UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

Commission File Number: 001-41568

Erayak Power

Solution Group Inc.

No. 528, 4th Avenue

Binhai Industrial Park

Wenzhou, Zhejiang Province

People’s Republic of China 325025

+86-577-86829999

(Address, including zip code, and telephone

number, including area code, of Registrant’s principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

In connection with the annual general meeting

of shareholders of Erayak Power Solution Group Inc. (the “Company”), attached hereto and incorporated by reference herein are Notice

of Annual General Meeting and Proxy Statement and Form of Proxy Card.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Erayak Power Solution Group Inc. |

| |

|

| Date: October 7, 2024 |

By: |

/s/ Lingyi Kong |

| |

Name: |

Lingyi Kong |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

Erayak Power Solution Group Inc.

No. 528, 4th Avenue

Binhai Industrial Park

Wenzhou, Zhejiang Province

People’s Republic of China 325025

PROXY STATEMENT AND NOTICE OF

ANNUAL GENERAL MEETING OF SHAREHOLDERS

| To the shareholders of |

October 7, 2024 |

| Erayak Power Solution Group Inc. |

|

To our shareholders:

It is my pleasure to invite you to our Annual

General Meeting of Shareholders (the “Annual General Meeting”) on November 8, 2024, at 10 a.m., local time (November 7, 2024,

at 9 p.m., Eastern Time). The meeting will be held at our executive office at No. 528, 4th Avenue, Binhai Industrial Park, Wenzhou, Zhejiang

Province, People’s Republic of China 325025.

The matters to be acted upon at the meeting are

described in the Notice of Annual General Meeting of Shareholders and Proxy Statement.

YOUR VOTE IS VERY IMPORTANT. WHETHER OR NOT

YOU PLAN TO ATTEND THE ANNUAL GENERAL MEETING OF SHAREHOLDERS, WE URGE YOU TO VOTE AND SUBMIT YOUR PROXY ON THE INTERNET OR BY MAIL. IF

YOU ARE A REGISTERED SHAREHOLDER AND ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON. IF YOU HOLD YOUR SHARES

THROUGH A BANK OR BROKER AND WANT TO VOTE YOUR SHARES IN PERSON AT THE MEETING, PLEASE CONTACT YOUR BANK OR BROKER TO OBTAIN A LEGAL PROXY.

THANK YOU FOR YOUR SUPPORT.

| By order of the Board of Directors, |

|

| |

|

| /s/ Lingyi Kong |

|

| Lingyi Kong |

|

Chief Executive Officer and

Chairman of the Board |

|

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

Erayak Power Solution Group Inc.

| TIME: |

November 8, 2024, at 10 a.m., local time (November 7, 2024, at 9 p.m., Eastern Time) |

| PLACE: |

No. 528, 4th Avenue, Binhai Industrial Park, Wenzhou, Zhejiang Province, People’s Republic of China 325025 |

ITEMS OF BUSINESS:

| Proposal 1 |

By an ordinary resolution, to re-appoint five directors, Mr. Lingyi Kong, Mr. Wang-Ngai Mak, Mr. Jizhou Hou, Ms. Jing Chen, and Mr. Tsang Sheung, to serve on the Company’s board of directors (the “Board” or “Board of Directors”) until the next annual general meeting of shareholders or until their office is otherwise vacated or they are removed by an ordinary resolution of the shareholders or by a resolution of all the other directors (the “Reappointment of Directors”); |

| |

|

| Proposal 2 |

By an ordinary resolution, to ratify the appointment of Fortune CPA, Inc as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024 (the “Appointment of Fortune”); |

| |

|

| Proposal 3 |

By an ordinary resolution, to approve a reverse stock split of the Company’s ordinary shares, at a ratio of not less than 1-for-5 and not more than 1-for-20, with the final ratio to be determined by the Board of Directors in its sole discretion at any time after approval by the shareholders (the “Reverse Stock Split”), and authorize the Board of Directors to implement such reverse stock split at its discretion at any time prior to the one-year anniversary of the Annual General Meeting, in order to regain compliance with Nasdaq Listing Rule 5550(a)(2), which requires listed securities to maintain a minimum bid price of US$1.00 per share; |

| |

|

| Proposal 4 |

By a special resolution, to amend the Company’s

Articles of Association by the deletion of the existing Article 35.1 in its entirety and the insertion of the following language

a new Article 35.1:

35.1 Record Date Determination. For the

purpose of determining Members entitled to attend meetings, receive payment of any Distribution or capitalisation or for any other purpose,

the Directors may provide that the Register of Members shall be closed for transfers for a stated period which shall not in any case exceed

forty days. In lieu of, or apart from, closing the Register of Members, the Directors may fix in advance or arrears a date as the record

date for any such determination of Members.

|

| Proposal 5 |

By a special resolution, to amend and restate the Company’s Memorandum of Association to reflect the Reverse Stock Split, once implemented; |

| |

|

| Proposal 6 |

By an ordinary resolution, to adjourn the Annual General Meeting for any purpose, including to solicit additional proxies if there are insufficient votes at the time of the Annual General Meeting to approve the proposals described above. |

WHO MAY

VOTE: |

You may vote if you were a shareholder of record on October 7, 2024. |

| |

|

DATE OF

MAILING: |

This notice and the proxy statement are first being mailed to shareholders on or about October 7, 2024. |

| By order of the Board of Directors, |

|

| |

|

| /s/ Lingyi Kong |

|

| Linyi Kong |

|

Chief Executive Officer and

Chairman of the Board |

|

ABOUT THE ANNUAL GENERAL MEETING OF SHAREHOLDERS

What am I voting on?

You will be voting on the following:

| Proposal 1 |

By an ordinary resolution, to re-appoint five directors, Mr. Lingyi Kong, Mr. Wang-Ngai Mak, Mr. Jizhou Hou, Ms. Jing Chen, and Mr. Tsang Sheung, to serve on the Company’s board of directors (the “Board” or “Board of Directors”) until the next annual general meeting of shareholders or until their office is otherwise vacated or they are removed by an ordinary resolution of the shareholders or by a resolution of all the other directors (the “Reappointment of Directors”); |

| |

|

| Proposal 2 |

By an ordinary resolution, to ratify the appointment of Fortune CPA, Inc as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024 (the “Appointment of Fortune”); |

| |

|

| Proposal 3 |

By an ordinary resolution, to approve a reverse stock split of the Company’s ordinary shares, at a ratio of not less than 1-for-5 and not more than 1-for-20, with the final ratio to be determined by the Board of Directors in its sole discretion at any time after approval by the shareholders (the “Reverse Stock Split”), and authorize the Board of Directors to implement such reverse stock split at its discretion at any time prior to the one-year anniversary of the Annual General Meeting, in order to regain compliance with Nasdaq Listing Rule 5550(a)(2), which requires listed securities to maintain a minimum bid price of US$1.00 per share; |

| |

|

| Proposal 4 |

By a special resolution, to amend the Company’s

Articles of Association by the deletion of the existing Article 35.1 in its entirety and the insertion of the following language

a new Article 35.1:

35.1 Record Date Determination. For the

purpose of determining Members entitled to attend meetings, receive payment of any Distribution or capitalisation or for any other purpose,

the Directors may provide that the Register of Members shall be closed for transfers for a stated period which shall not in any case exceed

forty days. In lieu of, or apart from, closing the Register of Members, the Directors may fix in advance or arrears a date as the record

date for any such determination of Members.

|

| Proposal 5 |

By a special resolution, to amend and restate the Company’s Memorandum of Association to reflect the Reverse Stock Split, once implemented; |

| |

|

| Proposal 6 |

By an ordinary resolution, to adjourn the Annual General Meeting for any purpose, including to solicit additional proxies if there are insufficient votes at the time of the Annual General Meeting to approve the proposals described above. |

Who is entitled to vote?

You may vote if you owned ordinary shares of the

Company as of the close of business on October 7, 2024, which we refer to as the “Record Date.” Each Class A ordinary share

entitles the holder thereof to one (1) vote on each resolution submitted to a vote at the Annual General Meeting and each Class B ordinary

share entitles the holder thereof to twenty (20) votes on each resolution submitted to a vote at the Annual General Meeting. As of October

7, 2024, we had 2,700,000 Class A ordinary shares and 1,000,000 Class B ordinary shares issued outstanding.

How do I vote before the Annual General Meeting?

If you are a registered shareholder, you have

the following voting options:

| (1) | By Internet, which we encourage

if you have Internet access, at the address shown on your proxy card; |

| (2) | By mail, by completing, signing

and returning the enclosed proxy card; or |

| (3) | During the Annual General Meeting

in person. |

If you vote via the internet, your electronic

vote authorizes the named proxies in the same manner as if you signed, dated, and returned your proxy card. If you vote via the internet,

do not return your proxy card.

If you hold your shares through an account with

a bank or broker, your ability to vote by the Internet depends on their voting procedures. Please follow the directions that your bank

or broker provides.

Can I change my mind after I return my proxy?

You may change your vote at any time before the

polls close at the conclusion of voting at the Annual General Meeting. You may do this by (1) signing another proxy card with a later

date and returning it to us before the Annual General Meeting, (2) voting again over the Internet prior to the time of the Annual General

Meeting, or (3) voting at the Annual General Meeting if you are a registered shareholder or have followed the necessary procedures required

by your bank or broker.

What if I return my proxy card but do not provide

voting instructions?

Proxies that are signed and returned but do not

contain voting instructions will be voted “FOR” all of the proposals and in accordance with the best judgment of the named

proxies on any other matters properly brought before the Annual General Meeting.

What does it mean if I receive more than one

proxy card or instruction form?

It indicates that your ordinary shares are registered

differently and are in more than one account. To ensure that all shares are voted, please either vote each account on the Internet, or

sign and return all proxy cards. We encourage you to register all your accounts in the same name and address. Those holding shares through

a bank or broker should contact their bank or broker and request consolidation.

May shareholders ask questions at the Annual

General Meeting?

Yes. Representatives of the Company will answer

questions of general interest at the end of the Annual General Meeting. You may also submit questions in advance via email to ninayuan@erayaktech.com.

Such questions will also be addressed at the end of the Annual General Meeting.

How many votes must be present to hold the

Annual General Meeting?

Your shares are counted as present at the Annual

General Meeting if you attend the Annual General Meeting and vote in person or if you properly return a proxy by internet or mail. In

order for us to conduct our Annual General Meeting, shareholders holding in aggregate at least one-third (1/3rd) of the votes of our outstanding

and paid up ordinary shares as of the Record Date must be present in person or by proxy. This is referred to as a quorum.

For the purpose of determining whether the shareholders

have approved Proposal One, Proposal Three, Proposal Four and Proposal Five, abstentions and broker non-votes, if any, will not be counted

as votes cast and will not affect the outcome of these Proposals. Abstentions will be counted for purposes of determining whether there

is a quorum present.

For the purpose of determining whether the shareholders

have approved Proposal Two and Proposal Seven, abstentions, if any, will not be counted as votes cast and will not affect the outcome

of these Proposals, although they will be counted for purposes of determining whether there is a quorum present. If shareholders hold

their shares through a broker, bank or other nominee and do not instruct them how to vote, the broker may have authority to vote the shares

for Proposal Two and Proposal Six, which are considered routine matters.

If a quorum is not present or represented within

two hours from the time appointed for the Annual General Meeting, it shall stand adjourned to the next business day in the jurisdiction

in which the Annual General Meeting was to have been held at the same time and place or to such other time and place as the Directors

may determine, and if at the adjourned meeting a quorum is not present within half an hour from the time appointed for the Annual General

Meeting, the shareholders present shall be a quorum.

How many votes are needed to approve the Company’s

proposals?

Proposal 1. The Reappointment of Directors. This

proposal requires the affirmative (“FOR”) vote of a majority of votes cast by shareholders present or represented by proxy

and entitled to vote at the Annual General Meeting.

Proposal 2. The Appointment of Fortune. This proposal

requires the affirmative (“FOR”) vote of a majority of votes cast by shareholders present or represented by proxy and entitled

to vote at the Annual General Meeting.

Proposal 3. The Reverse Stock Split. This proposal

requires the affirmative (“FOR”) vote of a majority of votes cast by shareholders present or represented by proxy and entitled

to vote at the Annual General Meeting.

Proposal 4. Amendment of Article 35.1 of the Articles

of Association. This proposal requires the affirmative (“FOR”) vote of at least two-thirds of votes cast by shareholders present

or represented by proxy and entitled to vote at the Annual General Meeting.

Proposal 5. Amendment and restatement of the Memorandum

of Association to reflect the Reverse Stock Split. This proposal requires the affirmative (“FOR”) vote of at least two-thirds

of votes cast by shareholders present or represented by proxy and entitled to vote at the Annual General Meeting.

Proposal 6. The adjournment of the Annual General

Meeting. This proposal requires the affirmative (“FOR”) vote of a majority of votes cast by shareholders present or represented

by proxy and entitled to vote at the Annual General Meeting.

What are Abstentions and Broker Non-Votes?

All votes will be tabulated by the inspector of

election appointed for the Annual General Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker

non-votes. An abstention is the voluntary act of not voting by a shareholder who is present at the Annual General Meeting and entitled

to vote. A broker “non-vote” occurs when a broker nominee holding shares for a beneficial owner does not vote on a particular

proposal because the nominee does not have discretionary power for that particular item and has not received instructions from the beneficial

owner. If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted

to exercise voting discretion with respect to some of the matters to be acted upon at the Annual General Meeting. If you do not give your

broker or nominee specific instructions regarding such matters, your proxy will be deemed a “broker non-vote.”

The question of whether your broker or nominee

may be permitted to exercise voting discretion with respect to a particular matter depends on whether the particular proposal is deemed

to be a “routine” matter and how your broker or nominee exercises any discretion they may have in the voting of the shares

that you beneficially own. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters

that are considered to be “routine,” but not with respect to “non-routine” matters.

For any proposal that is considered a “routine”

matter, your broker or nominee may vote your shares in its discretion either for or against the proposal even in the absence of your instruction.

For any proposal that is considered a “non-routine” matter for which you do not give your broker instructions, the shares

will be treated as broker non-votes. “Broker non-votes” occur when a beneficial owner of shares held in street name does not

give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Broker non-votes

will not be considered to be shares “entitled to vote” on any “non-routine” matter and therefore will not be counted

as having been voted on the applicable proposal. Therefore, if you are a beneficial owner and want to ensure that shares you beneficially

own are voted in favor or against any or all of the proposals in this proxy statement, the only way you can do so is to give your broker

or nominee specific instructions as to how the shares are to be voted.

Abstentions and broker non-votes are not counted

as votes cast on an item and therefore will not affect the outcome of the vote on any proposal presented in this proxy statement. Abstentions

and broker non-votes, if any, will be counted for purposes of determining whether there is a quorum present at the Annual General Meeting.

Note that if you are a beneficial holder and do

not provide specific voting instructions to your broker, the broker that holds your shares will not be authorized to vote on the Proposals

One, Three, Four and Five because they are considered non-routine matters. Your broker or nominee may vote your shares in its discretion

either for or against Proposals Two and Six, which are considered routine matters.

Accordingly, we encourage you to provide voting

instructions to your broker, whether or not you plan to attend the Annual General Meeting.

PROPOSAL ONE

REAPPOINTMENT OF DIRECTORS

(ITEM 1 ON THE PROXY CARD)

General

Our Board currently consists of five directors,

Mr. Lingi Kong, Mr. Wang-Ngai Mak, Mr. Jizhou Hou, Ms. Jing Chen, and Mr. Tsang Sheung. At the Annual General Meeting, the shareholders

will vote on approving the reappointment of all of the existing directors. If reappointed, all directors will hold office until our next

annual general meeting, at which time shareholders will vote on the election and qualification of their successors.

No proxy may be voted for persons other than the

nominees listed below. If any nominee is unable or declines to serve as a director at the time of the Annual General Meeting, the Board

may appoint an alternative nominee to fill the vacancy.

The following table provides information regarding our director nominees:

| Name |

|

Age |

|

Position(s) |

| Lingyi Kong |

|

29 |

|

Chief Executive Officer, Chairman of the Board and Director |

| Wang-Ngai Mak |

|

59 |

|

Director |

| Jizhou Hou |

|

48 |

|

Independent Director, Chair of Nominating Committee |

| Jing Chen |

|

58 |

|

Independent Director, Chair of Audit Committee |

| Tsang Sheung |

|

64 |

|

Independent Director, Chair of Compensation Committee |

The following paragraphs set forth information

regarding the current ages, positions, and business experience of the nominees.

Lingyi Kong

Chairman of the Board and Chief Executive Officer

Age — 29

In 2018, Mr. Kong graduated from Ningbo University with a Bachelor’s

degree in Engineering Management. From 2018 to 2019, Mr. Kong served as an international business representative of Zhejiang Real

Electronics Company, leading the company’s business team to participate in the Dusseldorf Motor Show in Germany, the Berlin Electronics

Show in Germany, and the Guangzhou Trade Fair in China. At the same time, Mr. Kong visited Germany, France, Belgium, the Netherlands,

and Australia on behalf of the company for business interviews, and successfully obtained OEM contracts with well-known European

companies such as AEG, Projecta, Greencell, Einhell, and Duracell, among other well-known North American companies. Mr. Kong has been

serving as the Chairman of the Board of Erayak International since inception in July 2018.

Wang-Ngai Mak

Director

Age — 59

Mr. Mak is currently the Executive Vice President

of Barakah Capital Holdings (M) Sdn. Bhd. since 2011, where he is responsible for projects evaluation and business development. Mr. Mak

has extensive experience in business strategy, corporate development and management consulting. He served as Vice President, e-Banking,

in CITIC Ka Wah Bank (Hong Kong) from January 2000 to July 2003, in charge of the development of the Internet banking and stock trading

system. From February 2004 to February August 2009, Mr. Mak was employed at the ITG Systems Sdn. Bad in Malaysia, where he served as the

Chief Information Officer that planned, organized, and managed the entire information and data resource systems of the company, and would

later be promoted to become the CEO of the company and be in charge of investment appraisal and financing of telecommunications and credit

technology projects, and managing project development design and general operations. Mr. Mak worked as Executive Vice President for Daya

Bay Zhongnan Industrial Development Corporation from December 2017 to March 2020, a PRC state-owned company, where he handled long-term

investment projects such as environmental preservation and sustainable project to meet poverty alleviation requirements in Xichuan County

of Henan Provence and Lianping County of Guangdong Provence. Mr. Mak graduated with Honor from The Chinese University of Hong Kong

with a Bachelor’s degree in Philosophy in 1995.

Jizhou Hou

Independent Director, Chair of the Nominating

Committee

Age — 48

Mr. Hou is experienced in IoT and artificial intelligence with 20 years

of experience. At present, he is Chief Technology Officer of Feilu Cloud Computing Wenzhou Co., Ltd. in Wenzhou in Zhejiang Province.

From 2005 to 2009, Mr. Hou worked for Shanghai STMicroelectronics, where he was in charge of the Inner Mongolia Digital TV updating system

project. Mr. Hou also worked at BYD Automation as Chief architect of AI application in electric vehicles from 2005 to 2009. He earned

a Master’s degree in Artificial Intelligence from University of Science and Technology of China.

Jing Chen

Independent Director and Chair of the Audit

Committee

Age — 58

Ms. Jing Chen is currently serving as Vice President

of Future FinTech Group Inc. (Nasdaq: RAYA) since December 2020, and served as the Chief Financial Officer from May 2019 to November 2020.

Ms. Chen served as the CFO of AnZhiXinCheng (Beijing) Technology Co., Ltd. from August 2018 to May 2019. Ms. Chen has served as Independent

Director of Hello iPayNow (Beijing) Company Ltd. since April 2019. From August, 2017 to July, 2018, Ms. Chen served as CFO of Beijing

Logis Technology Development Co., Ltd., a company listed on The National Equities Exchange and Quotations Co., Ltd. of China which is

a Chinese over-the-counter stock trading system. From June 2016 to July 2017, Ms. Chen served as Group Chief Financial Officer of Beijing

AnWuYou Food Co., Ltd. Ms. Chen served as Chief Financial Officer Beijing DKI Investment Management Co., Ltd. from August 2012 to May

2016. Ms. Chen received a degree of Doctor of Business Administration from Victoria University, Neuchatel, Switzerland in March 2008 and

an MBA degree from City University of Seattle, Washington, U.S. in April, 2000. Ms. Chen holds Fellow Membership of CPA Australia (FCPA),

Fellow Membership of the Association of International Accountants U.K. (FAIA). Ms. Chen is a Member of the Chartered Institute of Management

Accountants (CIMA), a Senior Member of the International Financial Management (SIFM) accredited by the Ministry of Human Resources and

Social Security of PRC and a Certified Internal Control Professional, as granted by Internal Control Institute (ICI).

Tsang Sheung

Independent Director and Chair of Compensation

Committee

Age — 64

Mr. Tsang Sheung has served as a director of Fuji

(China) Industrial Technology Co., Ltd. in Hong Kong and as the General Manager of Shenzhen Zhongzhi Investment Co., Ltd. since 2009.

He started his career at Bank of China (Hong Kong) Limited as a journalist after obtaining his bachelor’s degree in law from Jinan

University in Guangzhou. Thereafter, he served successively as the director of the human resources, the director and then vice president

of the president’s office, and the assistant to the president of the management division. Having served as an integral part of the

restructuring and merger of Bank of China (Hong Kong) Group, Mr. Sheung has extensive experience in financial services, human resources,

and corporate communications.

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors

has been convicted in a criminal proceeding, excluding traffic violations or similar misdemeanors, nor has any been a party to any judicial

or administrative proceeding during the past five years that resulted in a judgment, decree or final order enjoining the person from future

violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal or state

securities laws, except for matters that were dismissed without sanction or settlement. Except as set forth in our discussion in “Related

Party Transactions” in our 2022 Annual Report, our directors and officers have not been involved in any transactions with us or

any of our affiliates or associates which are required to be disclosed pursuant to the rules and regulations of the SEC.

Board Leadership Structure

Mr. Lingyi Kong serves as the Chief Executive

Officer and the Chairman of the Board of Directors. As a smaller public company, we believe it is in the company’s best interest

to allow the company to benefit from guidance from key members of management in a variety of capacities. We do not have a lead independent

director and do not anticipate having a lead independent director because we will encourage our independent directors to freely voice

their opinions on a relatively small company board. We believe this leadership structure is appropriate because we are a relatively small

public company.

Vote Required

This Proposal requires the affirmative (“FOR”)

vote of a majority of votes cast by shareholders present or represented by proxy and entitled to vote at the Annual General Meeting. Unless

otherwise instructed on the proxy or unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR”

this proposal. Abstentions or broker non-votes, if any, will not be counted as votes cast, although abstentions and broker non-votes will

be counted for purposes of determining whether there is a quorum present.

Recommendation of the Board

THE BOARD UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS

VOTE “FOR” THIS PROPOSAL.

PROPOSAL TWO

RATIFICATION OF THE APPOINTMENT OF FORTUNE CPA, INC.

(ITEM 2 ON THE PROXY CARD)

General

We are proposing to ratify the appointment of

Fortune CPA, Inc. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024. The

Audit Committee of the Board of Directors has appointed Fortune CPA, Inc. to serve as the Company’s fiscal year 2024 independent

registered public accounting firm. Although the Company’s governing documents do not require the submission of this matter to shareholders,

the Board of Directors considers it desirable that the appointment of Fortune CPA, Inc. be ratified by shareholders.

Audit services to be provided by Fortune CPA,

Inc. for fiscal year 2024 will include the examination of the consolidated financial statements of the Company and services related

to periodic filings made with the SEC.

A representative

of Fortune CPA, Inc. is not expected to be present at the Annual General Meeting

and therefore will not (i) have the opportunity to make a statement if they so

desire or (ii) be available to respond to questions from shareholders.

If the appointment of Fortune CPA, Inc. is not

ratified, the Audit Committee of the Board of Directors will reconsider the appointment.

Changed of independent registered public accounting

firm during its two most recent fiscal years

On October 11, 2023, the Company dismissed its

former independent registered public accounting firm, TPS Thayer. Audit services provided by TPS Thayer for fiscal year ended December

31, 2022 included the examination of the consolidated financial statements of the Company, and services related to periodic filings made

with the SEC. On October 11, 2023, the Audit Committee of the Board of Directors approved the appointment of Fortune CPA, Inc. as its

new independent registered public accounting firm to audit and review the Company’s financial statements for fiscal year ended December

31, 2023.

Vote Required

This Proposal requires the affirmative (“FOR”)

vote of a majority of votes cast by shareholders present or represented by proxy and entitled to vote at the Annual General Meeting. Unless

otherwise instructed on the proxy or unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR”

this proposal. Abstentions or broker non-votes, if any, will not be counted as votes cast, although abstentions and broker-non votes will

be counted for purposes of determining whether there is a quorum present.

Recommendation of the Board

THE BOARD UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS

VOTE “FOR” THIS PROPOSAL.

PROPOSAL THREE

REVERSE STOCK SPLIT

(ITEM 3 ON THE PROXY CARD)

General

Our Board is recommending that our shareholders

approve a reverse stock split of the Company’s ordinary shares, at a ratio of not less than 1-for-5 and not

more than 1-for-20, with the final ratio to be determined by the Board of Directors in its sole discretion at

any time after approval by the shareholders, (the “Reverse Stock Split”), and

authorize the Board of Directors to implement such reverse stock split at its discretion at any time prior to the one-year anniversary

of the Annual General Meeting, in order to regain compliance with Nasdaq Listing Rule 5550(a)(2), which requires listed securities to

maintain a minimum bid price of US$1.00 per share. If the shareholders approve the Reverse Stock Split, and our Board decides

to implement it, the Reverse Stock Split will become effective as and when determined by the Board.

If implemented, the Reverse Stock Split will

be realized simultaneously for all ordinary shares and the ratio determined by our Board will be the same for all ordinary shares. The Reverse Stock Split

will affect all holders of our ordinary shares uniformly and each shareholder will hold the same percentage of our outstanding ordinary

shares immediately following the Reverse Stock Split as that shareholder held immediately prior to the Reverse Stock Split,

except for adjustments that may result from the treatment of fractional shares as described below. Additionally, the number of authorized

ordinary shares would be reduced and the par value of all of the ordinary shares would be increased, in each case in proportion to the

final Reverse Stock Split ratio as determined by the Board of Directors.

Background

Our Class A ordinary shares are currently listed

on The Nasdaq Capital Market (“Nasdaq”), and we are therefore subject to its continued listing requirements, including

requirements with respect to the market value of publicly-held shares, market value of listed shares, minimum bid price per share,

and minimum shareholder’s equity, among others, and requirements relating to board and committee independence. If we fail to satisfy

one or more of the requirements, we may be delisted from Nasdaq.

The minimum closing bid price requirement set

forth in Nasdaq Listing Rule 5550(a)(2) is $1.00. On November 15, 2023, we received a notice that we were not in compliance

with the $1.00 minimum closing bid price requirement.

In accordance with Nasdaq Listing Rule 5810(c)(3)(A) (the

“Compliance Period Rule”), we were provided an initial period of 180 calendar days, or until May 13, 2024, to

regain compliance with the bid price rule. On May 14, 2024, we were provided an additional period of 180 calendar days, or until

November 11, 2024, to regain compliance with the bid price rule. If, at any time before November 11, 2024, the bid price for our Class

A ordinary shares closes at $1.00 or more for a minimum of 10 consecutive business days as required under the Compliance Period Rule,

the Nasdaq staff will provide written notification to us that we comply with the bid price rule, unless the staff exercises its discretion

to extend this 10 day period pursuant to Nasdaq Listing Rule 5810(c)(3)(H).

If we do not regain compliance with the bid price

rule by November 11, 2024, the Nasdaq staff will provide written notification to us that our Class A ordinary shares may be delisted.

We would then be entitled to appeal the staff’s determination to a Nasdaq Listing Qualifications Panel and request a hearing. There

can be no assurance that, if we do appeal the delisting determination by the staff to the Nasdaq Listing Qualifications Panel, that such

appeal would be successful.

The closing price of our Class A ordinary shares

on October 4, 2024 was $0.71.

Purpose of the Proposed Reverse Stock Split

Our Board’s primary objective in proposing

the Reverse Stock Split is to raise the per share trading price of our ordinary shares. In particular, this will help us to

maintain the listing of our ordinary shares on Nasdaq.

Delisting from Nasdaq may adversely affect our

ability to raise additional financing through the public or private sale of equity securities, may significantly affect the ability of

investors to trade our securities and may negatively affect the value and liquidity of our ordinary shares. Delisting also could have

other negative results, including the potential loss of employee confidence, the loss of institutional investors or interest in business

development opportunities.

If we are delisted from Nasdaq and we are not

able to list our Class A ordinary shares on another exchange, our Class A ordinary shares could be quoted on the OTC Bulletin Board or

in the “pink sheets.” As a result, we could face significant adverse consequences including, among others:

| |

● |

a limited availability of market quotations for our securities; |

| |

● |

a determination that our ordinary shares is a “penny stock” which will require brokers trading in our ordinary shares to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our securities; |

| |

● |

a limited amount of news and little or no analyst coverage for us; |

| |

● |

we would no longer qualify for exemptions from state securities registration requirements, which may require us to comply with applicable state securities laws; and |

| |

● |

a decreased ability to issue additional securities (including pursuant to short-form registration statements on Form F-3) or obtain additional financing in the future. |

As of the Record Date, we were not in compliance

with the Nasdaq bid price requirement. Our Board believes that the proposed Reverse Stock Split is a potentially effective means for us

to regain or maintain compliance with the listing rules of Nasdaq and to avoid, or at least mitigate, the likely adverse consequences

of our ordinary shares being delisted from the Nasdaq by producing the immediate effect of increasing the bid price of our ordinary shares.

Increase the Market Price of our Class A Ordinary

Shares to a Level More Appealing for Investors

We also believe that the Reverse Stock Split could

enhance the appeal of our Class A ordinary shares to the financial community, including institutional investors, and the general investing

public. We believe that a number of institutional investors and investment funds are reluctant to invest in lower-priced securities

and that brokerage firms may be reluctant to recommend lower-priced securities to their clients, which may be due in part to a perception

that lower-priced securities are less promising as investments, are less liquid in the event that an investor wishes to sell its

shares, or are less likely to be followed by institutional securities research firms and therefore more likely to have less third-party analysis

of the Company available to investors. We believe that the reduction in the number of issued and outstanding our Class A ordinary shares

caused by the Reverse Stock Split, together with the anticipated increased share price immediately following and resulting from the Reverse

Stock Split, may encourage interest and trading in our Class A ordinary shares and thus possibly promote greater liquidity for our shareholders,

thereby resulting in a broader market for the Class A ordinary shares than that which currently exists.

We cannot assure you that all or any of the anticipated

beneficial effects on the trading market for our Class A ordinary shares will occur. Our Board cannot predict with certainty what effect

the Reverse Stock Split will have on the market price of our Class A ordinary shares, particularly over the longer term. Some

investors may view a Reverse Stock Split negatively, which could result in a decrease in our market capitalization. Additionally,

any improvement in liquidity due to increased institutional or brokerage interest or lower trading commissions may be offset by the lower

number of outstanding shares. We cannot provide you with any assurance that our shares will continue to qualify for listing on Nasdaq.

As a result, the trading liquidity of our Class A ordinary shares may not improve. In addition, investors might consider the increased

proportion of unissued authorized shares to issued shares to have an anti-takeover effect under certain circumstances, since the

proportion allows for dilutive issuances.

Determination of Ratio

The ratio of the Reverse Stock Split, if

approved and implemented, will be a ratio of not less than 1-for-5 and not more than 1-for-20, with the final ratio to be determined by

the Board of Directors in its sole discretion at any time after approval by the shareholders,

prior to the one-year anniversary of the Annual General Meeting. Even if approved, the Board will have discretion to delay or not

to implement the Reverse Stock Split.

In determining the Reverse Stock Split ratio,

our Board will consider numerous factors, including:

| |

● |

the historical and projected performance of our Class A ordinary shares; |

| |

● |

general economic and other related conditions prevailing in our industry and in the marketplace; |

| |

● |

the projected impact of the selected Reverse Stock Split ratio on trading liquidity in our Class A ordinary shares; |

| |

● |

our capitalization (including the number of our Class A ordinary shares issued and outstanding); |

| |

● |

the prevailing trading price for our Class A ordinary shares and the volume level thereof; and |

| |

● |

potential devaluation of our market capitalization as a result of a Reverse Stock Split. |

The purpose of asking for authorization to implement

the Reverse Stock Split at a ratio to be determined by the Board, as opposed to a ratio fixed in advance, is to give our Board

the flexibility to take into account then-current market conditions and changes in price of our Class A ordinary shares and to respond

to other developments that may be deemed relevant when considering the appropriate ratio.

Principal Effects of the Reverse Stock Split

A reverse stock split refers

to a reduction in the number of outstanding shares of a class of a company’s share capital, which may be accomplished, as in this

case, by consolidating all of our outstanding Class A ordinary shares into a proportionately smaller number of shares. For example, if

our Board decides to implement a 1-for-20 reverse stock split of our Class A ordinary shares, then a shareholder holding

10,000 of our Class A ordinary shares before the reverse stock split would instead hold 500 our Class A

ordinary shares immediately after the reverse stock split. The Reverse Stock Split will affect all of our shareholders

uniformly and will not affect any shareholder’s percentage ownership interests in our company or proportionate voting power, except

for minor adjustments due to the additional net share fractions that will need to be issued as a result of the treatment of fractional

shares. No fractional shares will be issued in connection with the Reverse Stock Split. Instead, we will issue one full share of

the post-Reverse Stock Split ordinary shares to any shareholder who would have been entitled to receive a fractional share as a result

of the process.

The principal effect of the Reverse Stock

Split will be that (i) the number of Class A ordinary shares issued and outstanding will be reduced from 2,700,000 Class

A ordinary shares as of October 7, 2024 to a number of Class A ordinary shares between

and including one-fifth to one-twentieth of that amount, as the case may be based on the ratio for the Reverse Stock Split as

determined by our Board, (ii) the number of Class B ordinary shares issued and outstanding will be reduced from 1,000,000 Class

B ordinary shares as of October 7, 2024 to a number of Class B ordinary shares between

and including one-fifth to one-twentieth of that amount, as the case may be based on the ratio for the Reverse Stock Split as

determined by our Board, and (iii) all outstanding options and warrants entitling the holders thereof to purchase Class A ordinary shares

or Class B ordinary shares will enable such holders to purchase, upon exercise of their options or warrants, as applicable, between and

including one-fifth to one-twentieth of the number of Class A ordinary shares or Class B ordinary shares (as applicable) which such holders

would have been able to purchase upon exercise of their options or warrants, as applicable, immediately preceding the Reverse Stock

Split at an exercise price equal to between and including five to twenty times the exercise price specified before the Reverse

Stock Split, resulting in essentially the same aggregate price being required to be paid therefor upon exercise thereof immediately preceding

the Reverse Stock Split, as the case may be based on the ratio for the Reverse Stock Split as determined by our Board.

The following table, which is for illustrative

purposes only, illustrates the effects of the Reverse Stock Split at certain ratios within the foregoing range, without giving

effect to any adjustments for fractional Class A ordinary shares, on our outstanding Class A ordinary shares and authorized but unissued

shares as of October 7, 2024.

| | |

Before

reverse | | |

After Reverse Split | |

| | |

stock split | | |

1-for-5 | | |

1-for-10 | | |

1-for-20 | |

| Class A ordinary shares Authorized | |

| 450,000,000 | | |

| 90,000,000 | | |

| 45,000,000 | | |

| 22,500,000 | |

| Par Value per Class A ordinary share | |

$ | 0.0001 | | |

$ | 0.0005 | | |

$ | 0.001 | | |

$ | 0.002 | |

| Class A ordinary shares Issued and Outstanding | |

| 27,000,000 | | |

| 5,400,000 | | |

| 2,700,000 | | |

| 1,350,000 | |

| Class A ordinary shares Underlying Options and Warrants | |

| - | | |

| - | | |

| - | | |

| - | |

| Class A ordinary shares Authorized and Unreserved | |

| 423,000,000 | | |

| 84,600,000 | | |

| 42,300,000 | | |

| 21,150,000 | |

The Reverse Stock Split will not change the terms

of our Class A ordinary shares. The new Class A ordinary shares will have the same voting rights and rights to dividends and distributions

and will be identical in all respects to the Class A ordinary shares now authorized. The Class A ordinary shares issued pursuant to the Reverse

Stock Split will remain fully paid and non-assessable. The Reverse Stock Split is not intended as, and will not have the

effect of, a “going private transaction” covered by Rule 13e-3 under the Securities Exchange Act of 1934,

as amended (the “Exchange Act”). We will continue to be subject to the periodic reporting requirements of the Exchange Act.

Accounting Matters

The Reverse Stock Split will increase

the par value of our Class A ordinary shares in proportion to the ratio of the Reverse Stock Split, as determined by our Board of Directors.

As a result, on the effective date of the Reverse Stock Split, the number of authorized Class A ordinary shares would be reduced

proportionate to the ratio of the Reverse Stock Split, as determined by our Board of Directors; however, the stated capital on our balance

sheet attributable to the Class A ordinary shares will not be affected. The per share net loss and net book value of our Class A ordinary

shares will be retroactively increased for each period because there will be fewer our Class A ordinary shares outstanding.

Effect on Authorized but Unissued Shares

The Reverse Stock Split will have the

effect of reducing the number of our authorized and unissued Class A ordinary shares in proportion to the ratio of the Reverse Stock Split,

as determined by our Board of Directors. See the table above under the caption “Principal Effects of the Reverse Stock Split”

that shows the number of unreserved Class A ordinary shares that would be available for issuance at various Reverse Stock Split ratios.

Our Board believes that we will need to raise

additional capital in the ordinary course of business. In addition, we may issue shares to acquire other companies or assets or engage

in business combination transactions. As of the date of this Proxy Statement, we have no specific plans, arrangements or understandings,

whether written or oral, with respect to the increase in shares available for issuance as a result of the Reverse Stock Split.

Certain Risks Associated with the Reverse Stock Split

Before voting on this proposal, you should consider

the following risks associated with the implementation of the Reverse Stock Split:

| |

● |

Although we expect that the Reverse Stock Split will result in an increase in the market price of our Class A ordinary shares, we cannot assure you that the Reverse Stock Split, if implemented, will increase the market price of our Class A ordinary shares in proportion to the reduction in the number of Class A ordinary shares outstanding or result in a permanent increase in the market price. The effect the Reverse Stock Split may have upon the market price of our Class A ordinary shares cannot be predicted with any certainty, and the history of similar reverse stock splits for companies in similar circumstances to ours is varied. The market price of our Class A ordinary shares is dependent on many factors, including our business and financial performance, general market conditions, prospects for future success and other factors detailed from time to time in the reports we file with the SEC. Accordingly, the total market capitalization of our Class A ordinary shares after the proposed Reverse Stock Split may be lower than the total market capitalization before the proposed Reverse Stock Split and, in the future, the market price of our Class A ordinary shares following the Reverse Stock Split may not exceed or remain higher than the market price prior to the proposed Reverse Stock Split. |

| |

● |

The Reverse Stock Split may result in some shareholders owning “odd lots” of less than 100 our Class A ordinary shares on a post-split basis. These odd lots may be more difficult to sell, or require greater transaction costs per share to sell, than shares in “round lots” of even multiples of 100 shares. |

| |

● |

While our Board believes that a higher share price may help generate investor interest, there can be no assurance that the Reverse Stock Split will result in a per share price that will attract institutional investors or investment funds or that such share price will satisfy the investing guidelines of institutional investors or investment funds. As a result, the trading liquidity of our Class A ordinary shares may not necessarily improve. |

Procedure for Effecting Reverse Stock Split and

Exchange of Stock Certificates

If the Reverse Stock Split is approved

by our shareholders, the Reverse Stock Split would become effective at such time prior to the one-year anniversary of the

Annual General Meeting as determined by our Board to be in the best interests of the Company and its shareholders. Even if the Reverse

Stock Split is approved by our shareholders, our Board has discretion not to carry out or to delay in carrying out the Reverse

Stock Split.

As soon as practicable after the effective time

of the Reverse Stock Split, shareholders will be notified that the Reverse Stock Split has been effected. If you hold Class A ordinary

shares in a book-entry or Direct Registration (DRS), your post-split our Class A ordinary shares will be automatically credited

electronically in book-entry or Direct Registration (DRS) form.

Some shareholders hold their Class A ordinary

shares in certificate form or a combination of certificate and book-entry form. Our transfer agent will act as exchange agent for

purposes of implementing the exchange of stock certificates, if applicable. If you are a shareholder holding shares in certificate form,

you will receive a transmittal letter from our transfer agent as soon as practicable after the effective time of the Reverse Stock

Split. The transmittal letter will be accompanied by instructions specifying how you can exchange your certificate representing the pre-Reverse

Stock Split Class A ordinary shares for a statement of holding. When you submit your certificate representing the pre-Reverse Stock Split

Class A ordinary shares, your post-Reverse Stock Split Class A ordinary shares will be held electronically in book-entry form or

in the Direct Registration System, as applicable. This means that, instead of receiving a new share certificate, you will receive a statement

of holding that indicates the number of post-Reverse Stock Split shares you own in book-entry form. We will no longer issue physical

share certificates unless you make a specific request for a share certificate representing your post-Reverse Stock Split ownership interest.

Shareholders should not destroy any share certificate(s) and

should not submit any certificate(s) until requested to do so.

Beginning on the effective time of the Reverse

Stock Split, each certificate representing pre-Reverse Stock Split shares will be deemed for all corporate purposes to evidence ownership

of post-Reverse Stock Split shares.

Fractional Shares

No fractional shares will be issued in connection

with the Reverse Stock Split. Instead, we will issue one full share of the post-Reverse Stock Split Class A ordinary shares

to any shareholder who would have been entitled to receive a fractional share as a result of the process. Each Class A ordinary shareholder

will hold the same percentage of the outstanding Class A ordinary shares immediately following the Reverse Stock Split as that

shareholder did immediately prior to the Reverse Stock Split, except for minor adjustment due to the additional net share fractions

that will need to be issued as a result of the treatment of fractional shares.

U.S. Federal Income Tax Consequences of

the Reverse Stock Split

The following is a summary of certain material

U.S. federal income tax consequences of the Reverse Stock Split to the holders of our Class A ordinary shares. It addresses

only shareholders who hold our Class A ordinary shares as capital assets. It does not purport to be complete, does not address all aspects

of U.S. federal income taxation that may be relevant to holders in light of their particular circumstances, does not address U.S. federal

estate or gift taxes, the alternative minimum tax or the Medicare tax on investment income and does not address shareholders subject to

special rules, including without limitation financial institutions, tax-exempt organizations, insurance companies, dealers in securities,

foreign shareholders, shareholders who hold their pre-Reverse Stock Split shares as part of a straddle, hedge or conversion transaction,

and shareholders who acquired their pre-Reverse Stock Split shares pursuant to the exercise of employee stock options or otherwise

as compensation. In addition, this summary does not consider or discuss the tax treatment of partnerships or other pass-through entities

or persons that hold our shares through such entities.

This summary is based on the Internal Revenue

Code of 1986, as amended (the “Code”), regulations, rulings, and decisions in effect on the date hereof, all of which are

subject to change (possibly with retroactive effect) and to differing interpretations. It does not address tax considerations under state,

local, foreign and other laws. This summary is for general information purposes only, and the tax treatment of a shareholder may vary

depending upon the particular facts and circumstances of such shareholder. Each shareholder is urged to consult with such shareholder’s

own tax advisor with respect to the tax consequences of the Reverse Stock Split.

The Reverse Stock Split is intended

to constitute a “recapitalization” within the meaning of Section 368(a)(1)(E) of the Code for U.S. federal

income tax purposes. Assuming that such treatment is correct, the Reverse Stock Split generally will not result in the recognition

of gain or loss for U.S. federal income tax purposes, except potentially with respect to any additional fractions of a share of our

Class A ordinary shares received as a result of the rounding up of any fractional shares that otherwise would be issued, as discussed

below. Subject to the following discussion regarding a shareholder’s receipt of a whole share of our Class A ordinary shares in

lieu of a fractional share, the adjusted basis of the new Class A ordinary shares will be the same as the adjusted basis of the Class

A ordinary shares exchanged for such new shares. The holding period of the new, post-Reverse Stock Split shares of the Class A ordinary

shares resulting from implementation of the Reverse Stock Split will include the shareholder’s respective holding periods

for the pre-Reverse Stock Split shares. Shareholders who acquired their our Class A ordinary shares on different dates or at different

prices should consult their tax advisors regarding the allocation of the tax basis of such shares. Additional information about the effects

of the Reverse Stock Split on the basis of holders of our Class A ordinary shares will be included in Internal Revenue Service

Form 8937, Report of Organizational Actions Affecting Basis of Securities, which we will post to our website on or before the 45th day

following the effective date of the Reverse Stock Split, if effected.

As described above in “Fractional Shares,”

no fractional our Class A ordinary shares will be issued as a result of the Reverse Stock Split. Instead, we will issue one (1) full

share of the post-Reverse Stock Split Class A ordinary shares to any shareholder who would have been entitled to receive a fractional

share as a result of the process. The U.S. federal income tax consequences of the receipt of such additional fraction of a share

of our Class A ordinary shares are not clear. A shareholder who receives one (1) whole share of our Class A ordinary shares in lieu

of a fractional share may recognize income or gain in an amount not to exceed the excess of the fair market value of such share over the

fair market value of the fractional share to which such shareholder was otherwise entitled. We are not making any representation as to

whether the receipt of one (1) whole share in lieu of a fractional share will result in income or gain to any shareholder, and shareholders

are urged to consult their own tax advisors as to the possible tax consequences of receiving a whole share in lieu of a fractional share

in the Reverse Stock Split.

We have not sought, and will not seek, any ruling

from the Internal Revenue Service or an opinion of tax counsel with respect to the matters discussed herein. The foregoing views are not

binding on the Internal Revenue Service or the courts, and there can be no assurance that the Internal Revenue Service or the courts will

accept the positions expressed above. The state and local tax consequences of a Reverse Stock Split may vary significantly as

to each holder of our Class A ordinary shares, depending upon the state in which such holder resides or does business. Accordingly, each

shareholder should consult with his or her own tax advisor with respect to all of the potential tax consequences to him or her of the Reverse

Stock Split.

Vote Required

This Proposal requires the affirmative (“FOR”)

vote of a majority of votes cast by shareholders present or represented by proxy and entitled to vote at the Annual General Meeting. Unless

otherwise instructed on the proxy or unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR”

this proposal. Abstentions or broker non-votes, if any, will not be counted as votes cast, although abstentions and broker non-votes will

be counted for purposes of determining whether there is a quorum present.

Recommendation of the Board

THE BOARD UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS

VOTE “FOR” THIS PROPOSAL.

PROPOSAL FOUR

Amendment

of Article 35.1 of the Articles of Association

(ITEM 4 ON THE PROXY CARD)

General

We are proposing to amend the Company’s

Articles of Association by deleting the existing Article 35.1 and replacing it with the following:

“35.1 Record Date Determination.

For the purpose of determining Members entitled to attend meetings, receive payment of any Distribution or capitalisation or for any other

purpose, the Directors may provide that the Register of Members shall be closed for transfers for a stated period which shall not in any

case exceed forty days. In lieu of, or apart from, closing the Register of Members, the Directors may fix in advance or arrears a date

as the record date for any such determination of Members.”

Potential Effects

If shareholders approve this proposal, the amendment

of the Articles of Association of the Company will become effective upon the required approval from shareholders being obtained.

Vote Required

This proposal requires the affirmative (“FOR”)

vote of at least two-thirds of votes cast by shareholders present or represented by proxy and entitled to vote at the Annual General Meeting.

Unless otherwise instructed on the proxy or unless authority to vote is withheld, shares represented by executed proxies will be voted

“FOR” this proposal. Abstentions or broker non-votes, if any, will not be counted as votes cast, although abstentions and

broker non-votes will be counted for purposes of determining whether there is a quorum present.

Recommendation of the Board

THE BOARD UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS

VOTE “FOR” THIS PROPOSAL.

PROPOSAL FIVE

AMENDMENT AND RESTATEMENT OF THE MEMORANDUM OF ASSOCIATION TO REFLECT THE REVERSE STOCK SPLIT

(ITEM 5 ON THE PROXY CARD)

General

We are proposing to amend and restate the Company’s

Memorandum of Association to reflect the Reverse Stock Split, once implemented.

Potential Effects

If shareholders approve this proposal, the amendment

and restatement of the Company’s Memorandum of Association will become effective upon the time at which the Reverse Stock Split

is implemented by the Board of Directors. The result of the vote on this Proposal Five will not affect the power of the Board of Directors

to implement to the Reverse Stock Split, if Proposal Three is approved.

Vote Required

This Proposal requires the affirmative (“FOR”)

vote of at least two-thirds of votes cast by shareholders present or represented by proxy and entitled to vote at the Annual General Meeting.

Unless otherwise instructed on the proxy or unless authority to vote is withheld, shares represented by executed proxies will be voted

“FOR” this proposal. Abstentions or broker non-votes, if any, will not be counted as votes cast, although abstentions and

broker non-votes will be counted for purposes of determining whether there is a quorum present.

Recommendation of the Board

THE BOARD UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS

VOTE “FOR” THIS PROPOSAL.

PROPOSAL SIX

ADJOURNMENT OF THE ANNUAL GENERAL MEETING

(ITEM 6 ON THE PROXY CARD)

General

This Proposal Six, if adopted, will allow the

Board to adjourn the Annual General Meeting to a later date or dates to permit further solicitation of proxies. The Adjournment Proposal

will only be presented to our shareholders in the event that there are insufficient votes for, or otherwise in connection with, the approval

of any of Proposals One through Proposal Five.

If this Proposal Six is not approved by our shareholders,

the Board may not be able to adjourn the Annual General Meeting to a later date in the event that there are insufficient votes for, or

otherwise in connection with, the approval of any of Proposals One through Proposal Five.

Vote Required

This proposal requires the affirmative (“FOR”)

vote of at least a majority of votes cast by shareholders present or represented by proxy and entitled to vote at the Annual General Meeting.

Unless otherwise instructed on the proxy or unless authority to vote is withheld, shares represented by executed proxies will be voted

“FOR” this proposal. Abstentions or broker non-votes, if any, will not be counted as votes cast, although abstentions and

broker non-votes will be counted for purposes of determining whether there is a quorum present.

Recommendation of the Board

THE BOARD UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS

VOTE “FOR” THIS PROPOSAL.

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Shareholders wishing to communicate with the Board

of Directors or any individual director may write to the Board of Directors or any individual director to Erayak Power Solution Group

Inc., No. 528, 4th Avenue, Binhai Industrial Park, Wenzhou, Zhejiang Province, People’s Republic of China 325025. Any such communication

must state the number of shares beneficially owned by the shareholder making the communication. All such communications will be forwarded

to the Board of Directors or to any individual director or directors to whom the communication is directed unless the communication is

clearly of a marketing nature or is unduly hostile, threatening, illegal, or similarly inappropriate, in which case the Company has the

authority to discard the communication or take appropriate legal action regarding the communication.

WHERE YOU CAN FIND MORE INFORMATION

The Company files reports and other documents

with the SEC under the Exchange Act. The Company’s SEC filings made electronically through the SEC’s EDGAR system are available

to the public at the SEC’s website at http://www.sec.gov. You may also read and copy any document we file with the SEC at

the SEC’s public reference room located at 100 F Street, NE, Room 1580, Washington, DC 20549. Please call the SEC at (800) SEC-0330

for further information on the operation of the public reference room.

| Date: October 7, 2024 |

By Order of the Board of Directors |

| |

|

| |

/s/ Lingyi Kong |

| |

Lingyi Kong

Chief Executive Officer and Chairman |

Exhibit 99.2

Annual General Meeting of Shareholders Proxy

Card – Erayak Power Solution Group Inc.

| Item 1 |

By an ordinary resolution, to re-appoint five directors, Mr. Lingyi Kong, Mr. Wang-Ngai Mak, Mr. Jizhou Hou, Ms. Jing Chen, and Mr. Tsang Sheung, to serve on the Company’s board of directors (the “Board” or “Board of Directors”) until the next annual general meeting of shareholders or until their office is otherwise vacated or they are removed by an ordinary resolution of the shareholders or by a resolution of all the other directors (the “Reappointment of Directors”). |

| ☐ For |

☐ Against |

☐

Abstain |

| Item 2 |

By an ordinary resolution, to ratify the appointment of Fortune CPA, Inc as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024 (the “Appointment of Fortune”). |

| ☐ For |

☐ Against |

☐

Abstain |

| Item 3 |

By an ordinary resolution, to approve a reverse stock split of the Company’s ordinary shares, at a ratio of not less than 1-for-5 and not more than 1-for-20, with the final ratio to be determined by the Board of Directors in its sole discretion at any time after approval by the shareholders (the “Reverse Stock Split”), and authorize the Board of Directors to implement such reverse stock split at its discretion at any time prior to the one-year anniversary of the Annual General Meeting, in order to regain compliance with Nasdaq Listing Rule 5550(a)(2), which requires listed securities to maintain a minimum bid price of US$1.00 per share. |

| ☐ For |

☐ Against |

☐ Abstain |

| Item 4 |

By a special resolution, to amend the Company’s

Articles of Association by the deletion of the existing Article 35.1 in its entirety and the insertion of the following language

a new Article 35.1:

35.1 Record Date Determination. For the

purpose of determining Members entitled to attend meetings, receive payment of any Distribution or capitalisation or for any other purpose,

the Directors may provide that the Register of Members shall be closed for transfers for a stated period which shall not in any case exceed

forty days. In lieu of, or apart from, closing the Register of Members, the Directors may fix in advance or arrears a date as the record

date for any such determination of Members. |

| ☐ For |

☐ Against |

☐

Abstain |

| Item 5 |

By a special resolution, to amend and restate the Company’s Memorandum of Association to reflect the Reverse Stock Split, once implemented. |

| ☐ For |

☐ Against |

☐ Abstain |

| Item 6 |

By an ordinary resolution, to adjourn the Annual General Meeting for any purpose, including to solicit additional proxies if there are insufficient votes at the time of the Annual General Meeting to approve the proposals described above. |

| ☐ For |

☐ Against |

☐

Abstain |

ERAYAK POWER SOLUTION GROUP INC.

Annual General Meeting of Shareholders

To Be Held on November 8, 2024

10 a.m., Local Time (November 7, 2024, at 9

p.m., Eastern Time)

Solicited on Behalf of the Board of Directors

for the Annual General Meeting of Shareholders on October 7, 2024

The undersigned hereby appoints Lingyi Kong as

the proxy with full power of substitution, to represent and to vote as set forth herein all the ordinary shares of Erayak Power Solution

Group Inc. which the undersigned is entitled to vote at the Annual General Meeting of Shareholders and any adjournments or postponements

thereof, as designated below. If no designation is made, the proxy, when properly executed, will be voted: (i) “FOR” Item

1; (ii) “FOR” Item 2; (iii) “FOR” Item 3; (iv) “FOR” Item 4; (v) “FOR” Item 5; and (vi)

“FOR” Item 6.

Electronic Delivery of Future Proxy Materials.

If you would like to reduce the costs incurred by Erayak Power Solution Group Inc. in mailing materials, you can consent to receiving

all future proxy statements, proxy cards and annual reports electronically via email or the internet. To sign up for electronic delivery,

please provide your email address below and check here to indicate you consent to receive or access proxy materials electronically in

future mailings.

Email Address:____________________________________

PLEASE INDICATE YOUR VOTE ON THE REVERSE SIDE

Date

Signature

Signature, if held jointly

________________ ________________________ ________________________

Note: This proxy must be signed exactly as the name appears hereon.

When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please

give full title as such. If the signer is a corporation, please sign full corporate name by a duly authorized officer, giving full title

as such. If signer is a partnership, please sign in partnership name by an authorized person.

To change the address on your account, please check the box at right

and indicate your new address.

VOTING INSTRUCTIONS

VOTE ON INTERNET

Go to http://www.vstocktransfer.com/proxy. Click

on Proxy Voter Login and log on using the control number. Voting will be open until 11:59 p.m., Eastern Time, November 6, 2024.

VOTE BY MAIL

Mark, sign and date your proxy card and return

it in the envelope we have provided.

VOTE BY E-MAIL

Mark, sign and date your proxy card and send it

to vote@vstocktransfer.com.

VOTE BY FAX

Mark, sign and date your proxy card and return

it to 646-536-3179.

VOTE IN PERSON

If you would like to vote in person, please attend

the Annual General Meeting at our executive office at No. 528, 4th Avenue, Binhai Industrial Park, Wenzhou, Zhejiang Province, People’s

Republic of China 325025 on November 8, 2024, at 10 a.m., local time (November 7, 2024, at 9 p.m., Eastern Time).

3

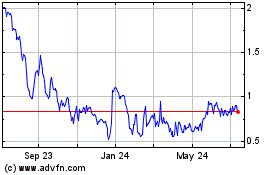

Erayak Power Solution (NASDAQ:RAYA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Erayak Power Solution (NASDAQ:RAYA)

Historical Stock Chart

From Nov 2023 to Nov 2024