Star Bulk Carriers Corp. (the "Company" or "Star Bulk") (Nasdaq:

SBLK), a global shipping company focusing on the transportation of

dry bulk cargoes, today announced its unaudited financial and

operating results for the first quarter of 2024. Unless otherwise

indicated or unless the context requires otherwise, all references

in this press release to "we," "us," "our," or similar references,

mean Star Bulk Carriers Corp. and, where applicable, its

consolidated subsidiaries.

Financial Highlights

|

(Expressed in thousands of U.S. dollars, except for daily rates and

per share data) |

|

|

|

First quarter 2024 |

First quarter 2023 |

|

Voyage Revenues |

$259,390 |

$224,035 |

|

Net income |

$74,856 |

$45,875 |

|

Adjusted Net income (1) |

$73,239 |

$37,077 |

|

Net cash provided by operating activities |

$114,262 |

$83,190 |

|

EBITDA (2) |

$126,336 |

$94,391 |

|

Adjusted EBITDA (2) |

$122,965 |

$84,802 |

|

Earnings per share basic |

$0.89 |

$0.45 |

|

Earnings per share diluted |

$0.89 |

$0.44 |

|

Adjusted earnings per share basic and diluted (1) |

$0.87 |

$0.36 |

|

Dividend per share for the relevant period |

$0.75 |

$0.35 |

|

Average Number of Vessels |

113.3 |

127.6 |

|

TCE Revenues (3) |

$195,664 |

$156,100 |

|

Daily Time Charter Equivalent Rate ("TCE") (3) |

$19,627 |

$14,199 |

|

Daily OPEX per vessel (4) |

$4,962 |

$4,858 |

|

Daily OPEX per vessel (as adjusted) (4) |

$4,962 |

$4,696 |

|

Daily Net Cash G&A expenses per vessel (5) |

$1,223 |

$1,059 |

| |

|

|

(1) Adjusted Net income and Adjusted

earnings per share are non-GAAP measures. Please see EXHIBIT I at

the end of this release for a reconciliation to Net income and

earnings per share, which are the most directly comparable

financial measures calculated and presented in accordance with

generally accepted accounting principles in the United States (“

U.S. GAAP”), as well as for the definition of each measure.

(2) EBITDA and Adjusted EBITDA are

non-GAAP liquidity measures. Please see EXHIBIT I at the end of

this release for a reconciliation of EBITDA and Adjusted EBITDA to

Net Cash Provided by / (Used in) Operating Activities, which is the

most directly comparable financial measure calculated and presented

in accordance with U.S. GAAP, as well as for the definition of each

measure. To derive Adjusted EBITDA from EBITDA, we exclude certain

non-cash gains / (losses).

(3) Daily Time Charter Equivalent

Rate (“TCE”) and TCE Revenues are non-GAAP measures. Please see

EXHIBIT I at the end of this release for a reconciliation to Voyage

Revenues, which is the most directly comparable financial measure

calculated and presented in accordance with U.S. GAAP. The

definition of each measure is provided in footnote (7) to the

Summary of Selected Data table below.

(4) Daily OPEX per vessel is

calculated by dividing vessel operating expenses by Ownership days

(defined below). Daily OPEX per vessel (as adjusted) is calculated

by dividing vessel operating expenses excluding increased costs due

to the COVID-19 pandemic or pre-delivery expenses for each vessel

on acquisition or change of management, if any, by Ownership days.

In the future we may incur expenses that are the same as or similar

to certain expenses (as described above) that were previously

excluded.

(5) Daily Net Cash G&A expenses

per vessel is calculated by (1) adding the Management fee

expense to the General and Administrative expenses, net of

share-based compensation expense and other non-cash charges and

(2) then dividing the result by the sum of Ownership days and

Charter-in days (defined below). Please see EXHIBIT I at the end of

this release for a reconciliation to General and administrative

expenses, which is the most directly comparable financial measure

calculated and presented in accordance with U.S.

GAAP.Petros Pappas, Chief Executive Officer of Star Bulk,

commented:

“During Q1 2024, Star Bulk successfully

leveraged a counter seasonally strong dry bulk market and generated

a Net Income of $74.9 million with a TCE per vessel per day of

$19,627. We are declaring a dividend of $0.75 per share,

representing the thirteenth consecutive dividend payment. Since

June 2021, we will have paid dividends totaling $11.52 per share to

each shareholder.

On April 9th we completed the merger with Eagle

Bulk Shipping Inc., a milestone transaction for both companies.

Having embarked on the work of integrating the best of both

organizations, we aim to take advantage of our combined scale,

technical and commercial knowledge and talented staff to better

serve our customers and strengthen our financial position. With a

scrubber fitted fleet of 161 vessels on a fully delivered basis, we

aspire to continue to provide safe and efficient transportation

solutions to our clients and strong financial returns to our

shareholders.

We continue modernizing our fleet, by taking

delivery during the quarter of three latest generation EEDI-Phase 3

long-term charter-in vessels, built at first class shipyards. At

the same time, we have taken advantage of elevated asset values to

continue selling primarily older and less fuel efficient vessels,

including seven vessels which we are delivering during Q2 2024.

These vessels average ~13.5 years of age, and will generate total

gross proceeds of $129.6 million before repayment of associated

debt.

We are optimistic about the medium term

prospects of the dry bulk market given the favorable order book and

upcoming, more stringent environmental regulations. Star Bulk

remains well positioned, with a strong balance sheet and an

efficient ship management platform, to take advantage of the

positive market backdrop and continue creating value for its

shareholders.”

Recent Developments

Declaration of Dividend

On May 22, 2024, pursuant to our dividend

policy, our Board of Directors declared a quarterly cash dividend

of $0.75 per share, payable on or about June 20, 2024 to all

shareholders of record as of June 6, 2024. The ex-dividend date is

expected to be June 5, 2024.

Eagle Merger Update

As previously announced, on December 11, 2023,

we entered into a definitive agreement with Eagle Bulk Shipping

Inc. (NYSE: EGLE) (“Eagle”) (the “Eagle Merger Agreement”) to

combine in an all-stock merger (the “Eagle Merger”). The Eagle

Merger was completed on April 9, 2024, following Eagle

shareholders’ approval and receipt of applicable regulatory

approvals and satisfaction of customary closing conditions. Each

Eagle shareholder received 2.6211 shares of Star Bulk common stock

for each share of Eagle common stock owned. Eagle common stock has

ceased trading and is no longer listed on the New York Stock

Exchange. Cash received following the Eagle Merger amounted to

$104.3 million.

Eagle’s 5.00% Convertible Senior

Notes

From and after the effective time of the Eagle

Merger (the “Effective Time”), the right to convert each $1,000

principal amount of Eagle's 5.00% Convertible Senior Notes due 2024

(the “Convertible Notes”) into shares of Eagle common stock was

changed into a right to convert such principal amount of

Convertible Notes into the kind and amount of shares of Star Bulk

common stock that a holder of a number of shares of Eagle common

stock equal to the conversion rate immediately prior to the

Effective Time would have been entitled to receive at the Effective

Time. Accordingly, from and after the Effective Time, each $1,000

principal amount of Convertible Notes will be convertible at a

conversion rate equal to 83.6702 shares of Star Bulk common stock

(subject to further adjustments for, among other things, cash

dividends).

In addition, following the consummation of the

Eagle Merger, we unconditionally guaranteed Eagle's obligations

under its Convertible Notes with respect to, among other things,

the due and punctual payment of, and interest on each Convertible

Note and the payment or delivery of amounts due in respect of

Eagle's conversion obligation. The Convertible Notes mature on

August 1, 2024.

Following the closing of the Eagle Merger, Star

Bulk is the largest U.S. listed dry bulk shipping company with a

global market presence and combined fleet of 161 owned vessels on a

fully delivered basis, 97% of which are fitted with scrubbers,

ranging from Newcastlemax/Capesize to Ultramax/Supramax

vessels.

Fleet Update

Vessel S&PIn connection with the previously

announced vessel sales, Pantagruel, Star Bovarius and Big Bang were

delivered to their new owners during the first quarter of 2024

while Star Dorado was delivered to her new owners in late April

2024.

In addition, in February, March and April 2024,

we agreed to sell vessels Star Audrey, Star Pyxis, Star Paola and

Crowned Eagle. Moreover, Eagle had agreed to sell the vessels

Crested Eagle and Stellar Eagle prior to the closing of the Eagle

Merger. In April 2024, two of these vessels were delivered to their

new owners while the remaining four vessels are expected to be

delivered to their new owners by June 2024.

Overall, during the second quarter of 2024, the

Company has already collected $53.9 million and expects to collect

an additional amount of $75.7 million with respect to the sale of 7

vessels. Debt prepaymets already made in connection with these

sales during the second quarter of 2024 amounted to $11.2 million

and an additional amount of $11.4 million will be prepaid until the

end of the second quarter of 2024.

Charter-In VesselsIn January and March 2024, we

took delivery of the newbuilding vessel Stargazer, an Ultramax

vessel built in Tsuneishi Cebu, as well as Star Voyager and Star

Explorer, two newbuilding Kamsarmax vessels built in Tsuneishi

Zhousan and JMU, respectively, all subject to seven-year charter-in

agreements.

Since February 2023, we have sold 23 vessels,

and one vessel became a constructive total loss, resulting in total

proceeds of $478.8 million, the majority of which has been used to

finance the purchase of 20.0 million shares from Oaktree at an

average share price of $19.00 per share.

Shares Outstanding Update

Following the completion of the Eagle Merger, as

of the date of this release, we have 113,810,792 shares

outstanding.

The Convertible Notes mature on August 1, 2024 and currently

have a conversion ratio of 83.6702 shares of Star Bulk common stock

per $1,000 principal amount of Convertible Notes (subject to

further adjustments for, among other things, cash dividends). Based

on the current conversion ratio, we expect to issue a net amount of

4,462,534 new shares of Star Bulk common stock upon maturity and

conversion of the Convertible Notes. On a fully diluted basis we

expect to have 118,544,612 common shares outstanding.

Financing

During April 2024, we entered into four new loan

facilities that provide for an aggregate loan amount of $388.1

million to refinance outstanding Eagle indebtedness resulting in

additional liquidity of $12.6 million as described below:

- On April 10, 2024, we entered into

a loan agreement with ABN AMRO Bank N.V. (the “ABN AMRO Loan”) for

a loan amount of up to $94.1 million, secured by first priority

mortgages on 12 Eagle vessels. The full amount of the loan was

drawn on April 12, 2024.

- On April 10, 2024, we entered into

a loan agreement with DNB Bank ASA (the “DNB Loan”) for a loan

amount of up to $100.0 million, secured by first priority mortgages

on 13 Eagle vessels. The full amount of the loan was drawn on April

12, 2024.

- On April 10, 2024, we entered into

a loan agreement with ING Bank N.V., London Branch (the “ING Loan”)

for a loan amount of up to $94.0 million, secured by first priority

mortgages on 12 Eagle vessels. The full amount of the loan was

drawn on April 12, 2024.

- On April 22, 2024, we entered into

a loan agreement with E.SUN Commercial Bank Ltd. (the “E.SUN Loan”)

for a loan amount of up to $100.0 million, secured by first

priority mortgages on 13 Eagle vessels. The full amount of the loan

was drawn on April 23, 2024.

The final maturities of the abovementioned loans

range from 5 years to 7 years.

In addition, following a number of interest rate

swaps we have entered into, we have an outstanding total notional

amount of $126.3 million under our financing agreements with an

average fixed rate of 61 bps and an average remaining maturity of

1.4 years. As of March 31, 2024, the Mark-to-Market value of our

outstanding interest rate swaps stood at $8.5 million, and our

cumulative net realized gain amounted to $33.8 million.

Vessel Employment Overview

Time Charter Equivalent Rate (“TCE rate”) is a

non-GAAP measure. Please see EXHIBIT I at the end of this release

for a reconciliation to Voyage Revenues, which is the most directly

comparable financial measure calculated and presented in accordance

with U.S. GAAP.

For the first quarter of 2024 our TCE rate for the

following main vessel categories was as follows:

| Newcastlemax

/ Capesize Vessels: |

$27,357 per day. |

| Post Panamax

/ Kamsarmax / Panamax Vessels: |

$15,134 per day. |

| Ultramax /

Supramax Vessels: |

$17,655 per day. |

Amounts shown throughout the press release and

variations in period–over–period comparisons are derived from the

actual unaudited numbers in our books and records. Reference to per

share figures below are based on 84,177,253 and 103,381,943

weighted average diluted shares for the first quarter of 2024 and

2023, respectively.

First Quarter 2024 and 2023 Results

For the first quarter of 2024, we had a net

income of $74.9 million, or $0.89 earnings per share, compared to a

net income for the first quarter of 2023 of $45.9 million, or $0.44

earnings per share. Adjusted net income, which excludes certain

non-cash items, was $73.2 million, or $0.87 earnings per share, for

the first quarter of 2024, compared to an adjusted net income of

$37.1 million for the first quarter of 2023, or $0.36 earnings per

share.

Net cash provided by operating activities for

the first quarter of 2024 was $114.3 million, compared to $83.2

million for the first quarter of 2023. Adjusted EBITDA, which

excludes certain non-cash items, was $123.0 million for the first

quarter of 2024, compared to $84.8 million for the first quarter of

2023.

Voyage revenues for the first quarter of 2024

increased to $259.4 million from $224.0 million in the first

quarter of 2023 and Time charter equivalent revenues (“TCE

Revenues”)1 increased to $195.7 million for the first quarter of

2024, compared to $156.1 million for the first quarter of 2023,

despite the decrease in the average number in our fleet during the

relevant periods. TCE rate for the first quarter of 2024 was

$19,627 compared to $14,199 for the first quarter of 2023 which is

indicative of the stronger market conditions prevailing during the

recent quarter.

Vessel operating expenses for the first quarters

of 2024 and 2023 amounted to $51.2 million and $55.8 million,

respectively. The decrease in our operating expenses was primarily

driven by the decrease in average number of vessels in our fleet to

113.3 from 127.6.

Drydocking expenses for the first quarters of

2024 and 2023 were $10.0 million and $8.0 million, respectively. In

each of the first quarters of 2024 and 2023, five vessels completed

their periodic dry docking surveys, but the vessels that completed

their dry docking surveys in the first quarter of 2024 were of

greater deadweight ton (“dwt”) scale which resulted in increased

drydocking expenses.

General and administrative expenses for the

first quarters of 2024 and 2023 were $10.7 million and $11.7

million, respectively, primarily due to the decrease in the stock

based compensation expense to $2.2 million from $3.4 million.

Vessel management fees for the first quarter of 2024 and 2023 were

$4.4 million and $4.2 million, respectively. Our daily net cash

general and administrative expenses per vessel (including

management fees and excluding share-based compensation and other

non-cash charges) for the first quarters of 2024 and 2023 were

$1,223 and $1,059, respectively. The increase in our daily G&A

expenses per vessel was primarily driven by the decrease in average

number of vessels in our fleet, something that we expect will

gradually be offset after the full integration of the Eagle

fleet.

Depreciation expense decreased to $32.0 million

for the first quarter of 2024 compared to $35.1 million for the

corresponding period in 2023. The fluctuation is primarily driven

by the decrease in the average number of vessels in our fleet to

113.3 from 127.6.

During the first quarter of 2023, an impairment

loss of $7.7 million was incurred, in connection with the sale of

two vessels. During the first quarter of 2024, no impairment loss

was incurred.

Other operational gain for the first quarter of

2024 decreased to $1.6 million from $33.2 million in the first

quarter of 2023. In the first quarter of 2023, other gains from

insurance claims relating to various vessels also included an

aggregate gain of $30.9 million from insurance proceeds and daily

detention compensation relating to Star Pavlina that became a

constructive total loss due to its prolonged detainment in Ukraine

following the ongoing conflict between Russia and Ukraine.

Our results for the first quarter of 2023

included a loss on write-down of inventories of $2.2 million

resulting from the valuation of the bunkers remaining on board our

vessels as a result of their lower net realizable value compared to

their historical cost. No such loss was incurred in the first

quarter of 2024.

During the first quarter of 2024, we incurred a

loss on forward freight agreements (“FFAs”) and bunker swaps of

$5.9 million, consisting of an unrealized loss of $3.2 million and

a realized loss of $2.7 million. During the first quarter of 2023,

we incurred a net gain on FFAs and bunker swaps of $1.3 million,

consisting of an unrealized loss of $4.9 million and a realized

gain of $6.2 million.

Our results for the first quarter of 2024

include an aggregate net gain of $8.8 million which resulted from

the completion of the previously announced sales of vessels Star

Glory, Pantagruel, Big Bang and Star Bovarius.

Interest and finance costs for the first

quarters of 2024 and 2023 were $20.5 million and $15.7 million,

respectively. The driving factor for this increase is the

significant increase in variable interest rates prevailing during

the corresponding periods which was partially offset by the

decrease in our weighted average outstanding indebtness and the

positive effect from our interest rate swaps.

Unaudited Consolidated Income Statements

| (Expressed

in thousands of U.S. dollars except for share and per share

data) |

First quarter 2024 |

|

First quarter 2023 |

| |

|

|

|

| |

|

|

|

|

Revenues: |

|

|

|

| Voyage

revenues |

$ |

259,390 |

|

|

$ |

224,035 |

|

|

Total revenues |

|

259,390 |

|

|

|

224,035 |

|

| |

|

|

|

|

Expenses: |

|

|

|

| Voyage

expenses |

|

(57,094 |

) |

|

|

(67,492 |

) |

| Charter-in

hire expenses |

|

(3,926 |

) |

|

|

(6,615 |

) |

| Vessel

operating expenses |

|

(51,172 |

) |

|

|

(55,785 |

) |

| Dry docking

expenses |

|

(10,021 |

) |

|

|

(8,007 |

) |

|

Depreciation |

|

(31,990 |

) |

|

|

(35,069 |

) |

| Management

fees |

|

(4,404 |

) |

|

|

(4,244 |

) |

| Loss on bad

debt |

|

- |

|

|

|

(300 |

) |

| General and

administrative expenses |

|

(10,695 |

) |

|

|

(11,665 |

) |

| Gain/(Loss)

on forward freight agreements and bunker swaps, net |

|

(5,921 |

) |

|

|

1,308 |

|

| Impairment

loss |

|

- |

|

|

|

(7,700 |

) |

| Other

operational loss |

|

(181 |

) |

|

|

(155 |

) |

| Other

operational gain |

|

1,617 |

|

|

|

33,233 |

|

| Gain on sale

of vessels |

|

8,769 |

|

|

|

- |

|

| Loss on

write-down of inventory |

|

- |

|

|

|

(2,166 |

) |

| |

|

|

|

|

Operating income |

|

94,372 |

|

|

|

59,378 |

|

| |

|

|

|

| Interest and

finance costs |

|

(20,499 |

) |

|

|

(15,702 |

) |

| Interest

income and other income/(loss) |

|

2,526 |

|

|

|

3,149 |

|

| Gain/(Loss)

on interest rate swaps, net |

|

(810 |

) |

|

|

(372 |

) |

| Gain/(Loss)

on debt extinguishment, net |

|

(813 |

) |

|

|

(419 |

) |

|

Total other expenses, net |

|

(19,596 |

) |

|

|

(13,344 |

) |

| |

|

|

|

|

Income before taxes and equity in income/(loss) of

investee |

$ |

74,776 |

|

|

$ |

46,034 |

|

| |

|

|

|

| Income tax

(expense)/refund |

|

106 |

|

|

|

(103 |

) |

| |

|

|

|

|

Income before equity in income/(loss) of

investee |

|

74,882 |

|

|

|

45,931 |

|

| |

|

|

|

| Equity in

income/(loss) of investee |

|

(26 |

) |

|

|

(56 |

) |

| |

|

|

|

| Net

income |

$ |

74,856 |

|

|

$ |

45,875 |

|

| |

|

|

|

| Earnings per

share, basic |

$ |

0.89 |

|

|

$ |

0.45 |

|

| Earnings per

share, diluted |

$ |

0.89 |

|

|

$ |

0.44 |

|

| Weighted

average number of shares outstanding, basic |

|

83,835,611 |

|

|

|

102,974,041 |

|

| Weighted

average number of shares outstanding, diluted |

|

84,177,253 |

|

|

|

103,381,943 |

|

| |

|

|

|

Unaudited Consolidated Condensed Balance Sheet

Data

|

(Expressed in thousands of U.S. dollars) |

| |

|

ASSETS |

March 31, 2024 |

|

December 31, 2023 |

|

Cash and cash equivalents and resticted cash, current |

$ |

266,524 |

|

|

259,729 |

| Vessel held

for sale |

|

- |

|

|

15,190 |

| Other

current assets |

|

179,806 |

|

|

179,478 |

|

TOTAL CURRENT ASSETS |

|

446,330 |

|

|

454,397 |

| |

|

|

|

| Advances for

vessels under construction |

|

17,952 |

|

|

- |

| Vessels and

other fixed assets, net |

|

2,441,744 |

|

|

2,539,743 |

| Restricted

cash, non current |

|

2,021 |

|

|

2,021 |

| Other

non-current assets |

|

113,580 |

|

|

32,094 |

|

TOTAL ASSETS |

$ |

3,021,627 |

|

$ |

3,028,255 |

| |

|

|

|

| Current

portion of long-term bank loans and lease financing |

|

180,604 |

|

|

251,856 |

| Other

current liabilities |

|

130,779 |

|

|

107,507 |

|

TOTAL CURRENT LIABILITIES |

|

311,383 |

|

|

359,363 |

| |

|

|

|

| Long-term

bank loans and lease financing non-current (net of unamortized

deferred finance fees of $7,147 and $8,606, respectively) |

|

916,063 |

|

|

985,247 |

| Other

non-current liabilities |

|

95,151 |

|

|

23,575 |

|

TOTAL LIABILITIES |

$ |

1,322,597 |

|

$ |

1,368,185 |

| |

|

|

|

|

SHAREHOLDERS' EQUITY |

|

1,699,030 |

|

|

1,660,070 |

| |

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

$ |

3,021,627 |

|

$ |

3,028,255 |

Unaudited Consolidated Condensed Cash Flow

Data

|

|

|

|

|

|

|

|

|

| (Expressed

in thousands of U.S. dollars) |

|

Three months ended March 31, 2024 |

|

|

|

Three months ended March 31, 2023 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Net

cash provided by / (used in) operating activities |

$ |

114,262 |

|

|

$ |

83,190 |

|

| |

|

|

|

|

|

|

|

|

Acquisition of other fixed assets |

|

(29 |

) |

|

|

(69 |

) |

|

Capital expenditures for vessel modifications/upgrades and advances

for vessels under construction |

|

(22,018 |

) |

|

|

(5,320 |

) |

|

Cash proceeds from vessel sales |

|

94,021 |

|

|

|

- |

|

|

Hull and machinery insurance proceeds |

|

591 |

|

|

|

358 |

|

| Net

cash provided by / (used in) investing

activities |

|

72,565 |

|

|

|

(5,031 |

) |

| |

|

|

|

|

|

|

|

|

Proceeds from vessels' new debt |

|

- |

|

|

|

47,000 |

|

|

Scheduled vessels' debt repayment |

|

(44,648 |

) |

|

|

(42,850 |

) |

|

Debt prepayment due to vessel total loss and sales |

|

(97,247 |

) |

|

|

(44,443 |

) |

|

Financing and debt extinguishment fees paid |

|

(133 |

) |

|

|

(587 |

) |

|

Repurchase of common shares |

|

- |

|

|

|

(7,005 |

) |

|

Dividends paid |

|

(38,003 |

) |

|

|

(62,050 |

) |

| Net

cash provided by / (used in) financing activities |

|

(180,031 |

) |

|

|

(109,935 |

) |

Summary of Selected Data

|

|

First quarter 2024 |

First quarter 2023 |

|

Average number of vessels (1) |

113.3 |

127.6 |

|

Number of vessels (2) |

111 |

127 |

|

Average age of operational fleet (in years) (3) |

11.9 |

11.2 |

|

Ownership days (4) |

10,314 |

11,483 |

|

Available days (5) |

9,969 |

10,994 |

|

Charter-in days (6) |

271 |

247 |

|

Daily Time Charter Equivalent Rate (7) |

$19,627 |

$14,199 |

|

Daily OPEX per vessel (8) |

$4,962 |

$4,858 |

|

Daily OPEX per vessel (as adjusted) (8) |

$4,962 |

$4,696 |

|

Daily Net Cash G&A expenses per vessel (9) |

$1,223 |

$1,059 |

(1) Average number of vessels is the number of

vessels that constituted our owned fleet for the relevant period,

as measured by the sum of the number of days each operating vessel

was a part of our owned fleet during the period divided by the

number of calendar days in that period.

(2) As of the last day of each period

presented.

(3) Average age of our operational fleet is

calculated as of the end of each period.

(4) Ownership days are the total calendar days

each vessel in the fleet was owned by us for the relevant period,

including vessels subject to sale and leaseback transactions and

finance leases.

(5) Available days are the Ownership days after

subtracting off-hire days for major repairs, dry docking or special

or intermediate surveys, change of management and vessels’

improvements and upgrades. The available days for the first quarter

of 2023 were also decreased by off-hire days relating to

disruptions in connection with crew changes as a result of the

COVID-19 pandemic. Our method of computing Available Days

may not necessarily be comparable to Available Days of other

companies.

(6) Charter-in days are the total days that we

charter-in third party vessels.

(7) Time charter equivalent rate represents the

weighted average daily TCE rates of our operating fleet (including

owned fleet and charter-in vessels). TCE rate is a measure of the

average daily net revenue performance of our operating fleet. Our

method of calculating TCE rate is determined by dividing (a) TCE

Revenues, which consists of Voyage Revenues net of voyage expenses,

charter-in hire expense, amortization of fair value of above/below

market acquired time charter agreements, if any, as well as

adjusted for the impact of realized gain/(loss) on forward freight

agreements (“FFAs”) and bunker swaps by (b) Available days for the

relevant time period. Available days do not include the Charter-in

days as per the relevant definitions provided above. Voyage

expenses primarily consist of port, canal and fuel costs that are

unique to a particular voyage, which would otherwise be paid by the

charterer under a time charter contract, as well as commissions. In

the calculation of TCE Revenues, we also include the realized

gain/(loss) on FFAs and bunker swaps as we believe that this method

better reflects the chartering result of our fleet and is more

comparable to the method used by some of our peers. TCE Revenues

and TCE rate, which are non-GAAP measures, provide additional

meaningful information in conjunction with Voyage Revenues, the

most directly comparable GAAP measure, because they assist our

management in making decisions regarding the deployment and use of

our vessels and because we believe that they provide useful

information to investors regarding our financial performance. TCE

rate is a standard shipping industry performance measure used

primarily to compare period-to-period changes in a shipping

company's performance despite changes in the mix of charter types

(i.e., voyage charters, time charters, bareboat charters and pool

arrangements) under which its vessels may be employed between the

periods. Our method of computing TCE Revenues and TCE rate

may not necessarily be comparable to those of other companies.

For a detailed calculation please see Exhibit I at the end of this

release with the reconciliation of Voyage Revenues to TCE.

(8) Daily OPEX per vessel is calculated by

dividing vessel operating expenses by Ownership days. Daily OPEX

per vessel (as adjusted) is calculated by dividing vessel operating

expenses excluding increased costs due to the COVID-19 pandemic or

pre-delivery expenses for each vessel on acquisition or change of

management, if any, by Ownership days. We exclude the

abovementioned expenses that may occur occasionally from our Daily

OPEX per vessel, since these generally represent items that we

would not anticipate occurring as part of our normal business on a

regular basis. We believe that Daily OPEX per vessel (as adjusted)

is a useful measure for our management and investors for period to

period comparison with respect to our operating cost performance

since such measure eliminates the effects of the items described

above, which may vary from period to period, are not part of our

daily business and derive from reasons unrelated to overall

operating performance. In the future we may incur expenses that are

the same as or similar to certain expenses (as described above)

that were previously excluded. Vessel operating expenses for the

first quarter of 2023 included additional crew expenses related to

the increased number and cost of crew changes performed during the

period as a result of COVID-19 restrictions imposed in 2020

estimated to be $1.4 million. In addition vessel operating expenses

for the first quarter of 2023, included pre-delivery expenses due

to change of management of $0.5 million.

(9) Please see Exhibit I at the end of this

release for the reconciliation to General and administrative

expenses, the most directly comparable GAAP measure. We believe

that Daily Net Cash G&A expenses per vessel is a useful measure

for our management and investors for period to period comparison

with respect to our financial performance since such measure

eliminates the effects of non-cash items which may vary from period

to period, are not part of our daily business and derive from

reasons unrelated to overall operating performance. In the future

we may incur expenses that are the same as or similar to certain

expenses (as described above) that were previously

excluded.EXHIBIT I: Non-GAAP Financial

Measures

EBITDA and Adjusted EBITDA Reconciliation

We include EBITDA (earnings before interest,

taxes, depreciation and amortization) herein since it is a basis

upon which we assess our liquidity position. It is also used by our

lenders as a measure of our compliance with certain loan covenants,

and we believe that it presents useful information to investors

regarding our ability to service and/or incur indebtedness.

To derive Adjusted EBITDA from EBITDA, we

exclude non-cash gains/(losses) such as those related to sale of

vessels, share based compensation expense, impairment loss, loss

from bad debt, unrealized gain/(loss) on derivatives and the equity

in income/(loss) of investee and other non-cash charges, if any,

which may vary from period to period and for different companies

and because these items do not reflect operational cash inflows and

outflows of our fleet.

EBITDA and Adjusted EBITDA do not represent and

should not be considered as alternatives to cash flow from

operating activities or net income, as determined by United States

generally accepted accounting principles, or U.S. GAAP. Our method

of computing EBITDA and Adjusted EBITDA may not necessarily be

comparable to other similarly titled captions of other

companies.

The following table reconciles net cash provided

by operating activities to EBITDA and Adjusted EBITDA:

| (Expressed

in thousands of U.S. dollars) |

First quarter 2024 |

|

First quarter 2023 |

|

Net cash provided by/(used in) operating activities |

$ |

114,262 |

|

|

$ |

83,190 |

|

| Net

decrease/(increase) in operating assets |

|

2,383 |

|

|

|

(4,039 |

) |

| Net

increase/(decrease) in operating liabilities, excluding

operating lease liability and including other non-cash charges |

|

(11,069 |

) |

|

|

(6,004 |

) |

| Impairment

loss |

|

- |

|

|

|

(7,700 |

) |

| Gain/(Loss)

on debt extinguishment, net |

|

(813 |

) |

|

|

(419 |

) |

| Share –

based compensation |

|

(2,161 |

) |

|

|

(3,446 |

) |

| Amortization

of debt (loans & leases) issuance costs |

|

(779 |

) |

|

|

(1,043 |

) |

| Unrealized

gain/(loss) on forward freight agreements and bunker swaps,

net |

|

(3,215 |

) |

|

|

(4,864 |

) |

| Unrealized

gain/(loss) on interest rate swaps, net |

|

(975 |

) |

|

|

(372 |

) |

| Total other

expenses, net |

|

19,596 |

|

|

|

13,344 |

|

| Gain from

insurance proceeds relating to vessel total loss |

|

- |

|

|

|

28,163 |

|

| Loss on bad

debt |

|

- |

|

|

|

(300 |

) |

| Income tax

expense/(refund) |

|

(106 |

) |

|

|

103 |

|

| Gain on sale

of vessels |

|

8,769 |

|

|

|

- |

|

| Gain from

Hull & Machinery claim |

|

470 |

|

|

|

- |

|

| Loss on

write-down of inventory |

|

- |

|

|

|

(2,166 |

) |

| Equity in

income/(loss) of investee |

|

(26 |

) |

|

|

(56 |

) |

|

EBITDA |

$ |

126,336 |

|

|

$ |

94,391 |

|

| |

|

|

|

| Equity in

(income)/loss of investee |

|

26 |

|

|

|

56 |

|

| Unrealized

(gain)/loss on forward freight agreements and bunker swaps,

net |

|

3,215 |

|

|

|

4,864 |

|

| Gain on sale

of vessels |

|

(8,769 |

) |

|

|

- |

|

| Loss on

write-down of inventory |

|

- |

|

|

|

2,166 |

|

| Gain from

insurance proceeds relating to vessel total loss |

|

- |

|

|

|

(28,163 |

) |

| Share-based

compensation |

|

2,161 |

|

|

|

3,446 |

|

| Loss on bad

debt |

|

- |

|

|

|

300 |

|

| Impairment

loss |

|

- |

|

|

|

7,700 |

|

| Other

non-cash charges |

|

(4 |

) |

|

|

42 |

|

|

Adjusted EBITDA |

$ |

122,965 |

|

|

$ |

84,802 |

|

Net income and Adjusted Net income

Reconciliation and Calculation of Adjusted Earnings Per

Share

To derive Adjusted Net Income and Adjusted

Earnings Per Share from Net Income, we exclude non-cash items, as

provided in the table below. We believe that Adjusted Net Income

and Adjusted Earnings Per Share assist our management and investors

by increasing the comparability of our performance from period to

period since each such measure eliminates the effects of such

non-cash items, as gain/(loss) on sale of assets, unrealized

gain/(loss) on derivatives, impairment loss and other items which

may vary from year to year, for reasons unrelated to overall

operating performance. In addition, we believe that the

presentation of the respective measure provides investors with

supplemental data relating to our results of operations, and

therefore, with a more complete understanding of factors affecting

our business than with GAAP measures alone. Our method of computing

Adjusted Net Income and Adjusted Earnings Per Share may not

necessarily be comparable to other similarly titled captions of

other companies.

|

(Expressed in thousands of U.S. dollars except for share and per

share data) |

|

|

|

|

|

|

|

|

First quarter 2024 |

|

|

|

First quarter 2023 |

|

| Net

income |

74,856 |

|

|

$ |

45,875 |

|

| Loss on bad

debt |

- |

|

|

|

300 |

|

| Share –

based compensation |

2,161 |

|

|

|

3,446 |

|

| Other

non-cash charges |

(4 |

) |

|

|

42 |

|

| Unrealized

(gain)/loss on forward freight agreements and bunker swaps,

net |

3,215 |

|

|

|

4,864 |

|

| Unrealized

(gain)/loss on interest rate swaps, net |

975 |

|

|

|

372 |

|

| Gain on sale

of vessels |

(8,769 |

) |

|

|

- |

|

| Impairment

loss |

- |

|

|

|

7,700 |

|

| Gain from

insurance proceeds relating to vessel total loss |

- |

|

|

|

(28,163 |

) |

| Loss on

write-down of inventory |

- |

|

|

|

2,166 |

|

| (Gain)/Loss

on debt extinguishment, net (non-cash) |

779 |

|

|

|

419 |

|

| Equity in

(income)/loss of investee |

26 |

|

|

|

56 |

|

|

Adjusted Net income |

73,239 |

|

|

$ |

37,077 |

|

| Weighted

average number of shares outstanding, basic |

83,835,611 |

|

|

|

102,974,041 |

|

| Weighted

average number of shares outstanding, diluted |

84,177,253 |

|

|

|

103,381,943 |

|

|

Adjusted Basic and Diluted Earnings Per Share |

0.87 |

|

|

$ |

0.36 |

|

Voyage Revenues to Daily Time Charter Equivalent (“TCE”)

Reconciliation

| (In

thousands of U.S. Dollars, except for TCE rates) |

First quarter 2024 |

|

First quarter 2023 |

|

Voyage revenues |

$ |

259,390 |

|

|

$ |

224,035 |

|

| Less: |

|

|

|

| Voyage

expenses |

|

(57,094 |

) |

|

|

(67,492 |

) |

| Charter-in

hire expenses |

|

(3,926 |

) |

|

|

(6,615 |

) |

| Realized

gain/(loss) on FFAs/bunker swaps, net |

|

(2,706 |

) |

|

|

6,172 |

|

| Time

Charter equivalent revenues |

$ |

195,664 |

|

|

$ |

156,100 |

|

| |

|

|

|

| Available

days |

|

9,969 |

|

|

|

10,994 |

|

|

Daily Time Charter Equivalent Rate ("TCE") |

$ |

19,627 |

|

|

$ |

14,199 |

|

Daily Net Cash G&A expenses per vessel

Reconciliation

| (In

thousands of U.S. Dollars, except for daily rates) |

First quarter 2024 |

|

First quarter 2023 |

|

General and administrative expenses |

$ |

10,695 |

|

|

$ |

11,665 |

|

| Plus: |

|

|

|

| Management

fees |

|

4,404 |

|

|

|

4,244 |

|

| Less: |

|

|

|

| Share –

based compensation |

|

(2,161 |

) |

|

|

(3,446 |

) |

| Other

non-cash charges |

|

4 |

|

|

|

(42 |

) |

| Net

Cash G&A expenses |

$ |

12,942 |

|

|

$ |

12,421 |

|

| |

|

|

|

| Ownership

days |

|

10,314 |

|

|

|

11,483 |

|

| Charter-in

days |

|

271 |

|

|

|

247 |

|

|

Daily Net Cash G&A expenses per vessel |

$ |

1,223 |

|

|

$ |

1,059 |

|

Conference Call details:

Our management team will host a conference call

to discuss our financial results on Thursday, May 23, 2024 at 11:00

a.m., Eastern Time (ET).

Participants should dial into the call 10

minutes before the scheduled time using the following numbers: +1

877 405 1226 (US Toll-Free Dial In) or +1 201 689 7823 (US and

Standard International Dial In), or +0 800 756 3429 (UK Toll Free

Dial In). Please quote “Star Bulk Carriers” to the operator and/or

conference ID 13746765. Click here for additional participant

International Toll-Free access numbers.

Alternatively, participants can register for the

call using the call me option for a faster connection to join the

conference call. You can enter your phone number and let the system

call you right away. Click here for the call me option.

Slides and audio webcast: There

will also be a live, and then archived, webcast of the conference

call and accompanying slides, available through the Company’s

website. To listen to the archived audio file, visit our website

www.starbulk.com and click on Events & Presentations.

Participants to the live webcast should register on the website

approximately 10 minutes prior to the start of the webcast.

About Star BulkStar Bulk is a

global shipping company providing worldwide seaborne transportation

solutions in the dry bulk sector. Star Bulk’s vessels transport

major bulks, which include iron ore, minerals and grain, and minor

bulks, which include bauxite, fertilizers and steel products. Star

Bulk was incorporated in the Marshall Islands on December 13, 2006

and maintains executive offices in Athens, New York, Limassol,

Singapore and Germany. Its common stock trades on the Nasdaq Global

Select Market under the symbol “SBLK”. As of May 22, 2024 and as

adjusted for the delivery of a) the vessels acquired in the Eagle

Merger, b) the agreed to be sold vessels to their new owner as

discussed above and c) the five firm Kamsarmax vessels currently

under construction, Star Bulk operates a fleet of 161 vessels, with

an aggregate capacity of 15.4 million dwt, consisting of 17

Newcastlemax, 16 Capesize, 1 Mini Capesize, 7 Post Panamax, 44

Kamsarmax, 2 Panamax, 48 Ultramax and 26 Supramax vessels with

carrying capacities between 53,489 dwt and 209,537 dwt.

In addition, as of the date of this release, we

have entered into long-term charter-in arrangements with respect to

two Kamsarmax newbuildings and one Ultramax newbuilding which are

expected to be delivered during 2024 with an approximate duration

of seven years per vessel plus optional years. In addition, in

November 2021 we took delivery of the Capesize vessel Star Shibumi,

under a long-term charter-in contract for a period up to November

2028. Further, as discussed above, in January 2024 we took delivery

of vessels Star Voyager, Star Explorer and Stargazer, each subject

to a seven-year charter-in arrangement.

Forward-Looking

StatementsMatters discussed in this press release may

constitute forward looking statements. The Private Securities

Litigation Reform Act of 1995 provides safe harbor protections for

forward-looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts.

We desire to take advantage of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995

and is including this cautionary statement in connection with this

safe harbor legislation. Words such as, but not limited to,

“believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,”

“targets,” “projects,” “likely,” “will,” “would,” “could,”

“should,” “may,” “forecasts,” “potential,” “continue,” “possible”

and similar expressions or phrases may identify forward-looking

statements.

The forward-looking statements in this press

release are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without

limitation, examination by our management of historical operating

trends, data contained in our records and other data available from

third parties. Although we believe that these assumptions were

reasonable when made, because these assumptions are inherently

subject to significant uncertainties and contingencies which are

difficult or impossible to predict and are beyond our control, we

cannot assure you that we will achieve or accomplish these

expectations, beliefs or projections.

In addition to these important factors, other

important factors that, in our view, could cause actual results to

differ materially from those discussed in the forward-looking

statements include the possibility that costs or difficulties

related to the integration of the Company's and Eagle's operations

will be greater than expected; risks related to the Eagle Merger

diverting management's attention from the Company's and Eagle's

ongoing business operations; the possibility that the expected

synergies and value creation from the Eagle Merger will not be

realized, or will not be realized within the expected time period;

the risk that shareholder litigation in connection with the

transactions may affect the timing or occurrence of the Eagle

Merger or result in significant costs of defense, indemnification

and liability; transaction costs related to the Eagle Merger;

general dry bulk shipping market conditions, including fluctuations

in charter rates and vessel values; the strength of world

economies; the stability of Europe and the Euro; fluctuations in

currencies, interest rates and foreign exchange rates; business

disruptions due to natural disasters or other disasters outside our

control, such as any new outbreaks or new variants of coronavirus

(“COVID-19”) that may emerge; the length and severity of epidemics

and pandemics, including their impact on the demand for seaborne

transportation in the dry bulk sector; changes in supply and demand

in the dry bulk shipping industry, including the market for our

vessels and the number of newbuildings under construction; the

potential for technological innovation in the sector in which we

operate and any corresponding reduction in the value of our vessels

or the charter income derived therefrom; changes in our expenses,

including bunker prices, dry docking, crewing and insurance costs;

changes in governmental rules and regulations or actions taken by

regulatory authorities; potential liability from pending or future

litigation and potential costs due to environmental damage and

vessel collisions; the impact of increasing scrutiny and changing

expectations from investors, lenders, charterers and other market

participants with respect to our Environmental, Social and

Governance (“ESG”) practices; our ability to carry out our ESG

initiatives and thereby meet our ESG goals and targets; new

environmental regulations and restrictions, whether at a global

level stipulated by the International Maritime Organization, and/or

regional/national level imposed by regional authorities such as the

European Union or individual countries; potential cyber-attacks

which may disrupt our business operations; general domestic and

international political conditions or events, including “trade

wars”, the ongoing conflict between Russia and Ukraine, the

conflict between Israel and Hamas and the Houthi attacks in the Red

Sea and the Gulf of Aden; the impact on our common shares and

reputation if our vessels were to call on ports located in

countries that are subject to restrictions imposed by the U.S. or

other governments; potential physical disruption of shipping routes

due to accidents, climate-related reasons (acute and chronic),

political events, public health threats, international hostilities

and instability, piracy or acts by terrorists; the availability of

financing and refinancing; the failure of our contract

counterparties to meet their obligations; our ability to meet

requirements for additional capital and financing to grow our

business; the impact of our indebtedness and the compliance with

the covenants included in our debt agreements; vessel breakdowns

and instances of off‐hire; potential exposure or loss from

investment in derivative instruments; potential conflicts of

interest involving our Chief Executive Officer, his family and

other members of our senior management; our ability to complete

acquisition transactions as and when planned and upon the expected

terms; and the impact of port or canal congestion or disruptions.

Please see our filings with the Securities and Exchange Commission

for a more complete discussion of these and other risks and

uncertainties. The information set forth herein speaks only as of

the date hereof, and the Company disclaims any intention or

obligation to update any forward‐looking statements as a result of

developments occurring after the date of this communication.

Contacts

Company: Simos Spyrou, Christos

Begleris Co ‐ Chief Financial Officers Star Bulk Carriers Corp. c/o

Star Bulk Management Inc. 40 Ag. Konstantinou Av. Maroussi 15124

Athens, Greece Email: info@starbulk.com www.starbulk.com

Investor Relations / Financial Media: Nicolas

Bornozis President Capital Link, Inc. 230 Park Avenue, Suite 1536

New York, NY 10169 Tel. (212) 661‐7566 E‐mail:

starbulk@capitallink.com www.capitallink.com

1 Please see the table at the end of this release for the

calculation of the TCE Revenues.

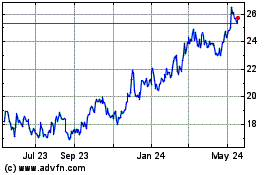

Star Bulk Carriers (NASDAQ:SBLK)

Historical Stock Chart

From Feb 2025 to Mar 2025

Star Bulk Carriers (NASDAQ:SBLK)

Historical Stock Chart

From Mar 2024 to Mar 2025