Royalty Pharma Announces Sale of MorphoSys Development Funding Bonds

30 January 2025 - 1:00AM

Royalty Pharma plc (Nasdaq: RPRX) today announced the closing of a

transaction to monetize the remaining fixed payments on the

MorphoSys Development Funding Bonds for $511 million in upfront

cash. This payment, combined with payments previously received,

results in total cash proceeds of $530 million on the $300 million

investment that was made in September 2022. The company generated

an attractive return by monetizing these future fixed payments at a

low discount rate of 5.35% and will redeploy these proceeds into

higher returning investment opportunities, including repurchasing

its shares and acquiring attractive new royalties.

“While Royalty Pharma does not generally sell royalty

investments, Novartis’ acquisition of MorphoSys created a unique

opportunity to convert a fixed stream of long-term payments with no

potential for outperformance into a large cash inflow today at an

attractive return for shareholders,” said Pablo Legorreta, Royalty

Pharma founder and Chief Executive Officer. “Earlier this year, we

updated our capital allocation framework, seeking to generate

attractive returns through a blend of royalty investments and share

repurchases. Royalty Pharma will benefit from enhanced flexibility

to pursue our disciplined capital allocation strategy.”

Transaction Details

Royalty Pharma entered into a long-term strategic funding

partnership with MorphoSys in 2021 to provide up to $2.025 billion

as part of MorphoSys’ acquisition of Constellation Pharmaceuticals.

Through that transaction, Royalty Pharma acquired royalties on

Tremfya and other development stage assets including trontinemab.

In connection with that transaction, Royalty Pharma purchased $300

million of Development Funding Bonds from MorphoSys in September

2022. In 2024, Novartis acquired MorphoSys.

Prior to the monetization transaction announced today, Royalty

Pharma received the first two quarterly repayments on the

Development Funding Bonds, amounting to $9.7 million in the fourth

quarter of 2024 and $9.7 million in January 2025. These payments

will be recorded in Portfolio Receipts. The $511 million

monetization proceeds will be treated as an asset sale and will not

be recorded as Portfolio Receipts. Following this sale to a

syndicate of investors, Royalty Pharma will no longer receive

Development Funding Bond payments over the remainder of 2025 and

beyond.

BofA Securities, Inc. acted as placement agent on behalf of

Royalty Pharma plc.

About Royalty Pharma

Founded in 1996, Royalty Pharma is the largest buyer of

biopharmaceutical royalties and a leading funder of innovation

across the biopharmaceutical industry, collaborating with

innovators from academic institutions, research hospitals and

non-profits through small and mid-cap biotechnology companies to

leading global pharmaceutical companies. Royalty Pharma has

assembled a portfolio of royalties which entitles it to payments

based directly on the top-line sales of many of the industry’s

leading therapies. Royalty Pharma funds innovation in the

biopharmaceutical industry both directly and indirectly – directly

when it partners with companies to co-fund late-stage clinical

trials and new product launches in exchange for future royalties,

and indirectly when it acquires existing royalties from the

original innovators. Royalty Pharma’s current portfolio includes

royalties on more than 35 commercial products, including Vertex’s

Trikafta, GSK’s Trelegy, Roche’s Evrysdi, Johnson & Johnson’s

Tremfya, Biogen’s Tysabri and Spinraza, AbbVie and Johnson &

Johnson’s Imbruvica, Astellas and Pfizer’s Xtandi, Novartis’

Promacta, Pfizer’s Nurtec ODT and Gilead’s Trodelvy, and 14

development-stage product candidates. For more information, visit

www.royaltypharma.com.

Forward-Looking Statements

The information set forth herein does not purport to be complete

or to contain all of the information you may desire. Statements

contained herein are made as of the date of this document unless

stated otherwise, and neither the delivery of this document at any

time, nor any sale of securities, shall under any circumstances

create an implication that the information contained herein is

correct as of any time after such date or that information will be

updated or revised to reflect information that subsequently becomes

available or changes occurring after the date hereof. This document

contains statements that constitute “forward-looking statements” as

that term is defined in the United States Private Securities

Litigation Reform Act of 1995, including statements that express

the company’s opinions, expectations, beliefs, plans, objectives,

assumptions or projections regarding future events or future

results, in contrast with statements that reflect historical facts.

Examples include discussion of Royalty Pharma’s strategies,

financing plans, growth opportunities, market growth, and plans for

capital deployment. In some cases, you can identify such

forward-looking statements by terminology such as “may,” “might,”

“will,” “should,” “expects,” “plans,” “anticipates,” “believes,”

“estimates,” “target,” “forecast,” “guidance,” “goal,” “predicts,”

“project,” “potential” or “continue,” the negative of these terms

or similar expressions. Forward-looking statements are based on

management’s current beliefs and assumptions and on information

currently available to the company. However, these forward-looking

statements are not a guarantee of Royalty Pharma’s performance, and

you should not place undue reliance on such statements.

Forward-looking statements are subject to many risks, uncertainties

and other variable circumstances, and other factors. Such risks and

uncertainties may cause the statements to be inaccurate and readers

are cautioned not to place undue reliance on such statements. Many

of these risks are outside of Royalty Pharma’s control and could

cause its actual results to differ materially from those it thought

would occur. The forward-looking statements included in this

document are made only as of the date hereof. Royalty Pharma does

not undertake, and specifically declines, any obligation to update

any such statements or to publicly announce the results of any

revisions to any such statements to reflect future events or

developments, except as required by law. For further information,

please reference Royalty Pharma’s reports and documents filed with

the U.S. Securities and Exchange Commission (“SEC”) by visiting

EDGAR on the SEC’s website at www.sec.gov.

Royalty Pharma Investor Relations and

Communications

+1 (212) 883-6637ir@royaltypharma.com

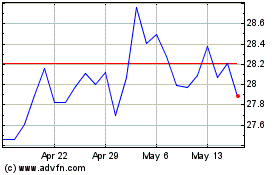

Royalty Pharma (NASDAQ:RPRX)

Historical Stock Chart

From Jan 2025 to Feb 2025

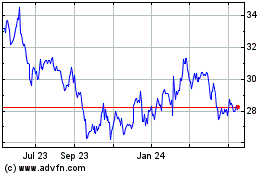

Royalty Pharma (NASDAQ:RPRX)

Historical Stock Chart

From Feb 2024 to Feb 2025