Coincheck Group N.V. ordinary shares and

warrants to begin trading on Nasdaq on December 11, 2024 as “CNCK”

and “CNCKW,” respectively.

Coincheck Group N.V. (“Coincheck”), a Dutch public limited

liability company and a holding company of a cryptocurrency trading

service company, and Thunder Bridge Capital Partners IV, Inc.

(Nasdaq: THCP, THCPU & THCPW) (“Thunder Bridge IV”), a special

purpose acquisition company, announced today the consummation of

their previously announced business combination. As a result, the

ordinary shares and warrants of Coincheck will commence trading on

Nasdaq on December 11, 2024 under the new ticker symbols “CNCK” and

“CNCKW,” respectively. The business combination was approved at a

special meeting of the shareholders of Thunder Bridge IV on

December 5, 2024.

“The completion of our business combination with Thunder Bridge

IV marks an extraordinary milestone for Coincheck,” said Oki

Matsumoto, Representative Executive Officer and Chairman of Monex

Group, Inc., and Executive Chairman of Coincheck. “Coincheck was

created through the fusion of a robust business foundation built in

Japan, combined with the strengths of the U.S. capital markets

through the close collaboration of exceptional business and capital

markets talent in both Japan and the U.S. We are incredibly proud

and excited to become a Nasdaq listed company and for what the

future holds for the Coincheck group companies and our

shareholders.”

“We are pleased to announce the closing of our merger with the

entire Coincheck team,” said Gary Simanson, President and CEO of

Thunder Bridge IV. “As a member of the board of directors and CEO

of Coincheck, I look forward to partnering with Oki and his team to

build one of the preeminent global crypto and Web3 companies in the

world.”

Coincheck Group N.V. (“CNCK” and “CNCKW”), is a global holding

company, headquartered in the Netherlands, operating in the crypto

asset and Web3 domains, and is the parent company of Coincheck,

Inc. (“Coincheck Japan”), which operates the regulated crypto asset

trading service “Coincheck” in Japan. Coincheck Japan is the

leading crypto asset exchange in Japan and is one of the most

established and trusted names in crypto. Coincheck Japan has been

recognized as Japan’s No.1* most downloaded trading app for five

consecutive years. Coincheck is on a mission to “Make Exchange of

New Value Easier” by utilizing crypto assets and blockchain

technology.

Coincheck Group N.V. is one of only two publicly listed

companies on NASDAQ having a crypto asset exchange as its core

business. As a newly listed NASDAQ company, and “Your Trusted

Global Partner in the Digital World,” Coincheck is well-positioned

to further solidify the group’s dominant position in Japan’s crypto

asset trading industry and to establish the group as a global

player in the crypto and Web3 industry worldwide.

The business combination resulted in gross proceeds of

approximately $31.6 million to the combined company, including

funds held in a restricted account pursuant to the terms of the

previously announced non-redemption agreement, and net of Thunder

Bridge IV shareholder redemptions.

J.P. Morgan Securities LLC served as sole financial advisor to

Monex Group, Inc., Coincheck Japan’s former direct parent company

and now the parent company of Coincheck, in connection with the

business combination. Galaxy Digital Partners LLC served as

financial advisor to Thunder Bridge IV and Barclays Capital Inc,

BTIG, LLC, Cantor Fitzgerald & Co., Inc, Keefe, Bruyette &

Woods, Inc., a Stifel Company, and KeyBanc Capital Markets Inc.

served as capital markets advisors to Thunder Bridge IV in

connection with the business combination. Nelson Mullins Riley

& Scarborough LLP, Mori Hamada & Matsumoto, Littler

Mendelson P.C. and Allen & Overy LLP served as legal advisors

to Thunder Bridge IV and Simpson Thacher & Bartlett LLP,

Anderson Mori & Tomotsune, and De Brauw Blackstone Westbroek

N.V. served as legal advisors to Coincheck and Monex Group,

Inc.

Forward Looking

Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Such statements include, but are not limited to, statements

about trading, future financial and operating results, plans,

objectives, expectations and intentions with respect to future

operations, products and services; and other statements identified

by words such as “will likely result,” “are expected to,” “will

continue,” “is anticipated,” “estimated,” “believe,” “intend,”

“plan,” “projection,” “outlook” or words of similar meaning or the

negative thereof. These forward-looking statements include, but are

not limited to, statements regarding Coincheck’s trading, industry

and market sizes, future opportunities for Coincheck , Coincheck

Japan and Thunder Bridge IV, Coincheck’s estimated future results

and the business combination between Thunder Bridge IV and

Coincheck.. Such forward-looking statements are based upon the

current beliefs and expectations of our management and are

inherently subject to significant business, economic and

competitive uncertainties and contingencies, many of which are

difficult to predict and generally beyond our control, which could

cause actual results or events to differ materially from those

presently anticipated including (i) a delay or failure to realize

the expected benefits from the business combination, (ii) risks

related to disruption of management’s time from ongoing business

operations due to the business combination, (iii) changes in the

cryptocurrency and digital asset markets in which Coincheck

competes, including with respect to its competitive landscape,

technology evolution or regulatory changes, (iv) changes in

domestic and global general economic conditions, (v) risk that

Coincheck may not be able to execute its growth strategies,

including identifying and executing acquisitions, (vi) risk that

Coincheck may not be able to develop and maintain effective

internal controls and (vii) and other risks and uncertainties

discussed in Coincheck’s filings with the U.S. Securities and

Exchange Commission. Coincheck undertakes no obligation to publicly

update or review any forward-looking statement, whether as a result

of new information, future developments, or otherwise, except as

required by law.

About Coincheck Group N.V.

Coincheck Group N.V. is a Dutch public limited liability company

and a holding company of Coincheck, Inc., , which operates the

“Coincheck” cryptocurrency trading service, and has achieved the

highest number of app downloads in Japan for 5 consecutive years*.

With the mission of “Making Exchange of New Value Easier,”

Coincheck, Inc. aims to create better services that allow people to

feel the value of new exchanges created by cryptocurrencies and

blockchain technologies, through the latest technology and advanced

security.

*Target: Cryptocurrency trading app in Japan, Period: January

2019-December 2023, Data cooperation: App Tweak

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241210703460/en/

Coincheck Group N.V. Media Relations For inquiries from

the press regarding this release, please contact: Coincheck Group

N.V. Public Relations coincheckIR@icrinc.com

Coincheck Group N.V. Investor Relations For inquiries

from the press regarding this release, please contact:

coincheckIR@icrinc.com

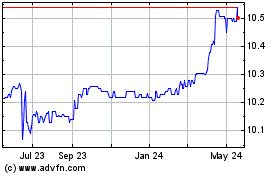

Thunder Bridge Captial P... (NASDAQ:THCP)

Historical Stock Chart

From Dec 2024 to Jan 2025

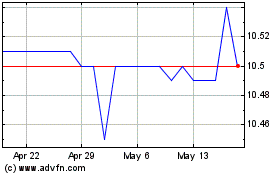

Thunder Bridge Captial P... (NASDAQ:THCP)

Historical Stock Chart

From Jan 2024 to Jan 2025