Vivid Seats Inc. (NASDAQ: SEAT) (“Vivid Seats” or “we”), a leading

marketplace that utilizes its technology platform to connect

millions of buyers with thousands of ticket sellers across hundreds

of thousands of events each year, today provided financial results

for the third quarter ended September 30, 2024.

"Demand remained robust in the third quarter,

although we experienced a headwind from concert supply, including

from venue and artist mix, that we believe to be temporary," said

Stan Chia, Vivid Seats CEO. "We expect industry growth to

accelerate in 2025 as concerts return to their long-term trend. In

the third quarter, we operated with discipline and delivered strong

unit economics, while executing strongly and generating synergies

with our Vegas.com acquisition through both cross-listed inventory

and by converting Vegas.com customers to Vivid Seats customers.

Lastly, we are excited to announce that Skybox Drive has exited its

beta phase and we are already in the process of onboarding more

than one hundred users, with hundreds more on our waitlist. As we

ramp adoption, the innovative pricing functionality of Skybox Drive

will further enforce the stickiness of Skybox and fortify our

already leading position with professional sellers."

Third Quarter 2024 Key Operational and

Financial Metrics

- Marketplace GOV of $871.7 million – down 13% from $998.9

million in Q3 2023

- Revenues of $186.6 million – down 1% from $188.1 million in Q3

2023

- Net income of $9.2 million – down 43% from $16.0 million in Q3

2023

- Adjusted EBITDA of $34.1 million – up 2% from $33.4 million in

Q3 2023

"Despite a decline in Marketplace GOV in the

third quarter, we held year-over-year revenues roughly flat and

grew Adjusted EBITDA through disciplined execution while

maintaining our strong unit economics," said Lawrence Fey,

Vivid Seats CFO. "Given third quarter concert supply dynamics and

expected marketing intensity in the fourth quarter, we are revising

our 2024 guidance. As more concert tour announcements come out over

the coming weeks, we will gain visibility into the 2025 concert

calendar, where we currently anticipate a return to healthy

growth."

Key Performance Indicators

('000s)

| |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Marketplace GOV(1) |

$ |

871,726 |

|

$ |

998,933 |

|

$ |

2,898,269 |

|

$ |

2,808,200 |

| Total

Marketplace orders(2) |

|

2,969 |

|

|

3,022 |

|

|

8,943 |

|

|

7,924 |

| Total Resale

orders(3) |

|

116 |

|

|

110 |

|

|

316 |

|

|

273 |

| Adjusted

EBITDA(4) |

$ |

34,077 |

|

$ |

33,367 |

|

$ |

117,172 |

|

$ |

106,879 |

|

(1) |

Marketplace Gross Order Value ("Marketplace GOV") represents the

total transactional amount of Marketplace segment orders placed on

our platform in a period, inclusive of fees, exclusive of taxes and

net of cancellations that occurred during that period. During the

three and nine months ended September 30, 2024, Marketplace

GOV was negatively impacted by cancellations in the amount of $35.4

million and $74.9 million, respectively, compared to $10.1 million

and $33.9 million during the three and nine months ended

September 30, 2023, respectively. |

| (2) |

Total Marketplace orders represents the volume of Marketplace

segment orders placed on our platform in a period, net of

cancellations that occurred during that period. During the three

and nine months ended September 30, 2024, our Marketplace

segment experienced 77,012 and 179,453 cancellations, respectively,

compared to 28,203 and 78,034 cancellations during the three and

nine months ended September 30, 2023, respectively. |

| (3) |

Total Resale orders represents the volume of Resale segment orders

in a period, net of cancellations that occurred during that period.

During the three and nine months ended September 30, 2024, our

Resale segment experienced 2,411 and 4,494 cancellations,

respectively, compared to 851 and 2,363 cancellations during the

three and nine months ended September 30, 2023,

respectively. |

| (4) |

Adjusted EBITDA is a financial measure not defined under accounting

principles generally accepted in the United States of America ("US

GAAP"). We believe Adjusted EBITDA provides useful information to

investors and others in understanding and evaluating our results of

operations, as well as provides a useful measure for making

period-to-period comparisons of our business performance. See the

Use of Non-GAAP Financial Measures section below for more

information and a reconciliation of Adjusted EBITDA to its most

directly comparable US GAAP measure. |

2024 Financial OutlookVivid Seats now

anticipates Marketplace GOV, revenues and Adjusted EBITDA for the

year ending December 31, 2024 to be:

- Marketplace GOV in the range of $3.8 to $4.0 billion

(previously $4.0 to $4.3 billion)

- Revenues in the range of $760.0 to $780.0 million (previously

$810.0 to $830.0 million)

- Adjusted EBITDA in the range of $145.0 to $155.0 million

(previously $160.0 to $170.0 million)*

Additional detail around the 2024 outlook will

be available on the third quarter 2024 earnings call.

*We calculate forward-looking Adjusted EBITDA

based on internal forecasts that omit certain information that

would be included in forward-looking net income, the most directly

comparable US GAAP measure. We do not attempt to provide a

reconciliation of forward-looking Adjusted EBITDA to

forward-looking net income because the timing and/or probable

significance of certain excluded items that have not yet occurred

and are out of our control is inherently uncertain and unavailable

without unreasonable efforts. Such items could have a significant

and unpredictable impact on our future US GAAP financial

results.

Webcast Details Vivid Seats

will host a webcast at 8:30 a.m. Eastern Time today to discuss the

third quarter 2024 financial results, business updates and

financial outlook. Participants may access the live webcast and

supplemental earnings presentation on the events page of the Vivid

Seats Investor Relations website at

https://investors.vividseats.com/events-and-presentations.

About Vivid Seats Founded in

2001, Vivid Seats is a leading online ticket marketplace committed

to becoming the ultimate partner for connecting fans to the live

events, artists, and teams they love. Based on the belief that

everyone should “Experience It Live,” the Chicago-based company

provides exceptional value by providing one of the widest

selections of events and tickets in North America and an industry

leading Vivid Seats Rewards program where all fans earn on every

purchase. Vivid Seats has been chosen as the official ticketing

partner by some of the biggest brands in the entertainment industry

including ESPN, Rolling Stone, and the Los Angeles Clippers. Vivid

Seats also owns Vivid Picks, a daily fantasy sports app. Through

its proprietary software and unique technology, Vivid Seats drives

the consumer and business ecosystem for live event ticketing and

enables the power of shared experiences to unite people. Vivid

Seats has been recognized by Newsweek as one of America’s Best

Companies for Customer Service in ticketing. Fans who want to have

the best live experiences can start by downloading the Vivid Seats

mobile app, going to vividseats.com, or calling 866-848-8499.

Forward-Looking Statements This

press release contains "forward-looking statements" within the

meaning of the "safe harbor" provisions of the U.S. Private

Securities Litigation Reform Act of 1995. The forward-looking

statements in this press release relate to, without limitation: our

future operating results and financial position, including our

expectations regarding Marketplace GOV, revenues and Adjusted

EBITDA; our expectations with respect to live event industry

growth, concert supply and our TAM and competitive positioning; our

business strategy; share repurchases and M&A opportunities; the

adoption and benefits of Skybox Drive; and the plans and objectives

of management for future operations. Words such as “anticipate,”

“believe,” “can,” “continue,” “could,” “designed,” “estimate,”

“expect,” “forecast,” “future,” “goal,” “intend,” “likely,” “may,”

“plan,” “project,” “propose,” “seek,” “should,” “target,” “will”

and “would,” as well as similar expressions which predict or

indicate future events and trends or which do not relate to

historical matters, are intended to identify such forward-looking

statements. Forward-looking statements are not guarantees of future

performance, conditions or results, and are subject to risks,

uncertainties and assumptions that can be difficult to predict

and/or outside of our control. Therefore, actual results may differ

materially from those contemplated by any forward-looking

statements. Important factors that could cause or contribute to

such differences include, but are not limited to: our ability to

generate sufficient cash flows or to raise additional capital when

necessary or desirable; the supply and demand of live concert,

sporting and theater events; our ability to maintain and develop

our relationships with ticket buyers, sellers and partners; changes

in internet search engine algorithms and dynamics, search engine

disintermediation or mobile application marketplace rules; our

ability to compete in the ticketing industry; our ability to

continue to maintain and improve our platform and develop

successful new solutions and enhancements or improve existing ones;

the impact of extraordinary events, including disease epidemics and

pandemics; our ability to identify suitable acquisition targets and

to complete planned acquisitions; the impact of our acquisitions

and strategic investments, including our integration of Wavedash

Co., Ltd. and Vegas.com, LLC; the effects of any recession and/or

heightened inflation; our ability to maintain the integrity of our

information systems and infrastructure, and to identify, assess and

manage relevant cybersecurity risks; and other factors discussed in

the “Risk Factors” sections of our most recent Annual Report on

Form 10-K, subsequent Quarterly Reports on Form 10-Q and other

filings with the Securities and Exchange Commission.

Forward-looking statements speak only as of the date of this press

release. We undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

Contacts:

Investors Kate Africk

Kate.Africk@vividseats.com

Media Julia Young

Julia.Young@vividseats.com

|

|

|

VIVID SEATS INC. CONDENSED CONSOLIDATED

BALANCE SHEETS (in thousands, except per share

data) (Unaudited) |

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

202,274 |

|

|

$ |

125,484 |

|

|

Restricted cash |

|

6,187 |

|

|

|

6,950 |

|

|

Accounts receivable – net |

|

65,306 |

|

|

|

58,481 |

|

|

Inventory – net |

|

22,254 |

|

|

|

21,018 |

|

|

Prepaid expenses and other current assets |

|

29,899 |

|

|

|

34,061 |

|

|

Total current assets |

|

325,920 |

|

|

|

245,994 |

|

|

Property and equipment – net |

|

9,589 |

|

|

|

10,156 |

|

|

Right-of-use assets – net |

|

9,344 |

|

|

|

9,826 |

|

|

Intangible assets – net |

|

225,128 |

|

|

|

241,155 |

|

|

Goodwill |

|

946,857 |

|

|

|

947,359 |

|

|

Deferred tax assets |

|

81,245 |

|

|

|

85,564 |

|

|

Investments |

|

7,152 |

|

|

|

6,993 |

|

|

Other non-current assets |

|

5,356 |

|

|

|

3,052 |

|

|

Total assets |

$ |

1,610,591 |

|

|

$ |

1,550,099 |

|

|

Liabilities, redeemable noncontrolling interests, and

shareholders' equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

224,328 |

|

|

$ |

257,514 |

|

|

Accrued expenses and other current liabilities |

|

159,781 |

|

|

|

191,642 |

|

|

Deferred revenue |

|

24,632 |

|

|

|

34,674 |

|

|

Current maturities of long-term debt |

|

3,950 |

|

|

|

3,933 |

|

|

Total current liabilities |

|

412,691 |

|

|

|

487,763 |

|

|

Long-term debt – net |

|

385,730 |

|

|

|

264,632 |

|

|

Long-term lease liabilities |

|

15,803 |

|

|

|

16,215 |

|

|

TRA liability |

|

162,233 |

|

|

|

165,699 |

|

|

Other liabilities |

|

22,659 |

|

|

|

29,031 |

|

|

Total long-term liabilities |

|

586,425 |

|

|

|

475,577 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

Redeemable noncontrolling interests |

|

282,033 |

|

|

|

481,742 |

|

|

Shareholders' equity |

|

|

|

|

|

|

Class A common stock, $0.0001 par value; 500,000,000 shares

authorized, 142,866,611 and 141,167,311 shares issued and

outstanding at September 30, 2024 and December 31, 2023,

respectively |

|

14 |

|

|

|

14 |

|

|

Class B common stock, $0.0001 par value; 250,000,000 shares

authorized, 76,225,000 shares issued and outstanding at September

30, 2024 and December 31, 2023 |

|

8 |

|

|

|

8 |

|

|

Additional paid-in capital |

|

1,333,518 |

|

|

|

1,096,430 |

|

|

Treasury stock, at cost, 11,433,749 and 7,291,497 shares at

September 30, 2024 and December 31, 2023, respectively |

|

(75,584 |

) |

|

|

(52,586 |

) |

|

Accumulated deficit |

|

(929,284 |

) |

|

|

(939,596 |

) |

|

Accumulated other comprehensive income |

|

770 |

|

|

|

747 |

|

|

Total shareholders' equity |

|

329,442 |

|

|

|

105,017 |

|

|

Total liabilities, redeemable noncontrolling interests, and

shareholders' equity |

$ |

1,610,591 |

|

|

$ |

1,550,099 |

|

| VIVID SEATS

INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (in thousands)

(Unaudited) |

| |

| |

Three Months EndedSeptember 30, |

|

|

Nine Months EndedSeptember 30, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenues |

$ |

186,605 |

|

|

$ |

188,133 |

|

|

$ |

575,773 |

|

|

$ |

514,576 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues (exclusive of depreciation and amortization shown

separately below) |

|

51,029 |

|

|

|

50,462 |

|

|

|

149,377 |

|

|

|

130,838 |

|

|

Marketing and selling |

|

67,835 |

|

|

|

77,006 |

|

|

|

205,695 |

|

|

|

196,970 |

|

|

General and administrative |

|

46,306 |

|

|

|

37,225 |

|

|

|

149,725 |

|

|

|

107,921 |

|

|

Depreciation and amortization |

|

10,669 |

|

|

|

3,301 |

|

|

|

31,654 |

|

|

|

8,603 |

|

|

Change in fair value of contingent consideration |

|

— |

|

|

|

20 |

|

|

|

— |

|

|

|

(998 |

) |

|

Income from operations |

|

10,766 |

|

|

|

20,119 |

|

|

|

39,322 |

|

|

|

71,242 |

|

|

Other expense (income): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense – net |

|

6,300 |

|

|

|

2,544 |

|

|

|

16,706 |

|

|

|

8,596 |

|

|

Other income |

|

(9,020 |

) |

|

|

(1,038 |

) |

|

|

(3,236 |

) |

|

|

(365 |

) |

|

Income before income taxes |

|

13,486 |

|

|

|

18,613 |

|

|

|

25,852 |

|

|

|

63,011 |

|

| Income tax

expense (benefit) |

|

4,290 |

|

|

|

2,595 |

|

|

|

7,136 |

|

|

|

(21,605 |

) |

| Net

income |

|

9,196 |

|

|

|

16,018 |

|

|

|

18,716 |

|

|

|

84,616 |

|

| Net income

attributable to redeemable noncontrolling interests |

|

3,900 |

|

|

|

9,341 |

|

|

|

8,405 |

|

|

|

35,045 |

|

| Net

income attributable to Class A common stockholders |

$ |

5,296 |

|

|

$ |

6,677 |

|

|

$ |

10,311 |

|

|

$ |

49,571 |

|

| VIVID SEATS

INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (in thousands) (Unaudited) |

|

|

| |

Nine Months EndedSeptember 30, |

|

| |

2024 |

|

|

2023 |

|

| Cash

flows from operating activities |

|

|

|

|

|

|

Net income |

$ |

18,716 |

|

|

$ |

84,616 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities |

|

|

|

|

|

|

Depreciation and amortization |

|

31,654 |

|

|

|

8,603 |

|

|

Amortization of leases |

|

1,379 |

|

|

|

467 |

|

|

Amortization of deferred financing costs |

|

718 |

|

|

|

688 |

|

|

Equity-based compensation |

|

38,284 |

|

|

|

20,488 |

|

|

Change in fair value of warrants |

|

(5,713 |

) |

|

|

(991 |

) |

|

Loss on asset disposals |

|

160 |

|

|

|

51 |

|

|

Deferred taxes |

|

3,378 |

|

|

|

(22,678 |

) |

|

Change in fair value of derivative asset |

|

537 |

|

|

|

83 |

|

|

Non-cash interest income |

|

(442 |

) |

|

|

(125 |

) |

|

Foreign currency revaluation loss |

|

266 |

|

|

|

542 |

|

|

Change in fair value of contingent consideration |

|

— |

|

|

|

(998 |

) |

|

Change in assets and liabilities: |

|

|

|

|

|

|

Accounts receivable – net |

|

(6,879 |

) |

|

|

(26,147 |

) |

|

Inventory – net |

|

(1,234 |

) |

|

|

(8,702 |

) |

|

Prepaid expenses and other current assets |

|

4,164 |

|

|

|

(19,239 |

) |

|

Accounts payable |

|

(33,113 |

) |

|

|

50,484 |

|

|

Accrued expenses and other current liabilities |

|

(35,140 |

) |

|

|

18,415 |

|

|

Deferred revenue |

|

(10,042 |

) |

|

|

2,464 |

|

|

Other non-current assets and liabilities |

|

(558 |

) |

|

|

6,365 |

|

| Net

cash provided by operating activities |

|

6,135 |

|

|

|

114,386 |

|

| Cash

flows from investing activities |

|

|

|

|

|

|

Purchases of property and equipment |

|

(767 |

) |

|

|

(785 |

) |

|

Purchases of personal seat licenses |

|

(737 |

) |

|

|

(542 |

) |

|

Investments in developed technology |

|

(14,334 |

) |

|

|

(7,770 |

) |

|

Disbursement of 2024 Sponsorship Loan |

|

(2,000 |

) |

|

|

— |

|

|

Acquisition of business, net of cash acquired |

|

— |

|

|

|

(55,935 |

) |

|

Investments in convertible promissory note and warrant |

|

— |

|

|

|

(6,000 |

) |

| Net

cash used in investing activities |

|

(17,838 |

) |

|

|

(71,032 |

) |

| Cash

flows from financing activities |

|

|

|

|

|

|

Payments of February 2022 First Lien Loan |

|

(689 |

) |

|

|

(2,063 |

) |

|

Repurchases of common stock as treasury stock |

|

(22,998 |

) |

|

|

(7,612 |

) |

|

Tax distributions |

|

(9,253 |

) |

|

|

(11,016 |

) |

|

Payments of Shoko Chukin Bank Loan |

|

(2,655 |

) |

|

|

— |

|

|

Payments of taxes related to net settlement of equity incentive

awards |

|

(645 |

) |

|

|

— |

|

|

Proceeds from June 2024 First Lien Loan |

|

125,500 |

|

|

|

— |

|

|

Payments of deferred financing costs and other debt-related

costs |

|

(315 |

) |

|

|

— |

|

|

Payment of liabilities under Tax Receivable Agreement |

|

(77 |

) |

|

|

— |

|

|

Payments of June 2024 First Lien Loan |

|

(987 |

) |

|

|

— |

|

|

Cash paid for milestone payments |

|

— |

|

|

|

(6,005 |

) |

| Net

cash provided by (used in) financing activities |

|

87,881 |

|

|

|

(26,696 |

) |

|

Impact of foreign exchange on cash, cash equivalents, and

restricted cash |

|

(151 |

) |

|

|

786 |

|

| Net

increase in cash, cash equivalents, and restricted

cash |

|

76,027 |

|

|

|

17,444 |

|

|

Cash, cash equivalents, and restricted cash – beginning of

period |

|

132,434 |

|

|

|

252,290 |

|

|

Cash, cash equivalents, and restricted cash – end of

period |

$ |

208,461 |

|

|

$ |

269,734 |

|

| VIVID SEATS

INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (in thousands) (Unaudited) |

|

|

|

Supplemental disclosure of cash flow

information: |

|

|

|

|

Cash paid for interest |

$ |

16,728 |

|

$ |

13,250 |

| Cash paid

for income tax |

$ |

5,144 |

|

$ |

401 |

Use of Non-GAAP Financial

Measures

We present Adjusted EBITDA, which is a non-GAAP

financial measure, because it is a measure frequently used by

analysts, investors and other interested parties to evaluate

companies in our industry. Further, we believe this measure is

helpful in highlighting trends in our operating results because it

excludes the impact of items that are outside of our control or not

reflective of ongoing performance related directly to the operation

of our business.

Adjusted EBITDA is a key measure used by our

management team internally to make operating decisions, including

those related to analyzing operating expenses, evaluating

performance, and performing strategic planning and annual

budgeting. Moreover, we believe Adjusted EBITDA provides useful

information to investors and others in understanding and evaluating

our results of operations, as well as provides a useful measure for

making period-to-period comparisons of our business performance and

highlighting trends in our operating results.

Adjusted EBITDA is not based on any

comprehensive set of accounting rules or principles and should not

be considered a substitute for, or superior to, financial measures

calculated in accordance with US GAAP. Adjusted EBITDA does not

reflect all amounts associated with our operating results as

determined in accordance with US GAAP and may exclude recurring

costs, such as interest expense – net, equity-based compensation,

litigation, settlements and related costs, change in fair value of

warrants, change in fair value of derivative assets and foreign

currency revaluation losses (gains). In addition, other companies

may calculate Adjusted EBITDA differently than we do, thereby

limiting its usefulness as a comparative tool. We compensate for

these limitations by providing specific information regarding the

US GAAP amounts excluded from Adjusted EBITDA.

The following table provides a reconciliation of

Adjusted EBITDA to its most directly comparable US GAAP measure,

net income (in thousands):

| |

Three Months EndedSeptember 30, |

|

|

Nine Months EndedSeptember 30, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net income |

$ |

9,196 |

|

|

$ |

16,018 |

|

|

$ |

18,716 |

|

|

$ |

84,616 |

|

| Income tax

expense (benefit) |

|

4,290 |

|

|

|

2,595 |

|

|

|

7,136 |

|

|

|

(21,605 |

) |

| Interest

expense – net |

|

6,300 |

|

|

|

2,544 |

|

|

|

16,706 |

|

|

|

8,596 |

|

| Depreciation

and amortization |

|

10,669 |

|

|

|

3,301 |

|

|

|

31,654 |

|

|

|

8,603 |

|

| Sales tax

liability(1) |

|

526 |

|

|

|

— |

|

|

|

2,613 |

|

|

|

— |

|

| Transaction

costs(2) |

|

1,243 |

|

|

|

2,290 |

|

|

|

6,649 |

|

|

|

7,234 |

|

| Equity-based

compensation(3) |

|

10,685 |

|

|

|

7,578 |

|

|

|

38,284 |

|

|

|

20,488 |

|

| Litigation,

settlements and related costs(4) |

|

157 |

|

|

|

26 |

|

|

|

164 |

|

|

|

260 |

|

| Change in

fair value of warrants(5) |

|

(3,952 |

) |

|

|

(1,664 |

) |

|

|

(5,713 |

) |

|

|

(991 |

) |

| Change in

fair value of derivative asset(6) |

|

456 |

|

|

|

83 |

|

|

|

537 |

|

|

|

83 |

|

| Change in

fair value of contingent consideration(7) |

|

— |

|

|

|

20 |

|

|

|

— |

|

|

|

(998 |

) |

| Loss on

asset disposals(8) |

|

38 |

|

|

|

34 |

|

|

|

160 |

|

|

|

51 |

|

| Foreign

currency revaluation losses (gains)(9) |

|

(5,531 |

) |

|

|

542 |

|

|

|

266 |

|

|

|

542 |

|

|

Adjusted EBITDA |

$ |

34,077 |

|

|

$ |

33,367 |

|

|

$ |

117,172 |

|

|

$ |

106,879 |

|

|

(1) |

We have historically incurred sales tax expense in jurisdictions

where we expected to collect and remit indirect taxes, but were not

yet collecting from customers. During the three and nine months

ended September 30, 2024, we accrued for additional sales and

indirect tax liabilities in jurisdictions where we are not yet

collecting from customers and settled certain local admission tax

liabilities for less than the amount that was accrued as of

December 31, 2023. |

| (2) |

Relates to legal, accounting, tax and other professional fees;

personnel-related costs, which consist of retention bonuses;

integration costs; and other transaction-related expenses. Costs in

the three and nine months ended September 30, 2024 primarily

related to the refinancing of our first lien loan, share

repurchases, acquisitions and strategic investments. Costs in the

three and nine months ended September 30, 2023 primarily

related to a secondary offering of our Class A common stock,

acquisitions and strategic investments. |

| (3) |

Relates to equity granted pursuant to our 2021 Incentive Award

Plan, as amended, and profits interests issued prior to our merger

transaction with Horizon Acquisition Corporation (the “Merger

Transaction”), neither of which are considered indicative of our

core operating performance. |

| (4) |

Relates to external legal costs, settlement costs and insurance

recoveries that were unrelated to our core business

operations. |

| (5) |

Relates to the revaluation of warrants to purchase common units of

Hoya Intermediate, LLC held by Hoya Topco, LLC following the Merger

Transaction. |

| (6) |

Relates to the revaluation of derivatives recorded at fair

value. |

| (7) |

Relates to the revaluation of Vivid Picks cash earnouts. |

| (8) |

Relates to asset disposals, which are not considered indicative of

our core operating performance. |

| (9) |

Relates to unrealized foreign currency revaluation losses (gains)

from the remeasurement of non-operating assets and liabilities

denominated in non-functional currencies on the balance sheet

date. |

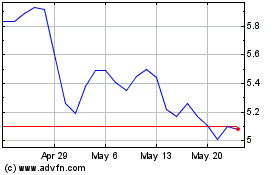

Vivid Seats (NASDAQ:SEAT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Vivid Seats (NASDAQ:SEAT)

Historical Stock Chart

From Nov 2023 to Nov 2024