Trustco Bank Announces Management Changes – Leonard, Curley, and Others Assume New Roles

17 July 2024 - 4:38AM

Robert J. McCormick, Chairman, President, and Chief Executive

Officer of TrustCo Bank Corp NY (TrustCo, Nasdaq: TRST) and Trustco

Bank, a subsidiary of TrustCo, announced the appointment of

Executive Vice President Robert M. Leonard as Chief Operating

Officer of TrustCo and Trustco Bank. Executive Vice President Kevin

M. Curley has been named Chief Banking Officer. The following

changes also have been made:

Carly Batista is now

Senior Vice President and Chief Operations OfficerMichael Ewell is

now Senior Vice President and Chief Risk OfficerJ.R. George is now

Senior Vice President and Chief Retail Banking OfficerMichelle

Simmonds is now Senior Vice President and Chief Lending Officer

Mr. McCormick also announced that Michael Hall,

the company’s General Counsel and Corporate Secretary, will

formally assume responsibility for Investor Relations of TrustCo.

Mr. Hall will report directly to the Chief Executive Officer.

Mr. Leonard began his career with Trustco Bank

in 1986 and has held a number of positions with the bank and its

parent company, most recently serving as Chief Risk Officer since

2016. Mr. Curley also has a long tenure with company, having

started in 1990. He too has served in many roles at the company,

most recently as Head of Retail Banking, having assumed that role

in 2022. Michael Hall joined the company in 2015 after previously

serving as one of the bank’s outside attorneys for several

years.

Carly Batista has been with Trustco Bank since

2004. Ms. Batista previously has been responsible for overseeing

the bank’s considerable branch network and also has overseen its

foundational retail banking operation. She will now oversee the

bank’s operations functions and its Planning and Systems

Department. Michael Ewell has been with the bank since 2001 and

most recently served as its Chief Compliance Officer and Chief

Information Security Officer. He will continue to oversee the

compliance and information security functions and will assume

responsibility for the risk function. Mr. George has been with the

company since 1999. He has overseen numerous areas of the bank and

most recently has led the Marketing and Planning and Systems

Departments. He will assume oversight of the bank’s entire branch

network and continue in his role overseeing marketing. Michelle

Simmonds has been with the bank since 1996. Ms. Simmonds likewise

is of long tenure, having overseen the Facilities and Retail

Lending Departments, among others. She will assume responsibility

for overseeing all of the bank’s lending operations.

Trustco Bank also has promoted Lesly Jean-Louis

to Vice President of Operations, focused on customer experience.

Additionally, Stacy Marble has been promoted to Vice President of

Operations, focused on technology. Mr. Jean-Louis and Ms. Marble

work from the bank’s regional headquarters in Longwood, Florida.

Trustco Bank has 52 branches in the Sunshine State.

Chairman McCormick said: “Years of hard and

dedicated work have positioned Trustco Bank with a deep bench of

highly talented and richly experienced leaders. I could not be more

pleased to enhance our organization by elevating all of these

talented bankers. Our customers, the communities we serve, and our

holding company’s shareholders all stand to reap considerable

benefit from these changes. I am excited to see the positive impact

of the fresh ideas and perspectives that will flow from these

promotions.”

Earlier this year, the Company announced that

Executive Vice President and Head of Commercial Loans, Scot R.

Salvador, will retire at the end of this year. Mr. Salvador joined

Trustco Bank in 1995 and held many positions with the company over

a distinguished career. Executive Vice President and Florida

Regional President Eric W. Schreck also will retire at the end of

this year. Mr. Schreck has been with the company since 1989.

Additional leadership changes at Trustco Bank are expected in

connection with Mr. Schreck’s retirement.

About TrustCo Bank Corp NY

TrustCo Bank Corp NY is a $6.2 billion savings

and loan holding company. Through its subsidiary, Trustco Bank,

Trustco operates 138 offices in New York, New Jersey, Vermont,

Massachusetts and Florida. Trustco has a more than 100-year

tradition of providing high-quality services, including a wide

variety of deposit and loan products. In addition, Trustco Bank’s

Financial Services Department offers a full range of investment

services, retirement planning and trust and estate administration

services. Trustco Bank is rated as one of the best performing

savings banks in the country. The common shares of TrustCo are

traded on the NASDAQ Global Select Market under the symbol

TRST. For more information, visit

www.trustcobank.com.

Forward-Looking Statements

All statements in this news release that are not

historical are forward-looking statements within the meaning of the

“safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements can be identified by

words such as “anticipate,” “intend,” “plan,” “goal,” “seek,”

“believe,” “project,” “estimate,” “expect,” “strategy,” “future,”

“likely,” “may,” “should,” “will” and similar references to future

developments, results or periods. TrustCo wishes to caution readers

not to place undue reliance on any such forward-looking statements,

which speak only as of the date made, and such forward-looking

statements are subject to factors and uncertainties that could

cause actual results to differ materially for TrustCo from the

views, beliefs and projections expressed in such statements.

Examples of these include, but are not limited to: volatility in

financial markets and the soundness of other financial

institutions; U.S. government shutdowns, credit rating downgrades,

or failure to increase the debt ceiling; changes in interest rates;

the effects of inflation and inflationary pressures and changes in

monetary and fiscal policies and laws, including changes in the

Federal funds target rate by, and interest rate policies of, the

Federal Reserve Board; ongoing armed conflicts (including the

Russia/Ukraine conflict and the conflict in Israel and surrounding

areas); the risks and uncertainties under the heading “Risk

Factors” in our most recent annual report on Form 10-K and, if any,

in our subsequent quarterly reports on Form 10-Q; the other

financial, operational and legal risks and uncertainties detailed

from time to time in TrustCo’s cautionary statements contained in

its filings with the Securities and Exchange Commission; and the

effect of all of such items on our operations, liquidity and

capital position, and on the financial condition of our borrowers

and other customers. The forward-looking statements contained in

this news release represent TrustCo management’s judgment as of the

date of this news release. TrustCo disclaims, however, any intent

or obligation to update forward-looking statements, either as a

result of future developments, new information or otherwise, except

as may be required by law.

| Contact: |

Robert M.

Leonard |

| |

Executive Vice President |

| |

(518) 381-3693 |

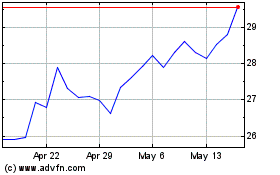

TrustCo Bank Corporation... (NASDAQ:TRST)

Historical Stock Chart

From Oct 2024 to Nov 2024

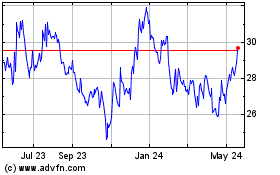

TrustCo Bank Corporation... (NASDAQ:TRST)

Historical Stock Chart

From Nov 2023 to Nov 2024