SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the

month of March 2025

RYANAIR HOLDINGS PLC

(Translation

of registrant's name into English)

c/o Ryanair Ltd Corporate Head Office

Dublin Airport

County Dublin Ireland

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file

annual

reports

under cover Form 20-F or Form 40-F.

Form

20-F..X.. Form 40-F

Indicate

by check mark whether the registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities

Exchange

Act of

1934.

Yes

No ..X..

If

"Yes" is marked, indicate below the file number assigned to the

registrant

in

connection with Rule 12g3-2(b): 82- ________

RYANAIR LIFTS PROHIBITION

ON NON-EU NATIONALS PURCHASING ORDINARY SHARES

As previously advised, Ryanair Holdings plc (the

"Company")

must ensure continued compliance by its EU

airline subsidiaries

with EU Regulation 1008/2008, which requires the Company to be

majority EU owned and controlled (see, for example:

https://investor.ryanair.com/investors-shareholders/ownership-limitations/).

On 5 February 2002, the Company announced that all Ordinary Shares

acquired in trades occurring after 7 February 2002 by parties who

do not certify that they are EU nationals at the time of

settlement, would be designated as Restricted Shares in accordance

with the Articles of Association of the Company and the relevant

investor would be required to dispose of such shares to an acquirer

who is an EU national (the "Purchase

Prohibition"). Since 1

January 2021, as a consequence of Brexit, the Purchase Prohibition

has also applied to UK nationals.

On 29 December 2020, the Company announced that from 1 January 2021

all Ordinary Shares and Depositary Shares held by or on behalf of

non-EU nationals (including UK nationals) would be treated as

Restricted Shares and that holders of Restricted Shares would not

be permitted to attend, speak or vote at the Company's general

meetings in respect of those Restricted Shares (the

"Voting

Restrictions").

On 12 September 2024, the Company announced

that, in anticipation of reaching the

threshold of 50% of issued share capital

being held by EU nationals, the Company would undertake a review of

its ownership and control restrictions, including engagement with

investors and regulators, with a view to potentially varying the

current approach in a manner that continues to ensure compliance

with EU Regulation 1008/2008 (the "O&C

Review").

The O&C Review has now been completed and EU nationals now hold

more than 50% of the Company's issued share

capital. Taking into account feedback from investors

representing a significant majority of the Company's issued share

capital, and the Company's regulators, the Board of the Company has

today resolved that it is in the best interest of the Company and

shareholders as a whole to:

1)

discontinue the Purchase Prohibition with immediate

effect;

2)

continue to apply the Voting Restrictions;

3)

update the market as appropriate on the proportion of the Company's

issued share capital held by EU nationals; and

4)

if required, reintroduce the Purchase Prohibition at an appropriate

time to ensure that the proportion of the Company's issued share

capital held by EU nationals is at least 20%.

For the avoidance of doubt:

● both EU and non-EU nationals can

now invest in Ryanair Holdings PLC via Ordinary Shares listed on

Euronext Dublin and/or Depositary Shares listed on

Nasdaq;

● those who have received

Restricted Share Notices which require them to dispose of their

Restricted Shares are no longer required to comply with such

disposal instructions;

● the Voting Restrictions will

continue to apply until such time as the Board determines that it

is possible to vary or remove such restrictions without there being

any risk to the airline licences held by the Company's subsidiaries

pursuant to EU Regulation 1008/2008;

● notwithstanding the powers vested

in the chairman of general meetings of the Company pursuant to

Article 41(J)(i) of the Articles of Association, the chairman will

not vote any Restricted Shares at any meeting of the Company;

and

● the Board shall retain its

ability to utilise all of the powers available under the Company's

Articles of Association in the face of any risk to the airline

licences held by the Company's subsidiaries pursuant to EU

Regulation 1008/2008.

END

This announcement contains inside information.

For further information, please contact:

Ryanair Holdings plc, Jamie Donovan, Head of Investor Relations, Tel:

+353 (0) 1 945 1212

Certain of the information included in this release is forward

looking and is subject to important risks and uncertainties that

could cause actual results to differ materially and that could

impact the price of Ryanair's securities. It is not

reasonably possible to itemise all of the many factors and specific

events that could affect the outlook and results of an airline

operating in the European economy and the price of its

securities. Among the factors that are subject to change and

could significantly impact Ryanair's expected results and the price

of its securities are the airline pricing environment, fuel costs,

competition from new and existing carriers, market prices for the

replacement of aircraft, costs associated with environmental,

safety and security measures, actions of the Irish, U.K., European

Union ("EU") and other governments and their respective regulatory

agencies, post-Brexit uncertainties, any further change in the

restrictions on the ownership of Ryanair's ordinary shares and the

voting rights of its shareholders and ADR holders, including as a

result of regulatory changes or the actions of Ryanair itself,

weather related disruptions, ATC strikes and staffing related

disruptions, delays in the delivery of contracted aircraft,

fluctuations in currency exchange rates and interest rates, airport

access and charges, labour relations, the economic environment of

the airline industry, the general economic environment in Ireland,

the U.K. and Continental Europe, the general willingness of

passengers to travel and other economics, social and political

factors, global pandemics such as Covid-19 and unforeseen security

events.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf

by the undersigned, hereunto duly authorized.

Date: 07

March, 2025

|

|

By:___/s/

Juliusz Komorek____

|

|

|

|

|

|

Juliusz

Komorek

|

|

|

Company

Secretary

|

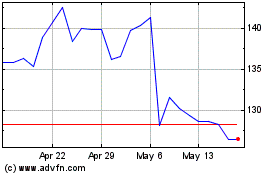

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Feb 2025 to Mar 2025

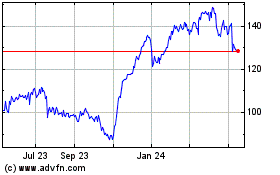

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Mar 2025