

the transfer is not to more than four joint holders. |

If our directors refuse to

register a transfer, they are required, within three months after the date on which the instrument of transfer was lodged, to send to

each of the transferor and the transferee notice of such refusal.

This, however, is unlikely

to affect market transactions of the Class A Ordinary Shares acquired by investors. The legal title to such shares and the registration

details of those shares in the Company’s register of members will remain with Depository Trust Company (“DTC”).

All market transactions with respect to those Class A Ordinary Shares will then be carried out without the need for any kind of registration

by the directors, as the market transactions will all be conducted through the DTC systems.

The registration of transfers

may, on 14 calendar days’ notice being given by advertisement in such one or more newspapers or by electronic means, be suspended

and our register of members closed at such times and for such periods as our board of directors may from time to time determine. The registration

of transfers, however, may not be suspended, and the register may not be closed, for more than 30 days in any year.

Conversion Rights

Each Class B Ordinary

Share is convertible into one fully paid and non-assessable Class A Ordinary Share: (a) at the option of the holder thereof, at any time

after the date of issuance of such share; immediately upon the occurrence of certain transfers of such Class B Ordinary Shares that are

not to affiliates of the relevant shareholder; and (c) immediately upon the closing of a transaction resulting in the initial holders

of the Class B Ordinary Shares holding fewer than 691,950 Class B Ordinary Shares.

All conversions of Class B Ordinary Shares

to Class A Ordinary Shares shall be effected by way of redemption or repurchase by the Company of the relevant Class B Ordinary Shares

and the simultaneous issue of Class A Ordinary Shares in consideration for such redemption or repurchase.

Re-classification and re-designation of

Class A Ordinary Shares

The directors, or the shareholders by ordinary

resolution, may authorize the re-classification and re-designation of any number of issued or unissued Class A Ordinary Shares into Class

B Ordinary Shares.

Liquidation Rights

If we are wound up, the shareholders

may, subject to the articles and any other sanction required by the Companies Act, pass a special resolution allowing the liquidator to

do either or both of the following:

| (a) |

to divide in specie among the shareholders the whole or any part of our assets and, for that purpose, to value any assets and to determine how the division shall be carried out as between the shareholders or different classes of shareholders; and |

| |

|

| (b) |

to vest the whole or any part of the assets in trustees for the benefit of shareholders and those liable to contribute to the winding up. |

The directors have the authority

to present a petition for our winding up to the Grand Court of the Cayman Islands on our behalf without the sanction of a resolution passed

at a general meeting.

Redemption and Purchase of Own Shares

Subject to the Companies Act

and any rights for the time being conferred on the shareholders holding a particular class of shares, we may by action of our directors:

| (a) |

issue shares that are to be redeemed or liable to be redeemed, at our option or the shareholder holding those redeemable shares, on the terms and in the manner our directors determine before the issue of those shares; |

| (b) |

with the consent by special resolution of the shareholders holding shares of a particular class, vary the rights attaching to that class of shares so as to provide that those shares are to be redeemed or are liable to be redeemed at our option on the terms and in the manner which the directors determine at the time of such variation; and |

| (c) |

purchase all or any of our own shares of any class including any redeemable shares on the terms and in the manner which the directors determine at the time of such purchase. |

We may make a payment in

respect of the redemption or purchase of its own shares in any manner authorized by the Companies Act, including out of any combination

of capital, our profits and the proceeds of a fresh issue of shares.

When making a payment in respect

of the redemption or purchase of shares, the directors may make the payment in cash or in specie (or partly in one and partly in the other)

if so authorized by the terms of the allotment of those shares or by the terms applying to those shares, or otherwise by agreement with

the shareholder holding those shares.

Variation of Rights of Shares

Whenever our capital is divided

into different classes of shares, the rights attaching to any class of share (unless otherwise provided by the terms of issue of the shares

of that class) may be varied either with the consent in writing of the holders of not less than two-thirds of the issued shares of that

class, or with the sanction of a resolution passed by a majority of not less than two-thirds of the holders of shares of the class present

in person or by proxy at a separate general meeting of the holders of shares of that class.

Unless the terms on which

a class of shares was issued state otherwise, the rights conferred on the shareholder holding shares of any class shall not be deemed

to be varied by the creation or issue of further shares ranking pari passu with the existing shares of that class.

Alteration of Share Capital

Subject to the Companies Act,

our shareholders may, by ordinary resolution:

| (a) |

increase our share capital by new shares of the amount fixed by that ordinary resolution and with the attached rights, priorities and privileges set out in that ordinary resolution; |

| |

|

| (b) |

consolidate and divide all or any of our share capital into shares of larger amount than our existing shares; |

| |

|

| (c) |

convert all or any of our paid up shares into stock, and reconvert that stock into paid up shares of any denomination; |

| |

|

| (d) |

sub-divide our shares or any of them into shares of an amount smaller than that fixed, so, however, that in the sub-division, the proportion between the amount paid and the amount, if any, unpaid on each reduced share shall be the same as it was in case of the share from which the reduced share is derived; and |

| |

|

| (e) |

cancel shares which, at the date of the passing of that ordinary resolution, have not been taken or agreed to be taken by any person and diminish the amount of our share capital by the amount of the shares so cancelled or, in the case of shares without nominal par value, diminish the number of shares into which our capital is divided. |

Subject to the Companies Act

and to any rights for the time being conferred on the shareholders holding a particular class of shares, our shareholders may, by special

resolution, subject to confirmation by the Grand Court of the Cayman Islands on an application by the Company for an order confirming

such reduction, reduce its share capital in any way.

Calls on Shares and Liens on Shares

Subject to the terms of allotment,

the directors may make calls on the shareholders in respect of any monies unpaid on their shares including any premium and each shareholder

shall (subject to receiving at least 14 clear days’ notice specifying when and where payment is to be made), pay to us the amount

called on his shares. Shareholders registered as the joint holders of a share shall be jointly and severally liable to pay all calls in

respect of the share. If a call remains unpaid after it has become due and payable the person from whom it is due and payable shall pay

interest on the amount unpaid from the day it became due and payable until it is paid at the rate fixed by the terms of allotment of the

share or in the notice of the call or if no rate is fixed, at the rate of ten percent per annum. The directors may, at their discretion,

waive payment of the interest wholly or in part.

We have a first and paramount

lien on all shares (whether fully paid up or not) registered in the name of a shareholder (whether solely or jointly with others). The

lien is for all monies payable to us by the shareholder or the shareholder’s estate:

| (a) |

either alone or jointly with any other person, whether or not that other person is a shareholder; and |

| |

|

| (b) |

whether or not those monies are presently payable. |

At any time the directors

may declare any share to be wholly or partly exempt from the lien on shares provisions of the articles.

We may sell, in such manner

as the directors may determine, any share on which the sum in respect of which the lien exists is presently payable, if due notice that

such sum is payable has been given (as prescribed by the articles) and, within 14 days of the date on which the notice is deemed to be

given under the articles, such notice has not been complied with.

Unclaimed Dividend

A dividend that remains unclaimed

for a period of six years after it became due for payment shall be forfeited to, and shall cease to remain owing by, the company.

Forfeiture or Surrender of Shares

If a shareholder fails to

pay any capital call, the directors may give to such shareholder not less than 14 clear days’ notice requiring payment and specifying

the amount unpaid including any interest which may have accrued, any expenses which have been incurred by us due to that person’s

default and the place where payment is to be made. The notice shall also contain a warning that if the notice is not complied with, the

shares in respect of which the call is made will be liable to be forfeited.

If such notice is not complied

with, the directors may, before the payment required by the notice has been received, resolve that any share the subject of that notice

be forfeited (which forfeiture shall include all dividends or other monies payable in respect of the forfeited share and not paid before

such forfeiture).

A forfeited share may be sold,

re-allotted or otherwise disposed of on such terms and in such manner as the directors determine and at any time before a sale, re-allotment

or disposition the forfeiture may be cancelled on such terms as the directors think fit.

A person whose shares

have been forfeited shall cease to be a shareholder in respect of the forfeited shares, but shall, notwithstanding such forfeiture,

remain liable to pay to us all monies which at the date of forfeiture were payable by him to us in respect of the shares, together

with all expenses and interest from the date of forfeiture or surrender until payment, but his liability shall cease if and when we

receive payment in full of the unpaid amount.

A

declaration, whether statutory or under oath, made by a director or the secretary shall be conclusive evidence that the person making

the declaration is our director or secretary and that the particular shares have been forfeited or surrendered on a particular date.

Subject to the execution of

an instrument of transfer, if necessary, the declaration shall constitute good title to the shares.

Share Premium Account

The directors shall establish

a share premium account and shall carry the credit of such account from time to time to a sum equal to the amount or value of the premium

paid on the issue of any share or capital contributed or such other amounts required by the Companies Act.

Inspection of Books and Records

Holders of our Class A

Ordinary Shares will have no general right under the Companies Act to inspect or obtain copies of our register of members or our corporate

records.

General Meetings

As a Cayman Islands exempted

company, we are not obligated by the Companies Act to call shareholders’ annual general meetings; accordingly, we may, but shall

not be obliged to, in each year hold a general meeting as an annual general meeting. Any annual general meeting held shall be held at

such time and place as may be determined by our board of directors. All general meetings other than annual general meetings shall be called

extraordinary general meetings.

The directors may convene

general meetings whenever they think fit. General meetings shall also be convened on the written requisition of one or more of the shareholders

entitled to attend and vote at our general meetings who (together) hold not less than ten percent of the rights to vote at such general

meeting in accordance with the notice provisions in the articles, specifying the purpose of the meeting and signed by each of the shareholders

making the requisition. If the directors do not convene such meeting for a date not later than 21 clear days’ after the date of

receipt of the written requisition, those shareholders who requested the meeting may convene the general meeting themselves within three

months after the end of such period of 21 clear days in which case reasonable expenses incurred by them as a result of the directors failing

to convene a meeting shall be reimbursed by us.

At least 14 days’ notice

of an extraordinary general meeting and 21 days’ notice of an annual general meeting shall be given to shareholders entitled to

attend and vote at such meeting. The notice shall specify the place, the day and the hour of the meeting and the general nature of that

business. In addition, if a resolution is proposed as a special resolution, the text of that resolution shall be given to all shareholders.

Notice of every general meeting shall also be given to the directors and our auditors.

Subject to the Companies Act

and with the consent of the shareholders who, individually or collectively, hold at least 90 percent of the voting rights of all those

who have a right to vote at a general meeting, a general meeting may be convened on shorter notice.

A quorum shall consist of

the presence (whether in person or represented by proxy) of one or more shareholders holding shares that represent not less than one-third

of the outstanding shares carrying the right to vote at such general meeting.

If, within 15 minutes from

the time appointed for the general meeting, or at any time during the meeting, a quorum is not present, the meeting, if convened upon

the requisition of shareholders, shall be cancelled. In any other case it shall stand adjourned to the same time and place seven days

or to such other time or place as is determined by the directors.

The chairman may, with the

consent of a meeting at which a quorum is present, adjourn the meeting. When a meeting is adjourned for seven days or more, notice of

the adjourned meeting shall be given in accordance with the articles.

At any general meeting a resolution

put to the vote of the meeting shall be decided on a show of hands, unless a poll is (before, or on, the declaration of the result of

the show of hands) demanded by the chairman of the meeting or by at least two shareholders having the right to vote on the resolutions

or one or more shareholders present who together hold not less than ten percent of the voting rights of all those who are entitled to

vote on the resolution. Unless a poll is so demanded, a declaration by the chairman as to the result of a resolution and an entry to that

effect in the minutes of the meeting, shall be conclusive evidence of the outcome of a show of hands, without proof of the number or proportion

of the votes recorded in favor of, or against, that resolution.

If a poll is duly demanded

it shall be taken in such manner as the chairman directs and the result of the poll shall be deemed to be the resolution of the meeting

at which the poll was demanded.

In the case of an equality

of votes, whether on a show of hands or on a poll, the chairman of the meeting at which the show of hands takes place or at which the

poll is demanded, shall not be entitled to a second or casting vote.

Capitalization of Profits

The directors may resolve

to capitalize:

| (a) |

any part of our profits not required for paying any preferential dividend (whether or not those profits are available for distribution); or |

| |

|

| (b) |

any sum standing to the credit of our share premium account or capital redemption reserve, if any. |

The amount resolved to be

capitalized must be appropriated to the shareholders who would have been entitled to it had it been distributed by way of dividend and

in the same proportions.

Register of Members

Under the Companies Act, we

must keep a register of members and there should be entered therein:

● the names and addresses of the

members and, a statement of the shares held by each member, which;

● distinguishes

each share by its number (so long as the share has a number);

● confirms

the amount paid or agreed to be considered as paid, on the shares of each member;

● confirms

the number and category of shares held by each member;

● confirms

whether each relevant category of shares held by a member carries voting rights under the articles of association of the company, and

if so, whether such voting rights are conditional;

● the

date on which the name of any person was entered on the register as a member; and

● the

date on which any person ceased to be a member.

For these purposes, “voting

rights” means rights conferred on shareholders in respect of their shares to vote at general meetings of the company on all or substantially

all matters. A voting right is conditional where the voting right arises only in certain circumstances.

Under the Companies

Act, the register of members of our company is prima facie evidence of the matters required to be set out therein (that is, the

register of members will raise a presumption of fact on the matters referred to above unless rebutted) and a shareholder registered

in the register of members is deemed as a matter of the Companies Act to have legal title to the shares as set against its name in

the register of members.

If the name of any person

is incorrectly entered in or omitted from our register of members, or if there is any default or unnecessary delay in entering on the

register the fact of any person having ceased to be a shareholder of our company, the person or shareholder aggrieved (or any shareholder

of our company or our company itself) may apply to the Grand Court of the Cayman Islands for an order that the register be rectified,

and the Court may either refuse such application or it may, if satisfied of the justice of the case, make an order for the rectification

of the register.

Preferred Shares

The

directors of the Company have general and unconditional authority to allot (with or without confirming rights of renunciation), grant

options over or otherwise deal with any unissued shares to such persons, at such times and on such terms and conditions as they may decide.

Subject to the Companies Act (Revised) of the Cayman Islands and the terms of our M&A and without limitation to the preceding sentence,

the directors may so deal with the unissued shares with or without preferred, deferred or other special rights or restrictions, whether

in regard to dividend, voting, return of capital or otherwise. Our Board may, issue preferred shares without action by our shareholders

to the extent there are authorized but unissued shares available.

You

should refer to the prospectus supplement relating to any preferred shares being offered for the specific terms of those shares.

Upon

issuance, the preferred shares will be fully paid and nonassessable, which means that its holders will have paid their purchase price

in full and we may not require them to pay additional funds.

Any

preferred share terms selected by the Board could decrease the amount of earnings and assets available for distribution to holders of

our Class A Ordinary Shares or adversely affect the rights and power, including voting rights, of the holders of our Class A Ordinary

Shares without any further vote or action by the shareholders. The rights of holders of our Class A Ordinary Shares will be subject to,

and may be adversely affected by, the rights of the holders of any preferred shares that may be issued by us in the future. The issuance

of preferred shares could also have the effect of delaying or preventing a change in control of our company or make removal of management

more difficult.

Description of Debt Securities

As used in this prospectus,

the term “debt securities” means the debentures, notes, bonds and other evidences of indebtedness that we may issue from time

to time. The debt securities will either be senior debt securities, senior subordinated debt or subordinated debt securities. We may also

issue convertible debt securities. Debt securities issued under an indenture (which we refer to herein as an Indenture) will be entered

into between us and a trustee to be named therein. It is likely that convertible debt securities will not be issued under an Indenture.

The Indenture or forms of

Indentures, if any, will be filed as exhibits to the registration statement of which this prospectus is a part.

As you read this section,

please remember that for each series of debt securities, the specific terms of your debt security as described in the applicable prospectus

supplement will supplement and, if applicable, may modify or replace the general terms described in the summary below. The statement we

make in this section may not apply to your debt security.

Events of Default Under the Indenture

Unless we provide otherwise

in the prospectus supplement or free writing prospectus applicable to a particular series of debt securities, the following are events

of default under the indentures with respect to any series of debt securities that we may issue:

| ● |

if we fail to pay the principal or premium, if any, when due and payable at maturity, upon redemption or repurchase or otherwise; |

| |

|

| ● |

if we fail to pay interest when due and payable and our failure continues for certain days; |

| |

|

| ● |

if we fail to observe or perform any other covenant contained in the Securities of a Series or in this Indenture, and our failure continues for certain days after we receive written notice from the trustee or holders of at least certain percentage in aggregate principal amount of the outstanding debt securities of the applicable series. The written notice must specify the Default, demand that it be remedied and state that the notice is a “Notice of Default”; |

| |

|

| ● |

if specified events of bankruptcy, insolvency or reorganization occur; and |

| |

|

| ● |

if any other event of default provided with respect to securities of that series, which is specified in a Board Resolution, a supplemental indenture hereto or an Officers’ Certificate as defined in the Form of Indenture. |

We covenant in the Form of

Indenture to deliver a certificate to the trustee annually, within certain days after the close of the fiscal year, to show that we are

in compliance with the terms of the indenture and that we have not defaulted under the indenture.

Nonetheless, if we issue debt

securities, the terms of the debt securities and the final form of indenture will be provided in a prospectus supplement. Please refer

to the prospectus supplement and the form of indenture attached thereto for the terms and conditions of the offered debt securities. The

terms and conditions may or may not include whether or not we must furnish periodic evidence showing that an event of default does not

exist or that we are in compliance with the terms of the indenture.

The statements and descriptions

in this prospectus or in any prospectus supplement regarding provisions of the Indentures and debt securities are summaries thereof, do

not purport to be complete and are subject to, and are qualified in their entirety by reference to, all of the provisions of the Indentures

(and any amendments or supplements we may enter into from time to time which are permitted under each Indenture) and the debt securities,

including the definitions therein of certain terms.

General

Unless otherwise specified

in a prospectus supplement, the debt securities will be direct secured or unsecured obligations of our company. The senior debt securities

will rank equally with any of our other unsecured senior and unsubordinated debt. The subordinated debt securities will be subordinate

and junior in right of payment to any senior indebtedness.

We may issue debt securities

from time to time in one or more series, in each case with the same or various maturities, at par or at a discount. Unless indicated in

a prospectus supplement, we may issue additional debt securities of a particular series without the consent of the holders of the debt

securities of such series outstanding at the time of the issuance. Any such additional debt securities, together with all other outstanding

debt securities of that series, will constitute a single series of debt securities under the applicable Indenture and will be equal in

ranking.

Should an indenture relate

to unsecured indebtedness, in the event of a bankruptcy or other liquidation event involving a distribution of assets to satisfy our outstanding

indebtedness or an event of default under a loan agreement relating to secured indebtedness of our company or its subsidiaries, the holders

of such secured indebtedness, if any, would be entitled to receive payment of principal and interest prior to payments on the senior indebtedness

issued under an Indenture.

Prospectus Supplement

Each prospectus supplement

will describe the terms relating to the specific series of debt securities being offered. These terms will include some or all of the

following:

| ● |

the title of debt securities and whether they are subordinated, senior subordinated or senior debt securities; |

| |

|

| ● |

any limit on the aggregate principal amount of debt securities of such series; |

| |

|

| ● |

the percentage of the principal amount at which the debt securities of any series will be issued; |

| |

|

| ● |

the ability to issue additional debt securities of the same series; |

| |

|

| ● |

the purchase price for the debt securities and the denominations of the debt securities; |

| |

|

| ● |

the specific designation of the series of debt securities being offered; |

| |

|

| ● |

the maturity date or dates of the debt securities and the date or dates upon which the debt securities are payable and the rate or rates at which the debt securities of the series shall bear interest, if any, which may be fixed or variable, or the method by which such rate shall be determined; |

| |

|

| ● |

the basis for calculating interest if other than 360-day year or twelve 30-day months; |