false

0001004989

0001004989

2025-01-03

2025-01-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 3, 2025

SPAR Group, Inc.

(Exact Name of Registrant as Specified in Charter)

| |

|

|

| Delaware |

0-27408 |

33-0684451 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File No.) |

(IRS Employer Identification No.) |

| |

|

|

| |

|

|

| 1910 Opdyke Court, Auburn Hills, MI |

|

48326 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant's telephone number, including area code: (248) 364-7727

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a - 12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered |

| |

|

|

|

|

| |

|

|

|

|

| Common Stock, $0.01 par value |

|

SGRP |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

SPAR Group, Inc. ("SGRP" or the "Corporation", and together with its subsidiaries, the "Company", "SPAR" or "SPAR Group") has listed its shares of common stock, par value $0.01 ("Common Stock") for trading through the Nasdaq Stock Market LLC ("Nasdaq") under the trading symbol "SGRP" and periodically files reports with the Securities and Exchange Commission ("SEC"). Reference is made to: (a) SGRP's 2023 Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC on April 1, 2024, and SGRP's First Amendment to the 2023 Annual Report on Form 10- K/A for the year ended December 31, 2023, as filed with the SEC on April 30, 2024 (as so amended, the "2023 Annual Report"); and (b) SGRP's Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other reports and statements as and when filed with the SEC (together with the 2023 Annual report, each an "SEC Report").

Item 3.01 - Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing

Background re Going Private Transaction

As previously announced, SGRP entered into the Agreement and Plan of Merger dated August 30, 2024, by and among SGRP, Highwire Capital LLC ("Highwire"), and Highwire Merger Co. I, Inc., a wholly owned subsidiary of Highwire, whereby SGRP is to be acquired in a merger by Highwire in an all cash transaction (the "Proposed Acquisition"). SGRP's stockholders approved the Proposed Acquisition in a special meeting conducted on October 25, 2024.

Following the closing of the Proposed Acquisition, the shares of SGRP would be privately owned by Highwire and no longer traded on Nasdaq.

On December 11, 2024, SGRP issued a press release confirming that the parties were committed to close the Proposed Acquisition, and today the parties continue to work towards that closing.

SGRP held an Annual Meeting of its stockholders on November 9, 2023 (at which all of SGRP's current directors were elected), and a Special Meeting of its stockholders on October 25, 2024 (at which the Proposed Acquisition was approved). However, anticipating the closing of the Proposed Acquisition, SGRP did not hold an Annual Meeting of its stockholders in 2024, which is the first year in which SGRP has not held an Annual Meeting of its stockholders.

Nasdaq Notice of Failure to Comply with its Annual Meeting Listing Rule

As a result of its failure to hold an Annual Meeting of its stockholders in 2024, SGRP received a notification letter from Nasdaq dated January 3, 2025 (the "Nasdaq Noncompliance Letter"), stating that SGRP no longer complies with Nasdaq Listing Rule 5620. Nasdaq Listing Rule 5620(a) requires that a listed company hold an annual meeting of shareholders (the "Annual Meeting Rule").

In the Nasdaq Noncompliance Letter, Nasdaq said that SGRP had 45 calendar days to submit a plan to Nasdaq to regain compliance with the Annual Meeting Rule (the "Compliance Plan"). If Nasdaq in its discretion accepts SGRP's Compliance Plan, Nasdaq can grant an exception of up to 180 calendar days from the fiscal year end, or until June 30, 2025, for SGRP to regain compliance with the Annual Meeting Rule. SGRP is working on its Compliance Plan.

Please see Item 1A -- Risk Factors -- Risks of a Nasdaq Delisting and Penny Stock Trading in the 2023 Annual Report.

The text of the Nasdaq Noncompliance Letter is attached to and filed with this Current Report as Exhibit 99.1 hereto and is hereby incorporated by reference into this Current Report. The descriptions of the Nasdaq Noncompliance Letter in this Current Report are subject to and are qualified in their entirety by the full text of the Nasdaq Noncompliance Letter.

Forward Looking Statements

This Current Report on Form 8-K and its exhibits (collectively, this "Current Report") contain forward-looking statements within the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, made by, or respecting, the Corporation and its subsidiaries. Forward-looking statements include information concerning the Proposed Acquisition. "Forward-looking statements" are defined in Section 27A of the Securities Act of 1933, as amended (the "Securities Act") and Section 21E of the Exchange Act, and other applicable federal and state securities laws, rules and regulations, as amended.

Readers can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. Words such as "may," "will," "expect," "intend," "believe," "estimate," "anticipate," "continue," "plan," "project," or the negative of these terms or other similar expressions also identify forward-looking statements. Forward-looking statements made by the Corporation in this Current Report on Form 8-K may include (without limitation) statements regarding: risks, uncertainties, cautions, circumstances and other factors ("Risks"). Those Risks include (without limitation): the uncertainty of the contents and submission timing of the Corporation's Compliance Plan or Nasdaq's acceptance of it; potential non- compliance with applicable Nasdaq annual meeting, director independence, bid price or other rules; the uncertainty of the closing of the Proposed Acquisition within the anticipated time period, or at all, due to any reason, including any failure to satisfy the conditions to the consummation of the Proposed Acquisition or to complete any necessary financing arrangements; the risk that the Proposed Acquisition disrupts our current plans and operations or diverts management's attention from its ongoing business; the impact of the news of the Proposed Acquisition or developments in it; the nature, cost and outcome of any legal proceedings related to the Proposed Acquisition; the impact of the Corporation's continued strategic review process, or any resulting action or inaction, should the Proposed Acquisition not occur; the impact of selling certain of the Corporation's subsidiaries or any resulting impact on revenues, earnings or cash; the impact of adding new directors or new finance team members; the potential of continuing negative effects of the COVID pandemic on the business of the Corporation and its subsidiaries (collectively, the "Company"); the Company's cash flow or financial condition; and plans, intentions, expectations.

For additional information and risk factors that could affect SPAR Group, see its 2023 Annual Report and other SEC Reports as filed with the SEC. The information contained in this Current Report on Form 8-K is made only as of the date hereof, even if subsequently made available by the Corporation on its website or otherwise.

You should carefully review and consider the Corporation's forward-looking statements (including all risk factors and other cautions and uncertainties) and other information made, contained or noted in or incorporated by reference into this Current Report on Form 8-K, but you should not place undue reliance on any of them. The results, actions, levels of activity, performance, achievements or condition of the Company (including its affiliates, assets, business, clients, capital, cash flow, credit, expenses, financial condition, income, legal costs, liabilities, liquidity, locations, marketing, operations, performance, prospects, sales, strategies, taxation or other achievement, results, risks, trends or condition) and other events and circumstances planned, intended, anticipated, estimated or otherwise expected by the Company (collectively, "Expectations"), and our forward-looking statements (including all Risks) and other information reflect the Corporation's current views about future events and circumstances. Although the Corporation believes those Expectations and views are reasonable, the results, actions, levels of activity, performance, achievements or condition of the Company or other events and circumstances may differ materially from our Expectations and views, and they cannot be assured or guaranteed by the Corporation, since they are subject to Risks and other assumptions, changes in circumstances and unpredictable events (many of which are beyond the Corporation's control). In addition, new Risks arise from time to time, and it is impossible for the Corporation to predict these matters or how they may arise or affect the Company. Accordingly, the Corporation cannot assure you that its Expectations will be achieved in whole or in part, that it has identified all potential Risks, or that it can successfully avoid or mitigate such Risks in whole or in part, any of which could be significant and materially adverse to the Company and the value of your investment in the Corporation's common stock.

These forward-looking statements reflect the Corporation's Expectations, views, Risks and assumptions only as of the date hereof, and the Corporation does not intend, assume any obligation, or promise to publicly update or revise any forward- looking statements (including any Risks or Expectations) or other information (in whole or in part), whether as a result of new information, new or worsening Risks or uncertainties, changed circumstances, future events, recognition, or otherwise.

Item 9.01. Financial Statements and Exhibits.

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

SPAR Group, Inc.

Date: January 8, 2025

By: /s/Michael R. Matacunas

Michael R. Matacunas, President & CEO

Exhibit 99.1

NASDAQ REGULATION

January 3, 2025

Mr. Lawrence David Swift

General Counsel

SPAR Group, Inc.

1910 Opdyke Court

Auburn Hills, MI 48326

Re: SPAR Group, Inc. (the “Company”)

Nasdaq Security: Common Stock

Nasdaq Symbol: SGRP

Dear Mr. Swift:

Since your Company has not yet held an annual meeting of shareholders within twelve months of the end of the Company’s fiscal year end, it no longer complies with our Listing Rules (the “Rules”) for continued listing.1 In addition, please see IM-5620 which specifies the securities subject to the annual meeting requirement. Under our Rules the Company now has 45 calendar days to submit a plan to regain compliance and if we accept your plan, we can grant an exception of up to 180 calendar days from the fiscal year end, or until June 30, 2025, to regain compliance. Your plan should be as definitive as possible, addressing any issues that you believe would support your request for an exception.

In determining whether to accept your plan, we will consider such things as the likelihood that the annual meeting can be held within the 180 day period, the Company’s past compliance history, the reasons for the delayed meeting, other corporate events that may occur within our review period, the Company’s overall financial condition and its public disclosures.2

Please email your plan to me at xxxxxxxx no later than February 18, 2025. After we review the plan, I will contact you if we have any questions or comments and will provide you with written notice of our decision. If we do not accept your plan, you will have the opportunity to appeal that decision to a Hearings Panel.3

Our Rules require that the Company promptly disclose receipt of this letter by either filing a Form 8-K, where required by SEC rules, or by issuing a press release. The announcement needs to be made no later than four business days from the date of this letter and must include the continued listing criteria that the Company does not meet, and a description of each specific basis and concern identified by Nasdaq in reaching the determination.4

The Company must also submit the announcement to Nasdaq’s MarketWatch Department.5 If the public announcement is made between the hours of 7:00 AM and 8:00 PM Eastern Time, the Company must submit the announcement to Nasdaq’s MarketWatch Department at least ten minutes prior its public release. If the public announcement is made outside of these hours, the Company must submit the announcement prior to 6:50 A.M. Eastern Time. Please note that if you do not make the required announcement trading in your securities will be halted.6

In addition, Nasdaq makes available to investors a list of all non-compliant companies, which is posted on our website at listingcenter.nasdaq.com. The Company will be included in this list beginning five business days from the date of this letter. As part of this process, an indicator reflecting the Company’s non-compliance will be broadcast over Nasdaq’s market data dissemination network and will also be made available to third party market data providers.

1See Listing Rules 5620(a) and 5810(c)(2)(G). In addition, please see IM-5620 which specifies the securities subject to the annual

meeting requirement.

2For additional information with respect to compliance plans please see attached “Nasdaq Online Resources” when preparing your plan of compliance. This attachment includes links to the Frequently Asked Questions section relating to continued listing.

3See Listing Rule 5815(a). See FAQ #428 available on the Nasdaq Listing Center.

4Listing Rule 5810(b).

5The notice must be submitted to Nasdaq’s MarketWatch Department through the Electronic Disclosure submission system available at nasdaq.net/ED/IssuerEntry.

6Listing IM-5810-1.

v3.24.4

Document And Entity Information

|

Jan. 03, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

SPAR Group, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 03, 2025

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

0-27408

|

| Entity, Tax Identification Number |

33-0684451

|

| Entity, Address, Address Line One |

1910 Opdyke Court

|

| Entity, Address, City or Town |

Auburn Hills

|

| Entity, Address, State or Province |

MI

|

| Entity, Address, Postal Zip Code |

48326

|

| City Area Code |

248

|

| Local Phone Number |

364-7727

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

SGRP

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001004989

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

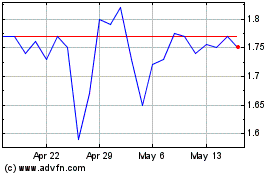

Spar (NASDAQ:SGRP)

Historical Stock Chart

From Feb 2025 to Mar 2025

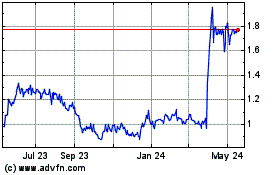

Spar (NASDAQ:SGRP)

Historical Stock Chart

From Mar 2024 to Mar 2025