Star Bulk Carriers Corp. (the "Company" or "Star Bulk") (Nasdaq:

SBLK), a global shipping company focusing on the transportation of

dry bulk cargoes, today announced that the Company’s Board further

amended its dividend policy which was in place since 2021. Unless

otherwise indicated or unless the context requires otherwise, all

references in this press release to "we," "us," "our," or similar

references, mean Star Bulk Carriers Corp. and, where applicable,

its consolidated subsidiaries.

Under the amended dividend policy, as set out

herein below, the Company may approve an allocation of up to 60% of

cash flow from operations less debt amortization, less

maintenance/upgrade CAPEX less any deficit of cash below $2.1

million per owned vessel (“Cash Flow”), towards quarterly

shareholder dividends.

Any remaining Cash Flow to be allocated, at the

Company’s discretion, to:

- Share

repurchases: Buybacks will be prioritized when the share price is

trading at a significant discount to the estimated net liquidation

value of the Company’s hard assets

- Growth

Opportunities: Cash Flow may be also used for opportunistic vessel

acquisitions and investments that will create enhanced returns over

time and for general corporate purposes.

New Share Repurchase Program

On December 13, 2024 our Board of Directors

cancelled the existing $50.0 million share repurchase program and

authorized a new share repurchase program of up to an aggregate of

$100.0 million (“New Share Repurchase Program”) under the same

conditions applying as per the previous share repurchase program.

Pursuant to the New Share Repurchase Program and using proceeds

from previous vessel sales, the Company bought back 293,474 shares

at an average price of $15.5. The repurchased shares will be

withdrawn and cancelled, leaving the total number of shares issued

and outstanding post cancellation at 117,730,112.

Petros Pappas, Chief Executive Officer of Star Bulk,

commented:

“For the past several months, our share has been available for

purchase at prices that appear to be more attractive than the

corresponding prices for dry bulk vessels. We are amending the

Company’s dividend policy to increase its flexibility to take

advantage of this market inefficiency for the benefit of all

shareholders.”

About Star BulkStar Bulk is a

global shipping company providing worldwide seaborne transportation

solutions in the dry bulk sector. Star Bulk’s vessels transport

major bulks, which include iron ore, minerals and grain, and minor

bulks, which include bauxite, fertilizers and steel products. Star

Bulk was incorporated in the Marshall Islands on December 13, 2006

and maintains executive offices in Athens, New York, Limassol,

Singapore, Germany and Denmark. Its common stock trades on the

Nasdaq Global Select Market under the symbol “SBLK”. As of the date

of this release on a fully delivered basis and as adjusted for the

delivery of a) the vessels agreed to be sold as discussed above and

b) the five firm Kamsarmax vessels currently under construction, we

own a fleet of 156 vessels, with an aggregate capacity of 15.0

million dwt consisting of 17 Newcastlemax, 15 Capesize, 1 Mini

Capesize, 7 Post Panamax, 44 Kamsarmax, 1 Panamax, 48 Ultramax and

23 Supramax vessels with carrying capacities between 53,489 dwt and

209,537 dwt.

In addition, in November 2021 we took delivery

of the Capesize vessel Star Shibumi, under a long-term charter-in

contract for a period up to November 2028. In January 2024 we took

delivery of vessels Star Voyager, Star Explorer and Stargazer, in

June 2024 we took delivery of the vessel Star Earendel, in October

2024, as discussed above, we took delivery of the vessel Star

Illusion and in November 2024, as discussed above, we took delivery

of the vessel Star Thetis, each subject to a seven-year charter-in

arrangement.

Forward-Looking Statements

Matters discussed in this press release may

constitute forward looking statements. The Private Securities

Litigation Reform Act of 1995 provides safe harbor protections for

forward-looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts.

We desire to take advantage of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995

and is including this cautionary statement in connection with this

safe harbor legislation. Words such as, but not limited to,

“believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,”

“targets,” “projects,” “likely,” “would,” “could,” “should,” “may,”

“forecasts,” “potential,” “continue,” “possible” and similar

expressions or phrases may identify forward-looking statements.

The forward-looking statements in this press

release are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without

limitation, examination by our management of historical operating

trends, data contained in our records and other data available from

third parties. Although we believe that these assumptions were

reasonable when made, because these assumptions are inherently

subject to significant uncertainties and contingencies which are

difficult or impossible to predict and are beyond our control, we

cannot assure you that we will achieve or accomplish these

expectations, beliefs or projections.

In addition to these important factors, other

important factors that, in our view, could cause actual results to

differ materially from those discussed in the forward-looking

statements include general dry bulk shipping market conditions,

including fluctuations in charter rates and vessel values; the

strength of world economies; the stability of Europe and the Euro;

fluctuations in interest rates and foreign exchange rates; the

impact of the expected discontinuance of the London Interbank

Offered Rate, or LIBOR, after 2021 on interest rates of our debt

that reference LIBOR; business disruptions due to natural disasters

or other disasters outside our control, such as the ongoing global

outbreak of the novel coronavirus (“COVID-19”); the length and

severity of epidemics and pandemics, including COVID-19 and its

impact on the demand for seaborne transportation in the dry bulk

sector; changes in supply and demand in the dry bulk shipping

industry, including the market for our vessels and the number of

new buildings under construction; the potential for technological

innovation in the sector in which we operate and any corresponding

reduction in the value of our vessels or the charter income derived

therefrom; changes in our operating expenses, including bunker

prices, dry docking, crewing and insurance costs; changes in

governmental rules and regulations or actions taken by regulatory

authorities; potential liability from pending or future litigation

and potential costs due to environmental damage and vessel

collisions; the impact of increasing scrutiny and changing

expectations from investors, lenders, charterers and other market

participants with respect to our Environmental, Social and

Governance ("ESG") policies; general domestic and international

political conditions or events, including “trade wars”; the impact

on our common shares and reputation if our vessels were to call on

ports located in countries that are subject to restrictions imposed

by the U.S. or other governments; potential disruption of shipping

routes due to accidents or political events; the availability of

financing and refinancing; ; the failure of our contract

counterparties to meet their obligations; our ability to meet

requirements for additional capital and financing to grow our

business; the impact of our indebtedness and the compliance with

the covenants included in our debt agreements; vessel breakdowns

and instances of off‐hire; potential exposure or loss from

investment in derivative instruments; potential conflicts of

interest involving our Chief Executive Officer, his family and

other members of our senior management and our ability to complete

acquisition transactions as and when planned. Please see our

filings with the Securities and Exchange Commission for a more

complete discussion of these and other risks and uncertainties. The

information set forth herein speaks only as of the date hereof, and

the Company disclaims any intention or obligation to update any

forward‐looking statements as a result of developments occurring

after the date of this communication.

|

Contacts |

|

| Company: Simos Spyrou, Christos Begleris Co ‐

Chief Financial Officers Star Bulk Carriers Corp. c/o Star Bulk

Management Inc. 40 Ag. Konstantinou Av.Maroussi 15124Athens, Greece

Email: info@starbulk.comwww.starbulk.com |

Investor Relations / Financial Media:Nicolas

Bornozis PresidentCapital Link, Inc.230 Park Avenue, Suite 1536New

York, NY 10169Tel. (212) 661‐7566 E‐mail: starbulk@capitallink.com

www.capitallink.com |

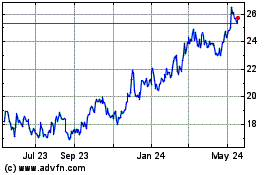

Star Bulk Carriers (NASDAQ:SBLK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Star Bulk Carriers (NASDAQ:SBLK)

Historical Stock Chart

From Feb 2024 to Feb 2025