Soluna Secures New $25M Growth Capital Line

09 September 2024 - 10:00PM

Business Wire

$10M Initial Draw to Repay Convertible Notes,

Fund Data Center Projects

Soluna Holdings, Inc. (“Soluna” or the “Company”), (NASDAQ:

SLNH), a developer of green data centers for intensive computing

applications including Bitcoin mining and AI, today announced that

it has entered into a $25 million Standby Equity Purchase Agreement

(“SEPA”) with a fund managed by Yorkville Advisors Global L.P

(“Yorkville“).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240909709160/en/

(Graphic: Business Wire)

The financing will enable Soluna to:

- Fund critical Soluna Cloud AI operations and data center

development activities.

- Deploy additional capital into projects to significantly

improve equity cash flows.

- Retire its existing Convertible Notes.

- Strengthen its balance sheet.

“The convergence of renewable energy and computing is real. The

energy demands of all forms of computing, including AI, are on the

rise. With this financing, and simplification of our capital

structure, we are now well-positioned to bring our winning formula

to bear on the new opportunities ahead. By deploying this fresh

capital to fuel business development in AI Hosting and Cloud and to

accretive data center projects we can begin to scale the Soluna

story,” said John Belizaire, CEO of Soluna.

This new capital and simplification of the capital structure

will enable Soluna to advance its AI data center designs, prepare

for the build-out of a 2 MW AI data center adjacent to its flagship

Project Dorothy, accelerate the development of the 166 MW Project

Kati – which includes AI – and complete the acquisition of new

sites for up to 20 MW of additional AI data center development. The

secured Convertible Notes will be replaced with more flexible

unsecured financing.

Deal Structure and Strategic Impact

The Yorkville SEPA offers flexible

terms designed to support Soluna's growth objectives:

- Two Initial tranches – The initial $10.0 million Advance will

net $9.3 million to Soluna and will be provided in two tranches,

70% at closing following receipt of third party consents and

satisfaction of customary closing conditions and 30% upon the

effectiveness of an S-1 registration to be filed and obtaining

necessary shareholder approvals via a shareholder meeting to be

scheduled.

- Unsecured and flexible – The financing is unsecured, with a

one-year term and 0% interest, free from warrants or other complex

financial instruments.

- Managed conversion – The agreement includes caps and floors on

monthly conversions, subject to meeting certain conditions, that

offer predictability in managing equity.

- Additional drawdowns – Further access to the remaining $15

million SEPA is possible as the initial advance is repaid and

thereafter, providing continued financial flexibility.

“This financing’s lack of warrants and other variable features

will help us achieve our goal to simplify our capital structure

while delivering much-needed growth capital,” continued Belizaire,

“both of which return great value to Soluna and our

shareholders.”

Northland Capital Markets acted as

the sole placement agent, with the 2nd Pre-Paid Advance contingent

on S-1 registration and shareholder approval.

More information about the financing can be found in the

Company’s upcoming 8-K.

Safe Harbor Statement

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates,” “confident” and similar statements. Soluna

Holdings, Inc. may also make written or oral forward-looking

statements in its periodic reports to the U.S. Securities and

Exchange Commission, in its annual report to shareholders, in press

releases and other written materials and in oral statements made by

its officers, directors or employees to third parties. Statements

that are not historical facts, including but not limited to

statements about Soluna’s beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties, further information regarding

which is included in the Company’s filings with the Securities and

Exchange Commission. All information provided in this press release

is as of the date of the press release, and Soluna Holdings, Inc.

undertakes no duty to update such information, except as required

under applicable law.

About Soluna Holdings, Inc. (SLNH)

Soluna is on a mission to make renewable energy a global

superpower using computing as a catalyst. The company designs,

develops, and operates digital infrastructure that transforms

surplus renewable energy into global computing resources. Soluna’s

pioneering data centers are strategically co-located with wind,

solar, or hydroelectric power plants to support high-performance

computing applications including Bitcoin Mining, Generative AI, and

other compute-intensive applications. Soluna’s proprietary software

MaestroOS(™) helps energize a greener grid while delivering

cost-effective and sustainable computing solutions, and superior

returns. To learn more visit solunacomputing.com. Follow us on X

(formerly Twitter) at @SolunaHoldings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240909709160/en/

Sam Sova Partner and CEO SOVA Sam@letsgosova.com

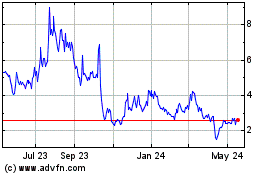

Soluna (NASDAQ:SLNH)

Historical Stock Chart

From Feb 2025 to Mar 2025

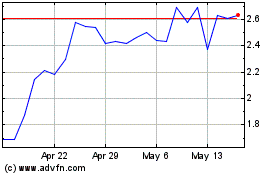

Soluna (NASDAQ:SLNH)

Historical Stock Chart

From Mar 2024 to Mar 2025