Cassava Sciences, Inc. (Nasdaq: SAVA), a biotechnology

company focused on a novel treatment for Alzheimer’s disease, today

reported financial results for the second quarter ended June 30,

2024. Net income was $6.2 million compared to a net loss of $26.4

million for the same period in 2023. Net cash used in operations

was $37.4 million during the first half of 2024, consistent with

previous guidance. Net cash use in second half 2024 is expected to

be $80 to $90 million, which includes an estimated $40 million loss

contingency related to advanced discussions to resolve the SEC’s

investigation of the Company recorded in the second quarter.

“We have made significant progress over the last

few months,” Rick Barry, Cassava’s Executive Chairman said. “The

Cassava Clinical Operations team in conjunction with Premier

Research have done a brilliant job in executing our Phase 3

program. We expect our last patient/last visit for our ReTHINK

trial in early Q4 and a top-line read out from the trial by

year-end. We also expect our second Phase 3 trial, ReFOCUS, to read

out in mid-year 2025. The success of our warrant program earlier in

the second quarter – which provided over $123 million net in equity

capital to Cassava – has provided the Company with a strong balance

sheet with enough liquidity to get well past our Phase 3 readouts.

We are very grateful for the confidence that investors, principal

investigators, patients and their loved ones have shown in Cassava.

Our team’s urgent focus is to deliver a best-in-class therapy for

Alzheimer’s patients.”

Current Updates on Phase 3 Clinical

ProgramBackground - Our Phase 3 program consists of two

global, double-blind, randomized, placebo-controlled studies of

simufilam in patients with mild-to-moderate Alzheimer’s disease

dementia. The goal is to evaluate overall risk/benefit for oral

simufilam twice-daily versus placebo in a large population of

people with Alzheimer’s disease over 12 and 18 months.

The target study population is people with

mild-to-moderate Alzheimer’s (MMSE score of 16-27) who are

biomarker-positive for Alzheimer’s disease pathology, and who meet

other inclusion/exclusion eligibility criteria of the study

protocols.

Phase 3 Trials – Our first Phase 3 study, called

RETHINK-ALZ, is designed to evaluate the safety and efficacy of

simufilam 100 mg tablets twice-daily versus matching placebo over

52 weeks (NCT04994483). Our second Phase 3 study, called

REFOCUS-ALZ, is designed to evaluate the safety and efficacy of

oral simufilam 100 mg and 50 mg tablets twice-daily versus matching

placebo over 76 weeks (NCT05026177). Clinical sites are in the

United States, Canada, Puerto Rico, Australia, and South Korea.

Premier Research International is the clinical research

organization (CRO) supporting the conduct of our Phase 3

clinical program.

Patient Enrollment – Both Phase 3 studies are

fully enrolled. Approximately 1,900 patients are randomized in

these studies, with approximately 800 patients randomized in the

52-week study (RETHINK-ALZ) and approximately 1,100 patients

randomized in the 76-week study (REFOCUS-ALZ). Approximately 90% of

patients are recruited from clinical sites in the U.S. and Canada.

The overall drop-out rate for both Phase 3 studies is in the range

of 20% to 23%, which is generally consistent with expectations. A

longer study will generally have a higher dropout rate versus a

similar shorter study.

Patient Completion – Over 555 patients have

completed the 52-week RETHINK-ALZ study. Over 420 patients have

completed the 76-week REFOCUS-ALZ study, for a total of over 975

completers.

Data and Safety Monitoring Board (DSMB) – The

DSMB is composed of independent clinical research experts who

periodically review interim patient safety data. Routine, scheduled

DSMB meetings were held September 2023 and March 2024. Both DSMB

meetings recommended that the Phase 3 studies continue as planned,

without modification.

Co-primary Efficacy Outcomes – The pre-specified

efficacy endpoints for the Phase 3 studies are ADAS-Cog12, a

cognitive scale, and ADCS-ADL, a functional scale.

Phase 3 Efficacy Results – All efficacy data

from our Phase 3 program remain blinded. No interim analyses on

efficacy outcomes are planned. We anticipate top-line data readout

for our 52-week study (RETHINK-ALZ) by the end of 2024. We

anticipate top-line data readout for our 76-week study

(REFOCUS-ALZ) approximately mid-year 2025.

Open-label Extension Study – This study is

designed to provide no-cost access to oral simufilam to Alzheimer’s

patients who have successfully completed a Phase 3 study of

simufilam and who meet other entry criteria. Approximately 89% of

patients who’ve completed treatment in a Phase 3 study have opted

to enter the open-label extension study. To date, over 870 patients

have entered the open-label extension study. The open-label study

is intended to continue for up to 36 months or until a new drug

application for simufilam has been reviewed by FDA. Cassava also

plans to add cognition and plasma biomarker monitoring to its

open-label extension trial for patients who have completed the

Phase 3 trials in order to gather additional long-term data on the

potential impact of simufilam treatment.

Financial Results for Second Quarter

2024

- At June 30,

2024, cash and cash equivalents were $207.3 million, with no

debt.

- Cash balance

includes total gross proceeds received from the cash-exercise of

common stock warrants in 2024 totaling $126.3 million, inclusive of

approximately $104.0 million received in second quarter 2024.

Holders exercised warrants for approximately 5.74 million common

shares at a price of $22 per share in 2024. There are no remaining

common stock warrants currently outstanding.

- Net income was

$6.2 million compared to a net loss of $26.4 million for the same

period in 2023. Net income resulted from the change in fair value

of warrant liabilities, a non-cash item. This warrant gain was

partially offset by an estimated $40.0 million loss contingency

recorded in respect of a potential resolution of the SEC’s

investigation and costs to conduct the Phase 3 clinical program, as

well as other studies with simufilam.

- Net cash used in

operations was $37.4 million during the first six months of 2024,

consistent with previous guidance.

- Net cash use in

operations for second half 2024 is expected to be $80 to $90

million, which includes an estimated $40 million loss contingency

related to advanced discussions to resolve the SEC’s investigation.

The Company estimates cash at year-end 2024 in a range from $117 to

$127 million.

- Research and

development (R&D) expenses were $15.2 million. This compared to

$25.0 million for the same period in 2023. R&D expenses

decreased due primarily to the completion of patient screening and

enrollment for our Phase 3 clinical program in the fall of

2023.

- General and

administrative (G&A) expenses were $46.2 million. This compared

to $3.8 million for the same period in 2023. G&A expenses

increased due primarily to the estimated loss contingency in

respect of a potential SEC resolution as well as a $1.2 million

increase in stock-based compensation expense due to new grant

awards in late 2023 and 2024, increased compensation costs and

higher legal related expenses.

Webcast DetailsDate: Thursday,

August 8th Time: 8:30 a.m. Eastern Time Audio Webcast:

https://www.CassavaSciences.com/company-presentations Or

https://edge.media-server.com/mmc/p/zjvmjjcr

About SimufilamSimufilam is

Cassava Sciences’ proprietary oral drug candidate. This

investigational drug binds to altered filamin A protein in the

brain and restores its normal shape and function. By targeting

altered filamin A, simufilam may help patients with Alzheimer’s

achieve better health outcomes. Cassava Sciences owns exclusive,

worldwide rights to its investigational product candidates and

related technologies, without royalty obligations to any third

party.

About Cassava Sciences,

Inc.Cassava Sciences is a clinical-stage biotechnology

company based in Austin, Texas. Our mission is to detect and treat

neurodegenerative diseases, such as Alzheimer’s disease. Our novel

science is based on stabilizing—but not removing—a critical protein

in the brain.

For more information, please visit:

https://www.CassavaSciences.com

For More Information Contact:

Sitrick And Company1-800-550-7521Mike_Sitrick@Sitrick.comSeth

Lubove: slubove@sitrick.comNY: Rich Wilner: rwilner@sitrick.com

800-699-1481

Cautionary Note Regarding

Forward-Looking Statements: This news release contains

forward-looking statements, including statements made pursuant to

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995, that may include but are not limited to

statements regarding: the potential for advanced discussions with

SEC to result in a resolution of the SEC investigation and our loss

contingency estimates related thereto; our ability to extend our

existing open-label extension trials, as contemplated or at all;

the design, scope, conduct, continuation, completion, intended

purpose, or future results of our on-going Phase 3 program of

simufilam in patients with Alzheimer's disease; the timing of

anticipated milestones; the assessment of interim safety data for

the Phase 3 program at prior DSMB meetings; the treatment of people

with Alzheimer’s disease dementia; the safety or efficacy of

simufilam in people with Alzheimer’s disease dementia; expected

cash balances and cash use in future periods; comments made by our

employees regarding simufilam, drug effects, and the treatment of

Alzheimer’s disease; and potential benefits, if any, of our product

candidates. These statements may be identified by words such as

“anticipate,” “believe,” “could,” “expect,” “forecast,” “intend,”

“may,” “plan,” “possible,” “potential,” “will,” and other words and

terms of similar meaning.

Such statements are based largely on our current

expectations and projections about future events. Such statements

speak only as of the date of this news release and are subject to a

number of risks, uncertainties and assumptions, including, but not

limited to, those risks relating to the ability to conduct or

complete clinical studies on expected timelines, the ability to

demonstrate the specificity, safety, efficacy or potential health

benefits of our product candidates, the apparent ability of

simufilam to favor patients with mild Alzheimer’s disease; the

apparent safety or tolerance of simufilam in our open-label

clinical trials; our current expectations regarding timing of

clinical data for our Phase 3 studies; any expected clinical

results of Phase 3 studies; the treatment of people with

Alzheimer’s disease dementia; and comments made by our employees

regarding simufilam, drug effects, and the treatment of Alzheimer’s

disease; potential benefits, if any, of our product candidates and

including those described in the section entitled “Risk Factors” in

our Annual Report on Form 10-K for the year ended December 31,

2023, and subsequent reports filed with the SEC. The foregoing sets

forth many, but not all, of the factors that could cause actual

results to differ from expectations in any forward-looking

statement. In light of these risks, uncertainties and assumptions,

the forward-looking statements and events discussed in this news

release are inherently uncertain and may not occur, and actual

results could differ materially and adversely from those

anticipated or implied in the forward-looking statements.

Accordingly, you should not rely upon forward-looking statements as

predictions of future events. Except as required by law, we

disclaim any intention or responsibility for updating or revising

any forward-looking statements. For further information regarding

these and other risks related to our business, investors should

consult our filings with the SEC, which are available on the SEC's

website at www.sec.gov.

All our pharmaceutical assets under development

are investigational product candidates. These have not been

approved for use in any medical indication by any regulatory

authority in any jurisdiction and their safety, efficacy or other

desirable attributes, if any, have not been established in any

patient population. Consequently, none of our product candidates

are approved or available for sale anywhere in the world.

Our clinical results from earlier-stage clinical

trials may not be indicative of future results from later-stage or

larger scale clinical trials and do not ensure regulatory approval.

You should not place undue reliance on these statements or any

scientific data we present or publish.

We are in the business of new drug discovery and

development. Our research and development activities are long,

complex, costly and involve a high degree of risk. Holders of our

common stock should carefully read our Annual Report on Form 10-K

and subsequent filings with the SEC in their entirety, including

the risk factors therein. Because risk is fundamental to the

process of drug discovery and development, you are cautioned to not

invest in our publicly traded securities unless you are prepared to

sustain a total loss of the money you have invested.

– Financial Tables Follow –

|

CASSAVA SCIENCES, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(unaudited, in thousands, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended June 30, |

|

Six months ended June 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

$ |

15,198 |

|

|

$ |

24,969 |

|

|

$ |

31,431 |

|

|

$ |

47,089 |

|

|

General and administrative |

|

46,204 |

|

|

|

3,808 |

|

|

|

49,905 |

|

|

|

8,200 |

|

|

Total operating expenses |

|

61,402 |

|

|

|

28,777 |

|

|

|

81,336 |

|

|

|

55,289 |

|

|

Operating loss |

|

(61,402 |

) |

|

|

(28,777 |

) |

|

|

(81,336 |

) |

|

|

(55,289 |

) |

|

Interest income |

|

2,316 |

|

|

|

2,198 |

|

|

|

4,092 |

|

|

|

4,249 |

|

|

Other income, net |

|

99 |

|

|

|

203 |

|

|

|

259 |

|

|

|

393 |

|

|

Gain from change in fair value of warrant liabilities |

|

65,142 |

|

|

|

— |

|

|

|

108,183 |

|

|

|

— |

|

|

Net income (loss) |

$ |

6,155 |

|

|

$ |

(26,376 |

) |

|

$ |

31,198 |

|

|

$ |

(50,647 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share, basic |

$ |

0.13 |

|

|

$ |

(0.63 |

) |

|

$ |

0.70 |

|

|

$ |

(1.21 |

) |

|

Net income (loss) per share, diluted |

|

0.13 |

|

|

|

(0.63 |

) |

|

|

(1.72 |

) |

|

|

(1.21 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares used in computing net income (loss) per

share, basic |

|

46,202 |

|

|

|

41,793 |

|

|

|

44,601 |

|

|

|

41,766 |

|

|

Weighted-average shares used in computing net income (loss) per

share, diluted |

|

46,202 |

|

|

|

41,793 |

|

|

|

45,152 |

|

|

|

41,766 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(unaudited, in thousands) |

|

|

|

|

|

|

|

|

June 30, 2024 |

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

|

|

$ |

207,291 |

|

|

$ |

121,136 |

|

|

Prepaid expenses and other current assets |

|

|

|

|

|

|

|

14,831 |

|

|

|

8,497 |

|

|

Total current assets |

|

|

|

|

|

|

|

222,122 |

|

|

|

129,633 |

|

|

Property and equipment, net |

|

|

|

|

|

|

|

21,364 |

|

|

|

21,854 |

|

|

Intangible assets, net |

|

|

|

|

|

|

|

82 |

|

|

|

176 |

|

|

Total assets |

|

|

|

|

|

|

$ |

243,568 |

|

|

$ |

151,663 |

|

|

Liabilities and stockholders' equity |

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

|

|

|

|

|

$ |

52,552 |

|

|

$ |

10,573 |

|

|

Accrued development expense |

|

|

|

|

|

|

|

1,596 |

|

|

|

3,037 |

|

|

Accrued compensation and benefits |

|

|

|

|

|

|

|

218 |

|

|

|

200 |

|

|

Other accrued liabilities |

|

|

|

|

|

|

|

228 |

|

|

|

385 |

|

|

Total current liabilities |

|

|

|

|

|

|

|

54,594 |

|

|

|

14,195 |

|

|

Stockholders' equity |

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock and additional paid-in-capital |

|

|

|

|

|

|

|

538,545 |

|

|

|

518,237 |

|

|

Accumulated deficit |

|

|

|

|

|

|

|

(349,571 |

) |

|

|

(380,769 |

) |

|

Total stockholders' equity |

|

|

|

|

|

|

|

188,974 |

|

|

|

137,468 |

|

|

Total liabilities and stockholders' equity |

|

|

|

|

|

|

$ |

243,568 |

|

|

$ |

151,663 |

|

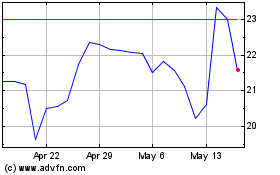

Cassava Sciences (NASDAQ:SAVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

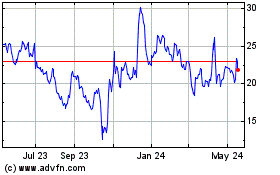

Cassava Sciences (NASDAQ:SAVA)

Historical Stock Chart

From Nov 2023 to Nov 2024