Sinclair, Inc. (Nasdaq: SBGI), the "Company" or "Sinclair,"

today reported financial results for the three and twelve months

ended December 31, 2024.

Highlights:

- Comprehensive refinancing substantially completed in early

2025

- Fourth quarter Operating Income and other key financial metrics

exceeded guidance range

- Record full-year 2024 political advertising revenues of $405

million, a 16% increase over 2020 levels excluding the Georgia

runoff of 2020

- Formed EdgeBeam Wireless, a joint venture with other major

broadcasters, to unlock the potential of ATSC 3.0 NextGen Broadcast

to offer nationwide coverage for data delivery

- Tennis Channel introduced a direct-to-consumer, streaming

service that merges its flagship 24-hour network with extensive

live and on-demand multi-court coverage

CEO Comment:

“We are pleased to close out a strong 2024 and we have entered

2025 on a high note. Our consolidated Adjusted EBITDA for the

fourth quarter exceeded our guidance range, along with various

other key financial metrics. This performance underscores the

continued dominance of broadcast TV as the leading platform for

advertisers to reach broad audiences,” said Chris Ripley,

Sinclair’s President and Chief Executive Officer. “As we move into

2025, we have substantially completed a comprehensive refinancing,

extending our debt maturities to over six and a half years,

de-risking our balance sheet and providing greater financial

flexibility. Our balance sheet now has the longest maturity profile

in the industry. Following the refinancing, we can turn our

attention to deploying the Ventures cash balance in multiple ways,

such as outside investments that we could consolidate in our

financial results, as well as the potential for returning a portion

of the cash to shareholders over time. Given our recent

retransmission rate agreements with distributors in 2024, as well

as coming to terms with our last network affiliation agreement

expiration before 2026, we have greatly enhanced visibility on both

our retransmission revenues as well as our reverse retransmission

expenses for the next several years. We remain confident in the

power of broadcast TV, including the new opportunities for our

joint venture, EdgeBeam, which we expect to drive meaningful

advancements for NextGen Broadcast in the years ahead.”

Recent Company

Developments:

Transactions:

- As described more fully in our February 12 press release, in

February 2025, the Company closed a comprehensive refinancing and

debt recapitalization to strengthen the Company's balance sheet and

better position it for long-term growth. The refinancing extended

maturities across the Company's various debt tranches over the

coming years with the closest material maturity at the end of 2029.

The Company's balance sheet is now the industry's longest in terms

of maturity profile.

Content and Distribution:

- In the fourth quarter 2024, the Company finalized a renewal

with DISH Network (“DISH”), for the continued multi-year carriage

of the Company’s broadcast television stations and Tennis Channel

on DISH’s direct broadcast satellite system.

- In November 2024, Tennis Channel introduced a

direct-to-consumer streaming service that merges its flagship

24-hour network with extensive live and on-demand multi-court

coverage.

- In January 2025, Sinclair and NBC announced a comprehensive,

multi-year agreement that renews station affiliation agreements for

all 21 of Sinclair’s owned and/or operated NBC affiliates, reaching

nearly 7 million U.S. TV households. The NBC affiliations were also

renewed by Sinclair partners in five markets where Sinclair

provides sales and other services under a joint sales agreement or

marketing service agreement.

- In 2024, Sinclair's newsrooms won a total of 232 journalism

awards, including 22 RTDNA Regional Edward R. Murrow Awards, 2

National Edward R. Murrow Awards for Outstanding Journalism, 37

regional Emmy awards, and one national Emmy award.

Corporate Social Responsibility Practices:

- In 2024, Sinclair partnered with more than 400 nonprofit and

civic organizations locally and across the country to help raise

nearly $25 million for nonprofit organizations, schools, community

agencies, and local disaster relief. In addition, Sinclair helped

to collect over 4.3 million pounds of food, over 250,000 diapers,

over 300,000 toys, and almost 6,300 units of blood for those in

need, while donating over $7 million in promotional airtime to

organizations.

- In January 2025, Sinclair announced that the company’s annual

Diversity Scholarship program opened for applications for the 2025

academic year. Having provided nearly $400,000 in tuition

assistance since 2013, the scholarship program aims to invest in

the future of the broadcast industry by helping students, including

from diverse backgrounds, complete their education and pursue

careers in journalism and marketing.

- In January 2025, Sinclair and Tennis Channel announced Sinclair

Cares: California Wildfires Relief, a fundraising initiative in

partnership with the Salvation Army to provide disaster relief

support across Southern California which helped provide critical

aid, shelter, food, fresh water, and support for wildfire survivors

and first responders in Los Angeles.

Investment Portfolio:

- During the fourth quarter, Sinclair Ventures, LLC (Ventures)

received approximately $47 million in cash from its minority

investments, including the exit of two real estate investments, and

invested approximately $9 million. For 2024, Ventures received $209

million in cash from its minority investments, of which $64 million

was reinvested.

NextGen Broadcasting (ATSC 3.0):

- In January 2025, the Company joined with broadcast peers The

E.W. Scripps Company, Gray Media, Inc., and Nexstar Media Group,

Inc. to form a new company, EdgeBeam Wireless, to provide robust

wireless data services to a wide range of businesses and industries

across the country. This joint venture creates a nationwide

spectrum footprint that no individual broadcaster could achieve on

its own, unlocking the potential of ATSC 3.0 to offer nationwide

coverage for data delivery to billions of potential devices on

market-disrupting terms.

- In December 2024, the Company acquired SK Telecom's stake in

CAST.ERA, previously a joint venture with the leading mobile

operator in South Korea, to develop wireless, cloud infrastructure

and artificial intelligence technologies related to NextGen

Broadcasting.

Financial Results:

Three Months Ended December 31, 2024

Consolidated Financial Results:

- Total revenues increased 22% to $1,004 million versus $826

million in the prior year period. Media revenues increased 21% to

$992 million versus $821 million in the prior year period.

- Total advertising revenues of $514 million increased 42% versus

$363 million in the prior year period. Core advertising revenues,

which exclude political revenues, of $311 million were down 8%

versus $339 million in the prior year period.

- Distribution revenues of $441 million increased versus $422

million in the prior year period.

- Operating income of $266 million increased versus an operating

loss of $386 million in the prior year period.

- Net income attributable to the Company was $176 million versus

net loss of $341 million in the prior year period.

- Adjusted EBITDA increased 83% to $330 million from $180 million

in the prior year period.

- Diluted earnings per common share was $2.61 as compared to

diluted loss per common share of $5.35 in the prior year

period.

Twelve Months Ended December 31, 2024

Consolidated Financial Results:

- Total revenues increased 13% to $3,548 million versus $3,134

million in the prior year period. Media revenues increased 13% to

$3,511 million versus $3,106 million in the prior year period.

- Total advertising revenues of $1,611 million increased 25%

versus $1,285 million in the prior year period. Core advertising

revenues, which exclude political revenues, of $1,206 million were

down 3% versus $1,241 million in the prior year period.

- Distribution revenues of $1,746 million increased versus $1,680

million in the prior year period.

- Operating income of $551 million increased versus operating

loss of $331 million in the prior year period.

- Net income attributable to the Company was $310 million versus

net loss of $291 million in the prior year period.

- Adjusted EBITDA increased 57% to $876 million from $557 million

in the prior year period

- Diluted earnings per common share was $4.69 as compared to

diluted loss per common share of $4.46 in the prior year

period.

Segment financial information is included in the following

tables for the periods presented. The Local Media segment consists

primarily of broadcast television stations, which the Company owns,

operates or to which the Company provides services, and includes

multicast networks and original content. The Local Media segment

assets are owned and operated by Sinclair Broadcast Group, LLC

(SBG). The Tennis segment consists primarily of Tennis Channel, a

cable network which includes coverage of most of tennis' top

tournaments and original professional sport and tennis lifestyle

shows; the Tennis Channel International subscription and streaming

service; Tennis Channel streaming service; T2 FAST, a 24-hours a

day free ad-supported streaming television channel; and Tennis.com.

Other includes non-broadcast digital solutions, technical services,

and other non-media investments. For periods presented subsequent

to June 1, 2023 (the date of the reorganization), the assets of the

Tennis segment and Other are owned and operated by Ventures.

Three months ended December 31,

2024

Local Media

Tennis

Other

Corporate and

Eliminations

Consolidated

($ in millions)

Distribution revenue

$

392

$

49

$

—

$

—

$

441

Core advertising revenue

300

7

9

(5

)

311

Political advertising revenue

203

—

—

—

203

Other media revenue

37

1

—

(1

)

37

Media revenues

$

932

$

57

$

9

$

(6

)

$

992

Non-media revenue

—

—

13

(1

)

12

Total revenues

$

932

$

57

$

22

$

(7

)

$

1,004

Media programming and production

expenses

$

387

$

27

$

—

$

—

$

414

Media selling, general and administrative

expenses

193

11

5

(6

)

203

Non-media expenses

2

—

12

—

14

Amortization of program contract costs

19

—

—

—

19

Corporate general and administrative

expenses

23

—

1

12

36

Stock-based compensation

8

—

—

—

8

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs

5

—

(1

)

—

4

Interest expense (net) (a)

68

—

(5

)

—

63

Capital expenditures

18

1

4

—

23

Distributions to the noncontrolling

interests

3

—

1

—

4

Cash distributions from investments

—

—

47

—

47

Net cash taxes paid

—

Net income

179

Operating income (loss)

258

14

6

(12

)

266

Adjusted EBITDA(b)

321

19

3

(13

)

330

Note: Certain amounts may not summarize to

totals due to rounding differences.

(a)

Interest expense (net) excludes deferred financing costs,

original issue discount amortization, and other non-cash interest

expense, and is net of interest income.

(b)

Adjusted EBITDA is defined as earnings before interest, tax,

depreciation and amortization, and non-recurring and unusual

transaction, implementation, legal, regulatory and other costs, as

well as certain non-cash items such as stock-based compensation

expense and other gains and losses less amortization of program

costs. Refer to the reconciliation at the end of this press release

and the Company’s website.

Three months ended December 31,

2023

Local Media

Tennis

Other

Corporate and

Eliminations

Consolidated

($ in millions)

Revenue:

Distribution revenue

$

373

$

49

$

—

$

—

$

422

Core advertising revenue

331

5

7

(4

)

339

Political advertising revenue

24

—

—

—

24

Other media revenue

37

—

—

(1

)

36

Media revenues

$

765

$

54

$

7

$

(5

)

$

821

Non-media revenue

—

—

7

(2

)

5

Total revenues

$

765

$

54

$

14

$

(7

)

$

826

Media programming and production

expenses

$

377

$

24

$

—

(1

)

$

400

Media selling, general and administrative

expenses

180

8

5

(3

)

190

Non-media expenses

2

—

13

(2

)

13

Amortization of program costs

21

—

—

—

21

Corporate general and administrative

expenses

25

—

3

501

529

Stock-based compensation

3

—

—

5

8

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs

15

—

4

480

499

Interest expense (net) (a)

70

—

(4

)

—

66

Capital expenditures

22

—

—

—

22

Distributions to the noncontrolling

interests

2

—

—

—

2

Net cash taxes paid

—

Net loss

(340

)

Operating income (loss)

111

16

(13

)

(500

)

(386

)

Adjusted EBITDA(b)

178

22

(3

)

(17

)

180

Note: Certain amounts may not summarize to

totals due to rounding differences.

(a)

Interest expense (net) excludes deferred financing costs,

original issue discount amortization, and other non-cash interest

expense, and is net of interest income.

(b)

Adjusted EBITDA is defined as earnings before interest, tax,

depreciation and amortization, and non-recurring and unusual

transaction, implementation, legal, regulatory and other costs, as

well as certain non-cash items such as stock-based compensation

expense and other gains and losses less amortization of program

costs. Refer to the reconciliation at the end of this press release

and the Company’s website.

Consolidated Balance Sheet and Cash

Flow Highlights of the Company:

- Total Company debt on the balance sheet as of December 31, 2024

was $4,129 million. Total gross debt outstanding as of December 31,

2024 was $4,165 million; pro forma for the refinancing, total gross

debt outstanding as of December 31, 2024 is $4,252 million.

- Cash and cash equivalents for the Company as of December 31,

2024 was $697 million, of which $291 million was SBG cash and $406

million was Ventures cash.

- As of December 31, 2024, 42.6 million Class A common shares and

23.8 million Class B common shares were outstanding, for a total of

66.4 million common shares.

- In December, the Company paid a quarterly cash dividend of

$0.25 per share.

- Capital expenditures for the fourth quarter of 2024 were $23

million.

Notes:

Certain reclassifications have been made to prior years'

financial information to conform to the presentation in the current

year.

Outlook:

The Company currently expects to achieve the following results

for the three months ending March 31, 2025 and the twelve months

ending December 31, 2025.

For the three months ending March 31,

2025 ($ in millions)

Local Media

Tennis

Other

Corporate and

Eliminations

Consolidated

Core advertising revenue

$270 to 280

$11 to 12

$8

$(6)

$283 to 294

Political advertising revenue

2 to 3

—

—

—

2 to 3

Advertising revenue

$272 to 283

$11 to 12

$8

$(6)

$285 to 297

Distribution revenue

397 to 399

56

—

—

453 to 455

Other media revenue

21

1

—

(2)

21

Media revenues

$691 to 703

$68 to 69

$8

$(8)

$759 to 773

Non-media revenue

—

—

6

—

6

Total revenues

$691 to 703

$68 to 69

$14

$(8)

$765 to 779

Media programming & production

expenses and media selling, general and administrative expenses

$576 to 578

$46

$7

$(8)

$621 to 623

Non-media expenses

2

—

9

11

Amortization of program costs

19

—

—

—

19

Corporate general and administrative

43

—

1

13

58

Stock-based compensation

26

—

—

27

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs

7

—

1

—

8

Interest expense (net)(a)

148

—

(5)

—

143

Capital expenditures

19 to 21

1

—

—

20 to 22

Distributions to the noncontrolling

interests

3

—

—

—

3

Cash distributions from equity

investments

—

—

12

—

12

Net cash tax payments

1

Operating Income

$2 to 13

$16 to 17

$(1)

$(15)

$2 to 14

Adjusted EBITDA(b)

$83 to 94

$21 to 23

$(3) to (2)

$(12)

$90 to 102

Note: Certain amounts may not summarize to

totals due to rounding differences.

(a)

Interest expense (net) excludes deferred financing costs,

original issue discount amortization, and other non-cash interest

expense, and is net of interest income. Includes $75 million

non-recurring fees and expenses associated with the financing.

(b)

Adjusted EBITDA is defined as earnings before interest, tax,

depreciation and amortization, and non-recurring and unusual

transaction, implementation, legal, regulatory and other costs, as

well as certain non-cash items such as stock-based compensation

expense and other gains and losses less amortization of program

costs.

For the twelve months ending December

31, 2025 ($ in millions)

Consolidated

Media programming & production

expenses and media selling, general and administrative expenses

$2,498 to 2,513

Non-media expenses

$45

Amortization of program costs

$71

Corporate general and administrative

$176

Stock based compensation

$54

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs

$33

Interest expense (net)(a)

369

Capital expenditures

$83 to 86

Distributions to noncontrolling

interests

$11

Cash distributions from equity

investments

$19

Net cash tax payments

$211 to 220

Note: Certain amounts may not summarize to

totals due to rounding differences.

(a)

Interest expense (net) excludes deferred financing costs,

original issue discount amortization, and other non-cash interest

expense, and is net of interest income. Includes $75 million

non-recurring fees and expenses associated with the financing.

Sinclair Conference Call:

The senior management of Sinclair will hold a conference call to

discuss the Company's fourth quarter 2024 results on Wednesday,

February 26, 2025, at 4:30 p.m. ET. The call will be webcast live

and can be accessed at www.sbgi.net under "Investor

Relations/Events and Presentations." After the call, an audio

replay will remain available at www.sbgi.net. The press and the

public will be welcome on the call in a listen-only mode. The

dial-in number is (888) 506-0062, with entry code 787591.

About Sinclair:

Sinclair, Inc. is a diversified media company and a leading

provider of local news and sports. The Company owns, operates

and/or provides services to 185 television stations in 86 markets

affiliated with all the major broadcast networks; and owns Tennis

Channel and multicast networks Comet, CHARGE!, TBD., and The Nest.

Sinclair’s content is delivered via multiple platforms, including

over-the-air, multi-channel video program distributors, and the

nation’s largest streaming aggregator of local news content,

NewsON. The Company regularly uses its website as a key source of

Company information which can be accessed at www.sbgi.net.

Sinclair, Inc. and Subsidiaries

Preliminary Unaudited Consolidated

Statements of Operations

(In millions, except share and per

share data)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

REVENUES:

Media revenues

$

992

$

821

$

3,511

$

3,106

Non-media revenues

12

5

37

28

Total revenues

1,004

826

3,548

3,134

OPERATING EXPENSES:

Media programming and production

expenses

414

400

1,661

1,611

Media selling, general and administrative

expenses

203

190

794

747

Amortization of program costs

19

21

74

80

Non-media expenses

14

13

53

49

Depreciation of property and equipment

25

25

101

105

Corporate general and administrative

expenses

36

529

185

694

Amortization of definite-lived intangible

assets

36

42

149

166

Loss on deconsolidation of subsidiary

—

—

—

10

(Gain) loss on asset dispositions and

other, net of impairment

(9

)

(8

)

(20

)

3

Total operating expenses

738

1,212

2,997

3,465

Operating income (loss)

266

(386

)

551

(331

)

OTHER INCOME (EXPENSE):

Interest expense including amortization of

debt discount and deferred financing costs

(74

)

(78

)

(304

)

(305

)

Gain on extinguishment of debt

—

—

1

15

Income (loss) from equity method

investments

26

(1

)

118

29

Other income (expense), net

7

3

29

(45

)

Total other expense, net

(41

)

(76

)

(156

)

(306

)

Income (loss) before income taxes

225

(462

)

395

(637

)

INCOME TAX (PROVISION) BENEFIT

(46

)

122

(76

)

358

NET INCOME (LOSS)

179

(340

)

319

(279

)

Net loss attributable to the redeemable

noncontrolling interests

—

—

—

4

Net income attributable to the

noncontrolling interests

(3

)

(1

)

(9

)

(16

)

NET INCOME (LOSS) ATTRIBUTABLE TO

SINCLAIR

$

176

$

(341

)

$

310

$

(291

)

EARNINGS (LOSS) PER COMMON SHARE

ATTRIBUTABLE TO SINCLAIR:

Basic earnings (loss) per share

$

2.64

$

(5.35

)

$

4.72

$

(4.46

)

Diluted earnings (loss) per share

$

2.61

$

(5.35

)

$

4.69

$

(4.46

)

Basic weighted average common shares

outstanding (in thousands)

66,415

63,506

65,782

65,125

Diluted weighted average common and common

equivalent shares outstanding (in thousands)

67,253

63,506

66,096

65,125

Adjusted EBITDA is a non-GAAP operating performance measure that

management and the Company’s Board of Directors use to evaluate the

Company’s operating performance and for executive compensation

purposes. The Company believes that Adjusted EBITDA provides useful

information to investors by allowing them to view the Company’s

business through the eyes of management and is a measure that is

frequently used by industry analysts, investors and lenders as a

measure of relative operating performance.

Adjusted EBITDA is provided on a forward-looking basis under the

section entitled “Outlook” above. The Company has not included a

reconciliation of projected Adjusted EBITDA to net income, which is

the most directly comparable GAAP measure, for the periods

presented in reliance on the unreasonable efforts exception

provided under Item 10(e)(1)(i)(B) of Regulation S-K. The Company’s

projected Adjusted EBITDA excludes certain items that are

inherently uncertain and difficult to predict including, but not

limited to, income taxes. Due to the variability, complexity and

limited visibility of the adjusting items that would be excluded

from projected Adjusted EBITDA in future periods, management does

not rely upon them for internal use or measurement of operating

performance, and therefore cannot create a quantitative projected

Adjusted EBITDA to net income reconciliation for the periods

presented without unreasonable efforts. A quantitative

reconciliation of projected Adjusted EBITDA to net income for the

periods presented would imply a degree of precision and certainty

as to these future items that does not exist and could be confusing

to investors. From a qualitative perspective, it is anticipated

that the differences between projected Adjusted EBITDA to net

income for the periods presented will consist of items similar to

those described in the reconciliation of historical results below.

The timing and amount of any of these excluded items could

significantly impact the Company’s net income for a particular

period. When planning, forecasting and analyzing future periods,

the Company does so primarily on a non-GAAP basis without preparing

a GAAP analysis.

In addition to the reconciliation of Adjusted EBITDA to its most

directly comparable GAAP measure, net income, below, the Company

also discloses a reconciliation of the Adjusted EBITDA of its

segments to its more directly comparable GAAP measure, segment

operating income.

Non-GAAP measures are not formulated in accordance with GAAP,

are not meant to replace GAAP financial measures and may differ

from other companies’ uses or formulations. Further discussions and

reconciliations of the Company's non-GAAP financial measures to

their most directly comparable GAAP financial measures can be found

on its website www.sbgi.net.

Sinclair, Inc. and Subsidiaries

Reconciliation of Non-GAAP Measurements

- Unaudited

All periods reclassified to conform

with current year GAAP presentation

(in millions)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Reconciliation of Net Income to

Adjusted EBITDA

Net income (loss)

$

179

$

(340

)

$

319

$

(279

)

Add: Income tax provision (benefit)

46

(122

)

76

(358

)

Add: Other income

(2

)

(7

)

(31

)

(4

)

Add: (Income) loss from equity method

investments

(26

)

1

(118

)

(29

)

Add: Loss from other investments and

impairments

3

13

33

91

Add: Gain on extinguishment of

debt/insurance proceeds

—

—

(3

)

(15

)

Add: Interest expense

74

78

304

305

Less: Interest income

(8

)

(9

)

(29

)

(42

)

Less: Loss on deconsolidation of

subsidiary

—

—

—

10

Less: (Gain) loss on asset dispositions

and other, net of impairment

(9

)

(8

)

(20

)

3

Add: Amortization of intangible assets

& other assets

36

42

149

166

Add: Depreciation of property &

equipment

25

25

101

105

Add: Stock-based compensation

8

8

57

50

Add: Non-recurring and unusual

transaction, implementation, legal, regulatory and other costs

4

499

38

554

Adjusted EBITDA

$

330

$

180

$

876

$

557

Three months ended December 31,

2024

Local Media

Tennis

Other

($ in millions)

Total revenues

$

932

$

57

$

22

Media programming and production

expenses

387

27

—

Media selling, general and administrative

expenses

193

11

5

Depreciation and amortization expenses

57

5

—

Amortization of program costs

19

—

—

Corporate general and administrative

expenses

23

—

1

Non-media expenses

2

—

12

Gain on asset dispositions and other, net

of impairment

(7

)

—

(2

)

Segment operating income

$

258

$

14

$

6

Reconciliation of Segment GAAP

Operating Income to Segment Adjusted EBITDA:

Segment operating income

$

258

$

14

$

6

Depreciation and amortization expenses

57

5

—

Gain on asset dispositions and other, net

of impairment

(7

)

—

(2

)

Stock-based compensation

8

—

—

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs

5

—

(1

)

Segment Adjusted EBITDA

$

321

$

19

$

3

Three months ended December 31,

2023

Local Media

Tennis

Other

($ in millions)

Total revenues

$

765

$

54

$

14

Media programming and production

expenses

377

24

—

Media selling, general and administrative

expenses

180

8

5

Depreciation and amortization expenses

58

6

4

Amortization of program costs

21

—

—

Corporate general and administrative

expenses

25

—

3

Non-media expenses

2

—

13

(Gain) loss on asset dispositions and

other, net of impairment

(9

)

—

2

Segment operating income (loss)

$

111

$

16

$

(13

)

Reconciliation of Segment GAAP

Operating Income to Segment Adjusted EBITDA:

Segment operating income (loss)

$

111

$

16

$

(13

)

Depreciation and amortization expenses

58

6

4

(Gain) loss on asset dispositions and

other, net of impairment

(9

)

—

2

Stock-based compensation

3

—

—

Non-recurring and unusual transaction,

implementation, legal, regulatory and other costs

15

—

4

Segment Adjusted EBITDA

$

178

$

22

$

(3

)

Forward-Looking

Statements:

The matters discussed in this news release, particularly those

in the section labeled "Outlook," include forward-looking

statements regarding, among other things, future operating results.

When used in this news release, the words "outlook," "intends to,"

"believes," "anticipates," "expects," "achieves," "estimates," and

similar expressions are intended to identify forward-looking

statements. Such statements are subject to a number of risks and

uncertainties. Actual results in the future could differ materially

and adversely from those described in the forward-looking

statements as a result of various important factors, including and

in addition to the assumptions set forth therein, but not limited

to, the rate of decline in the number of subscribers to services

provided by traditional and virtual multi-channel video programming

distributors ("Distributors"); the Company’s ability to generate

cash to service its substantial indebtedness; the successful

execution of outsourcing agreements; the successful execution of

retransmission consent agreements; the successful execution of

network and Distributor affiliation agreements; the Company’s

ability to identify and consummate acquisitions and investments, to

manage increased financial leverage resulting from acquisitions and

investments, and to achieve anticipated returns on those

investments once consummated; the Company’s ability to compete for

viewers and advertisers; pricing and demand fluctuations in local

and national advertising; the appeal of the Company’s programming

and volatility in programming costs; material legal, financial and

reputational risks and operational disruptions resulting from a

breach of the Company’s information systems; the impact of FCC and

other regulatory proceedings against the Company; compliance with

laws and uncertainties associated with potential changes in the

regulatory environment affecting the Company’s business and growth

strategy; the impact of pending and future litigation claims

against the Company; the Company’s limited experience in operating

or investing in non-broadcast related businesses; and any risk

factors set forth in the Company's recent reports on Form 10-Q

and/or Form 10-K, as filed with the Securities and Exchange

Commission. There can be no assurances that the assumptions and

other factors referred to in this release will occur. The Company

undertakes no obligation to publicly release the result of any

revisions to these forward-looking statements except as required by

law.

Category: Financial

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226569390/en/

Investor Contacts: Christopher C. King, VP, Investor Relations

Billie-Jo McIntire, VP, Corporate Finance (410) 568-1500 Media

Contact: jbellucci-c@sbgtv.com

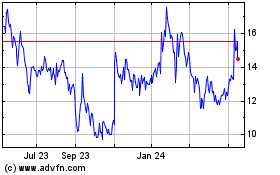

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Feb 2025 to Mar 2025

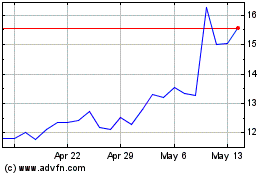

Sinclair (NASDAQ:SBGI)

Historical Stock Chart

From Mar 2024 to Mar 2025