Sinclair, Inc. (Nasdaq: SBGI), the "Company" or "Sinclair")

today announced that Sinclair Television Group, Inc. (“STG” or the

“Issuer”) has commenced a private exchange offer (the “Exchange

Offer”) to Eligible Holders (as defined below) of 4.375% Second-Out

First Lien Secured Notes due 2032 (144A CUSIP / ISIN: 829259BF6 /

US829259BF69; REG S CUSIP / ISIN: U8275QAN0 / USU8275QAN08) (the

“Exchange Second-Out Notes”) for any and all of the Issuer’s

outstanding 4.125% Senior Secured Notes due 2030 (144A CUSIP /

ISIN: 829259BA7 / US829259BA72; REG S CUSIP / ISIN: U8275QAK6 /

USU8275QAK68) (the “Existing Notes”), on the terms and subject to

the conditions set forth in a Confidential Offering Memorandum,

Offer to Exchange and Consent Solicitation Statement, dated as of

January 27, 2025 (the “Offer Documents”).

Concurrently with the Exchange Offer, the Issuer is soliciting

consents (the “Consent Solicitation”) from Eligible Holders of the

Existing Notes with respect to certain amendments, supplements and

other modifications (the “Proposed Amendments”) to the indenture

governing the Existing Notes (the “Existing Indenture”). The

Proposed Amendments would, among other things (a) eliminate

substantially all of the restrictive covenants and certain of the

events of default and related definitions contained in the Existing

Indenture, (b) permit the Issuer to consummate the financing

transactions (the “Other Transactions”) described in the previously

disclosed transaction support agreement (the “Transaction Support

Agreement”) and (c) provide for the termination of the liens on the

collateral securing the Existing Notes that remain outstanding

following completion of the Exchange Offer and Consent Solicitation

(as amended, the “4.125% Unsecured Notes”), with the 4.125%

Unsecured Notes constituting senior unsecured obligations of the

Issuer and the guarantors, subordinated in right of security to all

existing and future senior secured obligations of the Issuer and

the guarantors. Holders of Existing Notes may validly deliver their

consents in the Consent Solicitation by tendering Existing Notes,

in which case the holders will be deemed to have delivered their

consents (the “Exchange and Consent Option”) or by delivering their

consents without tendering Existing Notes (the “Consent Only

Option”) Eligible Holders may not tender Existing Secured Notes

without delivering their consents.

The Issuer must receive the consents from holders of at least

two-thirds (66 2/3%) in aggregate principal amount of outstanding

Existing Notes not owned by the Issuer or any of its affiliates

(the “Requisite Notes Consents”) to adopt the Proposed Amendments.

As of the date hereof, various holders of the Existing Notes who

are parties to the Transaction Support Agreement (such holders,

collectively, the “Support Agreement Consenting Holders”) hold

Existing Notes representing the Requisite Notes Consents and have

separately agreed to deliver consents to the Proposed Amendments

(by electing to participate in either the Exchange and Consent

Option or the Consent Only Option, as applicable to such holder).

Upon receipt of the Requisite Notes Consents, the Issuer and the

guarantors of the Existing Notes expect to execute a supplemental

indenture to the Existing Indenture (the “Supplemental Indenture”)

providing for the Proposed Amendments.

The Exchange Offer and Consent Solicitation, including the

Issuer’s acceptance of validly tendered Existing Notes and payment

of the applicable consideration, is conditioned on the satisfaction

or waiver of certain conditions precedent, including, but not

limited to, the substantially contemporaneous consummation of the

Other Transactions, as further described in the Offer Documents.

The Issuer may terminate, withdraw, amend or extend the Exchange

Offer and/or Consent Solicitation in its sole discretion, subject

to certain exceptions.

As of the date hereof, the Support Agreement Consenting Holders

have agreed to deliver the Requisite Notes Consents, and the

lenders party to the Transaction Support Agreement hold an

aggregate principal amount of the Issuer’s outstanding loans and

commitments under its existing credit facilities under its existing

credit agreement, in each case, necessary to consent to the Other

Transactions and the Exchange Offer and Consent Solicitation. By

executing the Transaction Support Agreement, the lenders and

noteholders party thereto agreed, among other things, to use

commercially reasonable efforts to support and take all

commercially reasonable actions necessary or reasonably requested

by the Issuer to facilitate the consummation of the Other

Transactions and the Exchange Offer and Consent Solicitation.

The following table sets forth the consideration offered in the

Exchange Offer and Consent Solicitation Statement:

Consideration per $1,000 Principal Amount of Existing

Notes Tendered

CUSIP/ISIN

Outstanding Principal Amount

of Existing Notes

Total Consideration if

Tendered at or prior to the Early Tender Time

Exchange Consideration if

Tendered after the Early Tender Time

144A: 829259BA7 /

US829259BA72;

REG S: U8275QAK6 /

USU8275QAK68

$737,410,000

$1,000 in aggregate principal

amount of Exchange Second-Out Notes

$990 in aggregate principal

amount of Exchange Second-Out Notes

The Exchange Offer will expire at 11:59 p.m., New York City

time, on March 7, 2025, unless extended or earlier terminated (the

“Expiration Time”) by the Issuer. Eligible Holders that validly

tender their Existing Notes and deliver their consents prior to

5:00 p.m., New York City time, on February 7, 2025 (the “Early

Tender Time”), and do not validly withdraw their Existing Notes or

validly revoke their consents prior to 5:00 p.m., New York City

time, on February 7, 2025 (the “Withdrawal Deadline”), will receive

the total consideration set out in the applicable column in the

table above. Holders that validly tender their Existing Notes and

deliver their consents after the Early Tender Time and on or before

the Expiration Time will receive the exchange consideration set out

in the applicable column in the table above. Validly tendered

Existing Notes may not be withdrawn and consents may not be revoked

after the Withdrawal Deadline, subject to limited exceptions.

The Issuer will settle all exchanges promptly after the Early

Tender Time (the “Early Settlement Date”) and/or Expiration Time

(the “Final Settlement Date”). The Early Settlement Date is

expected to occur on February 12, 2025, three business days

following the Early Tender Time, assuming the conditions to the

Exchange Offer have either been satisfied or waived by the Issuer

at or prior to the Expiration Time. The Final Settlement Date is

expected to occur on March 12, 2025, three business days following

the Expiration Time, assuming the conditions to the Exchange Offer

have either been satisfied or waived by the Issuer at or prior to

the Expiration Time.

In addition to the exchange consideration set out in the

applicable column in the table above, Eligible Holders whose

Existing Notes are accepted for exchange will receive a cash

payment equal to the accrued and unpaid interest on such Existing

Notes from and including the immediately preceding interest payment

date for such Existing Notes to, but excluding, the Early

Settlement Date. For the avoidance of doubt, accrued interest for

such Existing Notes will cease to accrue on the Early Settlement

Date for all Existing Notes accepted in the Exchange Offer and

Eligible Holders whose Existing Notes are tendered after the Early

Settlement Date and are accepted for purchase will not receive

payment in respect of any interest for the period from and

including the Early Settlement Date. Under no circumstances will

any interest be payable because of any delay in the transmission of

funds to Eligible Holders by DTC or its participants.

Holders delivering their consent pursuant to the Consent Only

Option must deliver (and not validly revoke) their consents by 5:00

p.m., New York City time, on February 7, 2025, unless extended

(such date and time, as the same may be extended, the “Consent Only

Deadline”). Consents delivered in accordance with the Consent Only

Option may be validly revoked at any time at or prior to the time

and date on which the Supplemental Indenture is executed (the

“Consent Time”) and may not be validly revoked at any time after

the Consent Time, even if the Consent Only Deadline is later than

the Consent Time. Holders who validly deliver consents pursuant to

the Consent Only Option will not receive any payment or any

Exchange Second-Out Notes through the Consent Solicitation.

The Exchange Second-Out Notes will mature on December 31, 2032.

The Issuer will pay interest at a rate of 4.375% per annum.

Interest on the Exchange Second-Out Notes will accrue from the date

of original issuance and will be payable semi-annually in arrears

on June 1 and December 1 of each year to the holders of record at

the close of business on May 15 and November 15, whether or not a

business day, prior to such interest payment date, provided that

interest payable on the maturity date shall be payable to the

person to whom principal shall be payable. The first interest

payment date is June 1, 2025.

The Issuer’s obligations under the Exchange Second-Out Notes

will be jointly and severally guaranteed, on a senior unsecured

basis, by Sinclair Broadcast Group, Inc., the Issuer’s direct

parent (“SBG”), and each wholly-owned subsidiary of the Issuer or

SBG that guarantees the Issuer’s new credit agreement entered into

upon consummation of the Other Transactions and the Exchange

Offer.

The Exchange Offer is being made, and the Exchange Second-Out

Notes are being offered and issued, only to holders of Existing

Notes who are reasonably believed to be (i) “qualified

institutional buyers” as defined in Rule 144A under the Securities

Act of 1933, as amended (the “Securities Act”) or (ii) not U.S.

persons (as defined in Regulation S under the Securities Act) or

purchasing for the account or benefit of U.S. persons, other than a

distributor, and are purchasing the Exchange Second-Out Notes in an

offshore transaction in accordance with Regulation S. The holders

of Existing Notes who are eligible to participate in the Exchange

Offer pursuant to the foregoing conditions are referred to as

“Eligible Holders.” Only Eligible Holders are authorized to receive

or review the Offering Documents or to participate in the Exchange

Offer and Consent Solicitation.

J.P. Morgan Securities LLC will act as sole Dealer Manager for

the Exchange Offer and Consent Solicitation.

The Offer Documents will be distributed only to holders of

Existing Notes that complete and return a letter of eligibility

confirming that they are Eligible Holders. Copies of the

eligibility letter are available to holders through the information

and exchange agent for the Exchange Offer and Consent Solicitation,

Ipreo LLC, at (888) 593-9546 (U.S. toll-free) or (212) 849-3880

(Banks and Brokers) or ipreo-exchangeoffer@ihsmarkit.com.

The Exchange Offer and Consent Solicitation is made only by, and

pursuant to the terms of, the Offer Documents, and the information

in this news release is qualified by reference thereto.

This press release shall not constitute an offer to sell or the

solicitation of an offer to exchange or purchase the Exchange

Second-Out Notes, nor shall there be any offer or exchange of the

Exchange Second-Out Notes in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful. In addition,

this press release is neither an offer to exchange or purchase nor

a solicitation of an offer to sell any Existing Notes in the

Exchange Offer or a solicitation of consents to the Proposed

Amendments, and this press release does not constitute a notice of

redemption with respect to any securities.

The Exchange Second-Out Notes have not been and will not be

registered under the Securities Act or any state securities laws

and may not be offered or sold in the United States absent

registration or an applicable exemption from registration

requirements. Accordingly, the Exchange Second-Out Notes are being

offered for exchange only to persons reasonably believed to be (i)

“qualified institutional buyers” (as defined in Rule 144A under the

Securities Act) or (ii) not U.S. persons (as defined in Regulation

S under the Securities Act) or purchasing for the account or

benefit of U.S. persons, other than a distributor, and are

purchasing the Exchange Second-Out Notes in an offshore transaction

in accordance with Regulation S.

Forward-Looking

Statements:

The matters discussed in this news release, particularly those

in the section labeled “Outlook,” include forward-looking

statements regarding, among other things, the Other Transactions.

When used in this news release, the words “outlook,” “intends to,”

“believes,” “anticipates,” “expects,” “achieves,” “estimates,” and

similar expressions are intended to identify forward-looking

statements. Such statements are subject to a number of risks and

uncertainties. Actual results in the future could differ materially

and adversely from those described in the forward-looking

statements as a result of various important factors, including and

in addition to the assumptions set forth therein, but not limited

to, the occurrence of any event, change or other circumstance that

could give rise to the termination of the Other Transactions or the

Exchange Offer and/or Consent Solicitation, the ability to

negotiate and reach agreement on definitive documentation relating

to the Other Transactions or the Exchange Offer and/or Consent

Solicitation, the ability to satisfy closing conditions to the

completion of the Other Transactions or the Exchange Offer and/or

Consent Solicitation; the Company’s ability to achieve the

anticipated benefits from the Other Transactions and the Exchange

Offer and/or Consent Solicitation; other risks related to the

completion of the Other Transactions, the Exchange Offer or the

Consent Solicitation and actions related thereto, the Company’s

ability the rate of decline in the number of subscribers to

services provided by traditional and virtual multi-channel video

programming distributors (“Distributors”); the Company’s ability to

generate cash to service its substantial indebtedness; the

successful execution of outsourcing agreements; the successful

execution of retransmission consent agreements; the successful

execution of network and Distributor affiliation agreements; the

Company’s ability to identify and consummate acquisitions and

investments, to manage increased financial leverage resulting from

acquisitions and investments, and to achieve anticipated returns on

those investments once consummated; the Company’s ability to

compete for viewers and advertisers; pricing and demand

fluctuations in local and national advertising; the appeal of the

Company’s programming and volatility in programming costs; material

legal, financial and reputational risks and operational disruptions

resulting from a breach of the Company’s information systems; the

impact of FCC and other regulatory proceedings against the Company;

compliance with laws and uncertainties associated with potential

changes in the regulatory environment affecting the Company’s

business and growth strategy; the impact of pending and future

litigation claims against the Company; the Company’s limited

experience in operating or investing in non-broadcast related

businesses; and any risk factors set forth in the Company’s recent

reports on Form 10-Q and/or Form 10-K, as filed with the Securities

and Exchange Commission. There can be no assurances that the

assumptions and other factors referred to in this release will

occur. The Company undertakes no obligation to publicly release the

result of any revisions to these forward-looking statements except

as required by law.

Category: Financial

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250126424154/en/

Investor Contacts: Chris King, VP,

Investor Relations Billie-Jo McIntire, VP, Corporate Finance (410)

568-1500

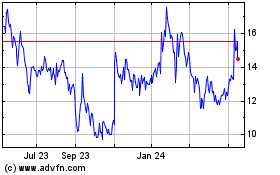

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Jan 2025 to Feb 2025

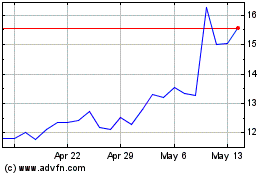

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Feb 2024 to Feb 2025