UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR

15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2025

Commission File Number: 001-40786

Sigma Lithium Corporation

(Translation of registrant's name into English)

2200 HSBC Building

885 West Georgia Street

Vancouver, British Columbia

V6C 3E8

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover

of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [ X ]

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

Sigma Lithium Corporation |

| |

|

(Registrant) |

| |

|

|

| Date: February 24, 2025 |

|

|

| |

|

Ana Cristina Cabral Gardner |

| |

|

Chief Executive Officer |

| |

|

|

Exhibit 99.1

SIGMA LITHIUM ADVANCES

CONSTRUCTION TO DOUBLE CAPACITY AND PROVIDES FY2024 PREVIEW AND FY2025 GUIDANCE

February 24, 2025. São Paulo, Brazil – Sigma Lithium Corporation

(TSXV/NASDAQ: SGML, BVMF: S2GM34) (“Sigma Lithium” or the “Company”), a leading global lithium

producer dedicated to powering the next generation of electric vehicles with carbon-neutral, socially and environmentally sustainable

lithium concentrate, provides an update on its advancement of the construction of its second Greentech industrial plant to double its

production capacity of lithium oxide concentrate.

The Company’s Co-Chairperson and CEO, Ana Cabral, will present

at the BMO Global Metals, Mining & Critical Minerals Conference on Tuesday, February 25, 2025, at 9:00 am ET. The presentation will

be webcast live at this link and will include the following disclosure of the Company’s expected financial and operational metrics

for the fourth quarter and full year of 2024, production volumes outlook for 2025-2026 period, and cost guidance for the full year 2025.

Q4 2024

| Financial and Operational metrics1 |

Unit |

4Q 2024 |

| Production Volumes duction Volumes |

tonnes |

77,000 |

| Unit Operating Cash Cost Plant Gate |

US$/t |

318 |

| Unit Operating Cash Cost FOB Brazil |

US$/t |

367 |

| Unit Operating Cash Cost CIF China |

US$/t |

427 |

FY 2024

| Financial and Operational metrics1 |

Unit |

FY 2024 |

| Unit Operating Cash Cost CIF China duction Volumes |

US$/t |

494 |

| Underlying Revenue |

millions of US$ |

181 |

| Cash gross margin |

% |

41 |

| Underlying EBITDA |

millions of US$ |

46 |

| Underlying EBITDA margin |

% |

25 |

2025-2026 Outlook

| Production Volumes |

Unit |

FY 2025 |

FY 2026 |

| Production Volumes Plant 1 Volumes |

tonnes |

270,000 |

270,000 |

| Production Volumes Plant 2 |

tonnes |

30,000 |

250,000 |

| Total |

tonnes |

300,000 |

520,000 |

2025 Cost Guidance

| Unit Operating Cost1 |

Unit |

FY 2025 |

| Cash Cost CIF China |

US$/tonne |

500 |

The accompanying slides have been made available on the Company’s

investor relations website.

_________________________________

1Financial metrics are based on the expected results for the twelve

months ending December 31, 2024. Underlying revenue represents expected revenues for the twelve months ending December 31, 2024, excluding

non-cash provisional price adjustments for the 2023 shipments (“Adjustments”). Unit operating Plant Gate costs include mining,

processing and on-site G&A expenses. It is calculated on an incurred basis, credits for any capitalised mine waste development costs,

and it excludes depreciation, depletion and amortization of mine and processing associated activities. When reported on FOB basis it includes

trucking, warehousing and port related expenses. CIF reported cash costs include ocean freight, insurance and royalties. Cash gross margin

is revenue, net of Adjustments and net of cost of products sold (excluding D&A), expressed as a percentage of reported revenues. Underlying

EBITDA is expected EBITDA for the twelve months ending December 31, 2024, excluding non-cash stock-based compensation and Adjustments.

| | |  | 1 | 1 |

UPDATE ON CONSTRUCTION TO DOUBLE PRODUCTION CAPACITY

Sigma Lithium is on track to double its production capacity in 2025,

with commissioning expected to begin in Q4 2025. A video of our construction progress is available for viewing here.

To date, the company has successfully completed 100% of the foundation

earthworks for the second Greentech industrial plant, staying on schedule and within budget. The first cement has been poured, and construction

has advanced to civil works, including the completion of water drainage infrastructure for the second industrial site. In addition, detailed

engineering with technical specifications has been completed for certain key equipment items with long manufacturing lead times (long-lead

items). Procurement and contractual negotiations have been completed, and orders for these items are expected to be placed within the

current quarter. Initial deliveries of the plant's equipment are expected to commence in June 2025, followed by the assembly of mechanical

structures.

Currently, there are 100 people working on the expansion project, with

plans to increase the workforce to 1,000 at peak construction. The Company has also accelerated its homecoming program with the creation

of a training center for heavy machinery operators in one of the neighboring communities.

Sigma Lithium has secured a US$100 million development bank credit line

from BNDES to fully fund the construction. The Company decided to continue advancing its construction, despite the current lithium cycle,

due to our low capital expenditure intensity (capex per tonne of capacity built). This efficiency is driven in part by our existing infrastructure,

which supports the additional Greentech Industrial Plant and enables us to fast-track construction timelines while controlling costs.

As one of the world’s lowest-cost producers, Sigma Lithium is

well-positioned to leverage economies of scale as we expand our capacity. This will further enhance our cost efficiency, diluting unitary

costs per tonne, as certain production costs, including G&A, are fixed. With the lithium market expected to experience significant

growth by the end of the decade, we are strategically positioned to meet the rising demand and capitalize on this opportunity for sustained

long-term growth and success.

ABOUT SIGMA LITHIUM

Sigma Lithium (TSXV/NASDAQ: SGML, BVMF: S2GM34) is a leading global

lithium producer dedicated to powering the next generation of electric vehicle batteries with carbon-neutral, socially and environmentally

sustainable chemical-grade lithium concentrate.

Sigma Lithium is one of the world’s largest lithium producers.

The Company operates at the forefront of environmental and social sustainability in the electric vehicle battery materials supply chain

at its Grota do Cirilo Operation in Brazil. Here, Sigma produces Quintuple Zero Green Lithium at its state-of-the-art Greentech lithium

beneficiation plant, delivering net zero carbon lithium, produced with zero carbon intensive energy, zero potable water, zero toxic chemicals

and zero tailings dams.

Phase 1 of the Company’s operations entered commercial production

in the second quarter of 2023. The Company has issued a Final Investment Decision, formally approving construction to double capacity

to 520,000 tonnes of lithium concentrate through the addition of a Phase 2 expansion of its Greentech Plant.

For more information about Sigma Lithium, visit https://www.sigmalithiumresources.com/

FOR ADDITIONAL INFORMATION PLEASE CONTACT

Irina Axenova, Vice President Investor Relations

ir@sigmalithium.com.br | +55

11 2985 0089

Sigma Lithium

|

Sigma Lithium |

|

@sigmalithium |

|

@SigmaLithium |

| | |  | 2 | 2 |

FORWARD-LOOKING STATEMENTS

This news release includes certain "forward-looking information"

under applicable Canadian and U.S. securities legislation, including but not limited to statements relating to timing and costs related

to the general business and operational outlook of the Company, the environmental footprint of tailings and positive ecosystem impact

relating thereto, donation and upcycling of tailings, timing and quantities relating to tailings and Green Lithium, achievements and projections

relating to the Zero Tailings strategy, achievement of ramp-up volumes, production estimates and the operational status of the Groto do

Cirilo Project, and other forward-looking information. All statements that address future plans, activities, events, estimates, expectations

or developments that the Company believes, expects or anticipates will or may occur is forward-looking information, including statements

regarding the potential development of mineral resources and mineral reserves which may or may not occur. Forward-looking information

contained herein is based on certain assumptions regarding, among other things: general economic and political conditions; the stable

and supportive legislative, regulatory and community environment in Brazil; demand for lithium, including that such demand is supported

by growth in the electric vehicle market; the Company’s market position and future financial and operating performance; the Company’s

estimates of mineral resources and mineral reserves, including whether mineral resources will ever be developed into mineral reserves;

and the Company’s ability to operate its mineral projects including that the Company will not experience any materials or equipment

shortages, any labour or service provider outages or delays or any technical issues. Although management believes that the assumptions

and expectations reflected in the forward-looking information are reasonable, there can be no assurance that these assumptions and expectations

will prove to be correct. Forward-looking information inherently involves and is subject to risks and uncertainties, including but not

limited to that the market prices for lithium may not remain at current levels; and the market for electric vehicles and other large format

batteries currently has limited market share and no assurances can be given for the rate at which this market will develop, if at all,

which could affect the success of the Company and its ability to develop lithium operations. There can be no assurance that such statements

will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking information. The Company disclaims any intention or obligation to update or

revise any forward-looking information, whether because of new information, future events or otherwise, except as required by law. For

more information on the risks, uncertainties and assumptions that could cause our actual results to differ from current expectations,

please refer to the current annual information form of the Company and other public filings available under the Company’s profile

at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of

this news release.

| 3

| 3

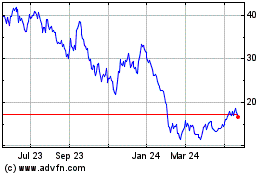

Sigma Lithium (NASDAQ:SGML)

Historical Stock Chart

From Jan 2025 to Feb 2025

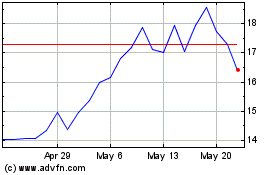

Sigma Lithium (NASDAQ:SGML)

Historical Stock Chart

From Feb 2024 to Feb 2025