Form 8-K - Current report

02 November 2024 - 8:20AM

Edgar (US Regulatory)

false

0001905956

0001905956

2024-10-29

2024-10-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

October 29, 2024

TREASURE GLOBAL INC

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41476 |

|

36-4965082 |

(State or other jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

|

276 5th Avenue, Suite 704 #739

New York, New York |

|

10001 |

| (Address of registrant’s principal executive office) |

|

(Zip code) |

+6012 643 7688

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.00001 per share |

|

TGL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

On October 29, 2024, Treasure Global Inc

(the “Company”) entered into a certain service agreement (the “Agreement”) with V GALLANT SDN BHD (“V

Gallant”), a private company incorporated in Malaysia. Pursuant to the Agreement, the Company engaged V Gallant for its

generative AI solutions and AI digital human technology services (the “Services”) in accordance with the terms and

conditions therein. The Company agreed to pay V Gallant a total consideration of USD16,000,000 to V Gallant and/or its nominees for

the Services and all associated hardware and software under the Agreement. The Services under this Agreement shall commence on

October 29, 2024, and shall be valid until December 31, 2025, unless the Agreement is mutually terminated or extended in writing or terminated by either the Company or V Gallant due to any breach or default of this Agreement, as the case may be.

The above summary of the Agreement is qualified

in its entirety by reference to the full text of the Agreement, which is attached hereto as Exhibit 10.1 and is incorporated herein by

reference.

Item 9.01. Financial Statement and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 1, 2024 |

TREASURE GLOBAL INC. |

| |

|

|

| |

By: |

/s/ Carlson Thow |

| |

Name: |

Carlson Thow |

| |

Title: |

Chief Executive Officer |

2

Exhibit 10.1

Dated 29 October

2024

TREASURE GLOBAL INC

(Registration No.: 790821)

(“TGL”)

AND

V GALLANT SDN BHD

(Registration No.: 202401039073 (1584920-W))

(“V GALLANT”)

SERVICE AGREEMENT

THIS AGREEMENT is made and entered into

on 29 October 2024,

BETWEEN

| (1) | TREASURE GLOBAL INC (Registration No. 790821), a company incorporated in Delaware and having an

address for service at 276, 5th Avenue Suite, 704 #739 New York, NY 10001, United States (“TGL”), |

AND

| (2) | V GALLANT SDN BHD (Registration No. 202401039073 (1584920-W)), a private company incorporated in

Malaysia and having its registered office at BO3-C-8, Menara 3A, 3, Jalan Bangsar, KL Eco City, 59200 Kuala Lumpur, Wilayah Persekutuan

Kuala Lumpur, Malaysia (“V Gallant”), |

TGL and V Gallant shall hereinafter individually

be referred to as “Party” and collectively referred to as “Parties”, where the context so requires.

RECITAL

| A. | TGL is a Malaysian solutions provider developing innovative technology platforms. |

| B. | V Gallant is principally involved in the trading of high-performance servers information technology hardware

and providing comprehensive information technology solutions. |

| C. | TGL wishes to develop an AI-enabled live streaming platform and AI digital human solutions. V Gallant

has expertise in developing generative AI solutions and AI digital human technology using technology supplied by NVIDIA Corporation (“NVIDIA”). |

| D. | TGL wishes to engage V Gallant for its Services and V Gallant agrees to provide its Service to TGL, in

accordance with the terms and conditions herein contained. V Gallant agrees to provide |

NOW THEREFORE, the Parties hereby mutually

agree as follows:

| 1. | DEFINITION AND INTERPRETATIONS |

In this Agreement, unless the context

or subject matter otherwise requires, the following words and expressions shall have the following meanings:

| |

“Agreement” |

: |

means this Service Agreement; |

| |

|

|

|

| |

“AI Digital Human Solutions” |

: |

means the artificial intelligence-powered digital human technology developed by V Gallant for TGL; |

| |

|

|

|

| |

“Event of Force Majeure” |

: |

has the meaning ascribed in Clause 11.1; |

| |

|

|

|

| |

“Fees” |

: |

means a total fee of USD16,000,000.00 (United States Dollars Sixteen Million) payable by TGL to V Gallant in accordance with Clause 4 of this Agreement; |

| |

|

|

|

| |

“IP Rights” |

: |

means patents, rights to inventions, copyright, trademarks, trade secrets, and all other intellectual property rights; |

| |

|

|

|

| |

“Live Streaming Platform” |

: |

means TGL’s proprietary platform developed by V Gallant incorporating AI Digital Human Solutions; |

| |

“NVIDIA KYC Requirements” |

: |

means the know-your-customer and compliance requirements imposed by NVIDIA in relation to the supply of the Products, as updated from time to time; |

| |

|

|

|

| |

“Other Expenses” |

: |

means all taxes and disbursements, e.g. travelling, dispatches, telephone calls, photocopying, correspondences and other customary expenses and any other out-of-pocket expenses or exceptional or additional costs which V Gallant may incur from time to time in connection with or incidental to the performance of the Services; |

| |

|

|

|

| |

“Services” |

: |

means the services to be provided by V Gallant to implement the AI Digital Human Solutions and Live Streaming Platform, more particularly described in the Clause 3 of this Agreement; |

| |

|

|

|

| |

“Term” |

: |

means the term of this Agreement as described in Clause 5 of this Agreement; and |

| |

|

|

|

| |

“TGL” |

: |

means Treasure Global Inc (Registration No. 790821), a company incorporated in the State of Delaware, United States and having an address for service at B03-C-13A, Menara 3A, KL Eco City, No. 3, Jalan Bangsar 59200 Kuala Lumpur; |

| |

|

|

|

| |

“TGL Shares” |

: |

means the ordinary shares in TGL; |

| |

|

|

|

| |

“Third Party Platforms” |

: |

means social media and content platforms including but not limited to TikTok, Instagram, Meta, Tencent, and other similar platforms; |

| |

|

|

|

| |

“True-Up Date” |

: |

means the expiry date of the sixth (6th) month from the day of the issuance of TGL Shares to V Gallant pursuant to Clause 4; |

| |

|

|

|

| |

“V Gallant” |

: |

means V Gallant Sdn Bhd (Registration No. 202401039073 (1584920-W)), a company incorporated in Malaysia, having its registered office at BO3-C-8, Menara 3A, 3, Jalan Bangsar, KL Eco City, 59200 Kuala Lumpur, Wilayah Persekutuan Kuala Lumpur, Malaysia; |

| |

|

|

|

| |

“VWAP” |

: |

means volume-weighted average price. |

Save to the extent that the context

or the express provisions of this Agreement otherwise require:

| (a) | words using the singular or plural number also include the plural or singular number, respectively; |

| (b) | the terms “hereof”, “herein”, “hereby”, “hereto” and similar

words refer to this entire Agreement and not any particular clause, schedule or any other subdivision of this Agreement; |

| (c) | a reference to a “clause” or “schedule” is to a clause or schedule to this Agreement; |

| (d) | the word “include” or “including” shall be deemed to be followed with “without

limitation” or “but not limited to” whether or not they are followed by such phrases or words of like import; |

| (e) | references to any statute or statutory provision shall be construed as a reference to the same as it may

have been, or may from time to time be, amended, modified or re-enacted; |

| (f) | references to “this Agreement” or any other agreement or document shall be construed as a

reference to such agreement or document as amended, modified or supplemented and in effect from time to time and shall include a reference

to any document which amends, modifies or supplements it, or is entered into, made or given pursuant to or in accordance with its terms; |

| (g) | the headings are for convenience only and shall be ignored in construing this Agreement; |

| (h) | references to persons include their successors and any permitted transferees and assigns; |

| (i) | no rule of construction shall apply to the detriment of any party by reason of that party having control

and/or was responsible for the preparation of this Agreement or any part thereof; |

| (j) | whenever this Agreement refers to a number of days, such reference shall be to calendar days unless business

days are specified; |

| (k) | in carrying out their obligations and duties under this Agreement, the Parties shall have an implied obligation

of good faith; and |

| (l) | each of the schedules and the appendices hereto shall form an integral part of this Agreement. |

| 2.1 | This Agreement is conditional upon TGL’s completion of all NVIDIA KYC Requirements to the satisfaction

of NVIDIA and receipt of NVIDIA’s approval in respect of any supply of NVIDIA products by V Gallant to TGL in the provision of the

Services. |

| 2.2 | V Gallant shall promptly inform TGL of all requisite NVIDIA KYC Requirements and use its best endeavours

to facilitate the process of obtaining approval from NVIDIA where necessary. |

| 2.3 | TGL shall provide all information and documentation reasonably required for NVIDIA KYC Requirements and

cooperate with any additional requests or inquiries from NVIDIA for purposes of the NVIDIA KYC Requirements. |

| 3.1 | Subject to the terms and conditions contained in this Agreement, TGL agrees to engage V Gallant and V

Gallant hereby agrees to provide the following Services to TGL: |

| 3.1.1 | V Gallant shall design, develop and deliver the Live Streaming Platform for TGL. The Platform shall be

engineered to enable high-quality live streaming capabilities enhanced by AI Digital Human Solutions, providing interactive experiences

that align with industry technical standards and user experience (UX) requirements; |

| 3.1.2 | V Gallant shall develop the Live Streaming Platform in accordance with TGL’s detailed specifications,

including but not limited to AI model development and training, digital human appearance and personality customization, language processing

and generation capabilities, emotional intelligence and expression systems, and real-time interaction mechanisms; |

| 3.1.3 | V Gallant shall ensure seamless integration of the AI Digital Human Solutions and Live Streaming Platform

with Third-Party Platforms, ensuring cross-platform compatibility and meeting performance standards; |

| 3.1.4 | V Gallant shall provide comprehensive ongoing technical support for both the Live Streaming Platform and

the AI Digital Human Solutions, including but not limited to bug detection and fixes, regular updates and troubleshooting to ensure consistent

performance; |

| 3.1.5 | V Gallant shall ensure that the Live Streaming Platform and the AI Digital Human Solutions comply with

all applicable technical standards, industry best practices and relevant regulations. This includes adhering to data security protocols,

data privacy laws, encryption standards, any specific requirements of the Third-Party Platforms, and adherence to streaming media standards

and protocols; and |

| 3.1.6 | V Gallant agrees to adhere to the project timeline as defined and agreed by both Parties. All deliverables

must be completed according to any specified deadline, with any potential delays communicated promptly and approved by TGL. |

| 3.2 | The Parties acknowledge that the Services outlined in this Clause 3 is not exhaustive and V Gallant may

perform other tasks and services as may be reasonably requested by TGL and agreed upon in writing. |

| 3.3 | V Gallant shall keep TGL informed about the progress of the Services from time to time and promptly respond

to TGL’s inquiries. |

| 4.1 | TGL agrees to pay V Gallant a total consideration of United States Dollar Sixteen Million (USD16,000,000)

(“Fees”) to V Gallant and/or its nominees for the Services and all associated hardware and software under this Agreement. |

| 4.2 | The total Fees include all software and hardware components that may be used by V Gallant in the delivery

of the Services, whether or not such components are listed in Schedule 1 (Hardware Components). |

| 4.3 | The Fees shall be payable by TGL to V Gallant and/or its nominees via the issuance of TGL Shares at a

determined issuance price of United States Dollar Sixty-Seven Cents (USD0.67) per TGL Share (“Issuance Price”) in the

following manner: |

| 4.3.1 | the first instalment, constituting a down payment of fifty percent (50%) of the Fees, being United States

Dollar Eight Million (USD8,000,000), shall be due upon execution of this Agreement; and |

| 4.3.2 | the remainder, constituting fifty percent (50%) of the Fees, being United States Dollar Eight Million

(USD8,000,000), shall be paid in twelve (12) equal monthly instalments, commencing from 31 January 2025, with each payment due on the

last day of each calendar month until 31 December 2025, unless otherwise mutually agreed in writing by the Parties. |

| 4.4 | The TGL Shares shall be issued on a restricted basis for a period of six (6) months pursuant to the requirements

of the Securities Act 1933, Rule 144. |

| 4.5 | On the True-Up Date, in the event that the 30-Day VWAP of the TGL Shares to be issued in accordance to

this Clause 4 falls below the amount of the Issuance Price, then TGL shall issue to V Gallant additional TGL Shares equal to the difference

between the Fees and the value of the TGL Shares on the True-up Date within fourteen (14) business days from the True-Up Date. |

| 4.6 | The Fees shall include all Other Expenses due and payable to V Gallant in rendering the Services under

this Agreement. |

| 5.1 | Both Parties acknowledge and agree that the Services under this Agreement shall commence on the date of

this Agreement (“Commencement Date”) and shall be valid until 31 December 2025 (“Term”) unless this

Agreement is mutually terminated in writing between the Parties or terminated by either Party due to any breach or default of this Agreement,

as the case may be. |

| 5.2 | This Agreement may be terminated at any time by either Party upon thirty (30) days written notice to the

Party. |

| 5.3 | The Term may be mutually extended in writing, and the Parties may negotiate any additional Fees applicable. |

| 5.4 | Notwithstanding the termination of this Agreement, the confidentiality obligations in this Agreement shall

survive the termination of this Agreement for one (1) year, or until the Confidential Information in question ceases to be confidential,

whichever is later. |

| 6. | INTELLECTUAL PROPERTY RIGHTS |

| 6.1 | Each Party shall retain all IP Rights owned by it prior to the Commencement Date (“Pre-Existing

IP”). |

| 6.2 | V Gallant hereby grants to TGL a perpetual and non-exclusive license to use any of V Gallant’s Pre-Existing

IP that is incorporated into or necessary for the use of the Live Streaming Platform or AI Digital Human Solutions. |

| 6.3 | All IP Rights in the Live Streaming Platform and AI Digital Human Solutions developed under this Agreement

(“Development IP”) shall vest in TGL upon successful completion of the development and acceptance testing, as evidence

by TGL’s written acceptance certificate. |

| 6.4 | Until the transfer of Development IP to TGL, V Gallant shall hold the Development IP in trust for TGL

and take all reasonable steps to protect it from unauthorized use or disclosure. |

| 6.5 | Where any third-party IP Rights are incorporated into the Live Streaming Platform or AI Digital Human

Solutions, V Gallant shall obtain all necessary licenses and rights and ensure the successful transfer to TGL for TGL’s intended

use. |

| 7. | CONFIDENTIAL INFORMATION |

| 7.1 | V Gallant acknowledges that during the Term, it may gain access to certain confidential and proprietary

information of TGL. Such confidential information may include, but is not limited to, trade secrets, financial information, client lists,

business plans, and operational strategies and any other information not in the public domain in relation to the affairs or business or

methods of carrying on business of the V Gallant and/or its subsidiaries and/or its affiliates (collectively referred to as “Confidential

Information”). |

| 7.2 | V Gallant shall use any Confidential Information revealed during the course of the Services, solely for

the purpose of the Services. V Gallant shall use its best effort to keep the Confidential Information in confidence and shall not disclose

any of the Confidential Information to any other person, provided, however, that it may make any disclosure of Confidential Information

to its representatives who on a need-to-know basis of such information and who agree to keep such information in confidence. |

| 7.3 | This Non-Disclosure of Confidential Information clause shall not apply to Confidential Information which

is or becomes publicly available, other than as a result of a breach of this provision or becomes lawfully available to both parties from

a third party free from any confidentiality restrictions. |

| 7.4 | Notwithstanding anything to the contrary herein, in the event of V Gallant’s termination, where

V Gallant may be required by law or by regulatory authority to, amongst others, disclose to the relevant authorities and the new consultation

service provider proposed to be appointed by TGL to replace V Gallant, if any, the termination together with the reason thereto, and V

Gallant may be required to make available all information relating to the incoming advisor, V Gallant agrees, to the extent practicable

to do so, to provide prior written notification to TGL of such disclosure. |

| 8. | REPRESENTATION, WARRANTIES AND UNDERTAKINGS |

| 8.1 | Each of the Parties represents, warrants, and undertakes to the other as follows: |

| 8.1.1 | it is duly organised or incorporated, validly existing under the laws of their respective countries of

its establishment and has full power and authority to own its assets and carry on its business; |

| 8.1.2 | it has full legal right, power and authority to execute, deliver and perform its obligations under this

Agreement; |

| 8.1.3 | all the necessary corporate resolutions and authorisations to enter into this Agreement and to perform

all obligations have been duly obtained; |

| 8.1.4 | by entering into this Agreement, it is not in breach or in contravention of any law or contract applicable

to it; |

| 8.1.5 | this Agreement, when executed, constitutes legal, valid and binding obligations, enforceable against it

in accordance with the terms thereof; and |

| 8.1.6 | the person signing this Agreement on behalf of it has been duly authorised to execute and deliver this

Agreement, including the prior approval by the Board of Directors of V Gallant and TGL. |

| 8.2 | In addition to the foregoing, V Gallant hereby represents and warrants to TGL as follows, which representations

and warranties shall be deemed repeated at all times throughout the Term: |

| 8.2.1 | it possesses all requisite expertise, experience and qualifications to provide the Services in accordance

with this Agreement; |

| 8.2.2 | it currently has in place a competent and qualified team of experts, advisors, technical employees and

all other relevant employees to provide the Services in accordance with this Agreement; |

| 8.2.3 | it will provide the Services with a reasonable standard of care, skill and professionalism consistent

with prevailing industry practices; |

| 8.2.4 | it will not breach or infringe the intellectual property rights of any other persons in discharging its

obligations contained in this Agreement; |

| 8.2.5 | it is duly licensed and authorised by the relevant authorities to provide the Services in accordance with

this Agreement; |

| 8.2.6 | in providing the Services under this Agreement, it will not breach any agreement, deed or other instruments

made by V Gallant with any other third parties; |

| 8.2.7 | the provision of the Services will not violate, infringe or contravene laws of Malaysia and any other

country in which TGL or any of its related or associated companies have a place of establishment or carries out business. |

Each Party will be solely responsible

for and bear all of its own respective expenses incurred at any time in connection with this Agreement.

| 10. | GOVERNING LAW AND JURISDICTION |

This Agreement and all matters arising

from or connected with it shall be governed by, construed and interpreted under the laws of Malaysia.

| 11.1 | Neither Party hereto shall be liable for any failure on its part to perform any obligations hereunder

resulting directly or indirectly from act of God, war or act of war, national emergency, flood, earthquake, boycott, blockade, embargo,

strike or lockout (other than a strike or lockout induced by the party so incapacitated), pandemic, movement control order, the action

or inaction of any governmental or local authority, civil disturbance or cause beyond their reasonable control (“Event of Force

Majeure”). |

| 11.2 | Each Party shall immediately notify the other Party in writing of the occurrence of any event of Force

Majeure applicable to its obligations under this Agreement, its consequences. If either Party considers the event of Force Majeure to

be of such severity or to be continuing for an aggregate period of three (3) months such that the Party is unable to perform any of its

obligations hereunder, this Agreement may be terminated by that Party by notice in writing to the other Party, which termination may take

effect immediately or on the date specified in the notice of termination at the option of the Party issuing the termination notice. Neither

Party shall have any liability to the other in respect of the termination of this Agreement as a result of the Event of Force Majeure

save and except for any antecedent breach or liability, which has arisen prior to the Event of Force Majeure. |

Any provision of this Agreement which

is invalid in respect of any law, regulation or any authority shall be invalid, without invalidating or affecting the remaining provisions

of this Agreement.

This Agreement may be signed in any

number of counterparts, each of which shall be deemed an original and all of which when taken together shall constitute one and the same

instrument.

This Agreement

constitutes the entire agreement between the Parties hereto with respect to the matters dealt with therein and supersedes any previous

agreement or understanding between the Parties hereto in relation to such matters.

[The rest

of this page is intentionally left blank]

This Agreement has been signed as and on behalf

of each of the Parties hereto and delivered on the date first above written.

TGL

|

Signed by

For and on behalf of

TREASURE GLOBAL INC

(Registration No. 790821) |

)

)

)

)

) |

|

| |

|

| |

Signatory |

| |

Name (in full): Carlson Thow |

V Gallant

|

Signed by

For and on behalf of

V GALLANT SDN BHD

(Registration No.: 202401039073

(1584920-W)) |

)

)

)

)

) |

|

| |

|

| |

Signatory |

| |

Name (in full): Dato’ Hoo Voon Him |

SCHEDULE 1

SOFTWARE AND HARDWARE COMPONENTS

This Schedule provides an indicative, non-exhaustive

list of hardware components that may be used in the development process. The development process may include software components which

are not stipulated in this Schedule. The components used may vary based on project requirements and technological developments but shall

meet the technical requirements and specifications set forth in this Schedule.

11

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

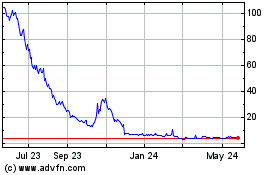

Treasure Global (NASDAQ:TGL)

Historical Stock Chart

From Feb 2025 to Mar 2025

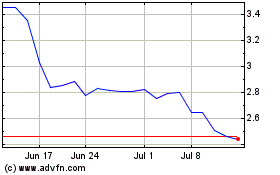

Treasure Global (NASDAQ:TGL)

Historical Stock Chart

From Mar 2024 to Mar 2025