Salarius Pharmaceuticals, Inc. (NASDAQ: SLRX), a clinical-stage

biopharmaceutical company developing therapies for patients with

cancer in need of new treatment options, and Decoy Therapeutics,

Inc., a privately held preclinical biopharmaceutical company

engineering the next generation of peptide conjugate therapeutics,

announce the signing of a definitive agreement under which Decoy

Therapeutics will merge with a wholly-owned subsidiary of Salarius

Pharmaceuticals, subject to the closing conditions set forth in the

definitive agreement. The newly formed company will be named Decoy

Therapeutics.

This proposed transaction is expected to facilitate multiple

value-creating inflection points with Decoy’s pipeline of peptide

conjugate therapeutics engineered by its IMP3ACT platform, which

allows for the rapid computational design and manufacturing of

innovative peptide conjugate therapeutics including rapid response

to novel viral pathogens such as avian H5N1 flu. Decoy’s product

pipeline targets unmet needs in respiratory infectious diseases and

gastroenterology (GI) oncology indications.

In addition, the combined company intends to incorporate

Salarius’ oral small molecule protein degrader SP-3164 into a

highly targeted peptide-based proteolysis targeting chimeras

(PROTACS) drug candidate. The ongoing development of Salarius’

seclidemstat for hematologic cancers in an investigator-initiated

Phase 1/2 clinical trial at MD Anderson Cancer Center (MDACC) will

be supported while the company evaluates strategic alternatives for

seclidemstat.

Executive Leadership and Management

Commentary

The combined company will be led by Decoy’s Co-founders, Chief

Executive Officer Frederick “Rick” Pierce and Chief Scientific

Officer Barbara Hibner, by Decoy’s Chief Business Officer Peter

Marschel, Chief Technology Officer Mike Lipp and acting Chief

Medical Officer and Scientific Advisory Board Chair Shahin

Gharakhanian, M.D., and by Salarius’ Chief Financial Officer Mark

Rosenblum. The two companies have further agreed that upon closing

of the merger and a post-closing shareholder vote approving the

conversion of the preferred stock issued at closing, the newly

merged company’s Board of Directors will be comprised of Rick

Pierce and Barbara Hibner, and three independent Directors, two

appointed by Decoy’s Board and one by Salarius’ Board.

Rick Pierce is a life sciences executive with more than 25 years

of senior management experience across private and public

companies. Previously he served as Vice President of Corporate

Development and Investor Relations at Javelin Pharmaceuticals, a

publicly traded company that developed Dyloject™ through EMEA

approval, launch and NDA submission, at which time it was acquired

by Hospira, Inc., now a subsidiary of Pfizer. Earlier in his

career, Mr. Pierce spent 15 years in investment banking at bulge

bracket Wall Street firms primarily focused on corporate finance,

institutional sales and trading in healthcare, biotechnology and

technology, ultra-high-net worth individuals and family

offices.

Mr. Pierce commented, “Peptide conjugates have become one of the

most important drug classes as measured by prescription rates and

revenue growth. Our highly experienced team is excited to be able

to unlock significant shareholder value from our IMP3ACT platform,

which can rapidly design new peptide conjugate drugs by applying ML

and AI tools. Having access to capital and the visibility afforded

by a public listing are significant corporate milestones that

further enable Decoy to advance our expanded preclinical and

clinical candidates to address important unmet patient needs.”

"After undertaking a comprehensive strategic review process, we

believe that the proposed transaction with Decoy Therapeutics

offers the best opportunity to create significant near- and

long-term value,” stated David Arthur, President, CEO and Director

of Salarius Pharmaceuticals. “The compelling science supporting

Decoy’s peptide conjugate technology and the company’s management

team are truly impressive. Based on our diligence, we believe Decoy

is poised to advance multiple drug candidates that address

significant unmet needs in numerous therapeutic areas. The Board of

Salarius and I would like to thank our stockholders for their

support during this review process, and to reiterate the team’s

commitment to enhancing shareholder value with this transaction and

beyond.”

Upcoming Milestones

During the next 12 months, Decoy expects to advance its lead

asset, a pan-coronavirus antiviral, to the filing of an

Investigational New Drug (IND) application with the U.S. Food and

Drug Administration (FDA), and to make progress with its other

programs including a broad-acting antiviral against flu, COVID-19

and respiratory syncytial virus (RSV), and a peptide drug conjugate

targeting GI cancers.

Also during this time data may be reported from the ongoing

MDACC clinical trial in myelodysplastic syndrome (MDS) and chronic

myelomonocytic leukemia (CMML) patients who previously failed or

relapsed after hypomethylating agent therapy.

About the Proposed Transaction

Definitive agreements were executed with unanimous approvals by

the Boards of Directors of Salarius Pharmaceuticals and Decoy

Therapeutics. The closing consideration will consist primarily of

nonvoting preferred stock of Salarius, and it is expected that

following closing and a post-closing stockholder vote to approve

the conversion of the preferred shares into common stock, Decoy

investors would own approximately 86% of the outstanding shares of

the merged company and Salarius stockholders would own

approximately 14% of the outstanding shares, subject to adjustment,

in each case exclusive of any shares issued in any subsequent

financing. For further details on the transaction and conditions

for closing of the merger, please refer to the Form 8-K Salarius

Pharmaceuticals filed with the U.S. Securities and Exchange

Commission (SEC) in conjunction with this press release at

www.sec.gov.

Canaccord Genuity is serving as exclusive strategic advisor to

Salarius, and Hogan Lovells US LLP and Honigman LLP are serving as

legal counsel. Ladenburg Thalmann is serving as financial advisor

to Decoy, and Nason, Yeager, Gerson, Harris & Fumero, P.A. is

serving as legal counsel.

About Decoy Therapeutics, Inc.

Decoy Therapeutics is a preclinical-stage biotechnology company

that is leveraging machine learning and artificial intelligence

tools alongside high-speed synthesis techniques to rapidly design,

engineer and manufacture peptide conjugate drug candidates that

target serious unmet medical needs. The company’s initial pipeline

is focused on respiratory viruses and GI cancers. Decoy has

attracted financing from institutional investors as well as

significant non-dilutive capital from the Bill & Melinda Gates

Foundation, the Massachusetts Life Sciences Seed Fund, the Google

AI startup program and the NVIDIA Inception program. The company

has also received QuickFire Challenge award funding provided by

BARDA through BLUE KNIGHT™, a collaboration between Johnson &

Johnson Innovation – JLABS and the Biomedical Advanced Research and

Development Authority within the Administration for Strategic

Preparedness and Response. For more information, please visit

www.DecoyTx.com.

About Salarius Pharmaceuticals, Inc.

Salarius Pharmaceuticals is a clinical-stage biopharmaceutical

company with two drug candidates for patients with cancer in need

of new treatment options. Salarius’ product portfolio includes

seclidemstat, the company’s lead candidate, which is being studied

in an investigator-initiated Phase 1/2 clinical study in

hematologic cancers underway at MD Anderson Cancer Center as a

potential treatment for MDS and CML in patients with limited

treatment options. SP-3164, the company’s IND-stage second asset,

is an oral small molecule protein degrader. Salarius previously

received financial support for seclidemstat for the treatment of

Ewing sarcoma from the National Pediatric Cancer Foundation

and was a recipient of a Product Development Award from

the Cancer Prevention and Research Institute of

Texas (CPRIT). For more information, please visit

www.salariuspharma.com.

Non-Solicitation

This communication shall not constitute an offer to sell or the

solicitation of an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No public offer of

securities in connection with the merger shall be made except by

means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended.

Forward-Looking Statements This press release

contains forward-looking statements regarding Salarius, Decoy, the

proposed merger and other matters, including without limitation,

statements relating to the expected ownership percentages of the

combined company and plans and expectations relating to the

business, products including expected achievement of milestones for

its lead asset and future prospects of Decoy and the combined

company. These statements may discuss goals, intentions and

expectations as to future plans, trends, events, results of

operations or financial condition, or otherwise, based on current

beliefs of the management of Salarius, as well as assumptions made

by, and information currently available to, management.

Forward-looking statements generally include statements that are

predictive in nature and depend upon or refer to future events or

conditions, and include words such as “may,” “will,” “should,”

“would,” “expect,” “anticipate,” “plan,” “likely,” “believe,”

“estimate,” “project,” “intend,” and other similar expressions.

Statements that are not historical facts are forward-looking

statements. Forward-looking statements are based on current beliefs

and assumptions that are subject to risks and uncertainties and are

not guarantees of future performance. Actual results could differ

materially from those contained in any forward-looking statement as

a result of various factors, including, without limitation: the

risk that the conditions to the Closing are not satisfied,

including uncertainties as to the timing of the consummation of the

proposed merger; the ability of each of Salarius and Decoy to

consummate the merger; risks related to Salarius’ ability to

estimate and manage its operating expenses and its expenses

associated with the proposed merger pending the closing; risks that

the combined company will not achieve the synergies expected from

the proposed merger; risks that Salarius and the combined company

will not obtain sufficient financing to execute on their business

plans and risks related to Decoy’s products and development plans

including unanticipated issues with any IND application process.

Readers are urged to carefully review and consider the various

disclosures made by us in our reports filed with the SEC, including

the risk factors contained in Salarius’ Current Report on Form 8-K

filed on January 13, 2025 which attempt to advise interested

parties of the risks and factors that may affect the merger, and

the prospects, financial condition, results of operation and cash

flows of each of Salarius, Decoy and the combined company. If one

or more of these risks or uncertainties materialize, or if the

underlying assumptions prove incorrect, our actual results may vary

materially from those expected or projected.

CONTACTS:

Salarius Pharmaceuticals, Inc.

Alliance Advisors IRJody

Cainjcain@allianceadvisors.com310-691-7100

Decoy Therapeutics, Inc.

Investors and Media:Rick Pierce,

CEOPierce@decoytx.com617-447-8299

Business Development:Peter Marschel,

CBOPeter@Decoytx.com617-943-6305

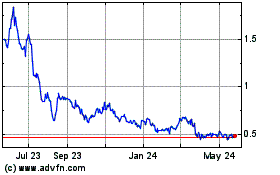

Salarius Pharmaceuticals (NASDAQ:SLRX)

Historical Stock Chart

From Dec 2024 to Jan 2025

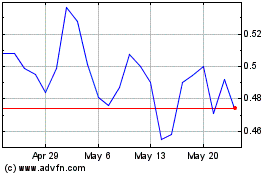

Salarius Pharmaceuticals (NASDAQ:SLRX)

Historical Stock Chart

From Jan 2024 to Jan 2025