false

0001867949

0001867949

2025-03-12

2025-03-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date

of earliest event reported): March 12, 2025

Chicago Atlantic Real Estate Finance, Inc.

(Exact name of Registrant as Specified in Its

Charter)

| Maryland |

|

001-41123 |

|

86-3125132 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 1680 Michigan Avenue Suite 700 Miami Beach, Florida |

|

33139 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

| Registrant’s Telephone Number, Including Area Code: 312 809-7002 |

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

REFI |

|

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On March 12, 2025, Chicago Atlantic Real Estate

Finance, Inc. (the “Company”) issued a press release announcing its financial results for the fourth quarter and year ended

December 31, 2024. The text of the press release is included as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

The information set forth under this Item 2.02,

including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information set forth under this Item 2.02, including

Exhibit 99.1, shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act

of 1933, as amended, unless it is specifically incorporated by reference therein.

Item 7.01 Regulation FD Disclosure.

On March 12, 2025, the Company disseminated a presentation

to be used in connection with its conference call to discuss its financial results for the fourth quarter ended December 31, 2024, which

will be held on Wednesday, March 12, 2025 at 9:00 a.m. (eastern time). A copy of the presentation has been posted to the Company’s

Investor Relations page of its website and is included herewith as Exhibit 99.2, and by this reference incorporated herein.

The information disclosed under this Item 7.01,

including Exhibit 99.2 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information provided herein shall not be

deemed incorporated by reference into any filing made under the Securities Act of 1933, as amended, except as expressly set forth by specific

reference in such filing.

Item 9.01 Financial Statements and Exhibits.

d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CHICAGO ATLANTIC REAL ESTATE FINANCE, INC. |

| |

|

|

| Date: March 12, 2025 |

By: |

/s/ Peter Sack |

| |

|

Peter Sack,

Co-Chief Executive Officer |

2

Exhibit 99.1

Chicago Atlantic Real Estate Finance Announces Fourth

Quarter 2024 Financial Results

CHICAGO— (March 12, 2025) Chicago

Atlantic Real Estate Finance, Inc. (NASDAQ: REFI) (“Chicago Atlantic” or the “Company”), a commercial mortgage

real estate investment trust, today announced its results for the fourth quarter and year ended December 31, 2024.

Peter Sack, Co-Chief Executive Officer,

noted, “Since establishing the Chicago Atlantic platform in 2019, we have maintained a disciplined underwriting process that

reflects the core tenets of successful direct lending. We focus on strong operators, the right states, cash flow, leverage, and

collateral to manage downside risk and protect principal. This consistent process has worked extremely well for us as we are the

largest platform focused on cannabis, and the third best exchange-listed mortgage REIT on a total return basis across all sectors of

the financial services industry, benchmarked since inception1. Our default underwriting assumption for several years now

has been that the federal regulatory environment remains unchanged and that operators will continue to need debt capital to grow.

This philosophy and our strong liquidity have enabled us to grow the portfolio in 2024 and build a pipeline of nearly $500 million

comprised of many of the leading operators and brands. We believe our remarkable consistency and the ability to work collaboratively

with our borrowers will be important assets in 2025.”

Portfolio Performance

| ● | As of December 31, 2024, total loan principal outstanding of $410.2 million, across 30 portfolio companies,

with $20.9 million of unfunded commitments. |

| ● | Portfolio weighted average yield to maturity was approximately 17.2% as of December 31, 2024, compared

with 18.3% as of September 30, 2024. The decrease primarily results from the 50-basis point prime rate cut during the quarter, and fourth

quarter advances originated at yields modestly below our historical weighted average. |

| ● | The aggregate loan portfolio, including loans held for investment and loans held at fair value, which

bear a variable interest rate was 62.1% as of December 31, 2024, compared with 62.8% as of September 30, 2024. Fixed rate loans

and loans with a prime rate floor greater than or equal to the prevailing prime rate increased from 31.9% as of December 31, 2023 to 37.9%

as of December 31, 2024. |

Investment Activity

| ● | During the fourth quarter, Chicago Atlantic had total gross originations of $90.7 million, of which $52.6

million and $38.1 million was funded to new borrowers and existing borrowers on delayed draw term loan facilities, respectively. |

| ● | As of December 31, 2024, one loan remains on non-accrual status, and all other loans are performing. |

Capital Activity and Dividends

| ● | During the fourth quarter, the Company entered into a $50.0 million unsecured term loan (the “Unsecured

Notes”) with a fixed interest rate of 9.0% and a maturity date of October 2028. The Unsecured Notes can be prepaid in whole or in

part at any time and can be repaid without penalty after two years. The full balance of the loan was drawn at closing and used to repay

current outstanding borrowings on the Company’s senior secured revolving credit facility and for other working capital purposes. |

| ● | As of December 31, 2024, the Company had $55.0 million drawn on its secured revolving credit facility

and $50.0 million of Unsecured Notes, resulting in a consolidated leverage ratio (debt to book equity) of approximately 34%. |

| ● | As of March 12, 2025, the Company has $71.5 million available on its secured revolving credit facility,

and total liquidity, net of estimated liabilities, of approximately $67 million. |

| 1 | Source: S&P Capital

IQ Total Return, inclusive of dividends declared and stock price appreciation/(depreciation), for exchange-listed mortgage REITs. Total

return is calculated based on a hypothetical $100 investment in Chicago Atlantic common stock on December 10, 2021 through December 31,

2024 (assuming reinvestment of dividends) for each calendar year. |

| ● | On January 13, 2025, Chicago Atlantic paid a regular quarterly cash dividend of $0.47 per share of common

stock for the fourth quarter of 2024 to common stockholders of record on December 31, 2024. Additionally, on January 13, 2025, Chicago

Atlantic paid a special cash dividend of $0.18 per share to stockholders of record on December 31, 2024 relating to undistributed earnings

for fiscal year 2024. |

Fourth Quarter 2024

Financial Results

| ● | Net interest income of approximately $14.1 million as of December 31, 2024, compared to $14.5 million

as of September 30, 2024. During the quarter, we recognized approximately $1.9 million in prepayment and other fee income. |

| ● | Interest expense decreased approximately $0.4 million due to lower weighted average borrowings during

the comparative period ending September 30, 2024. |

| ● | Total expenses of approximately $5.7 million before provision for current expected credit losses, representing

a sequential increase of approximately 34.1%. |

| ● | Net Income of approximately $7.9 million, or $0.39 per weighted average diluted common share, representing

a sequential decrease of 30.1% on a per share basis. |

| ● | The total reserve for current expected credit losses increased sequentially by $0.3 million to $4.3 million

and amounts to approximately 1.1% of the aggregate portfolio principal balance of loans held for investment of $410.2 million as of December

31, 2024. |

| ● | Distributable Earnings of approximately $9.2 million, or $0.47 and $0.46 per basic and diluted weighted

average common share, respectively. |

| ● | On a fully diluted basis, there were 21,240,464 and 20,060,677 common shares outstanding as of December

31, 2024 and September 30, 2024, respectively. |

Full Year 2024 Financial Results

| ● | Net interest income of approximately $55.0 million, representing a year-over-year decrease of 3.8%. The

decrease in interest income is partially driven by the decrease in the prime rate of 100 basis points during the year from 8.50% to 7.50%,

which impacted the approximately 62.1% of the Company’s aggregate loan portfolio, which bears a floating rate as of December 31,

2024. |

| ● | We recognized approximately $3.2 million in prepayment and other fee income during the year ended December 31,

2024, as compared to $3.5 million for the year ended December 31, 2023. |

| ● | Total expenses of approximately $18.3 million before provision for current expected credit losses, representing

a year-over-year increase of 3.6%. |

| ● | Net Income of approximately $37.0 million, or $1.88 per weighted average diluted common share. |

| ● | Distributable Earnings of approximately $40.0 million, or $2.08 per weighted average basic common share

and $2.03 per weighted average diluted common share, representing a year-over-year decrease of 10.5%. |

| ● | The Company declared a total of $2.06 in dividends per common share during 2024, compared to $2.17 during

2023. Total 2024 dividends included regular quarterly dividends totaling $1.88 per diluted share and a special dividend of $0.18 per diluted

share. |

| ● | Book value per common share decreased from $14.94 as of December 31, 2023 to $14.83 as of December 31,

2024. |

2025 Outlook

Chicago Atlantic offered the following outlook

for full year 2025:

| ● | The Company expects to maintain a dividend payout ratio based on Distributable Earnings per weighted average

diluted share of approximately 90% to 100% on a full year basis. |

| ● | If the Company’s taxable income requires additional distribution in excess of the regular quarterly

dividend, in order to meet its 2025 taxable income distribution requirements, the Company expects to meet that requirement with a special

dividend in the fourth quarter of 2025. |

Conference Call and Quarterly Earnings Supplemental Details

Chicago Atlantic will host a conference call and

live audio webcast, both open for the general public to hear, later today at 9:00 a.m. Eastern Time. The number to call for this interactive

teleconference is (833) 630-1956 (international callers: 412-317-1837). The live audio

webcast of the Company’s quarterly conference call will be available online in the Investor Relations section of the Company’s

website at www.refi.reit. The online replay will be available approximately one hour after the end

of the call and archived for one year.

Chicago Atlantic posted its Fourth Quarter 2024

Earnings Supplemental on the Investor Relations page of its website. Chicago Atlantic routinely posts important information for investors

on its website, www.refi.reit. The Company intends to use this website as a means of disclosing material information, for complying with

our disclosure obligations under Regulation FD and to post and update investor presentations and similar materials on a regular basis.

The Company encourages investors, analysts, the media and others interested in Chicago Atlantic to monitor the Investor Relations page

of its website, in addition to following its press releases, SEC filings, publicly available earnings calls, presentations, webcasts and

other information posted from time to time on the website. Please visit the IR Resources section of the website to sign up for email notifications.

About Chicago Atlantic Real Estate Finance,

Inc.

Chicago Atlantic Real Estate Finance, Inc. (NASDAQ:

REFI) is a market-leading commercial mortgage REIT utilizing significant real estate, credit and cannabis expertise to originate senior

secured loans primarily to state-licensed cannabis operators in limited-license states in the United States. REFI is part of the Chicago

Atlantic platform which has offices in Chicago, Miami, and New York and has deployed over $2 billion in credit and equity investments

to date.

Forward-Looking Statements

This release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect our current views and projections with respect

to, among other things, future events and financial performance. Words such as “believes,” “expects,” “will,”

“intends,” “plans,” “guidance,” “estimates,” “projects,” “anticipates,”

and “future” or similar expressions are intended to identify forward- looking statements. These forward-looking statements,

including statements about our future growth and strategies for such growth, are subject to the inherent uncertainties in predicting future

results and conditions and are not guarantees of future performance, conditions or results. More information on these risks and other

potential factors that could affect our business and financial results is included in our filings with the SEC. New risks and uncertainties

arise over time, and it is not possible to predict those events or how they may affect us. We do not undertake any obligation to publicly

update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required

by law.

Contact:

Tripp Sullivan

SCR Partners

IR@REFI.reit

CHICAGO ATLANTIC REAL ESTATE FINANCE, INC.

CONSOLIDATED BALANCE SHEETS

| | |

December 31, 2024 | | |

December 31, 2023 | |

| | |

| | |

| |

| Assets | |

| | |

| |

| Loans held for investment | |

$ | 364,238,847 | | |

$ | 337,238,122 | |

| Loans held for investment - related party | |

| 38,238,199 | | |

| 16,402,488 | |

| Loans held for investment, at carrying value | |

| 402,477,046 | | |

| 353,640,610 | |

| Current expected credit loss reserve | |

| (4,346,869 | ) | |

| (4,972,647 | ) |

| Loans held for investment at carrying value, net | |

| 398,130,177 | | |

| 348,667,963 | |

| Loans, at fair value - related party (amortized cost of $5,500,000 and $0, respectively) | |

| 5,335,000 | | |

| - | |

| Cash and cash equivalents | |

| 26,400,448 | | |

| 7,898,040 | |

| Other receivables and assets, net | |

| 459,187 | | |

| 705,960 | |

| Interest receivable | |

| 1,453,823 | | |

| 1,004,140 | |

| Related party receivables | |

| 3,370,339 | | |

| 107,225 | |

| Debt securities, at fair value | |

| - | | |

| 842,269 | |

| Total Assets | |

$ | 435,148,974 | | |

$ | 359,225,597 | |

| | |

| | | |

| | |

| Liabilities | |

| | | |

| | |

| Revolving loan | |

$ | 55,000,000 | | |

| 66,000,000 | |

| Notes payable, net | |

| 49,096,250 | | |

| - | |

| Dividend payable | |

| 13,605,153 | | |

| 13,866,656 | |

| Related party payables | |

| 2,043,403 | | |

| 2,051,531 | |

| Management and incentive fees payable | |

| 2,863,158 | | |

| 3,243,775 | |

| Accounts payable and other liabilities | |

| 2,285,035 | | |

| 1,135,355 | |

| Interest reserve | |

| 1,297,878 | | |

| 1,074,889 | |

| Total Liabilities | |

| 126,190,877 | | |

| 87,372,206 | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

Common stock, par value $0.01 per share, 100,000,000 shares authorized and

20,829,228 and 18,197,192 shares issued and outstanding, respectively | |

| 208,292 | | |

| 181,972 | |

| Additional paid-in-capital | |

| 318,886,768 | | |

| 277,483,092 | |

| Accumulated deficit | |

| (10,136,963 | ) | |

| (5,811,673 | ) |

| Total stockholders’ equity | |

| 308,958,097 | | |

| 271,853,391 | |

| | |

| | | |

| | |

| Total liabilities and stockholders’ equity | |

$ | 435,148,974 | | |

$ | 359,225,597 | |

CHICAGO ATLANTIC REAL ESTATE FINANCE, INC.

CONSOLIDATED STATEMENTS OF INCOME

| | |

Three months ended December 31, | | |

For the year ended December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues | |

| | |

| | |

| | |

| |

| Interest income | |

$ | 15,479,250 | | |

$ | 16,530,028 | | |

$ | 62,104,092 | | |

$ | 62,900,004 | |

| Interest expense | |

| (1,410,874 | ) | |

| (1,690,543 | ) | |

| (7,153,207 | ) | |

| (5,752,908 | ) |

| Net interest income | |

| 14,068,376 | | |

| 14,839,485 | | |

| 54,950,885 | | |

| 57,147,096 | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses | |

| | | |

| | | |

| | | |

| | |

| Management and incentive fees, net | |

| 2,863,158 | | |

| 3,243,775 | | |

| 8,061,896 | | |

| 8,782,834 | |

| General and administrative expense | |

| 1,490,103 | | |

| 1,426,554 | | |

| 5,388,967 | | |

| 5,260,287 | |

| Professional fees | |

| 483,408 | | |

| 555,623 | | |

| 1,811,067 | | |

| 2,153,999 | |

| Stock based compensation | |

| 845,524 | | |

| 537,131 | | |

| 3,058,674 | | |

| 1,479,736 | |

| (Benefit) provision for current expected credit losses | |

| 301,491 | | |

| (253,495 | ) | |

| (583,298 | ) | |

| 940,385 | |

| Total expenses | |

| 5,983,684 | | |

| 5,509,588 | | |

| 17,737,306 | | |

| 18,617,241 | |

| Change in unrealized (loss) gain on investments | |

| (165,000 | ) | |

| (37,163 | ) | |

| (240,604 | ) | |

| 75,604 | |

| Realized gain on debt securities, at fair value | |

| - | | |

| 104,789 | | |

| 72,428 | | |

| 104,789 | |

| Net Income before income taxes | |

| 7,919,692 | | |

| 9,397,523 | | |

| 37,045,403 | | |

| 38,710,248 | |

| Income tax expense | |

| - | | |

| - | | |

| - | | |

| - | |

| Net Income | |

$ | 7,919,692 | | |

$ | 9,397,523 | | |

$ | 37,045,403 | | |

$ | 38,710,248 | |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic earnings per common share | |

$ | 0.40 | | |

$ | 0.52 | | |

$ | 1.92 | | |

$ | 2.14 | |

| Diluted earnings per common share | |

$ | 0.39 | | |

$ | 0.51 | | |

$ | 1.88 | | |

$ | 2.11 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic weighted average shares of common stock outstanding | |

| 19,830,596 | | |

| 18,182,403 | | |

| 19,279,501 | | |

| 18,085,088 | |

| Diluted weighted average shares of common stock outstanding | |

| 20,256,628 | | |

| 18,564,530 | | |

| 19,713,916 | | |

| 18,343,725 | |

Distributable Earnings

In addition to using certain financial metrics

prepared in accordance with GAAP to evaluate our performance, we also use Distributable Earnings to evaluate our performance. Distributable

Earnings is a measure that is not prepared in accordance with GAAP. We define Distributable Earnings as, for a specified period, the net

income (loss) computed in accordance with GAAP, excluding (i) non-cash equity compensation expense, (ii) depreciation and amortization,

(iii) any unrealized gains, losses or other non-cash items recorded in net income (loss) for the period, regardless of whether such items

are included in other comprehensive income or loss, or in net income (loss); provided that Distributable Earnings does not exclude, in

the case of investments with a deferred interest feature (such as OID, debt instruments with PIK interest and zero coupon securities),

accrued income that we have not yet received in cash, (iv) provision for current expected credit losses and (v) one-time events pursuant

to changes in GAAP and certain non-cash charges, in each case after discussions between our Manager and our independent directors and

after approval by a majority of such independent directors. We believe providing Distributable Earnings on a supplemental basis to our

net income as determined in accordance with GAAP is helpful to stockholders in assessing the overall performance of our business. As a

REIT, we are required to distribute at least 90% of our annual REIT taxable income and to pay tax at regular corporate rates to the extent

that we annually distribute less than 100% of such taxable income. Given these requirements and our belief that dividends are generally

one of the principal reasons that stockholders invest in our common stock, we generally intend to attempt to pay dividends to our stockholders

in an amount equal to our net taxable income, if and to the extent authorized by our Board. Distributable Earnings is one of many factors

considered by our Board in authorizing dividends and, while not a direct measure of net taxable income, over time, the measure can be

considered a useful indicator of our dividends.

In our Annual Report on Form 10-K, we defined

Distributable Earnings so that, in addition to the exclusions noted above, the term also excluded from net income Incentive Compensation

paid to our Manager. We believe that revising the term Distributable Earnings so that it is presented net of Incentive Compensation, while

not a direct measure of net taxable income, over time, can be considered a more useful indicator of our ability to pay dividends. This

adjustment to the calculation of Distributable Earnings has no impact on period-to-period comparisons. Distributable Earnings should not

be considered as substitutes for GAAP net income. We caution readers that our methodology for calculating Distributable Earnings may differ

from the methodologies employed by other REITs to calculate the same or similar supplemental performance measures, and as a result, our

reported Distributable Earnings may not be comparable to similar measures presented by other REITs.

| | |

Three months ended December 31, | | |

For the year ended December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net Income | |

$ | 7,919,692 | | |

$ | 9,397,523 | | |

$ | 37,045,403 | | |

$ | 38,710,248 | |

| Adjustments to net income | |

| | | |

| | | |

| | | |

| | |

| Stock based compensation | |

| 845,524 | | |

| 537,131 | | |

| 3,058,674 | | |

| 1,479,736 | |

| Amortization of debt issuance costs | |

| (17,273 | ) | |

| 145,128 | | |

| 256,998 | | |

| 550,906 | |

| (Benefit) provision for current expected credit losses | |

| 301,491 | | |

| (253,495 | ) | |

| (583,298 | ) | |

| 940,385 | |

| Change in unrealized (loss) gain on investments | |

| 165,000 | | |

| 37,163 | | |

| 240,604 | | |

| (75,604 | ) |

| Distributable Earnings | |

$ | 9,214,434 | | |

$ | 9,863,450 | | |

$ | 40,018,381 | | |

$ | 41,605,671 | |

| Basic weighted average shares of common stock outstanding (in shares) | |

| 19,830,596 | | |

| 18,182,403 | | |

| 19,279,501 | | |

| 18,085,088 | |

| Basic Distributable Earnings

per Weighted Average Share | |

$ | 0.47 | | |

$ | 0.54 | | |

$ | 2.08 | | |

$ | 2.30 | |

| Diluted weighted average shares of common stock outstanding (in shares) | |

| 20,256,628 | | |

| 18,564,530 | | |

| 19,713,916 | | |

| 18,343,725 | |

| Diluted Distributable Earnings

per Weighted Average Share | |

$ | 0.46 | | |

$ | 0.53 | | |

$ | 2.03 | | |

$ | 2.27 | |

Exhibit 99.2

Earnings Supplemental For the quarter and year ended December 31, 2024

This presentation contains forward - looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21 E of the Securities and Exchange Act of 1934 , as amended (the “Exchange Act”), regarding future events and the future results of the Company that are based on current expectations, estimates, forecasts, projections about the industry in which the Company operates and the beliefs and assumptions of the management of the Company . Words such as “address,” “anticipate,” “believe,” “consider,” “continue,” “develop,” “estimate,” “expect,” “further,” “goal,” “intend,” “may,” “plan,” “potential,” “project,” “seek,” “should,” “target,” “will,” variations of such words and similar expressions are intended to identify such forward - looking statements . Such statements reflect the current views of the Company and its management with respect to future events and are subject to certain risks, uncertainties and assumptions . Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, the Company’s actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward - looking statements . This presentation has been prepared by the Company based on information it has obtained from sources it believes to be reliable . Summaries of documents contained in this presentation may not be complete . The Company does not represent that the information herein is complete . The information in this presentation is current only as of December 31 , 2024 , or such other date noted in this presentation, and the Company’s business or financial condition and other information in this presentation may change after that date . The Company undertakes no obligation to update any forward - looking statements in order to reflect any event or circumstance occurring after the date of this presentation or currently unknown facts or conditions . You are urged to review and carefully consider any cautionary statements and other disclosures, including the statements under the heading “Risk Factors” and elsewhere in the Company’s filings with the Securities and Exchange Commission . Factors that may cause actual results to differ materially from current expectations include, among others : the Company’s business and investment strategy ; global conflicts, such as the war between Russia and Ukraine and the war between Israel and Hamas and market volatility resulting from such conflicts ; the ability of Chicago Atlantic REIT Manager, LLC (the “Manager”) to locate suitable loan opportunities for the Company and allocate such opportunities among the Company and affiliates with similar investment strategies, monitor and actively manage the Company’s loan portfolio and implement the Company’s investment strategy ; allocation of loan opportunities to the Company by the Manager ; the Company’s projected operating results ; actions and initiatives of the U . S . or state governments and changes to government policies and the execution and impact of these actions, initiatives and policies, including the fact that cannabis remains illegal under federal law ; the estimated growth in and evolving market dynamics of the cannabis market ; the demand for cannabis cultivation and processing facilities ; shifts in public opinion regarding cannabis ; the state of the U . S . economy generally or in specific geographic regions ; economic trends and economic recoveries ; the amount and timing of the Company’s cash flows, if any, from the Company’s loans ; the Company’s ability to obtain and maintain financing arrangements ; the Company’s leverage ; changes in the value of the Company’s loans ; the Company’s investment and underwriting process ; rates of default or decreased recovery rates on the Company’s loans ; the degree to which any interest rate or other hedging strategies may or may not protect the Company from interest rate volatility ; changes in interest rates and impacts of such changes on the Company’s results of operations, cash flows and the market value of the Company’s loans ; interest rate mismatches between the Company’s loans and the Company’s borrowings used to fund such loans ; the impact of inflation on our operating results ; the departure of any of the executive officers or key personnel supporting and assisting the Company from the Manager or its affiliates ; impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters ; the Company’s ability to maintain the Company’s exclusion or exemption from registration under the Investment Company Act of 1940 ; the Company’s ability to qualify and maintain such qualification as a REIT for U . S . federal income tax purposes ; estimates relating to the Company’s ability to make distributions to its stockholders in the future ; the Company’s understanding of its competition ; and market trends in the Company’s industry, interest rates, real estate values, the securities markets or the economy in general . Market and Industry Data In this presentation, the Company relies on and refers to certain information and statistics obtained from third - party sources which it believes to be reliable, including reports by market research firms . The Company has not independently verified the accuracy or completeness of any such third - party information . Because the cannabis industry is relatively new and rapidly evolving, such market and industry data may be subject to significant change in a relatively short time period . Chicago Atlantic Real Estate Finance, Inc. | 2 Important Disclosure Information

▪ Commercial mortgage REIT and institutional lender to state - licensed operators in the cannabis industry. ▪ Manages a diversified portfolio of borrowers, geographies and asset types with strong real estate collateral coverage and loan - to - enterprise value ratios. ▪ Aims to provide risk - adjusted total returns for stockholders through consistent dividends and capital appreciation. ▪ Access to Sponsor’s leading cannabis lending platform as lead or co - lead arranger, and its proprietary sourcing network and direct originations team ▪ Experienced and robust origination team responsible for sourcing and closing over $2.1B in credit facilities since its inception in 2019. Chicago Atlantic Real Estate Finance, Inc. | 3 Chicago Atlantic Real Estate Finance Company Overview ~$493mm near - term pipeline under evaluation (1) $2.1B+ in loans closed since platform inception (1) 90+ cannabis loans closed across platform (1) $410.2mm outstanding loan principal (2) 17.2% gross portfolio yield (2) 1.1x real estate collateral coverage in current portfolio (2) Note: (1) As of December 31, 2024, includes potential syndications, and represents originations across Chicago Atlantic platform. (2) As of December 31, 2024, represents aggregate loan portfolio metrics.

Industry - Leading Management and Investment Team Deep Cannabis, Credit and Real Estate Expertise With Entrepreneurial Approach Peter Sack (1) Co - CEO ▪ Former Principal at BC Partners Credit, leading its cannabis practice ▪ Former private equity investor, focusing on distressed industrial opportunities ▪ MBA from University of Pennsylvania’s Wharton School of Business, BA from Yale University, and Fulbright Scholar Phil Silverman Chief Financial Officer ▪ Finance and accounting expert, with over 15 years of experience, focusing on financial reporting, operations, and internal controls within the asset management industry ▪ Former CFO of Chicago Atlantic Group, LLC ▪ B.S in Finance from Indiana University and holds the CPA designation Andreas Bodmeier (1) President and CIO ▪ Underwritten over $500mm in cannabis credit transactions ▪ Former Principal of consulting firm focused on FX and commodity risk management ▪ PhD in Finance and MBA from Chicago Booth and MSc from Humboldt University (Berlin) John Mazarakis (1) Executive Chairman ▪ Originated over $500mm in cannabis credit transactions ▪ Developed and owns over 1mm sf of real estate across 4 states ▪ Founded restaurant group with 30+ units and 1,200+ employees ▪ MBA from Chicago Booth and BA from University of Delaware Tony Cappell (1) Co - CEO ▪ Debt investor with over 15 years of experience, beginning at Wells Fargo Foothill ▪ Completed over 150 deals, comprising over $5bn in total credit ▪ MBA from Chicago Booth and BA from University of Wisconsin 1 0 0 YEA R S O F C O M B I N ED EXPER I EN C E A N D O VER $ 8 B I L L I O N I N R EA L EST A T E A ND CO M M E RCI A L CRE DI T Note: (1) Denotes member of Investment Committee David Kite (1) Chief Operating Officer ▪ Over 20 years of experience in investment management and real estate investments ▪ Former Partner and COO of Free Market Ventures ▪ Former Founder of K&K Capital Management ▪ MBA from Chicago Booth and BA from University of Illinois Chicago Atlantic Real Estate Finance, Inc. | 4

Veteran Independent Directors Significant Public Board, REIT, Financial and Corporate Governance Expertise Michael Steiner ▪ Current investor in Chicago Atlantic ▪ Founder and President of Service Energy and Petroleum Equipment, which are engaged in distribution of petroleum products ▪ Expert in highly regulated industries ▪ BA in History from Wake Forest University and MBA from University of Delaware Brandon Konigsberg ▪ Former CFO at J.P. Morgan Securities and Managing Director at JPMorgan Chase ▪ Current member of board of directors of GTJ REIT, SEC - registered equity REIT ▪ Former auditor at Goldstein, Golub and Kessler ▪ CPA and BA in Accounting from University of Albany and MBA from New York University’s Stern School of Business Jason Papastavrou ▪ Lead Independent Director ▪ Founder and CIO of ARIS Capital Management ▪ Current member of board of directors of GXO Logistics (NYSE:GXO); and, previous board member of XPO Logistics (NYSE:XPO) and United Rentals (NYSE:URI) ▪ BS in Mathematics and MS and PhD in Electrical Engineering and Computer Science from MIT Fredrick C. Herbst ▪ Audit Committee Chair ▪ Former CFO of Ready Capital (NYSE:RC) and Arbor Realty Trust (NYSE:ABR), two publicly traded, commercial mortgage REITs ▪ Former Managing Director of Waterfall Asset Management ▪ Former CFO of Clayton Holdings and The Hurst Companies ▪ CPA and BA in Accounting from Wittenberg University Chicago Atlantic Real Estate Finance, Inc. | 5

Target Loan Profile Chicago Atlantic Real Estate Finance, Inc. | 6 Presented for illustrative purposes only, actual loan characteristics may differ. Real estate financing, capital expenditure and growth/acquisition capital USES OF CAPITAL $10 - $50 million SIZE 2 - 3 years TERM Term loans and delayed draw term loans STRUCTURE Mortgage/deed of trust, stock pledge, all asset UCC - 1 lien, guarantees COLLATERAL 50 - 150 bps per month AMORTIZATION Below 60% LTV Limited license, vertically integrated operators TARGET Less than 2.0x SENIOR DEBT TO EBITDA RATIO Make - whole provisions and prepayment penalties OTHER TERMS Debt service coverage ratio, limited indebtedness, deposit account control agreements, minimum liquidity, monthly reporting requirements COVENANTS

Market Performance Total Returns vs. Major Indexes Source: Bloomberg (data assumes dividend reinvestment) Benchmarked since inception (12/10/2021) through January 2025

Market Performance Total Returns vs. Select Peers Source: Bloomberg (data assumes dividend reinvestment) Benchmarked since inception (12/10/2021) through January 2025.

Portfolio Diversification Our portfolio is diversified across operators, geographies, and asset types P RI NCI P A L O UT S T A NDI NG ( 1 ) By Loan Note: (1) As of December 31, 2024, and reflects aggregate of total loan portfolio including loans held for investment and loans at fair value 35.7% 25.6% 38.7% Top 5 Loans Next 5 Loans Remaining Loans Top 10 Loans = 61.3% of principal outstanding Weighted Average Loan Size = 5.1% 38.9% 32.2% 28.9% Fixed - rate Floating - rate (Floor < 7.50%) Floating - rate (Floor >= 7.50%) $410.2M By Rate Type Floating Loans by Prime Rate Floor 6.9% 7.6% 0.2% 7.7% 30.3% 17.1% 6.7% 3.0% 20.4% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 0.00% 3.25% 5.50% 6.25% 7.00% 7.50% 7.75% 8.00% 8.50% Rate Floor Chicago Atlantic Real Estate Finance, Inc. | 9

Portfolio Diversification (Continued) Our portfolio is diversified across operators, geographies, and asset types P RI NCI P A L O UT S T A NDI NG 1 Note: (1) As of December 31, 2024 and reflects aggregate of total loan portfolio including loans held for investment and loans at fair value. (2) SSO = single state operator, MSO = multi - state operator. Percentage of Real Estate Collateral by State and Operator Type 2 20.0% 18.0% 16.0% 14.0% 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% AZ CA FL IL MD MI MO NE NY NV OH MN OR PA WV Other MSO SSO 35.0% 15.5% 3.2% 46.2% Loans with Retail/Industrial collateral Loans with Retail collateral Loans with no real estate collateral Loans with Industrial collateral $410.2M By Real Estate Collateral Type 6% 5% 10% 15% 14% 9% 7% 6% 9% 1% 2% 2% 4% 1% 8% Michigan Florida Missouri Pennsylvania Nevada California Ohio Arizona Nebraska Minnesota Maryland Illinois New York West Virginia Other $410.2M Chicago Atlantic Real Estate Finance, Inc. | 10 By Location

Loan Collateral Coverage 47% loan to enterprise value and 1.1x real estate collateral coverage R EA L EST A T E C O L L A T E R A L C O VER A G E ( 2 ) 0.51 - 1.00x 1.01 - 1.50x 1.51 - 2.00x Portfolio Weighted Average (1.1x) P RI NCI P A L BY L T E V RA T I O ( 1 ) (1) Our loans to owner operators in the state - licensed cannabis industry are secured by additional collateral, including personal and corporate guarantee(s), where applicable subject to local laws and regulations. Loan to enterprise value ratio (LTEV) is calculated as total senior loan principal (pari - passu with REFI’s loan) outstanding divided by total value of collateral on a weighted average basis. (2) Expressed as percentage of total outstanding loan principal of $410.2 million as of December 31, 2024. $ - $20,000,000 $40,000,000 $60,000,000 $80,000,000 $100,000,000 $120,000,000 $140,000,000 $160,000,000 $180,000,000 20%< 21 - 40% 41 - 60% 61 - 80% Portfolio Weighted Average (47.0%) >80% 0% Chicago Atlantic Real Estate Finance, Inc. | 11 5% 10% 15% 20% 25% 30% <.50x >2.0x

Distributable Earnings and Dividends 1 1 Distributable earnings per share based on basic weighted average common shares outstanding at the end of each respective quarter. $ - $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q4 2022 Q1 2023 Q2 2023 Basic Distributable EPS Regular Dividend Q3 2023 Q4 2023 Special Dividend Chicago Atlantic Real Estate Finance, Inc. | 12

The Cannabis Landscape in the U.S. Where We See Opportunities THE CANNABIS INDUSTRY PRESENTS A SPECIAL OPPORTUNITY TO GENERATE ALPHA AND OUTSIZED RISK ADJUSTED RETURNS LACK OF TRADITIONAL FINANCING Banks generally don’t lend to firms in this industry, allowing higher interest rates, attractive collateral, and lender - friendly covenants. LOW CORRELATIONS TO TRADITIONAL MARKETS Medical cannabis behaves like pharmaceuticals, recreational cannabis behaves like tobacco and alcohol, both exhibiting low correlation with traditional markets. HIGH BARRIERS TO ENTRY Each state has unique investment characteristics, supply and demand dynamics, and legal frameworks, requiring sophisticated understanding of the industry and strong underwriting expertise. FOCUS ON LIMITED LICENSE STATES Limited license states have limited competition, lucrative license values, high wholesale prices, and less black - market presence. Chicago Atlantic Real Estate Finance, Inc. | 13

The Cannabis Landscape in the U.S. (cont’d) How the landscape changed over past 5 years 2019 2024 Sources: 1 - https://mjbizdaily.com/map - of - us - marijuana - legalization - by - state / . 2 - Statista 3 - MJBiz Factbook 2024 x Legal in 41 states and the District of Columbia 1 x Medical use only: 17 states x Recreational/Medical use: 24 states & District of Columbia x Industry revenue estimated at $32B in 2024 3 Legalized recreational and medical use Legalized medical use only No regulated use x Legal in 35 states and the District of Columbia 1 x Medical use only: 25 states x Recreational/Medical use: 10 states & District of Columbia x Industry revenue at $19.3B 2 Chicago Atlantic Real Estate Finance, Inc. | 14

$20.7 $24.3 $28.5 $32.0 $37.8 $40.5 $43.6 $11.4 $12.0 $12.3 $12.6 $13.2 $13.7 $14.4 2024 2025 2026 2027 Adult - Use Sales 2028 2029 Medical Sales 2030 $32.1 $36.3 $40.8 $45.5 $51.0 $54.2 The U.S. cannabis industry is estimated to be $32B in top - line retail revenue in 2024 and is projected to grow to $58B by 2030 1 : $58.0 The Cannabis Industry: Size of Opportunity and Growth Projections Sources: 1 - MJBiz Factbook 2024; ($ in billions). 2 - S&P Capital IQ and Company Filings of the 20 largest cannabis companies (ranked by market capitalization); equity and debt figures are as of 12/31/23. Assuming the cannabis market enterprise value at 1x revenue, and a 35% debt to 65% equity capital structure 2 , the current value of the U.S. cannabis debt market can be estimated to be approximately $12B . With our closed cannabis loans to date of $2.3B, Chicago Atlantic roughly represents 20% of the current U.S. cannabis debt market share . With the projected industry size of $58B in retail sales in 6 years , and assuming we maintain our current debt market share of 20%, the Chicago Atlantic private credit opportunity could grow to nearly $4B . Chicago Atlantic Real Estate Finance, Inc. | 15

Greater diversification Shorter loan durations Deal leads Lower LTVs Close relationships with management teams Ability to upsize REIT shares 50% of the origination fee We negotiate the deal Our borrower’s only source of debt Underwrite enterprise value in the borrowers Competitive Investment Landscape C O M P E T I T O R S : G R O U P S Mortgage REITs BDCs Sale/ Leaseback REITs Cannabis - Focused Lenders Community Banks Chicago Atlantic Real Estate Finance, Inc. | 16 C O M PET I T I VE A D V A N T A G ES

Comprehensive Investment Process SOURCE AND REVIEW 1 SCREENING 2 COLLATERAL GEOGRAPHY / INDUSTRY ▪ Focus primarily on U.S. borrowers ▪ (Local) industry dynamics ▪ Diversification / concentration vs. existing loan portfolio ▪ FINANCIALS / OPERATIONS ▪ Historical financial statements / tax returns ▪ Projects of the business and financials Current Capitalization ▪ Investor decks for equity raises ▪ Operational metrics vs industry peers TRANSACTION STRUCTURE ▪ Covenant packages ▪ Floating rate with Prime or SOFR floor ▪ Term and pre - payment fees ▪ Fixed annual amortization plus excess cash - flow recapture ▪ Real Estate, Stock Pledges, equipment, receivables and inventory ▪ Market comparable for liquidation ▪ In - place and to - be - acquired collateral ▪ External collateral available for credit enhancement UNDERWRITING 3 MARKET STUDY / BUSINESS REVIEW ▪ Evaluate borrower’s business strategy and market conditions FULL COVENANT PACKAGE ASSESSMENT ▪ Leverage, EBITDA, fixed charge coverage, minimum cash, etc. MANAGEMENT AND ONSITE MEETINGS ▪ Ability to further understand company and team FINANCIAL MODELING / SENSITIVITY ANALYSIS ▪ Core drivers of business / downside scenarios ▪ Serves as foundation for covenant creation COLLATERAL APPRAISALS AND ASSET VERIFICATIONS ▪ Assess value of the assets and whether they exist OVERVIEW ▪ Direct Origination ▪ Brand Recognition ▪ Ability to Act Timely ▪ Efficient Deal Process ▪ Relationships with PE Sponsors ▪ In - depth Knowledge PRICE / STRUCTURE ▪ Determine pricing and structure relative to underlying fundamentals without compromising on “zero loss” mentality CUSTOMER CALLS / BACKGROUND CHECKS ▪ Understand success of the company and ability of management team FINANCIAL STATEMENT, BANKING, AND TAX REVIEW ▪ Determine quality of earnings, after - tax cash flows and reporting requirements/capabilities Note: This summary of our process is for illustrative purposes only as actual process may differ from time to time, as appropriate to the investment considered. Chicago Atlantic Real Estate Finance, Inc. | 17

Comprehensive Investment Process (cont’d) STRUCTURING 4 MONITORING 5 QUARTERLY VALUATIONS REGULAR REPORTING BY BORROWERS ▪ Monthly reporting of financial and operational metrics by our borrowers provides an “early warning” approach to portfolio monitoring REGULAR INTERNAL MEETINGS ▪ Monthly tear sheet credit analysis including covenant compliance and forward - looking covenant default risk analysis prepared for investment committee ▪ Proprietary and customized analytics for each portfolio company ▪ Valuations underlying CECL reserves are performed with input from third - party valuation specialists, and in accordance with the Manager’s valuation policy INTERNAL CREDIT RATINGS ▪ Ratings assigned between 1 and 5 at quarterly portfolio review and will determine corrective action ▪ Covenant defaults allow for the implementation of corrective actions and a re - set of economics . to compensate for an increased risk profile CAPITAL PRESERVATION ▪ Typically, a first lien on the borrower’s assets, pledge of company stock, and validity guaranty ▪ Loans have covenants designed to provide the ability for early intervention STRONG CURRENT INCOME ▪ Contractual coupon and fees negotiated in loan terms ▪ Floating interest rate loans CONSERVATIVE STRUCTURE ▪ Conservative leverage and loan - to - value ratios with significant equity support ▪ Amortization features and excess cash - flow recapture for de - risking over life of loan RETURN ENHANCEMENT ▪ Additional yield generation through PIK interest, success fees, and prepayment fees, and make - whole protections. PREDICTABLE EXIT STRATEGY ▪ Fixed amortization and excess cash - flow recapture structured to ensure repayment without capital markets exit RECEIVE INVESTMENT COMMITTEE APPROVAL Note: This summary of our process is for illustrative purposes only as actual process may differ from time to time, as appropriate to the investment considered. Chicago Atlantic Real Estate Finance, Inc. | 18

Loan Origination Pipeline Driven by proprietary deal sourcing Total current pipeline of ~$492.9mm 1 ▪ Continued legalization at the state level creates a new influx of opportunities ▪ Increase in M&A activity requires additional debt financing ▪ Robust set of profitable operators and refinancing opportunities Note: (1) As of December 31, 2024, includes potential syndications, and represents origination opportunities across Chicago Atlantic platform. (2) As of December 31, 2024, reflects executed term sheets for investments that the Company is expected to participate. Over 1,000 Qualified Deals Sourced and Reviewed ~$37.4mm 1 in Upcoming Fundings $35.0mm 2 Term Sheets Executed Chicago Atlantic Real Estate Finance, Inc. | 19

Financial Overview For the quarter and year ended December 31, 2024 Appendix Chicago Atlantic Real Estate Finance, Inc. | 20

Consolidated Balance Sheets Notes referenced above refer to Consolidated Financial Statements on Form 10 - K as of December 31, 2024 Chicago Atlantic Real Estate Finance, Inc. | 21

Portfolio Overview 1 (as of December 31, 2024) YTM IRR PIK Rate Cash Rate Rate Type Unfunded Commitment Principal Balance Maturity Date Origination Date Location(s) Loan Number 17.1% 0.00% 14.00% Floating $ - $ 19,324,557 10/30/2026 10/27/2022 Various 1 17.3% 0.00% 11.50% Floating - 27,110,506 12/31/2025 12/31/2021 Michigan 2 22.2% 2.75% 17.88% Floating - 21,248,176 1/29/2027 7/31/2024 Various 3 17.0% 0.00% 11.91% Fixed - 6,626,809 6/17/2026 4/19/2021 Arizona 4 22.6% 0.00% 19.75% Floating - 2,564,180 4/30/2025 4/19/2021 Massachusetts 5 17.2% 0.00% 15.00% Floating - 4,958,123 1/30/2026 8/20/2021 Michigan 6 19.3% 2.00% 13.50% Floating - 24,293,793 6/30/2025 8/24/2021 Illinois, Arizona 7 15.0% 0.00% 10.00% Fixed - 8,491,943 12/31/2025 9/1/2021 West Virginia 8 17.5% 0.00% 28.25% Floating - 16,402,488 6/30/2024 9/3/2021 Pennsylvania 9 (2) 19.3% 2.00% 14.50% Floating - 11,159,358 10/31/2027 11/8/2021 Various 12 31.2% 0.00% 16.75% Fixed - 6,557,500 8/29/2025 12/30/2021 Florida 16 16.1% 5.00% 9.25% Floating - 45,024,611 12/31/2025 2/3/2022 Ohio 18 16.5% 5.00% 11.00% Fixed - 18,892,211 12/31/2025 3/11/2022 Florida 19 14.7% 2.00% 11.00% Fixed - 22,243,402 11/28/2025 5/9/2022 Missouri 20 23.3% 2.00% 14.50% Floating - 6,583,891 7/29/2026 7/1/2022 Illinois 21 18.7% 0.00% 15.50% Floating - 1,620,000 3/31/2026 3/27/2023 Arizona 23 21.7% 0.00% 18.00% Floating - 580,000 9/27/2026 9/27/2022 Oregon 24 16.6% 0.00% 15.00% Fixed - 25,093,595 6/29/2036 8/1/2023 New York 25 15.7% 0.00% 14.00% Floating - 17,400,000 6/30/2027 8/15/2023 Nebraska 27 17.4% 0.00% 15.00% Fixed - 2,466,705 3/13/2025 9/13/2023 Ohio 28 14.7% 1.50% 11.40% Fixed - 1,943,217 10/9/2026 10/11/2023 Illinois 29 18.7% 0.00% 16.25% Floating - 19,000,000 12/31/2026 12/19/2023 Missouri, Arizona 30 18.3% 0.00% 16.50% Floating - 6,680,000 5/3/2026 5/3/2023 California, Illinois 31 16.1% 0.00% 14.50% Floating - 6,000,000 8/15/2027 4/15/2024 Nevada 32 12.9% 0.00% 12.00% Fixed - 1,116,000 5/28/2027 5/20/2024 Minnesota 33 12.8% 0.00% 11.91% Fixed - 10,000,000 5/29/2026 6/17/2024 Arizona 34 16.3% 3.00% 12.00% Fixed - 24,256,045 8/23/2027 8/23/2024 California 35 15.2% 0.00% 13.75% Floating 2,000,000 25,000,000 1/1/2027 10/28/2024 Illinois 36 15.2% 1.00% 12.00% Fixed 10,000,000 20,019,444 11/24/2028 11/26/2024 Various 37 14.7% 0.00% 10.00% Fixed 2,935,000 2,065,000 12/13/2025 12/13/2024 Various 38 11.0% 0.00% 10.50% Fixed 6,000,000 5,500,000 6/26/2026 12/31/2024 Minnesota 39 17.2% 1.5% 13.6% 62.1% / 37.9% $ 20,935,000 $ 410,221,554 Subtotal Chicago Atlantic Real Estate Finance, Inc. | 22 1 The table above reflects the Company’s aggregate loan portfolio including loans held for investment and loans held at fair value. Refer to Note 3 and Note 5 of the consolidated financial statements within the Annual Report on Form 10 - K for additional information 2 Loan #9 is on non - accrual status as of December 31, 2024. This loan is presented on the consolidated balance sheet within loans held for investment – related party (see Note 9 to the consolidated financial statements).

Consolidated Statements of Operation Chicago Atlantic Real Estate Finance, Inc. | 22

Reconciliation of Distributable Earnings to GAAP Net Income Chicago Atlantic Real Estate Finance, Inc. | 23

About CHICAGO ATLANTIC The Sponsor is a credit - focused investment firm founded in 2019 REFI completed its IPO in December 2021 INCEPTION x Sponsor assets under management: $1.6B (1)(2) x One of the largest institutional lenders in the cannabis space SIZE 85 professionals, including over 30 investment professionals (2) TEAM Seeking preservation of capital and income generation predominantly through cannabis investment opportunities that are overlooked or underserved by conventional capital providers INVESTMENT PRINCIPLES x Annualized dividend yield of approximately 12 - 14%, distributed quarterly x No loss of principal since credit strategy inception PERFORMANCE x Chicago Atlantic REIT Manager, LLC, a subsidiary of Chicago Atlantic Group, LP x Management fee of 1.5% of Equity, with 50% pro - rata origination fee offset x Incentive fee of 20% of Core Earnings, with 8% hurdle rate and no catch - up EXTERNAL MANAGER AND AGREEMENT Chicago, Miami, and New York LOCATIONS 1 - Assets under management represent total committed investor capital, total available leverage including undrawn capital, and capital invested by co - investors and managed by the firm. 2 - As of September 30, 2024. Chicago Atlantic Real Estate Finance, Inc. | 24

v3.25.0.1

Cover

|

Mar. 12, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 12, 2025

|

| Entity File Number |

001-41123

|

| Entity Registrant Name |

Chicago Atlantic Real Estate Finance, Inc.

|

| Entity Central Index Key |

0001867949

|

| Entity Tax Identification Number |

86-3125132

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

1680 Michigan Avenue

|

| Entity Address, Address Line Two |

Suite 700

|

| Entity Address, City or Town |

Miami Beach

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33139

|

| City Area Code |

312

|

| Local Phone Number |

809-7002

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

REFI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

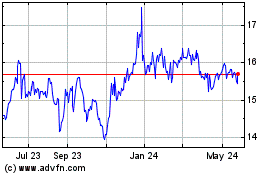

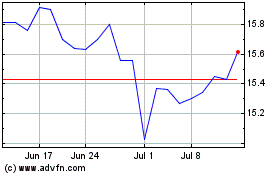

Chicago Atlantic Real Es... (NASDAQ:REFI)

Historical Stock Chart

From Feb 2025 to Mar 2025

Chicago Atlantic Real Es... (NASDAQ:REFI)

Historical Stock Chart

From Mar 2024 to Mar 2025