0001858848false00018588482025-02-062025-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 06, 2025 |

Tenaya Therapeutics, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40656 |

81-3789973 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

171 Oyster Point Boulevard Suite 500 |

|

South San Francisco, California |

|

94080 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (650) 825-6990 |

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

TNYA |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(c) Appointment of Principal Accounting Officer

Effective February 6, 2025, Mr. Tomohiro Higa, Senior Vice President, Finance, of Tenaya Therapeutics, Inc. (the “Company”), will assume the role of Interim Principal Accounting Officer (“Interim PAO”) for the Company in addition to his role as Senior Vice President, Finance.

Mr. Higa, age 56, has served as Tenaya’s Senior Vice President, Finance since January 2025 and previously as Vice President, Finance, from January 2020 until January 2025. Prior to joining the Company, Mr. Higa was Senior Director, Finance at CytomX Therapeutics, Inc. from January 2018 to January 2020 and as Senior Director, Finance at OncoMed Pharmaceuticals, Inc. from December 2014 to April 2017, each a publicly traded biopharmaceutical company. From 2006 to October 2014, he held various roles of increasing responsibility in the finance department at Amgen Inc. (“Amgen”) culminating in Director, Finance – Global Operations. Prior to Amgen, he served in several finance focused roles, including as Associate Director, Corporate Finance at Abgenix, Inc. and as Manager, Financial Planning & Analysis at Ventro Corporation (formerly Chemdex Corporation). Mr. Higa holds a B.A. in Economics from The University of Chicago and an M.B.A. from The University of Chicago Booth School of Business.

There are no arrangements or understandings between Mr. Higa and any other persons in connection with Mr. Higa’s appointment as Interim PAO. Mr. Higa has no family relationships with any of the Company’s directors or executive officers, and he has no direct or indirect material interest in any transaction or proposed transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K promulgated under the Exchange Act. Mr. Higa is continuing under the terms of his existing compensation arrangement with the Company.

In connection with Mr. Higa’s appointment, the Company plans to enter into its standard form of director and officer indemnification agreement with Mr. Higa. The foregoing description of the indemnification agreement is qualified in its entirety by reference to the full text of such agreement, the form of which was filed as Exhibit 10.1 to the Company’s registration statement on Form S-1/A, filed with the SEC on June 26, 2021, and incorporated in this Item 5.02 by reference.

(e) Repricing of Designated Underwater Options

The Board of Directors (the “Board”) of the Company approved an option repricing applicable to Faraz Ali, the Company’s Chief Executive Officer, effective as of February 6, 2025 (the “Effective Date”), which mirrored the terms of a repricing approved on January 24, 2025 applicable to certain other service providers as described on the Form 8-K filed by the Company on January 28, 2025 (the “Employee Repricing”), except that for Mr. Ali, the options eligible for repricing were limited to options with higher exercise prices than those eligible for the Employee Repricing. The repricing approved by the Board applied to nonstatutory stock options to purchase shares of the Company’s common stock that: (i) were granted to Mr. Ali under the Company’s Amended and Restated 2016 Equity Incentive Plan, as amended (the “2016 Plan”), and/or the Company’s 2021 Equity Incentive Plan (together with the 2016 Plan, the “Plans”) and applicable award agreements thereunder; (ii) as of the Effective Date, were held by Mr. Ali; and (iii) had an exercise price per share greater than $5.25 (the “Eligible Options”).

The new exercise price for Mr. Ali’s repriced options is $1.21 per share, which was the higher of the closing price of the Company’s common stock on the Effective Date and the closing price of the Company’s common stock on the effective date of the Employee Repricing. However, if Mr. Ali exercises a repriced Eligible Option before the Retention Goal Achievement (as defined below), he will be required to pay a premium exercise price that is equal to the exercise price per share of such Eligible Option immediately prior to the Effective Date. There was no change to the expiration dates or service-based vesting criteria of, or number of shares underlying, the Eligible Options and such options remain subject to the terms of the applicable Plans and award agreements. For the purposes of the repricing, “Retention Goal Achievement” means either (i) Mr. Ali has remained a Service Provider (as defined in the Plan under which the applicable option was granted) through the period that begins on the Effective Date and ends on July 24, 2025 (the “Retention Date”); or (ii) a Change in Control (as defined in the Plan under which the applicable option was granted) happens after the Effective Date but prior to the Retention Date while Mr. Ali remains a Service Provider.

The Board approved the repricing following careful consideration of various alternatives and a review of other applicable factors and receipt of the advice of the Company’s independent compensation consultant. The repricing, including the provision of the Retention Goal Achievement, was designed with the objectives of retaining and motivating Mr. Ali to continue to work in the best interests of the Company and its stockholders without incurring the stock dilution resulting from significant additional equity grants or significant additional cash expenditures resulting from additional cash compensation. As of the date of approval of the repricing, a substantial majority of the stock options held by Mr. Ali were “underwater,” with exercise prices per share above the current market price of a share of the Company’s common stock. The total number of shares underlying Mr. Ali’s repriced options was approximately 915,875 shares. The repriced options previously had exercise prices ranging from $5.64 to $15.19 per share.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

TENAYA THERAPEUTICS, INC. |

|

|

By: |

|

/s/ Jennifer Drimmer Rokovich |

|

|

|

|

Jennifer Drimmer Rokovich |

|

|

|

|

General Counsel and Secretary |

|

|

|

|

|

Date: February 7, 2025 |

|

|

|

|

v3.25.0.1

Document And Entity Information

|

Feb. 06, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 06, 2025

|

| Entity Registrant Name |

Tenaya Therapeutics, Inc.

|

| Entity Central Index Key |

0001858848

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-40656

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

81-3789973

|

| Entity Address, Address Line One |

171 Oyster Point Boulevard

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

South San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94080

|

| City Area Code |

(650)

|

| Local Phone Number |

825-6990

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

TNYA

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

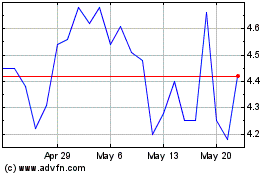

Tenaya Therapeutics (NASDAQ:TNYA)

Historical Stock Chart

From Feb 2025 to Mar 2025

Tenaya Therapeutics (NASDAQ:TNYA)

Historical Stock Chart

From Mar 2024 to Mar 2025