000088550812/312024Q3FALSExbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:purestrs:segment00008855082024-01-012024-09-3000008855082024-11-0800008855082024-09-3000008855082023-12-310000885508us-gaap:RealEstateMember2024-07-012024-09-300000885508us-gaap:RealEstateMember2023-07-012023-09-300000885508us-gaap:RealEstateMember2024-01-012024-09-300000885508us-gaap:RealEstateMember2023-01-012023-09-3000008855082024-07-012024-09-3000008855082023-07-012023-09-3000008855082023-01-012023-09-300000885508strs:LeasingOperationsMember2024-07-012024-09-300000885508strs:LeasingOperationsMember2023-07-012023-09-300000885508strs:LeasingOperationsMember2024-01-012024-09-300000885508strs:LeasingOperationsMember2023-01-012023-09-3000008855082022-12-3100008855082023-09-300000885508us-gaap:CommonStockMember2023-12-310000885508us-gaap:AdditionalPaidInCapitalMember2023-12-310000885508us-gaap:RetainedEarningsMember2023-12-310000885508us-gaap:TreasuryStockCommonMember2023-12-310000885508us-gaap:ParentMember2023-12-310000885508us-gaap:NoncontrollingInterestMember2023-12-310000885508us-gaap:CommonStockMember2024-01-012024-03-310000885508us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310000885508us-gaap:ParentMember2024-01-012024-03-3100008855082024-01-012024-03-310000885508us-gaap:TreasuryStockCommonMember2024-01-012024-03-310000885508us-gaap:RetainedEarningsMember2024-01-012024-03-310000885508us-gaap:NoncontrollingInterestMember2024-01-012024-03-310000885508us-gaap:CommonStockMember2024-03-310000885508us-gaap:AdditionalPaidInCapitalMember2024-03-310000885508us-gaap:RetainedEarningsMember2024-03-310000885508us-gaap:TreasuryStockCommonMember2024-03-310000885508us-gaap:ParentMember2024-03-310000885508us-gaap:NoncontrollingInterestMember2024-03-3100008855082024-03-310000885508us-gaap:CommonStockMember2024-04-012024-06-300000885508us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300000885508us-gaap:ParentMember2024-04-012024-06-3000008855082024-04-012024-06-300000885508us-gaap:RetainedEarningsMember2024-04-012024-06-300000885508us-gaap:NoncontrollingInterestMember2024-04-012024-06-300000885508us-gaap:CommonStockMember2024-06-300000885508us-gaap:AdditionalPaidInCapitalMember2024-06-300000885508us-gaap:RetainedEarningsMember2024-06-300000885508us-gaap:TreasuryStockCommonMember2024-06-300000885508us-gaap:ParentMember2024-06-300000885508us-gaap:NoncontrollingInterestMember2024-06-3000008855082024-06-300000885508us-gaap:CommonStockMember2024-07-012024-09-300000885508us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300000885508us-gaap:ParentMember2024-07-012024-09-300000885508us-gaap:NoncontrollingInterestMember2024-07-012024-09-300000885508us-gaap:RetainedEarningsMember2024-07-012024-09-300000885508us-gaap:CommonStockMember2024-09-300000885508us-gaap:AdditionalPaidInCapitalMember2024-09-300000885508us-gaap:RetainedEarningsMember2024-09-300000885508us-gaap:TreasuryStockCommonMember2024-09-300000885508us-gaap:ParentMember2024-09-300000885508us-gaap:NoncontrollingInterestMember2024-09-300000885508us-gaap:CommonStockMember2022-12-310000885508us-gaap:AdditionalPaidInCapitalMember2022-12-310000885508us-gaap:RetainedEarningsMember2022-12-310000885508us-gaap:TreasuryStockCommonMember2022-12-310000885508us-gaap:ParentMember2022-12-310000885508us-gaap:NoncontrollingInterestMember2022-12-310000885508us-gaap:CommonStockMember2023-01-012023-03-310000885508us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000885508us-gaap:ParentMember2023-01-012023-03-3100008855082023-01-012023-03-310000885508us-gaap:TreasuryStockCommonMember2023-01-012023-03-310000885508us-gaap:NoncontrollingInterestMember2023-01-012023-03-310000885508us-gaap:RetainedEarningsMember2023-01-012023-03-310000885508us-gaap:CommonStockMember2023-03-310000885508us-gaap:AdditionalPaidInCapitalMember2023-03-310000885508us-gaap:RetainedEarningsMember2023-03-310000885508us-gaap:TreasuryStockCommonMember2023-03-310000885508us-gaap:ParentMember2023-03-310000885508us-gaap:NoncontrollingInterestMember2023-03-3100008855082023-03-310000885508us-gaap:CommonStockMember2023-04-012023-06-300000885508us-gaap:ParentMember2023-04-012023-06-3000008855082023-04-012023-06-300000885508us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300000885508us-gaap:TreasuryStockCommonMember2023-04-012023-06-300000885508us-gaap:RetainedEarningsMember2023-04-012023-06-300000885508us-gaap:NoncontrollingInterestMember2023-04-012023-06-300000885508us-gaap:CommonStockMember2023-06-300000885508us-gaap:AdditionalPaidInCapitalMember2023-06-300000885508us-gaap:RetainedEarningsMember2023-06-300000885508us-gaap:TreasuryStockCommonMember2023-06-300000885508us-gaap:ParentMember2023-06-300000885508us-gaap:NoncontrollingInterestMember2023-06-3000008855082023-06-300000885508us-gaap:CommonStockMember2023-07-012023-09-300000885508us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300000885508us-gaap:ParentMember2023-07-012023-09-300000885508us-gaap:TreasuryStockCommonMember2023-07-012023-09-300000885508us-gaap:RetainedEarningsMember2023-07-012023-09-300000885508us-gaap:NoncontrollingInterestMember2023-07-012023-09-300000885508us-gaap:CommonStockMember2023-09-300000885508us-gaap:AdditionalPaidInCapitalMember2023-09-300000885508us-gaap:RetainedEarningsMember2023-09-300000885508us-gaap:TreasuryStockCommonMember2023-09-300000885508us-gaap:ParentMember2023-09-300000885508us-gaap:NoncontrollingInterestMember2023-09-300000885508us-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMemberstrs:AnnualIncentiveAwardMember2022-04-012022-04-300000885508us-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMemberstrs:AnnualIncentiveAwardMember2023-01-012023-03-310000885508us-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMember2023-01-012023-03-310000885508us-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMemberstrs:AnnualIncentiveAwardMember2024-01-012024-03-310000885508us-gaap:ImmediateFamilyMemberOfManagementOrPrincipalOwnerMember2024-01-012024-03-310000885508strs:SaintGeorgeLPMemberstrs:StratusPropertiesIncMember2024-09-300000885508strs:StratusBlock150LPMemberstrs:StratusPropertiesIncMember2024-09-300000885508strs:SaintJuneLPMemberstrs:StratusPropertiesIncMember2024-09-300000885508strs:HoldenHillsMemberstrs:StratusPropertiesIncMember2024-09-300000885508strs:StratusKingwoodL.P.Memberstrs:StratusPropertiesIncMember2024-09-300000885508strs:StratusBlock150LPMemberstrs:StratusPropertiesIncMember2023-01-012023-12-310000885508strs:StratusBlock150LPMemberstrs:StratusPropertiesIncMember2023-12-310000885508strs:StratusBlock150LPMemberstrs:StratusPropertiesIncMember2024-01-012024-09-3000008855082024-02-2900008855082024-08-310000885508strs:BloombergShortTermBankYieldIndexMemberstrs:StratusBlock150LPMemberstrs:StratusPropertiesIncMember2024-01-012024-06-300000885508us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberstrs:StratusBlock150LPMemberstrs:StratusPropertiesIncMember2024-01-012024-09-300000885508strs:SaintJuneLPMemberstrs:StratusPropertiesIncMember2023-06-012023-06-300000885508strs:SaintJuneLPMemberstrs:StratusPropertiesIncMember2023-06-300000885508strs:SaintJuneLPMember2024-01-012024-09-300000885508strs:SaintJuneLPMemberstrs:StratusPropertiesIncMember2023-10-010000885508strs:SaintJuneLPMemberstrs:StratusPropertiesIncMember2024-01-310000885508strs:SaintJuneLPMemberstrs:UnrelatedEquityInvestorMember2023-10-010000885508strs:SaintJuneLPMemberstrs:UnrelatedEquityInvestorMember2024-01-310000885508strs:SaintJuneLPMemberstrs:StratusPropertiesIncMember2024-04-300000885508strs:SaintJuneLPMemberstrs:UnrelatedEquityInvestorMember2024-04-300000885508us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberstrs:SaintJuneLPMemberstrs:StratusPropertiesIncMember2024-01-012024-09-300000885508strs:SaintGeorgeLPMemberstrs:StratusPropertiesIncMember2024-09-012024-09-300000885508strs:SaintGeorgeLPMemberstrs:UnrelatedEquityInvestorMember2024-09-012024-09-300000885508strs:A9CumulativeReturnMemberstrs:SaintGeorgeLPMemberstrs:StratusPropertiesIncMember2024-09-300000885508strs:A9CumulativeReturnMemberstrs:SaintGeorgeLPMemberstrs:UnrelatedEquityInvestorMember2024-09-300000885508strs:A9CumulativeReturnMemberstrs:SaintJuneLPMemberstrs:StratusPropertiesIncMember2024-09-300000885508strs:A9CumulativeReturnMemberstrs:SaintJuneLPMemberstrs:UnrelatedEquityInvestorMember2024-09-300000885508strs:A9CumulativeReturnMemberstrs:HoldenHillsMemberstrs:StratusPropertiesIncMember2024-09-300000885508strs:A9CumulativeReturnMemberstrs:HoldenHillsMemberstrs:UnrelatedEquityInvestorMember2024-09-300000885508strs:A9CumulativeReturnMemberstrs:StratusKingwoodL.P.Memberstrs:StratusPropertiesIncMember2024-09-300000885508strs:A9CumulativeReturnMemberstrs:StratusKingwoodL.P.Memberstrs:UnrelatedEquityInvestorMember2024-09-300000885508strs:A11CumulativeReturnMemberstrs:StratusKingwoodL.P.Memberstrs:StratusPropertiesIncMember2024-09-300000885508strs:A11CumulativeReturnMemberstrs:StratusKingwoodL.P.Memberstrs:UnrelatedEquityInvestorMember2024-09-300000885508strs:A12CumulativeReturnMemberstrs:SaintGeorgeLPMemberstrs:StratusPropertiesIncMember2024-09-300000885508strs:A12CumulativeReturnMemberstrs:SaintGeorgeLPMemberstrs:UnrelatedEquityInvestorMember2024-09-300000885508strs:A12CumulativeReturnMemberstrs:SaintJuneLPMemberstrs:StratusPropertiesIncMember2024-09-300000885508strs:A12CumulativeReturnMemberstrs:SaintJuneLPMemberstrs:UnrelatedEquityInvestorMember2024-09-300000885508strs:A12CumulativeReturnMemberstrs:HoldenHillsMemberstrs:StratusPropertiesIncMember2024-09-300000885508strs:A12CumulativeReturnMemberstrs:HoldenHillsMemberstrs:UnrelatedEquityInvestorMember2024-09-300000885508strs:A18CumulativeReturnMemberstrs:SaintGeorgeLPMemberstrs:StratusPropertiesIncMember2024-09-300000885508strs:A18CumulativeReturnMemberstrs:SaintGeorgeLPMemberstrs:UnrelatedEquityInvestorMember2024-09-300000885508strs:ThereafterCumulativeReturnMemberstrs:SaintGeorgeLPMemberstrs:StratusPropertiesIncMember2024-09-300000885508strs:ThereafterCumulativeReturnMemberstrs:SaintGeorgeLPMemberstrs:UnrelatedEquityInvestorMember2024-09-300000885508strs:ThereafterCumulativeReturnMemberstrs:SaintJuneLPMemberstrs:StratusPropertiesIncMember2024-09-300000885508strs:ThereafterCumulativeReturnMemberstrs:SaintJuneLPMemberstrs:UnrelatedEquityInvestorMember2024-09-300000885508strs:ThereafterCumulativeReturnMemberstrs:HoldenHillsMemberstrs:StratusPropertiesIncMember2024-09-300000885508strs:ThereafterCumulativeReturnMemberstrs:HoldenHillsMemberstrs:UnrelatedEquityInvestorMember2024-09-300000885508strs:ThereafterCumulativeReturnMemberstrs:StratusKingwoodL.P.Memberstrs:StratusPropertiesIncMember2024-09-300000885508strs:ThereafterCumulativeReturnMemberstrs:StratusKingwoodL.P.Memberstrs:UnrelatedEquityInvestorMember2024-09-300000885508strs:SaintGeorgePartnershipStratusKingwoodL.P.TheSaintJuneL.PStratusBlock150L.PAndHoldenHillsL.P.Member2024-09-300000885508strs:SaintGeorgePartnershipStratusKingwoodL.P.TheSaintJuneL.PStratusBlock150L.PAndHoldenHillsL.P.Member2023-12-310000885508us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberstrs:TheOaksatLakewayMember2024-09-300000885508us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberstrs:TheOaksatLakewayMember2023-12-310000885508us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberstrs:AmarraVillas_Member2024-07-012024-09-300000885508us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberstrs:AmarraVillas_Member2024-04-012024-06-300000885508us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberstrs:AmarraVillas_Member2024-01-012024-03-310000885508us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberstrs:AmarraVillas_Member2023-01-012023-03-310000885508us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberstrs:MagnoliaPlaceMember2024-07-012024-09-300000885508us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberstrs:MagnoliaPlaceMember2024-02-012024-02-290000885508us-gaap:ConstructionLoanPayableMemberstrs:MagnoliaPlaceConstructionLoanMember2024-02-290000885508strs:ComericaCreditFacilityMember2024-09-300000885508strs:ComericaCreditFacilityMember2023-12-310000885508strs:JonesCrossingConstructionLoanMember2024-09-300000885508strs:JonesCrossingConstructionLoanMember2023-12-310000885508strs:AnnieBMember2024-09-300000885508strs:AnnieBMember2023-12-310000885508strs:SaintGeorgeConstructionLoanMember2024-09-300000885508strs:SaintGeorgeConstructionLoanMember2023-12-310000885508strs:TheSaintJuneMember2024-09-300000885508strs:TheSaintJuneMember2023-12-310000885508strs:KingwoodPlaceConstructionLoanMember2024-09-300000885508strs:KingwoodPlaceConstructionLoanMember2023-12-310000885508strs:LantanaPlaceConstructionLoanMember2024-09-300000885508strs:LantanaPlaceConstructionLoanMember2023-12-310000885508strs:HoldenHillsConstructionLoanMember2024-09-300000885508strs:HoldenHillsConstructionLoanMember2023-12-310000885508strs:WestKilleenMarketconstructionloanMember2024-09-300000885508strs:WestKilleenMarketconstructionloanMember2023-12-310000885508strs:AmarraVillasCreditFacilityMember2024-09-300000885508strs:AmarraVillasCreditFacilityMember2023-12-310000885508strs:MagnoliaPlaceConstructionLoanMember2024-09-300000885508strs:MagnoliaPlaceConstructionLoanMember2023-12-310000885508us-gaap:RevolvingCreditFacilityMemberstrs:ComericaCreditFacilityMember2024-09-300000885508us-gaap:LetterOfCreditMemberstrs:ComericaCreditFacilityMember2024-09-300000885508us-gaap:LetterOfCreditMemberstrs:ComericaCreditFacilityHoldenHillsAndSectionNObligationMemberus-gaap:RevolvingCreditFacilityMember2023-05-010000885508us-gaap:LetterOfCreditMemberstrs:ComericaCreditFacilityMemberus-gaap:RevolvingCreditFacilityMemberstrs:LakewayMember2023-07-010000885508strs:JonesCrossingConstructionLoanMember2024-01-012024-09-300000885508strs:JonesCrossingConstructionLoanMember2023-02-012023-02-280000885508strs:JonesCrossingConstructionLoanMember2023-05-012023-05-110000885508strs:JonesCrossingConstructionLoanMember2023-10-012023-12-310000885508strs:AnnieBMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2024-02-012024-02-290000885508strs:AnnieBMemberstrs:OneMonthSOFRMember2024-02-012024-02-290000885508strs:AnnieBMember2024-02-012024-02-290000885508srt:ScenarioForecastMemberstrs:AnnieBMember2025-02-012025-02-280000885508us-gaap:SubsequentEventMemberus-gaap:LineOfCreditMemberstrs:TheSaintJuneMember2024-10-012024-10-310000885508us-gaap:SubsequentEventMemberus-gaap:LineOfCreditMemberstrs:TheSaintJuneMember2024-10-310000885508strs:TheSaintJuneMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-01-310000885508us-gaap:SubsequentEventMemberstrs:TheSaintJuneMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2024-10-012024-10-310000885508us-gaap:SubsequentEventMemberstrs:TheSaintJuneMember2024-10-012024-10-310000885508strs:AmarraVillasCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2024-06-192024-06-190000885508us-gaap:LineOfCreditMemberstrs:AmarraVillasCreditFacilityMember2022-09-300000885508us-gaap:LineOfCreditMemberstrs:AmarraVillasCreditFacilityMember2024-06-190000885508strs:AnnieBMemberstrs:OneMonthSOFRMember2024-06-192024-06-190000885508us-gaap:LineOfCreditMemberstrs:AmarraVillasCreditFacilityMember2024-07-012024-09-300000885508us-gaap:LineOfCreditMemberstrs:AmarraVillasCreditFacilityMember2024-04-012024-06-300000885508us-gaap:LineOfCreditMemberstrs:AmarraVillasCreditFacilityMember2024-01-012024-03-310000885508us-gaap:LineOfCreditMemberstrs:AmarraVillasCreditFacilityMember2023-03-012023-03-310000885508us-gaap:SubsequentEventMemberstrs:ComericaCreditFacilityMemberstrs:OneMonthSOFRMember2024-11-012024-11-300000885508us-gaap:SubsequentEventMemberstrs:ComericaCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2024-11-012024-11-300000885508us-gaap:SubsequentEventMemberstrs:SaintGeorgeConstructionLoanMemberstrs:OneMonthSOFRMember2024-11-012024-11-300000885508us-gaap:SubsequentEventMemberstrs:SaintGeorgeConstructionLoanMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2024-11-012024-11-300000885508us-gaap:SubsequentEventMemberstrs:HoldenHillsConstructionLoanMemberstrs:OneMonthSOFRMember2024-11-012024-11-300000885508us-gaap:SubsequentEventMemberstrs:HoldenHillsConstructionLoanMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2024-11-012024-11-3000008855082022-07-012022-09-3000008855082022-09-0100008855082022-07-012023-11-0800008855082023-11-090000885508strs:KingwoodPlace_Memberus-gaap:DeferredProfitSharingMember2023-12-310000885508us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:DeferredProfitSharingMember2024-07-012024-09-300000885508us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:DeferredProfitSharingMember2023-07-012023-09-300000885508us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:DeferredProfitSharingMember2024-01-012024-09-300000885508us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:DeferredProfitSharingMember2023-01-012023-09-300000885508strs:ProjectDevelopmentCostsMemberus-gaap:DeferredProfitSharingMember2024-07-012024-09-300000885508strs:ProjectDevelopmentCostsMemberus-gaap:DeferredProfitSharingMember2023-07-012023-09-300000885508strs:ProjectDevelopmentCostsMemberus-gaap:DeferredProfitSharingMember2024-01-012024-09-300000885508strs:ProjectDevelopmentCostsMemberus-gaap:DeferredProfitSharingMember2023-01-012023-09-300000885508us-gaap:DeferredProfitSharingMember2024-07-012024-09-300000885508us-gaap:DeferredProfitSharingMember2023-07-012023-09-300000885508us-gaap:DeferredProfitSharingMember2024-01-012024-09-300000885508us-gaap:DeferredProfitSharingMember2023-01-012023-09-300000885508us-gaap:DeferredProfitSharingMember2024-09-300000885508us-gaap:DeferredProfitSharingMember2023-12-310000885508strs:RealEstateOperationsMemberstrs:DevelopedPropertyMember2024-07-012024-09-300000885508strs:RealEstateOperationsMemberstrs:DevelopedPropertyMember2023-07-012023-09-300000885508strs:RealEstateOperationsMemberstrs:DevelopedPropertyMember2024-01-012024-09-300000885508strs:RealEstateOperationsMemberstrs:DevelopedPropertyMember2023-01-012023-09-300000885508strs:RealEstateOperationsMemberstrs:UndevelopedPropertyMember2024-07-012024-09-300000885508strs:RealEstateOperationsMemberstrs:UndevelopedPropertyMember2023-07-012023-09-300000885508strs:RealEstateOperationsMemberstrs:UndevelopedPropertyMember2024-01-012024-09-300000885508strs:RealEstateOperationsMemberstrs:UndevelopedPropertyMember2023-01-012023-09-300000885508strs:RealEstateOperationsMemberstrs:RealEstateCommissionsAndOtherMember2024-07-012024-09-300000885508strs:RealEstateOperationsMemberstrs:RealEstateCommissionsAndOtherMember2023-07-012023-09-300000885508strs:RealEstateOperationsMemberstrs:RealEstateCommissionsAndOtherMember2024-01-012024-09-300000885508strs:RealEstateOperationsMemberstrs:RealEstateCommissionsAndOtherMember2023-01-012023-09-300000885508strs:LeasingOperationsMember2024-07-012024-09-300000885508strs:LeasingOperationsMember2023-07-012023-09-300000885508strs:LeasingOperationsMember2024-01-012024-09-300000885508strs:LeasingOperationsMember2023-01-012023-09-300000885508us-gaap:OperatingSegmentsMemberstrs:RealEstateOperationsMember2024-07-012024-09-300000885508us-gaap:OperatingSegmentsMemberstrs:LeasingOperationsMember2024-07-012024-09-300000885508strs:EliminationsandOtherMember2024-07-012024-09-300000885508us-gaap:OperatingSegmentsMemberstrs:RealEstateOperationsMember2024-09-300000885508us-gaap:OperatingSegmentsMemberstrs:LeasingOperationsMember2024-09-300000885508strs:EliminationsandOtherMember2024-09-300000885508us-gaap:OperatingSegmentsMemberstrs:RealEstateOperationsMember2023-07-012023-09-300000885508us-gaap:OperatingSegmentsMemberstrs:LeasingOperationsMember2023-07-012023-09-300000885508strs:EliminationsandOtherMember2023-07-012023-09-300000885508us-gaap:OperatingSegmentsMemberstrs:RealEstateOperationsMember2023-09-300000885508us-gaap:OperatingSegmentsMemberstrs:LeasingOperationsMember2023-09-300000885508strs:EliminationsandOtherMember2023-09-300000885508us-gaap:OperatingSegmentsMemberstrs:RealEstateOperationsMember2024-01-012024-09-300000885508us-gaap:OperatingSegmentsMemberstrs:LeasingOperationsMember2024-01-012024-09-300000885508strs:EliminationsandOtherMember2024-01-012024-09-300000885508us-gaap:OperatingSegmentsMember2024-01-012024-09-300000885508us-gaap:OperatingSegmentsMemberstrs:RealEstateOperationsMember2023-01-012023-09-300000885508us-gaap:OperatingSegmentsMemberstrs:LeasingOperationsMember2023-01-012023-09-300000885508strs:EliminationsandOtherMember2023-01-012023-09-300000885508us-gaap:OperatingSegmentsMember2023-01-012023-09-30

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one) | | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2024

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-37716

Stratus Properties Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | |

| Delaware | | 72-1211572 |

| (State or other jurisdiction of | | (I.R.S. Employer Identification No.) |

| incorporation or organization) | | |

| | | | | | | | | | | | | | | | | | | | |

| 212 Lavaca Street, Suite 300 | | | | |

| Austin | | TX | | | | 78701 |

| (Address of principal executive offices) | | | | (Zip Code) |

(512) 478-5788

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | STRS | The NASDAQ Stock Market |

| | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☑ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☑ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☑ | Smaller reporting company | ☑ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☑ No

On November 8, 2024, there were 8,086,201 issued and outstanding shares of the registrant’s common stock, par value $0.01 per share.

| | | | | |

| STRATUS PROPERTIES INC. |

| TABLE OF CONTENTS |

| | |

| | |

| | Page |

| |

| |

| | |

| |

| | |

| |

| | |

| |

| |

| |

| | |

| |

| | |

| |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

| |

| | |

| |

| | |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

STRATUS PROPERTIES INC.

CONSOLIDATED BALANCE SHEETS (Unaudited)

(In Thousands)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Cash and cash equivalents | $ | 19,638 | | | $ | 31,397 | |

| Restricted cash | 698 | | | 1,035 | |

| Real estate held for sale | 4,884 | | | 7,382 | |

| Real estate under development | 261,212 | | | 260,642 | |

| Land available for development | 74,912 | | | 47,451 | |

| Real estate held for investment, net | 137,177 | | | 144,112 | |

| Lease right-of-use assets | 10,368 | | | 11,174 | |

| Deferred tax assets | 173 | | | 173 | |

| Other assets | 14,118 | | | 14,400 | |

| Total assets | $ | 523,180 | | | $ | 517,766 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Liabilities: | | | |

| Accounts payable | $ | 12,341 | | | $ | 15,629 | |

| Accrued liabilities, including taxes | 6,283 | | | 6,660 | |

| Debt | 181,540 | | | 175,168 | |

| Lease liabilities | 15,564 | | | 15,866 | |

| Deferred gain | 2,131 | | | 2,721 | |

| Other liabilities | 5,186 | | | 7,117 | |

| Total liabilities | 223,045 | | | 223,161 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| Equity: | | | |

| Stockholders’ equity: | | | |

| Common stock | 97 | | | 96 | |

| Capital in excess of par value of common stock | 200,557 | | | 197,735 | |

| Retained earnings | 29,108 | | | 26,645 | |

| Common stock held in treasury | (33,395) | | | (32,997) | |

| Total stockholders’ equity | 196,367 | | | 191,479 | |

| Noncontrolling interests in subsidiaries | 103,768 | | | 103,126 | |

| Total equity | 300,135 | | | 294,605 | |

| Total liabilities and equity | $ | 523,180 | | | $ | 517,766 | |

The accompanying Notes to Consolidated Financial Statements (Unaudited) are an integral part of these consolidated financial statements.

STRATUS PROPERTIES INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME (Unaudited)

(In Thousands, Except Per Share Amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Real estate operations | $ | 3,971 | | | $ | — | | | $ | 29,723 | | | $ | 2,551 | |

| Leasing operations | 4,920 | | | 3,669 | | | 14,165 | | | 10,450 | |

| Total revenues | 8,891 | | | 3,669 | | | 43,888 | | | 13,001 | |

| Cost of sales: | | | | | | | |

| Real estate operations | 5,344 | | | 1,467 | | | 25,046 | | | 8,651 | |

| Leasing operations | 1,964 | | | 1,381 | | | 5,384 | | | 3,786 | |

| Depreciation and amortization | 1,365 | | | 967 | | | 4,168 | | | 2,865 | |

| Total cost of sales | 8,673 | | | 3,815 | | | 34,598 | | | 15,302 | |

| Gain on sale of assets | (1,626) | | | — | | | (1,626) | | | — | |

| General and administrative expenses | 3,363 | | | 3,183 | | | 11,670 | | | 11,973 | |

| Total | 10,410 | | | 6,998 | | | 44,642 | | | 27,275 | |

| Operating loss | (1,519) | | | (3,329) | | | (754) | | | (14,274) | |

| Loss on extinguishment of debt | — | | | — | | | (59) | | | — | |

| Other income, net | 163 | | | 472 | | | 522 | | | 1,501 | |

| Loss before income taxes and equity in unconsolidated affiliate's loss | (1,356) | | | (2,857) | | | (291) | | | (12,773) | |

| Provision for income taxes | (58) | | | (356) | | | (204) | | | (2,016) | |

| Equity in unconsolidated affiliate's loss | — | | | (4) | | | — | | | (10) | |

| Net loss and total comprehensive loss | (1,414) | | | (3,217) | | | (495) | | | (14,799) | |

| Total comprehensive loss attributable to noncontrolling interests | 1,050 | | | 373 | | | 2,958 | | | 853 | |

| Net (loss) income and total comprehensive (loss) income attributable to common stockholders | $ | (364) | | | $ | (2,844) | | | $ | 2,463 | | | $ | (13,946) | |

| | | | | | | |

| Basic net (loss) income per share attributable to common stockholders | $ | (0.05) | | | $ | (0.36) | | | $ | 0.31 | | | $ | (1.74) | |

| | | | | | | |

| Diluted net (loss) income per share attributable to common stockholders: | $ | (0.05) | | | $ | (0.36) | | | $ | 0.30 | | | $ | (1.74) | |

| | | | | | | |

Weighted-average shares of common stock outstanding: | | | | | | | |

Basic | 8,080 | | | 8,003 | | | 8,059 | | | 7,993 | |

| Diluted | 8,080 | | | 8,003 | | | 8,186 | | | 7,993 | |

The accompanying Notes to Consolidated Financial Statements (Unaudited) are an integral part of these consolidated financial statements.

STRATUS PROPERTIES INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(In Thousands)

| | | | | | | | | | | |

| Nine Months Ended |

| | September 30, |

| | 2024 | | 2023 |

| Cash flow from operating activities: | | | |

| Net loss | $ | (495) | | | $ | (14,799) | |

Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 4,168 | | | 2,865 | |

| Cost of real estate sold | 19,115 | | | 2,080 | |

| Loss on extinguishment of debt | 59 | | | — | |

| Stock-based compensation | 1,314 | | | 1,479 | |

| Debt issuance cost amortization | 1,028 | | | 631 | |

| Gain on sale of assets | (1,626) | | | — | |

| Equity in unconsolidated affiliate’s loss | — | | | 10 | |

| Purchases and development of real estate properties | (22,925) | | | (34,697) | |

| Write-off of capitalized project costs | 721 | | | — | |

| Decrease in other assets | 233 | | | 2,223 | |

| (Decrease) increase in accounts payable, accrued liabilities and other | (3,994) | | | 908 | |

| Net cash used in operating activities | (2,402) | | | (39,300) | |

| | | |

| Cash flow from investing activities: | | | |

| Capital expenditures | (22,962) | | | (36,178) | |

| Proceeds from sale of assets, net of fees | 8,586 | | | — | |

| Payments on master lease obligations | (649) | | | (730) | |

| Other | — | | | 5 | |

| Net cash used in investing activities | (15,025) | | | (36,903) | |

| | | |

| Cash flow from financing activities: | | | |

| Borrowings from project loans | 27,672 | | | 41,656 | |

| Payments on project and term loans | (25,058) | | | (8,472) | |

| Payment of dividends | (356) | | | (678) | |

| Finance lease principal payments | (12) | | | (11) | |

| Stock-based awards net payments | (376) | | | (789) | |

Noncontrolling interest contributions | 3,600 | | | 40,000 | |

| Purchases of treasury stock | — | | | (2,064) | |

| Financing costs | (139) | | | (2,758) | |

| Net cash provided by financing activities | 5,331 | | | 66,884 | |

| Net decrease in cash, cash equivalents and restricted cash | (12,096) | | | (9,319) | |

| Cash, cash equivalents and restricted cash at beginning of year | 32,432 | | | 45,709 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 20,336 | | | $ | 36,390 | |

The accompanying Notes to Consolidated Financial Statements (Unaudited), which include information regarding noncash transactions, are an integral part of these consolidated financial statements.

STRATUS PROPERTIES INC.

CONSOLIDATED STATEMENTS OF EQUITY (Unaudited)

(In Thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Stockholders’ Equity | | | | |

| | | | | | | Retained Earnings (Accumulated Deficit) | | Common Stock

Held in Treasury | | Total | | Noncontrolling Interests in Subsidiaries | | |

| | Common Stock | | Capital in Excess of Par Value | | | | | | |

| Number

of Shares | | At Par

Value | | | | Number

of Shares | | At

Cost | | | | Total

Equity |

| Balance at December 31, 2023 | 9,586 | | | $ | 96 | | | $ | 197,735 | | | $ | 26,645 | | | 1,583 | | | $ | (32,997) | | | $ | 191,479 | | | $ | 103,126 | | | $ | 294,605 | |

| Vested stock-based awards | 78 | | | 1 | | | (1) | | | — | | | — | | | — | | | — | | | — | | | — | |

| Director fees paid in shares of common stock | — | | | — | | | 6 | | | — | | | — | | | — | | | 6 | | | — | | | 6 | |

| Stock-based compensation | — | | | — | | | 442 | | | — | | | — | | | — | | | 442 | | | — | | | 442 | |

| Grant of restricted stock units (RSUs) under the Profit Participation Incentive Plan (PPIP) | — | | | — | | | 1,492 | | | — | | | — | | | — | | | 1,492 | | | — | | | 1,492 | |

Tender of shares for stock-based awards | — | | | — | | | — | | | — | | | 16 | | | (376) | | | (376) | | | — | | | (376) | |

| Excise tax on 2023 common stock repurchases | — | | | — | | | — | | | — | | | — | | | (22) | | | (22) | | | — | | | (22) | |

| Total comprehensive income (loss) | — | | | — | | | — | | | 4,552 | | | — | | | — | | | 4,552 | | | (855) | | | 3,697 | |

| Balance at March 31, 2024 | 9,664 | | | 97 | | | 199,674 | | | 31,197 | | | 1,599 | | | (33,395) | | | 197,573 | | | 102,271 | | | 299,844 | |

| Vested stock-based awards | 12 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Director fees paid in shares of common stock | — | | | — | | | 6 | | | — | | | — | | | — | | | 6 | | | — | | | 6 | |

| Stock-based compensation | — | | | — | | | 434 | | | — | | | — | | | — | | | 434 | | | — | | | 434 | |

| Total comprehensive loss | — | | | — | | | — | | | (1,725) | | | — | | | — | | | (1,725) | | | (1,053) | | | (2,778) | |

| Balance at June 30, 2024 | 9,676 | | | 97 | | | 200,114 | | | 29,472 | | | 1,599 | | | (33,395) | | | 196,288 | | | 101,218 | | | 297,506 | |

| Vested stock-based awards | 9 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Director fees paid in shares of common stock | — | | | — | | | 6 | | | — | | | — | | | — | | | 6 | | | — | | | 6 | |

| Stock-based compensation | — | | | — | | | 437 | | | — | | | — | | | — | | | 437 | | | — | | | 437 | |

| Contributions from noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 3,600 | | | 3,600 | |

| Total comprehensive loss | — | | | — | | | — | | | (364) | | | — | | | — | | | (364) | | | (1,050) | | | (1,414) | |

| Balance at September 30, 2024 | 9,685 | | | $ | 97 | | | $ | 200,557 | | | $ | 29,108 | | | 1,599 | | | $ | (33,395) | | | $ | 196,367 | | | $ | 103,768 | | | $ | 300,135 | |

STRATUS PROPERTIES INC.

CONSOLIDATED STATEMENTS OF EQUITY (Unaudited) (Continued)

(In Thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Stockholders’ Equity | | | | |

| | | | | | | Retained Earnings (Accumulated Deficit) | | Common Stock

Held in Treasury | | Total | | Noncontrolling Interests in Subsidiaries | | |

| | Common Stock | | Capital in Excess of Par Value | | | | | | |

| Number

of Shares | | At Par

Value | | | | Number

of Shares | | At

Cost | | | | Total

Equity |

| Balance at December 31, 2022 | 9,439 | | | $ | 94 | | | $ | 195,773 | | | $ | 41,452 | | | 1,448 | | | $ | (30,071) | | | $ | 207,248 | | | $ | 64,825 | | | $ | 272,073 | |

| Vested stock-based awards | 40 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Director fees paid in shares of common stock | — | | | — | | | 6 | | | — | | | — | | | — | | | 6 | | | — | | | 6 | |

| Stock-based compensation | — | | | — | | | 529 | | | — | | | — | | | — | | | 529 | | | — | | | 529 | |

Tender of shares for stock-based awards | — | | | — | | | — | | | — | | | 11 | | | (216) | | | (216) | | | — | | | (216) | |

| Common stock repurchases | — | | | — | | | — | | | — | | | 44 | | | (894) | | | (894) | | | — | | | (894) | |

| Contributions from noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 40,000 | | | 40,000 | |

| Total comprehensive loss | — | | | — | | | — | | | (5,801) | | | — | | | — | | | (5,801) | | | (472) | | | (6,273) | |

| Balance at March 31, 2023 | 9,479 | | | 94 | | | 196,308 | | | 35,651 | | | 1,503 | | | (31,181) | | | 200,872 | | | 104,353 | | | 305,225 | |

| Vested stock-based awards | 93 | | | 2 | | | — | | | — | | | — | | | — | | | 2 | | | — | | | 2 | |

| Director fees paid in shares of common stock | — | | | — | | | 6 | | | — | | | — | | | — | | | 6 | | | — | | | 6 | |

| Stock-based compensation | — | | | — | | | 505 | | | — | | | — | | | — | | | 505 | | | — | | | 505 | |

| Tender of shares for stock-based awards | — | | | — | | | — | | | — | | | 28 | | | (573) | | | (573) | | | — | | | (573) | |

| Common stock repurchases | — | | | — | | | — | | | — | | | 31 | | | (695) | | | (695) | | | — | | | (695) | |

| Total comprehensive loss | — | | | — | | | — | | | (5,301) | | | — | | | — | | | (5,301) | | | (8) | | | (5,309) | |

| Balance at June 30, 2023 | 9,572 | | | 96 | | | 196,819 | | | 30,350 | | | 1,562 | | | (32,449) | | | 194,816 | | | 104,345 | | | 299,161 | |

| Vested stock-based awards | 14 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Director fees paid in shares of common stock | — | | | — | | | 6 | | | — | | | — | | | — | | | 6 | | | — | | | 6 | |

| Stock-based compensation | — | | | — | | | 468 | | | — | | | — | | | — | | | 468 | | | — | | | 468 | |

| Common stock repurchases | — | | | — | | | — | | | — | | | 18 | | | (475) | | | (475) | | | — | | | (475) | |

| Total comprehensive loss | — | | | — | | | — | | | (2,844) | | | — | | | — | | | (2,844) | | | (373) | | | (3,217) | |

| Balance at September 30, 2023 | 9,586 | | | $ | 96 | | | $ | 197,293 | | | $ | 27,506 | | | 1,580 | | | $ | (32,924) | | | $ | 191,971 | | | $ | 103,972 | | | $ | 295,943 | |

The accompanying Notes to Consolidated Financial Statements (Unaudited) are an integral part of these consolidated financial statements.

STRATUS PROPERTIES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

1.GENERAL

The unaudited condensed consolidated financial statements and the accompanying notes are prepared in accordance with generally accepted accounting principles (GAAP) in the United States (U.S.) and should be read in conjunction with the consolidated financial statements and notes thereto for the year ended December 31, 2023, included in Stratus Properties Inc.’s (Stratus) Annual Report on Form 10-K for the year ended December 31, 2023 (Stratus 2023 Form 10-K) filed with the U.S. Securities and Exchange Commission on March 28, 2024. The information furnished herein reflects all adjustments that are, in the opinion of management, necessary for a fair statement of the results for the interim periods reported and consist of normal recurring adjustments. The results of operations for any interim period are not necessarily indicative of the results of operations for any other future interim period or for a full fiscal year.

Related Party Transactions. In April 2022, Stratus hired the son of Stratus’ President and Chief Executive Officer as an employee at an annual salary of $100 thousand. As an employee, he received the same health and retirement benefits provided to all Stratus employees, annual incentive awards and two awards under the Profit Participation Incentive Plan (PPIP). In first-quarter 2023, he received $22 thousand as an annual incentive award for 2022, and his annual salary was increased to $120 thousand. In first-quarter 2024, he received $22 thousand as an annual incentive award for 2023, and his annual salary was increased to $124 thousand. In September 2024, the employee resigned from employment with Stratus, resulting in the forfeiture of his two outstanding awards under the PPIP. Refer to Note 7 for discussion of the PPIP. For additional information regarding Stratus’ related parties, including LCHM Holdings, LLC and JBM Trust, refer to Notes 1 and 2 in the Stratus 2023 Form 10-K.

2. EARNINGS PER SHARE

Stratus’ basic net (loss) income per share of common stock was calculated by dividing the net (loss) income attributable to common stockholders by the weighted-average shares of common stock outstanding during the period. A reconciliation of net loss and weighted-average shares of common stock outstanding for purposes of calculating diluted net (loss) income per share follows (in thousands, except per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net loss and total comprehensive loss | $ | (1,414) | | | $ | (3,217) | | | $ | (495) | | | $ | (14,799) | |

| Total comprehensive loss attributable to noncontrolling interests | 1,050 | | | 373 | | | 2,958 | | | 853 | |

| Net (loss) income and total comprehensive (loss) income attributable to common stockholders | $ | (364) | | | $ | (2,844) | | | $ | 2,463 | | | $ | (13,946) | |

| | | | | | | |

Basic weighted-average shares of common stock outstanding | 8,080 | | | 8,003 | | | 8,059 | | | 7,993 | |

Add shares issuable upon vesting of dilutive restricted stock units (RSUs) a | — | | | — | | | 127 | | | — | |

Diluted weighted-average shares of common stock outstanding | 8,080 | | | 8,003 | | | 8,186 | | | 7,993 | |

| | | | | | | |

| Basic net (loss) income per share attributable to common stockholders | $ | (0.05) | | | $ | (0.36) | | | $ | 0.31 | | | $ | (1.74) | |

| | | | | | | |

| Diluted net (loss) income per share attributable to common stockholders | $ | (0.05) | | | $ | (0.36) | | | $ | 0.30 | | | $ | (1.74) | |

| | | | | | | |

| | | | | | | |

a.Excludes 185 thousand shares for third-quarter 2024, 178 thousand shares for third-quarter 2023 and 232 thousand shares for the first nine months of 2023 of common stock associated with RSUs that were anti-dilutive as a result of net losses. Excludes 17 thousand shares for the first nine months of 2024 of common stock associated with RSUs that were anti-dilutive.

3. LIMITED PARTNERSHIPS

Stratus has entered into strategic partnerships for certain development projects. Stratus, through its subsidiaries, is a partner in the following limited partnerships: The Saint George Apartments, L.P. (10.0 percent indirect equity interest), Stratus Block 150, L.P. (31.0 percent indirect equity interest), The Saint June, L.P. (34.13 percent indirect equity interest), Holden Hills, L.P. (50.0 percent indirect equity interest) and Stratus Kingwood Place, L.P. (60.0 percent indirect equity interest). For additional information regarding Stratus' partnerships, refer to Note 2 in the Stratus 2023 Form 10-K.

Operating Loans/Additional Capital Contributions to Partnerships. In 2023, Stratus made operating loans totaling $2.3 million to Stratus Block 150, L.P. to facilitate the partnership’s ability to pay ongoing costs of The Annie B project during the pre-construction period. In February 2024 and August 2024, Stratus made additional operating loans of $2.4 million and $1.1 million, respectively, to Stratus Block 150, L.P. The loans are subordinate to The Annie B land loan and must be repaid before distributions may be made to the partners. Until February 2024, the interest rate on the loans was the one-month Bloomberg Short Term Bank Yield Index (BSBY) Rate plus 5.00 percent. In February 2024, the interest rate on the loans was changed to the one-month Term Secured Overnight Financing Rate (SOFR) plus 5.00 percent.

In June 2023, Stratus made an operating loan of $750 thousand to The Saint June, L.P. to support the partnership’s ability to pay its construction loan interest, which had risen above the amount originally budgeted due to interest rate increases over the past two years. In October 2023 and January 2024, Stratus made additional operating loans of $250 thousand and $339 thousand, respectively, to The Saint June, L.P., and the Class B Limited Partner made operating loans of $250 thousand and $339 thousand, respectively, to The Saint June, L.P. In April 2024, Stratus made an additional operating loan of $85 thousand to The Saint June, L.P., and the Class B Limited Partner made an additional operating loan of $165 thousand to The Saint June, L.P. The loans bear interest at the one-month Term SOFR plus 5.00 percent, are subordinate to The Saint June construction loan and must be repaid before distributions may be made to the partners.

In September 2024, Stratus contributed additional capital of $400 thousand in cash to The Saint George Apartments, L.P., representing its 10 percent equity share, and the Class B Limited Partner contributed additional capital of $3.6 million in cash to The Saint George Apartments, L.P. to support the partnership’s ability to pay its construction loan interest, which has exceeded the amount budgeted due to interest rate increases over the past two years.

Potential Returns. The following table presents the distribution percentages for the limited partnerships in which Stratus’ potential returns may increase above its relative equity interest if certain hurdles are achieved.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Distribution Percentages |

| The Saint George Apartments, L.P. | | The Saint June, L.P. | | Holden Hills, L.P. | | Stratus Kingwood Place, L.P. |

| Stratus | Third-party Class B Limited Partner | | Stratus | Third-party Class B Limited Partner | | Stratus | Third-party Class B Limited Partner | | Stratus | Third-party Class B Limited Partners |

| Until all partners have received a return of their capital contributions and a 9.00 percent cumulative return; | 10.00 | % | 90.00 | % | | 34.13 | % | 65.87 | % | | 50.00 | % | 50.00 | % | | 60.00 | % | 40.00 | % |

| Until all partners have received an 11.00 percent cumulative return; | — | | — | | | — | | — | | | — | | — | | | 68.00 | | 32.00 | |

| Until the Class B limited partner has received a 12.00 percent cumulative return; | 20.00 | | 80.00 | | | 44.13 | | 55.87 | | | 55.00 | | 45.00 | | | — | | — | |

| Until the Class B limited partner has received an 18.00 percent cumulative return; | 30.00 | | 70.00 | | | — | | — | | | — | | — | | | — | | — | |

| Thereafter | 50.00 | | 50.00 | | | 54.13 | | 45.87 | | | 65.00 | | 35.00 | | | 76.00 | | 24.00 | |

Accounting for Limited Partnerships. Stratus has performed evaluations and concluded that The Saint George Apartments, L.P., Stratus Block 150, L.P., The Saint June, L.P., Stratus Kingwood Place, L.P. and Holden Hills, L.P.

are variable interest entities (VIEs) and that Stratus is the primary beneficiary of each VIE. Accordingly, the partnerships’ results are consolidated in Stratus’ financial statements. Stratus will continue to re-evaluate which entity is the primary beneficiary of these partnerships in accordance with applicable accounting guidance.

The cash and cash equivalents held at these limited partnerships are subject to restrictions on distribution to Stratus pursuant to the individual partnership loan agreements.

Stratus’ consolidated balance sheets include the following assets and liabilities of the partnerships, net of intercompany balances (including the operating loans made by Stratus), which are eliminated (in thousands):

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

Assets: a | | | |

| Cash and cash equivalents | $ | 7,796 | | | $ | 5,531 | |

| Restricted cash | 413 | | | 193 | |

| Real estate under development | 135,941 | | | 140,347 | |

| Land available for development | 36,403 | | | 1,911 | |

| Real estate held for investment | 82,108 | | | 87,005 | |

| Lease right-of-use assets | 217 | | | 420 | |

| Other assets | 3,206 | | | 3,122 | |

| Total assets | 266,084 | | | 238,529 | |

Liabilities: b | | | |

| Accounts payable | 9,280 | | | 12,751 | |

| Accrued liabilities, including taxes | 2,965 | | | 1,793 | |

| Debt | 126,529 | | | 100,205 | |

| Lease liabilities | 219 | | | 421 | |

| Other liabilities | 276 | | | 391 | |

| Total liabilities | 139,269 | | | 115,561 | |

| Net assets | $ | 126,815 | | | $ | 122,968 | |

a.Substantially all of the assets are available to settle obligations of the partnerships only.

b.The Kingwood Place construction loan has a 25.0 percent repayment guaranty and The Saint George construction loan has a completion guaranty and a 25.0 percent repayment guaranty. The guaranty of The Saint June construction loan converted to a 50.0 percent repayment guaranty upon completion of the project in fourth-quarter 2023. All of the rest of the debt is subject to a full repayment guaranty. Certain of the guaranties terminate if the project meets specified financial and other conditions. The creditors for the remaining liabilities do not have recourse to the general credit of Stratus. See Note 6 of the Stratus 2023 Form 10-K for additional information.

4. ASSET SALES

The Oaks at Lakeway. Stratus has remaining lease obligations pursuant to a Pad Sites Master Lease entered into in connection with the sale of The Oaks at Lakeway, as described in Note 9 of the Stratus 2023 Form 10-K under the heading “Deferred Gain on Sale of The Oaks at Lakeway.” A related contract liability is presented as a deferred gain in the consolidated balance sheets in the amount of $2.1 million at September 30, 2024 and $2.7 million at December 31, 2023. The reduction in the deferred gain balance primarily reflects Pad Sites Master Lease payments. The remaining deferred gain balance is expected to be reduced primarily by future Pad Sites Master Lease payments.

Amarra Villas. In third-quarter 2024, Stratus sold one of the Amarra Villas homes for $4.0 million. In second-quarter 2024, Stratus sold one of the Amarra Villas homes for $3.6 million. In first-quarter 2024, Stratus sold two of the Amarra Villas homes for a total of $7.6 million. In first-quarter 2023, Stratus sold one of the Amarra Villas homes for $2.5 million.

Magnolia Place. In third-quarter 2024, Stratus completed the sale of Magnolia Place – Retail for $8.9 million, generating a pre-tax net cash proceeds of approximately $8.6 million and a pre-tax gain of $1.6 million. In first-quarter 2024, Stratus completed the sale of approximately 47 acres of undeveloped land in Magnolia, Texas planned for a second phase of retail development, all remaining pad sites and up to 600 multi-family units, for

$14.5 million. In connection with this sale, the Magnolia Place construction loan, which had a balance of $8.8 million, was repaid.

5. FAIR VALUE MEASUREMENTS

Fair value accounting guidance includes a hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 inputs) and the lowest priority to unobservable inputs (Level 3 inputs).

The carrying value for certain Stratus financial instruments (i.e., cash and cash equivalents, restricted cash, accounts payable and accrued liabilities) approximates fair value because of their short-term nature and generally negligible credit losses.

The fair value of Stratus’ debt also approximates fair value, as the interest rates are variable and approximate prevailing market interest rates available for similar mortgage debt. Stratus’ debt is recorded at cost and is not actively traded. Fair value is estimated based on discounted future expected cash flows at estimated current market interest rates available for similar mortgage debt. Accordingly, Stratus’ debt is classified within Level 2 of the fair value hierarchy. The fair value of debt does not represent the amounts that will ultimately be paid upon the maturities of the loans.

6. DEBT AND EQUITY

Debt

The components of Stratus’ debt follow (in thousands):

| | | | | | | | | | | | |

| | September 30,

2024 | | December 31,

2023 | |

| Comerica Bank revolving credit facility | $ | — | | | $ | — | | |

| Jones Crossing loan | 22,402 | | | 22,340 | | |

| The Annie B land loan | 12,556 | | | 13,983 | | |

| Construction loans: | | | | |

| The Saint George | 42,555 | | | 24,657 | | |

| The Saint June | 30,525 | | | 27,668 | | |

| Kingwood Place | 28,894 | | | 28,160 | | |

Lantana Place | 22,744 | | | 22,961 | | |

| Holden Hills | 12,000 | | | 5,736 | | |

West Killeen Market | 5,210 | | | 5,250 | | |

Amarra Villas credit facility | 4,654 | | | 15,682 | | |

| Magnolia Place | — | | | 8,731 | | |

Total debt a | $ | 181,540 | | | $ | 175,168 | | |

a.Includes net reductions for unamortized debt issuance costs of $1.4 million at September 30, 2024, and $2.2 million at December 31, 2023.

Comerica Bank revolving credit facility. As of September 30, 2024, the maximum amount that could be borrowed under the Comerica Bank revolving credit facility was $52.9 million, resulting in availability of $39.6 million, net of letters of credit. Letters of credit, totaling $13.3 million, have been issued under the revolving credit facility, $11.0 million of which secure Stratus’ obligation to build certain roads and utilities facilities benefiting Holden Hills and Section N and $2.3 million of which secure Stratus’ obligations, which are subject to certain conditions, to construct and pay for certain utility infrastructure in Lakeway, Texas, which is expected to be utilized by the planned multi-family project on Stratus’ remaining land in Lakeway.

Jones Crossing loan. The Jones Crossing loan requires the Jones Crossing project to meet a debt service coverage ratio (DSCR) test of 1.15 to 1.00 measured quarterly, and starting June 30, 2023, on a rolling 12-month basis. If the DSCR falls below 1.15 to 1.00, a “Cash Sweep Period” (as defined in the Jones Crossing loan) results, which limits Stratus’ ability to receive cash from its Jones Crossing subsidiary. The DSCR fell below 1.15 to 1.00 in each of fourth-quarter 2022 and first-quarter 2023, and the Jones Crossing subsidiary made principal payments of $231 thousand and $1.7 million in February 2023 and May 2023, respectively, to bring the DSCR back above the threshold and a Cash Sweep Period did not occur. As permitted under the Jones Crossing loan agreement, in

August 2023 the Jones Crossing subsidiary separated the ground lease for the multi-family parcel (the Multi-Family Phase) from the primary ground lease, and the Multi-Family Phase was released from the loan collateral. In October 2023, the Jones Crossing loan was modified effective August 1, 2023 to remove the Multi-Family Phase from certain defined terms and to revise the DSCR calculation to exclude the Multi-Family Phase from expenses on a retroactive basis beginning in second-quarter 2023. Accordingly, the DSCR met the threshold in second-quarter and third-quarter 2023. In fourth-quarter 2023, the DSCR was slightly below the threshold, and a $13 thousand principal payment was made in first-quarter 2024 to bring the DSCR back above the threshold and a Cash Sweep Period did not occur.

The Annie B land loan. In February 2024, The Annie B land loan was modified to extend the maturity to September 1, 2025, and change the interest rate to Term SOFR Rate plus 3.00 percent. Under The Annie B land loan, Term SOFR Rate is defined as one-month Term SOFR plus 0.10 percent and is subject to a floor of 0.50 percent. In connection with the modification, Stratus made a $1.4 million principal payment on the loan and is required to make another principal payment of $630 thousand in February 2025.

The Saint June construction loan. In October 2024, The Saint June construction loan was modified to (i) extend the maturity date of the loan to October 2, 2025; (ii) increase the aggregate commitment under the loan by $2.0 million to $32.3 million; (iii) decrease the interest rate applicable margin from 2.85 percent to 2.35 percent; and (iv) require payment of an exit fee for prepayments and repayments of the loan of 1.00 percent of the principal amount of such amounts repaid, subject to certain exceptions. Accordingly, the loan bears interest at the one-month Term SOFR plus 2.35 percent, subject to a 3.50 percent floor. The loan is payable in monthly installments of principal and interest of approximately $40,000, with the outstanding principal due at maturity. The Saint June, L.P. has an option to extend the maturity of the loan for an additional 12-month term if certain conditions are met.

Amarra Villas credit facility. In June 2024, the Amarra Villas credit facility was modified to, among other things, extend the maturity to June 19, 2026, change the interest rate to Term SOFR Rate plus 3.00 percent (subject to a floor of 5.00 percent) and lower the commitment amount from $18.0 million to $10.5 million. Under the Amarra Villas credit facility, Term SOFR Rate is defined as one-month Term SOFR plus 0.10 percent and is subject to a floor of 0.50 percent.

Principal paydowns occur as homes are sold, and amounts are borrowed as homes are constructed. Paydowns made in connection with a sale of an Amarra Villas home reduce the commitment amount by the amount of the payment, and such amounts may not be re-borrowed. In third-quarter 2024, Stratus made a $3.7 million principal payment on the credit facility upon the closing of a sale of one of the Amarra Villas homes. In second-quarter 2024, Stratus made a $3.5 million principal payment on the credit facility upon the closing of a sale of one of the Amarra Villas homes. In first-quarter 2024, Stratus made principal payments totaling $7.2 million on the credit facility upon the closing of the sales of two of the Amarra Villas homes. In first-quarter 2023, Stratus made a $2.2 million principal payment on the credit facility upon the closing of a sale of one of the Amarra Villas homes.

Magnolia Place construction loan. In February 2024, this loan was repaid in full in connection with the sale of approximately 47 acres of undeveloped land.

Change in benchmark interest rate on the Comerica Bank revolving credit facility and The Saint George and Holden Hills construction loans. In November 2024, in connection with the discontinuance of the BSBY benchmark rate, the benchmark interest rate on the Comerica Bank revolving credit facility and The Saint George and Holden Hills construction loans will be replaced. As adjusted, advances under the Comerica Bank revolving credit facility will bear interest at one-month Term SOFR plus 0.50 percent (with a floor of 0.00 percent), plus 4.00 percent. As adjusted, advances under The Saint George construction loan will bear interest at one-month Term SOFR plus 0.60 percent (with a floor of 0.00 percent) plus 2.35 percent. As adjusted, advances under the Holden Hills construction loan will bear interest at one-month Term SOFR plus 0.60 percent (with a floor of 0.50 percent), plus 3.00 percent.

For additional information regarding Stratus’ debt, refer to Note 6 in the Stratus 2023 Form 10-K.

Interest Expense and Capitalization. Interest costs (before capitalized interest) totaled $4.0 million in third-quarter 2024, $3.4 million in third-quarter 2023, $11.9 million for the first nine months of 2024 and $8.7 million for the first nine months of 2023. All of these interest costs were capitalized for all periods presented. Capitalized interest is primarily related to development activities at our Barton Creek properties (primarily Amarra Villas, Holden Hills and Section N) and The Saint George for the 2024 periods. Capitalized interest was primarily related to development

activities at our Barton Creek properties (primarily Holden Hills, Section N and The Saint June), The Saint George and The Annie B for the 2023 periods.

Equity

The Comerica Bank revolving credit facility, Amarra Villas credit facility, The Annie B land loan, The Saint George construction loan, Kingwood Place construction loan and Holden Hills construction loan require Comerica Bank’s prior written consent for any common stock repurchases in excess of $1.0 million or any dividend payments.

Dividends. On September 1, 2022, with written consent from Comerica Bank, Stratus’ Board of Directors (Board) declared a special cash dividend of $4.67 per share (totaling $40.0 million) on Stratus’ common stock, which was paid on September 29, 2022 to stockholders of record as of September 19, 2022. Accrued liabilities included $0.3 million as of September 30, 2024, and $0.6 million as of December 31, 2023, representing dividends accrued for unvested RSUs in accordance with the terms of the awards. The accrued dividends are paid to the holders of the RSUs as the RSUs vest.

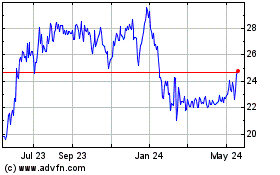

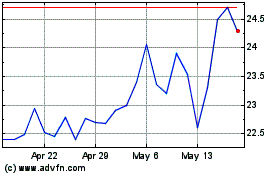

Share Repurchase Programs. In 2022, with written consent from Comerica Bank, Stratus’ Board approved a share repurchase program, which authorized repurchases of up to $10.0 million of Stratus’ common stock. The repurchase program authorized Stratus, in management’s discretion, to repurchase shares from time to time, subject to market conditions and other factors. In October 2023, Stratus completed the share repurchase program. In total, Stratus acquired 389,378 shares of its common stock under the share repurchase program for a total cost of $10.0 million at an average price of $25.68 per share. As required by the Inflation Reduction Act of 2022 (IR Act), Stratus recorded $22 thousand in excise tax in first-quarter 2024 for the 2023 share repurchases. The excise tax liability is included in accrued liabilities in the consolidated balance sheet.

In November 2023, with written consent from Comerica Bank, Stratus’ Board approved a new share repurchase program, which authorizes repurchases of up to $5.0 million of Stratus’ common stock. The repurchase program authorizes Stratus, in management’s and the Capital Committee of the Board’s discretion, to repurchase shares from time to time, subject to market conditions and other factors. As of September 30, 2024, Stratus had not purchased any shares under the new program.

7. PROFIT PARTICIPATION INCENTIVE PLAN AND LONG-TERM INCENTIVE PLAN

In July 2018, the Compensation Committee (the Committee) adopted the PPIP. In February 2023, the Committee approved the Long-term Incentive Plan (LTIP), which amends and restates the PPIP, and is effective for participation interests awarded under development projects on or after its effective date. Outstanding participation interests granted under the PPIP will continue to be governed by the terms of the prior PPIP. The PPIP and LTIP provide participants with economic incentives tied to the success of the development projects designated by the Committee as approved projects under the PPIP and LTIP. Estimates related to the awards may change over time as a result of differences between projected and actual development progress and costs, market conditions and the timing of capital transactions or valuation events. Refer to Notes 1 and 8 of the Stratus 2023 Form 10-K for further discussion.

In July 2023, Kingwood Place reached a valuation event under the PPIP and Stratus obtained an appraisal of the property to determine the payout under the PPIP. The accrued liability under the PPIP related to Kingwood Place was reduced to $1.6 million at December 31, 2023, and was settled in RSUs with a three-year vesting period awarded to eligible participants in the first quarter of 2024.

Under the terms of the PPIP and LTIP, the number of RSUs granted in connection with settlement of approved projects is determined by reference to the 12-month trailing average stock price for the year the project reaches a payment event, whereas the grant date fair value of the RSUs for accounting purposes is based on the grant date closing price.

A summary of PPIP/LTIP costs follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended | |

| September 30, | | September 30, | |

| 2024 | | 2023 | | 2024 | | 2023 | |

Charged to general and administrative expense | $ | 9 | | | $ | (205) | | | $ | 168 | | | $ | 84 | | |

| Capitalized (credited) to project development costs | (71) | | | 136 | | | 42 | | | 237 | | |

Total PPIP/LTIP costs | $ | (62) | | | $ | (69) | | | $ | 210 | | | $ | 321 | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

At September 30, 2024, outstanding awards under the PPIP included Amarra Villas, Jones Crossing – Retail, Magnolia Place and The Saint June, and outstanding awards under the LTIP included The Saint George. The accrued liability for the PPIP and LTIP totaled $1.8 million at September 30, 2024, and $3.1 million at December 31, 2023 (included in other liabilities).

8. INCOME TAXES

Stratus’ accounting policy for and other information regarding its income taxes are further described in Notes 1 and 7 in the Stratus 2023 Form 10-K.

Stratus has a full valuation allowance against its U.S. Federal net deferred tax assets as of both September 30, 2024 and December 31, 2023. Stratus has recorded a deferred tax asset totaling $173 thousand at both September 30, 2024 and December 31, 2023 related to state income taxes.

In evaluating the recoverability of the remaining deferred tax assets, management considered available positive and negative evidence, giving greater weight to the uncertainty regarding projected future financial results. Upon a change in facts and circumstances, management may conclude that sufficient positive evidence exists to support a reversal of, or decrease in, the valuation allowance in the future, which would favorably impact Stratus’ results of operations. Stratus’ future results of operations may be negatively impacted by an inability to realize a tax benefit for future tax losses or for items that will generate additional deferred tax assets that are not more likely than not to be realized.

The difference between Stratus’ consolidated effective income tax rate of (70) percent for the first nine months of 2024 and the U.S. Federal statutory income tax rate of 21 percent was primarily attributable to state income taxes, noncontrolling interests in subsidiaries, the presence of a valuation allowance against its U.S. Federal net deferred tax assets as of September 30, 2024, and the executive compensation limitation. The difference between Stratus’ consolidated effective income tax rate of (16) percent for the first nine months of 2023 and the U.S. Federal statutory income tax rate of 21 percent was primarily attributable to state income taxes, noncontrolling interests in subsidiaries, the presence of a valuation allowance against its U.S. Federal net deferred tax assets as of September 30, 2023, and the executive compensation limitation.

On August 16, 2022, the IR Act was enacted in the United States. Among other provisions, the IR Act imposes a new one percent excise tax on the fair market value of net corporate stock repurchases made by covered corporations, effective for tax years beginning after December 31, 2022. Stratus recorded $22 thousand in such excise taxes in first-quarter 2024 for share repurchases in 2023. Refer to Note 6 for discussion of Stratus’ share repurchase programs.

9. BUSINESS SEGMENTS

Stratus has two operating segments: Real Estate Operations and Leasing Operations.

The Real Estate Operations segment is comprised of Stratus’ real estate assets (developed for sale, under development and available for development), which consists of its properties in Austin, Texas (including the Barton Creek Community, which includes Section N, Holden Hills, Amarra multi-family and commercial land, Amarra Villas, Amarra Drive lots and other vacant land; the Circle C community; the Lantana community, which includes a portion of Lantana Place planned for a multi-family phase known as The Saint Julia; The Saint George; and the land for The Annie B); in Lakeway, Texas, located in the greater Austin area (Lakeway); in College Station, Texas (land for future phases of retail and multi-family development and retail pad sites at Jones Crossing); and in Magnolia, Texas (potential development of approximately 11 acres planned for future multi-family use), Kingwood, Texas (a retail pad site) and New Caney, Texas (New Caney), each located in the greater Houston area.

The Leasing Operations segment is comprised of Stratus’ real estate assets held for investment that are leased or available for lease and includes The Saint June, West Killeen Market, Kingwood Place, the retail portion of Lantana Place, the completed retail portion of Jones Crossing, retail pad sites subject to ground leases at Lantana Place, Kingwood Place and Jones Crossing, and, prior to its sale in third-quarter 2024, the retail portion of Magnolia Place.

Stratus uses operating income or loss to measure the performance of each segment. General and administrative expenses, which primarily consist of employee salaries, wages and other costs, are managed on a consolidated basis and are not allocated to Stratus’ operating segments. The following segment information reflects management determinations that may not be indicative of what the actual financial performance of each segment would be if it were an independent entity.

Revenues from Contracts with Customers. Stratus’ revenues from contracts with customers follow (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Real Estate Operations: | | | | | | | |

| Developed property sales | $ | 3,950 | | | $ | — | | | $ | 15,198 | | | $ | 2,493 | |

| Undeveloped property sales | — | | | — | | | 14,500 | | | — | |

| Commissions and other | 21 | | | — | | | 25 | | | 58 | |

| 3,971 | | | — | | | 29,723 | | | 2,551 | |

| Leasing Operations: | | | | | | | |

| Rental revenue | 4,920 | | | 3,669 | | | 14,165 | | | 10,450 | |

| 4,920 | | | 3,669 | | | 14,165 | | | 10,450 | |

| | | | | | | |

| Total revenues from contracts with customers | $ | 8,891 | | | $ | 3,669 | | | $ | 43,888 | | | $ | 13,001 | |

Financial Information by Business Segment. Summarized financial information by segment for the three months ended September 30, 2024, based on Stratus’ internal financial reporting system utilized by its chief operating decision maker, follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Real Estate Operations a | | Leasing Operations | | Corporate, Eliminations and Other b | | Total |

| Revenues: | | | | | | | |

| Unaffiliated customers | $ | 3,971 | | | $ | 4,920 | | | $ | — | | | $ | 8,891 | |

Cost of sales, excluding depreciation and amortization | (5,344) | | | (1,964) | | | — | | | (7,308) | |

| Depreciation and amortization | (48) | | | (1,333) | | | 16 | | | (1,365) | |

Gain on sale of assets c | — | | | 1,626 | | | — | | | 1,626 | |

| General and administrative expenses | — | | | — | | | (3,363) | | | (3,363) | |

| Operating (loss) income | $ | (1,421) | | | $ | 3,249 | | | $ | (3,347) | | | $ | (1,519) | |

Capital expenditures and purchases and development of real estate properties | $ | 6,608 | | | $ | 6,820 | | | $ | — | | | $ | 13,428 | |

Total assets at September 30, 2024 d | 349,701 | | | 154,257 | | | 19,222 | | | 523,180 | |

a.Includes sales commissions and other revenues together with related expenses.

b.Includes consolidated general and administrative expenses and eliminations of intersegment amounts.

c.Represents a pre-tax gain on the sale of Magnolia Place – Retail in third-quarter 2024 of $1.6 million.

d.Corporate, eliminations and other includes cash and cash equivalents and restricted cash of $18.7 million. The remaining cash and cash equivalents and restricted cash is reflected in the operating segments’ assets.

Summarized financial information by segment for the three months ended September 30, 2023, based on Stratus’ internal financial reporting system utilized by its chief operating decision maker, follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Real Estate Operations a | | Leasing Operations | | Corporate, Eliminations and Other b | | Total |

| Revenues: | | | | | | | |

| Unaffiliated customers | $ | — | | | $ | 3,669 | | | $ | — | | | $ | 3,669 | |

Cost of sales, excluding depreciation and amortization | (1,467) | | | (1,381) | | | — | | | (2,848) | |

| Depreciation and amortization | (38) | | | (934) | | | 5 | | | (967) | |

| General and administrative expenses | — | | | — | | | (3,183) | | | (3,183) | |

| Operating (loss) income | $ | (1,505) | | | $ | 1,354 | | | $ | (3,178) | | | $ | (3,329) | |

Capital expenditures and purchases and development of real estate properties | $ | 13,613 | | | $ | 12,701 | | | $ | — | | | $ | 26,314 | |

Total assets at September 30, 2023 c | 302,927 | | | 164,565 | | | 34,529 | | | 502,021 | |

a.Includes sales commissions and other revenues together with related expenses.

b.Includes consolidated general and administrative expenses and eliminations of intersegment amounts.

c.Corporate, eliminations and other includes cash and cash equivalents and restricted cash of $34.3 million. The remaining cash and cash equivalents and restricted cash is reflected in the operating segments’ assets.

Summarized financial information by segment for the first nine months ended September 30, 2024, based on Stratus’ internal financial reporting system utilized by its chief operating decision maker, follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Real Estate Operations a | | Leasing Operations | | Corporate, Eliminations and Other b | | Total |

| Revenues: | | | | | | | |

| Unaffiliated customers | $ | 29,723 | | | $ | 14,165 | | | $ | — | | | $ | 43,888 | |

Cost of sales, excluding depreciation and amortization | (25,046) | | | (5,384) | | | — | | | (30,430) | |

| Depreciation and amortization | (136) | | | (4,080) | | | 48 | | | (4,168) | |

Gain on sale of assets c | — | | | 1,626 | | | — | | | 1,626 | |

| General and administrative expenses | — | | | — | | | (11,670) | | | (11,670) | |

| Operating income (loss) | $ | 4,541 | | | $ | 6,327 | | | $ | (11,622) | | | $ | (754) | |

Capital expenditures and purchases and development of real estate properties | $ | 22,925 | | | $ | 22,962 | | | $ | — | | | $ | 45,887 | |

a.Includes sales commissions and other revenues together with related expenses.

b.Includes consolidated general and administrative expenses and eliminations of intersegment amounts.

c.Represents a pre-tax gain on the sale of Magnolia Place – Retail in third-quarter 2024 of $1.6 million.

Summarized financial information by segment for the first nine months ended September 30, 2023, based on Stratus’ internal financial reporting system utilized by its chief operating decision maker, follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Real Estate Operations a | | Leasing Operations | | Corporate, Eliminations and Other b | | Total |

| Revenues: | | | | | | | |

| Unaffiliated customers | $ | 2,551 | | | $ | 10,450 | | | $ | — | | | $ | 13,001 | |

Cost of sales, excluding depreciation and amortization | (8,651) | |

| (3,786) | | | — | | | (12,437) | |

| Depreciation and amortization | (115) | | | (2,764) | | | 14 | | | (2,865) | |

| General and administrative expenses | — | | | — | | | (11,973) | | | (11,973) | |

| Operating (loss) income | $ | (6,215) | | | $ | 3,900 | | | $ | (11,959) | | | $ | (14,274) | |

Capital expenditures and purchases and development of real estate properties | $ | 34,697 | | | $ | 36,178 | | | $ | — | | | $ | 70,875 | |

a.Includes sales commissions and other revenues together with related expenses.

b.Includes consolidated general and administrative expenses and eliminations of intersegment amounts.

10. SUBSEQUENT EVENTS

Stratus evaluated events after September 30, 2024, and through the date the financial statements were issued, and determined any events or transactions occurring during this period that would require recognition or disclosure are appropriately addressed in these financial statements.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

In Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A), “we,” “us,” “our” and “Stratus” refer to Stratus Properties Inc. and all entities owned or controlled by Stratus Properties Inc. You should read the following discussion in conjunction with our consolidated financial statements and accompanying notes, related MD&A and discussion of our business and properties included in our Annual Report on Form 10-K for the year ended December 31, 2023 (2023 Form 10-K) filed with the United States (U.S.) Securities and Exchange Commission (SEC) and the unaudited consolidated financial statements and accompanying notes included in this Form 10-Q. The results of operations reported and summarized below are not necessarily indicative of future operating results, and future results could differ materially from those anticipated in forward-looking statements (refer to “Cautionary Statement” and Part I, Item 1A. “Risk Factors” of our 2023 Form 10-K for further discussion). All subsequent references to “Notes” refer to Notes to Consolidated Financial Statements (Unaudited) located in Part I, Item 1. “Financial Statements” herein, unless otherwise stated.

OVERVIEW