Results Reflect Challenged Customer Experience;

Management is Developing a Plan to Get Back to Starbucks and Will

Provide Insights into Its Plan during the Q4 and Full Fiscal Year

2024 Earnings Call

Starbucks Corporation (NASDAQ: SBUX) today reported preliminary

financial results for its 13-week fiscal fourth quarter and 52-week

fiscal year ended September 29, 2024. GAAP results in fiscal 2024

and fiscal 2023 include items that are excluded from non-GAAP

results. Please refer to the reconciliation of GAAP measures to

non-GAAP measures at the end of this release for more

information.

For the fourth quarter of fiscal year 2024, global comparable

store sales declined 7%, and consolidated net revenues declined 3%

to $9.1 billion, or a 3% decline on a constant currency basis. GAAP

earnings per share is $0.80, down 25% over prior year. Non-GAAP

earnings per share is also $0.80, declining 24% on a constant

currency basis.

The company’s results were primarily driven by softness in North

America’s revenues in the quarter, specifically a 6% decline in

U.S. comparable store sales, driven by a 10% decline in comparable

transactions, partially offset by a 4% increase in average ticket.

The accelerated investments in an expanded range of product

offerings coupled with more frequent in-app promotions and

integrated marketing to entice frequency across the customer base

did not improve customer behaviors, specifically traffic across

both Starbucks Rewards and non-SR customer segments, resulting in

lower-than-expected performance. Additionally, China comparable

store sales declined 14%, driven by an 8% decline in average ticket

compounded by a 6% decline in comparable transactions, weighed down

by intensified competition and a soft macro environment that

impacted consumer spending.

For the full fiscal year 2024, global comparable store sales

declined 2%, and consolidated net revenues increased 1% to $36.2

billion, also a 1% increase on a constant currency basis. GAAP

earnings per share is $3.31, down 8% over prior year. Non-GAAP

earnings per share is also $3.31, declining 6% on a constant

currency basis. The lower-than-expected performance for the full

fiscal year was a result of pronounced traffic decline, including a

cautious consumer environment, and our targeted and accelerated

investments not improving customer behaviors, as well as the macro

and competitive environment in China pressuring our results

further.

Given the company’s ceo transition coupled with the current

state of the business, guidance will be suspended for the full

fiscal year 2025. This will allow ample opportunity to complete an

assessment of the business and solidify key strategies, while

stabilizing and positioning the business for long-term growth.

With a strategic reset underway, the company remains committed

to creating shareholder value and is announcing that its Board of

Directors approved an increase in the quarterly cash dividend from

$0.57 to $0.61 per share of outstanding common stock. The dividend

and related increase demonstrates the company’s confidence in the

long-term growth.

“Despite our heightened investments, we were unable to change

the trajectory of our traffic decline, resulting in pressures in

both our top-line and bottom-line. While our efficiency efforts

continued to produce according to plan, they were not enough to

outpace the impact of the decline in traffic,” commented Rachel

Ruggeri, chief financial officer. “We are developing a plan to turn

around our business, but it will take time. We want to amplify our

confidence in the business, and provide some certainty as we drive

our turnaround. For that reason, we have increased our dividend,”

Ruggeri added.

“Our fourth quarter performance makes it clear that we need to

fundamentally change our strategy so we can get back to growth and

that's exactly what we are doing with our ‘Back to Starbucks’

plan,” commented Brian Niccol, chairman and chief executive

officer. “I’ve spent my first several weeks in stores engaging with

and listening to feedback from our partners and customers. It’s

clear that Starbucks is a much-loved brand. We need to focus on

what has always set us apart — a welcoming coffeehouse where people

gather and where we serve the finest coffee, handcrafted by our

skilled baristas. We are energized and the team is already moving

quickly. I’ll share more details at our upcoming earnings call, but

invite you to listen to my initial thoughts on our investor

relations website,” Niccol concluded.

Starbucks released a video of prepared remarks by Brian Niccol,

chairman and chief executive officer. The video is available at

https://investor.starbucks.com/ and the video will be available on

the company’s website until the end of day, Thursday, December 5,

2024. The company uses its website as a tool to disclose important

information about the company and comply with its disclosure

obligations under Regulation Fair Disclosure. A transcript of the

video accompanies this Release.

Starbucks plans to release its actual fourth quarter and full

fiscal year 2024 financial results after market close on Wednesday,

October 30, 2024, with a conference call to follow at 2:00 p.m.

Pacific Time. The conference call will be webcast, including closed

captioning, and can be accessed on the company’s website at

https://investor.starbucks.com/. A replay of the webcast will be

available on the company’s website until the end of day, Friday,

December 13, 2024.

About Starbucks

Since 1971, Starbucks Coffee Company has been committed to

ethically sourcing and roasting high-quality arabica coffee. Today,

with more than 40,000 stores worldwide, the company is the premier

roaster and retailer of specialty coffee in the world. Through our

unwavering commitment to excellence and our guiding principles, we

bring the unique Starbucks Experience to life for every customer

through every cup. To share in the experience, please visit us in

our stores or online at stories.starbucks.com or

www.starbucks.com.

Forward-Looking

Statements

Certain statements contained herein and in the prepared remarks

from our chairman and ceo are “forward-looking” statements within

the meaning of applicable securities laws and regulations.

Generally, these statements can be identified by the use of words

such as “aim,” “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “feel,” “forecast,” “intend,” “may,”

“outlook,” “plan,” “potential,” “predict,” “project,” “seek,”

“should,” “will,” “would,” and similar expressions intended to

identify forward-looking statements, although not all

forward-looking statements contain these identifying words. By

their nature, forward-looking statements involve risks,

uncertainties, and other factors (many beyond our control) that

could cause our actual results to differ materially from our

historical experience or from our current expectations or

projections. Our forward-looking statements, and the risks and

uncertainties related thereto, include, but are not limited to,

those described under the “Risk Factors” and “Management's

Discussion and Analysis of Financial Condition and Results of

Operations” sections of the company’s most recently filed periodic

reports on Form 10-K and Form 10-Q and in other filings with the

SEC, as well as:

- our ability to preserve, grow, and leverage our brands,

including the risk of negative responses by consumers (such as

boycotts or negative publicity campaigns) or governmental actors

(such as retaliatory legislative treatment) who object to certain

actions taken or not taken by the Company, which responses could

adversely affect our brand value;

- the acceptance of the company’s products and changes in

consumer preferences, consumption, or spending behavior and our

ability to anticipate or react to them; shifts in demographic or

health and wellness trends; or unfavorable consumer reaction to new

products, platforms, reformulations, or other innovations;

- our anticipated operating expenses, including our anticipated

total capital expenditures;

- the costs associated with, and the successful execution and

effects of, our existing and any future business opportunities,

expansions, initiatives, strategies, investments, and plans,

including our Back to Starbucks plan;

- the impacts of partner investments and changes in the

availability and cost of labor including any union organizing

efforts and our responses to such efforts;

- the ability of our business partners, suppliers and third-party

providers to fulfill their responsibilities and commitments;

- higher costs, lower quality, or unavailability of coffee,

dairy, cocoa, energy, water, raw materials, or product

ingredients;

- the impact of adverse weather conditions or natural

disasters;

- the impact of significant increases in logistics costs;

- a worsening in the terms and conditions upon which we engage

with our manufacturers and source suppliers, whether resulting from

broader local or global conditions, or dynamics specific to our

relationships with such parties;

- unfavorable global or regional economic conditions and related

economic slowdowns or recessions, low consumer confidence, high

unemployment, weak credit or capital markets, budget deficits,

burdensome government debt, austerity measures, higher interest

rates, higher taxes, political instability, higher inflation, or

deflation;

- inherent risks of operating a global business including

geopolitical instability, local labor policies and conditions,

including labor strikes and work stoppages, protectionist trade

policies, or economic or trade sanctions, and compliance with local

trade practices and other regulations;

- failure to attract or retain key executive or partner talent or

successfully transition executives;

- the potential negative effects of incidents involving food or

beverage-borne illnesses, tampering, adulteration, contamination or

mislabeling;

- negative publicity related to our company, products, brands,

marketing, executive leadership, partners, board of directors,

founder, operations, business performance, expansions, initiatives,

strategies, investments, plans, or prospects;

- potential negative effects of a material breach, failure, or

corruption of our information technology systems or those of our

direct and indirect business partners, suppliers or third-party

providers, or failure to comply with data protection laws;

- our environmental, community, and farmer promises and any

reaction related thereto, such as the rise in opposition to “ESG”

and inclusion and diversity efforts;

- risks associated with acquisitions, dispositions, business

partnerships, or investments – such as acquisition integration,

termination difficulties or costs, or impairment in recorded

value;

- the impact of foreign currency translation, particularly a

stronger U.S. dollar;

- the impact of substantial competition from new entrants,

consolidations by competitors, and other competitive activities,

such as pricing actions (including price reductions, promotions,

discounting, couponing, or free goods), marketing, category

expansion, product introductions, or entry or expansion in our

geographic markets;

- the impact of changes in U.S. tax law and related guidance and

regulations that may be implemented, including on tax rates;

- the impact of health epidemics, pandemics, or other public

health events on our business and financial results, and the risk

of negative economic impacts and related regulatory measures or

voluntary actions that may be put in place, including restrictions

on business operations or social distancing requirements, and the

duration and efficacy of such restrictions;

- failure to comply with anti-corruption laws, trade sanctions

and restrictions, or similar laws or regulations; and

- the impact of significant legal disputes and proceedings, or

government investigations.

In addition, many of the foregoing risks and uncertainties are,

or could be, exacerbated by any worsening of the global business

and economic environment. A forward-looking statement is neither a

prediction nor a guarantee of future events or circumstances, and

those future events or circumstances may not occur. You should not

place undue reliance on the forward-looking statements, which speak

only as of the date of this report. We are under no obligation to

update or alter any forward-looking statements, whether as a result

of new information, future events, or otherwise.

Key Metrics

The company's financial results and long-term growth model will

continue to be driven by new store openings, comparable store sales

growth and operating margin management. We believe these key

operating metrics are useful to investors because management uses

these metrics to assess the growth of our business and the

effectiveness of our marketing and operational strategies.

Non-GAAP Disclosure

In addition to the GAAP results provided in this release, the

company provides certain non-GAAP financial measures that are not

in accordance with, or alternatives for, generally accepted

accounting principles in the United States (GAAP). When provided to

investors, our non-GAAP financial measures of non-GAAP general and

administrative expenses (G&A), non-GAAP operating income,

non-GAAP operating income growth (loss), non-GAAP operating margin,

non-GAAP effective tax rate and non-GAAP earnings per share exclude

the below-listed items and their related tax impacts, as management

does not believe they contribute to a meaningful evaluation of the

company’s future operating performance or comparisons to the

company's past operating performance. The GAAP measures most

directly comparable to non-GAAP G&A, non-GAAP operating income,

non-GAAP operating income growth (loss), non-GAAP operating margin,

non-GAAP effective tax rate and non-GAAP earnings per share are

G&A, operating income, operating income growth (loss),

operating margin, effective tax rate and diluted net earnings per

share, respectively.

Non-GAAP

Exclusion

Rationale

Restructuring and impairment costs

Management excludes restructuring and

impairment costs for reasons discussed above. These expenses are

anticipated to be completed within a finite period of time.

Transaction and integration-related

costs

Management excludes transaction and

integration costs for reasons discussed above. Additionally, we

incur certain costs associated with certain divestiture activities.

The majority of these costs will be recognized over a finite period

of time.

Gain on sale of assets

Management excludes the gain related to

the sale of assets to Nestlé, primarily consisting of intellectual

properties associated with the Seattle's Best Coffee brand, as

these items do not reflect future gains or tax impacts for reasons

discussed above.

The Company also presents constant currency information to

provide a framework for assessing how our underlying businesses

performed excluding the effect of foreign currency rate

fluctuations. To present the constant currency information, current

period results for entities reporting in currencies other than

United States dollars are converted into United States dollars

using the average monthly exchange rates from the comparative

period rather than the actual exchange rates in effect during the

respective periods, excluding related hedging activities. We

believe the presentation of results on a constant currency basis in

addition to GAAP results helps users better understand our

performance, because it excludes the effects of foreign currency

volatility that are not indicative of our underlying operating

results.

Non-GAAP G&A, non-GAAP operating income, non-GAAP operating

income growth (loss), non-GAAP operating margin, non-GAAP effective

tax rate, non-GAAP earnings per share and constant currency may

have limitations as analytical tools. These measures should not be

considered in isolation or as a substitute for analysis of the

company’s results as reported under GAAP. Other companies may

calculate these non-GAAP financial measures differently than the

company does, limiting the usefulness of those measures for

comparative purposes.

STARBUCKS CORPORATION

NET REVENUE CONSTANT CURRENCY

RECONCILIATION

(unaudited, in millions)

Quarter Ended

Consolidated

Revenue for the quarter ended Oct 1, 2023

as reported (GAAP)

$

9,373.6

Revenue for the quarter ended Sep 29, 2024

as reported (GAAP)

$

9,074.0

Change (%)

(3.2

)%

Constant Currency Impact (%)

0.3

%

Change in Constant Currency (%)

(2.9

)%

Year Ended

Consolidated

Revenue for the year ended Oct 1, 2023 as

reported (GAAP)

$

35,975.6

Revenue for the year ended Sep 29, 2024 as

reported (GAAP)

$

36,176.2

Change (%)

0.6

%

Constant Currency Impact (%)

0.7

%

Change in Constant Currency (%)

1.3

%

STARBUCKS CORPORATION

RECONCILIATION OF SELECTED

GAAP MEASURES TO NON-GAAP MEASURES

(unaudited, in millions, except

per share data)

Quarter Ended

Consolidated

Sep 29,

2024

Oct 1,

2023

Change

Constant Currency

Impact

Change in Constant

Currency

Diluted net earnings per share, as

reported (GAAP)

$

0.80

$

1.06

(24.5)%

Non-GAAP EPS

$

0.80

$

1.06

(24.5)%

0.9%

(23.6)%

Year Ended

Consolidated

Sep 29,

2024

Oct 1,

2023

Change

Constant Currency

Impact

Change in Constant

Currency

Diluted net earnings per share, as

reported (GAAP)

$

3.31

$

3.58

(7.5)%

Restructuring and impairment costs (1)

—

0.02

Transaction and integration-related costs

(2)

—

0.00

Gain from sale of assets

—

(0.08

)

Income tax effect on Non-GAAP adjustments

(3)

—

0.02

Non-GAAP EPS

$

3.31

$

3.54

(6.5)%

0.9%

(5.6)%

(1)

Represents costs associated with our

restructuring efforts.

(2)

Fiscal 2023 includes transaction-related

expenses related to the sale of our Seattle's Best Coffee

brand.

(3)

Adjustments were determined based on the

nature of the underlying items and their relevant jurisdictional

tax rates.

Appendix

Transcript of Prepared Remarks by Brian Niccol, chairman and

chief executive officer

I think, as you know, last month I made a commitment that we

would get “Back to Starbucks.”

That means focusing on what has always set Starbucks apart — a

welcoming coffeehouse where people gather, and where we serve the

finest coffee, handcrafted by our skilled baristas. It’s our

enduring identity. And it’s why millions of customers around the

world visit Starbucks every single day.

People love Starbucks, but I’ve heard from some customers that

we've drifted from our core, that we’ve made it harder to be a

customer than it should be, and that we’ve stopped communicating

with them. As a result, some are visiting less often, and I think

today’s results tell that same story.

To welcome all our customers back and return to growth, we need

to fundamentally change our recent strategy.

“Back to Starbucks” is that fundamental change.

I believe that our problems are very fixable and that we have

significant strengths to build on. I’ve spent my career

understanding, stewarding and building brands, and it’s clear the

Starbucks brand is strong and enduring. When we stay true to our

core identity and focus on delivering a great partner and customer

experience, our customers come — and importantly, they come

back.

Since taking this role, I’ve been digging in to understand our

business. I’ve spent most of my time in stores talking with our

partners and customers. I’ve also met with support center teams. I

already have some learnings, and we’re applying those learnings to

stabilize the business in the near-term and to shape our go-forward

strategy. We have a clear plan, and we are already taking quick

action, regardless of any challenges in the consumer environment.

We know we must operate at our best every time we serve our

customers.

I look forward to sharing more and taking questions on next

week’s earnings call. But, today, I want to share some of what I’ve

seen and where we need to focus:

At Starbucks, coffee comes first.

No one matches our expertise. Our deep engagement with coffee

farmers, our skilled roasters, the premium equipment we use in our

coffeehouses, and the skill of our baristas are all unmatched. We

offer something for everyone: fresh brewed coffee from our Clover

Vertica, high-quality espresso for everything from Americanos to

Flat Whites, innovations in cold coffee with our reformulated iced

coffee, and the popular Iced Shaken Espresso platform. Through

product development, marketing, and in-store experience, we need to

remind everyone that we are, and always have been, Starbucks Coffee

Company.

From the very beginning, Starbucks has always been about our

green apron partners.

Everything we do starts and ends with them. We must ensure our

baristas have the time and tools they need to provide exceptional

customer service, and that they are supported by strong leaders and

managers across every store. Every person at Starbucks must work

harder to support our retail teams, moving faster to respond to

their feedback and get them what they need. Our green apron

partners want to provide exceptional service to our customers. And

as leaders, we need to remove those things that might stop them

from doing that.

We’ll also build on our legacy by making Starbucks the best job

in retail, offering our baristas meaningful career growth and

industry-leading benefits, like the opportunity for U.S. partners

to earn a free four-year college degree.

We need to offer a great experience to our customers every

single time, especially during the morning peak.

We are reorienting all our work to ensure we deliver a

high-quality handcrafted beverage, prepared quickly and with care,

and handed directly to the customer by our barista. This is the

moment of truth. This commitment will drive every decision we make.

To succeed, we need to address staffing in our stores, remove

bottlenecks, and simplify things for our baristas. We need to

refine mobile order and pay so it doesn’t overwhelm the café

experience. We know how to make these improvements, and when we do,

we know customers will visit more often.

We must reestablish ourselves as the community

coffeehouse.

Starbucks has always been a place where people come together. We

are revisiting our stores to make sure we’re offering the amenities

you’d expect in a community coffeehouse. Even if customers don’t

want to stay in the café each time they visit, we know they expect

our stores to look and feel like the community coffeehouse they

remember.

We have to reintroduce Starbucks to the world.

We’re fundamentally changing our marketing. We’ve been focusing

on Starbucks Rewards customers rather than talking to all our

customers. And we’re changing that quickly, as you likely have

already seen. We’re prioritizing our brand, highlighting the

handcrafted products customers expect, and showcasing the coffee

innovation that sets Starbucks apart. We will simplify our overly

complex menu, fix our pricing architecture, and ensure that every

customer feels Starbucks is worth it every single time they

visit.

As we do all this, we’re committed to innovating with discipline

and prioritizing investments that will improve the experience for

both our partners and customers.

As I said last month, my near-term focus is the U.S. It’s our

biggest business and we need to return it to growth. But we also

have significant opportunities around the world. Our team is

focused on how we return Starbucks China to growth and getting all

our international businesses performing again.

Throughout my career, I’ve learned and applied some powerful

lessons. If you stay true to your core identity, take care of

customers and your team, simplify the business, deliver

consistently high-quality products and experiences, and tell your

story effectively, you will be successful.

So we have a lot of work ahead of us, but I am confident we can

get all these things right at Starbucks. I’m convinced that if we

get back to Starbucks — with a focus on coffee and customers

combined with a welcoming coffeehouse experience created by our

green apron partners — we will remind people of why they love

Starbucks. They will visit more often, and we will return this

company to strong growth.

Getting “Back to Starbucks” is our plan, and we’ll share our

progress as we go.

Thank you for listening and I look forward to sharing the

progress with you in the future.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241022788428/en/

Starbucks Contact, Investor Relations: Tiffany Willis

investorrelations@starbucks.com

Starbucks Contact, Media: Emily Albright

press@starbucks.com

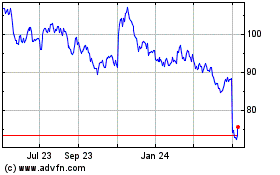

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Nov 2024 to Dec 2024

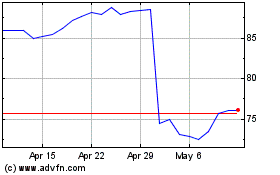

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Dec 2023 to Dec 2024