UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

SHINECO,

INC.

(Name

of Issuer)

COMMON

STOCK, PAR VALUE $0.001 PER SHARE

(Title

of Class of Securities)

824567408

(CUSIP

Number)

Shanchun

Huang

Flat

111 Coleherne Court

Old

Brompton Road, London SW5 0ED

Tel:

+447999 688888

(Name,

Address and Telephone Number of Person Authorized to

Receive

Notices and Communications)

July

8, 2024

(Date

of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

* The remainder of this cover page shall be

filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

| 1 |

NAMES

OF REPORTING PERSONS

Shanchun

Huang |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS (See Instructions)

PF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT

TO ITEMS 2(d) or 2(e) ☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Malta |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY EACH

REPORTING

PERSON

WITH

|

7 |

SOLE

VOTING POWER

1,248,924 |

| 8 |

SHARED

VOTING POWER

n/a |

| 9 |

SOLE

DISPOSITIVE POWER

1,248,924 |

| 10 |

SHARED

DISPOSITIVE POWER

n/a |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,248,924 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

(See Instructions) |

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

13.3%(1) |

| 14 |

TYPE

OF REPORTING PERSON (See Instructions)

IN |

| (1) |

This

percentage is calculated based upon 9,373,165 shares of the Issuer’s common stock issued and outstanding as of July 9, 2024. |

Item

1. Security and Issuer.

This

Schedule 13D relates to the common stock par value $0.001 per share (the “Common Stock”) of Shineco, Inc., a Delaware Corporation

(the “Issuer”). The address of the principal executive offices of the Issuer is T1, South Tower, Jiazhaoye Square, Chaoyang

District, Beijing, People’s Republic of China 100022.

Item

2. Identity and Background.

a)

Name:

This

statement is filed by Shanchun Huang, a Malta citizen (the “Reporting Person”).

(b)

Residence or business address:

The

principal mailing address of the Reporting Person is Flat 111 Coleherne Court, Old Brompton Road London SW5 0ED.

(c)

Principal business of each reporting person and address:

The

principal business of the Reporting Person is investment.

Address:

Flat 111 Coleherne Court, Old Brompton Road, London SW5 0ED

(d)

— (e) During the last five years, the Reporting Person has not been: (i) convicted in a criminal proceeding (excluding traffic

violations or similar misdemeanors) or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction

and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting

or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) The Reporting Person

is a citizen of the Republic of Malta.

Item

3. Source and Amount of Funds or Other Consideration.

All

shares of Common Stock were purchased with the Reporting Person’s personal funds. The total amount of the funds used

to make the purchases described in Item 4 was $5,000,000.

Item

4. Purpose of Transaction.

(a)-(j)

On June 20, 2024, the Issuer entered into a securities

purchase agreement (the “Purchase Agreement”) with the Reporting Person, pursuant to which the Issuer sold and issued to

the Reporting Person 1,000,000 shares of Common Stock at a price of $ 5.00 per share on July 8, 2024.

The

Reporting Person acquired all of his shares of the Issuer’s Common Stock for investment purposes. The Reporting Person believes

the securities of the Issuer represent an attractive investment opportunity.

The

Reporting Person has had and anticipates having further discussions with officers and directors of the Issuer in connection with

the Reporting Person’s investment in the Issuer. The topics of these conversations will cover a range of issues, including those

relating to the business, management, operations, capital allocation, asset allocation, capital and corporate structure, distribution

policy, financial condition, mergers and acquisitions strategy, overall business strategy, executive compensation, and corporate governance.

The Reporting Person may also communicate with other shareholders or interested parties, such as industry analysts, existing or potential

strategic partners or competitors, investment professionals, and other investors. The Reporting Person may at any time reconsider and

change his intentions relating to the foregoing. The Reporting Person may also take one or more of the actions described in subsections

(a) through (j) of Item 4 of Schedule 13D and may discuss such actions with the Issuer’s management, other shareholders of the

Issuer, and other interested parties, such as those set out above.

The

Reporting Person intends to review his investments in the Issuer on a continuing basis. Depending on various factors, including, without

limitation, the Issuer’s financial positions and strategic direction, the outcome of the discussions and actions referenced above,

actions taken by the board of directors, price levels of the Common Stock, other investment opportunities available to the Reporting

Person, tax implications, conditions in the securities market and general economic and industry conditions, the Reporting Person may

in the future take actions with respect to its investment position in the Issuer as it deems appropriate, including, without limitation,

purchasing additional Common Stock or other instruments that are based upon or relating to the value of the Common Stock or the Issuer

in the open market or otherwise, selling some or all of the interest in the Issuer held by the Reporting Person,

and/or engaging in hedging or similar transactions with respect to the Common Stock.

The

Reporting Person is an affiliate of the Issuer and

intends to continue to take an active role in the Issuer’s management and strategic direction.

There can be no assurance that the Reporting

Person will pursue any of the matters set forth above. Moreover, there can be no assurance that the Reporting Person will or will not

develop any plans or proposals with respect to any of the foregoing matters or take any particular action or actions with respect to

some or all of his holdings in the Issuer, or as to the timing of any such matters should they be so pursued by the Reporting Person.

The Reporting Person reserve the right, at any time and in Reporting Person’s sole discretion, to take or refrain from taking any

of the actions set forth above.

Except as described in this Item 4, as

of the date of this statement the Reporting Person has no present plan or proposal that relates to or would result in any of the matters

set forth in subsections (a) through (j) of Item 4 of Schedule 13D.

Item

5. Interest in Securities of the Issuer.

(a)

The Reporting Person owns an aggregate of 1,248,924 shares of the Issuer’s Common Stock. Based upon 9,373,165 shares of the Issuer’s

common stock outstanding as of July 9, 2024, the shares of the Issuer’s Common Stock beneficially owned by the Reporting Person

constitute approximately 13.3% of the Common Stock of the Issuer as calculated in accordance with Rule 13d-3(d)(1).

(b)

Mr. Huang may be deemed to hold sole voting and dispositive power over 1,248,924 shares of common stock of the Issuer.

(c)

To the best knowledge of the Reporting Person, except as set forth in this Schedule 13D, the Reporting Person has not effected any other

transactions in any securities of the Issuer in the past 60 days.

(d)

To the best knowledge of the Reporting Person, except as set forth in this Schedule 13D, no person other than the Reporting Person has

the right to receive, or the power to direct the receipt of, dividends from, or the proceeds from the sale of the shares of Common

Stock reported in Item 5(a).

(e)

Not applicable.

Item

6. Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

Other

than as described herein, there are no contracts, arrangements, understandings or relationships (legal or otherwise) between the Reporting

Person and any other person with respect to any securities.

Item

7. Material to be Filed as Exhibits.

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| Date:

July 12, 2024 |

|

| |

|

| /s/

Shanchun Huang |

|

| Shanchun

Huang |

|

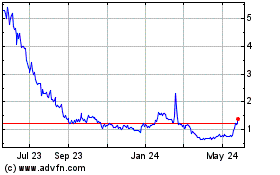

Shineco (NASDAQ:SISI)

Historical Stock Chart

From Dec 2024 to Jan 2025

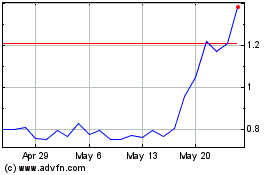

Shineco (NASDAQ:SISI)

Historical Stock Chart

From Jan 2024 to Jan 2025