ReNew Announces Results for the First Quarter for Fiscal Year 2025 (Q1 FY25), ended June 30, 2024 24% surge in operating capacity YoY; reiterates FY25 MW and EBITDA guidance

16 August 2024 - 6:30AM

Business Wire

ReNew Energy Global Plc (“ReNew” or “the Company”) (Nasdaq: RNW,

RNWWW), a leading decarbonization solutions company, today

announced its unaudited consolidated IFRS results for the

three-month period ended June 30, 2024.

Operating Highlights:

- As of June 30, 2024, the Company’s portfolio consisted of ~15.6

GWs, of which ~9.6 GWs are commissioned and ~6.0 GWs are committed,

compared to ~13.7 GWs as of June 30, 2023.

- The Company’s commissioned capacity has increased 14.0%

year-over-year to ~9.6 GWs as of June 30, 2024. Subsequent to the

end of the quarter, the Company commissioned 400 MWs of solar and

14 MWs of wind capacity, taking the total commissioned capacity to

~10 GWs as of August 15, 2024.

- Revenue for Q1 FY25 was INR 22,811 million (US$ 274 million),

compared to INR 21,250 million (US$ 255 million) for Q1 FY24. Net

profit for Q1 FY25 was INR 394 million (US$ 5 million) compared to

INR 2,983 million (US$ 36 million) for Q1 FY24. Adjusted EBITDA for

Q1 FY25 was INR 18,979 million (US$ 228 million), as against INR

18,599 million (US$ 223 million) for Q1 FY24.

Note: the translation of Indian rupees into U.S. dollars has

been made at INR 83.33 to US$ 1.00.

FY25 Guidance

The Company reiterates its FY25 guidance and expects to complete

construction of between 1,900 to 2,400 MWs by the end of Fiscal

Year 2025. The Company’s Adjusted EBITDA and Cash Flow to Equity

guidance for FY25 are subject to weather being similar to FY24. The

Company anticipates continued net gains on sales of assets, which

is part of ReNew’s capital recycling strategy, and has included INR

1-2 billion of gains in the guidance below:

Financial Year

Adjusted EBITDA

Cash Flow to equity

(CFe)

FY25

INR 76 – INR 82 billion

INR 12 – INR 14 billion

The Company also reiterates its long-term and run rate guidance

provided in Q4 FY24 results.

Note: the translation of Indian rupees into U.S. dollars has

been made at INR 83.33 to US$ 1.00.

Webcast and Conference call information

A conference call has been scheduled to discuss the earnings

results at 8:30 AM EDT (6:00 PM IST) on August 16, 2024. The

conference call can be accessed live at:

https://edge.media-server.com/mmc/p/ucbu5ouj or by phone

(toll-free) by dialing:

US/ Canada: (+1) 855 881 1339 France: (+33) 0800 981 498

Germany: (+49) 0800 182 7617 Hong Kong: (+852) 800 966 806 India:

(+91) 0008 0010 08443 Japan: (+81) 005 3116 1281 Singapore: (+65)

800 101 2785 Sweden: (+46) 020 791 959 UK: (+44) 0800 051 8245 Rest

of the world: (+61) 7 3145 4010 (toll)

An audio replay will be available following the call on our

investor relations website at

https://investor.renew.com/news-events/events

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended and the Private Securities Litigation Reform Act of

1995, including statements regarding our future financial and

operating guidance, operational and financial results such as

estimates of nominal contracted payments remaining and portfolio

run rate, and the assumptions related to the calculation of the

foregoing metrics. The risks and uncertainties that could cause our

results to differ materially from those expressed or implied by

such forward-looking statements include: the availability of

additional financing on acceptable terms; changes in the commercial

and retail prices of traditional utility generated electricity;

changes in tariffs at which long-term PPAs are entered into;

changes in policies and regulations including net metering and

interconnection limits or caps; the availability of rebates, tax

credits and other incentives; the availability of solar panels and

other raw materials; our limited operating history, particularly as

a relatively new public company; our ability to attract and retain

relationships with third parties, including solar partners; our

ability to meet the covenants in our debt facilities;

meteorological conditions; supply disruptions; solar power

curtailments by state electricity authorities and such other risks

identified in the registration statements and reports that our

Company has filed or furnished with the U.S. Securities and

Exchange Commission, or SEC, from time to time. Portfolio

represents the aggregate megawatts capacity of solar power plants

pursuant to PPAs, signed or allotted or where we have received a

letter of award. There is no assurance that we will be able to sign

a PPA even though we have received a letter of award. All

forward-looking statements in this press release are based on

information available to us as of the date hereof, and we assume no

obligation to update these forward-looking statements.

About ReNew

Unless the context otherwise requires, all references in this

press release to “we,” “us,” or “our” refers to ReNew and its

subsidiaries.

ReNew is a leading decarbonization solutions company listed on

Nasdaq (Nasdaq: RNW, RNWWW). ReNew's clean energy contracted

portfolio of ~15.6 GW as of Aug 15, 2024, is one of the largest

globally. In addition to being a major independent power producer

in India, we provide end-to-end solutions in a just and inclusive

manner in the areas of clean energy, value-added energy offerings

through digitalization, storage, and carbon markets that

increasingly are integral to addressing climate change. For more

information, visit www.renew.com and follow us on

LinkedIn, Facebook, Twitter and

Instagram.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240815022436/en/

Press Enquiries Shilpa Narani |

shilpa.narani@renew.com

Investor Enquiries Nathan Judge, Anunay Shahi, Nitin Vaid

| ir@renew.com

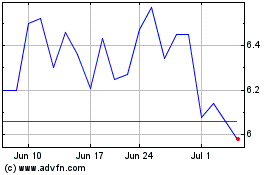

ReNew Energy Global (NASDAQ:RNW)

Historical Stock Chart

From Oct 2024 to Nov 2024

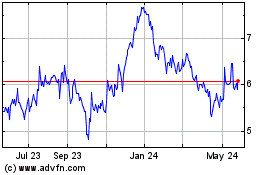

ReNew Energy Global (NASDAQ:RNW)

Historical Stock Chart

From Nov 2023 to Nov 2024