0000915358 False 0000915358 2024-09-19 2024-09-19 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 19, 2024

_______________________________

SIGMATRON INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 000-23248 | 36-3918470 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

2201 Landmeier Road

Elk Grove Village, Illinois 60007

(Address of Principal Executive Offices) (Zip Code)

(847) 956-8000

(Registrant's telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock $0.01 par value per share | SGMA | The NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On September 19, 2024, the Registrant issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | SIGMATRON INTERNATIONAL, INC. |

| | | |

| | | |

| Date: September 19, 2024 | By: | /s/ Gary R. Fairhead |

| | | Gary R. Fairhead |

| | | Chief Executive Officer |

| | | |

EXHIBIT 99.1

Sigmatron International, Inc. Reports First Quarter Financial Results For Fiscal 2025

ELK GROVE VILLAGE, Ill., Sept. 19, 2024 (GLOBE NEWSWIRE) -- SigmaTron International, Inc. (NASDAQ: SGMA), an electronic manufacturing services company, today reported revenues and earnings for the fiscal quarter ended July 31, 2024.

For the three months ended July 31, 2024, revenues decreased $13.4 million, or 14 percent, to $84.8 million compared to $98.1 million for the same period in the prior year. Net income/(loss) for the three-month period ended July 31, 2024, was a loss of $3.3 million compared to income of $0.3 million for the same period in the prior year. Basic and diluted income/(loss) per share for the three months ended July 31, 2024 was a loss of $0.54, compared to income of $0.04 income per share for the same period last year.

Commenting on SigmaTron’s first quarter fiscal 2025 results, Gary R. Fairhead, Chief Executive Officer and Chairman of the Board, said, “The softness that we have seen in our revenue has continued as expected and disclosed in our press release dated September 3, 2024. As we stated, the softness has continued through the first quarter of fiscal 2025 and our customers continued to indicate that they believe activity will start to increase in the fourth quarter of calendar 2024. As you can see from the financial statements, revenue is down 14.4% year over year for the first quarter. However, sequentially, the first quarter of fiscal 2025 was up 4.4% over the fourth quarter of fiscal 2024. We hope that’s the beginning of the trend that we have been told to expect. We have continued to react to these market conditions as we have been throughout this period by reductions in overhead and costs coupled with reduced manufacturing schedules. We have already done another reduction in August and we will continue to evaluate the situation as we finish calendar 2024.

“Also, as mentioned several times before, one area of focus remains the reduction of inventory to reduce working capital requirements and that has continued during the first quarter as expected. It will remain a focus for the balance of this calendar year. Our relationships with our customers remain excellent. We are working with many of them on new projects and remain optimistic that calendar 2025 will be a much stronger year. We have continued to discuss this situation with others in our industry and understand that this softness seems to be pervasive across many of their customers and markets as well. We have also continued our efforts with Lincoln International to de-lever our balance sheet and we have made progress in several areas. We remain hopeful that our customers’ expectations will start to materialize sooner rather than later and in the interim, we will continue to focus on managing the market conditions as we currently are experiencing them.”

About SigmaTron International, Inc.

Headquartered in Elk Grove Village, Illinois, SigmaTron International, Inc. operates in one reportable segment as an independent provider of electronic manufacturing services (“EMS”). The EMS segment includes printed circuit board assemblies, electro-mechanical subassemblies and completely assembled (box-build) electronic products. The Company and its wholly-owned subsidiaries operate manufacturing facilities in Elk Grove Village, Illinois; Acuna, Chihuahua, and Tijuana Mexico; Union City, California; Suzhou, China; and Biên Hòa City, Vietnam. In addition, the Company maintains an International Procurement Office and Compliance and Sustainability Center in Taipei, Taiwan. The Company also provides design services in Elk Grove Village, Illinois, U.S.

Forward-Looking Statements

Note: This press release contains forward-looking statements. Words such as “continue,” “anticipate,” “will,” “expect,” “believe,” “plan,” and similar expressions identify forward-looking statements. These forward-looking statements are based on the current expectations of the Company. Because these forward-looking statements involve risks and uncertainties, the Company’s plans, actions and actual results could differ materially. Such statements should be evaluated in the context of the direct and indirect risks and uncertainties inherent in the Company’s business including, but not necessarily limited to, the Company’s continued dependence on certain significant customers; the continued market acceptance of products and services offered by the Company and its customers; pricing pressures from the Company’s customers, suppliers and the market; the activities of competitors, some of which may have greater financial or other resources than the Company; the variability of the Company’s operating results; the impact of material weaknesses in internal controls over financial reporting; the results of long-lived assets and goodwill impairment testing; the risks inherent in any merger, acquisition or business combination, including the ability to achieve the expected benefits of acquisitions as well as the expenses of acquisitions; the collectability of aged account receivables; the variability of the Company’s customers’ requirements; the impact of inflation on the Company’s operating results; the availability and cost of necessary components and materials; the impact acts of war may have to the supply chain; the ability of the Company and its customers to keep current with technological changes within its industries; regulatory compliance, including conflict minerals; the continued availability and sufficiency of the Company’s credit arrangements; the costs of borrowing under the Company’s senior and subordinated credit facilities, including under the rate indices that replaced LIBOR; increasing interest rates; the ability to meet the Company’s financial and restrictive covenants under its loan agreements; changes in U.S., Mexican, Chinese, Vietnamese or Taiwanese regulations affecting the Company’s business; the turmoil in the global economy and financial markets; public health crises, including COVID-19 and variants; the continued availability of scarce raw materials, exacerbated by global supply chain disruptions, necessary for the manufacture of products by the Company; the stability of the U.S., Mexican, Chinese, Vietnamese and Taiwanese economic, labor and political systems and conditions; global business disruption caused by the Russian invasion of Ukraine and related sanctions and the Israel-Hamas conflict; currency exchange fluctuations; and the ability of the Company to manage its growth. These and other factors which may affect the Company’s future business and results of operations are identified throughout the Company’s Annual Report on Form 10-K, and as risk factors, may be detailed from time to time in the Company’s filings with the Securities and Exchange Commission. These statements speak as of the date of such filings, and the Company undertakes no obligation to update such statements in light of future events or otherwise unless otherwise required by law.

For Further Information Contact:

SigmaTron International, Inc.

James J. Reiman

1-800-700-9095

| CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS | | | |

| | | | | |

| | | | | |

| | | Three Months | | Three Months |

| | | Ended | | Ended |

| | | July 31, | | July 31, |

| | | | 2024 | | | | 2023 | |

| | | | | |

| Net sales | | | 84,776,978 | | | | 98,130,356 | |

| | | | | |

| Cost of products sold | | | 78,371,784 | | | | 88,479,136 | |

| | | | | |

| Gross profit | | | 6,405,194 | | | | 9,651,220 | |

| | | | | |

| Selling and administrative expenses | | | 6,623,866 | | | | 6,842,805 | |

| | | | | |

| Operating (loss) income | | | (218,672 | ) | | | 2,808,415 | |

| | | | | |

| Other expense | | | (2,268,275 | ) | | | (2,700,451 | ) |

| | | | | |

| (Loss) income before income tax | | | (2,486,947 | ) | | | 107,964 | |

| | | | | |

| Income tax (expense) benefit | | | (802,213 | ) | | | 154,135 | |

| | | | | |

| Net (loss)/income | | $ | (3,289,160 | ) | | $ | 262,099 | |

| | | | | |

| | | | | |

| | | | | |

| Net (loss)/income per common share - basic | | $ | (0.54 | ) | | $ | 0.04 | |

| | | | | |

| Net (loss)/income per common share - diluted | | $ | (0.54 | ) | | $ | 0.04 | |

| | | | | |

| Weighted average number of common equivalent | | | | |

| shares outstanding - assuming dilution | | | 6,119,288 | | | | 6,100,284 | |

| | | | | |

| | | | | |

| CONDENSED CONSOLIDATED BALANCE SHEETS | | | | |

| | | | | |

| | | July 31, | | April 30, |

| | | | 2024 | | | | 2024 | |

| | | | | |

| Assets: | | | | |

| | | | | |

| Current assets | | $ | 167,894,193 | | | | 175,902,619 | |

| | | | | |

| Machinery and equipment-net | | | 32,497,960 | | | | 33,755,078 | |

| | | | | |

| Deferred income taxes | | | 8,752,870 | | | | 4,432,210 | |

| Intangibles | | | 897,567 | | | | 979,188 | |

| Other assets | | | 8,799,128 | | | | 8,724,880 | |

| | | | | |

| Total assets | | $ | 218,841,718 | | | $ | 223,793,975 | |

| | | | | |

| Liabilities and stockholders' equity: | | | | |

| | | | | |

| Current liabilities | | $ | 145,416,405 | | | | 145,888,791 | |

| | | | | |

| Long-term obligations | | | 10,571,046 | | | | 11,832,931 | |

| | | | | |

| Stockholders' equity | | | 62,854,267 | | | | 66,072,253 | |

| | | | | |

| Total liabilities and stockholders' equity | | $ | 218,841,718 | | | $ | 223,793,975 | |

| | | | | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

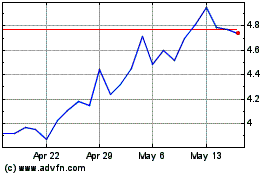

Sigmatron (NASDAQ:SGMA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Sigmatron (NASDAQ:SGMA)

Historical Stock Chart

From Dec 2023 to Dec 2024