SoundThinking, Inc. (Nasdaq: SSTI)

(“SoundThinking” or the “Company”), a leading public safety

technology company, today reported financial results for the fourth

quarter and fiscal year ended December 31, 2024.

Fourth Quarter 2024 Financial and

Operational Highlights

- Revenues decreased 10% to $23.4 million, compared to $26.0

million for the same quarter of 2023.

- Gross profit decreased 22% to $11.7 million (50% of revenues),

compared to $15.0 million (58% of revenues) for the same quarter of

2023.

- GAAP net loss totaled $4.1 million, compared to GAAP net income

of $3.6 million for the same quarter of 2023.

- Adjusted EBITDA1 totaled $1.7 million (7% of revenues),

compared to $4.8 million (18% of revenues) for the same quarter of

2023.

- Went “live” with ShotSpotter in 3 new cities, 1 new university

and 7 expansions with existing customers.

1 See the section below titled “Non-GAAP

Financial Measures and Key Business Metrics” for more information

about Adjusted EBITDA and its reconciliation to GAAP net income

(loss).

Full Year 2024 Financial and Operational

Highlights

- Revenues increased 10% to a record $102.0 million, compared to

$92.7 million in 2023.

- Gross profit increased 10% to $57.9 million (57% of revenues),

compared to $52.7 million (57% of revenues) in 2023.

- GAAP net loss totaled $9.2 million, compared to GAAP net loss

of $2.7 million in 2023.

- Adjusted EBITDA2 totaled $14.4 million (14% of revenues),

compared to $14.3 million (15% of revenues) in 2023.

- Annual recurring revenue2 starting on January 1, 2025 was $95.6

million, compared to $95.4 million on January 1, 2024. Revenue

retention rate2 was 105%, compared to 107% in 2023.

- Sales and marketing spend per $1.00 of new annualized contract

value2 was $0.63, compared to $0.52 in 2023.

- Went “live” with ShotSpotter in 20 new cities, 5 universities

and 24 expansions with current customers.

2 See the section below titled “Non-GAAP

Financial Measures and Key Business Metrics” for more information

about Adjusted EBITDA and its reconciliation to GAAP net income

(loss), annual recurring revenue, revenue retention rate and sales

and marketing spend per $1.00 of new annualized contract value.

Management Commentary

“Innovation and consistent execution against our

strategic growth priorities enabled us to achieve record revenue of

$102.0 million for the full year 2024 despite having to delay

approximately $3.5 million in revenues from being recognized in the

fourth quarter,” said President and CEO Ralph Clark. “We believe

the progress we are making with our key operational and financial

improvements underscores the durability of our business model and

the continued demands for our solutions.”

“I am enthusiastic about our market positioning

and growth potential in both domestic and international markets

across our differentiated SafetySmart Platform. In 2024,

ShotSpotter went live in 20 new cities and 5 universities and we

deployed 126 new ShotSpotter go-live miles, approximately 30 of

which were a recapture of Puerto Rico. In 2025 thus far, we

announced a three-year contract renewal valued at approximately

$21.9 million in aggregate with the New York Police Department for

the deployment of our ShotSpotter acoustic gunshot detection

system. The customers we serve recognize the holistic value that

our solutions provide to save lives and better protect their

communities.”

“Looking forward in 2025, we plan to continue

innovating and executing against our strategic and financial growth

priorities to deliver meaningful value for our stakeholders,

particularly through the integration of AI-driven capabilities. By

incorporating AI and data-driven solutions into our platform, we

aim to enhance efficiency and provide even more actionable insights

to the agencies and the communities those agencies serve. Our sales

pipeline is encouraging and I am pleased that we are starting the

year with strong momentum. ARR is starting the year at $95.6

million and we are raising our 2025 revenue guidance range to

$111.0 million to $113.0 million, representing a 10% year-over-year

growth at the midpoint. We are also raising our 2025 Adjusted

EBITDA margin guidance range to 21% to 23%.”

Fourth Quarter 2024 Financial

Results

The fourth quarter 2024 financial results were

affected by the delay of approximately $3.5 million of two contract

renewals, one of which has renewed and the second of which is

currently expected to renew in the first quarter of 2025.

Revenues for the fourth quarter of 2024 were

$23.4 million, compared to $26.0 million for the same quarter of

2023.

Gross profit for the fourth quarter of 2024 was

$11.7 million (50% of revenues), compared to $15.0 million (58% of

revenues) for the same period in 2023.

Total operating expenses for the fourth quarter

of 2024 were $15.5 million, compared to $10.6 million for the same

period in 2023. Operating expenses for the fourth quarter of 2023

included the contingent consideration reduction of $4.8 million

related to the Forensic Logic and SafePointe acquisitions.

Net loss for the fourth quarter of 2024 totaled

$4.1 million or $0.32 per basic share and diluted share (based on

12.6 million basic and diluted weighted-average shares

outstanding), compared to net income of $3.6 million or $0.29 per

basic share and $0.28 per diluted share (based on 12.7 million

basic and 12.9 million diluted weighted-average shares

outstanding), for the same period in 2023.

Adjusted EBITDA for the fourth quarter of 2024

totaled $1.7 million, compared to $4.8 million in the same period

last year.

At quarter end, the Company had $13.2 million in

cash and cash equivalents, $25.2 million in accounts receivable and

contract assets, net, $44.2 million in deferred revenue, $4.0

million in debt related to borrowings to partially fund the

SafePointe acquisition in the third quarter of 2023, and

approximately $21.0 million available on our credit facility.

Full Year 2024 Financial

Results

The full year 2024 financial results were

affected by the delay of approximately $3.5 million of two contract

renewals, one of which has renewed and the second of which is

currently expected to renew in the first quarter of 2025.

Revenues in 2024 increased 10% to $102.0 million

from $92.7 million in 2023. The increase in revenues was primarily

due to new and expanding customer subscriptions.

Gross profit in 2024 increased 10% to $57.9

million (57% of revenues) from $52.7 million (57% of revenues) for

the same period in 2023.

Total operating expenses in 2024 increased 22%

to $65.7 million from $54.0 million in 2023 primarily due to a full

year of expenses related to SafePointe, compared to four months in

2023, as well as personnel-related costs as we continue to grow our

business. In addition, operating expenses in 2023 included the

contingent consideration adjustment of $5.7 million in 2023

associated with the Forensic Logic and SafePointe acquisitions.

Net loss in 2024 totaled $9.2 million or $(0.72)

per basic and diluted share (based on 12.7 million basic and

diluted weighted-average shares outstanding), compared to net loss

in 2023 which totaled $2.7 million or $(0.22) per basic and diluted

share (based on 12.4 million basic and diluted weighted-average

shares outstanding).

Adjusted EBITDA for 2024 totaled $14.4 million,

compared to $14.3 million in 2023.

Financial Outlook

The Company is raising its full year 2025

revenue guidance range to $111.0 million to $113.0 million,

representing 10% year-over-year growth at the midpoint. The Company

is also raising its Adjusted EBITDA margin guidance to 21% to 23%

for the full year 2025. The Company also expects ARR to increase

from $95.6 million at the beginning of 2025 to approximately $110.0

million at the start of 2026.

The Company’s financial outlook statements are

based on current expectations. The preceding statements are

forward-looking, and actual results could differ materially

depending on market conditions and the factors set forth under

“Safe Harbor Statement” below. The Company has not reconciled its

Adjusted EBITDA outlook to GAAP net income (loss) due to the

uncertainty and variability of interest income (expense), income

taxes, depreciation and amortization, stock-based compensation

expenses and acquisition-related expenses, including adjustments to

the Company’s contingent consideration obligation, which are

reconciling items between Adjusted EBITDA and GAAP net income

(loss). Because the Company cannot reasonably predict such items, a

reconciliation to forecasted GAAP net income (loss) is not

available without unreasonable effort. Such items could have a

significant impact on the calculation of GAAP net income (loss).

For more information, see “Non-GAAP Financial Measures and Key

Business Metrics” below.

Conference Call

SoundThinking will hold a conference call today

February 25, 2025 at 4:30 p.m. Eastern Time (1:30 p.m. Pacific

Time) to discuss these results and provide an update on business

conditions.

SoundThinking management will host the

presentation, followed by a question-and-answer period.

U.S. dial-in: 1-877-407-8029 International

dial-in: 1-201-689-8029 Conference ID: 13751116

A live audio webcast of the conference call will

be available in listen-only mode simultaneously and available for

replay here and via the investor relations section of the Company’s

website at https://www.soundthinking.com/.

Please call the conference telephone number five

minutes prior to the start time. An operator will register your

name and organization.

A replay of the call will be available after 7:30

p.m. Eastern time on the same day through March 11, 2025.

U.S. replay dial-in: 877-660-6853 International

replay dial-in: 1-201-612-7415 Replay ID: 13751116

Non-GAAP Financial Measures and Key

Business Metrics

Adjusted Net Income (Loss):

Adjusted net income (loss), a non-GAAP financial measure,

represents the Company’s net income (loss) before

acquisition-related expenses, including adjustments to the

Company's contingent consideration obligation, restructuring

expense and loss from disposal of fixed assets.

Adjusted EBITDA: Adjusted

EBITDA, a non-GAAP financial measure, represents the Company’s net

income (loss) before interest (income) expense, income taxes,

depreciation, amortization and impairment, restructuring costs and

losses on restructuring related fixed asset disposals, stock-based

compensation expense and acquisition-related expenses, including

adjustments to the Company's contingent consideration obligation.

Adjusted EBITDA is a measure used by management internally to

understand and evaluate the Company’s core operating performance

and trends across accounting periods and in connection with

developing future operating plans, making strategic decisions

regarding the allocation of capital and considering initiatives

focused on cultivating new markets for its solutions. In

particular, the exclusion of these expenses in calculating Adjusted

EBITDA facilitates comparisons of the Company’s operating

performance on a period-to-period basis.

SoundThinking believes adjusted net income

(loss) and Adjusted EBITDA also provide useful information to

investors and others in understanding and evaluating its operating

results in the same manner as its management and board of

directors. For example, SoundThinking adjusts EBITDA for

stock-based compensation expense and acquisition-related expenses

because such expenses often vary for reasons that are generally

unrelated to financial and operational performance in a particular

period. Stock-based compensation is utilized by SoundThinking to

attract and retain employees with a goal of long-term retention and

the alignment of employee interests with those of the Company and

its stockholders, rather than to address operational performance

for any particular period’s financial performance measures, in

particular net income (loss), or its other GAAP financial

results.

The following table presents a reconciliation of GAAP net income

(loss), the most directly comparable GAAP measure, to adjusted net

loss, for each of the periods indicated (in thousands, except share

and per share data):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

GAAP net income (loss) |

|

$ |

(4,079 |

) |

|

$ |

3,643 |

|

|

$ |

(9,180 |

) |

|

$ |

(2,718 |

) |

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition-related expenses |

|

|

— |

|

|

|

(97 |

) |

|

|

— |

|

|

|

767 |

|

|

Restructuring expense |

|

|

(10 |

) |

|

|

— |

|

|

|

336 |

|

|

|

— |

|

|

Loss on disposal of fixed assets |

|

|

18 |

|

|

|

— |

|

|

|

23 |

|

|

|

— |

|

|

Change in fair value of contingent consideration |

|

|

— |

|

|

|

(4,763 |

) |

|

|

(554 |

) |

|

|

(5,686 |

) |

|

Adjusted net loss |

|

$ |

(4,071 |

) |

|

$ |

(1,217 |

) |

|

$ |

(9,375 |

) |

|

$ |

(7,637 |

) |

|

Net loss per share, basic |

|

$ |

(0.32 |

) |

|

$ |

0.29 |

|

|

$ |

(0.72 |

) |

|

$ |

(0.22 |

) |

|

Net loss per share, diluted |

|

$ |

(0.32 |

) |

|

$ |

0.28 |

|

|

$ |

(0.72 |

) |

|

$ |

(0.22 |

) |

|

Adjusted net loss per share, basic and diluted |

|

$ |

(0.32 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.74 |

) |

|

$ |

(0.61 |

) |

|

Weighted-average shares used in computing net (loss) income per

share and adjusted net (loss) income per share, basic |

|

|

12,589,833 |

|

|

|

12,736,747 |

|

|

|

12,710,236 |

|

|

|

12,425,132 |

|

|

Weighted-average shares used in computing net (loss) income per

share and adjusted net (loss) income per share, diluted |

|

|

12,589,833 |

|

|

|

12,856,219 |

|

|

|

12,710,236 |

|

|

|

12,425,132 |

|

The following table presents a reconciliation of

Adjusted EBITDA to GAAP net income (loss), the most directly

comparable GAAP measure, for each of the periods indicated (in

thousands):

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

GAAP net income (loss) |

|

$ |

(4,079 |

) |

|

$ |

3,643 |

|

|

$ |

(9,180 |

) |

|

$ |

(2,718 |

) |

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest (income) expense, net |

|

|

(22 |

) |

|

|

112 |

|

|

|

154 |

|

|

|

48 |

|

|

Income taxes |

|

|

111 |

|

|

|

561 |

|

|

|

778 |

|

|

|

1,204 |

|

|

Depreciation, amortization and impairment |

|

|

2,699 |

|

|

|

2,626 |

|

|

|

10,673 |

|

|

|

10,752 |

|

|

Restructuring expense |

|

|

(10 |

) |

|

|

— |

|

|

|

336 |

|

|

|

— |

|

|

Loss on disposal of fixed assets |

|

|

18 |

|

|

|

— |

|

|

|

23 |

|

|

|

— |

|

|

Stock-based compensation expense |

|

|

3,000 |

|

|

|

2,710 |

|

|

|

12,128 |

|

|

|

9,982 |

|

|

Change in fair value of contingent consideration |

|

|

— |

|

|

|

(4,763 |

) |

|

|

(554 |

) |

|

|

(5,686 |

) |

|

Acquisition-related expenses |

|

|

— |

|

|

|

(97 |

) |

|

|

— |

|

|

|

767 |

|

|

Adjusted EBITDA |

|

$ |

1,717 |

|

|

$ |

4,792 |

|

|

$ |

14,358 |

|

|

$ |

14,349 |

|

Annual Recurring Revenue (ARR):

ARR is calculated for a year based on the expected GAAP revenue for

the year from contracts that are in effect on January 1st of such

year, assuming all such contracts that are due for renewal during

the year renew as expected on or near their renewal date, and

including contracts executed during the year after January 1st, but

for which GAAP revenue recognition starts January 1st of the

year.

Revenue Retention

Rate: We calculate our revenue

retention rate for each year by dividing the (a) total revenues for

such year from those customers who were customers during the

corresponding prior year by (b) the total revenues from all

customers in the corresponding prior year. For the purposes of

calculating our revenue retention rate, we count as customers all

entities with which we had contracts in the applicable year.

Revenue retention rate for any given period does not include

revenues attributable to customers first acquired during such

period. We focus on our revenue retention rate because we

believe that this metric provides insight into revenues related to

and retention of existing customers. If our revenue retention rate

for a year exceeds 100%, this indicates a low churn and means that

the revenues retained during the year, including from customer

expansions, more than offset the revenues that we lost from

customers that did not renew their contracts during the year.

Sales and Marketing Spend per $1.00 of

New Annualized Contract Value: We calculate sales and

marketing spend annually as the total sales and marketing expense

during a year divided by the first 12 months of contract value for

contracts entered into during the same year. We use this metric to

measure the efficiency of our sales and marketing efforts in

acquiring customers, renewing customer contracts, and expanding

their coverage areas.

Forward-Looking Statements

This press release and earnings call referencing

this press release contains "forward-looking statements" within the

meaning of the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995, including but not limited to

statements regarding the Company’s expectations for its estimated

revenue and Adjusted EBITDA for 2025, the Company's expectations

for the increase in its ARR, ability to drive profitable growth and

build upon existing contracts and partnerships, including in the

United States and internationally, the potential renewal of the

customer contract with New York Police Department and the timing of

such renewal, and the Company’s plan to continue innovating and

executing against its strategic and financial growth priorities to

deliver meaningful value to its stakeholders, the Company's

expectations of benefits through integration of AI-driven

capabilities, operating momentum, sales pipeline, revenue growth,

operating leverage and margin expansion in 2025 and beyond. Words

such as "expect," "anticipate," "should," "believe," "target,"

"project," "goals," "estimate," "potential," "predict," "may,"

"will," "could," "intend," or variations of these terms or the

negative of these terms and similar expressions are intended to

identify these forward-looking statements. Forward-looking

statements are subject to a number of risks and uncertainties, many

of which involve factors or circumstances that are beyond the

Company’s control. The Company’s actual results could differ

materially from those stated or implied in forward-looking

statements due to a number of factors, including but not limited

to: the Company’s ability to renew its contract with New York

Police Department and the timing of such renewal; the Company’s

ability to successfully negotiate and execute contracts with new

and existing customers in a timely manner, if at all; the Company’s

ability to maintain and increase sales, including sales of the

Company’s newer product lines; the availability of funding for the

Company’s customers to purchase the Company’s solutions; the

complexity, expense and time associated with contracting with

government entities; the Company’s ability to maintain and expand

coverage of existing public safety customer accounts and further

penetrate the public safety market; the potential effects of

negative publicity; the Company’s ability to sell its solutions

into international and other new markets; the lengthy sales cycle

for the Company’s solutions; changes in federal funding available

to support local law enforcement; the Company’s ability to deploy

and deliver its solutions; the Company’s ability to maintain and

enhance its brand; and the Company’s ability to address the

business and other impacts and uncertainties associated with

macroeconomic factors, as well as other risk factors included in

the Company’s most recent annual report on Form 10-K and other SEC

filings. These forward-looking statements are made as of the date

of this press release and are based on current expectations,

estimates, forecasts and projections as well as the beliefs and

assumptions of management. Except as required by law, the Company

undertakes no duty or obligation to update any forward-looking

statements contained in this press release and the earnings call

referencing this press release as a result of new information,

future events or changes in its expectations.

About SoundThinking, Inc.

SoundThinking, Inc. (Nasdaq: SSTI) is a leading public safety

technology company that delivers AI- and data-driven solutions for

law enforcement, civic leadership, and security professionals.

SoundThinking is trusted by more than 300 customers and has worked

with approximately 2,100 agencies to drive more efficient,

effective, and equitable public safety outcomes. The Company’s

SafetySmart™ platform includes ShotSpotter®, the leading

acoustic gunshot detection system; CrimeTracer™, the leading law

enforcement search engine; CaseBuilder™, a one-stop investigation

management system; ResourceRouter™, software that directs patrol

and community anti-violence resources to help maximize their

impact; SafePointe®, an AI-based weapons detection system; and

PlateRanger powered by Rekor, a leading ALPR solution.

SoundThinking has been designated a Great Place to Work®

Company.

Company Contact:

Alan Stewart, CFO SoundThinking, Inc. +1 (510)

794-3100 astewart@soundthinking.com

Investor Relations Contacts:

Ankit Hira Solebury Strategic Communications for

SoundThinking, Inc. +1 (203) 546 0444 ahira@soleburystrat.com

|

|

|

SoundThinking, Inc. Consolidated

Statements of Operations (In thousands except

share and per share data)

(Unaudited) |

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenues |

|

$ |

23,411 |

|

|

$ |

26,045 |

|

|

$ |

102,031 |

|

|

$ |

92,717 |

|

|

Costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

11,511 |

|

|

|

10,993 |

|

|

|

43,542 |

|

|

|

39,874 |

|

|

Impairment of property and equipment |

|

|

193 |

|

|

|

42 |

|

|

|

605 |

|

|

|

114 |

|

|

Total costs |

|

|

11,704 |

|

|

|

11,035 |

|

|

|

44,147 |

|

|

|

39,988 |

|

|

Gross profit |

|

|

11,707 |

|

|

|

15,010 |

|

|

|

57,884 |

|

|

|

52,729 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

6,523 |

|

|

|

7,379 |

|

|

|

28,138 |

|

|

|

26,959 |

|

|

Research and development |

|

|

3,484 |

|

|

|

3,242 |

|

|

|

13,925 |

|

|

|

12,138 |

|

|

General and administrative |

|

|

5,515 |

|

|

|

4,751 |

|

|

|

23,894 |

|

|

|

20,557 |

|

|

Restructuring expense |

|

|

(10 |

) |

|

|

- |

|

|

|

336 |

|

|

|

- |

|

|

Change in fair value of contingent consideration |

|

|

- |

|

|

|

(4,763 |

) |

|

|

(554 |

) |

|

|

(5,686 |

) |

|

Total operating expenses |

|

|

15,512 |

|

|

|

10,609 |

|

|

|

65,739 |

|

|

|

53,968 |

|

|

Operating income (loss) |

|

|

(3,805 |

) |

|

|

4,401 |

|

|

|

(7,855 |

) |

|

|

(1,239 |

) |

|

Other income (expense), net |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (expense), net |

|

|

22 |

|

|

|

(112 |

) |

|

|

(154 |

) |

|

|

(48 |

) |

|

Other expense, net |

|

|

(185 |

) |

|

|

(85 |

) |

|

|

(393 |

) |

|

|

(227 |

) |

|

Total other expense, net |

|

|

(163 |

) |

|

|

(197 |

) |

|

|

(547 |

) |

|

|

(275 |

) |

|

Income (loss) before income taxes |

|

|

(3,968 |

) |

|

|

4,204 |

|

|

|

(8,402 |

) |

|

|

(1,514 |

) |

|

Provision for income taxes |

|

|

111 |

|

|

|

561 |

|

|

|

778 |

|

|

|

1,204 |

|

|

Net income (loss) |

|

$ |

(4,079 |

) |

|

$ |

3,643 |

|

|

$ |

(9,180 |

) |

|

$ |

(2,718 |

) |

|

Net income (loss) per share, basic |

|

$ |

(0.32 |

) |

|

$ |

0.29 |

|

|

$ |

(0.72 |

) |

|

$ |

(0.22 |

) |

|

Net income (loss) per share, diluted |

|

$ |

(0.32 |

) |

|

$ |

0.28 |

|

|

$ |

(0.72 |

) |

|

$ |

(0.22 |

) |

|

Weighted-average shares used in computing net income (loss) per

share, basic |

|

|

12,589,833 |

|

|

|

12,736,747 |

|

|

|

12,710,236 |

|

|

|

12,425,132 |

|

|

Weighted-average shares used in computing net income (loss) per

share, diluted |

|

|

12,589,833 |

|

|

|

12,856,219 |

|

|

|

12,710,236 |

|

|

|

12,425,132 |

|

|

|

|

SoundThinking, Inc. Consolidated Balance

Sheets (In thousands except share and per share

data) (Unaudited) |

|

|

|

|

|

December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

Assets |

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

13,183 |

|

|

$ |

5,703 |

|

|

Accounts receivable and contract asset, net |

|

|

25,170 |

|

|

|

30,700 |

|

|

Prepaid expenses and other current assets |

|

|

5,175 |

|

|

|

3,902 |

|

|

Total current assets |

|

|

43,528 |

|

|

|

40,305 |

|

|

Property and equipment, net |

|

|

20,131 |

|

|

|

21,028 |

|

|

Operating lease right-of-use assets |

|

|

1,878 |

|

|

|

2,315 |

|

|

Goodwill |

|

|

34,213 |

|

|

|

34,213 |

|

|

Intangible assets, net |

|

|

33,182 |

|

|

|

36,938 |

|

|

Other assets |

|

|

3,861 |

|

|

|

3,909 |

|

|

Total assets |

|

$ |

136,793 |

|

|

$ |

138,708 |

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

3,442 |

|

|

$ |

3,031 |

|

|

Line of credit |

|

|

4,000 |

|

|

|

7,000 |

|

|

Deferred revenue, short-term |

|

|

38,401 |

|

|

|

41,265 |

|

|

Accrued expenses and other current liabilities |

|

|

10,216 |

|

|

|

8,521 |

|

|

Total current liabilities |

|

|

56,059 |

|

|

|

59,817 |

|

|

Deferred revenue, long-term |

|

|

5,832 |

|

|

|

812 |

|

|

Deferred tax liability |

|

|

1,361 |

|

|

|

1,226 |

|

|

Other liabilities |

|

|

1,142 |

|

|

|

2,096 |

|

|

Total liabilities |

|

|

64,394 |

|

|

|

63,951 |

|

|

Stockholders' equity |

|

|

|

|

|

|

|

Common stock: $0.005 par value; 500,000,000 shares authorized;

12,634,479 and 12,761,448 shares issued and outstanding as of

December 31, 2024 and 2023, respectively |

|

|

64 |

|

|

|

64 |

|

|

Additional paid-in capital |

|

|

177,021 |

|

|

|

170,139 |

|

|

Accumulated deficit |

|

|

(104,298 |

) |

|

|

(95,118 |

) |

|

Accumulated other comprehensive loss |

|

|

(388 |

) |

|

|

(328 |

) |

|

Total stockholders' equity |

|

|

72,399 |

|

|

|

74,757 |

|

|

Total liabilities and stockholders' equity |

|

$ |

136,793 |

|

|

$ |

138,708 |

|

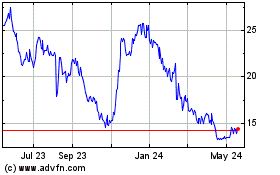

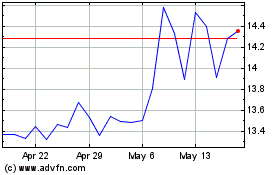

SoundThinking (NASDAQ:SSTI)

Historical Stock Chart

From Feb 2025 to Mar 2025

SoundThinking (NASDAQ:SSTI)

Historical Stock Chart

From Mar 2024 to Mar 2025