Third Harmonic Bio, Inc. (Nasdaq: THRD), a biopharmaceutical

company focused on advancing the next wave of medicine for

inflammatory diseases, today reported financial results for the

fourth quarter and full year ended December 31, 2023.

“Our team’s execution continues to be outstanding,

with the filing of our U.S. IND for THB335 ahead of our internal

timelines for submission,” said Natalie Holles, Chief Executive

Officer of Third Harmonic Bio. “We look forward to the agency’s

feedback and the opportunity to initiate clinical studies during

the second quarter for this potentially first-in-class oral

wild-type KIT inhibitor for the treatment of chronic spontaneous

urticaria and other mast cell-mediated inflammatory diseases.”

The Phase 1 SAD/14-day MAD study is designed to

evaluate safety, pharmacokinetics and pharmacodynamics of THB335 in

healthy volunteers, followed by planned Phase 2 expansion initially

focusing on chronic spontaneous urticaria.

Third Harmonic Bio has a strong financial position

with cash and cash equivalents totaling $269.1 million as of

December 31, 2023, and continues to be managed in a capital

efficient manner.

Summary of Financial Results

Cash Position: Cash and cash

equivalents totaled $269.1 million as of December 31, 2023.

Based on the company’s current operating plan, Third Harmonic Bio

believes that its existing cash and cash equivalents will be

sufficient to fund its operating expenses and capital expenditure

requirements through at least 2026.

R&D Expenses: Research and

development (R&D) expenses decreased to $5.9 million for the

three months ended December 31, 2023, from $9.3 million for

the same period in 2022. R&D expenses for the year ended

December 31, 2023 decreased to $24.0 million, from $24.4

million for the same period in 2022. The decreases were primarily

due to decreases in development costs relating to the termination

of the THB001 program, partially offset by increases in discovery

and development and personnel-related costs relating to the

research and nonclinical development of THB335 and other

next-generation discovery efforts.

G&A Expenses: General and

administrative (G&A) expenses increased to $4.5 million for the

three months ended December 31, 2023, from $4.3 million for

the same period in 2022. G&A expenses for the year ended

December 31, 2023 increased to $20.0 million, from $13.3

million for the same period in 2022. The increases were primarily

attributable to increased costs associated with being a public

company and personnel-related expenses.

Net Loss: Net loss for the three

months ended December 31, 2023 decreased to $6.8 million from

a net loss of $11.5 million for the same period in 2022. Net loss

for the year ended December 31, 2023 was $30.8 million,

compared to a net loss of $35.2 million for the same period in

2022. The decreases were primarily due to increased costs

associated with being a public company and personnel-related

expenses, partially offset by increases in interest income.

About Third Harmonic Bio, Inc.

Third Harmonic Bio is a biopharmaceutical company

focused on advancing the next wave of medicine for inflammatory

diseases through the development of novel, highly selective,

small-molecule inhibitors of KIT, a cell surface receptor that

serves as the master regulator of mast cell function and survival.

Early clinical studies demonstrate that KIT inhibition has the

potential to revolutionize the treatment of a broad range of

mast-cell-mediated inflammatory diseases, and that a titratable,

oral small molecule inhibitor may provide the optimal therapeutic

profile against this target. Third Harmonic Bio’s lead product

candidate, THB335, is a titratable, oral, small molecule inhibitor

expected to enter clinical trials during the second quarter of

2024. For more information, please visit the Third Harmonic Bio

website: www.thirdharmonicbio.com.

Forward-Looking Statement

This press release contains “forward-looking”

statements within the meaning of the safe harbor provisions of the

U.S. Private Securities Litigation Reform Act of 1995, including,

but not limited to, the expected timing for clinical activities for

THB335, and the sufficiency of Third Harmonic Bio’s cash and cash

equivalents to fund its operating expenses and capital expenditure

requirements through at least 2026. Forward-looking statements can

be identified by words such as: “anticipate,” “intend,” “plan,”

“goal,” “seek,” “believe,” “project,” “estimate,” “expect,”

“strategy,” “future,” “likely,” “may,” “should,” “will” and similar

references to future periods. These statements are subject to

numerous risks and uncertainties, including risks and uncertainties

related to Third Harmonic Bio’s cash forecasts, ability to advance

its product candidates, the receipt and timing of potential

regulatory submissions, designations, approvals and

commercialization of product candidates, our ability to protect our

intellectual property, the timing and results of preclinical and

clinical trials, changes to laws or regulations, market conditions,

geopolitical events, and further impacts of pandemics or health

epidemics, that could cause actual results to differ materially

from what Third Harmonic Bio expects. Further information on

potential risk factors that could affect Third Harmonic Bio’s

business and its financial results are detailed under the heading

“Risk Factors” included in Third Harmonic Bio’s Annual Report on

Form 10-K for the year ended December 31, 2023, filed with the

U.S. Securities and Exchange Commission (SEC) on March 26, 2024,

and in Third Harmonic Bio’s other filings filed from time to time

with the SEC. Third Harmonic Bio undertakes no obligation to

publicly update any forward-looking statement, whether written or

oral, that may be made from time to time, whether as a result of

new information, future developments or otherwise.

Investor and Media Contact:

Lori Murray lori.murray@thirdharmonicbio.com

|

THIRD HARMONIC BIO, INC.Condensed

consolidated balance sheet

data(Unaudited) |

|

|

(In thousands) |

|

|

|

|

|

|

December 31, 2022 |

|

December 31, 2023 |

|

|

Assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

288,877 |

|

$ |

269,070 |

|

|

Other current assets |

|

3,958 |

|

|

3,376 |

|

|

Non-current assets |

|

5,840 |

|

|

5,265 |

|

|

Total assets |

$ |

298,675 |

|

$ |

277,711 |

|

|

Liabilities |

|

|

|

|

|

|

|

Current liabilities |

$ |

5,653 |

|

$ |

5,418 |

|

|

Non-current liabilities |

|

3,954 |

|

|

3,208 |

|

|

Total liabilities |

|

9,607 |

|

|

8,626 |

|

|

Stockholders' equity |

|

289,068 |

|

|

269,085 |

|

|

Total liabilities and stockholders'

equity |

$ |

298,675 |

|

$ |

277,711 |

|

|

|

|

|

THIRD HARMONIC BIO, INC.Condensed

consolidated statements of

operations(Unaudited) |

|

|

(In thousands of, except per share and share amounts) |

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

|

|

2022 |

|

|

|

2023 |

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

$ |

24,407 |

|

|

$ |

23,964 |

|

|

|

General and administrative |

|

13,301 |

|

|

|

19,990 |

|

|

|

Total operating expenses |

|

37,708 |

|

|

|

43,954 |

|

|

|

Loss from operations |

|

37,708 |

|

|

|

43,954 |

|

|

|

Other (income) expense, net |

|

(2,553 |

) |

|

|

(13,130 |

) |

|

|

Net loss |

$ |

35,155 |

|

|

$ |

30,824 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share of common stock, basic and diluted |

$ |

2.45 |

|

|

$ |

0.78 |

|

|

|

Weighted-average common stock outstanding, basic and diluted |

|

14,353,102 |

|

|

|

39,645,392 |

|

|

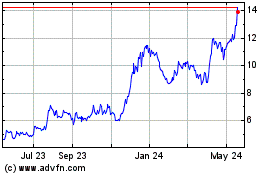

Third Harmonic Bio (NASDAQ:THRD)

Historical Stock Chart

From Jan 2025 to Feb 2025

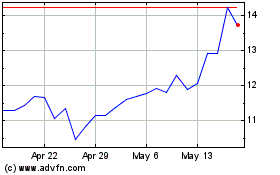

Third Harmonic Bio (NASDAQ:THRD)

Historical Stock Chart

From Feb 2024 to Feb 2025