false

0001799191

0001799191

2024-09-19

2024-09-19

0001799191

TOI:CommonStockParValue0.0001Member

2024-09-19

2024-09-19

0001799191

TOI:RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockEachAtExercisePriceOf11.50PerShareMember

2024-09-19

2024-09-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

September

19, 2024

Date of Report (Date of earliest event reported)

THE ONCOLOGY INSTITUTE, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39248 |

|

84-3562323 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 18000 Studebaker Road, Suite 800, Cerritos, CA |

|

90703 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area

code: (562) 735-3226

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 |

|

TOI |

|

The Nasdaq Stock Market LLC |

| Redeemable Warrants, each whole Warrant exercisable for one share of Common Stock, each at an exercise price of $11.50 per share |

|

TOIIW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Resignation of Chief Financial Officer

On September 19, 2024, Mihir Shah, the Chief Financial Officer, principal

financial officer, and principal accounting officer of The Oncology Institute, Inc. (the “Company”), delivered a notice of resignation

effective as of October 14, 2024. His departure is not related to the operations, policies or practices of the Company or any issues regarding

accounting policies or practices. Following his resignation as an officer and employee of the Company, Mr. Shah will assist with the transition

of his role and consult for the Company as an advisor pursuant to a consulting arrangement for an indefinite period at an agreed-upon

hourly rate for his services.

Appointment of new Chief Financial Officer

On September 20, 2024, the Company appointed Robert Carter to replace Mr.

Shah as the Company’s Chief Financial Officer, with effect on October 14, 2024, and in such role, he will serve as the Company’s

principal financial officer and principal accounting officer.

Biography

Mr. Carter, aged 39, is currently the Company’s Senior Vice President,

Finance.

With over a decade of finance leadership experience in the healthcare sector,

Mr. Carter is a seasoned executive dedicated to driving financial excellence and strategic growth. He joined The Oncology Institute in

December 2021 as Vice President of Finance and was promoted to Senior Vice President in 2023. In this role, he has overseen corporate

finance, financial planning and analysis (FP&A), treasury and investor relations, playing a crucial role in shaping the Company’s

financial strategy.

Mr. Carter’s extensive background spans various healthcare sectors,

including pharmaceutical finance, Medicare Advantage, Medi-Cal, and physician group practices.

Before joining the Company, Mr. Carter served as Head of FP&A at Hoag

Health System, a multi-specialty physician group practice and management services organization (MSO) from March 2020 to December 2021.

Also, Mr. Carter previously served as the senior director of national pharmacy finance for Kaiser Permanente from May 2017 to March 2020.

He also previously held several leadership positions in FP&A at SCAN Health Plan and McKesson US Pharma, where he honed his skills

in financial management and strategic planning.

Mr. Carter earned his B.S. in finance from California State University,

East Bay, and continues to leverage his expertise to foster innovation and growth in the healthcare finance landscape.

Employment Terms

In connection with his promotion to Chief Financial Officer, the

Company expects to enter into an employment agreement (the “Employment Agreement”) with Mr. Carter. Pursuant to the Employment

Agreement, Mr. Carter’s initial annual base salary will be $375,000, and his target annual bonus will be 40% of his base salary,

with his actual bonus to be determined under the Company’s applicable bonus plan. Mr. Carter will also receive an equity award with

an aggregate value that has not yet been determined, which award is expected to be granted in the form of stock options and/or restricted

stock units. The equity awards to Mr. Carter are expected to be granted on the Company’s next regular quarterly grant date and will

be subject to the Company’s standard vesting schedules.

The Employment Agreement will have a three-year initial term with additional

one-year automatic extensions thereafter. In the event that Mr. Carter is terminated by us without “cause” or by the executive

with “good reason” (each as defined in the employment agreement), then he will be eligible for salary continuation for 12

months and payments or reimbursements for the cost of COBRA premiums for the 12-month severance period, subject to execution of a general

release of claims. Mr. Carter will be subject to certain post-employment obligations, including a post-employment non-solicitation of

employees covenant, confidentiality obligations, and indefinite non-disparagement obligations.

Mr. Carter has no family relationships with any director, executive officer,

or person nominated or chosen by the Company to become a director or executive officer of the Company. Mr. Carter is not a party to any

transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

The foregoing is a summary of the material terms of the Employment Agreement.

The summary does not purport to be complete and is qualified in its entirety by reference to the Employment Agreement, which will be filed

as an exhibit to the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ending September 30, 2024 and incorporated herein

by reference.

Mr. Carter has entered into the Company’s standard form of indemnification

agreement.

| Item 7.01 |

Regulation FD Disclosure. |

On September 23, 2024, the Company issued a press release announcing Mr. Shah’s resignation

and the appointment of Mr. Carter. The full text of the press release is attached as Exhibit 99.1 to this report and is hereby

incorporated by reference herein.

The information included in this Current Report on Form 8-K under this

Item 7.01 (including Exhibit 99.1) shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed

incorporated by reference into any filing made by the Company under the Exchange Act or the Securities Act of 1933, as amended, except

as shall be expressly set forth by specific reference in such a filing.

| Item 9.01. | Financial Statements and Exhibits. |

| (d) | The following exhibits are being filed herewith: |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: September 23, 2024 |

THE ONCOLOGY INSTITUTE, INC. |

| |

|

| |

By: |

/s/ Mark Hueppelsheuser |

| |

|

Mark Hueppelsheuser

General Counsel |

EXHIBIT 99.1

The Oncology Institute Announces CFO Transition

Rob Carter promoted to

Chief Financial Officer

CERRITOS, Calif., Sept. 23, 2024 (GLOBE

NEWSWIRE) -- The Oncology Institute, Inc. (NASDAQ: TOI) (“TOI” or the “Company”),

today announced that Chief Financial Officer, Mihir Shah, will transition out of the organization effective October 14, 2024, to pursue

other opportunities. Rob Carter, Senior Vice President of Finance at TOI, will be promoted to Chief Financial Officer.

Mr. Carter brings over a decade of finance leadership experience across

several notable healthcare institutions. Mr. Carter joined TOI in 2021, and is responsible for corporate finance, FP&A and investor

relations. Prior to joining TOI, Mr. Carter oversaw financial planning and analysis at Hoag Health System. Prior to that, he served in

various financial leadership roles at Kaiser Permanente, SCAN Health Plan, and McKesson.

Dr. Daniel Virnich, Chief Executive Officer at TOI,

commented, “I’m excited to announce the promotion of Rob to the role of Chief Financial Officer. He brings a wealth of experience

in both oncology and large health systems, has been instrumental to our finance operations over the last several years, and is the right

leader for the next phase of TOI’s growth.”

Dr. Virnich added, “I want to thank Mihir for his many contributions

to TOI. Over the past two and a half years he has led us through our early years as a public company and significantly improved our capabilities

around reporting, compliance, and analytics as well as a number of other critical capabilities in finance and accounting. On behalf of

the whole team, we wish him the best in his future endeavors.”

Mr. Carter commented,

“I’m honored by the opportunity to serve as the next CFO for The Oncology Institute. I

believe we have an incredible amount of growth and innovation ahead of us, and I look forward to continue working closely with

Dan and the rest of our leadership team to ensure we are delivering value to our patients and payor partners every day.”

About The Oncology Institute

Founded in 2007, TOI is advancing oncology by delivering highly specialized,

value-based cancer care in

the community setting. TOI offers cutting-edge, evidence-based cancer care to a population

of over 1.8 million patients including clinical trials, transfusions, and other services traditionally associated with the most advanced

care delivery organizations. With nearly 126 employed clinicians and more than 700 teammates in over 70 clinic locations and growing,

TOI is changing oncology for the better. For more information visit www.theoncologyinstitute.com.

Investors

Solebury Strategic Communications

investors@theoncologyinstitute.com

v3.24.3

Cover

|

Sep. 19, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 19, 2024

|

| Entity File Number |

001-39248

|

| Entity Registrant Name |

THE ONCOLOGY INSTITUTE, INC.

|

| Entity Central Index Key |

0001799191

|

| Entity Tax Identification Number |

84-3562323

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

18000 Studebaker Road

|

| Entity Address, Address Line Two |

Suite 800

|

| Entity Address, City or Town |

Cerritos

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90703

|

| City Area Code |

(562)

|

| Local Phone Number |

735-3226

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.0001 |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001

|

| Trading Symbol |

TOI

|

| Security Exchange Name |

NASDAQ

|

| Redeemable Warrants, each whole warrant exercisable for one share of common stock, each at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable Warrants, each whole Warrant exercisable for one share of Common Stock, each at an exercise price of $11.50 per share

|

| Trading Symbol |

TOIIW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=TOI_CommonStockParValue0.0001Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=TOI_RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockEachAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

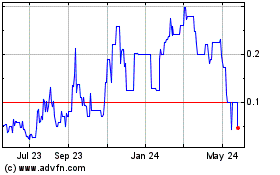

Oncology Institute (NASDAQ:TOIIW)

Historical Stock Chart

From Dec 2024 to Jan 2025

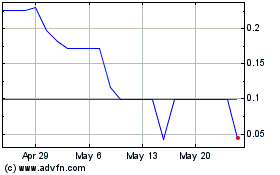

Oncology Institute (NASDAQ:TOIIW)

Historical Stock Chart

From Jan 2024 to Jan 2025