UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of January 2025

Commission file number: 001-41516

TH International Limited

2501 Central Plaza

227 Huangpi North Road

Shanghai, People’s Republic of China,

200003

+86-021-6136-6616

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

EXPLANATORY NOTE

On January 24, 2025, TH International Limited (the “Company”)

issued a press release announcing its receipt of a staff determination letter from Nasdaq notifying the Company that because the Company

had not regained compliance with the Nasdaq requirement to maintain a minimum closing bid price of $1.00 per share, unless the Company

requests an appeal of this determination, the Company’s ordinary shares would be scheduled for delisting from The Nasdaq Capital

Market.

The Company plans to timely request a hearing before the Panel, if

necessary, which will stay the suspension and the Company’s ordinary shares will continue to trade on Nasdaq pending the decision.

To regain compliance, an issuer must evidence a closing bid price of at least $1.00 per share for a minimum of 10, though generally not

more than 20, consecutive trading days. Following the Company’s implementation of a reverse stock split on January 13, 2025, the

bid price for the Company’s ordinary shares has closed above $1.00 per share for 9 consecutive trading days as of the close of the

market today.

A copy of the press release is filed as Exhibit 99.1 to this Report

on Form 6-K and is incorporated herein by reference.

INDEX TO EXHIBITS

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

TH International Limited |

| |

|

| |

/s/ Yongchen Lu |

| |

Yongchen Lu |

| |

Chief Executive Officer |

Date: January 24, 2025

3

Exhibit 99.1

Tims China Announces Receipt of Listing

Notice from Nasdaq

SHANGHAI and NEW YORK, January 24, 2025

(GLOBE NEWSWIRE) -- -- TH International Limited (Nasdaq: THCH) (the “Company”), the exclusive operator of Tim

Hortons coffee shops in China, today announced that on January 21, 2025, the Company received notice from the Listing Qualifications

Staff (the “Staff”) of The Nasdaq Stock Market LLC (“Nasdaq”) indicating that, due to the Company’s

continued non-compliance with the minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) (the “Rule”)

as of January 15, 2025, unless the Company timely requests a hearing before a Nasdaq Hearings Panel (the “Panel”), the

Staff had determined to delist the Company’s ordinary shares. The Company plans to timely request a hearing before the Panel, if necessary. The request

for a hearing will stay any further delisting action by Nasdaq at least until the Staff renders a compliance determination or the

hearing is held and any extension that may be granted by the Panel following the hearing expires.

As previously disclosed, on July 19, 2024, the

Staff notified the Company that the bid price of its ordinary shares had closed below $1.00 per share for the previous 30 consecutive

business days, and, in accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company received a 180-calendar day period to regain compliance

with the Rule, through January 15, 2025. The Company did not evidence compliance with the Rule by January 15, 2025, and was not otherwise

eligible for a second 180-day grace period to do so. Accordingly, the Staff was required to issue the notice dated January 21, 2025.

To evidence compliance with the Rule, an

issuer must evidence a closing bid price of at least $1.00 per share for a minimum of 10, though generally not more than 20, consecutive

trading days. Following the Company’s implementation of a reverse stock split on January 13, 2025, the bid price for the Company’s

ordinary shares has closed above $1.00 per share for 9 consecutive trading days as of the close of the market today.

ABOUT TH INTERNATIONAL LIMITED

TH International Limited (Nasdaq: THCH) (“Tims

China”) is the parent company of the exclusive master franchisees of Tim Hortons coffee shops in mainland China, Hong Kong and Macau.

Tims China was founded by Cartesian Capital Group and Tim Hortons Restaurants International, a subsidiary of Restaurant Brands International

(TSX: QSR) (NYSE: QSR).

The Company’s philosophy is rooted in world-class

execution and data-driven decision making and centered around true local relevance, continuous innovation, genuine community, and absolute

convenience. For more information, please visit https://www.timschina.com.

FORWARD-LOOKING STATEMENTS

Certain statements in this earnings release may be

considered forward-looking statements within the meaning of the “safe harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995, such as the Company’s ability to further grow its business and store network, optimize its cost structure,

improve its operational efficiency, and achieve profitable growth. Forward-looking statements are statements that are not historical facts

and generally relate to future events or the Company’s future financial or other performance metrics. In some cases, you can identify

forward-looking statements by terminology such as “believe,” “may,” “will,” “potentially,”

“estimate,” “continue,” “anticipate,” “intend,” “could,” “would,”

“project,” “target,” “plan,” “expect,” or the negatives of these terms or variations of

them or similar terminology. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results

to differ materially from those expressed or implied by such forward looking statements. New risks and uncertainties may emerge from time

to time, and it is not possible to predict all risks and uncertainties. These forward-looking statements are based upon estimates and

assumptions that, while considered reasonable by the Company and its management, as the case may be, are inherently uncertain and subject

to material change. Factors that may cause actual results to differ materially from current expectations include various factors beyond

management’s control, including, but not limited to, general economic conditions and other risks, uncertainties and factors set

forth in the sections entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements”

in the Company’s Annual Report on Form 20-F, and other filings it makes with the Securities and Exchange Commission. Nothing in

this communication should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved

or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking

statements in this communication, which speak only as of the date they are made and are qualified in their entirety by reference to the

cautionary statements herein. Except as required by law, the Company expressly disclaims any obligations or undertaking to release publicly

any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations

with respect thereto or any change in events, conditions, or circumstances on which any statement is based.

INVESTOR AND MEDIA CONTACTS

Investor Relations

Gemma Bakx

IR@timschina.com, or gemma.bakx@cartesiangroup.com

Public and Media Relations

Patty Yu

Patty.Yu@timschina.com

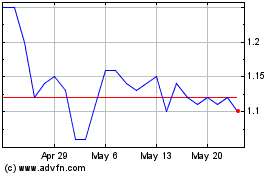

TH (NASDAQ:THCH)

Historical Stock Chart

From Feb 2025 to Mar 2025

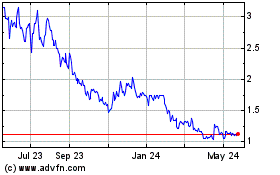

TH (NASDAQ:THCH)

Historical Stock Chart

From Mar 2024 to Mar 2025