Summit State Bank (Nasdaq: SSBI) today reported net income for the

quarter ended March 31, 2022 of $3,935,000 and diluted earnings per

share of $0.59. This compares to net income of $3,317,000 and

diluted earnings per share of $0.50 for the quarter ended March 31,

2021. Additionally, a quarterly dividend of $0.12 per share was

declared for common shareholders.

Dividend

The Board of Directors declared a $0.12 per

share quarterly dividend on April 25, 2022 to be paid on May 19,

2022 to shareholders of record on May 12, 2022.

Net Income and Results of

Operations

Net income increased $618,000 or 19% the first

quarter of 2022 compared to first quarter of 2021. Net interest

income increased to $9,882,000 in the first quarter of 2022

compared to $9,190,000 in the first quarter of 2021.

“The Bank is pleased to announce continued

earnings growth in the first quarter of 2022,” noted Brian Reed,

President and CEO. “Since the onset of the pandemic, the Bank

placed equal focus on helping our customers through hardships while

also growing our core operations. Most of our customers have

adapted to a new normal with their operations showing positive

trends. We are also adjusting to a new steady state and are seeing

the benefits from investing time and resources into our business to

make it stronger and more sustainable.”

The net interest margin for the first quarter of

2022 was 4.28%, annualized return on average assets was 1.66% and

annualized return on average equity was 18.69%. The first quarter

of 2021 had a net interest margin of 4.35%, annualized return on

average assets of 1.54% and annualized return on average equity of

17.80%.

Interest income increased to $10,879,000 in the

first quarter of 2022 compared to $10,409,000 in the first quarter

of 2021, this was an increase of 5%. The increase in interest

income is attributable to a $1,296,000 increase in core loan

interest yield primarily driven by increased volume, $27,000

increase in investment interest, and a $859,000 decrease in PPP

loan volumes and forgiveness. Excluding PPP, core interest income

increased to $10,681,000 in the first quarter of 2022 compared to

$9,352,000 in the first quarter of 2021, this was a 14%

increase.

Net loans and deposits increased when comparing

the first quarter of 2022 to 2021. Net loans increased 9% to

$817,618,000 at March 31, 2022 compared to $749,940,000 at March

31, 2021. Excluding PPP loans, net loans increased 15% to

$804,341,000 at March 31, 2022 when compared to March 31, 2021.

Total deposits increased 10% to $831,934,000 at March 31, 2022

compared to $747,350,000 at March 31, 2021. Most of the deposit

increase is due to the Bank’s ongoing focus to organically grow

local deposits.

Non-interest income increased in the first

quarter of 2022 to $1,955,000 compared to $694,000 in the first

quarter of 2021. The Bank recognized $1,546,000 in gains on sales

of SBA guaranteed loan balances in the first quarter of 2022

compared to $348,000 in gains on sales of SBA guaranteed loans

balances in the first quarter of 2021.

Operating expenses increased 30% in the first

quarter of 2022 to $6,286,000 compared to $4,839,000 in the first

quarter of 2021. The increase in expenses is primarily due to a

$506,000 increase in salaries and benefits net of deferred fees and

costs due to filling pandemic-related vacant positions from the

prior year, a $380,000 increase in commissions directly related to

the Bank’s loan portfolio growth, a $196,000 increase in Stock

Appreciation Rights benefits, and $95,000 increase in marketing and

donations.

There were no nonperforming assets at March 31,

2022 compared to $467,000 or 0.05% of total assets on March 31,

2021.

The Bank had a provision expense of $111,000 in

the first quarter of 2022. The allowance for credit losses to total

loans was 1.57% on March 31, 2022 and 1.51% on March 31, 2021. Most

of the increase in the allowance for credit loss was due to the

early conversion of the Current Expected Credit Loss (“CECL”) on

January 1, 2021.

“Throughout the pandemic we were deliberate with

our objective to continue growing core operations and are coming

out of this unforgettable global crisis with a positive outlook,”

states Reed. “We are cognizant of the challenges that lie ahead

with the global economy. We plan to remain steadfast in our

intention to serve our local community, remain a reliable resource

for our customers, and continue to be focused on the longer-term

growth of our Bank.”

About Summit State Bank

Summit State Bank, a local community bank, has

total assets of $981 million and total equity of $84 million at

March 31, 2022. Headquartered in Sonoma County, the Bank

specializes in providing exceptional customer service and

customized financial solutions to aid in the success of local small

businesses and nonprofits throughout Sonoma County.

Summit State Bank is committed to embracing the

diverse backgrounds, cultures and talents of its employees to

create high performance and support the evolving needs of its

customers and community it serves. At the center of diversity is

inclusion, collaboration, and a shared vision for delivering

superior service to customers and results for shareholders.

Presently, 64% of management are women and minorities with 60%

represented on the Executive Management Team. Through the

engagement of its team, Summit State Bank has received many

esteemed awards including: Best Business Bank, Best Places to Work

in the North Bay, Top Community Bank Loan Producer, Raymond James

Bankers Cup, and Super Premier Performing Bank. Summit State Bank’s

stock is traded on the Nasdaq Global Market under the symbol SSBI.

Further information can be found at www.summitstatebank.com.

Forward-looking Statements

Except for historical information contained

herein, the statements contained in this news release, are

forward-looking statements within the meaning of the “safe harbor”

provisions of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. This release may contain forward-looking statements that

are subject to risks and uncertainties. Such risks and

uncertainties may include but are not necessarily limited to

fluctuations in interest rates, inflation, government regulations

and general economic conditions, and competition within the

business areas in which the Bank will be conducting its operations,

including the real estate market in California and other factors

beyond the Bank’s control. Such risks and uncertainties could cause

results for subsequent interim periods or for the entire year to

differ materially from those indicated. You should not place undue

reliance on the forward-looking statements, which reflect

management’s view only as of the date hereof. The Bank undertakes

no obligation to publicly revise these forward-looking statements

to reflect subsequent events or circumstances.

Contact:Brian ReedPresident and CEOSummit State

Bank(707) 568-4908

|

|

|

|

|

|

|

|

|

SUMMIT STATE BANK |

|

STATEMENTS OF INCOME |

|

(In thousands except earnings per share data) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

March 31, 2022 |

|

March 31, 2021 |

|

|

|

|

|

(Unaudited) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

Interest income: |

|

|

|

|

|

Interest and fees on loans |

$ |

10,419 |

|

$ |

9,976 |

|

|

Interest on deposits with banks |

|

12 |

|

|

7 |

|

|

Interest on investment securities |

|

383 |

|

|

383 |

|

|

Dividends on FHLB stock |

|

65 |

|

|

43 |

|

|

|

|

Total interest income |

|

10,879 |

|

|

10,409 |

|

Interest expense: |

|

|

|

|

|

Deposits |

|

710 |

|

|

933 |

|

|

Federal Home Loan Bank advances |

|

193 |

|

|

192 |

|

|

Junior Subordinated Debt |

|

94 |

|

|

94 |

|

|

|

|

Total interest expense |

|

997 |

|

|

1,219 |

|

|

|

|

Net interest income before provision for credit losses |

|

9,882 |

|

|

9,190 |

|

Provision for credit losses |

|

111 |

|

|

335 |

|

|

|

|

Net interest income after provision for credit losses |

|

9,771 |

|

|

8,855 |

|

Non-interest income: |

|

|

|

|

|

Service charges on deposit accounts |

|

209 |

|

|

203 |

|

|

Rental income |

|

79 |

|

|

86 |

|

|

Net gain on loan sales |

|

1,546 |

|

|

348 |

|

|

Net securities gain |

|

6 |

|

|

7 |

|

|

Other income |

|

115 |

|

|

50 |

|

|

|

|

Total non-interest income |

|

1,955 |

|

|

694 |

|

Non-interest expense: |

|

|

|

|

|

Salaries and employee benefits |

|

3,964 |

|

|

3,018 |

|

|

Occupancy and equipment |

|

409 |

|

|

414 |

|

|

Other expenses |

|

1,913 |

|

|

1,407 |

|

|

|

|

Total non-interest expense |

|

6,286 |

|

|

4,839 |

|

|

|

|

Income before provision for income taxes |

|

5,440 |

|

|

4,710 |

|

Provision for income taxes |

|

1,505 |

|

|

1,393 |

|

|

|

|

Net income |

$ |

3,935 |

|

$ |

3,317 |

|

|

|

|

|

|

|

|

|

Basic earnings per common share (1) |

$ |

0.59 |

|

$ |

0.50 |

|

Diluted earnings per common share (1) |

$ |

0.59 |

|

$ |

0.50 |

|

|

|

|

|

|

|

|

|

Basic weighted average shares of common stock outstanding (1) |

|

6,685 |

|

|

6,677 |

|

Diluted weighted average shares of common stock outstanding

(1) |

|

6,685 |

|

|

6,677 |

|

|

|

|

|

|

|

|

|

(1) Adjusted for 10% stock dividend declared; effective October 29,

2021 |

|

|

|

|

|

|

|

|

|

|

|

SUMMIT STATE BANK |

|

BALANCE SHEETS |

|

(In thousands except share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2022 |

|

December 31, 2021 |

|

March 31, 2021 |

|

|

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

$ |

65,897 |

|

$ |

40,699 |

|

$ |

46,949 |

|

|

|

|

Total cash and cash equivalents |

|

65,897 |

|

|

40,699 |

|

|

46,949 |

|

|

|

|

|

|

|

|

|

|

|

Investment securities: |

|

|

|

|

|

|

|

Available-for-sale (at fair value; amortized cost of $69,131, |

|

|

|

|

|

|

|

|

$69,902 and $68,966) |

|

63,332 |

|

|

69,367 |

|

|

68,973 |

|

|

|

|

Total investment securities |

|

63,332 |

|

|

69,367 |

|

|

68,973 |

|

|

|

|

|

|

|

|

|

|

|

Loans, less allowance for credit losses of $13,006, $12,329 and

$11,476 |

|

817,618 |

|

|

820,987 |

|

|

749,940 |

|

Bank premises and equipment, net |

|

5,584 |

|

|

5,677 |

|

|

5,943 |

|

Investment in Federal Home Loan Bank stock, at cost |

|

4,320 |

|

|

4,320 |

|

|

3,429 |

|

Goodwill |

|

|

4,119 |

|

|

4,119 |

|

|

4,119 |

|

Affordable housing investment |

|

9,136 |

|

|

3,500 |

|

|

- |

|

Accrued interest receivable and other assets |

|

11,728 |

|

|

9,411 |

|

|

6,790 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

$ |

981,734 |

|

$ |

958,080 |

|

$ |

886,143 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND |

|

|

|

|

|

|

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

Demand - non interest-bearing |

$ |

256,253 |

|

$ |

234,824 |

|

$ |

220,197 |

|

|

Demand - interest-bearing |

|

152,823 |

|

|

147,289 |

|

|

111,646 |

|

|

Savings |

|

61,563 |

|

|

69,982 |

|

|

44,588 |

|

|

Money market |

|

174,447 |

|

|

168,637 |

|

|

164,621 |

|

|

Time deposits that meet or exceed the FDIC insurance limit |

|

29,585 |

|

|

29,255 |

|

|

37,147 |

|

|

Other time deposits |

|

157,263 |

|

|

161,613 |

|

|

169,151 |

|

|

|

|

Total deposits |

|

831,934 |

|

|

811,600 |

|

|

747,349 |

|

|

|

|

|

|

|

|

|

|

|

Federal Home Loan Bank advances |

|

48,500 |

|

|

48,500 |

|

|

53,500 |

|

Junior subordinated debt |

|

5,895 |

|

|

5,891 |

|

|

5,880 |

|

Affordable housing commitment |

|

6,573 |

|

|

2,483 |

|

|

- |

|

Accrued interest payable and other liabilities |

|

5,124 |

|

|

5,324 |

|

|

3,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

898,026 |

|

|

873,798 |

|

|

810,634 |

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity |

|

|

|

|

|

|

|

Preferred stock, no par value; 20,000,000 shares authorized; |

|

|

|

|

|

|

|

|

no shares issued and outstanding |

|

- |

|

|

- |

|

|

- |

|

|

Common stock, no par value; shares authorized - 30,000,000

shares; |

|

|

|

|

|

|

|

|

issued and outstanding 6,684,759 6,684,759 and 6,676,509 (1) |

|

37,014 |

|

|

37,014 |

|

|

36,981 |

|

|

Retained earnings |

|

50,777 |

|

|

47,644 |

|

|

38,524 |

|

|

Accumulated other comprehensive income, net |

|

(4,083 |

|

|

(376 |

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total shareholders' equity |

|

83,708 |

|

|

84,282 |

|

|

75,509 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity |

$ |

981,734 |

|

$ |

958,080 |

|

$ |

886,143 |

|

|

|

|

|

|

|

|

|

|

|

(1) Adjusted for 10% stock dividend declared; effective October 29,

2021 |

|

|

|

Financial Summary |

|

(Dollars in thousands except per share data) |

|

|

|

|

|

|

|

As of and for the |

|

|

Three Months Ended |

|

|

March 31, 2022 |

|

March 31, 2021 |

|

|

(Unaudited) |

|

(Unaudited) |

|

Statement of Income Data: |

|

|

|

|

Net interest income |

$ |

9,882 |

|

$ |

9,190 |

|

Provision for credit losses |

|

111 |

|

|

335 |

|

Non-interest income |

|

1,955 |

|

|

694 |

|

Non-interest expense |

|

6,286 |

|

|

4,839 |

|

Provision for income taxes |

|

1,505 |

|

|

1,393 |

|

Net income |

$ |

3,935 |

|

$ |

3,317 |

|

|

|

|

|

|

Selected per Common Share Data: |

|

|

|

|

Basic earnings per common share (5) |

$ |

0.59 |

|

$ |

0.50 |

|

Diluted earnings per common share (5) |

$ |

0.59 |

|

$ |

0.50 |

|

Dividend per share (5) |

$ |

0.12 |

|

$ |

0.12 |

|

Book value per common share (1)(5) |

$ |

12.52 |

|

$ |

12.44 |

|

|

|

|

|

|

Selected Balance Sheet Data: |

|

|

|

|

Assets |

$ |

981,734 |

|

$ |

886,143 |

|

Loans, net (5) |

|

817,618 |

|

|

749,940 |

|

Deposits |

|

831,934 |

|

|

747,350 |

|

Average assets |

|

959,103 |

|

|

872,980 |

|

Average earning assets |

|

935,736 |

|

|

856,663 |

|

Average shareholders' equity |

|

85,405 |

|

|

75,554 |

|

Nonperforming loans |

|

- |

|

|

467 |

|

Total nonperforming assets |

|

- |

|

|

467 |

|

Troubled debt restructures (accruing) |

|

2,112 |

|

|

2,176 |

|

|

|

|

|

|

Selected Ratios: |

|

|

|

|

Return on average assets (2) |

|

1.66% |

|

|

1.54% |

|

Return on average common shareholders' equity (2) |

|

18.69% |

|

|

17.80% |

|

Efficiency ratio (3) |

|

53.13% |

|

|

48.99% |

|

Net interest margin (2) |

|

4.28% |

|

|

4.35% |

|

Common equity tier 1 capital ratio |

|

9.36% |

|

|

10.21% |

|

Tier 1 capital ratio |

|

9.36% |

|

|

10.21% |

|

Total capital ratio |

|

11.30% |

|

|

12.32% |

|

Tier 1 leverage ratio |

|

8.40% |

|

|

8.10% |

|

Common dividend payout ratio (4) |

|

20.38% |

|

|

21.95% |

|

Average shareholders' equity to average assets |

|

8.90% |

|

|

8.65% |

|

Nonperforming loans to total loans |

|

0.00% |

|

|

0.06% |

|

Nonperforming assets to total assets |

|

0.00% |

|

|

0.05% |

|

Allowance for credit losses to total loans |

|

1.57% |

|

|

1.51% |

|

Allowance for credit losses to nonperforming loans |

N/A |

|

|

2458.47% |

|

|

|

(1) Total shareholders' equity divided by total common shares

outstanding. |

|

(2) Annualized. |

|

(3) Non-interest expenses to net interest and non-interest income,

net of securities gains. |

|

(4) Common dividends divided by net income available for common

shareholders. |

|

(5) Adjusted for 10% stock dividend declared; effective October 29,

2021 |

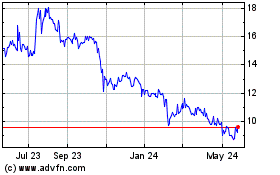

Summit State Bank (NASDAQ:SSBI)

Historical Stock Chart

From Oct 2024 to Nov 2024

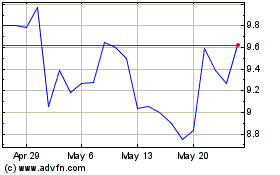

Summit State Bank (NASDAQ:SSBI)

Historical Stock Chart

From Nov 2023 to Nov 2024