false

0001551693

0001551693

2024-01-15

2024-01-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES ACT OF 1934

Date of Report (Date of earliest event reported):

January 15, 2024

SIENTRA, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-36709 |

|

20-5551000 |

(State or other jurisdiction

of incorporation |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

3333 Michelson Drive, Suite 650

Irvine, California |

|

92612 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

805 562-3500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each

exchange on which registered |

| Common Stock, par value $0.01 per share |

|

SIEN |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On January 15, 2024 (the “Effective

Date”), Sientra, Inc., a Delaware corporation (the “Company”), entered into that certain Amendment No. 1 to Temporary

Waiver and Exchange Agreement and Temporary Amendment to Facility Agreement (the “Temporary Waiver Amendment”), which

(i) amended that certain Temporary Waiver and Exchange Agreement, dated as of October 30, 2023, by and among the Company, as

borrower, certain of the Company’s subsidiaries from time to time party thereto, as guarantors, and Deerfield Partners, L.P., as

agent and lender (“Deerfield”), which was disclosed by the Company in a Current Report on Form 8-K filed with the Securities

and Exchange Commission on October 31, 2023 (the “Original Temporary Waiver”) in connection with that certain Amended

and Restated Facility Agreement, dated as of October 12, 2022 (as so amended and restated, and as the same may be further amended,

modified, restated or otherwise supplemented from time to time from time to time, including as temporarily amended by the Temporary Waiver

Amendment, the “Facility Agreement”) by and among the Company, as borrower, certain of the Company’s subsidiaries

from time to time party thereto, as guarantors, and Deerfield and (ii) temporarily amended the Facility Agreement(the “Temporary

Facility Agreement Amendment”).

Temporary Waiver Amendment

The Temporary Waiver Amendment extends, subject

to certain conditions as set forth in the Original Temporary Waiver, the original waiver period included in the Original Temporary Waiver,

which spanned from October 30, 2023 to January 15, 2024, to January 28, 2024 (the “Amended Waiver Period”).

Temporary Facility Agreement Amendment

The Temporary Facility Agreement Amendment provides

that, solely during the Amended Waiver Period, the minimum cash balance covenant contained in Section 6.10(b) of the Facility Agreement

is temporarily reduced from $10,000,000 to $8,000,000.

Forward-Looking Statements

This current report on Form 8-K contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended, based on management’s current assumptions and expectations of future events and trends, which affect or

may affect the Company’s business, strategy, operations or financial performance, and actual results may differ materially from

those expressed or implied in such statements due to numerous risks and uncertainties. Forward-looking statements are made only as of

the date of this Current Report on Form 8-K. The words “believe,” “may,” “might,” “could,”

“will,” “aim,” “estimate,” “continue, “anticipate,” “intend,” “expect,”

“plan,” “position,” or the negative of those terms, and similar expressions that convey uncertainty of future

events or outcomes are intended to identify estimates, projections and other forward-looking statements. Forward-looking statements may

include information concerning the Company’s ability to comply with the terms of the Facility Agreement, including financial covenants,

both during and after any waiver period, and/or obtain any additional waivers of any terms of the Company’s Facility Agreement to

the extent required, the Company’s unaudited financial information for the third quarter ended September 30, 2023, the Company’s

possible or assumed future results of operations, including descriptions of the Company’s revenues, operating expense, profitability,

outlook and overall business strategy, the Company’s ability and timing to successfully integrate the Viality™ with AuraClens™

fat transfer system and SimpliDerm® human Acellular Dermal Matrix into its existing operations, the reception of plastic surgeons

to the Company’s products, the Company’s ability to expand into aesthetic applications outside of breast procedures, the Company’s

ability to add additional products and strategic partnerships, the Company’s ability to capture additional market share and customer

accounts in the plastic surgery market, and the Company’s ability to obtain and execute on any strategic alternatives. Such statements

are subject to risks and uncertainties, including the audit of the Company’s financial statements which audit is not yet complete

and the numbers presented here could differ from the final audited financial statements presented by the Company, the Company’s

ability to recapture delayed procedures resulting from the COVID-19 pandemic and other macroeconomic pressures, the positive reaction

from plastic surgeons and their patients to the Company’s products, the ability to meet consumer demand including any potential

supply issues resulting from the COVID-19 pandemic or the war in Ukraine, the growth of the plastic surgery market and breast procedures,

and the ability of the Company to execute on its commercial, operational, marketing, research and development and regulatory plans, and

the Company’s ability to obtain and execute on any strategic alternatives. Additional factors that could cause actual results to

differ materially from those contemplated in this Current Report on Form 8-K can be found in the Risk Factors section of Sientra’s

public filings with the Securities and Exchange Commission. All statements other than statements of historical fact are forward-looking

statements. The words “believe,” “may,” “might,” “could,” “will,” “aim,”

“estimate,” “continue, “anticipate,” “intend,” “expect,” “plan,” “position,”

or the negative of those terms, and similar expressions that convey uncertainty of future events or outcomes are intended to identify

estimates, projections and other forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements,

and such estimates, projections and other forward-looking statements speak only as of the date they were made, and, except to the extent

required by law, the Company undertakes no obligation to update or review any estimate, projection or forward-looking statement. Actual

results may differ from those set forth in this Current Report on Form 8-K due to the risks and uncertainties inherent in the Company’s

business.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

SIENTRA, INC. |

| |

|

| Date: January 16, 2024 |

By: |

/s/ Ronald Menezes |

| |

|

Ronald Menezes |

| |

|

President and Chief Executive Officer |

3

Exhibit 10.1

AMENDMENT NO. 1 TO TEMPORARY WAIVER AND

EXCHANGE AGREEMENT

AND TEMPORARY AMENDMENT TO FACILITY AGREEMENT

This AMENDMENT NO. 1

TO TEMPORARY WAIVER AND EXCHANGE AGREEMENT AND TEMPORARY AMENDMENT TO FACILITY AGREEMENT (this “Agreement”),

dated as of January 15, 2024, is by and among Sientra, Inc., a Delaware corporation (the “Borrower”), the

other Loan Parties (as defined in the Facility Agreement (as defined below)) signatory hereto, and Deerfield Partners, L.P., in its capacity

as Agent for the Lenders (in such capacity, the “Agent”) and as a lender (the “Lender”).

Capitalized terms used but not otherwise defined in this Agreement shall have the respective meanings given to them in the Temporary Waiver

and Exchange Agreement (as defined below) or the Facility Agreement, as applicable.

RECITALS:

A.

The Borrower, the other Loan Parties signatory hereto and the Lender are parties to (i) that certain Amended and Restated

Facility Agreement, dated as of October 12, 2022 (as so amended and restated, and as further amended, restated, amended and restated,

supplemented or otherwise modified prior to the date hereof, the “Existing Facility Agreement”), and temporarily

amended by this Agreement, the “Facility Agreement”) and (ii) that certain Temporary Waiver and Exchange

Agreement, dated as of October 30, 2023 (the “Existing Temporary Waiver and Exchange Agreement” and, as amended

by this Agreement and as may be further amended, restated, amended and restated, supplemented or otherwise modified from time to time,

the “Temporary Waiver and Exchange Agreement”).

B.

The Borrower has requested that the Lender, being the sole “Lender” within the meaning of the Facility Agreement and

constituting the Required Lenders, amend certain terms of the Existing Temporary Waiver and Exchange Agreement and temporarily amend certain

terms of the Facility Agreement and, upon the terms and subject to the conditions and limitations set forth in this Agreement (including

the satisfaction of the conditions set forth in Section 3.01 of this Agreement), and in reliance on the agreements and covenants

set forth herein, the Lender is willing to do so.

NOW, THEREFORE, in consideration

of the foregoing and the mutual covenants and agreements contained herein, and other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally bound, agree as follows:

Article

I.

AMENDMENT

TO THE EXISTING TEMPORARY WAIVER AND EXCHANGE AGREEMENT

AND TEMPORARY AMENDMENT TO THE EXISTING FACILITY AGREEMENT

Section 1.01.

Amendment to Existing Temporary Waiver and Exchange Agreement. Effective as of the Effective Date (as defined below), Section 2.01(a)

of the Existing Temporary Waiver Agreement is hereby amended by deleting each reference to “January 15, 2024” appearing

therein and inserting “January 28, 2024” in lieu thereof.

Section 1.02. Temporary

Amendment to Existing Facility Agreement. Effective as of the Effective Date (as defined below), and notwithstanding anything to

the contrary in the Existing Temporary Waiver and Exchange Agreement, the Existing Facility Agreement, or any other Facility Document,

the parties hereto hereby agree that, solely during the Waiver Period (as amended hereby), the minimum cash balance covenant contained

in Section 6.10(b) of the Existing Facility Agreement is hereby temporarily amended by deleting the reference to “$10,000,000”

appearing therein and inserting “$8,000,000” in lieu thereof.

Article

II.

REPRESENTATIONS

AND WARRANTIES

Section 2.01.

Representations and Warranties of the Borrower and the other Loan Parties. The Borrower and each other Loan Party, jointly

and severally, hereby represent and warrant to the Lender as of the date of this Agreement as follows:

(a)

Organization and Good Standing. Each Loan Party (i) is duly organized, validly existing and in good standing under

the laws of the jurisdiction of its incorporation or organization, as applicable and (ii) has all powers to (A) own its assets

and has powers and all Permits necessary in the operation of its business as presently conducted or as proposed to be conducted, except

where the failure to have such Permits could not reasonably be expected to have a Material Adverse Effect.

(b)

Authority. Each Loan Party has all powers to enter into, execute, deliver and perform its obligations under, this Agreement

and otherwise to carry out its obligations hereunder. The execution and delivery by the Borrower and each other Loan Party signatory thereto

of this Agreement and the consummation by it of the transactions contemplated hereby have been duly authorized by all necessary action

on the part of the Borrower and such Loan Party, and no further action of the Borrower or such Loan Party, its board of directors, managers,

members or stockholders, as applicable, is required in connection herewith.

(c)

Binding Effect. This Agreement has been duly executed and delivered by the Borrower and the other Loan Parties, and constitutes

a valid and binding agreement or instrument of such Loan Party, enforceable against such Loan Party in accordance with its terms, except

as the enforceability thereof may be limited by bankruptcy, insolvency or other similar laws relating to the enforcement of creditors’

rights generally and by general equitable principles.

(d)

Non-Contravention. The execution, delivery and performance by each Loan Party of this Agreement do not and will not (with

or without notice, the passage of time or both) (i) violate, conflict with or cause a breach or a default under (A) any Law

applicable to any Loan Party, (B) any of the Organizational Documents of any Loan Party, or (C) any agreement or instrument

binding upon it, except for such violations, conflicts, breaches or defaults which, with respect to this clause (C), would

not reasonably be expected to have a Material Adverse Effect or (ii) result in the creation or imposition of any Lien on any part

of the properties or assets of the Borrower or any other Loan Party.

(e)

No Unlawful Payments. Neither the Borrower nor any other Loan Party, nor to the knowledge of the Borrower, any of

its and their directors or officers or any employee, agent, affiliate, representative of or other person associated with or acting on

behalf of the Borrower or any other Loan Party, has (a) used any corporate funds for any unlawful contribution, gift, entertainment or

other unlawful expense relating to political activity, (b) made any direct or indirect unlawful payment to any foreign or domestic government

official or employee from corporate funds, (c) violated or is in violation of any provision of the U.S. Foreign Corrupt Practices

Act of 1977, as amended, or (d) made any bribe, unlawful rebate, payoff, influence payment, kickback or other unlawful payment.

(f)

Financial Information. All information delivered to Agent and pertaining to the financial condition of any Loan Party fairly

presents in all material respects the financial position of such Loan Party as of such respective date in conformity with GAAP (and as

to unaudited financial statements, subject to normal year-end adjustments and the absence of footnote disclosures). Since September 30,

2023, there has been no material adverse change in the business, operations, properties or condition (financial or otherwise) of any Loan

Party.

(g)

Litigation. Except as has been disclosed to Agent in writing prior to the date hereof, to the best of Borrower’s knowledge,

there is no Litigation pending against, or to such Loan Party’s knowledge, threatened in writing against or affecting, any Loan

Party or, to the best of such Loan Party’s knowledge, any party to any Facility Document other than a Loan Party involving more

than, individually or in the aggregate, Five Hundred Thousand Dollars ($500,000). There is no Litigation pending in which an adverse decision

would reasonably be expected to have a Material Adverse Effect or which in any manner draws into question the validity of any of the Facility

Documents.

(h)

Regulated Entities. No Loan Party is an “investment company” or a company “controlled” by an “investment

company” or a “subsidiary” of an “investment company,” all within the meaning of the Investment Company

Act of 1940.

(i) Listing; Registration. The Common Stock is listed on the Principal Market. During the last twelve months, trading in the

Common Stock has not been suspended by the SEC or the Principal Market. As of the date of this Agreement, other than as disclosed in the

SEC Documents, neither the Borrower nor any of its Subsidiaries has received any communication, written or oral, from the SEC or the Principal

Market regarding the suspension or termination of trading of the Common Stock on the Principal Market. The Common Stock is registered

pursuant to Section 12(b) of the Exchange Act, and neither the Borrower nor any of its Subsidiaries has taken, or presently intend to

take, any action designed to terminate, or that is likely to have the effect of terminating, the registration of the Common Stock under

the Exchange Act; nor has the Borrower or any of its Subsidiaries received any notification that the SEC is contemplating terminating

such registration. The Common Stock is eligible for clearing through DTC, through its Deposit/Withdrawal At Custodian (DWAC) system, and

the Borrower is eligible for and participating in the Direct Registration System (DRS) of DTC with respect to the Common Stock. The transfer

agent for the Common Stock is a participant in, and the Common Stock is eligible for transfer pursuant to, DTC’s Fast Automated

Securities Transfer Program. The Common Stock is not, and has not at any time been, subject to any DTC “chill,” “freeze”

or similar restriction with respect to any DTC services, including the clearing of transactions in shares of Common Stock through DTC.

(j)

No Default. Except for (x) the Existing Events of Default and (y) any alleged Event of Default resulting from, or related

to, the Borrower’s failure to timely file its Annual Report on Form 10-K for the fiscal year ended December 31, 2022, no Event of

Default, or to such Loan Party’s knowledge, Default, has occurred and is continuing. No Loan Party is in breach or default under

or with respect to any contract, agreement, lease or other instrument to which it is a party or by which its property is bound or affected,

which breach or default would reasonably be expected to have a Material Adverse Effect.

(k)

Full Disclosure. Except for the transactions contemplated by this Agreement or disclosed in the Announcing Form 8-K, no

event, liability, development or circumstance has occurred or exists, or is contemplated to occur with respect to the Borrower or any

of its Subsidiaries, or any of its or their business, properties, prospects, operations or financial condition, that, under applicable

securities laws, is required to have been, or be, publicly disclosed by the Borrower (on SEC Form 8-K otherwise) prior to, on or within

four (4) Business Days after the date this representation is made, and, in either case, that has not been publicly disclosed by the Borrower

at least one (1) Business Day prior to the date this representation is made. None of the written information (financial or otherwise)

furnished by or on behalf of any Loan Party to Agent or any Lender in connection with the consummation of the transactions contemplated

by this Agreement or any other Facility Documents, contains any untrue statement of a material fact or omits to state a material fact

necessary to make the statements contained herein or therein not misleading in light of the circumstances under which such statements

were made.

Article

III.

CONDITIONS PRECEDENT.

Section 3.01.

Conditions to Effectiveness. This Agreement shall become effective on the date when the Administrative Agent (or its counsel)

shall have received from the Borrower and each other Loan Party a counterpart of this Agreement signed by such party (the first such date,

the “Effective Date”).

Article

IV.

MISCELLANEOUS

Section 4.01.

Entire Agreement. This Agreement contains the entire understanding of the Agent, the Lenders and the Borrower with respect

to the matters covered hereby and supersede any and all other written and oral communications, negotiations, commitments and writings

with respect thereto.

Section 4.02.

Amendments and Waivers. No amendment, restatement, modification, supplement, change, termination or waiver of any provision

of this Agreement, and no consent to any departure by the Borrower therefrom, shall in any event be effective without the written concurrence

of the Borrower and the Lender.

Section 4.03.

Successors and Assigns. This Agreement shall bind and inure to the respective successors and permitted assigns of the parties

hereof. No party hereunder may assign its rights or obligations hereunder without the prior written consent of the other parties hereto.

Section 4.04.

Notices. Any notice, request or other communication to be given or made under this Agreement shall be in writing and shall

be given in accordance with Section 8.1 of the Facility Agreement, the provisions of which are incorporated by reference herein,

with the same force and effect as if fully set forth herein, mutatis mutandis.

Section 4.05.

Governing Law; Venue; Jurisdiction; Service of Process; WAIVER OF JURY TRIAL. The provisions of Section 8.3 of the

Facility Agreement are incorporated by reference herein, with the same force and effect as if fully set forth herein, mutatis mutandis.

Section 4.06.

Counterparts; Effectiveness. This Agreement may be executed in several counterparts, and by each party hereto on separate

counterparts, each of which and any photocopies, facsimile copies and other electronic methods of transmission thereof shall be deemed

an original, but all of which together shall constitute one and the same agreement.

Section 4.07.

General Release.

(a)

Effective as of the Effective Date, in consideration of, among other things, the Lender’s and Agent’s execution and

delivery of this Agreement, the Borrower and each other Loan Party, on behalf of itself and its agents, representatives, officers, directors,

advisors, employees, subsidiaries, affiliates, successors and assigns (collectively, the “Releasors”), hereby

waives, releases and discharges, to the fullest extent permitted by law, each Releasee (as defined below) from any and all claims (including,

without limitation, crossclaims, counterclaims, rights of set-off and recoupment), actions, causes of action, suits, debts, accounts,

interests, liens, promises, warranties, damages and consequential damages, demands, agreements, bonds, bills, specialties, covenants,

controversies, variances, trespasses, judgments, executions, liabilities, costs, expenses or claims whatsoever, that such Releasor now

has or hereafter may have, of whatsoever nature and kind, whether known or unknown, whether now existing or hereafter arising, whether

arising at law or in equity or upon contract or tort, or under any state or federal law or otherwise (collectively, the “Claims”),

against the Agent or any Lender in their capacities as such and each of their respective affiliates, subsidiaries, shareholders and “controlling

persons” (within the meaning of the federal securities laws), and their respective successors and assigns and each and all of the

officers, directors, employees, agents, attorneys, advisors and other representatives of each of the foregoing (collectively, the “Releasees”),

based in whole or in part on facts, whether or not now known, existing on or before the date of this Agreement, that relate to, arise

out of or otherwise are in connection with this Agreement or the transactions contemplated hereby, in each case, to the extent that the

applicable acts or omissions of the applicable Releasee(s) occurred on or prior to the date of this Agreement (collectively, the “Released

Matters”); provided that this Section 4.07(a) shall not release any Releasee from (i) its duties, obligations

and agreements specifically set forth in this Agreement and (ii) any Released Matters arising from the bad faith, gross negligence,

willful misconduct or actual fraud of any Releasee.

(b)

Each of the Releasors, hereby absolutely, unconditionally and irrevocably, covenants and agrees with, and in favor of, each Releasee

that it will not sue (at law, in equity, in any regulatory proceeding or otherwise) any Releasee on the basis of any Claim released, remised

and discharged by the Borrower or the other Loan Parties pursuant to Section 4.07(a) hereof; provided that this Section 4.07(b)

shall not restrict, inhibit or otherwise prevent any Releasor from seeking declaratory judgment (or other declaratory relief), asserting

any defenses or counterclaims resulting from, or related to, claims brought against the such Releasor by any Releasee (including any claims

brought by any Releasee with respect to any alleged Event of Default resulting from, or related to, the Borrower’s failure to timely

file its Annual Report on Form 10-K for the fiscal year ended December 31, 2022). If the Borrower, the Loan Parties or any of

their respective successors, assigns or other legal representatives violates the foregoing covenant, the Borrower and the other Loan Parties,

each for itself and its successors, assigns and legal representatives, agrees to pay, in addition to such other damages as any Releasee

may sustain as a result of such violation, all reasonable attorneys’ fees and costs incurred by any Releasee as a result of such

violation.

Section 4.08.

No Third Party Beneficiaries. Nothing in this Agreement, express or implied, is intended to or shall confer upon any person

(other than the parties to this Agreement) any right, benefit or remedy of any nature whatsoever under or by reason of this Agreement,

except that the Releasees shall be deemed to be express third party beneficiaries of Section 4.07.

Section 4.09.

[Reserved].

Section 4.10.

Effect of Headings. The division of this Agreement into Articles and Sections and the use of headings and captions is for

convenience of reference only and shall not modify or affect the interpretation or construction of this Agreement or any of its provisions.

Section 4.11.

Severability. If any provision of this Agreement shall be invalid, illegal or unenforceable in any respect under any law,

the validity, legality and enforceability of the remaining provisions hereof or thereof shall not in any way be affected or impaired thereby.

The parties hereto shall endeavor in good faith negotiations to replace the invalid, illegal or unenforceable provisions with valid provisions

the economic effect of which comes as close as possible to that of the invalid, illegal or unenforceable provision.

Section 4.12.

Reservation of Rights. Neither the Agent nor the Lender has hereby waived any of the Agent’s or Lender’s rights

or remedies arising from any breach or default or any right otherwise available under the Facility Agreement, any other Transaction Document

or at law or in equity as to the Note. Each of the Agent and the Lender expressly reserves all such rights and remedies.

Section 4.13.

Interpretation. The provisions of Section 1.2 of the Facility Agreement are incorporated by reference herein, with

the same force and effect as if fully set forth herein, mutatis mutandis.

Section 4.14.

[Reserved].

Section 4.15.

[Reserved].

Section 4.16.

No Modification; Facility Agreement. Except as expressly set forth herein, nothing contained herein shall be deemed to constitute

a waiver of compliance with any term or condition contained in the Facility Agreement, the Note or any of the other Facility Documents.

Except as expressly stated herein, the Agent and Lender reserve all rights, privileges and remedies under the Facility Documents. Except

as amended or consented to hereby, the Facility Agreement and other Facility Documents remain unmodified and in full force and effect.

The parties hereto acknowledge and agree that this Agreement shall constitute a Facility Document.

Section 4.17.

Reaffirmation. Each of the Loan Parties as debtor, grantor, pledgor, guarantor, assignor, or in other any other similar

capacity in which such Loan Party grants liens or security interests in its property or otherwise acts as accommodation party or guarantor,

as the case may be, hereby (a) ratifies and reaffirms as of the date hereof all of its payment and performance obligations, contingent

or otherwise, under each of the Facility Documents to which it is a party (after giving effect hereto) and, (b) to the extent such Loan

Party granted Liens on or security interests in any of its property pursuant to any such Facility Documents as security for or otherwise

guaranteed the Liabilities of the Borrower under or with respect to the Facility Documents, ratifies and reaffirms as of the date hereof

such guarantee and grant of security interests and Liens and confirms and agrees that such security interests and liens hereafter secure

all of the Liabilities as amended hereby. Each of the Loan Parties hereby consents to this Agreement and each of the other Facility Documents

remains in full force and effect and is hereby ratified and reaffirmed as of the date hereof. The execution of this Agreement shall not

operate as a waiver of any right, power or remedy of the Agent or Lender, constitute a waiver of any provision of any of the Facility

Documents or serve to effect a novation of the Liabilities.

Section 4.18.

No Fiduciary Relationship. The provisions of Section 8.26 of the Facility Agreement are incorporated by reference herein,

with the same force and effect as if fully set forth herein, mutatis mutandis.

[Remainder of Page Intentionally

Left Blank; Signature Pages Follow]

IN WITNESS WHEREOF,

each party hereto has caused this Agreement to be duly executed as of the date first written above.

| |

THE BORROWER: |

| |

|

|

| |

SIENTRA, INC. |

| |

|

|

| |

By: |

/s/ Andrew Schmidt |

| |

Name: |

Andrew Schmidt |

| |

Title: |

CFO |

| |

|

|

| |

OTHER LOAN PARTIES: |

| |

|

|

| |

MIST HOLDINGS, INC. |

| |

|

|

| |

By: |

/s/ Andrew Schmidt |

| |

Name: |

Andrew Schmidt |

| |

Title: |

CFO |

| |

|

|

| |

MIST, INC. |

| |

|

|

| |

By: |

/s/ Andrew Schmidt |

| |

Name: |

Andrew Schmidt |

| |

Title: |

CFO |

| |

|

|

| |

MIST INTERNATIONAL, INC. |

| |

|

|

| |

By: |

/s/ Andrew Schmidt |

| |

Name: |

Andrew Schmidt |

| |

Title: |

CFO |

[Signature Page to Amendment No. 1 to Temporary

Waiver and Exchange Agreement and Temporary Amendment to Facility Agreement]

| |

AGENT

AND LENDER: |

| |

|

|

| |

DEERFIELD PARTNERS, L.P. |

| |

|

|

| |

By: Deerfield Mgmt, L.P., its General Partner |

| |

By: J.E. Flynn Capital, LLC, its General Partner |

| |

|

|

| |

By: |

/s/ David J. Clark |

| |

Name: |

David J. Clark |

| |

Title: |

Authorized Signatory |

[Signature Page to Amendment No. 1 to Temporary

Waiver and Exchange Agreement and Temporary Amendment to Facility Agreement]

v3.23.4

Cover

|

Jan. 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 15, 2024

|

| Entity File Number |

001-36709

|

| Entity Registrant Name |

SIENTRA, INC.

|

| Entity Central Index Key |

0001551693

|

| Entity Tax Identification Number |

20-5551000

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3333 Michelson Drive

|

| Entity Address, Address Line Two |

Suite 650

|

| Entity Address, City or Town |

Irvine

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92612

|

| City Area Code |

805

|

| Local Phone Number |

562-3500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

SIEN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

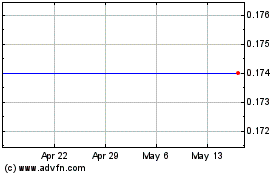

Sientra (NASDAQ:SIEN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sientra (NASDAQ:SIEN)

Historical Stock Chart

From Nov 2023 to Nov 2024