Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

29 May 2024 - 5:54AM

Edgar (US Regulatory)

Nuveen

Nasdaq

100

Dynamic

Overwrite

Fund

Portfolio

of

Investments

March

31,2024

(Unaudited)

Shares

Description

(a)

Value

LONG-TERM

INVESTMENTS

-

101.0%

X

–

COMMON

STOCKS

-

99

.3

%

X

1,276,556,540

Automobiles

&

Components

-

2.8%

40,233

Ford

Motor

Co

$

534,294

4,110

Lear

Corp

595,457

195,730

(b)

Tesla

Inc

34,407,377

Total

Automobiles

&

Components

35,537,128

Capital

Goods

-

1.5%

1,478

(b)

Axon

Enterprise

Inc

462,437

1,024

(b)

Boeing

Co/The

197,622

9,138

Caterpillar

Inc

3,348,437

3,812

(b),(c)

Enovix

Corp

30,534

7,764

Fortive

Corp

667,859

30,184

General

Electric

Co

5,298,197

584

HEICO

Corp

111,544

2,990

Howmet

Aerospace

Inc

204,606

6,441

(b),(c)

Plug

Power

Inc

22,157

7,632

Rockwell

Automation

Inc

2,223,430

116

TransDigm

Group

Inc

142,866

4,996

United

Rentals

Inc

3,602,666

5,734

Vertiv

Holdings

Co,

Class

A

468,296

1,840

Watsco

Inc

794,825

1,390

WW

Grainger

Inc

1,414,047

Total

Capital

Goods

18,989,523

Commercial

&

Professional

Services

-

0.6%

21,698

(b)

ACV

Auctions

Inc,

Class

A

407,271

634

Booz

Allen

Hamilton

Holding

Corp

94,111

1,124

Equifax

Inc

300,693

19,936

Robert

Half

Inc

1,580,526

7,070

Rollins

Inc

327,129

4,378

Tetra

Tech

Inc

808,660

9,596

Veralto

Corp

850,781

7,562

Waste

Connections

Inc

1,300,740

9,915

Waste

Management

Inc

2,113,382

Total

Commercial

&

Professional

Services

7,783,293

Consumer

Discretionary

Distribution

&

Retail

-

7.3%

3,906

(b)

Abercrombie

&

Fitch

Co,

Class

A

489,539

383,020

(b),(d)

Amazon.com

Inc

69,089,148

5,446

American

Eagle

Outfitters

Inc

140,452

940

(b)

AutoZone

Inc

2,962,551

1,817

(b)

Burlington

Stores

Inc

421,889

1,711

(b)

Carvana

Co

150,414

52,348

(b)

Coupang

Inc

931,271

8,039

Dick's

Sporting

Goods

Inc

1,807,650

1,571

Dillard's

Inc,

Class

A

740,946

12,343

(b)

Etsy

Inc

848,211

2,402

(b)

Five

Below

Inc

435,675

5,972

Gap

Inc/The

164,529

14,472

Genuine

Parts

Co

2,242,147

20,421

LKQ

Corp

1,090,686

4,325

Lowe's

Cos

Inc

1,101,707

14,611

(b)

Ollie's

Bargain

Outlet

Holdings

Inc

1,162,597

7,621

Pool

Corp

3,075,074

4,547

(b)

Savers

Value

Village

Inc

87,666

24,886

TJX

Cos

Inc/The

2,523,938

Nuveen

Nasdaq

100

Dynamic

Overwrite

Fund

(continued)

Portfolio

of

Investments

March

31,2024

(Unaudited)

Shares

Description

(a)

Value

Consumer

Discretionary

Distribution

&

Retail

(continued)

6,915

Tractor

Supply

Co

$

1,809,794

2,331

(b)

Ulta

Beauty

Inc

1,218,833

4,507

(b)

Wayfair

Inc,

Class

A

305,935

3,191

Williams-Sonoma

Inc

1,013,238

Total

Consumer

Discretionary

Distribution

&

Retail

93,813,890

Consumer

Durables

&

Apparel

-

0.4%

2,696

(b)

Deckers

Outdoor

Corp

2,537,637

27,957

NIKE

Inc,

Class

B

2,627,399

3,437

(b)

Skechers

USA

Inc,

Class

A

210,550

Total

Consumer

Durables

&

Apparel

5,375,586

Consumer

Services

-

3.1%

6,160

Booking

Holdings

Inc

22,347,741

1,740

(b)

Chipotle

Mexican

Grill

Inc

5,057,780

21,002

Darden

Restaurants

Inc

3,510,484

433

Domino's

Pizza

Inc

215,149

13,319

(b)

DraftKings

Inc,

Class

A

604,816

602

(b)

Duolingo

Inc

132,789

26,996

Hilton

Worldwide

Holdings

Inc

5,758,517

4,279

McDonald's

Corp

1,206,464

10,345

Service

Corp

International/US

767,702

1,480

Wingstop

Inc

542,272

Total

Consumer

Services

40,143,714

Consumer

Staples

Distribution

&

Retail

-

2.3%

25,248

(b)

BJ's

Wholesale

Club

Holdings

Inc

1,910,011

2,618

Casey's

General

Stores

Inc

833,702

210,528

(b)

HF

Foods

Group

Inc

736,848

24,681

Kroger

Co/The

1,410,026

22,357

(b)

Performance

Food

Group

Co

1,668,727

25,877

(b)

Sprouts

Farmers

Market

Inc

1,668,549

60,824

Sysco

Corp

4,937,692

17,183

Target

Corp

3,044,999

46,686

(b)

US

Foods

Holding

Corp

2,519,643

179,118

Walmart

Inc

10,777,530

Total

Consumer

Staples

Distribution

&

Retail

29,507,727

Energy

-

0.3%

4,902

(b)

Clean

Energy

Fuels

Corp

13,137

666

ConocoPhillips

84,768

5,519

Hess

Corp

842,420

32,582

NOV

Inc

636,001

3,259

Pioneer

Natural

Resources

Co

855,488

8,314

Schlumberger

NV

455,690

5,484

Select

Water

Solutions

Inc

50,617

21,805

TechnipFMC

PLC

547,524

423

Texas

Pacific

Land

Corp

244,710

698

(b)

Weatherford

International

PLC

80,563

Total

Energy

3,810,918

Equity

Real

Estate

Investment

Trusts

(REITs)

-

0.2%

55,254

CubeSmart

2,498,586

Total

Equity

Real

Estate

Investment

Trusts

(REITs)

2,498,586

Financial

Services

-

2.4%

3,005

(b)

Affirm

Holdings

Inc

111,966

5,861

(b)

Berkshire

Hathaway

Inc,

Class

B

2,464,668

666

(b)

Coinbase

Global

Inc,

Class

A

176,570

Shares

Description

(a)

Value

Financial

Services

(continued)

11,527

Jack

Henry

&

Associates

Inc

$

2,002,586

8,130

Mastercard

Inc,

Class

A

3,915,164

8,682

Moody's

Corp

3,412,286

19,418

Morgan

Stanley

1,828,399

143,943

(b)

PayPal

Holdings

Inc

9,642,742

3,079

S&P

Global

Inc

1,309,960

11,343

SEI

Investments

Co

815,562

11,700

(b)

Toast

Inc,

Class

A

291,564

17,825

Visa

Inc,

Class

A

4,974,601

Total

Financial

Services

30,946,068

Food,

Beverage

&

Tobacco

-

3.0%

1,462

(b)

Boston

Beer

Co

Inc/The,

Class

A

445,062

70,834

(b)

Bridgford

Foods

Corp

794,049

35,266

Brown-Forman

Corp,

Class

B

1,820,431

7,539

Bunge

Global

SA

772,898

10,507

Cal-Maine

Foods

Inc

618,337

37,908

(b)

Celsius

Holdings

Inc

3,143,331

97,069

Coca-Cola

Co/The

5,938,682

190

Coca-Cola

Consolidated

Inc

160,818

7,494

Constellation

Brands

Inc,

Class

A

2,036,570

4,567

(b)

Freshpet

Inc

529,133

40,685

General

Mills

Inc

2,846,730

853

Ingredion

Inc

99,673

22,636

(b)

Laird

Superfood

Inc

54,326

17,629

Lamb

Weston

Holdings

Inc

1,878,017

20,310

McCormick

&

Co

Inc/MD

1,560,011

242,394

(b)

Monster

Beverage

Corp

14,369,116

10,703

(b)

Post

Holdings

Inc

1,137,515

3,676

(b)

Simply

Good

Foods

Co/The

125,094

12,843

Tyson

Foods

Inc,

Class

A

754,269

Total

Food,

Beverage

&

Tobacco

39,084,062

Health

Care

Equipment

&

Services

-

1.8%

26,882

Abbott

Laboratories

3,055,408

1,197

(b)

Align

Technology

Inc

392,520

13,236

(b)

Alphatec

Holdings

Inc

182,524

11,805

(b)

Axonics

Inc

814,191

2,837

Becton

Dickinson

&

Co

702,016

45,774

(b)

Boston

Scientific

Corp

3,135,061

9,791

Cardinal

Health

Inc

1,095,613

845

Cencora

Inc

205,327

1,020

(b)

Cooper

Cos

Inc/The

103,489

10,457

(b)

Edwards

Lifesciences

Corp

999,271

768

Embecta

Corp

10,191

1,777

(b)

Glaukos

Corp

167,553

11,126

(b)

Inari

Medical

Inc

533,826

2,477

(b)

Inspire

Medical

Systems

Inc

532,035

17,865

(b)

LENSAR

Inc

63,421

4,308

McKesson

Corp

2,312,750

313

(b)

Novocure

Ltd

4,892

271

(b)

Penumbra

Inc

60,482

2,672

(b)

PROCEPT

BioRobotics

Corp

132,050

2,655

(b)

RxSight

Inc

136,945

5,192

(b)

Schrodinger

Inc/United

States

140,184

1,347

(b)

Shockwave

Medical

Inc

438,624

19,914

Stryker

Corp

7,126,623

695

(b),(c)

TransMedics

Group

Inc

51,388

929

UnitedHealth

Group

Inc

459,576

2,900

(b)

Veeva

Systems

Inc,

Class

A

671,901

Nuveen

Nasdaq

100

Dynamic

Overwrite

Fund

(continued)

Portfolio

of

Investments

March

31,2024

(Unaudited)

Shares

Description

(a)

Value

Health

Care

Equipment

&

Services

(continued)

1

(b)

Venus

Concept

Inc

$

1

Total

Health

Care

Equipment

&

Services

23,527,862

Household

&

Personal

Products

-

0.2%

1,256

Colgate-Palmolive

Co

113,103

4,331

(b)

elf

Beauty

Inc

849,006

1,884

Estee

Lauder

Cos

Inc/The,

Class

A

290,418

11,199

Procter

&

Gamble

Co/The

1,817,038

Total

Household

&

Personal

Products

3,069,565

Insurance

-

0.0%

4,744

(b),(c)

Lemonade

Inc

77,849

Total

Insurance

77,849

Materials

-

0.3%

4,212

Ball

Corp

283,720

6,845

(b)

comScore

Inc

105,413

4,584

Linde

PLC

2,128,443

3,839

Sherwin-Williams

Co/The

1,333,400

Total

Materials

3,850,976

Media

&

Entertainment

-

16.0%

416,655

(b)

Alphabet

Inc,

Class

A

62,885,739

298,496

(b),(d)

Alphabet

Inc,

Class

C

45,449,001

448

(b)

AMC

Entertainment

Holdings

Inc,

Class

A

1,667

642,116

Comcast

Corp,

Class

A

27,835,729

11,325

(b)

Lions

Gate

Entertainment

Corp,

Class

A

112,684

10,553

(b)

Live

Nation

Entertainment

Inc

1,116,191

37,991

(b)

Match

Group

Inc

1,378,313

124,999

Meta

Platforms

Inc

60,697,014

25,957

New

York

Times

Co/The,

Class

A

1,121,862

6,270

News

Corp,

Class

B

169,666

15,223

(b)

ROBLOX

Corp,

Class

A

581,214

12,831

(b)

Roku

Inc

836,196

42,393

Saga

Communications

Inc,

Class

A

945,788

8,142

TKO

Group

Holdings

Inc

703,550

11,379

Walt

Disney

Co/The

1,392,334

Total

Media

&

Entertainment

205,226,948

Pharmaceuticals,

Biotechnology

&

Life

Sciences

-

4.8%

3,964

(b)

89bio

Inc

46,141

21,953

Agilent

Technologies

Inc

3,194,381

66,016

(d)

Amgen

Inc

18,769,669

803

(b)

Arcus

Biosciences

Inc

15,161

1,819

(b)

Arvinas

Inc

75,088

4,186

(b)

Biohaven

Ltd

228,932

1,796

(b)

BioMarin

Pharmaceutical

Inc

156,863

3,399

(b)

Blueprint

Medicines

Corp

322,429

4,277

(b)

Bridgebio

Pharma

Inc

132,245

2,012

(b)

Cerevel

Therapeutics

Holdings

Inc

85,047

5,019

(b)

Charles

River

Laboratories

International

Inc

1,359,898

5,067

(b)

Cytokinetics

Inc

355,247

16,193

Danaher

Corp

4,043,716

22,400

(b)

Day

One

Biopharmaceuticals

Inc

370,048

6,554

(b)

Editas

Medicine

Inc

48,631

2,706

Eli

Lilly

&

Co

2,105,160

5,556

(b)

Exelixis

Inc

131,844

172,825

Gilead

Sciences

Inc

12,659,431

48,226

(b),(c)

ImmunityBio

Inc

258,974

13,603

(b)

Insmed

Inc

369,049

Shares

Description

(a)

Value

Pharmaceuticals,

Biotechnology

&

Life

Sciences

(continued)

3,844

(b)

Ionis

Pharmaceuticals

Inc

$

166,637

7,172

(b)

Iovance

Biotherapeutics

Inc

106,289

22,160

(b)

Kura

Oncology

Inc

472,673

1,618

(b)

Madrigal

Pharmaceuticals

Inc

432,071

7,810

(b)

Neurocrine

Biosciences

Inc

1,077,155

13,272

(b)

Regeneron

Pharmaceuticals

Inc

12,774,167

4,581

(b)

Revance

Therapeutics

Inc

22,539

4,032

(b)

REVOLUTION

Medicines

Inc

129,951

14,185

(b)

Roivant

Sciences

Ltd

149,510

3,102

(b)

SpringWorks

Therapeutics

Inc

152,681

7,934

(b)

Twist

Bioscience

Corp

272,216

8,154

(b)

Ultragenyx

Pharmaceutical

Inc

380,710

193

West

Pharmaceutical

Services

Inc

76,372

Total

Pharmaceuticals,

Biotechnology

&

Life

Sciences

60,940,925

Semiconductors

&

Semiconductor

Equipment

-

21.6%

166,423

(b),(d)

Advanced

Micro

Devices

Inc

30,037,687

94,350

Analog

Devices

Inc

18,661,486

165,056

Applied

Materials

Inc

34,039,499

9,301

(b)

Axcelis

Technologies

Inc

1,037,248

37,356

Broadcom

Inc

49,512,016

15,643

(b)

Cirrus

Logic

Inc

1,447,916

5,054

(b)

Credo

Technology

Group

Holding

Ltd

107,094

2,309

(b)

Enphase

Energy

Inc

279,343

10,198

Entegris

Inc

1,433,227

6,555

(b)

First

Solar

Inc

1,106,484

2,690

(b)

FormFactor

Inc

122,745

420,372

Intel

Corp

18,567,831

37,130

(b)

Lattice

Semiconductor

Corp

2,904,680

13,569

(b)

MACOM

Technology

Solutions

Holdings

Inc

1,297,739

2,974

(b),(c)

Maxeon

Solar

Technologies

Ltd

9,903

6,123

Monolithic

Power

Systems

Inc

4,147,843

9,503

(b)

Navitas

Semiconductor

Corp

45,329

84,542

NVIDIA

Corp

76,388,769

7,607

(b)

Onto

Innovation

Inc

1,377,476

12,494

Power

Integrations

Inc

893,946

12,202

(b)

Qorvo

Inc

1,401,156

140,959

QUALCOMM

Inc

23,864,359

11,536

(b)

Rambus

Inc

713,040

9,889

(b)

Silicon

Laboratories

Inc

1,421,247

20,407

Skyworks

Solutions

Inc

2,210,486

16,275

(b)

SYNAPTICS

INC

1,587,789

9,086

Taiwan

Semiconductor

Manufacturing

Co

Ltd,

Sponsored

ADR

1,236,150

3,690

Teradyne

Inc

416,343

9,995

Universal

Display

Corp

1,683,658

Total

Semiconductors

&

Semiconductor

Equipment

277,952,489

Software

&

Services

-

16.5%

1,868

(b)

Appfolio

Inc,

Class

A

460,910

6,319

(b)

AppLovin

Corp,

Class

A

437,401

52,492

(b)

Autodesk

Inc

13,669,967

4,846

Bentley

Systems

Inc,

Class

B

253,058

6,843

(b)

Braze

Inc,

Class

A

303,145

11,942

(b),(c)

C3.ai

Inc,

Class

A

323,270

5,650

(b)

Cleanspark

Inc

119,837

20,252

(b)

Confluent

Inc,

Class

A

618,091

9,383

(b)

Dayforce

Inc

621,248

5,238

(b)

DocuSign

Inc

311,923

15,187

(b)

DoubleVerify

Holdings

Inc

533,975

16,008

(b)

Dropbox

Inc,

Class

A

388,994

Nuveen

Nasdaq

100

Dynamic

Overwrite

Fund

(continued)

Portfolio

of

Investments

March

31,2024

(Unaudited)

Shares

Description

(a)

Value

Software

&

Services

(continued)

20,808

(b)

Dynatrace

Inc

$

966,324

2,978

(b)

Elastic

NV

298,515

1,335

(b)

Fair

Isaac

Corp

1,668,229

14,290

(b)

Freshworks

Inc,

Class

A

260,221

5,922

(b)

Gitlab

Inc,

Class

A

345,371

8,062

(b)

Guidewire

Software

Inc

940,916

7,482

(b)

HashiCorp

Inc,

Class

A

201,640

2,688

(b)

HubSpot

Inc

1,684,193

3,345

(b)

Intapp

Inc

114,734

9,067

(b)

Manhattan

Associates

Inc

2,268,835

5,006

(b)

Marathon

Digital

Holdings

Inc

113,035

365,081

Microsoft

Corp

153,596,878

393

(b),(c)

MicroStrategy

Inc,

Class

A

669,892

11,808

(b)

Nutanix

Inc,

Class

A

728,790

40,479

Oracle

Corp

5,084,567

80,164

(b)

Palantir

Technologies

Inc,

Class

A

1,844,574

1,053

(b)

Paylocity

Holding

Corp

180,969

7,008

(b)

Procore

Technologies

Inc

575,847

24,964

(b)

PTC

Inc

4,716,698

4,804

(b)

Qualys

Inc

801,643

3,549

(b)

Riot

Platforms

Inc

43,440

22,714

Salesforce

Inc

6,841,003

21,736

(b)

SentinelOne

Inc,

Class

A

506,666

6,953

(b)

ServiceNow

Inc

5,300,967

5,606

(b)

Smartsheet

Inc,

Class

A

215,831

16,980

(b)

Sprinklr

Inc,

Class

A

208,345

7,614

(b)

Sprout

Social

Inc,

Class

A

454,632

6,834

(b)

Tenable

Holdings

Inc

337,805

2,332

(b)

Tyler

Technologies

Inc

991,123

36,872

(b)

UiPath

Inc,

Class

A

835,888

10,300

(b)

Varonis

Systems

Inc

485,851

1,869

(b)

Workiva

Inc

158,491

4,315

(b)

Zoom

Video

Communications

Inc,

Class

A

282,072

Total

Software

&

Services

211,765,804

Technology

Hardware

&

Equipment

-

11.9%

742,091

(d)

Apple

Inc

127,253,765

497,907

Cisco

Systems

Inc

24,850,538

8,099

(b)

Keysight

Technologies

Inc

1,266,522

Total

Technology

Hardware

&

Equipment

153,370,825

Telecommunication

Services

-

0.4%

32,495

Spok

Holdings

Inc

518,295

31,079

Telephone

and

Data

Systems

Inc

497,886

100,308

Verizon

Communications

Inc

4,208,924

Total

Telecommunication

Services

5,225,105

Transportation

-

0.8%

11,239

Delta

Air

Lines

Inc

538,011

228

FedEx

Corp

66,061

4,575

JB

Hunt

Transport

Services

Inc

911,569

26,971

(b)

Lyft

Inc,

Class

A

521,889

2,687

Norfolk

Southern

Corp

684,836

1,881

(b)

Saia

Inc

1,100,385

33,792

(b)

Uber

Technologies

Inc

2,601,646

10,994

Union

Pacific

Corp

2,703,754

4,685

(b)

XPO

Inc

571,710

Total

Transportation

9,699,861

Investments

in

Derivatives

Shares

Description

(a)

Value

Utilities

-

1.1%

4,894

American

Water

Works

Co

Inc

$

598,096

15,430

Atmos

Energy

Corp

1,834,164

13,565

CMS

Energy

Corp

818,512

10,727

Consolidated

Edison

Inc

974,119

13,604

Duke

Energy

Corp

1,315,643

19,654

FirstEnergy

Corp

759,037

17,908

NRG

Energy

Inc

1,212,193

69,334

PG&E

Corp

1,162,038

3,827

Public

Service

Enterprise

Group

Inc

255,567

22,816

Sempra

1,638,873

52,824

Southern

Co/The

3,789,594

Total

Utilities

14,357,836

Total

Common

Stocks

(cost

$397,950,578)

1,276,556,540

Shares

Description

(a)

Value

X

–

EXCHANGE-TRADED

FUNDS

-

1

.7

%

X

21,441,750

82,500

Vanguard

Total

Stock

Market

ETF

$

21,441,750

Total

Exchange-Traded

Funds

(cost

$20,139,642)

21,441,750

Type

Description

(e)

Number

of

Contracts

Notional

Amount

(f)

Exercise

Price

Expiration

Date

Value

OPTIONS

PURCHASED

-

0

.0

%

Put

S&P

500

Index

60

$

27,000,000

$

4500

4/19/24

$

10,050

Total

Options

Purchased

(cost

$24,142)

60

$

27,000,000

10,050

Total

Long-Term

Investments

(cost

$418,114,362)

1,298,008,340

Shares

Description

(a)

Coupon

Value

INVESTMENTS

PURCHASED

WITH

COLLATERAL

FROM

SECURITIES

LENDING

-

0.1%

1,568,680

(g)

State

Street

Navigator

Securities

Lending

Government

Money

Market

Portfolio

5.340%(h)

$

1,568,680

Total

Investments

Purchased

with

Collateral

from

Securities

Lending

(cost

$1,568,680)

1,568,680

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

SHORT-TERM

INVESTMENTS

-

0.1%

–

REPURCHASE

AGREEMENTS

-

0

.1

%

X

1,101,278

$

1,101

(i)

Fixed

Income

Clearing

Corp

(FICC)

1.600%

4/01/24

$

1,101,278

Total

Repurchase

Agreements

(cost

$1,101,278)

1,101,278

Total

Short-Term

Investments

(cost

$1,101,278)

1,101,278

Total

Investments

(cost

$

420,784,320

)

-

101

.2

%

1,300,678,298

Other

Assets

&

Liabilities,

Net

- (1.2)%

(

15,468,985

)

Net

Assets

Applicable

to

Common

Shares

-

100%

$

1,285,209,313

Nuveen

Nasdaq

100

Dynamic

Overwrite

Fund

(continued)

Portfolio

of

Investments

March

31,2024

(Unaudited)

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Options

Written

Type

Description

(e)

Number

of

Contracts

Notional

Amount

(f)

Exercise

Price

Expiration

Date

Value

Call

Russell

2000

Index/Old

(112)

$

(

24,640,000

)

$

2,200

4/19/24

$

(

132,160

)

Call

NASDAQ

100

Stock

INDEX

(165)

(

295,350,000

)

17,900

4/19/24

(

8,655,075

)

Call

NASDAQ

100

Stock

INDEX

(30)

(

54,600,000

)

18,200

4/19/24

(

947,400

)

Call

NASDAQ

100

Stock

INDEX

(35)

(

64,400,000

)

18,400

4/19/24

(

728,000

)

Call

Invesco

QQQ

Trust

Series

1

(1,000)

(

44,500,000

)

445

4/26/24

(

818,500

)

Call

Invesco

QQQ

Trust

Series

1

(500)

(

22,350,000

)

447

4/26/24

(

368,000

)

Call

S&P

500

Index

(70)

(

36,750,000

)

5,250

4/30/24

(

553,700

)

Call

S&P

500

Index

(140)

(

73,640,000

)

5,260

4/30/24

(

1,029,000

)

Call

S&P

500

Index

(70)

(

37,100,000

)

5,300

4/30/24

(

364,000

)

Call

S&P

500

Index

(120)

(

63,600,000

)

5,300

5/10/24

(

840,000

)

Total

Options

Written

(premiums

received

$12,116,172)

(2,242)

$(716,930,000)

$(14,435,835)

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Common

Stocks

$

1,276,556,540

$

–

$

–

$

1,276,556,540

Exchange-Traded

Funds

21,441,750

–

–

21,441,750

Options

Purchased

10,050

–

–

10,050

Investments

Purchased

with

Collateral

from

Securities

Lending

1,568,680

–

–

1,568,680

Short-Term

Investments:

Repurchase

Agreements

–

1,101,278

–

1,101,278

Investments

in

Derivatives:

Options

Written

(14,435,835)

–

–

(14,435,835)

Total

$

1,285,141,185

$

1,101,278

$

–

$

1,286,242,463

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

(a)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(b)

Non-income

producing;

issuer

has

not

declared

an

ex-dividend

date

within

the

past

twelve

months.

(c)

Investment,

or

a

portion

of

investment,

is

out

on

loan

for

securities

lending.

The

total

value

of

the

securities

out

on

loan

as

of

the

end

of

the

reporting

period

was

$1,429,366.

(d)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

derivatives.

(e)

Exchange-traded,

unless

otherwise

noted.

(f)

For

disclosure

purposes,

Notional

Amount

is

calculated

by

multiplying

the

Number

of

Contracts

by

the

Exercise

Price

by

100.

(g)

The

Fund

may

loan

securities

representing

up

to

one

third

of

the

value

of

its

total

assets

(which

includes

collateral

for

securities

on

loan)

to

broker

dealers,

banks,

and

other

institutions.

The

collateral

maintained

by

the

Fund

shall

have

a

value,

at

the

inception

of

each

loan,

equal

to

not

less

than

100%

of

the

value

of

the

loaned

securities.

The

cash

collateral

received

by

the

Fund

is

invested

in

this

money

market

fund.

(h)

The

rate

shown

is

the

one-day

yield

as

of

the

end

of

the

reporting

period.

(i)

Agreement

with

Fixed

Income

Clearing

Corporation,

1.600%

dated

3/28/24

to

be

repurchased

at

$1,101,474

on

4/1/24,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

4.750%

and

maturity

date

2/15/41,

valued

at

$1,123,408.

ADR

American

Depositary

Receipt

ETF

Exchange-Traded

Fund

REIT

Real

Estate

Investment

Trust

S&P

Standard

&

Poor's

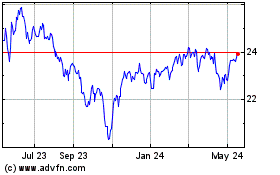

Nuveen Nasdaq 100 Dynami... (NASDAQ:QQQX)

Historical Stock Chart

From Jan 2025 to Feb 2025

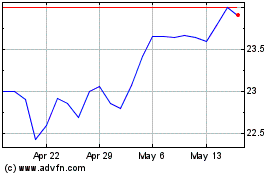

Nuveen Nasdaq 100 Dynami... (NASDAQ:QQQX)

Historical Stock Chart

From Feb 2024 to Feb 2025