false2024Q30001635282--12-31http://fasb.org/us-gaap/2024#OtherAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherAccruedLiabilitiesCurrent33.3333.3333.33505033.33xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:purermni:claimrmni:institutionrmni:dayrmni:lease00016352822024-01-012024-09-300001635282us-gaap:CommonStockMember2024-01-012024-09-3000016352822024-10-2800016352822024-09-3000016352822023-12-3100016352822024-07-012024-09-3000016352822023-07-012023-09-3000016352822023-01-012023-09-300001635282us-gaap:CommonStockMember2024-06-300001635282us-gaap:CommonStockMember2023-06-300001635282us-gaap:CommonStockMember2023-12-310001635282us-gaap:CommonStockMember2022-12-310001635282us-gaap:CommonStockMember2024-07-012024-09-300001635282us-gaap:CommonStockMember2023-07-012023-09-300001635282us-gaap:CommonStockMember2023-01-012023-09-300001635282us-gaap:CommonStockMember2024-09-300001635282us-gaap:CommonStockMember2023-09-3000016352822024-06-3000016352822023-06-3000016352822022-12-310001635282us-gaap:AdditionalPaidInCapitalMember2024-06-300001635282us-gaap:AdditionalPaidInCapitalMember2023-06-300001635282us-gaap:AdditionalPaidInCapitalMember2023-12-310001635282us-gaap:AdditionalPaidInCapitalMember2022-12-310001635282us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001635282us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001635282us-gaap:AdditionalPaidInCapitalMember2024-01-012024-09-300001635282us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300001635282us-gaap:AdditionalPaidInCapitalMember2024-09-300001635282us-gaap:AdditionalPaidInCapitalMember2023-09-300001635282us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001635282us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001635282us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001635282us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001635282us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300001635282us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001635282us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-09-300001635282us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-300001635282us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300001635282us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001635282us-gaap:RetainedEarningsMember2024-06-300001635282us-gaap:RetainedEarningsMember2023-06-300001635282us-gaap:RetainedEarningsMember2023-12-310001635282us-gaap:RetainedEarningsMember2022-12-310001635282us-gaap:RetainedEarningsMember2024-07-012024-09-300001635282us-gaap:RetainedEarningsMember2023-07-012023-09-300001635282us-gaap:RetainedEarningsMember2024-01-012024-09-300001635282us-gaap:RetainedEarningsMember2023-01-012023-09-300001635282us-gaap:RetainedEarningsMember2024-09-300001635282us-gaap:RetainedEarningsMember2023-09-300001635282us-gaap:TreasuryStockCommonMember2024-06-300001635282us-gaap:TreasuryStockCommonMember2024-09-300001635282us-gaap:TreasuryStockCommonMember2023-06-300001635282us-gaap:TreasuryStockCommonMember2023-09-300001635282us-gaap:TreasuryStockCommonMember2023-12-310001635282us-gaap:TreasuryStockCommonMember2022-12-3100016352822023-09-300001635282rmni:RiminiIIInjunctionProceedingsMember2024-09-300001635282rmni:OriginalCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2024-04-300001635282rmni:OriginalCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2024-04-302024-04-300001635282rmni:A2024CreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2024-04-302024-04-300001635282rmni:A2024CreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2024-04-300001635282us-gaap:LineOfCreditMember2024-09-300001635282us-gaap:LineOfCreditMember2023-12-310001635282us-gaap:LineOfCreditMember2024-07-012024-09-300001635282us-gaap:LineOfCreditMember2024-01-012024-09-300001635282us-gaap:LineOfCreditMember2023-07-012023-09-300001635282us-gaap:LineOfCreditMember2023-01-012023-09-300001635282rmni:A2024CreditFacilityMemberus-gaap:LineOfCreditMember2024-04-300001635282rmni:A2024CreditFacilityMemberus-gaap:SecuredDebtMember2024-04-302024-04-300001635282us-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MinimumMember2024-04-302024-04-300001635282us-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MaximumMember2024-04-302024-04-300001635282us-gaap:LineOfCreditMemberus-gaap:BaseRateMembersrt:MinimumMember2024-04-302024-04-300001635282us-gaap:LineOfCreditMemberus-gaap:BaseRateMembersrt:MaximumMember2024-04-302024-04-300001635282rmni:A2024CreditFacilityMemberus-gaap:LineOfCreditMembersrt:MinimumMember2024-04-302024-04-300001635282rmni:A2024CreditFacilityMemberus-gaap:LineOfCreditMembersrt:MaximumMember2024-04-302024-04-300001635282rmni:A2024CreditFacilityMemberus-gaap:LineOfCreditMember2024-04-302024-04-300001635282rmni:A2024CreditFacilityMemberus-gaap:LineOfCreditMember2024-01-012024-09-300001635282rmni:A2024CreditFacilityMemberus-gaap:LineOfCreditMember2024-09-300001635282rmni:A2023AmendedCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MinimumMember2023-02-282023-02-280001635282rmni:A2023AmendedCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MaximumMember2023-02-282023-02-280001635282rmni:A2023AmendedCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMembersrt:MinimumMember2023-02-282023-02-280001635282rmni:A2023AmendedCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMembersrt:MaximumMember2023-02-282023-02-280001635282rmni:A2024CreditFacilityMemberus-gaap:LineOfCreditMember2024-07-012024-09-300001635282rmni:A2024CreditFacilityMemberus-gaap:LineOfCreditMember2023-07-012023-09-300001635282rmni:A2024CreditFacilityMemberus-gaap:LineOfCreditMember2023-01-012023-09-300001635282us-gaap:FairValueInputsLevel2Memberrmni:A2024CreditFacilityMemberus-gaap:LineOfCreditMember2024-09-300001635282us-gaap:FairValueInputsLevel2Memberrmni:A2024CreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001635282rmni:A2024CreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001635282us-gaap:InterestRateSwapMember2024-04-302024-04-300001635282us-gaap:InterestRateSwapMember2024-04-300001635282rmni:TwoThousandsAndThirteenPlanMember2023-02-232023-02-230001635282rmni:A2024LTIPlanMemberus-gaap:PhantomShareUnitsPSUsMembersrt:MinimumMember2024-09-300001635282rmni:A2024LTIPlanMemberus-gaap:PhantomShareUnitsPSUsMembersrt:MaximumMember2024-09-300001635282us-gaap:PhantomShareUnitsPSUsMember2024-05-062024-05-060001635282us-gaap:PhantomShareUnitsPSUsMemberrmni:A2023LTIPlanMember2024-09-300001635282us-gaap:PhantomShareUnitsPSUsMember2024-07-012024-09-300001635282us-gaap:PhantomShareUnitsPSUsMember2023-07-012023-09-300001635282us-gaap:PhantomShareUnitsPSUsMember2024-01-012024-09-300001635282us-gaap:PhantomShareUnitsPSUsMember2023-01-012023-09-300001635282us-gaap:PhantomShareUnitsPSUsMember2024-09-300001635282us-gaap:RestrictedStockUnitsRSUMemberrmni:TwoThousandsAndThirteenPlanMember2024-01-012024-09-300001635282rmni:TwoThousandsAndThirteenPlanMemberus-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMember2024-01-012024-09-300001635282rmni:TwoThousandsAndThirteenPlanMemberus-gaap:RestrictedStockUnitsRSUMembersrt:MaximumMember2024-01-012024-09-300001635282us-gaap:RestrictedStockUnitsRSUMemberrmni:TwoThousandsAndThirteenPlanMember2024-07-012024-09-300001635282us-gaap:RestrictedStockUnitsRSUMemberrmni:TwoThousandsAndThirteenPlanMember2023-07-012023-09-300001635282us-gaap:RestrictedStockUnitsRSUMemberrmni:TwoThousandsAndThirteenPlanMember2023-01-012023-09-300001635282us-gaap:RestrictedStockUnitsRSUMemberrmni:TwoThousandsAndThirteenPlanMember2024-09-300001635282us-gaap:EmployeeStockOptionMember2024-01-012024-09-300001635282us-gaap:EmployeeStockOptionMemberrmni:StockPlansMember2024-01-012024-09-300001635282rmni:StockOptionsPlansMember2023-12-310001635282rmni:StockOptionsPlansMember2023-01-012023-12-310001635282rmni:StockOptionsPlansMember2024-01-012024-09-300001635282rmni:StockOptionsPlansMember2024-09-300001635282us-gaap:EmployeeStockOptionMember2024-09-300001635282us-gaap:EmployeeStockOptionMember2023-12-310001635282rmni:TwoThousandsAndThirteenPlanMember2023-12-310001635282rmni:TwoThousandsAndThirteenPlanMember2024-01-012024-09-300001635282rmni:TwoThousandsAndThirteenPlanMember2024-09-300001635282us-gaap:CostOfSalesMember2024-07-012024-09-300001635282us-gaap:CostOfSalesMember2023-07-012023-09-300001635282us-gaap:CostOfSalesMember2024-01-012024-09-300001635282us-gaap:CostOfSalesMember2023-01-012023-09-300001635282us-gaap:SellingAndMarketingExpenseMember2024-07-012024-09-300001635282us-gaap:SellingAndMarketingExpenseMember2023-07-012023-09-300001635282us-gaap:SellingAndMarketingExpenseMember2024-01-012024-09-300001635282us-gaap:SellingAndMarketingExpenseMember2023-01-012023-09-300001635282us-gaap:GeneralAndAdministrativeExpenseMember2024-07-012024-09-300001635282us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012023-09-300001635282us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-09-300001635282us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-300001635282rmni:TwoThousandsAndThirteenPlanMemberus-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2024-01-012024-09-300001635282rmni:TwoThousandsAndThirteenPlanMemberus-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-01-012024-09-300001635282rmni:TwoThousandsAndThirteenPlanMemberus-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-01-012024-09-300001635282us-gaap:PhantomShareUnitsPSUsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-09-300001635282us-gaap:PhantomShareUnitsPSUsMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-09-300001635282rmni:OracleLitigationMember2015-01-012016-12-310001635282rmni:OracleLitigationMember2016-01-012016-12-310001635282rmni:RiminiIInjunctionProceedingsMember2023-10-012023-10-310001635282rmni:RiminiIInjunctionProceedingsMember2022-01-012023-10-310001635282rmni:RiminiIInjunctionProceedingsMember2022-01-012022-01-310001635282rmni:RiminiIInjunctionProceedingsMember2023-11-012023-11-300001635282rmni:RiminiIInjunctionProceedingsMember2023-12-012023-12-310001635282rmni:RiminiIIInjunctionProceedingsMember2023-11-012023-11-300001635282rmni:RiminiIInjunctionProceedingsMember2023-11-300001635282rmni:AttorneysFeesMember2024-09-232024-09-230001635282rmni:TaxableCostsMember2024-09-232024-09-230001635282us-gaap:ProductConcentrationRiskMemberrmni:PeopleSoftSoftwareProductServicesMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300001635282us-gaap:ProductConcentrationRiskMemberrmni:PeopleSoftSoftwareProductServicesMemberus-gaap:SalesRevenueNetMember2024-01-012024-09-300001635282rmni:RiminiStreetIncMemberrmni:AdamsStreetPartnersMemberus-gaap:RelatedPartyMember2024-01-012024-09-300001635282us-gaap:EmployeeStockOptionMember2024-07-012024-09-300001635282us-gaap:EmployeeStockOptionMember2023-07-012023-09-300001635282us-gaap:EmployeeStockOptionMember2024-01-012024-09-300001635282us-gaap:EmployeeStockOptionMember2023-01-012023-09-300001635282us-gaap:PhantomShareUnitsPSUsMember2024-07-012024-09-300001635282us-gaap:PhantomShareUnitsPSUsMember2023-07-012023-09-300001635282us-gaap:PhantomShareUnitsPSUsMember2024-01-012024-09-300001635282us-gaap:PhantomShareUnitsPSUsMember2023-01-012023-09-300001635282us-gaap:RestrictedStockUnitsRSUMember2024-07-012024-09-300001635282us-gaap:RestrictedStockUnitsRSUMember2023-07-012023-09-300001635282us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300001635282us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001635282rmni:RestrictedStockUnitsRSUsAndPerformanceStockUnitsPSUsMember2024-07-012024-09-300001635282rmni:RestrictedStockUnitsRSUsAndPerformanceStockUnitsPSUsMember2023-07-012023-09-300001635282rmni:RestrictedStockUnitsRSUsAndPerformanceStockUnitsPSUsMember2024-01-012024-09-300001635282rmni:RestrictedStockUnitsRSUsAndPerformanceStockUnitsPSUsMember2023-01-012023-09-300001635282us-gaap:WarrantMember2024-07-012024-09-300001635282us-gaap:WarrantMember2023-07-012023-09-300001635282us-gaap:WarrantMember2024-01-012024-09-300001635282us-gaap:WarrantMember2023-01-012023-09-300001635282us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001635282us-gaap:FairValueInputsLevel2Memberus-gaap:CashEquivalentsMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001635282us-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001635282us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2023-12-310001635282us-gaap:FairValueInputsLevel2Memberus-gaap:CashEquivalentsMemberus-gaap:USTreasurySecuritiesMember2023-12-310001635282us-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:USTreasurySecuritiesMember2023-12-310001635282us-gaap:CashEquivalentsMember2023-12-310001635282us-gaap:ShortTermInvestmentsMember2023-12-310001635282us-gaap:InterestRateSwapMember2024-09-300001635282rmni:DepositsAndOtherAssetsNoncurrentMember2024-09-300001635282rmni:DepositsAndOtherAssetsNoncurrentMember2023-12-310001635282us-gaap:OtherNoncurrentLiabilitiesMember2024-09-300001635282us-gaap:OtherNoncurrentLiabilitiesMember2023-12-310001635282rmni:AccumulatedOtherComprehensiveIncomeLossMember2024-09-300001635282rmni:AccumulatedOtherComprehensiveIncomeLossMember2023-12-310001635282us-gaap:InterestRateSwapMember2024-07-012024-09-300001635282us-gaap:InterestRateSwapMember2023-07-012023-09-300001635282us-gaap:InterestRateSwapMember2024-01-012024-09-300001635282us-gaap:InterestRateSwapMember2023-01-012023-09-300001635282country:US2024-07-012024-09-300001635282country:US2023-07-012023-09-300001635282country:US2024-01-012024-09-300001635282country:US2023-01-012023-09-300001635282us-gaap:NonUsMember2024-07-012024-09-300001635282us-gaap:NonUsMember2023-07-012023-09-300001635282us-gaap:NonUsMember2024-01-012024-09-300001635282us-gaap:NonUsMember2023-01-012023-09-300001635282country:JPus-gaap:GeographicConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2024-07-012024-09-300001635282country:JPus-gaap:GeographicConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-09-300001635282us-gaap:NonUsMember2024-09-300001635282us-gaap:NonUsMember2023-12-310001635282country:US2024-09-300001635282country:IN2024-09-300001635282rmni:NonUSAndNonIndiaMember2024-09-300001635282country:US2023-12-310001635282country:IN2023-12-310001635282rmni:NonUSAndNonIndiaMember2023-12-310001635282rmni:SingleFinancialInstitutionMember2024-09-300001635282rmni:SingleFinancialInstitutionMember2023-12-310001635282rmni:ThreeFinancialInstitutionsMember2024-09-300001635282rmni:ThreeFinancialInstitutionsMember2023-12-310001635282rmni:SingleFinancialInstitutionMember2023-12-310001635282rmni:SingleFinancialInstitutionMember2024-09-300001635282srt:MinimumMember2024-09-300001635282srt:MaximumMember2024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One) | | | | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended September 30, 2024 | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File Number: 001-37397

| | |

| Rimini Street, Inc. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Delaware | | 36-4880301 |

(State or other jurisdiction of incorporation or

organization) | | (I.R.S. Employer Identification No.) |

| | |

1700 S. Pavilion Center Drive, Suite 330, Las Vegas, NV | | 89135 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

| Registrant's telephone number, including area code: | | (702) 839-9671 |

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | |

| Title of each class: | | Trading Symbol(s) | Name of each exchange on which registered: |

| | | | |

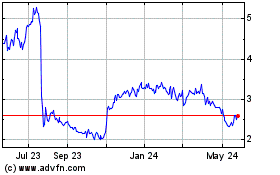

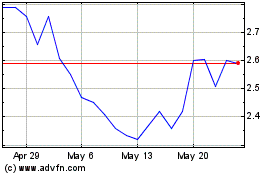

| Common Stock, par value $0.0001 per share | | RMNI | The Nasdaq Global Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | |

Large accelerated filer ¨ | Accelerated filer þ | Non-accelerated filer ¨ |

| | | | | | | | |

Smaller reporting company ☐ | | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No þ

The registrant had approximately 90,920,000 shares of its $0.0001 par value common stock outstanding as of October 28, 2024.

RIMINI STREET, INC.

TABLE OF CONTENTS | | | | | | | | |

| | Page |

| | |

| |

| | |

| | |

| | |

| Unaudited Condensed Consolidated Balance Sheets | |

| | |

| Unaudited Condensed Consolidated Statements of Operations and Comprehensive Income | |

| | |

| Unaudited Condensed Consolidated Statements of Stockholders' Deficit | |

| | |

| Unaudited Condensed Consolidated Statements of Cash Flows | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

PART I - FINANCIAL INFORMATION

ITEM 1. Financial Statements.

RIMINI STREET, INC.

Unaudited Condensed Consolidated Balance Sheets

(In thousands, except per share amounts) | | | | | | | | | | | |

| September 30, | | December 31, |

| | 2024 | | 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 119,494 | | | $ | 115,424 | |

| Restricted cash | 429 | | | 428 | |

Accounts receivable, net of allowance of $1,053 and $656, respectively | 66,996 | | | 119,430 | |

| Deferred contract costs, current | 16,637 | | | 17,934 | |

| Short-term investments | — | | | 9,826 | |

| Prepaid expenses and other | 25,190 | | | 25,647 | |

| Total current assets | 228,746 | | | 288,689 | |

| Long-term assets: | | | |

Property and equipment, net of accumulated depreciation and amortization of $20,794 and $18,231, respectively | 10,431 | | | 10,496 | |

| Operating lease right-of-use assets | 6,895 | | | 5,941 | |

| Deferred contract costs, noncurrent | 20,836 | | | 23,559 | |

| Deposits and other | 4,743 | | | 6,109 | |

| Deferred income taxes, net | 72,191 | | | 59,002 | |

| Total assets | $ | 343,842 | | | $ | 393,796 | |

| LIABILITIES, REDEEMABLE PREFERRED STOCK AND STOCKHOLDERS’ DEFICIT | | | |

| Current liabilities: | | | |

| Current maturities of long-term debt | $ | 3,093 | | | $ | 5,912 | |

| Accounts payable | 4,559 | | | 5,997 | |

| Accrued compensation, benefits and commissions | 33,867 | | | 38,961 | |

| Other accrued liabilities | 74,284 | | | 18,128 | |

| Operating lease liabilities, current | 4,384 | | | 4,321 | |

| Deferred revenue, current | 202,281 | | | 263,115 | |

| Total current liabilities | 322,468 | | | 336,434 | |

| Long-term liabilities: | | | |

| Long-term debt, net of current maturities | 67,959 | | | 64,228 | |

| Deferred revenue, noncurrent | 21,033 | | | 23,859 | |

| Operating lease liabilities, noncurrent | 6,806 | | | 6,841 | |

| Other long-term liabilities | 2,350 | | | 1,930 | |

| Total liabilities | 420,616 | | | 433,292 | |

Commitments and contingencies (Note 8) | | | |

| Stockholders’ deficit: | | | |

| | | |

Preferred stock; $0.0001 par value. Authorized 99,820 (excluding 180 shares of Series A Preferred Stock) no other series has been designated | — | | | — | |

Common stock; $0.0001 par value. Authorized 1,000,000 shares; issued and outstanding 90,841 and 89,595 shares, respectively | 9 | | | 9 | |

| Additional paid-in capital | 175,125 | | | 167,988 | |

| Accumulated other comprehensive loss | (5,651) | | | (4,167) | |

| Accumulated deficit | (245,141) | | | (202,210) | |

| Treasury stock, at cost | (1,116) | | | (1,116) | |

| Total stockholders' deficit | (76,774) | | | (39,496) | |

| Total liabilities and stockholders' deficit | $ | 343,842 | | | $ | 393,796 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

RIMINI STREET, INC.

Unaudited Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

(In thousands, except per share amounts) | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Revenue | $ | 104,672 | | | $ | 107,453 | | | $ | 314,540 | | | $ | 319,386 | | | | | |

| Cost of revenue | 41,135 | | | 40,110 | | | 126,230 | | | 118,802 | | | | | |

| Gross profit | 63,537 | | | 67,343 | | | 188,310 | | | 200,584 | | | | | |

| Operating expenses: | | | | | | | | | | | |

| Sales and marketing | 35,781 | | | 35,593 | | | 112,299 | | | 107,356 | | | | | |

| General and administrative | 16,528 | | | 18,384 | | | 54,460 | | | 55,475 | | | | | |

| Reorganization costs | 1,431 | | | — | | | 4,639 | | | 59 | | | | | |

| Litigation costs and related recoveries: | | | | | | | | | | | |

| Litigation expense | 58,512 | | | — | | | 58,512 | | | — | | | | | |

| Professional fees and other costs of litigation | 879 | | | 2,127 | | | 5,406 | | | 5,475 | | | | | |

Litigation costs and related recoveries, net | 59,391 | | | 2,127 | | | 63,918 | | | 5,475 | | | | | |

| Total operating expenses | 113,131 | | | 56,104 | | | 235,316 | | | 168,365 | | | | | |

| Operating income (loss) | (49,594) | | | 11,239 | | | (47,006) | | | 32,219 | | | | | |

| Non-operating income and (expenses): | | | | | | | | | | | |

| Interest expense | (1,577) | | | (1,413) | | | (4,401) | | | (4,139) | | | | | |

| Other income (expenses), net | (642) | | | 990 | | | 1,814 | | | 1,799 | | | | | |

| Income (loss) before income taxes | (51,813) | | | 10,816 | | | (49,593) | | | 29,879 | | | | | |

| Income taxes | 8,713 | | | (4,015) | | | 6,662 | | | (13,171) | | | | | |

| Net income (loss) | (43,100) | | | 6,801 | | | (42,931) | | | 16,708 | | | | | |

| Other comprehensive income | | | | | | | | | | | |

| Foreign currency translation gain (loss) | 1,555 | | | (1,061) | | | (9) | | | (1,011) | | | | | |

| Derivative instrument and other adjustments, net of tax | (1,284) | | | 140 | | | (1,475) | | | 302 | | | | | |

| Comprehensive income (loss) | $ | (42,829) | | | $ | 5,880 | | | $ | (44,415) | | | $ | 15,999 | | | | | |

| | | | | | | | | | | |

| Net income (loss) attributable to common stockholders | $ | (43,100) | | | $ | 6,801 | | | $ | (42,931) | | | $ | 16,708 | | | | | |

| | | | | | | | | | | |

| Net income (loss) per share attributable to common stockholders: | | | | | | | | | | | |

| Basic | $ | (0.47) | | | $ | 0.08 | | | $ | (0.48) | | | $ | 0.19 | | | | | |

| Diluted | $ | (0.47) | | | $ | 0.08 | | | $ | (0.48) | | | $ | 0.19 | | | | | |

| Weighted average number of shares of Common Stock outstanding: | | | | | | | | | | | |

| Basic | 90,776 | | | 89,228 | | | 90,343 | | | 88,942 | | | | | |

| Diluted | 90,776 | | | 89,357 | | | 90,343 | | | 89,322 | | | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

RIMINI STREET, INC.

Unaudited Condensed Consolidated Statements of Stockholders' Deficit

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Common Stock, Shares | | | | | | | |

| Beginning of period | 90,698 | | | 89,085 | | | 89,595 | | | 88,517 | |

| Exercise of stock options for cash | — | | | — | | | — | | | 57 | |

| Restricted stock units vested | 143 | | | 238 | | | 1,246 | | | 922 | |

| Issuance of Common Stock | — | | | — | | | — | | | 75 | |

| Retired shares of Common Stock | — | | | — | | | — | | | (248) | |

| End of period | 90,841 | | | 89,323 | | | 90,841 | | | 89,323 | |

| Total Stockholders' Deficit, beginning of period | $ | (36,119) | | | $ | (62,061) | | | $ | (39,496) | | | $ | (77,170) | |

| Common Stock, Amount | | | | | | | |

| Beginning of period | 9 | | | 9 | | | 9 | | | 9 | |

| Exercise of stock options for cash | — | | | — | | | — | | | — | |

| Restricted stock units vested | — | | | — | | | — | | | — | |

| Retired shares of Common Stock | — | | | — | | | — | | | — | |

| End of period | 9 | | | 9 | | | 9 | | | 9 | |

| Additional Paid-in Capital | | | | | | | |

| Beginning of period | 172,951 | | | 161,391 | | | 167,988 | | | 156,401 | |

| Stock based compensation expense | 2,174 | | | 3,131 | | | 7,137 | | | 9,056 | |

| Exercise of stock options for cash | — | | | — | | | — | | | 79 | |

| Restricted stock units vested | — | | | — | | | — | | | — | |

| Retired shares of Common Stock | — | | | — | | | — | | | (1,014) | |

| End of period | 175,125 | | | 164,522 | | | 175,125 | | | 164,522 | |

| Accumulated Other Comprehensive Loss | | | | | | | |

| Beginning of period | (5,922) | | | (3,983) | | | (4,167) | | | (4,195) | |

| Other comprehensive income (loss) | 271 | | | (921) | | | (1,484) | | | (709) | |

| End of period | (5,651) | | | (4,904) | | | (5,651) | | | (4,904) | |

| Accumulated Deficit | | | | | | | |

| Beginning of period | (202,041) | | | (218,362) | | | (202,210) | | | (228,269) | |

| Net income (loss) | (43,100) | | | 6,801 | | | (42,931) | | | 16,708 | |

| End of period | (245,141) | | | (211,561) | | | (245,141) | | | (211,561) | |

| Treasury Stock | (1,116) | | | (1,116) | | | (1,116) | | | (1,116) | |

| Total Stockholders' Deficit, end of period | $ | (76,774) | | | $ | (53,050) | | | $ | (76,774) | | | $ | (53,050) | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

RIMINI STREET, INC.

Unaudited Condensed Consolidated Statements of Cash Flows

(In thousands) | | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net income (loss) | $ | (42,931) | | | $ | 16,708 | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Stock-based compensation expense | 7,137 | | | 9,056 | |

| Depreciation and amortization | 2,650 | | | 2,001 | |

| Accretion and amortization of debt discount and issuance costs | 600 | | | 728 | |

| Deferred income taxes | (12,951) | | | 6,263 | |

| Amortization and accretion related to operating right of use assets | 3,359 | | | 3,347 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 51,058 | | | 54,112 | |

| Prepaid expenses, deposits and other | (196) | | | (4,339) | |

| Deferred contract costs | 4,020 | | | 674 | |

| Accounts payable | (1,390) | | | (2,551) | |

| Accrued compensation, benefits, commissions and other liabilities | 48,297 | | | (14,702) | |

| Deferred revenue | (60,822) | | | (57,684) | |

| Net cash provided by (used in) operating activities | (1,169) | | | 13,613 | |

| CASH FLOWS USED IN INVESTING ACTIVITIES: | | | |

| Capital expenditures | (2,698) | | | (3,654) | |

| Payment for purchases of investments | (7,458) | | | (24,118) | |

| Proceeds from maturities of investments | 10,948 | | | 23,614 | |

| Proceeds from sale of investments | 6,336 | | | — | |

| Net cash provided by (used in) investing activities | 7,128 | | | (4,158) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Proceeds from the 2024 Credit Facility | 2,938 | | | — | |

| Principal payments on the Original Credit Facility | (2,625) | | | (3,938) | |

| Payments to repurchase and retire Common Stock | — | | | (1,014) | |

| Principal payments on capital leases | (267) | | | (247) | |

| Proceeds from exercise of employee stock options | — | | | 79 | |

| Net cash provided by (used in) financing activities | 46 | | | (5,120) | |

| Effect of foreign currency translation changes | (1,934) | | | (5,109) | |

| Net change in cash, cash equivalents and restricted cash | 4,071 | | | (774) | |

| Cash, cash equivalents and restricted cash at beginning of period | 115,852 | | | 109,434 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 119,923 | | | $ | 108,660 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

RIMINI STREET, INC.

Unaudited Condensed Consolidated Statements of Cash Flows, Continued

(In thousands)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | |

| Cash paid for interest | $ | 3,789 | | | $ | 3,409 | |

| Cash paid for income taxes | 2,662 | | | 4,164 | |

| SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING ACTIVITIES: | | | |

| Increase in payables for capital expenditures | $ | 34 | | | $ | 669 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

RIMINI STREET, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 — NATURE OF BUSINESS AND BASIS OF PRESENTATION

Nature of Business

Rimini Street, Inc. (the “Company”) is a global provider of end-to-end enterprise software support, products and services. The Company offers a comprehensive family of unified solutions to run, manage, support, customize, configure, connect, protect, monitor, and optimize clients’ enterprise application, database, and technology software platforms.

Basis of Presentation and Consolidation

The Unaudited Condensed Consolidated Financial Statements, which include the accounts of the Company and its wholly-owned subsidiaries, are prepared in conformity with generally accepted accounting principles in the United States of America (“U.S. GAAP”). All significant intercompany balances and transactions have been eliminated. The accompanying Unaudited Condensed Consolidated Financial Statements have been prepared by the Company pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”) regarding interim financial reporting. Accordingly, certain information and footnote disclosures required by U.S. GAAP for complete financial statements have been condensed or omitted in accordance with such rules and regulations. In the opinion of management, all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation of the Unaudited Condensed Consolidated Financial Statements have been included. These Unaudited Condensed Consolidated Financial Statements should be read in conjunction with the Company’s Audited Consolidated Financial Statements for the year ended December 31, 2023, included in the Company’s 2023 Annual Report on Form 10-K as filed with the SEC on February 28, 2024 (the “2023 Form 10-K”).

The accompanying Unaudited Condensed Consolidated Balance Sheet and related disclosures as of December 31, 2023 have been derived from the Company’s audited financial statements. The Company’s financial condition as of September 30, 2024, and operating results for the three and nine months ended September 30, 2024, are not necessarily indicative of the financial condition and results of operations that may be expected for any future interim period or for the year ending December 31, 2024.

NOTE 2 — LIQUIDITY AND SIGNIFICANT ACCOUNTING POLICIES

Liquidity

As of September 30, 2024, the Company’s current liabilities exceeded its current assets by $93.7 million, and the Company recorded a net loss of $43.1 million for the three months ended September 30, 2024. This was a result of the Company accruing a $58.5 million liability for Oracle’s attorneys’ fees and costs. See Note 8 for further information regarding this accrual.

As of September 30, 2024, the Company had available cash, cash equivalents and restricted cash of $119.9 million. As of September 30, 2024, the Company’s current liabilities included $202.3 million of deferred revenue whereby the costs of fulfilling the Company's commitments to provide services to its clients was approximately 39% of the related deferred revenue for the three months ended September 30, 2024.

On April 30, 2024, the Company amended its $90 million five-year term loan (the “Original Credit Facility”) into a new five-year term loan of $75 million (the “2024 Credit Facility,” and together with the Original Credit Facility, the “Credit Facilities”). Annual minimum principal payments over the five-year term for the 2024 Credit Facility are 5%, 5%, 7.5%, 7.5% and 10%, respectively, with the remaining balance due at the end of the term. See Note 5 for further information regarding the Company's 2024 Credit Facility and the Original Credit Facility.

Additionally, the Company is obligated to make operating and financing lease payments that are due within the next 12 months in the aggregate amount of $1.9 million. During the three months ended September 30, 2024, the global economy continued to experience interest rate and inflationary pressures, geopolitical conflicts, global supply chain issues, a rise in energy prices and the continuing effects of fiscal and monetary policies adopted by governments. Assuming the Company’s ability to operate continues not to be significantly adversely impacted by the related changes in the macroeconomic environment, geopolitical pressures, or the litigation matters described in Note 8, the Company believes that current cash, cash equivalents, restricted cash, and future cash flow from operating activities will be sufficient to meet the Company’s anticipated cash needs, including 2024 Credit Facility repayments, working capital needs, capital expenditures and other contractual obligations for at least 12 months from the issuance date of these financial statements.

RIMINI STREET, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Use of Estimates

The preparation of financial statements and related disclosures in conformity with U.S. GAAP requires the Company to make judgments, assumptions, and estimates that affect the amounts reported in its consolidated financial statements and accompanying notes. The Company bases its estimates and assumptions on current facts, historical experience, and various other factors that it believes are reasonable under the circumstances to determine the carrying values of assets and liabilities that are not readily apparent from other sources. The Company’s accounting estimates include, but are not necessarily limited to, valuation of accounts receivable, valuation assumptions for stock options and leases, deferred income taxes and the related valuation allowances, and the evaluation and measurement of contingencies. To the extent there are material differences between the Company’s estimates and actual results, the Company’s future consolidated results of operations may be affected.

Recent Accounting Pronouncements

Recently Adopted Standards. The following accounting standards will be adopted during fiscal year 2024:

In November 2023, the FASB issued ASU 2023-07, “Segment Reporting - Improvements to Reportable Segment Disclosures.” The guidance expands annual and interim disclosure requirements for reportable segments, primarily through enhanced disclosures about significant segment expenses. ASU 2023-07 is effective for annual periods beginning after December 15, 2023 and interim periods within fiscal years beginning after December 15, 2024. The Company will be adopting this guidance for the year ending December 31, 2024 and is still assessing the impact on the disclosures to its Consolidated Financial Statements.

NOTE 3 - DEFERRED CONTRACT COSTS AND DEFERRED REVENUE

Activity for deferred contract costs consisted of the following (in thousands): | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Deferred contract costs, current and noncurrent, as of the beginning of period | $ | 37,307 | | | $ | 40,106 | | | $ | 41,493 | | | $ | 40,726 | |

| Capitalized commissions during the period | 5,015 | | | 4,913 | | | 10,753 | | | 13,630 | |

| Amortized deferred contract costs during the period | (4,849) | | | (4,966) | | | (14,773) | | | (14,303) | |

| Deferred contract costs, current and noncurrent, as of the end of period | $ | 37,473 | | | $ | 40,053 | | | $ | 37,473 | | | $ | 40,053 | |

Deferred revenue activity consisted of the following (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Deferred revenue, current and noncurrent, as of the beginning of period | $ | 262,793 | | | $ | 285,324 | | | $ | 286,974 | | | $ | 299,921 | |

| Billings, net | 65,193 | | | 60,528 | | | 250,880 | | | 257,864 | |

| Revenue recognized | (104,672) | | | (107,453) | | | (314,540) | | | (319,386) | |

| Deferred revenue, current and noncurrent, as of the end of period | $ | 223,314 | | | $ | 238,399 | | | $ | 223,314 | | | $ | 238,399 | |

The Company’s remaining performance obligations represent all future non-cancellable revenue under contract that has not yet been recognized as revenue and includes deferred revenue and unbilled amounts. As of September 30, 2024, remaining performance obligations amounted to $574.6 million, of which $223.3 million was billed and recorded as deferred revenue. As of September 30, 2023, remaining performance obligations amounted to $550.1 million, of which $238.4 million was billed and recorded as deferred revenue.

Deferred revenue is a contract liability that consists of billings issued that are non-cancellable and payments received in advance of revenue recognition. The Company typically invoices its customers at the beginning of the contract term, in annual and multi-year installments. Deferred revenue is recognized as the Company satisfies its performance obligations over the term

RIMINI STREET, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

of the contracted service period. The Company expects to recognize revenue on approximately $202.3 million of deferred revenue over the next 12 months, with the remaining deferred revenue balance recognized thereafter.

NOTE 4 — OTHER FINANCIAL INFORMATION

Other Accrued Liabilities, including Accrued Reorganization Costs

Other accrued liabilities consisted of the following (in thousands):

| | | | | | | | | | | |

| September 30, | | December 31, |

| | 2024 | | 2023 |

| Accrued sales and other taxes | $ | 5,295 | | | $ | 7,963 | |

| Accrued professional fees | 3,187 | | | 3,551 | |

| Accrued reorganization costs | 697 | | | — | |

| Current maturities of capital lease obligations | 382 | | | 360 | |

| Income taxes payable | 910 | | | 1,771 | |

| Accrued litigation costs | 58,845 | | | 82 | |

| Other accrued expenses | 4,968 | | | 4,401 | |

| Total other accrued liabilities | $ | 74,284 | | | $ | 18,128 | |

During the second quarter of 2024, the Company began a process to optimize its cost structure. The reorganization activity consisted of the following (in thousands):

| | | | | |

| Nine Months Ended September 30, |

| 2024 |

| Accrued reorganization costs, as of the beginning of period | $ | — | |

| Charges | 4,639 | |

| Cash Payments | (3,945) | |

| Foreign currency impact | 3 | |

| Accrued reorganization costs, as of the end of period | $ | 697 | |

NOTE 5 — DEBT

Debt is presented net of debt discounts and issuance costs in the Company's balance sheets and consisted of the following (in thousands):

| | | | | | | | | | | | | | |

| | September 30, | | December 31, |

| | 2024 | | 2023 |

| Credit Facilities | | $ | 71,052 | | | $ | 70,140 | |

| Less current maturities | | (3,093) | | | (5,912) | |

| Long-term debt, net of current maturities | | $ | 67,959 | | | $ | 64,228 | |

For the three and nine months ended September 30, 2024, the Company made principal payments under the Credit Facilities totaling $0.9 million and $2.6 million, respectively. For the three and nine months ended September 30, 2023, the Company made quarterly principal payments under the Original Credit Facility totaling $1.7 million and $3.9 million, respectively.

On April 30, 2024, the Company refinanced its Original Credit Facility, which had an outstanding principal balance of $70.9 million, with the 2024 Credit Facility, a new five-year senior secured credit facility consisting of a $75.0 million term loan and a $35.0 million revolving line of credit. For the term loan, the Company has a choice of interest rates between (a) the Secured Overnight Financing Rate (“SOFR”) and (b) a Base Rate (as defined in the 2024 Credit Facility), in each case plus an

RIMINI STREET, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

applicable margin. The applicable margin is based on the Company’s Consolidated Total Leverage Ratio (as defined in the 2024 Credit Facility) and whether the Company elects SOFR (ranging from 2.75% to 3.5%) or Base Rate (ranging from 1.75% to 2.5%). The revolving line of credit bears interest on the unused portion of the credit line at rates of 25 to 40 basis points, depending on the Company’s Consolidated Total Leverage Ratio. Annual minimum principal payments over the five-year term for the 2024 Credit Facility are 5%, 5%, 7.5%, 7.5%, and 10%, respectively, with the remaining balance due at the end of the term.

The refinancing was accounted for as a debt modification under ASC 470-50 as the terms of the 2024 Credit Facility were not substantially different than the terms of the Original Credit Facility. Under debt modification accounting, third party costs are expensed as incurred. During the nine months ended September 30, 2024, the Company expensed $0.2 million in third party transaction costs in connection with the modification. Fees paid to the creditor of $1.1 million were included with the remaining unamortized discount from the Original Credit Facility and are being amortized as an adjustment to interest expense over the remaining term of the 2024 Credit Facility.

Pursuant to a Guaranty and Security Agreement, dated April 30, 2024, among the Credit Parties (as defined in the 2024 Credit Facility) and Capital One, National Association, as agent (the “2024 Guaranty and Security Agreement”), the obligations under the 2024 Credit Facility are guaranteed by certain of the Company’s subsidiaries and are secured, subject to customary permitted liens and exceptions, by a lien on substantially all assets of the Credit Parties.

The 2024 Credit Facility contains certain financial covenants, including a minimum fixed charge coverage ratio greater than 1.25, a total leverage ratio less than 3.75, and a minimum liquidity balance of at least $20 million in U.S. cash.

In February 2023, the Company amended its Original Credit Facility. The amendment implemented, among other things, certain changes in the reference rate from the London Interbank Offered Rate (“LIBOR”) to SOFR. As of February 28, 2023, the Company had a choice of interest rates between (a) Adjusted Term SOFR and (b) Base Rate (as defined in the Original Credit Facility), in each case plus an applicable margin. The applicable margin was based on the Company’s Consolidated Leverage Ratio (as defined in the Original Credit Facility) and whether the Company elected Adjusted Term SOFR (ranging from 1.75 to 2.50%) or Base Rate (ranging from 0.75 to 1.50%).

For the three months ended September 30, 2024 and 2023, the average interest rate under both the 2024 Credit Facility and the Original Credit Facility was 8.1% and 7.1%, respectively. For the nine months ended September 30, 2024 and 2023, the average interest rate under both the 2024 Credit Facility and the Original Credit Facility was 7.7% and 6.8%, respectively.

The fair value of the 2024 Credit Facility was $75.0 million (Level 2 inputs) as of September 30, 2024 compared to the carrying value of $71.1 million as of September 30, 2024. The fair value of the Original Credit Facility was $73.1 million (Level 2 inputs) as of December 31, 2023 compared to the carrying value of $72.3 million as of December 31, 2023.

Effective April 30, 2024, the Company’s interest rate swap agreement was amended in connection with the 2024 Credit Facility to match the new five-year term. The new interest rate swap agreement has a notional value of $40.0 million, with a fixed payer SOFR rate of 3.71% and an initial floating SOFR rate of 5.32%. The floating rate is reset at each month end and the term of the interest rate swap agreement coincides with that of the 2024 Credit Facility. See Note 11 for further information regarding the fair value accounting for the interest rate swap agreement. The modification of the interest rate swap agreement did not have a material impact on the Company’s Unaudited Condensed Consolidated Financial Statements.

Under the 2024 Credit Facility, the Company has $35.0 million in available borrowings under the revolving line of credit as of September 30, 2024. There were no borrowings under the revolving line of credit during the three months ended September 30, 2024.

Interest Expense

The components of interest expense are presented below (in thousands):

RIMINI STREET, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Credit Facilities: | | | | | | | |

| Interest expense | $ | 1,378 | | | $ | 1,147 | | | $ | 3,723 | | | $ | 3,351 | |

| Accretion expense related to discount and issuance costs | 166 | | | 245 | | | 600 | | | 728 | |

| Interest on finance leases and other | 33 | | | 21 | | | 78 | | | 60 | |

| $ | 1,577 | | | $ | 1,413 | | | $ | 4,401 | | | $ | 4,139 | |

For both the three months ended September 30, 2024 and 2023, interest expense included a reduction related to interest rate swap payments received of $0.2 million, respectively.

For both the nine months ended September 30, 2024 and 2023, interest expense included a reduction related to the interest rate swap payments received of $0.6 million, respectively.

NOTE 6 — COMMON STOCK OFFERING, RESTRICTED STOCK UNITS, STOCK OPTIONS AND WARRANTS

Common Stock Retired

During the three and nine months ended September 30, 2024, the Company did not acquire any shares of its Common Stock. During the three and nine months ended September 30, 2023, the Company acquired 0.2 million shares of its Common Stock at a cost of $1.0 million. Upon completion of all repurchase transactions, the associated shares of Common Stock were retired.

Stock Plans

The Company’s stock plans consist of the 2007 Stock Plan (the “2007 Plan”) and the 2013 Equity Incentive Plan, as amended and restated in July 2017 (the “2013 Plan”). The 2007 Plan and the 2013 Plan are collectively referred to as the “Stock Plans”. On February 23, 2024, pursuant to the “evergreen” provisions of the 2013 Plan, the Board of Directors authorized an increase of approximately 3.6 million shares available for grant under the 2013 Plan.

On May 3, 2024, the Company’s Board of Directors, approved the Company’s 2024 Long-Term Incentive Plan (the “2024 LTI Plan”), consisting of awards of performance units (“PSUs”), restricted stock units (“RSUs”) and stock options to purchase shares of the Company’s Common Stock under the terms of the Company’s 2013 Plan, as amended, effective May 6, 2024.

On March 31, 2023, the Company’s Board of Directors, approved the Company’s 2023 Long-Term Incentive Plan (the “2023 LTI Plan”), consisting of awards of PSUs, RSUs and stock options to purchase shares of the Company’s Common Stock under the terms of the Company’s 2013 Plan, as amended, effective April 3, 2023.

For additional information about the Stock Plans, please refer to Note 8 to the Company’s Consolidated Financial Statements for the year ended December 31, 2023, included in Part II, Item 8 of the 2023 Form 10-K. The information presented below provides an update for activity under the Stock Plans for the three and nine months ended September 30, 2024.

Performance Units

Under the 2024 LTI Plan, the Company granted PSUs which will be measured over a performance period beginning on January 1, 2024 and ending on December 31, 2024 (the “Performance Period”), but will remain subject to a continued service-based vesting requirement. Half of the PSUs awarded are eligible to vest based on the Company’s achievement against a target adjusted EBITDA goal for fiscal year 2024, and the remaining half of the PSUs awarded will be eligible to vest based on the Company’s achievement against a target total revenue goal for fiscal year 2024. The ultimate number of PSUs that may vest (as calculated, the “Earned PSUs”) range from zero to 200% of the granted PSUs. On May 6, 2024, the Company granted 0.8 million PSUs at a grant price of $2.47.

The Earned PSUs under the April 3, 2023 grant were earned at 151%. Under the terms of the 2023 LTI Plan, the Earned PSUs will vest in equal annual installments on the first, second and third anniversaries of the Date of Grant, generally subject to the awardee continuing to be a Service Provider through the applicable vesting date.

RIMINI STREET, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The Company recognized compensation expense related to PSUs of $0.2 million and $0.4 million for the three months ended September 30, 2024 and 2023, respectively. For the nine months ended September 30, 2024 and 2023, the Company recognized expense of $1.0 million and $0.7 million, respectively. As of September 30, 2024, the unrecognized expense of $0.8 million net of forfeitures is expected to be charged to expense on a graded basis as the PSUs vest over a weighted-average period of approximately 1.5 years.

Restricted Stock Units

For the nine months ended September 30, 2024, the Board of Directors granted RSUs under the 2013 Plan to employees for an aggregate of approximately 1.7 million shares of Common Stock. RSU grants vest over periods generally ranging from 12 to 36 months from the respective grant dates and the awards are subject to forfeiture upon termination of employment or service on the Board of Directors, as applicable. Based on the weighted average fair market value of the Common Stock on the date of grant of $2.63 per share, the aggregate fair value for the shares underlying the RSUs amounted to $4.5 million as of the grant date that will be recognized as compensation cost over the vesting period.

For the three months ended September 30, 2024 and 2023, the Company recognized compensation expense related to RSUs of approximately $1.3 million and $1.8 million, respectively. For the nine months ended September 30, 2024 and 2023, the Company recognized compensation expense related to RSUs of approximately $3.8 million and $5.7 million, respectively. As of September 30, 2024, the unrecognized expense of $4.7 million net of forfeitures is expected to be charged to expense on a straight-line basis as the RSUs vest over a weighted-average period of approximately 1.7 years.

Stock Options

For the nine months ended September 30, 2024, the Board of Directors granted stock options for the purchase of an aggregate of approximately 0.9 million shares of Common Stock at exercise prices that were equal to the fair market value of the Common Stock on the date of grant. Options granted to employees generally vest as to one-third of the shares subject to the award on each anniversary of the designated vesting commencement date, which may precede the grant date of such award, and expire ten years after the grant date.

The following table sets forth a summary of stock option activity under the Stock Plans for the nine months ended September 30, 2024 (shares in thousands): | | | | | | | | | | | | | | | | | |

| | Shares | | Price (1) | | Term (2) |

| Outstanding, December 31, 2023 | 7,800 | | | $ | 5.77 | | | 5.9 |

| Granted | 877 | | | 2.59 | | | |

| Forfeited | (331) | | | 4.82 | | | |

| Expired | (1,000) | | | 5.91 | | | |

| Outstanding, September 30, 2024 (3)(4) | 7,346 | | | 5.41 | | | 6.0 |

| Vested, September 30, 2024 (3) | 4,820 | | | 6.20 | | | 4.6 |

(1)Represents the weighted average exercise price.

(2)Represents the weighted average remaining contractual term until the stock options expire in years.

(3)As of September 30, 2024, the aggregate intrinsic value of all stock options outstanding was $3 thousand. As of September 30, 2024, there was no aggregate intrinsic value related to the vested stock options.

(4)The number of outstanding stock options that are not expected to ultimately vest due to forfeiture amounted to 0.3 million shares as of September 30, 2024.

The aggregate fair value of approximately 0.9 million stock options granted for the nine months ended September 30, 2024 amounted to $1.4 million, or $1.61 per stock option as of the grant date utilizing the Black-Scholes-Merton (“BSM”) method. The fair valued derived under the BSM method will result in the recognition of compensation cost over the vesting period of the stock options. For the nine months ended September 30, 2024, the fair value of each stock option grant under the Stock Plans was estimated on the date of grant using the BSM option-pricing model, with the following weighted-average assumptions:

RIMINI STREET, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| | | | | |

| Expected life (in years) | 6.0 |

| Volatility | 64% |

| Dividend yield | 0% |

| Risk-free interest rate | 4.34% |

| Fair value per share of Common Stock on date of grant | $2.59 |

As of September 30, 2024 and December 31, 2023, total unrecognized compensation costs related to unvested stock options, net of estimated forfeitures, was $3.1 million and $4.6 million, respectively. As of September 30, 2024, the unrecognized costs are expected to be charged to expense on a straight-line basis over a weighted-average vesting period of approximately 1.7 years.

Shares Available for Grant

The following table presents activity affecting the total number of shares available for grant under the 2013 Plan for the nine months ended September 30, 2024 (in thousands):

| | | | | |

| Available, December 31, 2023 | 8,481 | |

| Newly authorized by Board of Directors | 3,584 | |

| Stock options granted | (877) | |

| RSUs and PSUs granted | (2,815) | |

| Expired options under Stock Plans | 1,000 | |

| Forfeited options under Stock Plans | 331 | |

| Forfeited RSUs and PSUs under Stock Plans | 397 | |

| Available, September 30, 2024 | 10,101 | |

Stock-Based Compensation Expense

Stock-based compensation expense attributable to PSUs, RSUs and stock options is classified as follows (in thousands): | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenue | $ | 373 | | | $ | 503 | | | $ | 1,348 | | | $ | 1,423 | |

| Sales and marketing | 566 | | | 817 | | | 1,546 | | | 2,067 | |

| General and administrative | 1,235 | | | 1,811 | | | 4,243 | | | 5,566 | |

| Total | $ | 2,174 | | | $ | 3,131 | | | $ | 7,137 | | | $ | 9,056 | |

Warrants

As of September 30, 2024, warrants were outstanding for an aggregate of 3.4 million shares of Common Stock exercisable at $5.64 per share. For additional information about these warrants, please refer to Note 8 to the Company’s Consolidated Financial Statements for the year ended December 31, 2023, included in Part II, Item 8 of the 2023 Form 10-K.

NOTE 7 — INCOME TAXES

For the three months ended September 30, 2024 and 2023, the Company’s effective tax rate was 16.8% and 37.1%, respectively. For the nine months ended September 30, 2024 and 2023, the Company’s effective tax rate was 13.4% and 44.1%, respectively. The Company’s income tax benefit (expense) was attributable to the income (loss) before income taxes, which was offset, in part, to earnings in the foreign jurisdictions subject to income taxes and foreign withholding taxes. The Company did not have any material changes to its conclusions regarding valuation allowances for deferred income tax assets or uncertain tax positions for the three and nine months ended September 30, 2024 and 2023.

RIMINI STREET, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For additional information about income taxes, please refer to Note 9 to the Company’s Consolidated Financial Statements for the year ended December 31, 2023, included in Part II, Item 8 of the 2023 Form 10-K.

NOTE 8 — COMMITMENTS AND CONTINGENCIES

Purchase Commitments

The Company’s purchase commitments as of September 30, 2024 are primarily related to agreements to purchase services in the ordinary course of business. During the three months ended September 30, 2024, the Company executed an agreement associated with an existing supplier that increased the Company’s minimum purchase obligations by $1.5 million through September 2027. As of September 30, 2024, the total minimum purchase obligations totaled $10.8 million. There have been no other material changes outside the normal course of business to the Company’s non-cancellable purchases commitments. For additional information, please refer to Note 10 to the Company’s Consolidated Financial Statements for the year ended December 31, 2023, included in Part II, Item 8 of the 2023 Form 10-K.

Retirement Plan

The Company has defined contribution plans for both its U.S. and foreign employees. For certain of these plans, employees may contribute up to the statutory maximum, which is set by law each year. The plans also provide for employer contributions. For the three months ended September 30, 2024 and 2023, the Company’s matching contributions to these plans totaled $0.8 million and $1.0 million, respectively. For the nine months ended September 30, 2024 and 2023, the Company’s matching contributions to these plans totaled $2.7 million and $2.6 million, respectively.

Rimini I Litigation

In January 2010, certain subsidiaries of Oracle Corporation (together with its subsidiaries individually and collectively, “Oracle”) filed a lawsuit, Oracle USA, Inc. et al. v. Rimini Street, Inc. et al. (United States District Court for the District of Nevada) (the “District Court”) (“Rimini I”), against the Company and its Chief Executive Officer, Chairman of the Board and President, Seth Ravin, alleging that certain of the Company’s processes (Process 1.0) violated Oracle’s license agreements with its customers and that the Company committed acts of copyright infringement and violated other federal and state laws. The litigation involved the Company’s business processes and the manner in which the Company provided services to its clients.

After completion of a jury trial in 2015 and subsequent appeals, the final outcome of Rimini I was that Mr. Ravin was found not liable for any claims and the Company was found liable for only one claim: “innocent infringement,” a jury finding that the Company did not know and had no reason to know that its former support processes were infringing. The jury also found that the infringement did not cause Oracle to suffer lost profits. The Company was ordered to pay a judgment of $124.4 million in 2016, which the Company promptly paid and then pursued appeals. With interest, attorneys’ fees and costs, the total judgment paid by the Company to Oracle after the completion of all appeals was approximately $89.9 million. A portion of such judgment was paid by the Company’s insurance carriers.

Rimini I Injunction Proceedings

Since November 2018, the Company has been subject to a permanent injunction (the “Rimini I Injunction”) prohibiting it from using certain support processes that had been found in Rimini I to “innocently” infringe certain Oracle copyrights. The Rimini I Injunction does not prohibit the Company’s provision of support services for any Oracle product lines, but rather defines the manner in which the Company can provide support services for certain Oracle product lines.

In July 2020, Oracle filed a motion to show cause with the District Court contending that the Company was in violation of the Rimini I Injunction, and the Company opposed this motion, disputing Oracle’s claims. After completion of an evidentiary hearing in September 2021, findings and order by the District Court in January 2022 and a subsequent appeal by the Company to the Ninth Circuit Court of Appeals (“Court of Appeals”), the final outcome of the proceedings, which were resolved in October 2023 on remand to the District Court, was a finding that the Company had violated the Rimini I Injunction in four instances, entitling Oracle to $0.5 million in sanctions (representing a $0.1 million adjustment to the $0.6 million sanctions award originally paid by the Company to Oracle in January 2022). In addition, the Company complied with the District Court’s January 2022 order to quarantine certain computer files and provide proof of such quarantining to Oracle. Oracle reimbursed the Company $0.1 million in November 2023 for the portion of the sanctions award that was reduced on appeal.

RIMINI STREET, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

In its January 2022 findings and order, the District Court also ruled that Oracle could recover its reasonable attorneys’ fees and costs relating to the Rimini I Injunction Proceedings. In December 2023, the District Court accepted a joint stipulation between Oracle and the Company (the “Stipulation”) resolving the issue of Oracle’s recovery of attorneys’ fees and costs upon the Company’s payment of approximately $9.7 million to Oracle. Also per the Stipulation, the Company agreed that it would forego any remaining appellate rights with respect to this matter.

As a result of the Stipulation and the subsequent payment by the Company of the amount described above, all matters relating to the Rimini I Injunction Proceedings have been resolved. At this time, the Company believes that it is in substantial compliance with the Rimini I Injunction.

Rimini II Litigation

In October 2014, the Company filed a separate lawsuit, Rimini Street Inc. v. Oracle Int’l Corp., in the District Court against Oracle seeking a declaratory judgment that the Company’s revised “Process 2.0” support practices, in use since at least July 2014, did not infringe certain Oracle copyrights (“Rimini II”). The Company’s operative complaint asserted declaratory judgment, tort, and statutory claims, including a request for injunctive relief against Oracle for unfair competition in violation of the California Unfair Competition Law. Oracle asserted counterclaims including copyright infringement claims, violations of the Digital Millennium Copyright Act (“DMCA”) and Lanham Act, breach of contract and business tort violations with respect to PeopleSoft and other Oracle-branded products, including J.D. Edwards, Siebel, Oracle Database and Oracle E-Business Suite (“EBS”).

In October 2022, Oracle withdrew all of its monetary damages claims against the Company and the Company’s Chief Executive Officer, Chairman of the Board and President, Mr. Ravin, in Rimini II and moved to proceed with a bench trial instead of a jury trial for its claims for equitable relief.

The District Court entered an order on October 24, 2022, dismissing with prejudice Oracle’s claims in Rimini II “for monetary relief of any kind under any legal theory[,] including but not limited to claims for damages, restitution, unjust enrichment, and engorgement. . . .” In addition, Oracle’s claims for breach of contract, inducing breach of contract and an accounting, were dismissed with prejudice, meaning that the claims (including for monetary damages) were dismissed on their merits and the judgment rendered is final. Prior to the date of the District Court’s order dismissing with prejudice all of Oracle’s claims for monetary relief, no damages of any kind were awarded by the District Court in Rimini II. The parties each reserved the right to seek or object to any attorneys’ fees and/or costs to the extent permissible by law.

In July 2023, the District Court issued its findings of fact and conclusions of law in Rimini II, accompanied by a permanent injunction against the Company (the “Rimini II Injunction”) which is subject to an administrative stay and is not currently effective. The District Court found infringement as to Oracle’s PeopleSoft and Oracle Database products but did not find infringement as to Oracle’s EBS, Siebel and J.D. Edwards products, further ordering that the Company was entitled to a declaration of non-infringement for Oracle’s EBS product. The District Court also found in favor of Oracle on its DMCA and Lanham Act claims, enjoining the Company from making certain statements and prohibiting certain actions in connection with the manner of marketing, selling and providing services to clients of the Oracle products in question as further described below, and on indirect and vicarious copyright infringement claims against the Company’s Chief Executive Officer, Chairman of the Board and President, Mr. Ravin. The District Court denied the Company’s California Unfair Competition Law claim and other declaratory judgment claims.

In July 2023, the Company filed a notice of appeal in the District Court, commencing an appeal of the District Court’s July 2023 Rimini II judgment and Injunction and filed an emergency motion with the District Court to stay enforcement of the Rimini II Injunction pending the Company’s appeal of the Rimini II judgment and Injunction.

In August 2023, the District Court issued an order denying the Company’s emergency motion to stay the Rimini II Injunction pending the Company’s appeal with the Court of Appeals, but it granted an administrative stay of the Rimini II Injunction pending the outcome of a motion to stay to be filed by the Company with the Court of Appeals. Shortly thereafter, the Company filed the separate motion to stay the Rimini II Injunction with the Court of Appeals, asserting that certain provisions of the Rimini II Injunction are vague and overbroad, that the District Court committed legal error, that certain provisions would require the Company to commit criminal acts to comply with its terms, and that the Rimini II Injunction would cause the Company and third parties “irreparable harm,” among other grounds.

RIMINI STREET, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

In September 2023, the Court of Appeals issued an order holding the Company’s appeal of the District Court’s decision in Rimini II in abeyance pending the District Court’s resolution of a motion filed by Oracle in August 2023 to amend the Rimini II judgment pertaining to an update, technical specification and tool related to Oracle’s EBS software product. The District Court denied Oracle’s motion to amend on January 9, 2024.

On January 18, 2024, the Ninth Circuit issued an order lifting the stay of the Company’s appeal.

On June 5, 2024, a three-judge panel of the Ninth Circuit heard oral argument on the Company’s appeal. As of the date of this Report, a decision on the Company’s appeal remains pending.

Also as of the date of this Report, the Court of Appeals has not issued a decision on the Company’s motion to stay the Rimini II Injunction. Accordingly, the Rimini II Injunction, as issued by the District Court, is currently stayed by the District Court, meaning that it is not currently effective. The Rimini II Injunction is primarily directed at Oracle’s PeopleSoft software product and, if effective, would limit, but not fully prohibit, the support services the Company can provide its clients using Oracle’s PeopleSoft software product.

Among other things, the Rimini II Injunction requires the Company to immediately and permanently delete certain PeopleSoft software environments, files and updates identified in the Rimini II Injunction, as well as to delete and immediately and permanently discontinue use of certain Company-created automated tools. The Rimini II Injunction also prohibits using, distributing, copying, or making derivative works from certain files, and it prohibits the transfer or copying of PeopleSoft files, updates, and modifications, and portions of PeopleSoft software that are developed, tested, or exist in one client’s systems to the Company’s systems or another client’s systems.

The Rimini II Injunction also specifies that the Company shall not remove, alter or omit any Oracle copyright notices or other Oracle copyright management information from any file that contains an Oracle copyright notice and prohibits the Company from publicly making statements or statements substantially similar to those the District Court found to be “false and misleading,” which are listed in the Rimini II Injunction.

While the Company plans to continue to vigorously pursue a stay of the Rimini II Injunction pending appeal and its appeal of the Rimini II judgment and Injunction, it is unable to predict the timing or outcome of these matters. No assurance is or can be given that the Company will succeed in its efforts to stay the Rimini II Injunction in full or in part pending appeal or prevail in all or part of its Rimini II appeal.

There were no monetary damages included in the District Court’s judgment in Rimini II.

In November 2023, Oracle filed a motion with the District Court requesting attorneys’ fees and costs of approximately $70.6 million relating to the Rimini II litigation. The Company filed its opposition to Oracle’s motion in February 2024. In its opposition, the Company argued that the District Court should deny Oracle’s motion in its entirety. The Company further argued that, should the District Court award any attorneys’ fees to Oracle, such fees should not have exceeded $14.5 million. Following Oracle’s filing of a reply brief in March 2024, the matter was under consideration for determination by the District Court. On September 23, 2024, the District Court issued its order on Oracle’s motion for attorneys’ fees and costs, granting in part the motion and denying in part the motion. The District Court awarded Oracle $58.2 million in attorneys’ fees and $0.3 million in costs. As of September 30, 2024, the Company accrued $58.5 million related to this matter and paid Oracle in full on October 22, 2024. On September 24, 2024, the Company filed a notice of appeal in the District Court, commencing an appeal of the District Court’s award of attorneys’ fees and costs to Oracle. As of the date of this Report, the Company’s appeal remains pending. The Company’s opening brief is due on January 21, 2025, and Oracle’s answering brief is due February 20, 2025. The Company’s optional reply brief is due 21 days after Oracle files its answering brief.

While the Company plans to continue to vigorously pursue its appeal of the District Court’s award of attorneys’ fees and costs to Oracle in the Rimini II litigation, it is unable to predict the timing or outcome of this matter. No assurance is or can be given that the Company will prevail in its appeal.

If the Rimini II Injunction becomes effective in its current form, it would impact the Company’s delivery of PeopleSoft support services to clients in the future, as well as potentially impact the Company’s previously announced plans to wind down the offering of services for Oracle PeopleSoft products. However, the associated costs are not currently estimable and are required to be recorded when incurred. Accordingly, the Company has made no accrual as of September 30, 2024. Any required changes to how support services are delivered to the Company’s PeopleSoft clients could have a material adverse impact on the

RIMINI STREET, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Company’s financial position, results of operations and cash flows. The percentage of revenue derived from services the Company provides solely for Oracle’s PeopleSoft software product was approximately 8% of the Company’s total revenue for the three and nine months ended September 30, 2024.

The Company reserves all rights, including appellate rights, with respect to the District Court’s rulings in Rimini II and the Rimini II Injunction, including the award of attorneys’ fees and costs to Oracle.

Other Litigation

From time to time, the Company may be a party to litigation and subject to claims incident to the ordinary course of business. Although the results of litigation and claims cannot be predicted with certainty, the Company currently believes that the final outcome of these ordinary course matters will not have a material adverse effect on its business. Regardless of the outcome, litigation can have an adverse impact on the Company because of judgment, defense and settlement costs, diversion of management resources and other factors. At each reporting period, the Company evaluates whether or not a potential loss amount or a potential range of loss is probable and reasonably estimable under ASC 450, Contingencies. Legal fees are expensed as incurred.

Liquidated Damages

The Company enters into agreements with clients that contain provisions related to liquidated damages that would be triggered in the event that the Company is no longer able to provide services to these clients. The maximum cash payments related to these liquidated damages is approximately $8.7 million and $9.3 million as of September 30, 2024 and December 31, 2023, respectively. To date, the Company has not incurred any costs as a result of such provisions and has not accrued any liabilities related to such provisions in these Unaudited Condensed Consolidated Financial Statements.

NOTE 9 — RELATED PARTY TRANSACTIONS

An affiliate of Adams Street Partners and its affiliates (collectively referred to as “ASP”) is a member of the Company’s Board of Directors. As of September 30, 2024, ASP owned approximately 25.9% of the Company’s issued and outstanding shares of Common Stock.

NOTE 10 —EARNINGS PER SHARE

The Company computes earnings per share in accordance with ASC Topic 260, Earnings per Share. Basic earnings per share of Common Stock is computed by dividing net income attributable to common stockholders by the weighted average number of shares of basic Common Stock outstanding. Diluted earnings per share of Common Stock is calculated by adjusting the basic earnings per share of Common Stock for the effects of potential dilutive Common Stock shares outstanding such as stock options, restricted stock units and warrants.

For the three and nine months ended September 30, 2024 and 2023, basic and diluted net earnings per share of Common Stock were computed by dividing the net income (loss) attributable to common stockholders by the weighted average number of common shares outstanding during the respective periods. The following tables set forth the computation of basic and diluted net income (loss) attributable to common stockholders (in thousands, except per share amounts):

RIMINI STREET, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Income (loss) attributable to common stockholders: | | | | | | | |

| Net income (loss) | $ | (43,100) | | | $ | 6,801 | | | $ | (42,931) | | | $ | 16,708 | |

| | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Weighted average number of shares of Common Stock outstanding: | | | | | | | |

| Basic | 90,776 | | | 89,228 | | | 90,343 | | | 88,942 | |

| Stock options | — | | | — | | | — | | | 18 | |

| PSUs | — | | | — | | | — | | | — | |