60 Degrees Pharmaceuticals Announces Pricing of $2.4 Million Public Offering

31 January 2024 - 1:00AM

60 Degrees Pharmaceuticals, Inc. (

NASDAQ: SXTP;

SXTPW) (“60 Degrees Pharmaceuticals” or the “Company”),

specialists in developing and marketing new medicines for the

treatment and prevention of infectious diseases, announced today

the pricing of its public offering of 5,260,901 units (the “Units”)

at a price to the public of $0.385 per Unit and 999,076 pre-funded

units (the “Pre-Funded Units”) at a price to the public of $0.375

per Pre-Funded Unit. Each Unit consists of one share of common

stock and one warrant exercisable for one share of common stock

(the “Warrant”). Each Warrant will have an exercise price of

$0.4235 per share, be exercisable immediately upon issuance and

expire five years from the date of issuance. Each Pre-Funded

Unit consists of one pre-funded warrant exercisable for one share

of common stock (the “Pre-Funded Warrant”) and one Warrant

identical to the Warrants included in the Units. The purchase price

of each Pre-Funded Unit is equal to the price per Unit being

sold to the public in this offering, minus $0.01, and the exercise

price of each Pre-Funded Warrant is $0.01 per share. The Pre-Funded

Warrants will be immediately exercisable and may be exercised at

any time until all of the Pre-Funded Warrants are exercised in

full. The closing of the offering is expected to occur on or about

January 31, 2024, subject to the satisfaction of customary closing

conditions.

The underwriters have been granted an option,

exercisable within 45 days after the closing of this offering, to

purchase shares of the Company’s common stock at a price of $0.385

per share and/or Warrants at a price of $0.01 per Warrant and/or

Pre-Funded Warrants at a price of $0.375 per Pre-Funded Warrant, or

any combination of additional shares of common stock, Warrants

and/or Pre-Funded Warrants, representing, in the aggregate, up to

15% of the number of Units sold in this offering, 15% of the

Warrants underlying the Units and Pre-Funded Units sold in this

offering and 15% of the Pre-Funded Warrants underlying the

Pre-Funded Units sold in this offering, in all cases less the

underwriting discount to cover over-allotments, if any.

WallachBeth Capital LLC is the Sole Bookrunner for the offering.

Sichenzia Ross Ference Carmel LLP is acting as legal counsel to the

Company and TroyGould PC, is acting as legal counsel to the

underwriters.

The gross proceeds to the Company from the

offering are expected to be approximately $2.4 million, before

deducting underwriter fees and other offering expenses payable by

the Company. The Company intends to use the net proceeds from the

offering for working capital and general corporate purposes; the

relaunch of the Company’s FDA-approved ARAKODA®

(tafenoquine), for malaria prevention; and

research and development activities.

The offering is being conducted pursuant to the

Company’s registration statement on Form S-1 (File No. 333-276641)

previously filed with the Securities and Exchange Commission

(“SEC”) and declared effective by the SEC on January 29, 2024. A

final prospectus relating to the offering will be filed with the

SEC and will be available on the SEC’s website at www.sec.gov.

Electronic copies of the final prospectus relating to this

offering, when available, may be obtained from WallachBeth Capital,

LLC, via email: cap-mkts@wallachbeth.com, or by calling +1 (646)

237-8585, or by standard mail at WallachBeth Capital LLC, Attn:

Capital Markets, 185 Hudson St., Suite 1410, Jersey City, NJ 07311,

USA.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall there be any sale of these securities in any state or

other jurisdiction in which such offer, solicitation or sale would

be unlawful prior to the registration or qualification under the

securities laws of any such state or other jurisdiction.

About 60 Degrees Pharmaceuticals, Inc.

60 Degrees Pharmaceuticals, Inc., founded in

2010, specializes in developing and marketing new medicines for the

treatment and prevention of infectious diseases that affect the

lives of millions of people. 60 Degrees Pharmaceuticals

successfully achieved FDA approval of its lead product, ARAKODA®

(tafenoquine), for malaria prevention, in 2018. 60

Degrees Pharmaceuticals also collaborates with prominent research

organizations in the U.S., Australia and Singapore. 60 Degrees

Pharmaceuticals’ mission has been supported through in-kind funding

from the U.S. Department of Defense and private institutional

investors including Knight Therapeutics Inc., a Canadian-based

pan-American specialty pharmaceutical company. 60 Degrees

Pharmaceuticals is headquartered in Washington D.C., with a

majority-owned subsidiary in Australia. Learn more at

www.60degreespharma.com.

Forward-Looking Statements

The statements contained herein may include

prospects, statements of future expectations and other

forward-looking statements that are based on management’s current

views and assumptions and involve known and unknown risks and

uncertainties. Actual results, performance or events may differ

materially from those expressed or implied in such forward-looking

statements. Factors or events that could cause our actual results

to differ may emerge from time to time, and it is not possible for

us to predict all of them. The statements expressed herein are

those only of 60 Degrees Pharmaceuticals.

Forward-looking terminology, such as “may,”

“will,” “should,” “expect,” “anticipate,” “project,” “estimate,”

“intend,” “continue” or “believe” or the negatives thereof, or

other variations thereon or comparable terminology, may discuss our

plans, strategies, prospects and expectations concerning our

business, operating results, financial condition and other similar

matters. However, we are not able to predict accurately or control

these matters. Any forward-looking statement made by us in this

press release speaks only as of the date on which we make it. We

undertake no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

Media Contact:Sheila A. BurkeMethod Health

Communicationsmethodhealthcomms@gmail.com(484) 667-6330

Investor Contact:Patrick

Gaynespatrickgaynes@60degreespharma.com(310) 989-5666

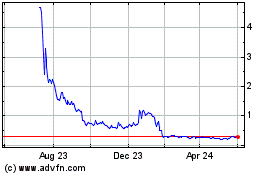

60 Degrees Pharmaceuticals (NASDAQ:SXTP)

Historical Stock Chart

From Dec 2024 to Jan 2025

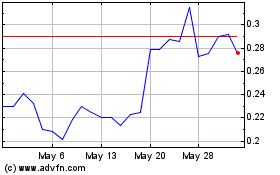

60 Degrees Pharmaceuticals (NASDAQ:SXTP)

Historical Stock Chart

From Jan 2024 to Jan 2025