0000867773SUNPOWER CORPfalse00008677732024-08-022024-08-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 2, 2024

SunPower Corporation

(Exact name of registrant as specified in its charter)

001-34166

(Commission File Number)

| | | | | |

| Delaware | 94-3008969 |

(State or other jurisdiction

of incorporation) | (I.R.S. Employer

Identification No.) |

880 Harbour Way South, Suite 600, Richmond, California 94804

(Address of principal executive offices, with zip code)

(408) 240-5500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of exchange on which registered |

| Common Stock, $0.001 par value per share | SPWR | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 1.01. | Entry into a Material Definitive Agreement. |

The information set forth below under Item 1.03 of this Current Report on Form 8-K (“Report”) regarding the Asset Purchase Agreement (as defined below) is incorporated herein by reference.

| | | | | |

| Item 1.03. | Bankruptcy or Receivership. |

Voluntary Petition for BankruptcyOn August 5, 2024 (the “Petition Date”), SunPower Corporation (the “Company”) and certain of its direct and indirect subsidiaries (collectively, the “Company Parties”) filed voluntary petitions (the “Chapter 11 Cases”) under Chapter 11 of the U.S. Bankruptcy Code (the “Bankruptcy Code”) in the U.S. Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). On the Petition Date, the Company Parties filed a motion with the Bankruptcy Court seeking to jointly administer the Chapter 11 Cases under the caption “In re SunPower Corporation, et al., Case No. 24-11649”. The Company Parties intend to use this court-supervised process to pursue a range of options to maximize value of their assets and address their financial obligations.

The Company Parties continue to operate their businesses and manage their properties as “debtors-in-possession” under the jurisdiction of the Bankruptcy Court and in accordance with the Bankruptcy Code and orders of the Bankruptcy Court. The Company Parties have filed a number of customary “first day” motions seeking the Bankruptcy Court’s authorization to support their operations during the court-supervised process, including a consensual cash collateral motion and a motion to pay certain employee wages and benefit obligations. The Company Parties expect that the Bankruptcy Court will approve the relief sought in these motions on an interim basis.

Asset Purchase Agreement

On August 5, 2024, prior to the filing of the Chapter 11 Cases, the Company and its subsidiaries named therein (together, the “Sellers”) entered into an Asset Purchase Agreement (the “Asset Purchase Agreement”) with Complete Solaria, Inc., a Delaware corporation (“Purchaser”), pursuant to which, subject to the terms and conditions set forth in the Asset Purchase Agreement, Purchaser agreed to acquire certain assets related to the Sellers’ Blue Raven Solar business, New Homes business, and non-installing Dealer network (collectively, the “Assets”) and assume certain specified liabilities of the Sellers (collectively, the “Liabilities” and such acquisition of the Assets and assumption of the Liabilities together, the “Transaction”), for a total purchase price of $45.0 million in cash (the “Purchase Price”). 10% of the Purchase Price shall be paid by Purchaser into an escrow account (the “Deposit”).

Upon Bankruptcy Court approval, Purchaser is expected to be designated as the “stalking horse” bidder in connection with a sale of the Assets under section 363 of the Bankruptcy Code. The Transaction will be conducted through a Bankruptcy Court-supervised process pursuant to Bankruptcy Court-approved bidding procedures and is subject to the receipt of higher or better offers from competing bidders at an auction, approval of the sale by the Bankruptcy Court, and the satisfaction of certain conditions. Subject to Bankruptcy Court approval, in the event that Purchaser is not the successful bidder at the auction, Purchaser may be entitled to a break-up fee equal to approximately 3% of the Purchase Price plus reimbursement of expenses up to $550,000.

The Asset Purchase Agreement contains customary representations, warranties and covenants of the parties for a transaction involving the acquisition of assets from a debtor in bankruptcy, and the completion of the Transaction is subject to a number of customary conditions, which, among others, include the entry of an order of the Bankruptcy Court authorizing and approving the Transaction, the performance by each party of its obligations under the Asset Purchase Agreement and the accuracy of each party’s representations, subject to certain materiality qualifiers.

The Asset Purchase Agreement may be terminated by either party in certain scenarios, including for breach or upon failure to obtain Bankruptcy Court approval. Upon termination of the Asset Purchase Agreement, the Deposit will be returned to Purchaser, except in the event of certain specified termination triggers, including due to the Purchaser’s material breach of the Asset Purchase Agreement such that the closing conditions specified therein could not be satisfied by September 30, 2024.

The foregoing summary of the Asset Purchase Agreement does not purport to be complete and is qualified in its entirety by the full text of the Asset Purchase Agreement, a copy of which is filed as Exhibit 10.1 to this Report and incorporated herein by reference.

The representations, warranties and covenants set forth in the Asset Purchase Agreement have been made only for purposes of the Asset Purchase Agreement and solely for the benefit of the parties thereto, and may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Asset Purchase Agreement instead of establishing these matters as facts. In addition, information regarding the subject matter of the representations and warranties made in the Asset Purchase Agreement may change after the date of the Asset Purchase Agreement and do not purport to be accurate as of the date of this Report. Accordingly, investors should not rely upon the representations and warranties in the Asset Purchase Agreement as statements of factual information.

| | | | | |

| Item 2.03. | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth under Item 1.03 of this Report is incorporated herein by reference.

| | | | | |

| Item 2.04. | Triggering Events that Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement. |

The filing of the Chapter 11 Cases constitutes an event of default that has accelerated obligations under the following debt instruments and agreements (collectively, the “Debt Instruments”):

•Credit Agreement, dated as of September 12, 2022, as amended, by and among the Company, certain of its subsidiaries as guarantors party thereto, the lenders and L/C issuers party thereto, and Bank of America, N.A., as administrative agent; and

•Second Lien Credit Agreement, dated as of February 14, 2024, by and among the Company, certain of its subsidiaries as guarantors party thereto, the lenders party thereto, GLAS USA LLC, as Administrative Agent, and GLAS Americas, LLC, as Collateral Agent.

The Debt Instruments provide that, as of the filing of the Chapter 11 Cases, the unpaid principal and interest due thereunder shall be immediately due and payable, which such amounts are currently equal to approximately $509 million. Any efforts to enforce such payment obligations under the Debt Instruments are automatically stayed upon the filing of the Chapter 11 Cases, and the creditors’ rights of enforcement prescribed in the Debt Instruments are subject to the applicable provisions of the Bankruptcy Code.

| | | | | |

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On August 2, 2024, the board of directors of the Company (the “Board”) approved Matthew Henry, a Managing Director at Alvarez & Marsal North America, LLC (“A&M”), as replacing Thomas H. Werner as the principal executive officer (“PEO”) of the Company. Mr. Werner will continue to serve in his capacity as Executive Chairman of the Board. Additionally, on August 4, 2024, Matthew Henry was engaged by the Company as Chief Transformation Officer (“CTO”).

In connection with Mr. Henry’s appointments, the Company entered into an engagement letter with A&M, effective August 4, 2024 (the “Engagement Letter”), for Mr. Henry’s services to the Company. Mr. Henry will continue to be employed by A&M and will not receive any compensation directly from the Company. Under the Engagement Letter, the Company shall compensate A&M at a rate of $1,250 per hour for Mr. Henry’s services in connection with his performance as the CTO and PEO.

Mr. Henry, age 41, is a Managing Director in A&M’s North American commercial restructuring practice. Mr. Henry has been with A&M since 2008 and has successfully advised clients spanning a range of industries, including the energy industry. Prior to joining A&M, Mr. Henry worked in investment banking, advising on acquisitions by private equity and publicly traded companies. Mr. Henry holds a Bachelor’s Degree in finance from University of Nevada, Reno and a Master’s Degree in business administration from Arizona State University.

Mr. Henry does not have any family relationships with any director or executive officer of the Company, and there are no understandings or arrangements between Mr. Henry and any other person pursuant to which Mr. Henry was appointed to serve as the CTO and PEO. In addition, there have been no transactions directly or indirectly involving Mr. Henry that would be required to be disclosed pursuant to Item 404(a) of Regulation S-K promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

| | | | | |

| Item 7.01. | Regulation FD Disclosure. |

Press ReleaseOn August 5, 2024, the Company issued a press release announcing the Asset Purchase Agreement as well as the filing of the Chapter 11 Cases. A copy of this press release is attached to this Report as Exhibit 99.1.

Nasdaq Delisting Notice

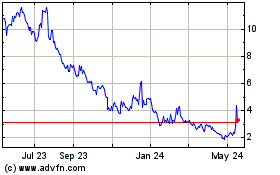

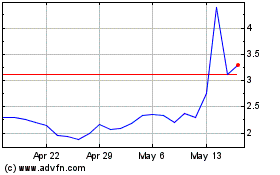

The Company expects to receive a notice from The Nasdaq Stock Market (“Nasdaq”) that the Common Stock, $0.001 par value per share, of the Company (the “Common Stock”) no longer meets the eligibility requirements necessary for listing pursuant to Nasdaq Listing Rule 5110(b) as a result of the Chapter 11 Cases. If the Company receives such notice, the Company does not intend to appeal Nasdaq’s determination and, therefore, it is expected that its Common Stock will be delisted. The delisting of the Common Stock would not affect the Company’s post-petition status and does not presently change its reporting requirements under the rules of the Securities and Exchange Commission (the “SEC”).

Dissolvement of Office of the Chairman

As previously announced on February 27, 2024, the Board established an Office of the Chairman led by Mr. Werner and included other key members of the Executive Leadership Team of the Company. Effective August 2, 2024, the Board dissolved the Office of the Chairman.

Additional Information on the Chapter 11 Cases

Court filings and information about the Chapter 11 Cases can be found at a website maintained by the Company Parties’ claim agent, Epiq Corporate Restructuring, LLC (“Epiq”), at https://dm.epiq11.com/SunPower or by contacting Epiq at (888) 410-9433 (Toll Free), +1 (971) 298-7638 (International) or by e-mail at SunPowerinfo@epiqglobal.com. The documents and other information available via website or elsewhere are not part of this Current Report and shall not be deemed incorporated therein.

The information disclosed in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such a filing.

Cautionary Note Regarding the Company Parties’ Securities The Company Parties caution that trading in their securities, including the Common Stock, during the pendency of the Chapter 11 Cases is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders of the Company’s securities in the Chapter 11 Cases. In particular, the Company expects that its equity holders could experience a significant or complete loss on their investment, depending on the outcome of the Chapter 11 Cases.

Cautionary Statement Regarding Forward-Looking Information

This Report and the exhibits hereto contain certain “forward-looking statements.” All statements other than statements of historical fact are “forward-looking” statements for purposes of the U.S. federal and state securities laws. These statements may be identified by the use of forward-looking terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “our vision,” “plan,” “potential,” “preliminary,” “predict,” “should,” “will,” or “would” or the negative thereof or other variations thereof or comparable terminology. These forward-looking statements are subject to a number of factors and uncertainties that could cause the Company’s actual results to differ materially from those expressed in or contemplated by the forward-looking statements. Such factors include, but are not limited to: risks attendant to the bankruptcy process, including the Company’s ability to obtain court approval from the Bankruptcy Court with respect to motions or other requests made to the Bankruptcy Court throughout the course of the Chapter 11 Cases; the Company Parties’ ability to negotiate and confirm a sale of its assets under Section 363 of the Bankruptcy Code; the effects of the Chapter 11 Cases, including increased legal and other professional costs necessary to execute the Company’s liquidation, on the Company’s liquidity (including the availability of operating capital during the pendency of the Chapter 11 Cases), results of operations or business prospects; the effects of the Chapter 11 Cases on the interests of various constituents and financial stakeholders; the length of time that the Company will operate under Chapter 11 protection and the continued availability of operating capital during the pendency of the Chapter 11 Cases; objections to the Company’s restructuring process or other pleadings filed that could protract the Chapter 11 Cases; risks associated with third-party motions in the Chapter 11 Cases; Bankruptcy Court rulings in the Chapter 11 Cases and the outcome of the Chapter 11 Cases in general; the Company’s ability to comply with the restrictions imposed by the terms and conditions of its financing arrangements; employee attrition and the Company’s ability to retain senior management and other key personnel due to the distractions and uncertainties; the Company’s ability to maintain relationships with suppliers, customers, employees and other third parties and regulatory authorities as a result of the Chapter 11 Cases; the impact and timing of any cost-savings measures and related local law requirements in various jurisdictions; finalization of the Company’s annual and quarterly financial statements; risks relating to the delisting of the Common Stock from Nasdaq and future quotation of the Common Stock; the impact of litigation and regulatory proceedings; the impact and timing of any cost-savings measures; and other factors discussed in the Company’s Annual Report on Form 10-K/A filed with the SEC. These risks and uncertainties may cause the Company’s actual results, performance, liquidity or achievements to differ materially from any future results, performance, liquidity or achievements expressed or implied by these forward-looking statements. For a further list and description of such risks and uncertainties, please refer to the Company’s filings with the SEC that are available at www.sec.gov. The Company cautions you that the list of important factors included in the Company’s SEC filings may not contain all of the material factors that are important to you. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this report may not in fact occur. The Company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

| | | | | |

Item 9.01. | Financial Statements and Exhibits. |

| | | | | |

Exhibit No. | Description of Exhibits |

| 10.1 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| SUNPOWER CORPORATION |

| | |

| August 6, 2024 | By: | /S/ ELIZABETH EBY |

| Name: | Elizabeth Eby |

| Title: | Executive Vice President and Chief Financial Officer

|

___________________________________________________________________________

ASSET PURCHASE AGREEMENT

DATED AS OF AUGUST 5, 2024

BY AND AMONG

COMPLETE SOLARIA, INC., AS PURCHASER,

AND

SUNPOWER CORPORATION

AND ITS SUBSIDIARIES NAMED HEREIN,

AS SELLERS

__________________________________________________________________________

TABLE OF CONTENTS

Page

ASSET PURCHASE AGREEMENT

This Asset Purchase Agreement (this “Agreement”), dated as of August 5, 2024, is made by and among, (a) Complete Solaria, Inc., a Delaware corporation (“Purchaser”), and (b)(i) SunPower Corporation, a Delaware corporation (“SunPower Corporation”), and (ii) the direct and indirect subsidiaries of SunPower Corporation as set forth in the signature pages attached hereto (together with SunPower Corporation, each a “Seller” and, collectively, the “Sellers”). Purchaser and Sellers are referred to herein individually as a “Party” and together as the “Parties.” Capitalized terms used herein shall have the meanings set forth herein including Article IX.

WHEREAS, on or shortly following the date of this Agreement, each Seller intends to file a voluntary petition and commence cases (the “Chapter 11 Cases”) under chapter 11 of the United States Code, 11 U.S.C. §§ 101-1532 (the “Bankruptcy Code”), in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”);

WHEREAS, Purchaser desires to purchase the Acquired Assets (as defined below) and assume the Assumed Liabilities (as defined below) from Sellers, and Sellers desire to sell, convey, assign, and transfer to Purchaser the Acquired Assets together with the Assumed Liabilities, in a sale authorized by the Bankruptcy Court pursuant to, inter alia, sections 105, 363 and 365 of the Bankruptcy Code, in accordance with the other applicable provisions of the Bankruptcy Code and the Federal Rules of Bankruptcy Procedure and the local rules for the Bankruptcy Court, all on the terms and subject to the conditions set forth in this Agreement and subject to the entry and terms of the Sale Order; and

WHEREAS, in connection with the Chapter 11 Cases and subject to the terms and conditions contained herein, following entry of the Sale Order finding the Purchaser as the Successful Bidder at the Auction, Sellers shall sell and transfer to the Purchaser, and the Purchaser shall purchase and acquire from Sellers, pursuant to, inter alia, sections 105, 363 and 365 of the Bankruptcy Code, in accordance with the other applicable provisions of the Bankruptcy Code and the Federal Rules of Bankruptcy Procedure and the local rules for the Bankruptcy Court, the Acquired Assets, and the Purchaser shall assume from Sellers the Assumed Liabilities, all as more specifically provided herein and in the Sale Order.

NOW, THEREFORE, the Parties hereby agree as follows.

ARTICLE I

Purchase and Sale of Acquired Assets;

Assumption of Assumed Liabilities

Section 1.1 Purchase and Sale of the Acquired Assets. Pursuant to sections 105, 363 and 365 of the Bankruptcy Code, on the terms and subject to the conditions set forth herein and in the Sale Order at the Closing (as defined below), each Seller shall sell, transfer, assign, convey, and deliver to Purchaser, and Purchaser shall purchase, acquire, and accept from such Seller, all of such Seller’s right, title and interest in and to, as of the Closing, the Acquired Assets, free and clear of all Encumbrances other than Permitted Encumbrances. “Acquired

Assets” means all of each Seller’s right, properties, title and interest in and to, as of the Closing, to all assets relating to the (i) New Homes Business, (ii) Non-Installing Dealer Business and (iii) the Blue Raven Business, in each case, as presently conducted (collectively the “Acquired Businesses”), including, solely to the extent relating to the Acquired Businesses, the following assets of such Seller, but excluding in all cases the Excluded Assets (as defined below):

(a) Subject to modification in accordance with Section 1.5, all Contracts listed on Schedule 1.1(a), including any backup data maintained by Sellers in connection therewith (collectively, the “Assigned Contracts”) and all rights and benefits thereunder;

(b) copies of the Transferred Employee Records, but excluding from the foregoing any credit card numbers or related customer payment sources, social security numbers, or other information to the extent prohibited by Law;

(c) the Transferred Intellectual Property set forth on Schedule 1.1(c);

(d) the name “SunPower” or any derivation thereof;

(e) all prepositioned Inventory associated with the New Homes Business set forth on Schedule 1.1(e) and held by certain of its installer partners as set forth therein;

(f) all goodwill associated with the Acquired Assets and Acquired Businesses;

(g) to the extent transferable, all benefits, proceeds and other amounts payable under any policy of insurance relating to the Acquired Assets and all rights and benefits thereunder, which shall be Assigned Contracts;

(h) the Leases set forth on Schedule 1.1(h) (the “Assumed Leases”), together with (to the extent of the Sellers’ interest therein) the buildings, fixtures and improvements, including tenant improvements, located on or attached to the underlying real property, and all rights arising thereunder, and all tenements, hereditaments, appurtenances and other real property rights appertaining thereto, subject to the rights of the applicable landlord (including rights to ownership or use of such property) under such Assumed Leases;

(i) all prepaid expenses (other than prepaid insurance), including certain deposits, of any Seller, which are related to the Acquired Businesses and are set forth on Schedule 1.1(i);

(j) all Computer Systems set forth on Schedule 1.1(j);

(k) all information technology systems and applications set forth on Schedule 1.1(k);

(l) to the extent transferable, the Permits issued to, or for the benefit of, any Seller, all rights and benefits thereunder, and all pending applications or filings therefor

and renewals thereof, which are related to the Acquired Businesses and that are set forth on Schedule 1.1(l);

(m) the list of each non-installing dealer relating to the Non-Installing Dealer Business and select information regarding such non-installing dealer, in each case, as set forth on Schedule 1.1(m);

(n) all Accounts Receivable related solely to the Acquired Businesses and Acquired Assets;

(o) a copy of the books and records of any Seller related solely to the Acquired Assets or the Assumed Liabilities; and

(p) other assets of the Sellers (other than Excluded Assets and Excluded Liabilities) that related solely to the operation of the Acquired Assets and Acquired Businesses which are identified after the date hereof and mutually agreed in writing by Purchaser and Sellers prior to the Closing.

Section 1.2 Excluded Assets. Notwithstanding anything to the contrary in this Agreement, in no event shall any Seller be deemed to sell, transfer, assign, convey or deliver, and such Seller shall retain all right, title and interest to, in and under any properties, rights interests or other assets of such Seller other than the Acquired Assets (collectively, the “Excluded Assets”) which shall include:

(a) all Accounts Receivable of the Sellers to the extent not related to the Acquired Assets or Acquired Businesses;

(b) all Equity Interests of any of the Sellers’ direct or indirect Subsidiaries;

(c) all of the Sellers’ rights under this Agreement;

(d) all of the Sellers’ rights under any Excluded Asset;

(e) all Contracts to which any Seller is a party other than the Assigned Contracts, including independent contractor agreements;

(f) all payments for the purchase of goods, including but not limited to customer deposits and prepaid amounts;

(g) all Leases to which any Seller is a party other than the Assumed Leases;

(h) all assets of Albatross Software;

(i) all Tax Returns or Tax refunds of a Seller Tax Group or any Seller or Affiliate thereof;

(j) all Tax refunds with respect to the Acquired Assets (excluding, for the avoidance of doubt, any Tax refund described in Section 1.2(i) and any Tax refunds received by the Seller in relation a Tax attributable to the Acquired Assets and paid by the Purchaser after Closing) allocable to a Pre-Closing Tax Period, as determined pursuant to Section 5.11; and

(k) all software, Intellectual Property Rights, Computer Systems, and information technology systems and applications, including the PVS6 gateway and related technology, that are owned, used in, relate to, or are necessary for the conduct and performance of (i) services to all lease customers under the existing maintenance services agreements pursuant to which Sellers provide certain operating and maintenance services to those subsidiaries of SunStrong Capital Holdings, LLC who own PV and storage systems (each, an “Owner”), (ii) the existing lease and loan services agreements, pursuant to which SunPower Capital Services, LLC provides certain lease and loan services to the Owners, and (iii) the existing transaction management and asset management agreements pursuant to which SunStrong Capital Holdings, LLC and SunPower Capital Services, LLC provide certain administrative and management services, provided, however, the Sellers shall (A) subject to the entry of an Order by the Bankruptcy Court, provide the purchaser with a license to utilize the PVS6 gateway and related technology with respect to the Acquired Assets and (B) use commercially reasonable efforts to transfer the servicing of the Acquired Assets to a go-forward servicer; and

(l) all computers of Sellers’ employees that are ultimately hired by Purchaser; provided, however that at such time that the Sellers no longer need to maintain and/or preserve the computers and it is determined that the computers may be transferred, all computers of Sellers will be transferred to Purchaser at no additional cost.

Section 1.3 Assumption of Certain Liabilities. On the terms and subject to the conditions set forth herein and in the Sale Order effective as of the Closing, Purchaser shall irrevocably assume from each Seller (and from and after the Closing pay, perform, discharge, or otherwise satisfy in accordance with their respective terms), and such Seller shall irrevocably transfer, assign, convey, and deliver to Purchaser, only the following Liabilities, without duplication (collectively, the “Assumed Liabilities”):

(a) all Liabilities arising out of or relating to the ownership and operation of the Acquired Assets, Assigned Contracts or Acquired Businesses, arising at or after the Petition Date that are due and payable after the Closing (including, for the avoidance of doubt, accounts payable due and payable after the Closing);

(b) all Liabilities (i) in respect of Transferred Employees arising at or after the Closing and (ii) assumed by Purchaser pursuant to Section 5.9;

(c) all cure costs required to be paid pursuant to section 365 of the Bankruptcy Code in connection with the assumption and assignment of the Assigned Contracts (the “Cure Costs”);

(d) any Liability for Taxes (including the payment thereof) attributable to the Acquired Assets for a taxable period (or portion thereof) beginning after the Closing Date (as determined pursuant to Section 5.11);

(e) Transfer Taxes; and

(f) subject to Purchaser’s further review, certain customer deposits to be identified by the Parties in good faith prior to the Closing.

Section 1.4 Excluded Liabilities. Except for the Assumed Liabilities, Purchaser shall not assume, be obligated to pay, perform or otherwise discharge or in any other manner be liable or responsible for any Liabilities of, or Action against, Sellers of any kind or nature whatsoever, whether absolute, accrued, contingent or otherwise, liquidated or unliquidated, due or to become due, known or unknown, currently existing or hereafter arising, matured or unmatured, direct or indirect, and however arising, whether existing before or on the Closing Date (as defined below) or arising thereafter as a result of any act, omission, or circumstances taking place prior to the Closing (collectively, the “Excluded Liabilities”), including the following Liabilities of any of the Sellers or of any predecessor of any of the Sellers, whether incurred or accrued by any of the Sellers before or after the Closing Date:

(a) all Cure Costs for Contracts or Leases to which any Seller is a party that are not Assigned Contracts or Assumed Leases;

(b) any Liability of the Sellers or of any of their predecessors associated with any and all indebtedness, including any guarantees of third party obligations and reimbursement obligations to guarantors of the Sellers’ or any of their respective Affiliates’ obligations, and including any guarantee obligations or imputed Liability through veil piercing incurred in connection with the Sellers’ Affiliates;

(c) all Liability of the Sellers or of any of their predecessors associated with payments for the purchase of goods, including but not limited to customer deposits and prepaid amounts;

(d) all Retained Taxes;

(e) all Liabilities of the Sellers or of any of their predecessors under this Agreement and the transactions contemplated hereby or thereby;

(f) any Liabilities in respect of any Contracts or Leases to which any Seller is a party that are not Assigned Contracts or Assumed Leases, including any Liabilities arising out of the rejection of any such Contracts or Leases pursuant to Section 365 of the Bankruptcy Code;

(g) except for Liabilities expressly identified as Assumed Liabilities, all Liabilities for fees, costs and expenses that have been incurred or that are incurred or owed by the Sellers or of any of their predecessors in connection with this Agreement or the administration of the Bankruptcy Cases (including all fees and expenses of professionals

engaged by the Sellers) and administrative expenses and priority claims accrued through the Closing Date and specified post-closing administrative wind-down expenses of the bankrupt estates pursuant to the Bankruptcy Code (which such amounts shall be paid by the Sellers from the proceeds collected in connection with the Excluded Assets) and all costs and expenses incurred in connection with (i) the negotiation, execution and consummation of the transactions contemplated under this Agreement and each of the other documents delivered in connection herewith; and (ii) the consummation of the transactions contemplated by this Agreement, including any retention bonuses, “success” fees, change of control payments and any other payment obligations of the Sellers or of any of their predecessors payable as a result of the consummation of the transactions contemplated by this Agreement and the documents delivered in connection herewith;

(h) except for Liabilities expressly identified as Assumed Liabilities, all employment-related Liabilities of the Sellers, including (i) Liabilities for any action resulting from the Sellers’ employees’ separation of employment with the Sellers, including any severance or separation pay, (ii) employment-related Liabilities resulting from the transactions contemplated hereby whether before, on or after the Closing, (iii) Liabilities arising out of or relating to any collective bargaining Contract, labor negotiation, employment Contract, and consulting Contract with the Sellers, (iv) any Liabilities arising from or related to payroll and payroll Taxes for the current and former employees or independent contractors or other service providers of the Sellers to such person at any time on or prior to the Closing, (v) Liabilities of the Sellers for vacation, sick leave, parental leave, and other paid-time off accrued by the Sellers on and prior to Closing, (vi) all Liabilities with respect to any current or former employee of the Sellers including the Executive Employment Contracts, and (vii) all Liabilities for any failure to comply with applicable Laws or obligations under any Contract, in each case arising out of or related to employment of employees of the Sellers or engagement of independent contractors of the Sellers;

(i) all Liabilities related to the WARN Act, to the extent applicable, with respect to the Sellers’ termination of employment of the Sellers’ employees on or prior to Closing (for the avoidance of doubt reference to the Sellers in clause (h) and (i) shall refer to the Sellers and its Affiliates);

(j) all Liabilities arising under or relating to Company Benefit Plans (including all assets, trusts, insurance policies and administration service contracts related thereto);

(k) all Liabilities of the Sellers or of any of their predecessors to their respective equity holders respecting dividends, distributions in liquidation, redemptions of interests, option payments or otherwise, and any Liability of the Sellers or of any of their predecessors pursuant to any Contract or Lease set forth on Schedule 1.1(a), or has any material business arrangement with, or has any material financial obligations to or is owed any financial obligations from, any Seller or, to the Knowledge of the Sellers, any actual competitor, vendor or licensor of any Seller that is not an Assigned Contract

(l) all Liabilities arising out of or relating to any business or property formerly owned or operated by any of the Sellers, any Affiliate or predecessor thereof, but not presently owned and operated by any of the Sellers as of the date hereof;

(m) all Liabilities relating to claims, actions, suits, arbitrations, litigation matters, proceedings or investigations (in each case whether involving private parties, Governmental Authorities, or otherwise) involving, against, or affecting any Acquired Asset, the Acquired Businesses, the Sellers, any of their Affiliates or predecessors, or any assets or properties of the Sellers or of any of their predecessors, in each case arising out of the ownership or operation of the Acquired Businesses or any Acquired Asset prior to the Closing;

(n) all Liabilities arising under Environmental Laws, other than to the extent arising out of the ownership or operation of the Acquired Businesses or any Acquired Asset from and after the Closing, whether or not yet booked as accounts payable by Sellers as of or prior to the Closing;

(o) all accounts payable of the Sellers or of any of their predecessors existing as of or prior to the Closing;

(p) all Liabilities outstanding as of and arising after the Closing for any contract for delivery of or returns of products previously sold to customers, whether or not any customer has provided a deposit for the sale except for under any Assigned Contract;

(q) all Liabilities of the Sellers or of any of their predecessors arising out of any Contract, Permit, or claim that is not transferred to Purchaser hereunder; and

(r) all Liabilities for all Professional Fees Amounts.

Section 1.5 Assumption/Rejection of Certain Contracts.

(a) Sellers shall provide timely and proper written notice of a proposed Sale Order to all parties to any executory Contracts or unexpired leases to which Sellers or any of their respective Subsidiaries or Affiliates is a party that are Assigned Contracts and take all other actions reasonably necessary to cause such Contracts to be assumed by Sellers and assigned to Purchaser pursuant to Section 365 of the Bankruptcy Code to the extent that such Contracts are Assigned Contracts at the Closing. The Sale Order shall provide that as of and conditioned on the occurrence of the Closing, Sellers shall assign or cause to be assigned to Purchaser or an Affiliate of Purchaser designated by Purchaser, as applicable, the Assigned Contracts, each of which shall be identified by the name or appropriate description and date of the Assigned Contract (if available), the other party to the Assigned Contract and the address of such party for notice purposes, all included in a notice filed with the Bankruptcy Court the Bankruptcy Court (the “Cure Notice”). The Cure Notice shall also set forth Sellers’ good faith estimate of the amounts necessary to cure any defaults under each of the Assigned Contracts as determined by Sellers based on their books and records or as otherwise determined by the Bankruptcy Court. At the Closing, Sellers shall, pursuant to the Sale Order and the Assignment and Assumption

Agreement, assign to Purchaser (the consideration for which is included in the Purchase Price), all Assigned Contracts that may be assigned by Sellers to Purchaser pursuant to sections 363 and 365 of the Bankruptcy Code.

(b) Sellers shall transfer and assign, or shall cause to be transferred or assigned, all Assigned Contracts to Purchaser or an Affiliate of Purchaser designated by Purchaser, and Purchaser or such designated Affiliate of Purchaser shall assume all Assigned Contracts, as of the Closing Date pursuant to section 365 of the Bankruptcy Code and the Sale Order. As promptly as practicable following the date hereof, Purchaser and Sellers shall use commercially reasonable efforts to cooperate and determine the Cure Costs under each Assigned Contract, if any, so as to permit the assumption and assignment of each such Assigned Contract pursuant to section 365 of the Bankruptcy Code in connection with the Transaction.

(c) Purchaser shall have the right to notify Sellers in writing of any Assigned Contract (other than purchase orders) that it does not wish to assume or a Contract that is related to the Acquired Assets to which any Seller is a party that Purchaser wishes to add as an Assigned Contract up to two (2) Business Days prior to the Bid Deadline (as defined in the Bidding Procedures Order), and (i) any such previously considered Assigned Contract that Purchaser no longer wishes to assume shall be automatically deemed removed from the Schedules related to Assigned Contracts and automatically deemed added to the Excluded Assets, in each case, without any adjustment to the Purchase Price, and (ii) any such previously considered Contract that is related to the Acquired Assets that Purchaser wishes to assume as an Assigned Contract shall be automatically deemed added to the Schedules related to Assigned Contracts, automatically deemed removed from the Excluded Assets, and assumed by Sellers to sell and assign to Purchaser, in each case, without any adjustment to the Purchase Price. Purchaser shall be solely responsible for the payment, performance and discharge when due of the Liabilities under the Assigned Contracts arising or that are otherwise payable from the time of and after the Closing.

(d) Notwithstanding anything to the contrary in this Agreement, a Contract shall not be assigned to, or assumed by, Purchaser to the extent that such Contract is rejected by any Seller or its Affiliates or terminated by such Seller, its Affiliates or any other party thereto, or terminates or expires by its terms, on or prior to such time as it is to be assumed by Purchaser as an Assigned Contract hereunder and is not continued or otherwise extended upon assumption.

(e) Notwithstanding anything to the contrary in this Agreement, to the extent an Acquired Asset requires any consent or approval from any party, including any Governmental Body (other than, and in addition to and determined after giving effect to any Order of the Bankruptcy Court, including the Sale Order) in order to permit the sale or transfer to Purchaser of the applicable Seller’s right, title and interest in and to such asset, and such consent or approval has not been obtained prior to such time as such right, title and interest is to be transferred by Purchaser hereunder, such asset shall not be

transferred to, or received by, Purchaser. If any Acquired Asset is deemed not to be assigned pursuant to this clause (e), the Closing shall nonetheless take place subject to the other terms and conditions set forth herein and, thereafter, through the earlier of (x) such time as such consent or approval from the applicable party, including any Governmental Body, is obtained and (y) six (6) months following the Closing (or the closing of the Chapter 11 Cases or dissolution of Sellers, if earlier), Sellers and Purchaser shall (A) use reasonable best efforts to secure such consents or approvals as promptly as practicable after the Closing and (B) cooperate in good faith in any lawful and commercially reasonable arrangement reasonably proposed by Purchaser, including subcontracting, licensing, or sublicensing to Purchaser any or all of Sellers’ rights and obligations with respect to any such Acquired Asset, under which (1) Purchaser shall obtain (without infringing upon the legal rights of such third party or violating any Law) the economic rights and benefits (net of the amount of any related Tax costs imposed on Sellers or their respective Affiliates or any direct costs associated with the retention and maintenance of such Acquired Asset incurred by Sellers or their respective Affiliates) with respect to such Acquired Asset with respect to which such consent or approval has not been obtained and (2) Purchaser shall assume and timely discharge all related burdens and obligations with respect to such Acquired Asset. Upon satisfying any requisite consent or approval requirement applicable to such Acquired Asset after the Closing, the applicable Seller’s right, title and interest in and to such Acquired Asset shall promptly be transferred and assigned to Purchaser in accordance with the terms of this Agreement, the Sale Order and the Bankruptcy Code.

(f) If at any time after the Closing, any Seller or Purchaser becomes aware that such Seller continues to hold any Acquired Asset, including an Assigned Contract, or any asset necessary for the operation of the Acquired Businesses that should have been conveyed in accordance with this Agreement, such Party will promptly notify the other Party and such Seller shall use its commercially reasonable efforts to transfer (or cause to be transferred) such Acquired Asset or asset to Purchaser. Following written confirmation from the Purchaser, the Purchaser will assume any Assumed Liabilities associated therewith upon receipt, in each case, without further consideration being due or paid from Purchaser to such Seller. If at any time after the Closing, Purchaser becomes aware that it holds any Excluded Asset, Purchaser will promptly notify Sellers and use its commercially reasonable efforts to transfer (or cause to be transferred) such Excluded Asset to the applicable Seller, without further consideration being due or paid from any Seller to Purchaser.

ARTICLE II

Consideration; Payment; Closing

Section 2.1 Consideration; Payment. The aggregate consideration (collectively, the “Purchase Price”) to be paid by Purchaser for the purchase of the Acquired Assets shall be: (i) the assumption of Assumed Liabilities and (ii) a cash payment in an amount equal to forty five million United States Dollars ($45,000,000) (the “Cash Consideration”). At the Closing, Purchaser shall deliver, or cause to be delivered, to Sellers Cash Consideration less the Deposit

(the “Closing Date Payment”) and shall assume the Assumed Liabilities. The Cash Consideration and any payment required to be made pursuant to any other provision hereof shall be made in cash by wire transfer of immediately available funds to such bank account as shall be designated in writing by the applicable Party to (or for the benefit of) whom such payment is to be made at least two (2) Business Days prior to the date such payment is to be made.

Section 2.2 Deposit.

(a) Purchaser has or will within two (2) Business Days of the date hereof, made an earnest money deposit with Epiq Corporate Restructuring, LLC (the “Escrow Agent”) in a cash amount equal to 10% of the Cash Consideration (the “Deposit”), by wire transfer of immediately available funds for deposit into a separate, segregated, interest bearing escrow account maintained by the Escrow Agent in accordance with the Bidding Procedures Order. The Deposit shall not be subject to any Encumbrance, attachment, trustee process, or any other judicial process of any creditor of any Sellers or Purchaser and shall be applied against payment of the Purchase Price on the Closing Date.

(b) If, prior to the Closing, this Agreement has been terminated by Sellers pursuant to Section 7.1(d) or Section 7.1(f) (or by Purchaser pursuant to Section 7.1(b) or Section 7.1(c), in each case in circumstances where Sellers would be entitled to terminate this Agreement pursuant to Section 7.1(d) or Section 7.1(f)), then Sellers shall retain the Deposit together with all received investment income, if any.

(c) If, prior to the Closing, this Agreement has been terminated by any Party, other than as contemplated by Section 2.2(b), then the Deposit, together with all received investment income, if any, shall be returned to Purchaser within five Business Days after such termination.

(d) The Parties agree that Sellers’ right to retain the Deposit, as set forth in Section 2.2(b), is not a penalty, but rather is liquidated damages in a reasonable amount that will compensate Sellers for their efforts and resources expended and the opportunities foregone while negotiating this Agreement and in reliance on this Agreement and on the expectation of the consummation of the Transactions, which amount would otherwise be impossible to calculate with precision.

(e) If the Closing occurs, at the Closing the Parties shall deliver joint written instructions to the Escrow Agent directing the Escrow Agent to transfer by wire transfer of immediately available funds 100% of the Deposit (together with any and all investment interest thereon, if any) to such account(s) as may be designated by Sellers.

Section 2.3 Closing. The closing of the purchase and sale of the Acquired Assets, the delivery of the Purchase Price and the assumption of the Assumed Liabilities in accordance with this Agreement (the “Closing”) will take place by telephone conference and electronic exchange of at 9:00 a.m. Central Time on the second (2nd) Business Day following full satisfaction or due waiver (by the Party entitled to the benefit of such condition) of the closing conditions set forth

in Article VI (other than conditions that by their terms or nature are to be satisfied at the Closing, but subject to the satisfaction or waiver of such conditions at the Closing), or at such other place, time and date as the Parties may agree in writing. The date on which the Closing actually occurs is referred to herein as the “Closing Date.”

Section 2.4 Closing Deliveries by Sellers. At or prior to the Closing, Sellers shall deliver to Purchaser:

(a) a bill of sale and assignment and assumption agreement substantially in the form of Exhibit A attached hereto (the “Assignment and Assumption Agreement”) duly executed by each applicable Seller, in each case, with respect to the applicable Acquired Assets;

(b) an IRS Form W-9 executed by each Seller or its regarded owner;

(c) an Intellectual Property Assignment Agreement and such other documents that may be reasonably requested by Purchaser to transfer the Transferred Intellectual Property, each in a form and substance mutually agreed by Purchaser and Seller Representative prior to the Closing;

(d) To the extent Sellers are able, using commercially reasonable efforts to provide any post-Closing transition services and as may be requested by the Purchaser for market rate with all costs to be borne by Purchaser or as otherwise determined after the date hereof by the Parties, a duly executed transition services agreement, in form and substance to be mutually agreed by Purchaser and Seller Representative prior to the Closing (the “TSA”); and

(e) an officer’s certificate, dated as of the Closing Date, executed by a duly authorized officer of each Seller certifying that the conditions set forth in Section 6.3(a) and Section 6.3(b) have been satisfied.

Section 2.5 Closing Deliveries by Purchaser. At the Closing, Purchaser shall deliver to (or at the direction of) Sellers:

(a) payment of the Cash Consideration as set forth in Section 2.1;

(b) the Assignment and Assumption Agreement duly executed by Purchaser;

(c) a duly executed TSA, to the extent necessary;

(d) an officer’s certificate, dated as of the Closing Date, executed by a duly authorized officer of Purchaser certifying that the conditions set forth in Section 6.2(a) and Section 6.2(b) have been satisfied; and

(e) countersigned Intellectual Property Assignment Agreement.

Section 2.6 Withholding. Purchaser shall not be entitled to deduct or withhold any Taxes from any amounts payable pursuant to this Agreement.

ARTICLE III

Representations and Warranties of Sellers

Except as disclosed in any forms, statements or other documents filed with the Bankruptcy Court, as disclosed in any public filings of Sellers, or as set forth in the Schedules delivered by Sellers concurrently herewith and as updated from time to time, each Seller represents and warrants to Purchaser as of the date hereof and solely with respect to each such Seller and the applicable Acquired Assets as follows:

Section 3.1 Organization and Qualification. Such Seller is a corporation, limited liability company or limited partnership, as applicable, duly incorporated or organized, validly existing, and in good standing under the Laws of the jurisdiction of its incorporation or formation. Such Seller is duly licensed or qualified to do business under the Laws of each jurisdiction in which the nature of the business conducted by it makes such licensing or qualification necessary, except where failure to be so licensed, qualified or in good standing would not, individually or in the aggregate, reasonably be expected to result in a Material Adverse Effect.

Section 3.2 Authorization of Agreement. Subject to requisite Bankruptcy Court approvals:

(a) such Seller has all necessary power and authority to execute and deliver this Agreement and the other Transaction Agreements to which such Seller is a party and to perform its obligations hereunder and to consummate the Transactions;

(b) the execution, delivery and performance by such Seller of this Agreement and the other Transaction Agreements to which Seller is a party, and the consummation by such Seller of the Transactions, have been duly authorized by all requisite corporate action, limited liability company action or limited partnership action on the part of such Seller, as applicable, and no other organizational proceedings on such Seller’s part are necessary to authorize the execution, delivery and performance by such Seller of this Agreement or the other Transaction Agreements and the consummation by it of the Transactions; and

(c) this Agreement and the other Transaction Agreements to which such Seller is a party have been, or will be, duly executed and delivered by such Seller and, assuming due authorization, execution and delivery hereof and thereof by the other parties hereto and thereto, constitutes, or will constitute, legal, valid and binding obligations of such Seller, enforceable against such Seller in accordance with its and their terms, except that such enforceability (a) may be limited by bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and other similar Laws of general application affecting or relating to the enforcement of creditors’ rights generally and

(b) is subject to general principles of equity, whether considered in a proceeding at law or in equity (collectively, the “Enforceability Exceptions”).

Section 3.3 Conflicts; Consents. Except as related to, or as a result of, the filing or pendency of the Bankruptcy Cases, as set forth on Schedule 3.3 and assuming that requisite Bankruptcy Court approvals are obtained and, neither the execution and delivery by such Seller of this Agreement or the other Transaction Agreements, nor the consummation by such Seller of the Transactions, nor performance or compliance by such Seller with any of the terms or provisions hereof or thereof, will (i) conflict with or violate any provision of such Seller’s certificate of incorporation or bylaws, certificate of formation or limited liability company agreement, certificate of limited partnership, partnership agreement or other governing documents, as applicable (ii) violate or constitute a breach of or default (with or without notice or lapse of time, or both) under or give rise to a right of termination, modification, or cancelation of any obligation or to the loss of any benefit, any of the terms or provisions of any assigned contract or accelerate such Seller’s obligations under any such assigned contract, or (iii) result in the creation of any Encumbrance (other than a Permitted Encumbrance) on any Acquired Assets, except, in each case, as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

Section 3.4 Title to Assets; Sufficiency of Assets.

(a) Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect, the Sellers have good and valid title to, or, in the case of leased or subleased Acquired Assets, valid and subsisting leasehold interests in, all Acquired Assets, free and clear of all Encumbrances (other than Permitted Encumbrances). Pursuant to the Sale Order, the Sellers will convey such title to or rights to use, all of the Acquired Assets, free and clear of all Encumbrances (other than Permitted Encumbrances).

(b) Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect or as set forth on Schedule 3.4(b), all tangible assets of the Acquired Assets and the Acquired Businesses are (i) in good working order and condition in all material respects, ordinary wear and tear excepted, (ii) have been reasonably maintained, (iii) are suitable in all material respects for the uses for which they are being utilized in the Acquired Assets and the Acquired Businesses as conducted by Sellers as of the date hereof, (iv) do not require more than regularly scheduled maintenance in the Ordinary Course consistent with past practice and the established maintenance policies of Sellers, as applicable, in order to keep them in good operating condition, and (v) comply in all material respects with all requirements under any Laws and any licenses which govern the use and operation thereof. Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect, the Acquired Assets constitute the material properties, assets and rights reasonably necessary, and are sufficient in all material respects, for the conduct of the Acquired Assets and the Acquired Businesses as currently conducted, taking into account the fact

that the Excluded Assets shall not be acquired by Purchaser pursuant to the terms of this Agreement.

Section 3.5 Assigned Contracts and Assumed Leases. Schedule 3.5 sets forth a complete list, as of the date hereof, of all (i) Assigned Contracts and (ii) Assumed Leases.

Section 3.6 Real Property. Schedule 3.6(b)(i) sets forth a list of each Assumed Lease and the real property location which is the subject thereof (together, the “Leased Real Property”). The Sellers have made available to Purchaser, prior to the date of this Agreement, a true, correct and complete copy of each Assumed Lease. With respect to each Assumed Lease, (a) assuming due authorization and delivery by the other party thereto, such Assumed Lease constitutes the valid and legally binding obligation of the Sellers party thereto and, to the Sellers’ Knowledge, the counterparty thereto, enforceable against such Sellers and, to the Sellers’ Knowledge, the counterparty thereto in accordance with its terms and conditions, subject to applicable bankruptcy, insolvency, moratorium or other similar Laws relating to creditors’ rights and general principles of equity, and (b) except as set forth in Schedule 3.6(ii) neither such Sellers nor, to the Sellers’ Knowledge, the counterparty thereto is in breach or default under such Assumed Lease, and to the Sellers’ Knowledge no event has occurred or condition exists that, with notice or lapse of time, or both, would constitute a default by any Seller or, to the Sellers’ Knowledge, by any other party thereto, except (i) for those defaults that will be cured by the payment of Cure Costs in accordance with the Sale Order or waived in accordance with section 365 of the Bankruptcy Code (or that need not be cured under the Bankruptcy Code to permit the assumption and assignment of the Assumed Leases) or (ii) to the extent such breach or default would not reasonably be expected to have a Material Adverse Effect. To the Sellers’ Knowledge, no Person that is not a Seller has any right to possess, use or occupy any of the Leased Real Property except as set forth on Schedule 3.6(iii). The leasehold interests of the Sellers in the Assumed Leases are subject to no Encumbrances other than Permitted Encumbrances.

Section 3.7 Employees.

(a) No Seller (with respect to the Transferred Employees) or the Acquired Businesses or the Acquired Assets is party to any collective bargaining agreements or similar labor-related Contracts with any labor union representing any Continuing Employees. Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect, (i) there is no written demand from any labor union seeking recognition as the exclusive bargaining representative of any Continuing Employees by such Seller or any Acquired Businesses or the Acquired Assets and (ii) there is no pending or, to the Knowledge of Sellers, threatened, strike, lockout, organized labor slowdown, or concerted work stoppage by any Continuing Employees.

(b) Each Seller (with respect to Transferred Employees) and the Acquired Businesses and the Acquired Assets are in compliance with all applicable Laws respecting employment practices and labor, including those related to wages and hours, collective bargaining, unemployment insurance, workers’ compensation, immigration, harassment and discrimination, disability rights and benefits, affirmative action, and

employee layoffs except where the failure to be in compliance would not reasonably be expected to result in a Material Adverse Effect.

(c) There is no Action pending or, to the Knowledge of Sellers, threatened in writing against such Seller (with respect to Transferred Employees) or any Acquired Business or Acquired Asset alleging a violation of any applicable labor or employment Law brought by any Continuing Employee before any Governmental Body, except for such Actions (or threatened Actions) that, if adversely determined, would not, individually or in the aggregate, reasonably be expected to result in a Material Adverse Effect.

Section 3.8 Litigation; Decrees. Except as set forth in Schedule 3.8 or arising in connection with, or out of, the Bankruptcy Cases (or any actions which are the subject matter thereof), there is no Litigation pending that (a) would reasonably be expected to be material to the Acquired Assets or (b) challenges the validity or enforceability of this Agreement or that seeks to enjoin or prohibit consummation of the transactions contemplated hereby and thereby. Other than the Bankruptcy Case, no Seller is subject to any outstanding Decree that would (i) reasonably be expected to be material to the Acquired Assets or Acquired Businesses or (ii) prevent or materially delay such Seller’s ability to consummate the transactions contemplated hereby or by the Related Agreements or perform in any material respect its obligations hereunder.

Section 3.9 Data Privacy. Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect and except as set forth on Schedule 3.9, in connection with its collection, storage, transfer, marketing, sales, security, and/or use of any Personal Information, each Seller is and, during the last twelve (12) months, has been in compliance in all material respects with applicable Laws that regulate the privacy and/or security of Personal Information (the “Privacy Laws”). Except as set forth on Schedule 3.9, neither the execution, delivery, or performance of this Agreement, nor the consummation of any of the transactions contemplated under this Agreement will violate applicable Privacy Laws in any material respects. Each Seller has commercially reasonable physical, technical, organizational and administrative security measures in place that are designed to protect all Personal Information collected by it or on its behalf from and against material unauthorized access, loss, modification, destruction, use or disclosure, and all such measures are in accordance with applicable Privacy Laws in all material respects. Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect and to the Knowledge of Sellers, since June 30, 2024 there has been no unauthorized access, use, modification, or disclosure of Personal Information, or any event that constitutes a security breach or similar term under applicable Law, in the possession or control of each Seller or any.

Section 3.10 Environmental Matters. Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect and solely with respect to the Assumed Leases:

(a) The Sellers are, and to the Knowledge of the Sellers, during the twelve (12) months prior to the date hereof have been, in compliance in all material respects with

all Environmental Laws, which compliance has included obtaining, maintaining, and making required filings for issuance or renewal of all Material Permits, licenses and authorizations required under Environmental Laws for the operations of the Sellers and their respective Subsidiaries as currently conducted.

(b) The Sellers have not, during the twelve (12) months prior to the date hereof, received, nor is there any pending or, to the Knowledge of the Sellers, any threatened, written notice or Litigation regarding any actual or alleged violation of, or liability or obligation under, Environmental Laws that would reasonably be expected to be material to the Sellers and their respective Subsidiaries taken as a whole.

(c) Except for a Release that would not reasonably be expected to be material to the Sellers and their Subsidiaries taken as a whole, there has been no Release of a Hazardous Substance (x) at, on, about, under or from the corporate offices, or (y) arising from or relating to the operations of the Sellers or their respective Subsidiaries.

(d) None of the Sellers or any of their respective Subsidiaries, has manufactured, distributed, treated, stored, arranged for or permitted the disposal of, transported, handled, or exposed any Person to, any Hazardous Substance, except for such action that was taken in compliance in all material respects with applicable Environmental Law or would not reasonably be expected to be material to the Sellers and their respective Subsidiaries taken as a whole.

(e) None of the Sellers or any of their respective Subsidiaries has contractually assumed, pursuant to any acquisition, divestiture, or merger, any obligation of another Person under any Environmental Law that could reasonably be expected to result in material liability or any other material obligation to the Sellers or their respective Subsidiaries under any applicable Environmental Law.

(f) Neither the execution of this Agreement nor the consummation of the transactions contemplated hereby will require any investigation or remediation activities or notice to, filing or registration with, or consent of any Governmental Authority or other third party pursuant to any transaction-triggered Environmental Law, including with respect to the New Jersey Industrial Site Recovery Act, N.J.S.A. 13:1K-6 et seq.

(g) The Sellers have made available to Purchaser copies and results of any material reports, studies, analyses, tests, or monitoring and any other material documents or correspondence in the Sellers’ possession relating to environmental conditions or Liabilities under Environmental Law with respect to the operations of the Sellers and their respective Subsidiaries, corporate offices.

Section 3.11 Taxes.

(a) The Sellers have timely filed all material Tax Returns required to be filed by the Sellers with respect to the Acquired Assets or the Acquired Businesses with the appropriate Governmental Authorities (taking into account any extension of time to file

granted or to be obtained on behalf of the Sellers); and all such Tax Returns are true, complete, and correct in all material respects;

(b) All material Taxes imposed on the Sellers with respect to the Acquired Assets or the Acquired Businesses that are due and owing (taking into account applicable extensions) have been paid (other than any Taxes (i) the nonpayment of which is permitted or required by the Bankruptcy Code, or (ii) that are being contested in good faith and for which appropriate reserves have been made in accordance with GAAP);

(c) There are no material pending (or threatened) audits, examinations, investigations or other proceedings, in each case for which a Seller has received written notice or to the Knowledge of the Sellers, relating to a material amount of Taxes with respect to the Acquired Assets or the Acquired Businesses;

(d) There are no Encumbrances relating to material Taxes (other than Permitted Encumbrances) on any Acquired Assets; and

(e) In the last twelve (12) months and other than as set forth in public filings of SunPower Corporation, no claim has been made in writing by a Governmental Authority in a jurisdiction where a Seller does not currently file Tax Returns with respect to an Acquired Asset that such Seller may be subject to Tax by that jurisdiction with respect to such Acquired Asset.

(f) Sellers have not received written notice of any material Tax deficiency outstanding, proposed or assessed, with respect to the Acquired Assets.

(g) None of the Acquired Assets constitutes stock, partnership interests or any other equity interest in any Person for U.S. federal income Tax purposes.

(h) Notwithstanding anything herein to the contrary, this Section 3.11 contains the sole and exclusive representations and warranties with respect to Taxes, and no representation or warranty is made in this Section 3.11 regarding (i) any taxable period (or portion thereof) beginning after the Closing Date, or (ii) the availability or unavailability of any tax attribute or tax refund.

Section 3.12 Intellectual Property.

(a) Except as set forth on Schedule 3.12(a), the Sellers own all right, title and interest in and to the Transferred Intellectual Property that is owned or purported to be owned by the Sellers (the “Owned Intellectual Property”), free and clear of all Encumbrances (other than Permitted Encumbrances). Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect, and to the Knowledge of the Sellers, except as set forth in Schedule 3.12(a) or as otherwise contemplated by this Agreement, the Transferred Intellectual Property constitutes all Intellectual Property Rights owned or held for use by the Sellers in the conduct of the Acquired Businesses. Except as would not, individually or in the aggregate, reasonably

be expected to have a Material Adverse Effect, Sellers own all right, title and interest in, or have a valid and enforceable written license or other permission to use, all Transferred Intellectual Property. Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect, and to the Knowledge of the Sellers, the Transferred Intellectual Property is sufficient to conduct the Acquired Businesses as presently conducted. Except as set forth in Schedule 3.12(a), all Owned Intellectual Property is currently owned by the Sellers.

(b) Trademarks:

(i) Schedule 3.12(b) contains a complete and accurate list of all registered and applied for Transferred Trademarks, including for each applicable trademark or service mark, trademark registration numbers and registration dates, as applicable (the “Registered Trademarks”).

(ii) Except as would not, individually or in the aggregate, reasonably be expected to be material to the Acquired Businesses, and except as set forth on Schedule 3.12(b), all of the material Registered Trademarks are subsisting and in full force and effect.

(iii) Except as would not, individually or in the aggregate, reasonably be expected to be material to the Acquired Businesses, and except as set forth on Schedule 3.12(b), no material Registered Trademark is the subject of any opposition, invalidation or cancellation proceeding, in each case which is pending and unresolved, and no such action has been threatened in writing during the past twelve (12) months.

(c) Copyrights:

(i) Schedule 3.12(c) contains a complete and accurate list of all registered Transferred Copyrights, including title, registration number and registration date (the “Registered Copyrights”).

(ii) Except as would not, individually or in the aggregate, reasonably be expected to be material to the Acquired Businesses, all of the Registered Copyrights are in full force and effect.

(d) Patents:

(i) Schedule 3.12(d) contains a complete and accurate list of all issued Transferred Patents, including owner, patent number and issuance date (the “Registered Patents”).

(ii) Except as would not, individually or in the aggregate, reasonably be expected to be material to the Acquired Businesses, all of the Registered Patents are subsisting and in full force and effect.

(e) Except as set forth on Schedule 3.12(d), to the Knowledge of the Sellers, during the past twelve (12) months, there has not been and there is not now any actual unauthorized use, infringement or misappropriation of any of the Owned Intellectual Property by any third party, except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

(f) Except as set forth in Schedule 3.12(f), during the past twelve (12) months, the Sellers have not brought any actions or lawsuits that are pending and unresolved alleging infringement, misappropriation or other violation of any of the Owned Intellectual Property by any third party. Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect, and except as set forth in Schedule 3.12(f), to the Knowledge of Sellers, no Person is infringing upon any Owned Intellectual Property. Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect, and to the Knowledge of the Sellers, the Sellers have not entered into any Contract granting any third party the right to bring infringement actions with respect to any of the Owned Intellectual Property that will survive the Closing. Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect, to the Knowledge of the Sellers there is no pending claim or claim threatened in writing with respect to the Owned Intellectual Property: (i) contesting the right of the Sellers to use, exercise, sell, license, transfer or dispose of any of the Owned Intellectual Property; or (ii) challenging the ownership, validity or enforceability of any of the Owned Intellectual Property. Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect, and to the Knowledge of the Sellers, no Owned Intellectual Property is subject to any outstanding order, judgment, decree, stipulation or agreement related to or restricting in any manner the use, licensing, assignment, transfer or conveyance thereof by the Sellers.

(g) Schedule 3.12(a) contains a listing of all material Contracts to which the Sellers are a party that relates to the settlement of any claims related to the Owned Intellectual Property (including co-existence agreements).

(h) Except as set forth on Schedule 3.12(a), and to the Knowledge of the Sellers, the operation and conduct of the Acquired Businesses as currently conducted by the Sellers, including the Sellers’ marketing, license, sale or use of any products or services anywhere in the world in connection with the Acquired Businesses has not, in the last twelve (12) months, and does not as of the Closing Date infringe, misappropriate or violate any Intellectual Property Rights of any third party, in each case except as would not, individually or in the aggregate, reasonably be expected to be have a Material Adverse Effect. To the Knowledge of the Sellers, there is no pending claim or claim threatened in writing alleging that the operation of the Acquired Businesses (including the Sellers’ marketing, license, sale or use of any products or services anywhere in the world in connection with the Acquired Businesses) as currently conducted by the Sellers infringes, misappropriates or otherwise violates any Intellectual Property Rights of any third party or violates any Contract with any third party to which the Sellers are a party or

by which they are bound, in each case except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

(i) Except as set forth in Schedule 3.12(a), to the Knowledge of the Sellers, the Sellers have the full right, power and authority to sell, assign, transfer and convey all of their right, title and interest in and to the Transferred Intellectual Property to Purchaser, and upon Closing, Purchaser will acquire from the Sellers good and marketable title to the Owned Intellectual Property, free of Encumbrances (other than Permitted Encumbrances).

(j) Except as would not, individually or in the aggregate, reasonably be expected to be material to the Acquired Businesses, and to the Knowledge of the Sellers, except as set forth in Schedule 3.12(a), the Sellers have secured from each present or former employee, officer, director, agent, outside contractor or consultant of the Sellers who contributed to the development of any material Owned Intellectual Property on behalf of the Sellers a written and enforceable agreement that contain (A) a non-disclosure obligation with respect to the Sellers’ confidential information and (B) a valid assignment to one or more of the Sellers of all rights, title and interest in and to such Owned Intellectual Property, unless in respect of assignment agreements, a Seller owns such Owned Intellectual Property by operation of Law. Except as would not, individually or in the aggregate, reasonably be expected to be material to the Acquired Businesses, the Sellers have taken commercially reasonable and appropriate steps to protect, maintain and preserve the confidentiality of any material trade secrets included in the Owned Intellectual Property. Except as would not, individually or in the aggregate, reasonably be expected to be material to the Acquired Businesses, any disclosure by the Sellers of such trade secrets to any third party has been pursuant to the terms of a written agreement with such third party.